Key Insights

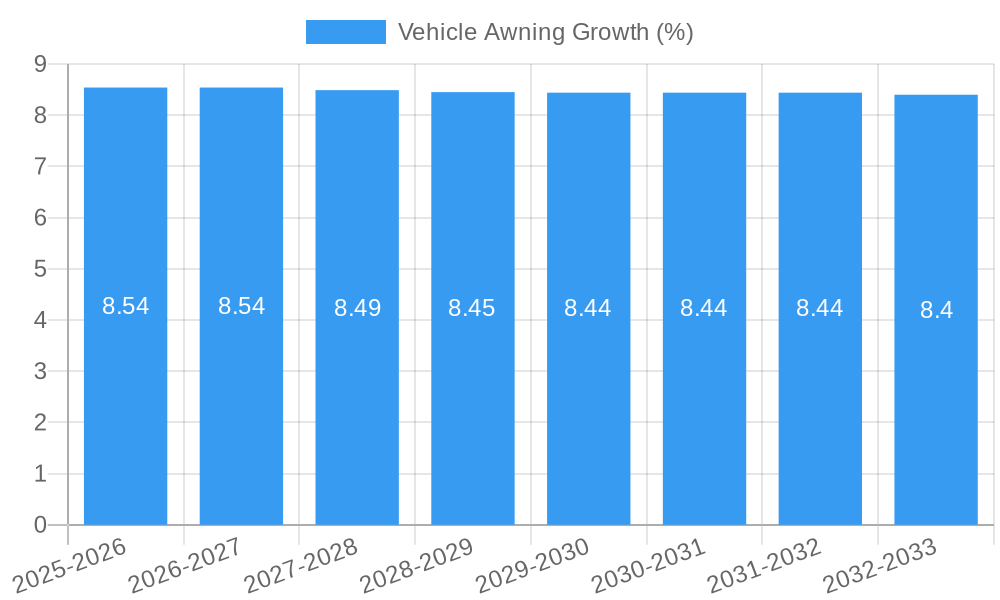

The global vehicle awning market is poised for substantial growth, projected to reach an estimated $550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% expected to carry it through 2033. This expansion is primarily fueled by the burgeoning popularity of outdoor recreation, adventure travel, and the increasing adoption of overlanding and camping as lifestyle choices. As more individuals seek to escape urban confines and connect with nature, the demand for portable and convenient shade solutions for their vehicles rises. Key market drivers include the growing trend of vehicle customization, with enthusiasts investing in accessories that enhance both functionality and aesthetics for their off-road and camping adventures. Furthermore, advancements in materials science, leading to lighter, more durable, and weather-resistant awning designs, are contributing to their wider appeal and adoption. The market is segmented by application, with Online Sales expected to witness significant growth due to the convenience and broader reach offered by e-commerce platforms, alongside Offline Sales through specialized automotive and outdoor equipment retailers. Types of awnings, including the versatile Pull-Out Awning, the more expansive 270º Awning, and the streamlined 180º Awning, cater to diverse user needs and vehicle types.

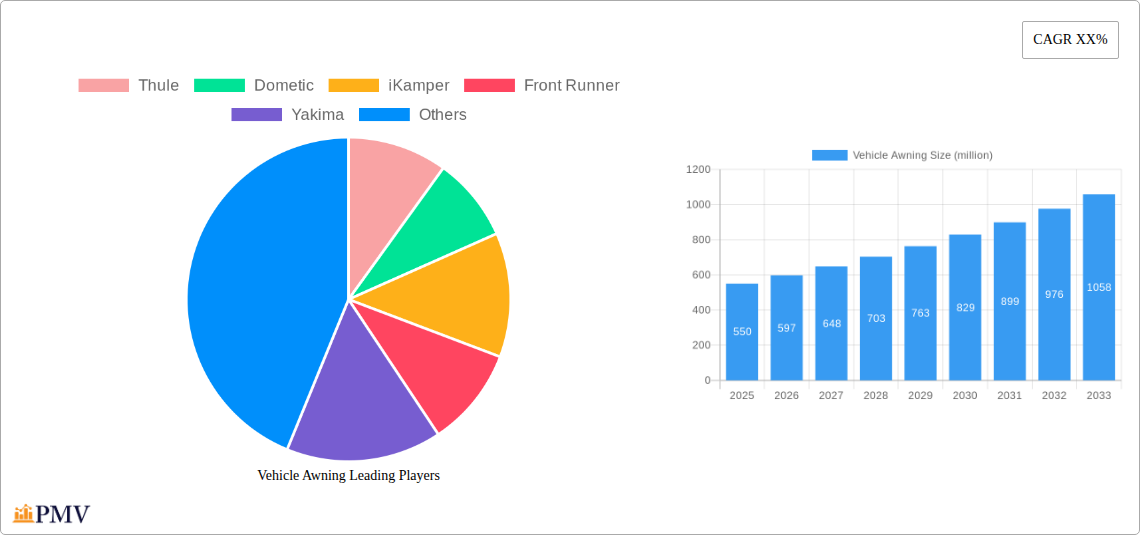

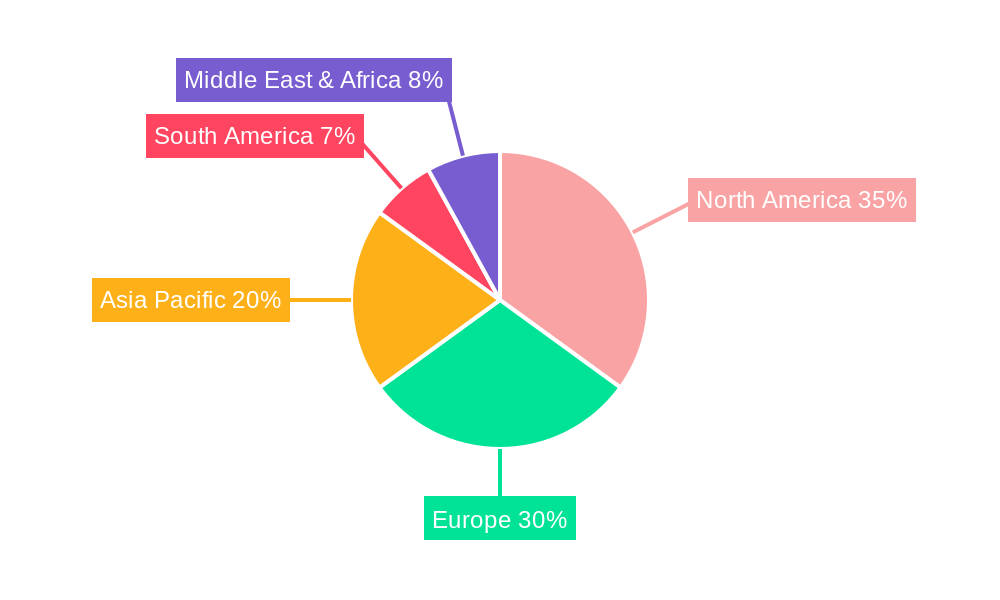

Despite the optimistic outlook, certain restraints could temper growth. The initial cost of high-quality vehicle awnings can be a barrier for some consumers, particularly those new to outdoor activities. Additionally, the need for proper installation and maintenance, which can sometimes require specialized tools or knowledge, might deter a segment of the market. However, the industry is actively addressing these challenges through product innovation, offering more user-friendly installation guides and maintenance tips. Emerging trends also point towards the integration of smart features, such as built-in LED lighting and even solar power capabilities, further enhancing the utility and appeal of vehicle awnings. Geographically, North America and Europe are expected to lead the market, driven by a well-established culture of outdoor exploration and a high disposable income. The Asia Pacific region presents significant untapped potential, with rising interest in adventure tourism and increasing vehicle ownership driving future growth. Companies like Thule, Dometic, and iKamper are at the forefront, innovating and expanding their product portfolios to capture this growing market.

Comprehensive Vehicle Awning Market Analysis: Trends, Opportunities, and Competitive Landscape (2019-2033)

This in-depth report provides a granular analysis of the global vehicle awning market, covering a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033. It examines the vehicle awning market size, growth trajectory, and key industry developments. Our research delves into leading companies like Thule, Dometic, iKamper, Front Runner, Yakima, DARCHE, ARB, Rhino-Rack, Alu-Cab, Fiamma, James Baroud, TentBox, and Segments across Application: Online Sales, Offline Sales and Types: Pull-Out Awning, 180º Awning, 270º Awning. Discover market drivers, challenges, and innovations shaping this dynamic sector, offering actionable insights for automotive aftermarket manufacturers, outdoor recreation suppliers, and investment firms.

Vehicle Awning Market Structure & Competitive Dynamics

The global vehicle awning market exhibits a moderately concentrated structure, with established players like Thule and Dometic holding significant market share. Innovation ecosystems are robust, driven by advancements in materials, designs, and ease of deployment, fostering continuous product development. Regulatory frameworks, primarily concerning vehicle accessory standards and outdoor equipment safety, are generally supportive, though regional variations exist. Product substitutes, such as portable shelters and canopies, present a minor competitive threat. End-user trends indicate a strong preference for durable, lightweight, and easy-to-install vehicle awnings, particularly among the growing demographic of adventure travelers and overlanders. Merger and acquisition (M&A) activities are strategic, focusing on expanding product portfolios, gaining market access, and acquiring innovative technologies. For instance, recent M&A deals have been valued in the tens of millions, aimed at consolidating market presence and increasing revenue streams, contributing to an overall market value projected to reach over $XX million by 2025.

- Market Concentration: Moderate, with key players dominating specific niches.

- Innovation Ecosystems: Driven by material science, design optimization, and smart integration.

- Regulatory Frameworks: Supportive, with adherence to automotive accessory and outdoor equipment standards.

- Product Substitutes: Limited impact from portable shelters and basic canopies.

- End-User Trends: High demand for ease of use, durability, and integrated features.

- M&A Activities: Strategic focus on portfolio expansion and technological acquisition, with deal values in the tens of millions.

Vehicle Awning Industry Trends & Insights

The vehicle awning industry is experiencing significant growth, propelled by an increasing Compound Annual Growth Rate (CAGR) estimated at XX% for the forecast period. This expansion is fueled by a confluence of factors, including the burgeoning adventure travel and overlanding trends, which have seen a substantial surge in participation. Consumers are increasingly seeking integrated solutions for their outdoor excursions, and vehicle awnings offer a convenient and reliable extension of their living space. Technological disruptions are also playing a pivotal role, with advancements in lightweight yet robust materials like ripstop polyester and aluminum alloys leading to more durable and portable awning designs. Furthermore, the integration of smart features, such as integrated LED lighting and weather-resistant fabrics with UV protection, is enhancing product appeal and driving consumer demand.

The rise of online sales channels has democratized access to vehicle awnings, allowing a wider consumer base to explore and purchase products from a vast array of brands, including specialized manufacturers and smaller niche players. This shift has also fostered greater price transparency and competitive pricing strategies. Conversely, offline sales through automotive accessory stores, outdoor recreation retailers, and specialized 4x4 fitment centers remain crucial for hands-on product experience and expert advice, contributing to XX% of total sales.

Consumer preferences are evolving towards versatile and adaptable awning systems, such as the increasingly popular 270º awnings that provide extensive coverage, and 180º awnings for more compact setups. The demand for pull-out awnings remains strong due to their simplicity and quick deployment. Market penetration is deepening across developed economies, while emerging markets show significant untapped potential. The competitive landscape is characterized by both established brands and innovative startups, leading to a dynamic environment of product differentiation and strategic partnerships. The market penetration is estimated to be over XX% in North America and Europe, with significant growth opportunities in Asia-Pacific and Latin America.

Dominant Markets & Segments in Vehicle Awning

The North American region currently dominates the global vehicle awning market, driven by a robust outdoor recreation culture and a high prevalence of SUVs, trucks, and vans equipped for adventure travel. The United States, in particular, contributes significantly to this dominance due to its vast national parks, extensive road networks, and a strong consumer base for camping and off-road activities. Economic policies that support outdoor tourism and infrastructure development, such as improved national park access and support for overland travel, further bolster this regional leadership.

Within market segments, Online Sales are rapidly gaining traction and are projected to become the leading application channel by the end of the forecast period. This growth is attributed to the convenience, wider selection, and competitive pricing offered by e-commerce platforms, catering to a digitally savvy consumer base. Key drivers for the online segment include:

- E-commerce Penetration: Increasing internet access and smartphone usage globally.

- Digital Marketing Strategies: Targeted advertising and social media engagement by manufacturers.

- Customer Reviews and Ratings: Building trust and influencing purchasing decisions.

- Direct-to-Consumer (DTC) Models: Allowing brands to connect directly with their customer base.

In terms of product types, 270º Awnings are experiencing the most significant growth and are poised to capture a substantial market share. Their comprehensive coverage and adaptability for various camping scenarios make them highly desirable for serious overland enthusiasts. The key drivers for 270º awning dominance include:

- Enhanced Living Space: Providing a large sheltered area for cooking, dining, and relaxation.

- Weather Protection: Superior coverage against sun, rain, and wind.

- Versatility: Suitable for a wide range of vehicle types and camping setups.

- Technological Advancements: Lighter materials and improved deployment mechanisms.

While 270º awnings lead in growth, Pull-Out Awnings maintain a strong presence due to their simplicity, affordability, and ease of use, making them an excellent entry-level option. 180º Awnings cater to users seeking a balance between coverage and a more compact footprint, particularly those with smaller vehicles or limited roof space. The overall market size for vehicle awnings is estimated to reach over $XX million by 2025, with online sales and 270º awnings representing the most dynamic growth areas.

Vehicle Awning Product Innovations

Recent product innovations in the vehicle awning market are focused on enhancing user experience and expanding functionality. Key developments include the introduction of lighter yet more durable materials, such as advanced ripstop fabrics and reinforced aluminum frames, reducing overall weight for easier deployment and better fuel efficiency. Innovations in integrated LED lighting systems are providing ambient and functional lighting directly within the awning structure, eliminating the need for separate lighting solutions. Furthermore, many manufacturers are incorporating modular designs, allowing users to attach accessories like mosquito nets, walls, and annexes to create enclosed living spaces, thereby increasing the versatility of their vehicle awnings. These advancements offer significant competitive advantages by addressing consumer demand for convenience, comfort, and adaptability in outdoor adventures.

Report Segmentation & Scope

This report meticulously segments the vehicle awning market across key parameters to provide a comprehensive understanding of its dynamics. The segmentation is categorized by Application, encompassing Online Sales and Offline Sales, and by Type, including Pull-Out Awning, 180º Awning, and 270º Awning.

Online Sales are projected to grow at a substantial CAGR of XX% during the forecast period, driven by the increasing reach of e-commerce platforms and targeted digital marketing efforts. The market size for online sales is estimated to reach over $XX million by 2025, with key players increasingly focusing on their DTC strategies.

Offline Sales will continue to be a significant channel, particularly through specialized automotive accessory stores and outdoor recreation retailers. This segment is expected to grow at a CAGR of XX%, with a market size of approximately $XX million by 2025.

The Pull-Out Awning segment, valued at over $XX million by 2025, offers a steady growth trajectory with a CAGR of XX%. Its popularity stems from its ease of use and affordability, making it a staple for many outdoor enthusiasts.

The 180º Awning segment, estimated at over $XX million by 2025, is expected to witness a CAGR of XX%, catering to users who require a balance between coverage and a more compact footprint.

The 270º Awning segment is the fastest-growing, with an impressive CAGR of XX% and a projected market size of over $XX million by 2025. Its superior coverage and versatility are key drivers for this segment's expansion.

Key Drivers of Vehicle Awning Growth

The vehicle awning market is propelled by several critical growth drivers. The burgeoning adventure travel and overlanding lifestyle is a primary catalyst, with an increasing number of consumers investing in gear that enhances their outdoor experiences. This trend is supported by rising disposable incomes and a greater emphasis on work-life balance, encouraging more people to engage in activities like camping, hiking, and off-road exploration. Technological advancements in materials science have led to the development of lighter, more durable, and weather-resistant awnings, improving product performance and appeal. Furthermore, the expansion of e-commerce platforms has made vehicle awnings more accessible to a wider consumer base, driving sales and market penetration. Government initiatives promoting tourism and outdoor recreation in various regions also contribute to market expansion by fostering the necessary infrastructure and encouraging public engagement.

Challenges in the Vehicle Awning Sector

Despite the positive growth trajectory, the vehicle awning sector faces several challenges. High manufacturing costs, particularly for premium and feature-rich awnings, can be a deterrent for budget-conscious consumers, impacting mass adoption. Intense competition from both established brands and new entrants leads to price pressures and necessitates continuous innovation to maintain market share. Supply chain disruptions, exacerbated by global events, can impact raw material availability and lead times, affecting production and delivery. Consumer awareness and education regarding the benefits and proper usage of different awning types are also crucial, as some consumers may be hesitant due to perceived complexity or cost. Regulatory hurdles related to vehicle accessory fitting and product safety standards in certain regions can also pose challenges for market entry and expansion.

Leading Players in the Vehicle Awning Market

- Thule

- Dometic

- iKamper

- Front Runner

- Yakima

- DARCHE

- ARB

- Rhino-Rack

- Alu-Cab

- Fiamma

- James Baroud

- TentBox

Key Developments in Vehicle Awning Sector

- 2023: Thule launches its new generation of lightweight and aerodynamic vehicle awnings, focusing on ease of deployment and improved durability, contributing to XX% of their awning sales.

- 2023: Dometic introduces smart-connected awning features, including integrated LED lighting and app-controlled deployment, enhancing user convenience.

- 2024: iKamper releases its new "Skycamp 3.0" rooftop tent with an integrated awning system, expanding its product ecosystem and attracting a wider customer base.

- 2024: Front Runner expands its range of 270º awnings with new mounting solutions for a broader variety of vehicles, catering to the growing overland market.

- 2024: Yakima enhances its popular awning lineup with improved weather resistance and a focus on modularity, allowing for the addition of annexes and walls.

- 2024: ARB introduces a new heavy-duty 270º awning designed for extreme off-road conditions, further solidifying its position in the premium segment.

- 2025: Rhino-Rack unveils a completely redesigned pull-out awning with a focus on speed and simplicity, aiming to capture a larger share of the entry-level market.

- 2025: Alu-Cab patents a new retractable awning system with enhanced wind resistance and a more compact storage solution.

- 2025: Fiamma launches an updated line of awnings for campervans and motorhomes, featuring improved aesthetics and enhanced functionality.

- 2025: James Baroud introduces an integrated solar panel option for its awnings, providing off-grid power capabilities.

- 2025: TentBox unveils a new compact 180º awning designed specifically for smaller SUVs and crossovers.

- 2025: DARCHE launches a limited-edition range of awnings with enhanced UV protection and extended warranties, targeting the premium segment.

Strategic Vehicle Awning Market Outlook

The strategic outlook for the vehicle awning market remains exceptionally strong, driven by the enduring appeal of outdoor adventure and the continuous evolution of product offerings. The expansion of overland travel and van life culture presents a significant growth accelerator, encouraging consumers to invest in durable and versatile vehicle accessories. The increasing adoption of online sales channels will continue to democratize access, while technological innovations in materials, smart features, and modular designs will further enhance product value and consumer satisfaction. Emerging markets in Asia-Pacific and Latin America offer substantial untapped potential for market penetration, requiring tailored marketing strategies and product offerings. Strategic opportunities lie in the development of integrated vehicle accessory systems, partnerships with automotive manufacturers, and a continued focus on sustainability and lightweight design to meet evolving consumer expectations and regulatory trends.

Vehicle Awning Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Pull-Out Awning

- 2.2. 180º Awning

- 2.3. 270º Awning

Vehicle Awning Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vehicle Awning REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pull-Out Awning

- 5.2.2. 180º Awning

- 5.2.3. 270º Awning

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pull-Out Awning

- 6.2.2. 180º Awning

- 6.2.3. 270º Awning

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pull-Out Awning

- 7.2.2. 180º Awning

- 7.2.3. 270º Awning

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pull-Out Awning

- 8.2.2. 180º Awning

- 8.2.3. 270º Awning

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pull-Out Awning

- 9.2.2. 180º Awning

- 9.2.3. 270º Awning

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vehicle Awning Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pull-Out Awning

- 10.2.2. 180º Awning

- 10.2.3. 270º Awning

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thule

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dometic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 iKamper

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Front Runner

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yakima

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DARCHE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ARB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rhino-Rack

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alu-Cab

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fiamma

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 James Baroud

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TentBox

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Thule

List of Figures

- Figure 1: Global Vehicle Awning Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Vehicle Awning Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Vehicle Awning Revenue (million), by Application 2024 & 2032

- Figure 4: North America Vehicle Awning Volume (K), by Application 2024 & 2032

- Figure 5: North America Vehicle Awning Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Vehicle Awning Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Vehicle Awning Revenue (million), by Types 2024 & 2032

- Figure 8: North America Vehicle Awning Volume (K), by Types 2024 & 2032

- Figure 9: North America Vehicle Awning Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Vehicle Awning Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Vehicle Awning Revenue (million), by Country 2024 & 2032

- Figure 12: North America Vehicle Awning Volume (K), by Country 2024 & 2032

- Figure 13: North America Vehicle Awning Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Vehicle Awning Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Vehicle Awning Revenue (million), by Application 2024 & 2032

- Figure 16: South America Vehicle Awning Volume (K), by Application 2024 & 2032

- Figure 17: South America Vehicle Awning Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Vehicle Awning Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Vehicle Awning Revenue (million), by Types 2024 & 2032

- Figure 20: South America Vehicle Awning Volume (K), by Types 2024 & 2032

- Figure 21: South America Vehicle Awning Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Vehicle Awning Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Vehicle Awning Revenue (million), by Country 2024 & 2032

- Figure 24: South America Vehicle Awning Volume (K), by Country 2024 & 2032

- Figure 25: South America Vehicle Awning Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Vehicle Awning Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Vehicle Awning Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Vehicle Awning Volume (K), by Application 2024 & 2032

- Figure 29: Europe Vehicle Awning Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Vehicle Awning Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Vehicle Awning Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Vehicle Awning Volume (K), by Types 2024 & 2032

- Figure 33: Europe Vehicle Awning Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Vehicle Awning Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Vehicle Awning Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Vehicle Awning Volume (K), by Country 2024 & 2032

- Figure 37: Europe Vehicle Awning Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Vehicle Awning Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Vehicle Awning Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Vehicle Awning Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Vehicle Awning Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Vehicle Awning Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Vehicle Awning Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Vehicle Awning Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Vehicle Awning Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Vehicle Awning Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Vehicle Awning Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Vehicle Awning Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Vehicle Awning Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Vehicle Awning Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Vehicle Awning Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Vehicle Awning Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Vehicle Awning Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Vehicle Awning Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Vehicle Awning Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Vehicle Awning Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Vehicle Awning Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Vehicle Awning Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Vehicle Awning Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Vehicle Awning Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Vehicle Awning Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Vehicle Awning Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vehicle Awning Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vehicle Awning Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Vehicle Awning Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Vehicle Awning Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Vehicle Awning Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Vehicle Awning Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Vehicle Awning Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Vehicle Awning Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Vehicle Awning Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Vehicle Awning Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Vehicle Awning Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Vehicle Awning Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Vehicle Awning Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Vehicle Awning Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Vehicle Awning Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Vehicle Awning Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Vehicle Awning Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Vehicle Awning Volume K Forecast, by Country 2019 & 2032

- Table 81: China Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Vehicle Awning Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Vehicle Awning Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Awning?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Vehicle Awning?

Key companies in the market include Thule, Dometic, iKamper, Front Runner, Yakima, DARCHE, ARB, Rhino-Rack, Alu-Cab, Fiamma, James Baroud, TentBox.

3. What are the main segments of the Vehicle Awning?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Awning," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Awning report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Awning?

To stay informed about further developments, trends, and reports in the Vehicle Awning, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence