Key Insights

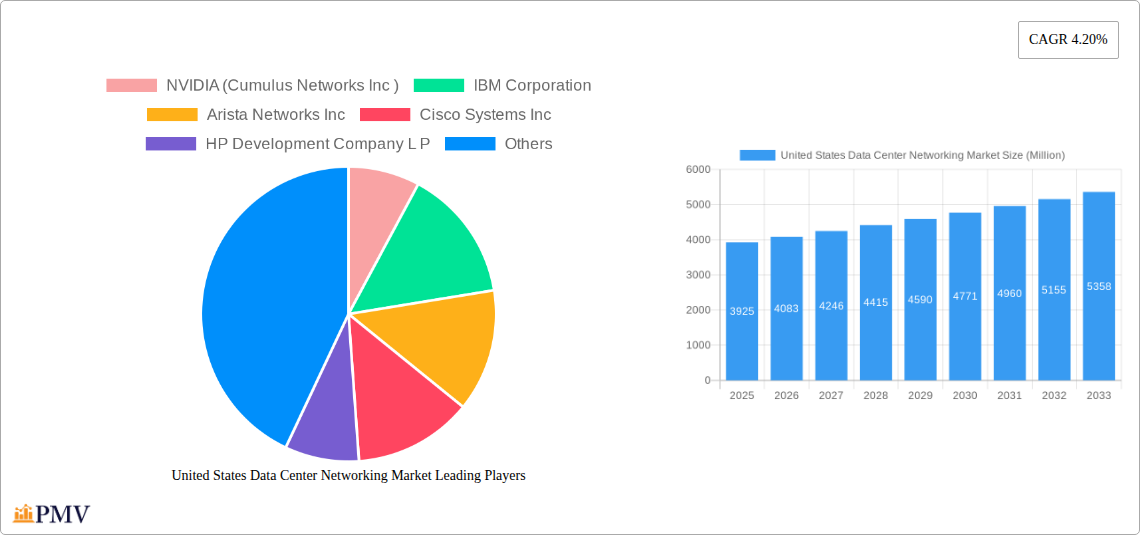

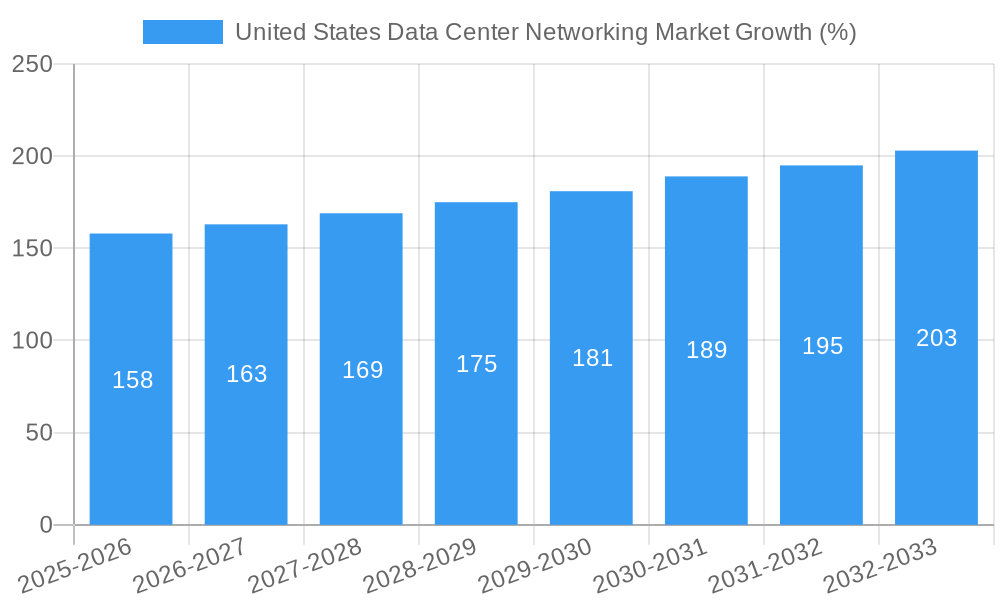

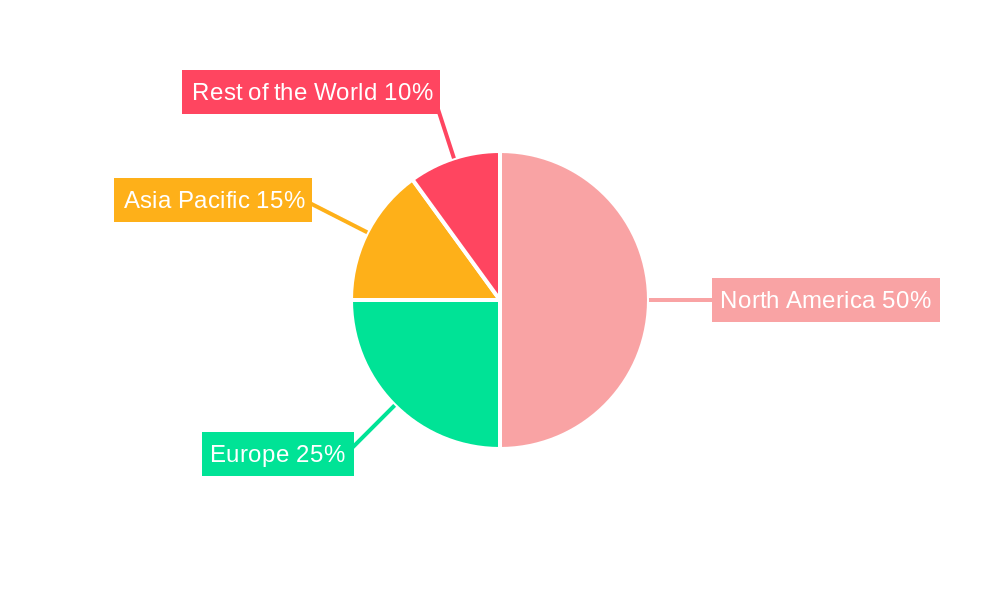

The United States data center networking market, valued at approximately $3.925 billion in 2025 (estimated based on the global market size of $7.85 billion and assuming a roughly 50% share for the US, a reasonable proportion given its economic strength and technological leadership), is projected to experience robust growth throughout the forecast period of 2025-2033. This growth is fueled by several key drivers: the increasing adoption of cloud computing and the associated need for high-speed, low-latency networking; the expansion of 5G networks and the resulting surge in data traffic; and the growing demand for edge computing solutions to process data closer to the source. Furthermore, the increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) are transforming data center architectures, creating opportunities for innovative networking solutions. The market's segmentation reveals significant contributions from IT & Telecommunication, BFSI, and Government sectors, which are heavily reliant on advanced networking infrastructure for operations and data management. Competitive forces are strong, with established players like Cisco, Arista, and Juniper, alongside emerging technology providers like NVIDIA (Cumulus Networks), vying for market share through innovation in areas such as AI-powered networking and improved security protocols.

The market's continued expansion is, however, subject to certain constraints. These include the high initial investment costs associated with upgrading data center infrastructure, the complexity of implementing and managing sophisticated networking solutions, and ongoing concerns about cybersecurity vulnerabilities within increasingly interconnected data center environments. Despite these challenges, the long-term outlook for the US data center networking market remains positive, primarily driven by the unrelenting growth in data generation and the consequent need for robust, scalable, and secure networking capabilities. The market is expected to benefit from sustained technological advancements, strategic partnerships, and increasing government initiatives promoting digital transformation. Furthermore, the increasing demand for hybrid and multi-cloud deployments will further stimulate growth as organizations strive for flexibility and efficiency in their data center operations.

United States Data Center Networking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States data center networking market, covering market size, growth drivers, challenges, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for businesses, investors, and researchers seeking to understand and navigate this dynamic market.

United States Data Center Networking Market Market Structure & Competitive Dynamics

The United States data center networking market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The market's competitive landscape is characterized by intense rivalry, driven by ongoing technological advancements and the increasing demand for high-performance networking solutions. Innovation ecosystems are thriving, fueled by substantial R&D investments from major vendors and startups. Regulatory frameworks, while generally supportive of technological advancement, are subject to change and could impact market dynamics. Product substitutes, such as software-defined networking (SDN) solutions, are exerting competitive pressure. End-user trends, such as the adoption of cloud computing and AI, are shaping the demand for advanced networking capabilities. Significant M&A activity has been observed in recent years, with deal values reaching xx Million. Key players such as Cisco and Arista have consistently engaged in strategic acquisitions to expand their product portfolios and market reach. For instance, the acquisition of xx company by xx company in 2022 resulted in a xx% increase in market share for the acquirer.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Ecosystems: Highly active, with significant R&D investment from both established players and new entrants.

- Regulatory Frameworks: Generally supportive, but subject to potential changes impacting market access and compliance.

- M&A Activity: Significant in recent years, with total deal values exceeding xx Million in the past five years. Notable transactions include [mention specific examples if available with deal values].

- End-User Trends: Strong adoption of cloud computing, AI, and big data analytics drives demand for high-bandwidth, low-latency networking solutions.

United States Data Center Networking Market Industry Trends & Insights

The United States data center networking market is experiencing robust growth, driven by several key factors. The increasing adoption of cloud computing and the proliferation of data centers are major contributors to this expansion. The market is also witnessing technological disruptions, with the emergence of software-defined networking (SDN), network function virtualization (NFV), and 5G networking technologies transforming the landscape. Consumer preferences are shifting towards more agile, scalable, and secure networking solutions, impacting vendors' product strategies. Competitive dynamics are characterized by intense rivalry, with companies constantly innovating to gain a competitive edge. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), driven by increasing demand from various end-user segments. Market penetration for advanced networking technologies like 400GbE and 800GbE is expected to reach xx% by 2033.

Dominant Markets & Segments in United States Data Center Networking Market

The IT & Telecommunication sector is currently the dominant end-user segment in the US data center networking market, representing xx% of the total market revenue in 2024. This is followed by the BFSI sector. The strongest regional growth is observed in [mention specific region, if available].

- By Component: The switch segment is the largest component, while other networking equipment, including routers and optical transceivers, represent significant portions of the market.

- By Product: High-speed Ethernet switches and routers dominate the market share, driven by the need for high bandwidth and low latency.

- By Service: Managed services and professional services are gaining traction, particularly with cloud adoption.

- By End-User:

- IT & Telecommunication: High demand for advanced networking solutions to support cloud infrastructure, data centers, and 5G deployment. Key drivers include investments in digital infrastructure and increasing data traffic.

- BFSI: Strong growth fueled by increased reliance on digital banking, financial transactions, and regulatory compliance needs.

- Government: Significant investments in cybersecurity and infrastructure modernization are driving market growth.

- Media & Entertainment: High demand for bandwidth and low latency to support streaming services and content delivery.

- Other End-Users: This segment includes healthcare, education, and other sectors adopting data center solutions.

United States Data Center Networking Market Product Innovations

Recent product innovations in the US data center networking market reflect a strong emphasis on high-speed connectivity, enhanced security, and improved manageability. Arista's introduction of its 7130 25G Series Ethernet switches underscores the market's demand for low-latency, high-performance networking solutions specifically for financial applications. NVIDIA's SpectrumXtreme platform showcases the integration of AI and accelerated networking technologies, driving efficiency and performance gains in cloud-based AI deployments. These advancements demonstrate a trend towards increased network agility, scalability, and automation, while improving overall performance and efficiency for data centers.

Report Segmentation & Scope

This report segments the US data center networking market by component (switches, routers, other networking equipment), product (Ethernet switches, routers, optical transceivers), services (managed services, professional services), and end-user (IT & telecommunication, BFSI, government, media & entertainment, other end-users). Each segment is analyzed in detail, providing insights into its market size, growth projections, and competitive landscape. The report offers detailed growth projections based on historical data, market trends, and expert analysis.

Key Drivers of United States Data Center Networking Market Growth

Several factors contribute to the growth of the US data center networking market. The increasing adoption of cloud computing and the rise of big data are driving the demand for high-bandwidth, low-latency networking solutions. Government initiatives promoting digital transformation are creating opportunities for market expansion. Furthermore, the advancements in networking technologies, such as 5G and SDN, are enabling greater scalability and efficiency in data center operations.

Challenges in the United States Data Center Networking Market Sector

The US data center networking market faces several challenges. Maintaining network security in the face of increasing cyber threats is a significant concern. Supply chain disruptions and increasing costs of components can impact market growth. The complexity of managing large-scale data center networks also poses a challenge for many organizations. The intense competition, characterized by consolidation and mergers, can pressure profit margins for smaller players.

Leading Players in the United States Data Center Networking Market Market

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- Arista Networks Inc

- Cisco Systems Inc

- HP Development Company L P

- Emerson Electric Co

- Dell Inc

- Schneider Electric

- Huawei Technologies Co Ltd

- VMware Inc

- Intel Corporation

- Eaton Corporation

Key Developments in United States Data Center Networking Market Sector

- October 2023: Arista Networks launched its 7130 25G Series Ethernet switches, significantly improving performance and reducing latency for financial applications.

- May 2023: NVIDIA announced SpectrumXtreme, an accelerated networking platform enhancing cloud-based AI performance and efficiency.

Strategic United States Data Center Networking Market Market Outlook

The US data center networking market presents significant growth opportunities driven by ongoing digital transformation across various sectors. The increasing adoption of cloud-based services, AI, and IoT technologies will continue to fuel demand for advanced networking solutions. Strategic partnerships and collaborations will be key for vendors to capitalize on this market potential, particularly in emerging areas like edge computing. The market's future is bright, promising substantial growth in the coming years.

United States Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

United States Data Center Networking Market Segmentation By Geography

- 1. United States

United States Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory constraints

- 3.4. Market Trends

- 3.4.1. Ethernet Switches is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America United States Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Unites States

- 6.1.2 Canada

- 7. Europe United States Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Rest of Europe

- 8. Asia Pacific United States Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 South Korea

- 8.1.5 Rest of Asia Pacific

- 9. Rest of the World United States Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NVIDIA (Cumulus Networks Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Arista Networks Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cisco Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HP Development Company L P

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Emerson Electric Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 VMware Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eaton Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: United States Data Center Networking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Data Center Networking Market Share (%) by Company 2024

List of Tables

- Table 1: United States Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: United States Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: United States Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Unites States United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Data Center Networking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United States Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 22: United States Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: United States Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Data Center Networking Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the United States Data Center Networking Market?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, Arista Networks Inc, Cisco Systems Inc, HP Development Company L P, Emerson Electric Co, Dell Inc, Schneider Electric, Huawei Technologies Co Ltd, VMware Inc, Intel Corporation, Eaton Corporation.

3. What are the main segments of the United States Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector.

6. What are the notable trends driving market growth?

Ethernet Switches is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

Regulatory constraints.

8. Can you provide examples of recent developments in the market?

October 2023: Arista Networks has introduced a portfolio of 25G Ethernet switches to support primarily financial applications that demand high performance and low latency. The new 7130 25G Series boxes are a significant power and features upgrade over the vendor’s current 7130 10G Ethernet line of devices and promise to reduce link latency 2.5-fold for data transmission by reducing queuing, serialization delays and eliminating the need for latency-inducing Forward Error Correction (FEC) typically required by 25G Ethernet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Data Center Networking Market?

To stay informed about further developments, trends, and reports in the United States Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence