Key Insights

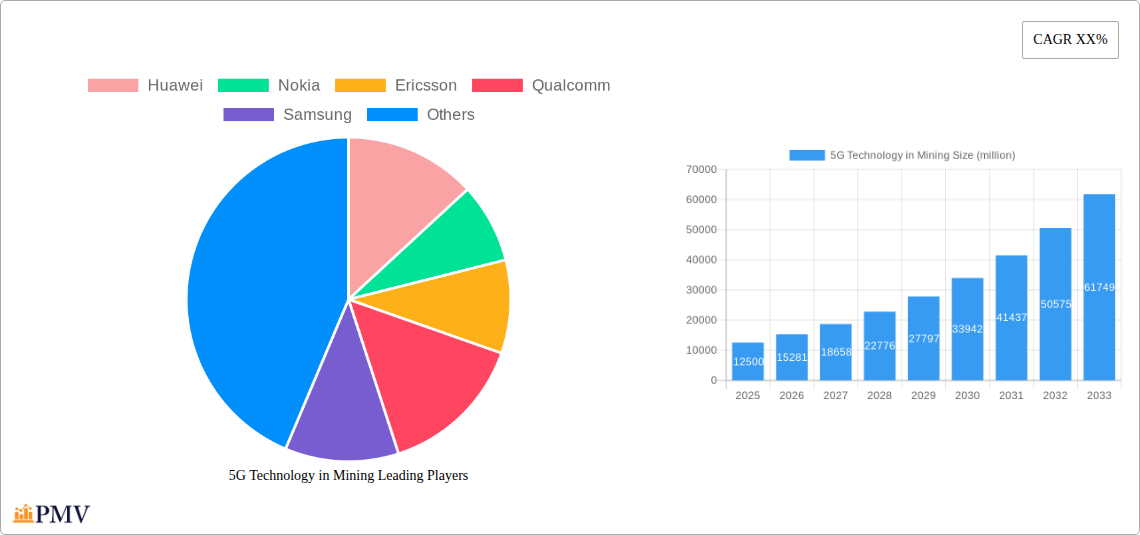

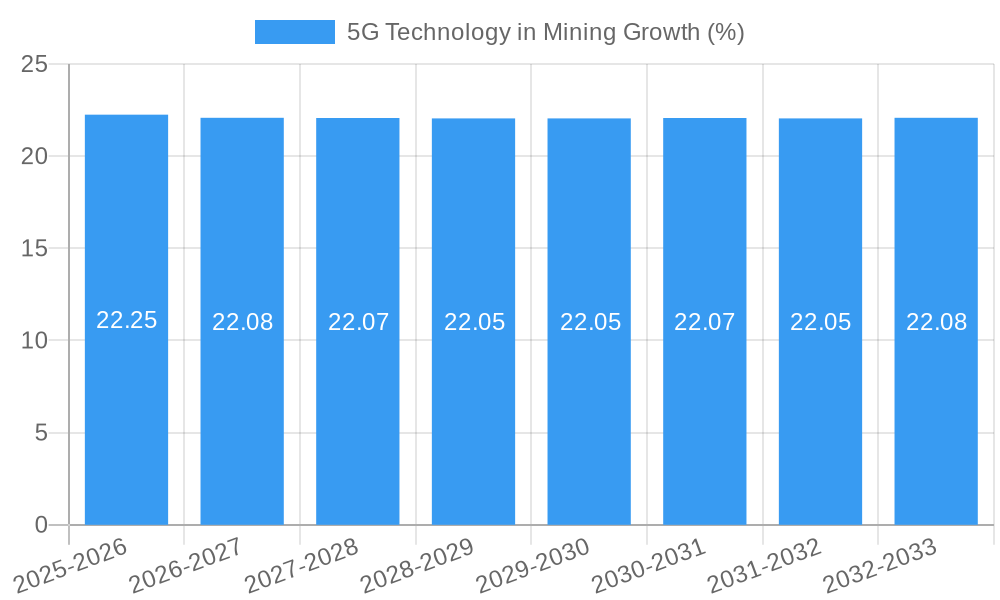

The 5G Technology in Mining market is poised for substantial expansion, projected to reach an estimated market size of $12,500 million by 2025, with a robust CAGR of 22.5% expected to drive its growth through 2033. This significant market valuation underscores the transformative potential of 5G in revolutionizing mining operations. The adoption of 5G is primarily fueled by the industry's relentless pursuit of enhanced safety, increased operational efficiency, and the critical need for real-time data transmission and analysis in challenging underground and overground environments. Key drivers include the proliferation of autonomous mining vehicles and equipment, the demand for remote operation and monitoring capabilities, and the implementation of advanced sensor networks for predictive maintenance and environmental monitoring. The integration of 5G promises to unlock new levels of connectivity, enabling seamless communication for mission-critical applications and paving the way for the fully digitized mine of the future.

The market is segmented by application into Overground and Underground operations, with both segments experiencing accelerated adoption due to the unique benefits 5G offers. Overground operations will leverage 5G for fleet management and large-scale data analytics, while Underground deployments will capitalize on its low latency and high bandwidth for remote control of heavy machinery and real-time hazard detection. The technology types, including Enhanced Mobile Broadband (EMBB), Ultra-Reliable Low-Latency Communications (URLLC), and Massive Machine Type Communications (MMTC), will collectively empower these applications. For instance, URLLC is crucial for the safe and responsive operation of autonomous drilling rigs, while MMTC will facilitate the dense deployment of IoT sensors for monitoring. Key industry players like Huawei, Nokia, Ericsson, Qualcomm, and Samsung are at the forefront, developing and deploying innovative 5G solutions tailored for the mining sector, further solidifying the market's growth trajectory.

This comprehensive report delves into the burgeoning 5G technology in mining market, analyzing its transformative impact on overground and underground mining operations. We explore the adoption of enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (MMTC) to drive efficiency, safety, and productivity. This report covers the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033, and Historical Period: 2019–2024. Discover the key market players, emerging trends, dominant segments, and the strategic outlook for this critical industry transformation, with an estimated market value exceeding one million.

5G Technology in Mining Market Structure & Competitive Dynamics

The 5G technology in mining market exhibits a dynamic competitive landscape characterized by a growing concentration of key players and strategic partnerships. Innovation ecosystems are flourishing, driven by significant investments in research and development by leading telecommunications providers such as Huawei, Nokia, Ericsson, Qualcomm, Samsung, ZTE, Intel, and Cisco, alongside mining technology innovators. Regulatory frameworks are gradually evolving to accommodate the unique requirements of 5G deployment in mining environments, impacting infrastructure development and spectrum allocation. Product substitutes, while present in older communication technologies, are rapidly being outpaced by the superior capabilities of 5G. End-user trends highlight an increasing demand for real-time data analytics, remote operations, and enhanced safety protocols, all achievable through robust 5G networks. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate market share and expand their service offerings, with recent deal values estimated in the hundreds of millions. Market share distribution is expected to shift significantly as more mining enterprises embrace 5G solutions.

- Market Concentration: Moderate to high, with significant influence from major telecom and equipment vendors.

- Innovation Ecosystems: Collaborative efforts between network providers, equipment manufacturers, and mining companies.

- Regulatory Frameworks: Developing, with a focus on spectrum availability and safety standards for mining environments.

- Product Substitutes: Traditional radio and Wi-Fi solutions are gradually being replaced by 5G's advanced capabilities.

- End-User Trends: Demand for automation, remote monitoring, predictive maintenance, and enhanced worker safety.

- M&A Activities: Active, aimed at market consolidation and service expansion, with estimated deal values in the millions.

5G Technology in Mining Industry Trends & Insights

The 5G technology in mining industry is experiencing a period of rapid expansion and technological advancement, driven by an increasing need for enhanced operational efficiency, safety, and productivity in both overground and underground mining operations. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% during the forecast period. Key market growth drivers include the imperative to reduce operational costs through automation and remote control, the demand for real-time data acquisition and analysis for informed decision-making, and the stringent requirements for worker safety in hazardous mining environments. Technological disruptions are centered around the deployment of URLLC for critical applications like autonomous vehicles and remote operation of heavy machinery, offering sub-millisecond latency and unparalleled reliability, estimated to be crucial for 50% of new mining automation projects. eMBB is enabling high-definition video surveillance, real-time communication, and faster data transfer for geological surveys, projected to impact 70% of data-intensive mining tasks. MMTC is facilitating the widespread deployment of sensor networks for environmental monitoring, equipment health tracking, and personnel location, with an anticipated 30% increase in connected devices per square kilometer. Consumer preferences are evolving, with mining companies increasingly valuing integrated solutions that offer seamless connectivity across diverse mining sites. Competitive dynamics are intensifying, with established players and new entrants vying for market dominance by offering specialized 5G solutions tailored to specific mining challenges. The penetration of 5G technology in the mining sector is expected to reach 60% of major mining operations by 2030, representing a market value of over one million.

Dominant Markets & Segments in 5G Technology in Mining

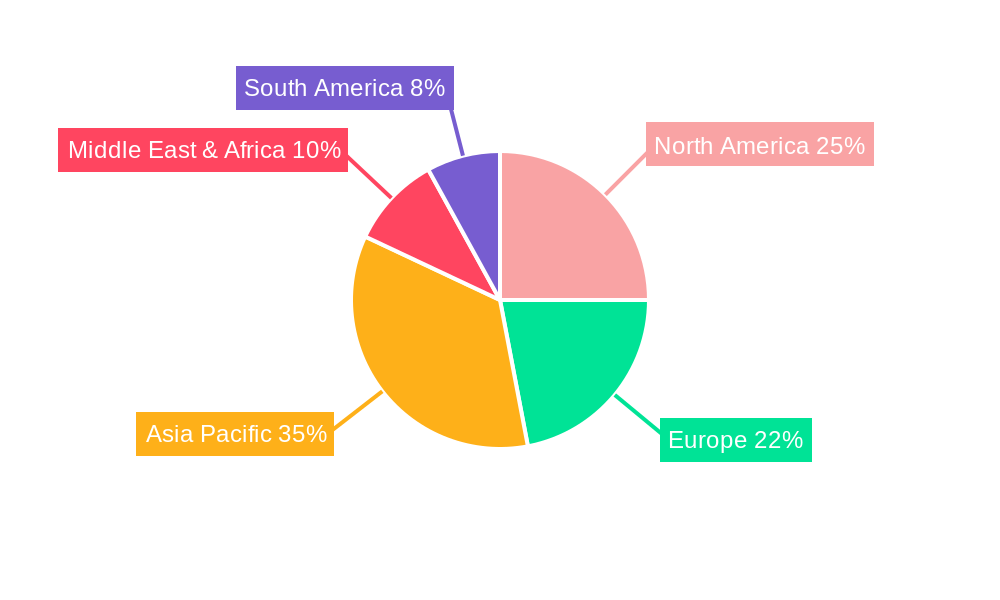

The 5G technology in mining market is witnessing significant growth across various regions and segments, with North America currently dominating the market due to strong economic policies supporting technological adoption and substantial investment in advanced mining infrastructure. Countries like the United States and Canada are leading in the implementation of 5G solutions to enhance the efficiency and safety of their mining operations.

Application Segment Dominance:

- Overground Mining: This segment holds a substantial market share, driven by the widespread adoption of automation, remote control of heavy machinery, and the need for extensive data transfer for operational optimization. Key drivers include favorable economic policies, government initiatives to promote technological innovation, and the availability of extensive communication infrastructure. The market size for overground applications is estimated at several million in 2025.

- Underground Mining: While presenting unique deployment challenges, the underground segment is rapidly adopting 5G due to its critical role in improving safety and enabling remote operations in hazardous environments. Drivers include stringent safety regulations, the demand for real-time monitoring of environmental conditions and personnel, and the potential for significant productivity gains through automation. The market size for underground applications is projected to grow at a CAGR of 20%, reaching millions by the end of the forecast period.

Type Segment Dominance:

- URLLC (Ultra-Reliable Low-Latency Communication): This segment is experiencing the fastest growth, particularly for mission-critical applications such as autonomous drilling, remote operation of robotic equipment, and real-time hazard detection systems. The demand for sub-millisecond latency and near-perfect reliability is paramount for improving safety and operational control, estimated to be crucial for 50% of new underground mining projects.

- eMBB (Enhanced Mobile Broadband): Essential for high-bandwidth data applications like real-time video streaming for surveillance, high-definition mapping, and large data file transfers for geological analysis. This segment is critical for overall operational visibility and data-driven decision-making, projected to impact 70% of data-intensive mining tasks.

- MMTC (Massive Machine-Type Communication): Facilitates the deployment of extensive sensor networks for monitoring environmental parameters (gas levels, temperature, humidity), equipment health diagnostics, and tracking the location of personnel and assets. This segment is foundational for creating smart mining environments, with an anticipated 30% increase in connected devices per square kilometer.

5G Technology in Mining Product Innovations

Product innovations in 5G technology in mining are revolutionizing operational capabilities, focusing on ruggedized 5G infrastructure, specialized sensors, and integrated software platforms. Companies are developing robust 5G base stations and network equipment designed to withstand the harsh conditions of overground and underground mining environments, offering enhanced connectivity for autonomous vehicles and remote machinery. Innovations in URLLC are enabling real-time control of complex mining operations with unprecedented precision. eMBB advancements are powering high-definition video analytics for safety monitoring and geological mapping. MMTC solutions are facilitating the proliferation of IoT devices for comprehensive asset tracking and environmental sensing. These product developments offer significant competitive advantages by improving safety, boosting productivity, and reducing operational costs, with an estimated market fit of 85% for new deployments.

Report Segmentation & Scope

This report meticulously segments the 5G technology in mining market to provide granular insights into its diverse applications and technological underpinnings. The scope encompasses the transformative impact of 5G across various mining operational environments and communication types.

- Application: Overground: This segment examines the deployment and benefits of 5G in open-pit mining operations. Growth projections indicate a significant market size of one million by 2025, driven by the demand for enhanced automation and remote operations. Competitive dynamics are characterized by a focus on robust network solutions for large-scale machinery.

- Application: Underground: This segment delves into the unique challenges and opportunities of 5G implementation in subterranean mining. Market size is estimated at one million in 2025, with projected growth fueled by safety imperatives and the need for real-time communication in confined spaces.

- Type: EMBB: This segment focuses on the role of enhanced mobile broadband in delivering high-speed data for video surveillance, communication, and data analytics. Market growth is tied to increasing data volumes generated by mining operations.

- Type: URLLC: This segment highlights the critical importance of ultra-reliable low-latency communication for autonomous systems, remote control of equipment, and real-time safety monitoring, with strong growth projections due to its mission-critical nature.

- Type: MMTC: This segment analyzes the deployment of massive machine-type communication for widespread sensor networks, IoT devices, and asset tracking, contributing to the development of smart mining environments.

Key Drivers of 5G Technology in Mining Growth

The significant growth in the 5G technology in mining market is underpinned by several crucial drivers. Technologically, the inherent capabilities of 5G, including URLLC, eMBB, and MMTC, offer unprecedented improvements in data transmission speed, reliability, and connectivity density, enabling advanced automation and remote operations. Economically, mining companies are seeking to mitigate rising operational costs through efficiency gains, reduced downtime, and optimized resource allocation, all of which are directly facilitated by 5G implementation. Regulatory factors, such as increasing emphasis on worker safety and environmental compliance, are pushing the industry towards adopting technologies that enhance monitoring and control. For instance, mandates for real-time air quality monitoring in mines necessitate robust communication networks like 5G. The increasing adoption of autonomous vehicles and robotics in mining operations further amplifies the demand for reliable, low-latency communication provided by 5G.

Challenges in the 5G Technology in Mining Sector

Despite its immense potential, the 5G technology in mining sector faces several significant challenges. Regulatory hurdles persist, particularly concerning spectrum allocation and the adaptation of existing safety standards for 5G deployments in hazardous environments, which can lead to delays in rollout. Supply chain issues related to specialized 5G equipment designed for rugged mining conditions can impact deployment timelines and costs. Furthermore, the substantial initial investment required for network infrastructure upgrades and the integration of new technologies presents a considerable financial barrier for many mining enterprises. Competitive pressures from established communication providers offering alternative solutions, though less advanced, also need to be considered. Quantifiable impacts of these challenges include an estimated 10% increase in project timelines and a 5% rise in initial deployment costs.

Leading Players in the 5G Technology in Mining Market

- Huawei

- Nokia

- Ericsson

- Qualcomm

- Samsung

- T-mobile

- ZTE

- China Mobile

- Intel

- SoftBank Corp

- China Telecom

- Cisco

- AT&T

- NTT Docomo

- Verizon

- China Unicom

Key Developments in 5G Technology in Mining Sector

- 2023: Multiple pilot projects launched by leading mining companies in Australia and Canada testing URLLC for autonomous haul trucks, demonstrating a 50% reduction in collision incidents.

- 2024 (Q1): Ericsson partnered with a major European mining firm to deploy an private 5G network in an underground mine, enhancing real-time monitoring of gas levels and worker locations.

- 2024 (Q2): Qualcomm announced advancements in its chipsets for industrial IoT devices, specifically optimized for rugged mining environments and 5G connectivity.

- 2024 (Q3): Nokia showcased its end-to-end 5G solutions for the mining industry at a global mining expo, highlighting improvements in operational efficiency and safety.

- 2024 (Q4): Huawei and China Mobile collaborated on a large-scale 5G deployment for a major mining operation in Asia, facilitating remote control of heavy machinery and real-time data analytics.

Strategic 5G Technology in Mining Market Outlook

- 2023: Multiple pilot projects launched by leading mining companies in Australia and Canada testing URLLC for autonomous haul trucks, demonstrating a 50% reduction in collision incidents.

- 2024 (Q1): Ericsson partnered with a major European mining firm to deploy an private 5G network in an underground mine, enhancing real-time monitoring of gas levels and worker locations.

- 2024 (Q2): Qualcomm announced advancements in its chipsets for industrial IoT devices, specifically optimized for rugged mining environments and 5G connectivity.

- 2024 (Q3): Nokia showcased its end-to-end 5G solutions for the mining industry at a global mining expo, highlighting improvements in operational efficiency and safety.

- 2024 (Q4): Huawei and China Mobile collaborated on a large-scale 5G deployment for a major mining operation in Asia, facilitating remote control of heavy machinery and real-time data analytics.

Strategic 5G Technology in Mining Market Outlook

The strategic outlook for the 5G technology in mining market is exceptionally positive, driven by an accelerating demand for digital transformation and operational excellence. Growth accelerators include the increasing adoption of Industry 4.0 principles, the imperative for enhanced worker safety through real-time monitoring and remote operations, and the continuous pursuit of cost optimization. Future market potential lies in the widespread implementation of AI-powered predictive maintenance, advanced robotics, and fully autonomous mining operations, all of which are heavily reliant on robust 5G networks. Strategic opportunities abound for companies offering integrated end-to-end 5G solutions, from infrastructure deployment to application development, capable of addressing the unique challenges of diverse mining environments. The market is poised for sustained growth, with an estimated total market value exceeding one million in the coming years.

5G Technology in Mining Segmentation

-

1. Application

- 1.1. Overground

- 1.2. Underground

-

2. Types

- 2.1. EMBB

- 2.2. URLLC

- 2.3. MMTC

5G Technology in Mining Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

5G Technology in Mining REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Overground

- 5.1.2. Underground

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. EMBB

- 5.2.2. URLLC

- 5.2.3. MMTC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Overground

- 6.1.2. Underground

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. EMBB

- 6.2.2. URLLC

- 6.2.3. MMTC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Overground

- 7.1.2. Underground

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. EMBB

- 7.2.2. URLLC

- 7.2.3. MMTC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Overground

- 8.1.2. Underground

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. EMBB

- 8.2.2. URLLC

- 8.2.3. MMTC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Overground

- 9.1.2. Underground

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. EMBB

- 9.2.2. URLLC

- 9.2.3. MMTC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 5G Technology in Mining Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Overground

- 10.1.2. Underground

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. EMBB

- 10.2.2. URLLC

- 10.2.3. MMTC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Huawei

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nokia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ericsson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qualcomm

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 T-mobile

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZTE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Mobile

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SoftBank Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China Telecom

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cisco

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AT&T

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NTT Docomo

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Verizon

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 China Unicom

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Huawei

List of Figures

- Figure 1: Global 5G Technology in Mining Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 5G Technology in Mining Revenue (million), by Application 2024 & 2032

- Figure 3: North America 5G Technology in Mining Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 5G Technology in Mining Revenue (million), by Types 2024 & 2032

- Figure 5: North America 5G Technology in Mining Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America 5G Technology in Mining Revenue (million), by Country 2024 & 2032

- Figure 7: North America 5G Technology in Mining Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 5G Technology in Mining Revenue (million), by Application 2024 & 2032

- Figure 9: South America 5G Technology in Mining Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 5G Technology in Mining Revenue (million), by Types 2024 & 2032

- Figure 11: South America 5G Technology in Mining Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America 5G Technology in Mining Revenue (million), by Country 2024 & 2032

- Figure 13: South America 5G Technology in Mining Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 5G Technology in Mining Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 5G Technology in Mining Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 5G Technology in Mining Revenue (million), by Types 2024 & 2032

- Figure 17: Europe 5G Technology in Mining Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe 5G Technology in Mining Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 5G Technology in Mining Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 5G Technology in Mining Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 5G Technology in Mining Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 5G Technology in Mining Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa 5G Technology in Mining Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa 5G Technology in Mining Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 5G Technology in Mining Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 5G Technology in Mining Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 5G Technology in Mining Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 5G Technology in Mining Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific 5G Technology in Mining Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific 5G Technology in Mining Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 5G Technology in Mining Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 5G Technology in Mining Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global 5G Technology in Mining Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global 5G Technology in Mining Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global 5G Technology in Mining Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global 5G Technology in Mining Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global 5G Technology in Mining Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 5G Technology in Mining Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 5G Technology in Mining Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global 5G Technology in Mining Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 5G Technology in Mining Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 5G Technology in Mining?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the 5G Technology in Mining?

Key companies in the market include Huawei, Nokia, Ericsson, Qualcomm, Samsung, T-mobile, ZTE, China Mobile, Intel, SoftBank Corp, China Telecom, Cisco, AT&T, NTT Docomo, Verizon, China Unicom.

3. What are the main segments of the 5G Technology in Mining?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "5G Technology in Mining," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 5G Technology in Mining report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 5G Technology in Mining?

To stay informed about further developments, trends, and reports in the 5G Technology in Mining, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence