Key Insights

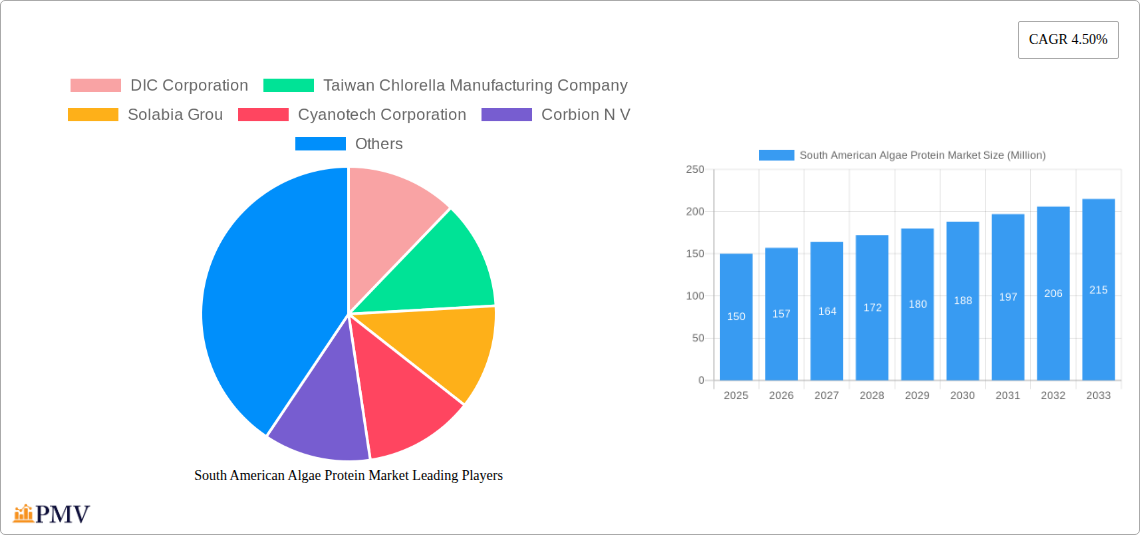

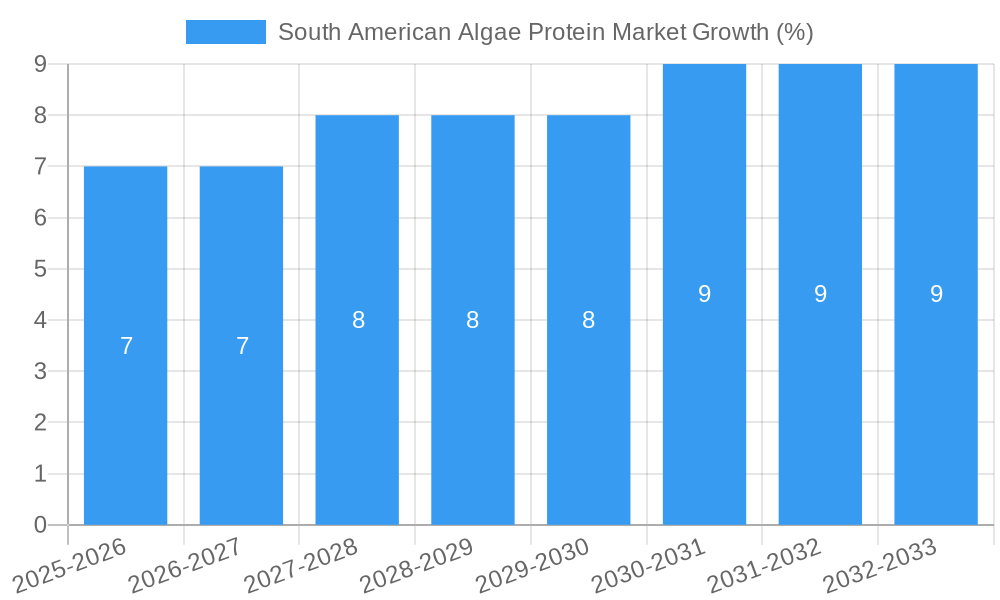

The South American algae protein market, currently experiencing robust growth, presents a lucrative opportunity for investors and businesses. Driven by increasing consumer awareness of the health benefits of plant-based proteins and the rising demand for sustainable food sources, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 4.50% from 2025 to 2033. Key segments driving this growth include spirulina and chlorella, primarily used in food and beverage applications and dietary supplements. The burgeoning health and wellness sector in South America, coupled with increasing disposable incomes, particularly in countries like Brazil and Argentina, fuels market expansion. Furthermore, the region's favorable climate and agricultural conditions are conducive to algae cultivation, supporting domestic production and reducing reliance on imports. However, challenges remain, including the relatively high cost of production compared to traditional protein sources and the need for greater consumer education about the benefits of algae protein. Companies like DIC Corporation, Taiwan Chlorella Manufacturing Company, and Solabia Group are actively shaping the market landscape through product innovation and strategic partnerships.

While the precise market size for 2025 is not provided, considering a CAGR of 4.5% and a historical period from 2019 to 2024, we can estimate a reasonable base year value. Assuming a moderate market size in 2024, and applying the CAGR, a projected market size for 2025 can be realistically extrapolated. The market segmentation shows strong demand for spirulina and chlorella. The food and beverage segment is expected to be a major contributor, reflecting broader trends toward plant-based diets. Continued growth will depend on addressing price sensitivity, expanding distribution channels, and fostering broader acceptance of algae proteins among consumers. Future market analysis should incorporate factors like technological advancements in algae cultivation and the evolving regulatory landscape.

South American Algae Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South American algae protein market, offering invaluable insights for stakeholders across the value chain. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, competitive landscapes, and future growth prospects, providing actionable intelligence for informed decision-making. The estimated market size in 2025 is valued at xx Million.

South American Algae Protein Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the South American algae protein market, focusing on market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with a few key players holding significant market share. However, the entry of new players and increased innovation are expected to intensify competition in the coming years.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025.

- Innovation Ecosystem: The market shows a growing interest in sustainable and innovative algae protein production technologies, leading to several R&D investments.

- Regulatory Frameworks: Varying regulatory landscapes across South American countries impact the market, necessitating country-specific compliance strategies.

- Product Substitutes: Plant-based and traditional protein sources pose competitive challenges to algae protein, impacting market penetration.

- End-User Trends: Increasing consumer awareness of health and environmental benefits drives the adoption of algae protein in various applications.

- M&A Activities: The past five years have witnessed xx M&A deals in the South American algae protein market, with a total transaction value of approximately xx Million. These deals reflect the industry's consolidation and strategic expansion.

South American Algae Protein Market Industry Trends & Insights

The South American algae protein market is experiencing significant growth, fueled by several factors. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration is steadily increasing, particularly within the food and beverage and dietary supplement sectors. Consumer preference shifts towards healthier and more sustainable food choices are key drivers of this growth. Technological advancements in algae cultivation and extraction are enhancing production efficiency and lowering costs. Competitive dynamics are characterized by both established players and emerging companies striving for market dominance. The increasing demand for sustainable protein sources coupled with technological disruptions in algae cultivation will reshape the industry over the coming years. This segment analysis offers a granular perspective on factors impacting market growth trajectory, product demand, and emerging trends within the South American Algae Protein market.

Dominant Markets & Segments in South American Algae Protein Market

This section identifies the leading regions, countries, and market segments within the South American algae protein market.

By Type:

- Spirulina: Spirulina dominates the market due to its high protein content, nutritional profile, and established market presence. Key drivers include:

- Growing consumer demand for functional foods and supplements.

- Favorable government policies promoting sustainable food production.

- Efficient cultivation techniques.

- Chlorella: Chlorella holds a significant market share, driven by its rich nutritional composition. Factors influencing its growth include:

- Increased awareness of Chlorella’s health benefits.

- Expanding applications in nutraceuticals.

- Growing consumer preference for organic products.

- Other Types: This segment is relatively smaller but is expected to see growth driven by research into novel algae species with unique protein profiles.

By Application:

- Food & Beverages: This segment is the largest, with algae protein incorporated into various products like protein bars, smoothies, and baked goods. Drivers include:

- Rising demand for plant-based protein alternatives.

- Growing health and wellness consciousness among consumers.

- Dietary Supplements: Algae protein’s nutritional richness positions it well within the dietary supplement sector, contributing to strong segment growth. Factors include:

- The booming health and wellness industry in South America.

- Growing acceptance of algae-based supplements.

- Pharmaceuticals: This segment exhibits promising growth potential as algae proteins are explored for their therapeutic properties. Drivers include:

- Research into algae's potential health benefits.

- Rising demand for natural remedies and functional foods.

- Other Applications: This segment encompasses various applications such as animal feed and cosmetics, with gradual but consistent market penetration.

Brazil currently holds the largest market share in South America owing to its significant population and robust food and beverage industry. Furthermore, favorable government regulations supporting sustainable agriculture contribute significantly to this market leadership.

South American Algae Protein Market Product Innovations

Recent innovations include the development of new algae strains with enhanced protein content and improved taste and texture profiles. Technological advancements in algae cultivation, such as closed photobioreactors, are increasing production efficiency and reducing costs. These advancements, combined with strategic partnerships and marketing efforts to highlight the unique benefits of algae protein, are shaping the competitive landscape.

Report Segmentation & Scope

The report segments the South American algae protein market by type (Spirulina, Chlorella, Other Types) and application (Food & Beverages, Dietary Supplements, Pharmaceuticals, Other Applications). Growth projections for each segment vary based on specific market drivers and challenges. Market sizes are detailed for each segment in the full report, alongside competitive analyses highlighting key players' market positions and strategies.

Key Drivers of South American Algae Protein Market Growth

Key drivers include the rising demand for sustainable and plant-based protein sources, increasing consumer awareness of health benefits, and technological advancements enabling efficient and cost-effective algae cultivation. Government initiatives promoting sustainable agriculture and investment in research and development also contribute significantly to market expansion.

Challenges in the South American Algae Protein Market Sector

Challenges include the relatively high cost of algae protein production compared to conventional protein sources, regulatory hurdles in some South American countries, and potential supply chain limitations. Competition from established protein sources, including soy and pea proteins, also poses a significant challenge to market growth.

Leading Players in the South American Algae Protein Market Market

- DIC Corporation

- Taiwan Chlorella Manufacturing Company

- Solabia Group

- Cyanotech Corporation

- Corbion N.V.

- Roquette Frères

- EID Parry

Key Developments in South American Algae Protein Market Sector

- January 2023: Solabia Group launched a new line of algae-based protein ingredients for the food and beverage industry.

- June 2022: DIC Corporation invested xx Million in expanding its algae cultivation facilities in Brazil.

- October 2021: A major merger occurred between two smaller algae protein producers in Chile, creating a larger player in the market. Further specific details are provided within the full report.

Strategic South American Algae Protein Market Market Outlook

The South American algae protein market presents substantial growth potential, driven by evolving consumer preferences, technological innovations, and supportive regulatory frameworks. Strategic opportunities exist for companies to invest in research and development, expand production capacity, and develop innovative algae-based products tailored to specific market needs. Focus on product diversification, sustainable production practices, and establishing strong distribution channels will be crucial for success in this rapidly evolving market.

South American Algae Protein Market Segmentation

-

1. Type

- 1.1. Spirulina

- 1.2. Chlorella

- 1.3. Other Types

-

2. Application

- 2.1. Food & Beverages

- 2.2. Dietary Supplements

- 2.3. Pharmaceuticals

- 2.4. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South American Algae Protein Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South American Algae Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Low-Sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Spirulina is Witnessing A Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Spirulina

- 5.1.2. Chlorella

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverages

- 5.2.2. Dietary Supplements

- 5.2.3. Pharmaceuticals

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Spirulina

- 6.1.2. Chlorella

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverages

- 6.2.2. Dietary Supplements

- 6.2.3. Pharmaceuticals

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Spirulina

- 7.1.2. Chlorella

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverages

- 7.2.2. Dietary Supplements

- 7.2.3. Pharmaceuticals

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Spirulina

- 8.1.2. Chlorella

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverages

- 8.2.2. Dietary Supplements

- 8.2.3. Pharmaceuticals

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 DIC Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Taiwan Chlorella Manufacturing Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Solabia Grou

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cyanotech Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Corbion N V

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Roquette Freres

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EID Parry

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 DIC Corporation

List of Figures

- Figure 1: South American Algae Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South American Algae Protein Market Share (%) by Company 2024

List of Tables

- Table 1: South American Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South American Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Algae Protein Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the South American Algae Protein Market?

Key companies in the market include DIC Corporation, Taiwan Chlorella Manufacturing Company, Solabia Grou, Cyanotech Corporation, Corbion N V, Roquette Freres, EID Parry.

3. What are the main segments of the South American Algae Protein Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Low-Sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Spirulina is Witnessing A Significant Growth.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Algae Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Algae Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Algae Protein Market?

To stay informed about further developments, trends, and reports in the South American Algae Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence