Key Insights

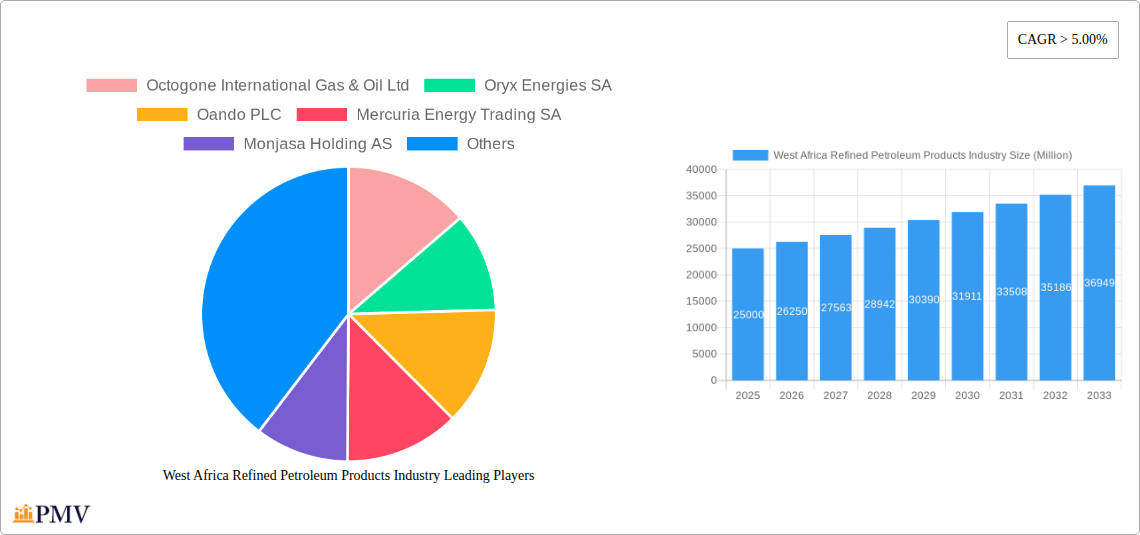

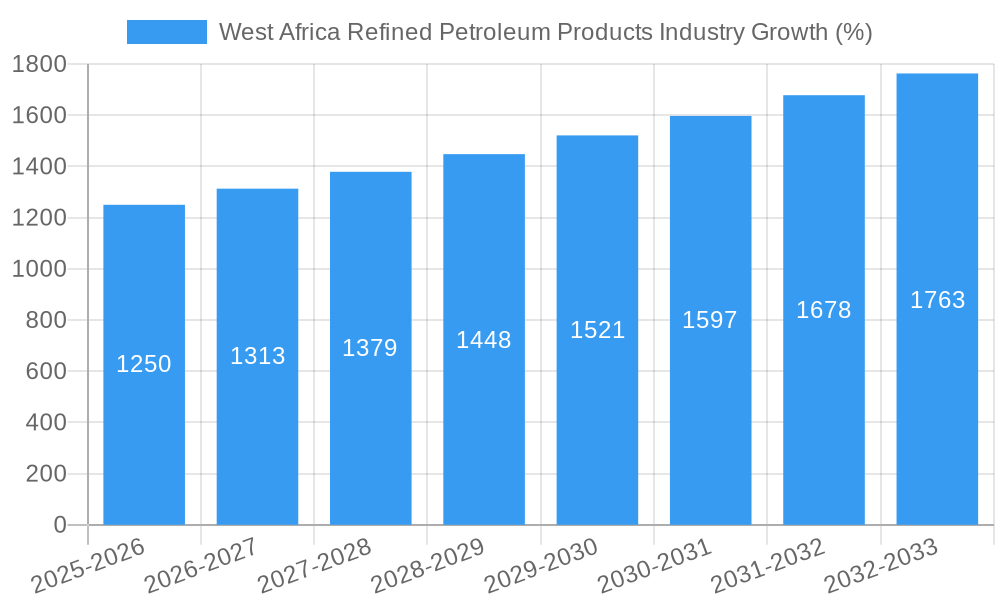

The West African refined petroleum products market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning automotive sector, coupled with increasing industrialization and urbanization, significantly boosts demand for gasoline, diesel, and other fuels. Secondly, the expanding aviation and marine sectors, particularly in coastal nations and major port cities, contribute to higher consumption of jet fuel and marine fuels respectively. The rising population and improving living standards further contribute to this growth. LPG adoption, while still relatively low compared to other fuels, is also experiencing positive growth driven by initiatives promoting cleaner cooking solutions and government support for LPG infrastructure development. However, market growth faces challenges. Price volatility in global crude oil markets poses a significant risk, impacting fuel prices and affordability. Furthermore, government policies aimed at diversifying energy sources and promoting renewable energy could potentially curb the long-term growth of refined petroleum products. Regional disparities also exist, with some countries witnessing faster growth than others due to variations in economic development and infrastructure. Leading players such as Vitol, Trafigura, and Oryx Energies are strategically positioned to capitalize on these opportunities, focusing on efficient supply chain management and adapting to evolving market dynamics. The market segmentation by fuel type (automotive, marine, aviation, LPG, others) allows for targeted investment strategies by companies seeking to navigate these complexities and secure a larger market share.

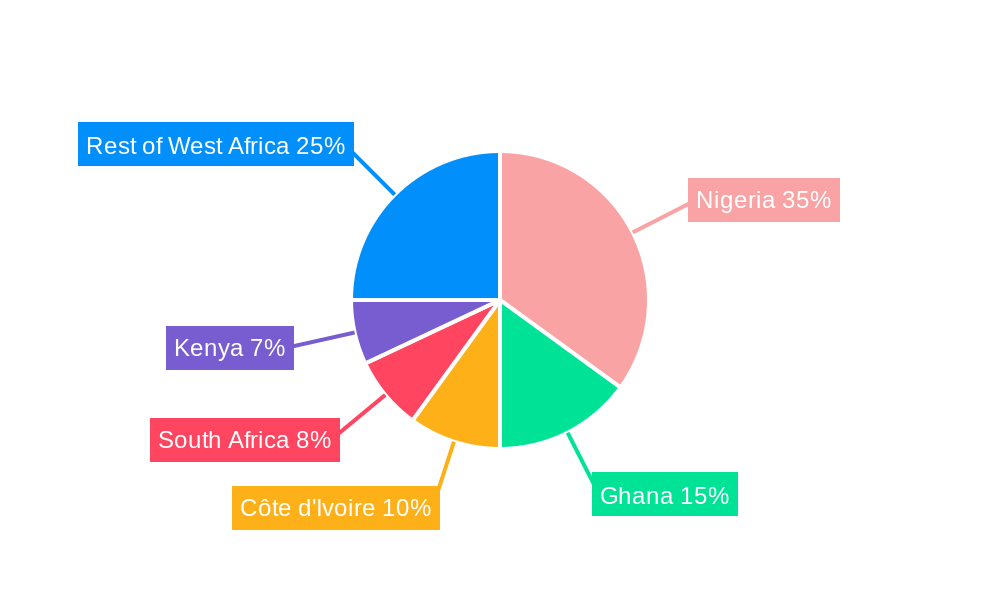

The competitive landscape is characterized by both international and regional players. International energy giants leverage their global expertise and networks, while local companies benefit from regional knowledge and established distribution channels. This dynamic interplay shapes pricing strategies, product offerings, and overall market competitiveness. Future growth will likely hinge on the successful integration of sustainable practices, the adoption of advanced technologies for refining and distribution, and government policies that balance energy security with environmental concerns. Focus on enhancing infrastructure, especially storage and distribution networks across West Africa, will be crucial for sustaining the market's trajectory. Specific growth patterns in nations like Nigeria, Ghana, and Côte d'Ivoire will significantly influence the overall market performance in the coming years. Analyzing these individual country profiles and their unique economic and regulatory environments is crucial for a comprehensive market understanding.

West Africa Refined Petroleum Products Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the West Africa refined petroleum products industry, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and incorporates expert forecasts to provide a clear and concise overview of this rapidly evolving sector. The Base Year for this report is 2025, with the Estimated Year also being 2025, and the Forecast Period spanning from 2025 to 2033. The Historical Period covered is 2019-2024.

West Africa Refined Petroleum Products Industry Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the West African refined petroleum products industry. The market is characterized by a mix of multinational corporations and local players, resulting in a moderately concentrated structure. Key players such as Vitol Holdings BV, Trafigura Group Pte Ltd, and Oryx Energies SA hold significant market share, estimated at xx%, xx%, and xx% respectively in 2025. However, the emergence of new refineries, like the Dangote refinery, is expected to reshape this landscape.

The regulatory environment varies across West African countries, impacting market access and operations. Innovation in the sector focuses on improving refining efficiency, developing cleaner fuels, and enhancing supply chain logistics. Product substitutes, such as biofuels, are gaining traction, driven by environmental concerns and government policies. The industry has witnessed several M&A activities in recent years, though the total deal value for the period 2019-2024 is estimated at $xx Million. These activities are primarily driven by expansion strategies and access to new markets. End-user trends reflect a growing demand for refined petroleum products, particularly automotive fuels, fuelled by increasing vehicle ownership and economic growth across the region.

West Africa Refined Petroleum Products Industry Industry Trends & Insights

The West Africa refined petroleum products market exhibits a robust growth trajectory, primarily driven by increasing energy consumption across various sectors, including transportation, industry, and power generation. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, driven by factors such as population growth, rising urbanization, and expanding industrial activities. Market penetration of refined products remains high, exceeding xx% in most West African countries, indicative of the sector's strong foundation and essential role in regional economies.

Technological advancements, particularly in refining technologies, are leading to improved efficiency and reduced emissions. However, the sector also faces challenges including infrastructure limitations, fluctuating crude oil prices, and environmental concerns. Consumer preferences are shifting towards cleaner fuels, prompting companies to invest in technologies that produce lower-emission products. Competitive dynamics are further intensified by the entry of new players and the expansion of existing ones. The market is also grappling with the need for sustainable practices and the increasing pressure to reduce carbon footprints.

Dominant Markets & Segments in West Africa Refined Petroleum Products Industry

Nigeria dominates the West African refined petroleum products market, accounting for xx% of the total regional market volume in 2025. This dominance is attributable to its large population, substantial industrial base, and significant energy consumption. Other key markets include Ghana, Ivory Coast, and Senegal.

- Key Drivers of Nigeria's Dominance:

- Large and growing population

- Significant industrial sector

- Extensive transportation network (though needing further investment)

- Relatively well-developed infrastructure compared to other West African nations.

The Automotive Fuels segment is the largest, representing approximately xx% of the total market in 2025. This segment is driven by the increasing number of vehicles on the road, boosted by economic growth and rising living standards. Marine fuels represent a substantial segment as well, reflecting the region's growing maritime activity. The LPG segment exhibits promising growth potential, driven by increasing awareness of cleaner cooking fuels and government initiatives to promote LPG adoption.

West Africa Refined Petroleum Products Industry Product Innovations

Recent innovations in the West African refined petroleum products industry primarily focus on improving fuel quality to meet stricter environmental regulations and enhance engine performance. The introduction of cleaner-burning fuels, along with advancements in refinery technologies, is a key trend. These innovations aim to improve efficiency, reduce emissions, and enhance the overall value proposition to end-users. The integration of smart technologies in supply chain management and distribution networks is gaining traction, leading to greater efficiency and reduced losses.

Report Segmentation & Scope

This report segments the West African refined petroleum products market based on product type:

Automotive Fuels: This segment includes gasoline, diesel, and other fuels used in automobiles. Market size in 2025 is estimated at $xx Million, with projected growth driven by increasing vehicle ownership and economic development. Competition is intense, with both multinational and local players vying for market share.

Marine Fuels: This segment encompasses fuels used in marine vessels and shipping. In 2025, it is valued at $xx Million, with anticipated growth fuelled by the expansion of maritime trade and shipping activities in the region. The segment is characterized by a smaller number of major players.

Aviation Fuels: This segment focuses on jet fuel and other aviation fuels. Its 2025 market size is estimated at $xx Million, showing growth aligned with the expansion of air travel and tourism across West Africa. Competition is relatively more consolidated within this segment.

Liquefied Petroleum Gas (LPG): This segment is experiencing rapid growth, fueled by government support for cleaner cooking fuels and increased consumer awareness. The 2025 market value is predicted to be $xx Million, with high projected growth rates over the forecast period.

Others: This includes specialized fuels and related products. This segment is comparatively smaller.

Key Drivers of West Africa Refined Petroleum Products Industry Growth

The growth of the West African refined petroleum products industry is propelled by several key factors: rapid population growth and urbanization driving increased energy demand; economic development and industrialization boosting energy consumption across various sectors; expansion of the transportation sector and rising vehicle ownership; and government investments in infrastructure and energy projects. The planned Dangote refinery and the BUA Group's petrochemical plant represent substantial investment driving increased capacity. These factors collectively contribute to a substantial and consistent market expansion.

Challenges in the West Africa Refined Petroleum Products Industry Sector

The West African refined petroleum products industry faces several challenges: inadequate refining capacity leading to reliance on imports; fluctuating crude oil prices impacting profitability and market stability; limited infrastructure and logistics bottlenecks hindering efficient distribution; and the environmental concerns associated with fossil fuels, leading to regulatory pressures and the need for cleaner energy transition initiatives. These challenges, if unaddressed, can significantly impact market growth and investment.

Leading Players in the West Africa Refined Petroleum Products Industry Market

- Octogone International Gas & Oil Ltd

- Oryx Energies SA

- Oando PLC

- Mercuria Energy Trading SA

- Monjasa Holding AS

- Vitol Holdings BV

- Puma Energy Holdings Pte Ltd

- Sahara Group Limited

- Trafigura Group Pte Ltd

- FuelSupply Co

Key Developments in West Africa Refined Petroleum Products Industry Sector

November 2021: Dangote Group announces the commissioning of its 650,000 b/d refinery in Lagos, Nigeria – set to be Africa's largest. NNPC to acquire a 20% stake. This development significantly boosts refining capacity and reduces import reliance.

2020: BUA Group contracts Axens Group to provide technology for a 200,000 b/d integrated refinery and petrochemical plant in Akwa Ibom, Nigeria. This project further enhances the region's refining capacity and diversifies the industry.

Strategic West Africa Refined Petroleum Products Industry Market Outlook

The West African refined petroleum products market presents significant growth opportunities driven by sustained economic development, increasing energy demand, and substantial investments in refining capacity. Strategic partnerships, technological innovation focused on cleaner fuels, and efficient supply chain management will be crucial for success. The sector's trajectory points towards sustained growth, although navigating the challenges related to infrastructure, price volatility, and environmental concerns will be vital for players to capitalize on the market's vast potential.

West Africa Refined Petroleum Products Industry Segmentation

-

1. Type

- 1.1. Automotive Fuels

- 1.2. Marine Fuels

- 1.3. Aviation Fuels

- 1.4. Liquefied Petroleum Gas(LPG)

- 1.5. Others

-

2. Geography

- 2.1. Nigeria

- 2.2. Ghana

- 2.3. Senegal

- 2.4. Others

West Africa Refined Petroleum Products Industry Segmentation By Geography

- 1. Nigeria

- 2. Ghana

- 3. Senegal

- 4. Others

West Africa Refined Petroleum Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Automotive fuels Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automotive Fuels

- 5.1.2. Marine Fuels

- 5.1.3. Aviation Fuels

- 5.1.4. Liquefied Petroleum Gas(LPG)

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ghana

- 5.2.3. Senegal

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ghana

- 5.3.3. Senegal

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Nigeria West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automotive Fuels

- 6.1.2. Marine Fuels

- 6.1.3. Aviation Fuels

- 6.1.4. Liquefied Petroleum Gas(LPG)

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ghana

- 6.2.3. Senegal

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Ghana West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automotive Fuels

- 7.1.2. Marine Fuels

- 7.1.3. Aviation Fuels

- 7.1.4. Liquefied Petroleum Gas(LPG)

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ghana

- 7.2.3. Senegal

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Senegal West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automotive Fuels

- 8.1.2. Marine Fuels

- 8.1.3. Aviation Fuels

- 8.1.4. Liquefied Petroleum Gas(LPG)

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ghana

- 8.2.3. Senegal

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Others West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automotive Fuels

- 9.1.2. Marine Fuels

- 9.1.3. Aviation Fuels

- 9.1.4. Liquefied Petroleum Gas(LPG)

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ghana

- 9.2.3. Senegal

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Octogone International Gas & Oil Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Oryx Energies SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Oando PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mercuria Energy Trading SA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Monjasa Holding AS

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Vitol Holdings BV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Puma Energy Holdings Pte Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sahara Group Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Trafigura Group Pte Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 FuelSupply Co

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Octogone International Gas & Oil Ltd

List of Figures

- Figure 1: West Africa Refined Petroleum Products Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: West Africa Refined Petroleum Products Industry Share (%) by Company 2024

List of Tables

- Table 1: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Region 2019 & 2032

- Table 3: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 5: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 7: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Region 2019 & 2032

- Table 9: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 11: South Africa West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 13: Sudan West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 15: Uganda West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 17: Tanzania West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 19: Kenya West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 23: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 25: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 27: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 29: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 31: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 33: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 35: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 37: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 39: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 41: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 43: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 45: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Refined Petroleum Products Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the West Africa Refined Petroleum Products Industry?

Key companies in the market include Octogone International Gas & Oil Ltd, Oryx Energies SA, Oando PLC, Mercuria Energy Trading SA, Monjasa Holding AS, Vitol Holdings BV, Puma Energy Holdings Pte Ltd, Sahara Group Limited, Trafigura Group Pte Ltd, FuelSupply Co.

3. What are the main segments of the West Africa Refined Petroleum Products Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand.

6. What are the notable trends driving market growth?

Automotive fuels Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, the Dangote group announced that they are likely to commission Dangote refinery in early 2022. The 650,000 b/d refinery is located in Lagos, Nigeria, and is believed to be Africa's largest upcoming integrated refinery, and the world's biggest single train facility. The state-owned company NNPC is expected to acquire 20% stake in the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Refined Petroleum Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Refined Petroleum Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Refined Petroleum Products Industry?

To stay informed about further developments, trends, and reports in the West Africa Refined Petroleum Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence