Key Insights

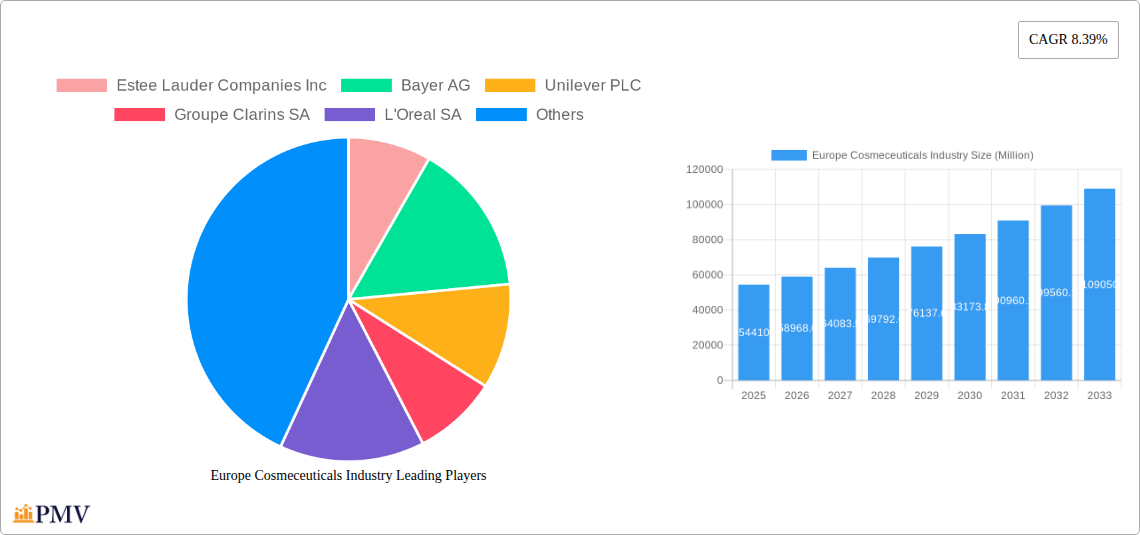

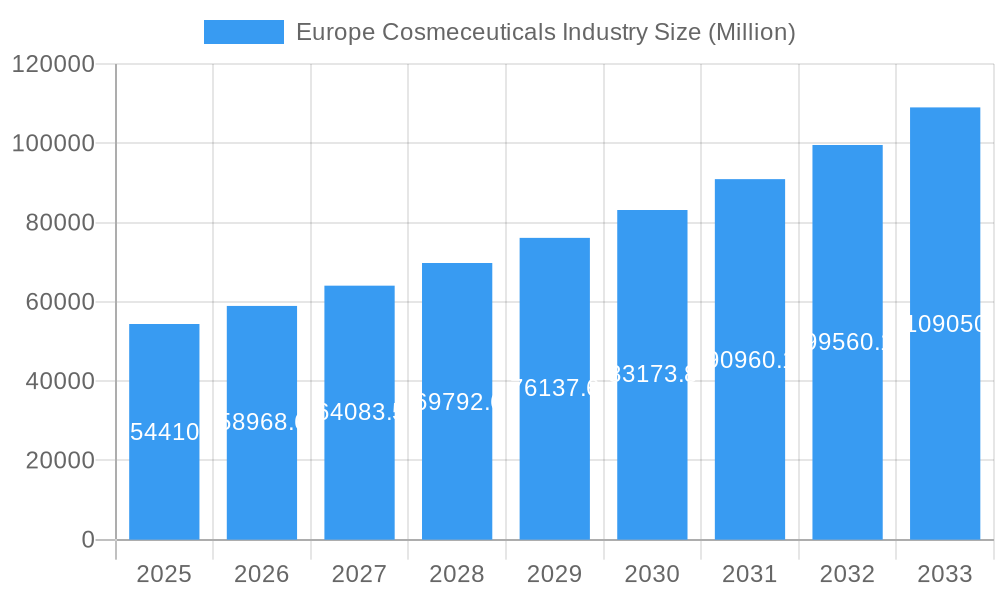

The European cosmeceuticals market, valued at €54.41 billion in 2025, is projected to experience robust growth, driven by a rising consumer awareness of skincare benefits beyond cosmetics and increasing disposable incomes. The market's Compound Annual Growth Rate (CAGR) of 8.39% from 2025 to 2033 indicates significant expansion potential. Key drivers include the surging demand for anti-aging products, heightened consumer interest in natural and organic ingredients, and the proliferation of online retail channels offering convenient access to a wider range of cosmeceuticals. Growth is further fueled by technological advancements leading to the development of innovative formulations with enhanced efficacy and targeted benefits. Market segmentation reveals strong performance across product categories, with skincare dominating, followed by hair care and oral care. Supermarkets/hypermarkets and online retail stores represent the leading distribution channels, reflecting evolving consumer purchasing habits. Leading players like L'Oréal, Estée Lauder, and Unilever are actively shaping the market through product innovation, strategic acquisitions, and aggressive marketing campaigns. However, potential restraints include stringent regulations governing cosmeceutical product claims and ingredient sourcing, as well as price sensitivity among certain consumer segments. The strong growth trajectory is anticipated to continue, driven by the aforementioned factors, with substantial growth potential in emerging markets within Europe.

Europe Cosmeceuticals Industry Market Size (In Billion)

The competitive landscape is characterized by both established multinational corporations and smaller, specialized brands. The presence of these diverse players fosters innovation and caters to a broad spectrum of consumer needs and preferences. Growth within specific European regions will vary, with countries like Germany, France, and the UK likely maintaining leading positions due to established consumer bases and strong retail infrastructure. The market is expected to see further consolidation as larger players seek to expand their market share through mergers and acquisitions, while smaller niche brands focus on differentiating themselves through unique product offerings and targeted marketing. This dynamic market presents numerous opportunities for growth and innovation, particularly for businesses focusing on sustainable and ethically sourced ingredients and those leveraging digital marketing strategies to reach a wider audience.

Europe Cosmeceuticals Industry Company Market Share

Europe Cosmeceuticals Industry: Market Analysis & Growth Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe cosmeceuticals industry, offering invaluable insights for businesses, investors, and stakeholders. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The report values are expressed in Millions. The analysis incorporates detailed segmentation by product type (skincare, haircare, oral care, other care) and distribution channel (supermarket/hypermarkets, convenience/grocery stores, online retail stores, specialty stores, other channels). Key players like Estee Lauder Companies Inc, Bayer AG, Unilever PLC, Groupe Clarins SA, L'Oreal SA, ORIFLAME COSMETICS GLOBAL SA, Johnson & Johnson Inc, Shiseido Co Ltd, Coty Inc, Procter & Gamble Company, and Beiersdorf AG are profiled, though the list is not exhaustive.

Europe Cosmeceuticals Industry Market Structure & Competitive Dynamics

The European cosmeceuticals market is characterized by a moderately concentrated structure with several multinational corporations holding significant market share. The industry exhibits a dynamic innovation ecosystem driven by ongoing research and development in active ingredients, delivery systems, and sustainable packaging. Stringent regulatory frameworks, including those related to ingredient safety and labeling, significantly influence market dynamics. The presence of substitute products, particularly natural and organic alternatives, poses competitive pressure. Consumer trends towards personalized skincare, clean beauty, and ethical sourcing are shaping product development and marketing strategies. M&A activity has been notable, with deals valuing xx Million shaping the competitive landscape and driving market consolidation. For example, the acquisition of Tula by Procter & Gamble demonstrates the strategic interest in the premium, clean skincare segment. Further analysis will show that the market share is dominated by a few key players while smaller niche players focus on innovation and specific consumer needs.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2024.

- M&A Activity: Significant activity observed in the past five years, with deal values totaling xx Million.

- Innovation Ecosystem: High investment in R&D, focusing on sustainable and technologically advanced products.

- Regulatory Landscape: Stringent regulations regarding ingredient safety and labeling.

- End-User Trends: Growing demand for personalized, clean, and ethically sourced cosmeceuticals.

Europe Cosmeceuticals Industry Industry Trends & Insights

The European cosmeceuticals market demonstrates robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. This growth is fueled by increasing consumer awareness of skincare benefits, rising disposable incomes, and the expanding online retail channel. Technological disruptions, particularly in personalized skincare and advanced delivery systems, are driving innovation and product differentiation. Consumer preferences are shifting towards clean beauty, sustainability, and products with clinically proven efficacy. Competitive dynamics are intensifying, with established players facing pressure from emerging brands and niche players focusing on specific consumer needs. Market penetration of cosmeceuticals is gradually increasing, with penetration in the skincare segment predicted to reach xx% by 2033. The market is also witnessing increasing popularity of customized and personalized skincare products, boosting industry growth.

Dominant Markets & Segments in Europe Cosmeceuticals Industry

The skincare segment is the most dominant in the European cosmeceuticals market, accounting for xx% of the total market value in 2024, driven by high consumer awareness and diverse product offerings. Online retail stores represent the fastest-growing distribution channel, exhibiting a CAGR of xx% during the forecast period. Germany and France are the leading national markets due to strong consumer demand and established retail infrastructure.

- Leading Region: Western Europe

- Leading Country: Germany, followed by France and UK

- Dominant Product Type: Skincare

- Fastest-Growing Distribution Channel: Online retail stores

Key Drivers for Dominant Segments:

- Skincare: Growing awareness of skin health and anti-aging benefits.

- Online Retail: Convenience, wider product selection, targeted marketing.

- Germany & France: High disposable incomes, strong consumer interest in beauty and personal care.

Europe Cosmeceuticals Industry Product Innovations

Recent innovations focus on sustainable and technologically advanced products. Beiersdorf's introduction of the world's first skincare product with recycled carbon showcases commitment to sustainability. Shiseido's launch of its new prestige skincare line, "Ulé," highlights the ongoing focus on premium and personalized skincare experiences within the market. The integration of AI and personalized consultations is also predicted to be a dominant technology in the coming years. These innovations are designed to meet the growing consumer demand for effective, ethical, and sustainable cosmeceutical products.

Report Segmentation & Scope

This report segments the European cosmeceuticals market by product type (skincare, haircare, oral care, other care) and distribution channel (supermarket/hypermarkets, convenience/grocery stores, online retail stores, specialty stores, other channels). Each segment is analyzed with respect to market size, growth projections, and competitive dynamics. Skincare is the largest segment and projects strong growth driven by innovations in active ingredients and delivery systems. Online retail is anticipated to be the fastest-growing distribution channel due to the convenience and reach afforded to consumers and producers alike. Each segment will be given further detailed analysis within the full report.

Key Drivers of Europe Cosmeceuticals Industry Growth

Several factors drive the growth of the European cosmeceuticals market:

- Rising disposable incomes: Increased spending power fuels demand for premium products.

- Growing consumer awareness: Increased knowledge of skin health and anti-aging benefits.

- Technological advancements: Innovations in active ingredients and delivery systems.

- Expansion of online retail: Growing accessibility and convenience for consumers.

- Stringent regulatory frameworks: Drive quality and safety standards, building consumer trust.

Challenges in the Europe Cosmeceuticals Industry Sector

The European cosmeceuticals industry faces challenges such as:

- Intense competition: Existing large players face competition from both new entrants and more affordable options.

- Regulatory hurdles: Compliance with stringent regulations is costly and complex.

- Fluctuating raw material costs: Impacts profitability and pricing strategies.

- Supply chain disruptions: Can affect product availability and lead times.

- Economic downturns: Consumer spending on non-essential items may reduce in difficult economic climates.

Leading Players in the Europe Cosmeceuticals Industry Market

Key Developments in Europe Cosmeceuticals Industry Sector

- January 2022: Procter & Gamble acquired Tula, a clean skincare brand.

- April 2022: Beiersdorf launched the world's first skincare product with recycled carbon.

- May 2022: Shiseido launched its new prestige skincare line, "Ulé," in France.

Strategic Europe Cosmeceuticals Industry Market Outlook

The European cosmeceuticals market presents significant growth potential, driven by increasing consumer demand for innovative, sustainable, and personalized products. Strategic opportunities lie in developing technologically advanced formulations, leveraging the expansion of the online retail channel, and catering to the growing consumer focus on ethical and sustainable practices. Further growth is expected with investments in personalized skincare technologies and the increasing emphasis on clean, green beauty.

Europe Cosmeceuticals Industry Segmentation

-

1. Product Type

-

1.1. Skin Care

- 1.1.1. Facial Cleansers

- 1.1.2. Moisturizer and Creams

- 1.1.3. Sun Protection

- 1.1.4. Toners

- 1.1.5. Other Skin Care Product Types

-

1.2. Hair Care

- 1.2.1. Shampoos and Conditioners

- 1.2.2. Hair Colorants and Dyes

- 1.2.3. Other Hair Care Product Types

- 1.3. Lip Care

- 1.4. Oral Care

-

1.1. Skin Care

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Specialty Stores

- 2.5. Other Distribution Channels

Europe Cosmeceuticals Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Cosmeceuticals Industry Regional Market Share

Geographic Coverage of Europe Cosmeceuticals Industry

Europe Cosmeceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Increasing aging population driving the market for anti ageing products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skin Care

- 5.1.1.1. Facial Cleansers

- 5.1.1.2. Moisturizer and Creams

- 5.1.1.3. Sun Protection

- 5.1.1.4. Toners

- 5.1.1.5. Other Skin Care Product Types

- 5.1.2. Hair Care

- 5.1.2.1. Shampoos and Conditioners

- 5.1.2.2. Hair Colorants and Dyes

- 5.1.2.3. Other Hair Care Product Types

- 5.1.3. Lip Care

- 5.1.4. Oral Care

- 5.1.1. Skin Care

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Specialty Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Skin Care

- 6.1.1.1. Facial Cleansers

- 6.1.1.2. Moisturizer and Creams

- 6.1.1.3. Sun Protection

- 6.1.1.4. Toners

- 6.1.1.5. Other Skin Care Product Types

- 6.1.2. Hair Care

- 6.1.2.1. Shampoos and Conditioners

- 6.1.2.2. Hair Colorants and Dyes

- 6.1.2.3. Other Hair Care Product Types

- 6.1.3. Lip Care

- 6.1.4. Oral Care

- 6.1.1. Skin Care

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Specialty Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Skin Care

- 7.1.1.1. Facial Cleansers

- 7.1.1.2. Moisturizer and Creams

- 7.1.1.3. Sun Protection

- 7.1.1.4. Toners

- 7.1.1.5. Other Skin Care Product Types

- 7.1.2. Hair Care

- 7.1.2.1. Shampoos and Conditioners

- 7.1.2.2. Hair Colorants and Dyes

- 7.1.2.3. Other Hair Care Product Types

- 7.1.3. Lip Care

- 7.1.4. Oral Care

- 7.1.1. Skin Care

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Specialty Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Skin Care

- 8.1.1.1. Facial Cleansers

- 8.1.1.2. Moisturizer and Creams

- 8.1.1.3. Sun Protection

- 8.1.1.4. Toners

- 8.1.1.5. Other Skin Care Product Types

- 8.1.2. Hair Care

- 8.1.2.1. Shampoos and Conditioners

- 8.1.2.2. Hair Colorants and Dyes

- 8.1.2.3. Other Hair Care Product Types

- 8.1.3. Lip Care

- 8.1.4. Oral Care

- 8.1.1. Skin Care

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Specialty Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Skin Care

- 9.1.1.1. Facial Cleansers

- 9.1.1.2. Moisturizer and Creams

- 9.1.1.3. Sun Protection

- 9.1.1.4. Toners

- 9.1.1.5. Other Skin Care Product Types

- 9.1.2. Hair Care

- 9.1.2.1. Shampoos and Conditioners

- 9.1.2.2. Hair Colorants and Dyes

- 9.1.2.3. Other Hair Care Product Types

- 9.1.3. Lip Care

- 9.1.4. Oral Care

- 9.1.1. Skin Care

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Specialty Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Skin Care

- 10.1.1.1. Facial Cleansers

- 10.1.1.2. Moisturizer and Creams

- 10.1.1.3. Sun Protection

- 10.1.1.4. Toners

- 10.1.1.5. Other Skin Care Product Types

- 10.1.2. Hair Care

- 10.1.2.1. Shampoos and Conditioners

- 10.1.2.2. Hair Colorants and Dyes

- 10.1.2.3. Other Hair Care Product Types

- 10.1.3. Lip Care

- 10.1.4. Oral Care

- 10.1.1. Skin Care

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Specialty Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Skin Care

- 11.1.1.1. Facial Cleansers

- 11.1.1.2. Moisturizer and Creams

- 11.1.1.3. Sun Protection

- 11.1.1.4. Toners

- 11.1.1.5. Other Skin Care Product Types

- 11.1.2. Hair Care

- 11.1.2.1. Shampoos and Conditioners

- 11.1.2.2. Hair Colorants and Dyes

- 11.1.2.3. Other Hair Care Product Types

- 11.1.3. Lip Care

- 11.1.4. Oral Care

- 11.1.1. Skin Care

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarket/Hypermarkets

- 11.2.2. Convenience/Grocery Stores

- 11.2.3. Online Retail Stores

- 11.2.4. Specialty Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Cosmeceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Skin Care

- 12.1.1.1. Facial Cleansers

- 12.1.1.2. Moisturizer and Creams

- 12.1.1.3. Sun Protection

- 12.1.1.4. Toners

- 12.1.1.5. Other Skin Care Product Types

- 12.1.2. Hair Care

- 12.1.2.1. Shampoos and Conditioners

- 12.1.2.2. Hair Colorants and Dyes

- 12.1.2.3. Other Hair Care Product Types

- 12.1.3. Lip Care

- 12.1.4. Oral Care

- 12.1.1. Skin Care

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarket/Hypermarkets

- 12.2.2. Convenience/Grocery Stores

- 12.2.3. Online Retail Stores

- 12.2.4. Specialty Stores

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Estee Lauder Companies Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Unilever PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Groupe Clarins SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 L'Oreal SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ORIFLAME COSMETICS GLOBAL SA*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Johnson & Johnson Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Shiseido Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Coty inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Procter & Gamble Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Beiersdorf AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Estee Lauder Companies Inc

List of Figures

- Figure 1: Europe Cosmeceuticals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Cosmeceuticals Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Cosmeceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Cosmeceuticals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Europe Cosmeceuticals Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Cosmeceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cosmeceuticals Industry?

The projected CAGR is approximately 8.39%.

2. Which companies are prominent players in the Europe Cosmeceuticals Industry?

Key companies in the market include Estee Lauder Companies Inc, Bayer AG, Unilever PLC, Groupe Clarins SA, L'Oreal SA, ORIFLAME COSMETICS GLOBAL SA*List Not Exhaustive, Johnson & Johnson Inc, Shiseido Co Ltd, Coty inc, Procter & Gamble Company, Beiersdorf AG.

3. What are the main segments of the Europe Cosmeceuticals Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Increasing aging population driving the market for anti ageing products.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

May 2022: Shiseido unveiled its latest prestige skincare line, "Ulé," in the vibrant beauty market of France. Customers can access Ulé's exquisite range of products through the brand's dedicated e-commerce platform and a luxurious boutique located in the heart of Paris.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cosmeceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cosmeceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cosmeceuticals Industry?

To stay informed about further developments, trends, and reports in the Europe Cosmeceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence