Key Insights

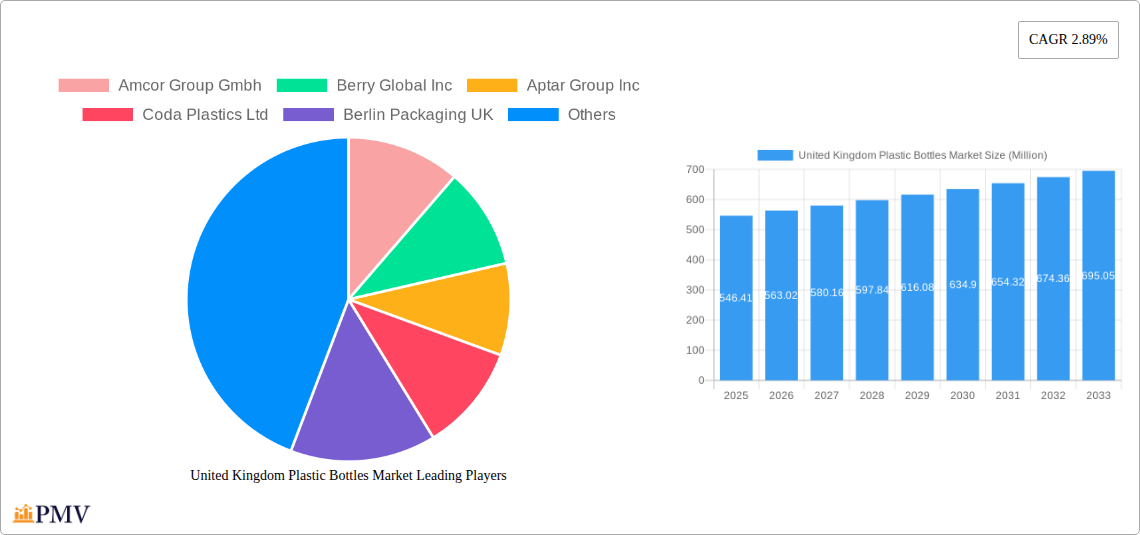

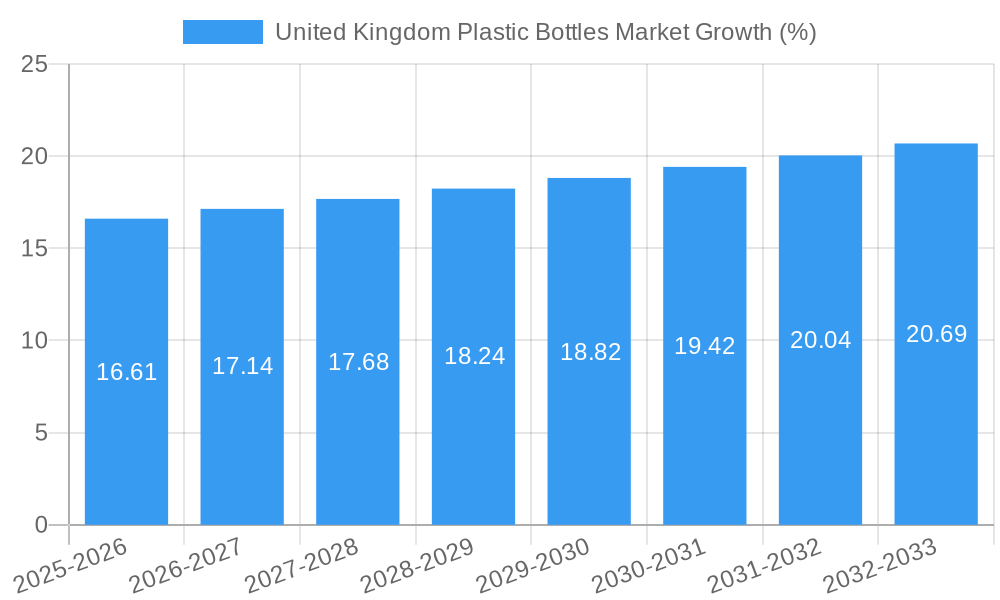

The United Kingdom plastic bottles market, valued at approximately £546.41 million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 2.89% from 2025 to 2033. This growth is driven by several factors, including the increasing demand for packaged beverages and consumer goods, the convenience and cost-effectiveness of plastic bottles, and advancements in lightweighting and sustainable plastic bottle technologies. However, the market faces challenges from growing environmental concerns regarding plastic waste and stricter regulations aimed at reducing plastic pollution. This necessitates a shift towards more sustainable packaging solutions, such as recycled PET (rPET) and biodegradable alternatives, influencing manufacturers' strategies and investments. Key players like Amcor Group, Berry Global, and Aptar Group are actively involved in innovation and the adoption of circular economy models to address these challenges and remain competitive. The market is segmented by bottle type (e.g., PET, HDPE, others), application (e.g., beverages, food, personal care), and end-use industry. Competition is intense, with both established and emerging players vying for market share, making innovation and effective supply chain management crucial for success.

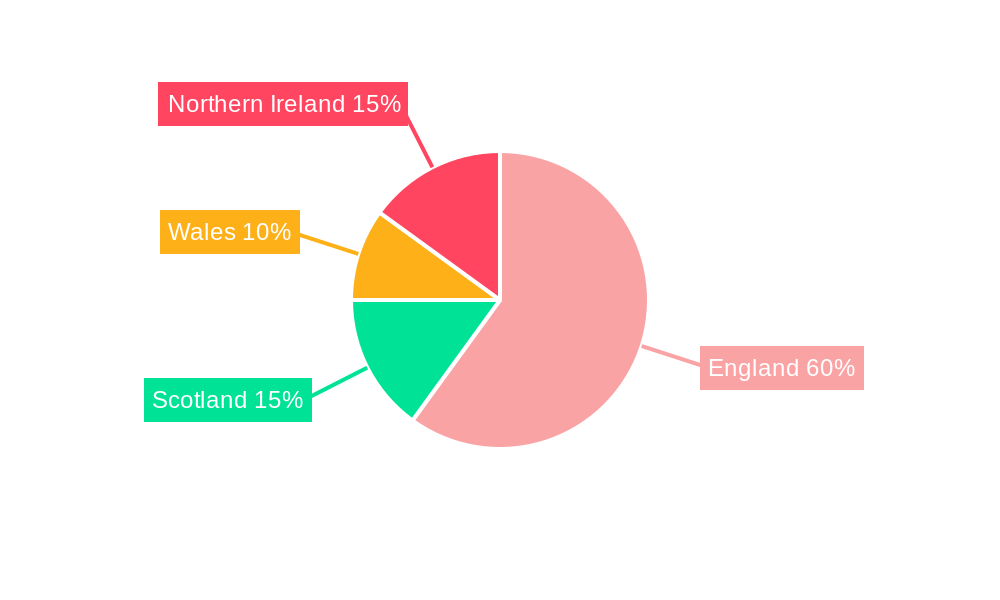

The regional distribution of the UK plastic bottles market likely reflects the population density and economic activity across the country. Southern England, for instance, would likely command a larger market share due to higher consumption. Competitive analysis within the market reveals a dynamic interplay between established players with extensive production capabilities and distribution networks, and smaller, more nimble emerging companies focusing on niche applications or sustainable alternatives. The competitive landscape is constantly evolving, driven by mergers and acquisitions, technological advancements, and shifting consumer preferences towards environmentally responsible products. Future market growth is expected to be influenced by government policies promoting sustainable packaging, advancements in recycling technologies, and the adoption of innovative packaging solutions that address environmental concerns without compromising functionality and affordability.

This in-depth report provides a comprehensive analysis of the United Kingdom plastic bottles market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, growth drivers, challenges, and key players, equipping you with the knowledge to navigate this dynamic sector.

United Kingdom Plastic Bottles Market Structure & Competitive Dynamics

The UK plastic bottles market exhibits a moderately concentrated structure, with a handful of major players dominating the landscape. Market share is influenced by factors like production capacity, innovation capabilities, and distribution networks. The regulatory framework, particularly concerning plastic waste reduction and recycling targets, significantly shapes competitive dynamics. The presence of substitutes, such as glass and alternative packaging materials, adds complexity. End-user trends, particularly the growing preference for sustainable and eco-friendly packaging, are driving innovation and influencing purchasing decisions. M&A activity is relatively moderate, with deal values fluctuating depending on market conditions. In 2024, the total M&A deal value in the UK plastic bottle market was estimated at £xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Ecosystems: Active, driven by sustainable packaging solutions and advancements in material science.

- Regulatory Frameworks: Stringent regulations on plastic waste are shaping the market, promoting recycling and sustainable alternatives.

- Product Substitutes: Glass, aluminum, and biodegradable alternatives exert competitive pressure.

- End-User Trends: Growing demand for eco-friendly and recyclable packaging.

- M&A Activities: Moderate activity, with deal values averaging £xx Million in recent years.

United Kingdom Plastic Bottles Market Industry Trends & Insights

The UK plastic bottles market is experiencing a period of significant transformation, driven by several key factors. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of £xx Million by 2033. Growth is fueled by the increasing demand for packaged goods across various sectors, including food and beverages, personal care, and pharmaceuticals. Technological advancements in materials science are enabling the development of lighter, stronger, and more sustainable plastic bottles. Consumer preference for convenience and on-the-go consumption further contributes to market growth. However, growing environmental concerns and stricter regulations are posing challenges, pushing manufacturers to adopt sustainable practices and materials. Market penetration of recycled PET bottles is increasing steadily, driven by both consumer demand and regulatory pressures.

Dominant Markets & Segments in United Kingdom Plastic Bottles Market

The dominance within the UK plastic bottles market is largely defined by regional consumption patterns and the concentration of major end-use industries. While specific regional data requires further analysis, certain segments showcase higher growth potential. The food and beverage sector currently dominates, followed by the personal care and household goods sectors.

- Key Drivers in Dominant Segments:

- Food & Beverage: High consumption of bottled drinks and packaged food products.

- Personal Care: Growing demand for convenient and portable personal care items.

- Pharmaceuticals: Need for sterile and tamper-evident packaging.

The dominance of these segments is driven by factors like high consumer demand, established distribution channels, and the prevalence of large-scale manufacturing facilities within the UK.

United Kingdom Plastic Bottles Market Product Innovations

Recent innovations in the UK plastic bottles market focus heavily on sustainability. Lightweighting techniques are reducing material usage, while the integration of recycled content and bio-based polymers is enhancing environmental performance. New bottle designs optimize functionality, shelf life, and recyclability. These innovations aim to meet the growing demand for eco-friendly packaging while maintaining product quality and cost-effectiveness. The market is seeing increased use of post-consumer recycled (PCR) content, along with exploring the potential of bioplastics.

Report Segmentation & Scope

The report segments the UK plastic bottles market based on material type (PET, HDPE, PP, etc.), application (food & beverage, personal care, pharmaceuticals, etc.), and packaging type (rigid, flexible, etc.). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the PET segment is projected to maintain a significant market share throughout the forecast period due to its high recyclability and versatility.

Key Drivers of United Kingdom Plastic Bottles Market Growth

Several factors contribute to the growth of the UK plastic bottles market:

- Rising Demand for Packaged Goods: The increasing consumption of packaged food, beverages, and consumer products fuels market growth.

- Technological Advancements: Innovations in materials and manufacturing processes are improving efficiency and sustainability.

- Favorable Economic Conditions: Overall economic growth and rising disposable incomes contribute to increased consumer spending.

- Government Regulations: While posing challenges, environmental regulations also drive innovation towards sustainable solutions.

Challenges in the United Kingdom Plastic Bottles Market Sector

The UK plastic bottles market faces significant challenges:

- Environmental Concerns: Growing public awareness of plastic pollution is leading to stricter regulations and consumer pressure for sustainable alternatives.

- Fluctuating Raw Material Prices: Price volatility in raw materials, particularly oil-based polymers, impacts profitability.

- Intense Competition: The market is highly competitive, with both established players and new entrants vying for market share.

- Recycling Infrastructure: Improvements in recycling infrastructure are needed to support the increased adoption of recycled materials.

Leading Players in the United Kingdom Plastic Bottles Market Market

- Amcor Group GmbH

- Berry Global Inc

- Aptar Group Inc

- Coda Plastics Ltd

- Berlin Packaging UK

- Esterform Packaging Ltd

- Cambrian Packaging

- Fernhill Packaging Ltd

- Robinson plc

- Measom Freer & Co Ltd

Key Developments in United Kingdom Plastic Bottles Market Sector

- October 2023: Wiltshire Dairy launched the UK's first refillable plastic milk bottle, signifying a move towards reusable packaging and reduced waste.

- May 2024: Lush cosmetics announced its transition to Prevented Ocean Plastic certified bottles, highlighting the growing adoption of sustainable materials within the industry.

Strategic United Kingdom Plastic Bottles Market Outlook

The future of the UK plastic bottles market hinges on sustainability. Companies that embrace circular economy principles, invest in innovative materials, and adapt to evolving regulations will be best positioned for success. Opportunities exist in developing lightweight, recycled, and bio-based bottles, as well as exploring innovative packaging solutions that minimize waste and enhance recyclability. The market is expected to see continued growth, driven by increasing consumer demand and ongoing technological advancements. However, navigating environmental regulations and adapting to changing consumer preferences will be crucial for sustained success.

United Kingdom Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Re

-

2. End-use Industries

- 2.1. Food

-

2.2. Beverage

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices & Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care & Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints & Coatings

- 2.8. Other End-use Industries

United Kingdom Plastic Bottles Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Demand From Beverage Sector

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Lightweight Packaging Methods; Demand From Beverage Sector

- 3.4. Market Trends

- 3.4.1. Rising Demand From the Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices & Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care & Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints & Coatings

- 5.2.8. Other End-use Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor Group Gmbh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aptar Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coda Plastics Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Packaging UK

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Esterform Packaging Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cambrian Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fernhill Packaging Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robinson plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Measom Freer & Co Ltd 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor Group Gmbh

List of Figures

- Figure 1: United Kingdom Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Plastic Bottles Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Plastic Bottles Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Plastic Bottles Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 4: United Kingdom Plastic Bottles Market Volume Million Forecast, by Resin 2019 & 2032

- Table 5: United Kingdom Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2019 & 2032

- Table 6: United Kingdom Plastic Bottles Market Volume Million Forecast, by End-use Industries 2019 & 2032

- Table 7: United Kingdom Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom Plastic Bottles Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: United Kingdom Plastic Bottles Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 10: United Kingdom Plastic Bottles Market Volume Million Forecast, by Resin 2019 & 2032

- Table 11: United Kingdom Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2019 & 2032

- Table 12: United Kingdom Plastic Bottles Market Volume Million Forecast, by End-use Industries 2019 & 2032

- Table 13: United Kingdom Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Plastic Bottles Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Plastic Bottles Market?

The projected CAGR is approximately 2.89%.

2. Which companies are prominent players in the United Kingdom Plastic Bottles Market?

Key companies in the market include Amcor Group Gmbh, Berry Global Inc, Aptar Group Inc, Coda Plastics Ltd, Berlin Packaging UK, Esterform Packaging Ltd, Cambrian Packaging, Fernhill Packaging Ltd, Robinson plc, Measom Freer & Co Ltd 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the United Kingdom Plastic Bottles Market?

The market segments include Resin, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 546.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Demand From Beverage Sector.

6. What are the notable trends driving market growth?

Rising Demand From the Beverage Sector.

7. Are there any restraints impacting market growth?

Increasing Adoption of Lightweight Packaging Methods; Demand From Beverage Sector.

8. Can you provide examples of recent developments in the market?

May 2024: British cosmetics retailer Lush announced its plans to transition its bottles to materials certified by Prevented Ocean Plastic. For over a decade, Lush has utilized 100% recycled PET for its clear bottles. In collaboration with Spectra Packaging, Lush rolled out certified recycled prevented ocean plastic for its 100 ml, 250 ml, and 500 ml bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the United Kingdom Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence