Key Insights

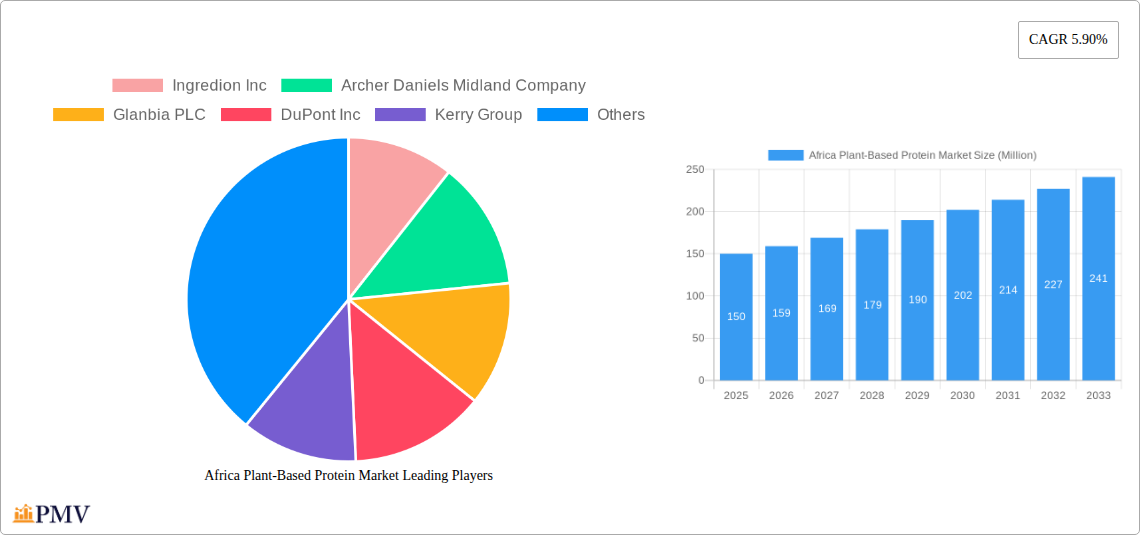

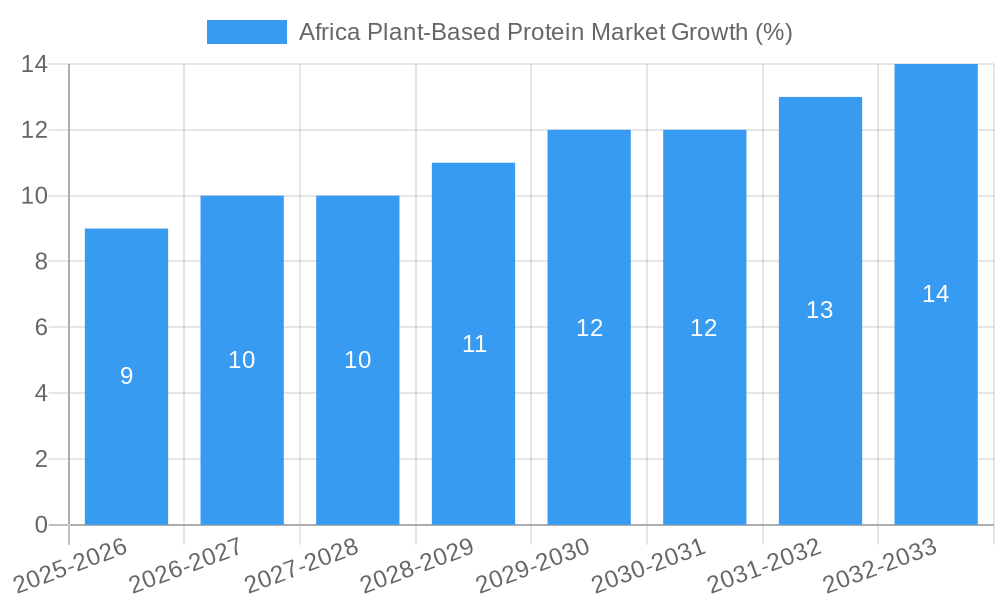

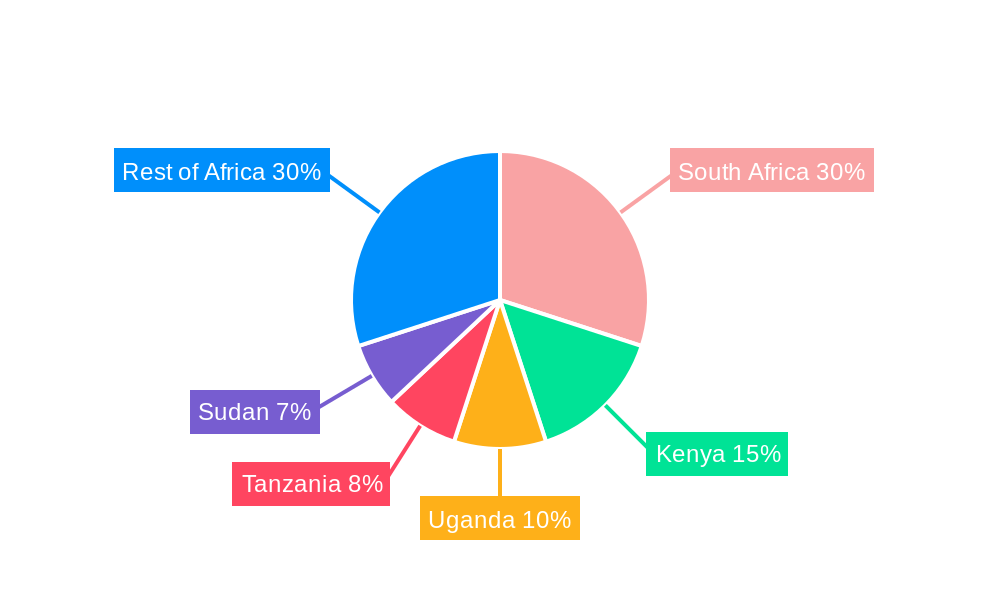

The African plant-based protein market, currently valued at an estimated $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Increasing health consciousness among African consumers is fueling demand for protein-rich alternatives to traditional meat sources. Growing awareness of the environmental benefits of plant-based diets, particularly concerning reduced carbon footprint and land usage, further contributes to market growth. Furthermore, the rising prevalence of vegetarianism and veganism, coupled with a growing middle class with increased disposable income, is creating a larger consumer base for plant-based protein products. The market is segmented by product type (wheat, soy, pea, and other proteins), form (isolates, concentrates, textured proteins), and application (bakery, meat alternatives, dietary supplements, beverages, snacks). South Africa, Kenya, and other rapidly developing nations within the region are showing significant growth potential, driven by expanding food processing industries and increasing investments in infrastructure supporting the food and beverage sector. Challenges remain, including limited awareness of plant-based proteins in certain regions, inconsistent supply chains, and potential infrastructural limitations affecting broader distribution. However, these challenges are expected to be mitigated by ongoing investments and growing market interest.

The market’s diverse product offerings cater to evolving consumer preferences. The protein isolate segment is expected to dominate due to its high protein concentration and versatility in applications. The bakery and meat extender segments are witnessing significant growth owing to the increasing demand for plant-based meat alternatives and functional bakery ingredients. Major players like Ingredion, ADM, Glanbia, DuPont, Kerry Group, Cargill, and Tate & Lyle are actively investing in research and development to introduce innovative plant-based protein products tailored to African consumer needs. Local players like Philafrica Foods are also contributing to market growth by providing locally sourced and processed options. The market’s future trajectory indicates a positive outlook, marked by continuous expansion across various segments and geographies within Africa. Further diversification of product offerings and targeted marketing campaigns aimed at raising consumer awareness will further propel market growth in the coming years.

Africa Plant-Based Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa plant-based protein market, offering invaluable insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, challenges, and future trends. The report incorporates detailed segmentation by product type, form, and application, providing a granular understanding of this dynamic market. Key players such as Ingredion Inc, Archer Daniels Midland Company, Glanbia PLC, DuPont Inc, Kerry Group, Cargill Inc, Tate & Lyle PLC, and Philafrica Foods are profiled, alongside an analysis of their market strategies and competitive landscape. The report also meticulously tracks significant industry developments and forecasts future growth prospects, offering a crucial strategic outlook for success in the African plant-based protein market. The total market value is projected to reach xx Million by 2033.

Africa Plant-Based Protein Market Market Structure & Competitive Dynamics

The African plant-based protein market exhibits a moderately concentrated structure, with both multinational corporations and regional players vying for market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and technological capabilities. Innovation ecosystems are still developing, with opportunities for technological advancements in protein extraction, processing, and formulation. Regulatory frameworks vary across African nations, creating both opportunities and challenges for market entry and expansion. The market experiences competition from traditional protein sources (meat, dairy), although increasing consumer awareness of health and environmental benefits is driving a shift toward plant-based alternatives. Mergers and acquisitions (M&A) activity, while not yet extensive, is anticipated to increase as larger players seek to expand their reach and consolidate their market position. Recent deals, though limited in publicly available data, show varying values (xx Million to xx Million).

- Market Share: Major players currently hold approximately xx% of the market share collectively, with the remaining share distributed among smaller regional companies and emerging players.

- M&A Activity: Consolidation is expected to increase in the coming years, potentially leading to a more concentrated market structure. The deal values are expected to increase, as larger companies seek to acquire promising regional companies.

Africa Plant-Based Protein Market Industry Trends & Insights

The Africa plant-based protein market is experiencing robust growth, driven by several factors. The rising consumer awareness of health benefits associated with plant-based diets, including reduced risk of chronic diseases, is a significant driver. Furthermore, increasing environmental concerns and the desire to reduce the carbon footprint of food consumption are pushing consumers towards more sustainable protein sources. Technological advancements in protein extraction and processing, enabling the production of higher-quality plant-based proteins, are also contributing to growth. The growing middle class in Africa, with increased disposable income, is fueling demand for diverse and convenient food options, including plant-based products. The market is also characterized by a growing preference for healthier and more sustainable food choices, particularly among younger demographics. The compound annual growth rate (CAGR) for the period 2025-2033 is estimated at xx%. Market penetration is currently at xx% and is projected to increase significantly. Competitive dynamics are shaping the market, with both established players and new entrants continuously innovating to capture market share.

Dominant Markets & Segments in Africa Plant-Based Protein Market

While data is currently limited on specific regional dominance, several factors suggest a high growth potential across the continent. The market is segmented into various product types (wheat protein, soy protein, pea protein, and other products), forms (protein isolate, protein concentrate, textured proteins), and applications (bakery, meat extenders and substitutes, dietary supplements, beverages, snacks, and other applications). Initial analysis suggests that the pea protein segment, driven by its functional properties and sustainability aspects, is demonstrating robust growth.

- Key Drivers:

- Growing urban population: The increasing concentration of population in urban areas creates a larger market for convenient and readily available plant-based protein options.

- Rising health consciousness: Growing awareness of health benefits associated with plant-based proteins is driving higher consumption.

- Government initiatives: Supportive policies aimed at promoting sustainable agriculture and food security can create further impetus.

- Infrastructure development: Improved cold chain infrastructure is essential to enhance product distribution and shelf-life.

- Economic growth: Increased disposable income is positively influencing consumer spending in this category.

South Africa is likely to be a dominant market initially, given its comparatively developed food processing infrastructure and higher disposable incomes. However, significant potential exists for growth in other regions as infrastructure and consumer awareness improve.

Africa Plant-Based Protein Market Product Innovations

Recent product innovations focus on enhancing the taste, texture, and functionality of plant-based proteins to better meet consumer expectations. This includes the development of new formulations for meat alternatives, bakery products, and other applications. Technological advancements such as precision fermentation and protein engineering are expected to further enhance the quality and functionality of plant-based proteins in the coming years. This improves their competitive position compared to traditional protein sources. The focus is on addressing consumer demand for improved taste and texture while maintaining nutritional value and sustainability.

Report Segmentation & Scope

The Africa plant-based protein market is segmented based on product type (wheat protein, soy protein, pea protein, other products), form (protein isolate, protein concentrate, textured proteins), and application (bakery, meat extenders and substitutes, dietary supplements, beverages, snacks, other applications). Each segment is analyzed in detail, considering growth projections, market sizes, and competitive dynamics. While precise figures for each segment are still under development and require extensive field research, preliminary estimates indicate significant growth potential across all segments. Competitive dynamics are shaped by factors like pricing strategies, product differentiation, and distribution networks.

Key Drivers of Africa Plant-Based Protein Market Growth

The growth of the Africa plant-based protein market is driven by several key factors: the rising health-conscious consumer base seeking healthier alternatives to animal protein; the growing demand for sustainable and environmentally friendly food options; technological advancements leading to improved taste, texture, and functionality of plant-based proteins; increased disposable incomes in urban areas increasing purchasing power; and supportive government policies promoting diversification of food sources and sustainable agriculture. The expanding food processing and retail infrastructure further contributes to the growth of this sector.

Challenges in the Africa Plant-Based Protein Market Sector

Challenges hindering the growth of the Africa plant-based protein market include limited awareness in certain regions; infrastructure limitations in some areas, such as cold chain logistics, impacting product shelf life and distribution; inconsistencies in regulatory frameworks across different countries; high import costs for certain raw materials and processing equipment; and competition from established traditional protein sources which benefit from well-developed infrastructure and entrenched consumer preference. Overcoming these challenges is crucial to the sector’s growth.

Leading Players in the Africa Plant-Based Protein Market Market

- Ingredion Inc

- Archer Daniels Midland Company

- Glanbia PLC

- DuPont Inc

- Kerry Group

- Cargill Inc

- Tate & Lyle PLC

- Philafrica Foods

Key Developments in Africa Plant-Based Protein Market Sector

- April 2022: Cargill launched RadiPure pea protein, promoting plant-based innovations in META (Middle East, Turkey, Africa, and India).

- February 2021: DuPont's Nutrition & Biosciences merged with IFF, creating a stronger player in the plant-based ingredients market.

- January 2021: Kerry introduced Radicle Solution Finder, a web-based tool assisting plant-based product development.

Strategic Africa Plant-Based Protein Market Market Outlook

The Africa plant-based protein market holds substantial future potential, driven by the factors previously mentioned. Strategic opportunities exist for companies that can address the unique challenges of the market, focusing on developing locally adapted products, building robust distribution networks, and engaging with local communities. Investing in research and development to improve the taste, texture, and affordability of plant-based proteins will be crucial for unlocking the market's full potential. The market is poised for significant growth, and proactive companies will be best positioned to capture market share and drive innovation.

Africa Plant-Based Protein Market Segmentation

-

1. Product Type

- 1.1. Wheat Protein

- 1.2. Soy Protein

- 1.3. Pea Protein

- 1.4. Other Products

-

2. Form

- 2.1. Protein Isolate

- 2.2. Protein Concentrate

- 2.3. Textured Proteins

-

3. Application

- 3.1. Bakery

- 3.2. Meat Extenders and Substitutes

- 3.3. Dietary Supplements

- 3.4. Beverages

- 3.5. Snacks

- 3.6. Other Applications

-

4. Geography

- 4.1. South Africa

- 4.2. Nigeria

- 4.3. Kenya

- 4.4. Rest of Africa

Africa Plant-Based Protein Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Kenya

- 4. Rest of Africa

Africa Plant-Based Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. Higher Production Cost of Fat Replacers

- 3.4. Market Trends

- 3.4.1. Soy Protein Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wheat Protein

- 5.1.2. Soy Protein

- 5.1.3. Pea Protein

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Protein Isolate

- 5.2.2. Protein Concentrate

- 5.2.3. Textured Proteins

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Meat Extenders and Substitutes

- 5.3.3. Dietary Supplements

- 5.3.4. Beverages

- 5.3.5. Snacks

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Kenya

- 5.4.4. Rest of Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Kenya

- 5.5.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wheat Protein

- 6.1.2. Soy Protein

- 6.1.3. Pea Protein

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Protein Isolate

- 6.2.2. Protein Concentrate

- 6.2.3. Textured Proteins

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Meat Extenders and Substitutes

- 6.3.3. Dietary Supplements

- 6.3.4. Beverages

- 6.3.5. Snacks

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Nigeria

- 6.4.3. Kenya

- 6.4.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Nigeria Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wheat Protein

- 7.1.2. Soy Protein

- 7.1.3. Pea Protein

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Protein Isolate

- 7.2.2. Protein Concentrate

- 7.2.3. Textured Proteins

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Meat Extenders and Substitutes

- 7.3.3. Dietary Supplements

- 7.3.4. Beverages

- 7.3.5. Snacks

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Nigeria

- 7.4.3. Kenya

- 7.4.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Kenya Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wheat Protein

- 8.1.2. Soy Protein

- 8.1.3. Pea Protein

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Protein Isolate

- 8.2.2. Protein Concentrate

- 8.2.3. Textured Proteins

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery

- 8.3.2. Meat Extenders and Substitutes

- 8.3.3. Dietary Supplements

- 8.3.4. Beverages

- 8.3.5. Snacks

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Nigeria

- 8.4.3. Kenya

- 8.4.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wheat Protein

- 9.1.2. Soy Protein

- 9.1.3. Pea Protein

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Protein Isolate

- 9.2.2. Protein Concentrate

- 9.2.3. Textured Proteins

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery

- 9.3.2. Meat Extenders and Substitutes

- 9.3.3. Dietary Supplements

- 9.3.4. Beverages

- 9.3.5. Snacks

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. South Africa

- 9.4.2. Nigeria

- 9.4.3. Kenya

- 9.4.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ingredion Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Archer Daniels Midland Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Glanbia PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DuPont Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kerry Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cargill Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Tate & Lyle PLC*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Philafrica Foods

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Ingredion Inc

List of Figures

- Figure 1: Africa Plant-Based Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Plant-Based Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Plant-Based Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Plant-Based Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 16: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 21: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 26: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 31: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Plant-Based Protein Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Africa Plant-Based Protein Market?

Key companies in the market include Ingredion Inc, Archer Daniels Midland Company, Glanbia PLC, DuPont Inc, Kerry Group, Cargill Inc, Tate & Lyle PLC*List Not Exhaustive, Philafrica Foods.

3. What are the main segments of the Africa Plant-Based Protein Market?

The market segments include Product Type, Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Soy Protein Dominates the Market.

7. Are there any restraints impacting market growth?

Higher Production Cost of Fat Replacers.

8. Can you provide examples of recent developments in the market?

In April 2022, with the launch of RadiPure pea protein, Cargill promoted plant-based innovations in META (Middle East, Turkey, Africa, and India). The solubility and flavor profile that clients require for the creation of food applications is provided by RadiPure pea protein. Pea protein is claimed to be an excellent substitute for a variety of applications due to such advantages and its emulsifying, viscosifying, and gelation qualities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Plant-Based Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Plant-Based Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Plant-Based Protein Market?

To stay informed about further developments, trends, and reports in the Africa Plant-Based Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence