Key Insights

The Uzbekistan power market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of >2.41% and market size XX, the exact figure for XX is needed for precise calculation), is projected to experience robust growth through 2033. This expansion is fueled by several key drivers. Increasing industrialization and urbanization within Uzbekistan necessitate a substantial rise in electricity demand. Furthermore, government initiatives aimed at improving energy infrastructure and diversifying the energy mix, with a focus on renewable energy sources, are significantly contributing to market growth. The shift towards renewables is a prominent trend, driven by both environmental concerns and a desire for energy independence. However, the market faces challenges. Existing infrastructure limitations, potential grid instability related to integrating intermittent renewable sources, and the need for substantial foreign investment to support large-scale renewable energy projects act as restraints on faster growth.

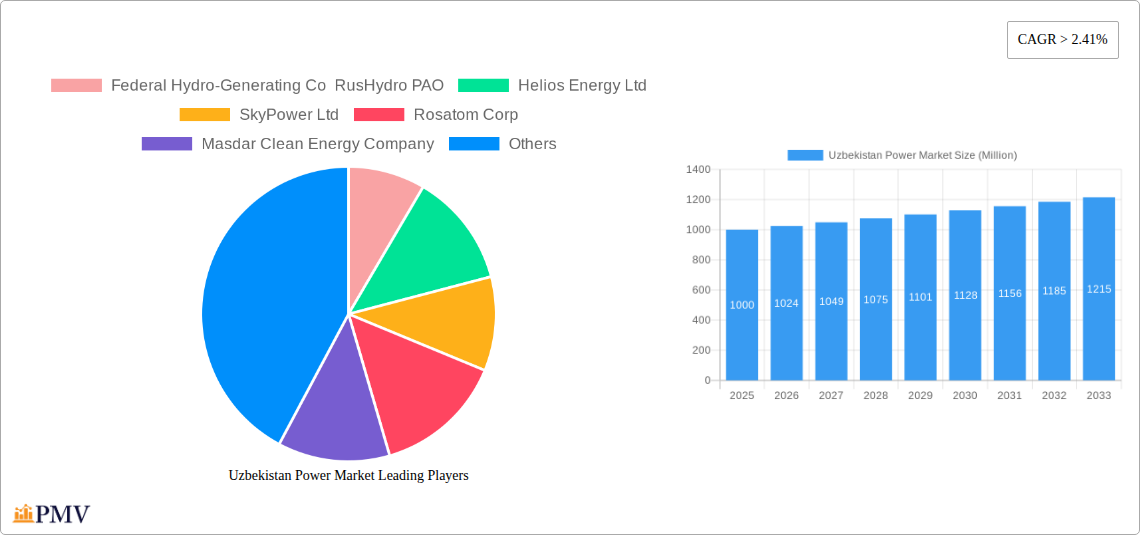

The market is segmented by fuel type, encompassing thermal, hydropower, and renewables. While thermal power currently holds a significant share, renewable energy sources, particularly solar and wind, are poised for substantial growth due to supportive government policies and decreasing technology costs. Key players in the Uzbekistan power market include Federal Hydro-Generating Co RusHydro PAO, Helios Energy Ltd, SkyPower Ltd, Rosatom Corp, Masdar Clean Energy Company, QISHLOQENERGOLOYIHA, and Mitsubishi Heavy Industries Ltd. These companies are actively involved in power generation, transmission, and distribution, shaping the competitive landscape. The ongoing expansion of renewable energy capacity and modernization of the grid will likely lead to increased competition and attract further foreign investment in the coming years, making Uzbekistan a steadily growing market for power generation and related services. Further analysis focusing on specific segment growth projections and regional variations would provide more granular insights.

This in-depth report provides a comprehensive analysis of the Uzbekistan power market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report includes detailed segmentation by fuel type (Thermal, Hydropower, Renewables) and incorporates extensive data analysis, forecasts, and expert commentary.

Uzbekistan Power Market Market Structure & Competitive Dynamics

This section analyzes the Uzbekistan power market's competitive landscape, focusing on market concentration, innovation, regulatory frameworks, and M&A activity. The market is characterized by a mix of state-owned enterprises and private players, with a relatively concentrated structure in the thermal power segment. The entry of international companies like Federal Hydro-Generating Co RusHydro PAO and Masdar Clean Energy Company signifies a growing interest in the sector. However, the regulatory framework still influences market dynamics. Several key metrics, including market share for major players and M&A deal values (estimated at xx Million USD in the past 5 years), are presented.

- Market Concentration: High concentration in thermal power, with xx% market share held by the top three players. Renewables segment shows more fragmentation.

- Innovation Ecosystem: Limited compared to global standards, with opportunities for technology transfer and local innovation in renewable energy.

- Regulatory Framework: Currently undergoing reforms to promote private investment and attract foreign capital. Streamlining licensing processes and improving grid infrastructure remain key policy objectives.

- Product Substitutes: Limited substitutes for electricity exist in the short term. However, improved energy efficiency and demand-side management strategies can influence demand.

- End-User Trends: Growing industrialization and increasing urbanization fuel electricity demand. The shift towards renewable energy and energy efficiency is gradually impacting consumption patterns.

- M&A Activities: Limited significant M&A activity observed recently but increased activity is anticipated with the liberalization of the market.

Uzbekistan Power Market Industry Trends & Insights

The Uzbekistan power market is experiencing significant transformation driven by government initiatives to diversify energy sources, improve energy security, and attract foreign investment. The Compound Annual Growth Rate (CAGR) for the overall market during 2025-2033 is projected to be xx%, primarily propelled by rising electricity consumption and investments in renewable energy projects. Market penetration of renewables is expected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, like the integration of smart grids and energy storage solutions, are gaining momentum. Consumer preferences are shifting towards cleaner energy sources, influencing policy and investment decisions.

Dominant Markets & Segments in Uzbekistan Power Market

The thermal power segment currently dominates the Uzbekistan power market, accounting for xx% of the total installed capacity in 2025, primarily due to existing infrastructure and readily available fuel resources. However, the renewable energy segment is experiencing rapid growth, driven by government policies promoting sustainable energy development. Hydropower remains a significant contributor, though its expansion is constrained by geographic factors and environmental concerns.

Thermal Power:

- Key Drivers: Existing infrastructure, readily available fossil fuels.

- Dominance Analysis: Large share of installed capacity, but facing pressure to reduce emissions.

Hydropower:

- Key Drivers: Existing hydropower plants, abundant water resources in certain regions.

- Dominance Analysis: Significant but limited expansion potential due to geographic and environmental constraints.

Renewables:

- Key Drivers: Government support for renewable energy development, declining technology costs, growing environmental awareness.

- Dominance Analysis: Rapid growth, but facing challenges in grid integration and energy storage.

Uzbekistan Power Market Product Innovations

Recent innovations focus on improving efficiency in thermal power plants, integrating renewable energy sources into the grid, and deploying advanced energy storage technologies. Smart grid technologies and digitalization initiatives enhance grid management and improve the reliability of power supply. These innovations are critical in addressing the country's growing electricity demand while mitigating environmental impact.

Report Segmentation & Scope

This report segments the Uzbekistan power market by fuel type: Thermal, Hydropower, and Renewables. Each segment’s market size, growth projections, and competitive dynamics are analyzed. The thermal power segment is expected to witness moderate growth, while hydropower and renewables are projected to experience significantly higher growth rates driven by government policies and increasing private sector involvement. The report also considers regional variations in market dynamics, though detailed regional breakdowns are not included in this summary.

Key Drivers of Uzbekistan Power Market Growth

Several factors drive the Uzbekistan power market's growth:

- Government Initiatives: Policies promoting renewable energy, energy efficiency, and foreign investment are crucial.

- Economic Growth: Rising industrialization and urbanization increase electricity demand.

- Technological Advancements: Cost reductions in renewable energy technologies accelerate their adoption.

Challenges in the Uzbekistan Power Market Sector

The sector faces several challenges, including:

- Grid Infrastructure: Outdated infrastructure limits the effective integration of renewable energy sources.

- Regulatory Hurdles: Complex permitting processes and regulatory uncertainties can hinder investment.

- Financing Constraints: Securing long-term financing for large-scale power projects remains a challenge.

Leading Players in the Uzbekistan Power Market Market

- Federal Hydro-Generating Co RusHydro PAO

- Helios Energy Ltd

- SkyPower Ltd

- Rosatom Corp

- Masdar Clean Energy Company

- QISHLOQENERGOLOYIHA

- Mitsubishi Heavy Industries Ltd

Key Developments in Uzbekistan Power Market Sector

- November 2022: Launch of a new power plant in Syrdaryo province with 1.7 Billion KWh annual capacity.

- November 2022: Agreement between Uzbekistan's government and Voltalia for 400-500 MW renewable energy projects (200 MW solar, 200 MW wind, 60 MW/240 MWh battery storage).

- June 2022: USD 143 Million World Bank concessional credit for improving building energy efficiency and regulatory frameworks for sustainable energy investment.

Strategic Uzbekistan Power Market Market Outlook

The Uzbekistan power market presents significant growth opportunities for investors and businesses. Continued government support for renewable energy, increasing private sector participation, and modernization of the grid infrastructure will drive substantial growth. Strategic partnerships between international and local companies will be vital in leveraging technological expertise and fostering sustainable development in the power sector. The focus on improving energy efficiency and reducing carbon emissions presents further avenues for innovation and investment.

Uzbekistan Power Market Segmentation

-

1. Power Generation Scenario - Fuel Type

-

1.1. Thermal

- 1.1.1. Overview

-

1.1.2. Key Project Information

- 1.1.2.1. Existing Projects

- 1.1.2.2. Planned and Upcoming Projects

- 1.2. Hydropower

- 1.3. Renewables

-

1.4. Nuclear

- 1.4.1. Planned Projects

-

1.1. Thermal

-

2. Power Transmission and Distribution Scenario

- 2.1. Overview

- 2.2. Projects

- 2.3. Planned and Upcoming Projects

Uzbekistan Power Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario - Fuel Type

- 5.1.1. Thermal

- 5.1.1.1. Overview

- 5.1.1.2. Key Project Information

- 5.1.1.2.1. Existing Projects

- 5.1.1.2.2. Planned and Upcoming Projects

- 5.1.2. Hydropower

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.4.1. Planned Projects

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution Scenario

- 5.2.1. Overview

- 5.2.2. Projects

- 5.2.3. Planned and Upcoming Projects

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario - Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Federal Hydro-Generating Co RusHydro PAO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Helios Energy Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SkyPower Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rosatom Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masdar Clean Energy Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 QISHLOQENERGOLOYIHA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Federal Hydro-Generating Co RusHydro PAO

List of Figures

- Figure 1: Uzbekistan Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uzbekistan Power Market Share (%) by Company 2024

List of Tables

- Table 1: Uzbekistan Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uzbekistan Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Uzbekistan Power Market Revenue Million Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 4: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 5: Uzbekistan Power Market Revenue Million Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 6: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 7: Uzbekistan Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Uzbekistan Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Uzbekistan Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Uzbekistan Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Uzbekistan Power Market Revenue Million Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 12: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 13: Uzbekistan Power Market Revenue Million Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 14: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 15: Uzbekistan Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Uzbekistan Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Power Market?

The projected CAGR is approximately > 2.41%.

2. Which companies are prominent players in the Uzbekistan Power Market?

Key companies in the market include Federal Hydro-Generating Co RusHydro PAO, Helios Energy Ltd, SkyPower Ltd, Rosatom Corp, Masdar Clean Energy Company, QISHLOQENERGOLOYIHA, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Uzbekistan Power Market?

The market segments include Power Generation Scenario - Fuel Type, Power Transmission and Distribution Scenario.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Thermal Power Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2022, Uzbekistan unveiled a new power plant that will extend its generating capacity. According to the Ministry of Energy, the power plant constructed in the Syrdaryo province's Khovos district will have the capacity to generate up to 1.7 billion KWh of electricity annually once it is fully operational.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Power Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence