Key Insights

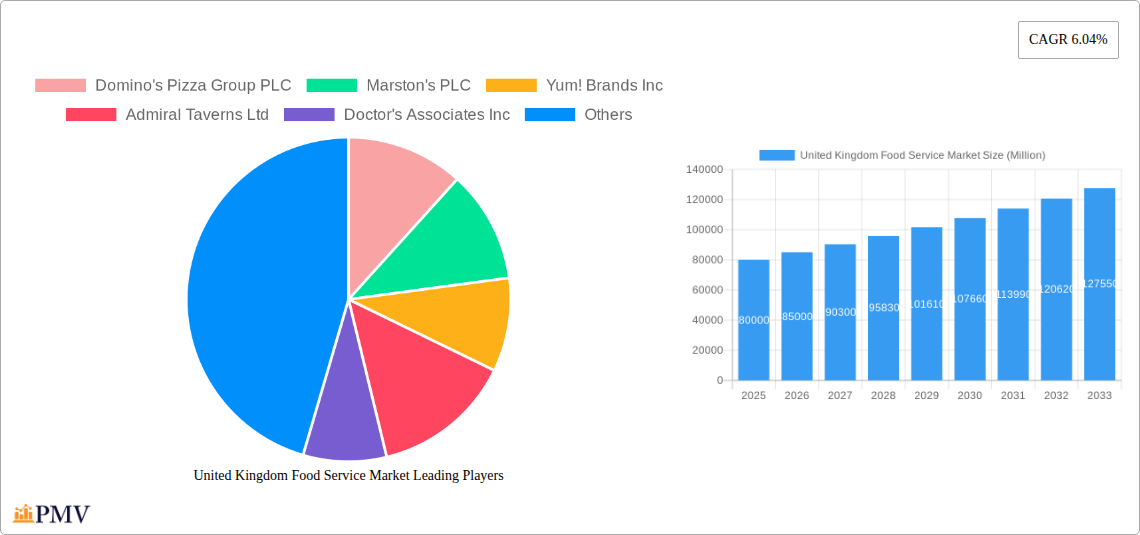

The United Kingdom food service market, valued at approximately £80 billion in 2025, is projected to experience robust growth, driven by several key factors. A rising population, increasing disposable incomes, and a shift towards convenience and out-of-home dining contribute significantly to this expansion. The market is highly segmented, encompassing diverse locations (leisure, lodging, retail, standalone, travel), food service types (cafes & bars, QSR cuisines), and outlet structures (chained, independent). The popularity of quick-service restaurants (QSRs) and the growing demand for diverse culinary experiences are shaping consumer preferences. Furthermore, the increasing adoption of online ordering and delivery services fuels market growth, especially within the QSR and cafe segments. Competition is intense, with established players like McDonald's, Costa Coffee, and Greggs alongside smaller independent businesses and international chains. However, challenges remain, including fluctuating ingredient costs, labor shortages, and the ongoing economic climate's impact on consumer spending.

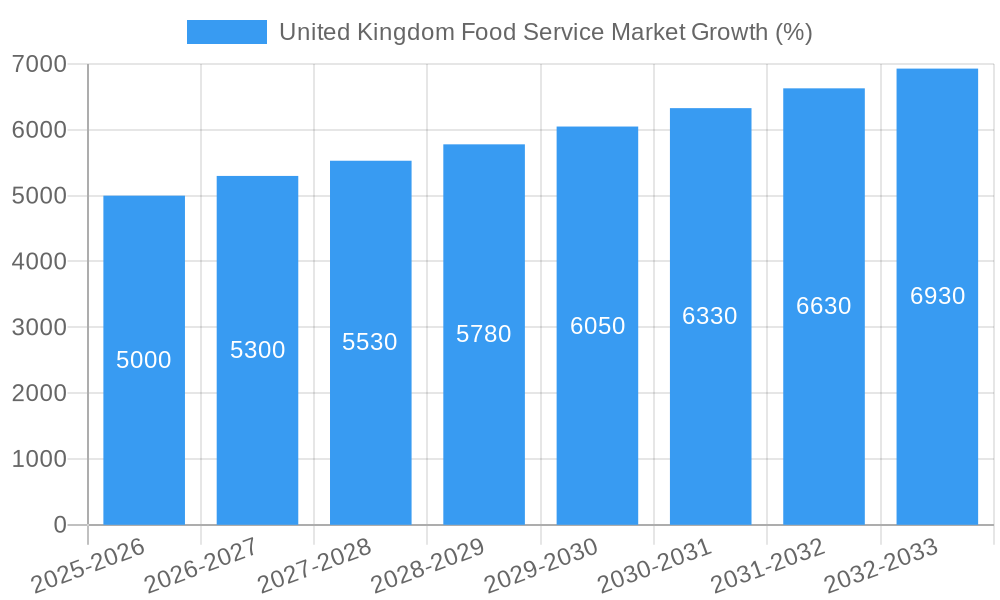

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 6.04%, suggesting a market value exceeding £130 billion by 2033. This growth trajectory is expected to be influenced by innovative menu offerings, technological advancements in food service operations, and evolving consumer expectations. Strategic acquisitions and mergers within the industry, aimed at market consolidation and expansion, are likely to accelerate this expansion. The specific growth within each segment will vary, with QSRs potentially experiencing faster growth due to their affordability and convenience, while higher-end dining establishments may see more moderate expansion tied to consumer confidence and discretionary spending. The regional distribution of growth may see a higher concentration in urban areas compared to rural locations, given the higher population density and easier accessibility of food service outlets.

This meticulously researched report provides a deep dive into the dynamic United Kingdom food service market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, growth drivers, and future potential. Expect detailed analysis across key segments, including location, foodservice type, and outlet type, with projections revealing significant market opportunities.

United Kingdom Food Service Market Market Structure & Competitive Dynamics

The UK food service market exhibits a complex structure characterized by both intense competition and significant consolidation. Market concentration is high, with major players like McDonald's Corporation and Tesco PLC holding substantial market share. However, a vibrant ecosystem of independent outlets and smaller chains continues to thrive, creating a diverse landscape. The market is also subject to a robust regulatory framework governing food safety, hygiene, and labor practices. Product substitutes, such as home-cooked meals and meal delivery kits, exert competitive pressure, forcing established players to innovate and adapt.

End-user trends, particularly the growing preference for convenience, health-conscious options, and diverse culinary experiences, significantly shape market dynamics. Mergers and acquisitions (M&A) activity is frequent, with deals often driven by a desire for expansion, brand diversification, and enhanced market reach. For example, the xx Million acquisition of [Company A] by [Company B] in [Year] illustrated the consolidation trend. Further analysis reveals the following:

- Market Share: Dominated by a few large players, with the top 5 controlling approximately xx% of the market in 2024.

- M&A Deal Values: Average deal size in the past five years has been approximately xx Million, reflecting a strong investment appetite.

- Innovation Ecosystems: Significant investment in technology-driven solutions, such as online ordering platforms and automated kitchen systems.

United Kingdom Food Service Market Industry Trends & Insights

The UK food service market is experiencing robust growth, driven by several key factors. Rising disposable incomes, changing consumer lifestyles, and the increasing popularity of dining out are major contributors. The market is estimated to reach xx Million by 2025, registering a Compound Annual Growth Rate (CAGR) of xx% from 2025-2033. Technological disruptions, including the rise of online food delivery platforms and the adoption of digital ordering systems, are transforming the industry. Consumer preferences are also shifting, with growing demand for healthier, sustainable, and ethically sourced food.

Competition is intense, with established chains facing challenges from emerging players and innovative business models. Market penetration of online delivery services is rapidly increasing, with xx% of consumers using such platforms at least once per month in 2024. This trend is expected to accelerate in the forecast period. Changing consumer preferences towards healthier eating also impact the market, with health-conscious outlets showing accelerated growth.

Dominant Markets & Segments in United Kingdom Food Service Market

The UK food service market is diverse, with different segments exhibiting varying growth trajectories. While the exact dominant segment varies by metric, several show significant dominance.

Key Drivers:

- Location: The retail segment (supermarkets and convenience stores with food service offerings) is expected to remain dominant due to convenience and accessibility. The leisure segment also shows considerable growth, boosted by tourism and an active social scene.

- Foodservice Type: QSR (Quick Service Restaurants) chains are the most prominent players, driven by cost-effectiveness and convenience. However, the cafes & bars segment also holds significant market share, driven by social and experiential demand.

- Outlet: Chained outlets dominate the market in terms of volume and revenue, showcasing the economies of scale and brand recognition of larger corporations. However, independent outlets continue to thrive and cater to unique, local tastes.

Dominance Analysis: The Retail segment, driven by major players like Tesco and Co-operative Group Limited, accounts for the largest share of the market in terms of revenue due to high volume sales. However, the Leisure segment is characterized by high profit margins driven by premium pricing in restaurants and bars. The growth of online delivery is expected to boost the standalone segment, driven by the proliferation of independent food businesses utilizing these platforms.

United Kingdom Food Service Market Product Innovations

Recent years have witnessed significant innovation within the UK food service market. Technological advancements such as AI-driven ordering systems, personalized recommendations, and kitchen automation are enhancing efficiency and customer experience. The increasing focus on sustainable practices, plant-based alternatives, and locally sourced ingredients is also driving product development. New menu items, catering to specific dietary needs and preferences, are constantly being introduced to meet the evolving demands of health-conscious consumers. These innovations are enhancing the overall customer experience and creating a competitive advantage for businesses that successfully adapt.

Report Segmentation & Scope

This report segments the UK food service market across several key dimensions:

Location: Leisure, Lodging, Retail, Standalone, Travel. The Retail segment is projected to grow at a CAGR of xx% from 2025 to 2033, fuelled by consumer trends and e-commerce advancements.

Foodservice Type: Cafes & Bars, Other QSR Cuisines. The cafes & bars sector is anticipated to experience steady growth, driven by consumer demand for social experiences.

Outlet: Chained Outlets, Independent Outlets. Chained outlets will retain a larger market share, while independent outlets will see growth fuelled by local community preference and unique offerings.

Key Drivers of United Kingdom Food Service Market Growth

Several factors contribute to the growth of the UK food service market:

- Rising Disposable Incomes: Increased spending power allows consumers to allocate more funds towards eating out.

- Changing Lifestyles: Busy lifestyles and time constraints fuel demand for convenient food options.

- Technological Advancements: Online ordering, delivery platforms, and automated systems enhance efficiency and reach.

- Tourism: International and domestic tourism contributes significantly to revenue in major cities.

Challenges in the United Kingdom Food Service Market Sector

The UK food service market faces several challenges:

- Rising Food Costs: Increased ingredient prices and supply chain disruptions impact profitability.

- Labor Shortages: The industry struggles to attract and retain skilled employees.

- Intense Competition: The highly competitive environment necessitates continuous innovation and cost optimization.

- Economic Uncertainty: Macroeconomic factors, such as inflation, can significantly impact consumer spending.

Leading Players in the United Kingdom Food Service Market Market

- Domino's Pizza Group PLC

- Marston's PLC

- Yum! Brands Inc

- Admiral Taverns Ltd

- Doctor's Associates Inc

- The Restaurant Group PLC

- PizzaExpress (Restaurants) Limited

- Nando's Group Holdings Limited

- Stonegate Group

- Tesco PLC

- Co-operative Group Limited

- Costa Coffee

- Starbucks Corporation

- Mitchells & Butlers PLC

- McDonald's Corporation

- Pizza Hut (U K ) Limited

- Whitbread PLC

- Greggs PLC

Key Developments in United Kingdom Food Service Market Sector

- August 2023: Starbucks announced plans to invest USD 32.78 Million in opening 100 new outlets, demonstrating continued market confidence.

- January 2023: Costa Coffee expanded its menu with new offerings, catering to evolving consumer preferences and dietary needs.

- December 2022: Co-op's partnership with Just Eat enhanced online delivery options, increasing market accessibility and convenience.

Strategic United Kingdom Food Service Market Market Outlook

The UK food service market presents significant opportunities for growth in the coming years. Continued investment in technology, a focus on sustainable practices, and an understanding of evolving consumer preferences will be crucial for success. The rise of online ordering and delivery platforms presents new avenues for expansion, while the increasing emphasis on health and wellness offers opportunities for innovative product development and market differentiation. Strategic partnerships and acquisitions will play a vital role in shaping the competitive landscape and driving future growth.

United Kingdom Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Food Service Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Rising coffee and tea consumption in the country especially in speciality tea/coffee is driving the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Germany United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Domino's Pizza Group PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Marston's PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Yum! Brands Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Admiral Taverns Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Doctor's Associates Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Restaurant Group PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 PizzaExpress (Restaurants) Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nando's Group Holdings Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Stonegate Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Tesco PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Co-operative Group Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Costa Coffee

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Starbucks Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Mitchells & Butlers PLC

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 McDonald's Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Pizza Hut (U K ) Limited

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Whitbread PLC

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Greggs PLC

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Domino's Pizza Group PLC

List of Figures

- Figure 1: United Kingdom Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: United Kingdom Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: United Kingdom Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: United Kingdom Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: United Kingdom Food Service Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Food Service Market?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the United Kingdom Food Service Market?

Key companies in the market include Domino's Pizza Group PLC, Marston's PLC, Yum! Brands Inc, Admiral Taverns Ltd, Doctor's Associates Inc, The Restaurant Group PLC, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, Stonegate Group, Tesco PLC, Co-operative Group Limited, Costa Coffee, Starbucks Corporation, Mitchells & Butlers PLC, McDonald's Corporation, Pizza Hut (U K ) Limited, Whitbread PLC, Greggs PLC.

3. What are the main segments of the United Kingdom Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Rising coffee and tea consumption in the country especially in speciality tea/coffee is driving the market growth.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Costa Coffee added new servings to its menu like Cajun Spiced Chicken Pizza Wrap, uzeTea Mellow Mango Superfuzions Tea, FuzeTea Spiced Apple flavor Superfuzions Tea, FuzeTea Citrus Zing Superfuzions Tea, vegan BBQ Chick'n Panini, Burts BBQ Lentil Chips, Poached Egg & Bacon Brioche, M&S Smoked Ham & Coleslaw Sandwich or the new M&S Minestrone with Bacon Soup, M&S pineapple chunks, and a new range of Chocolate Cornflake Cake and caramel cakes at its outlets in the United Kingdom.December 2022: Co-op partnered with Just Eat to launch an on-demand online delivery partnership, increasing access to quick convenience shopping in communities nationwide. Through the tie-up, shoppers can order items from Co-op for speedy delivery in under 30 minutes via the Just Eat app and website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Food Service Market?

To stay informed about further developments, trends, and reports in the United Kingdom Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence