Key Insights

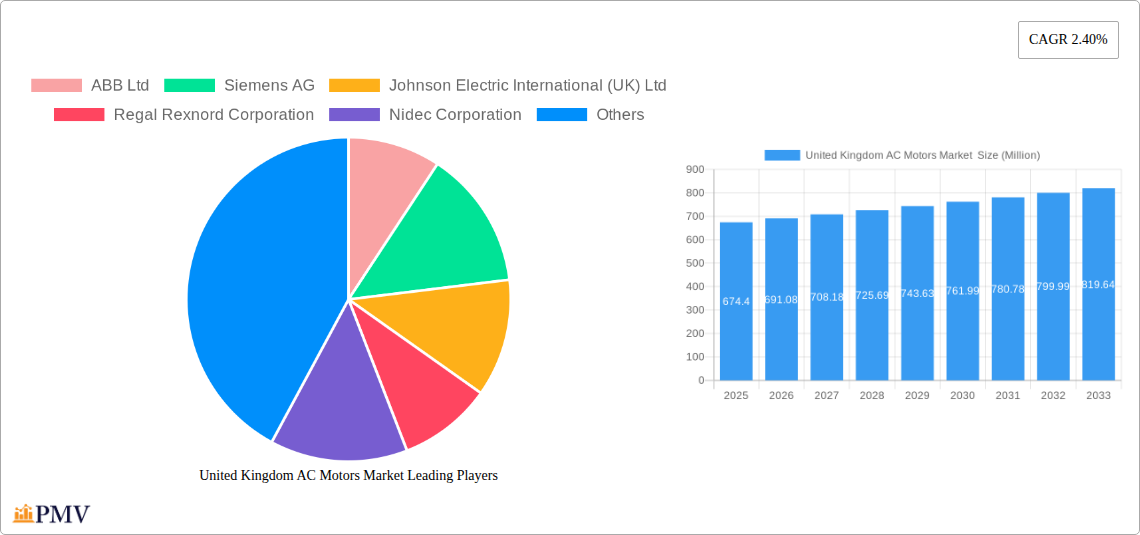

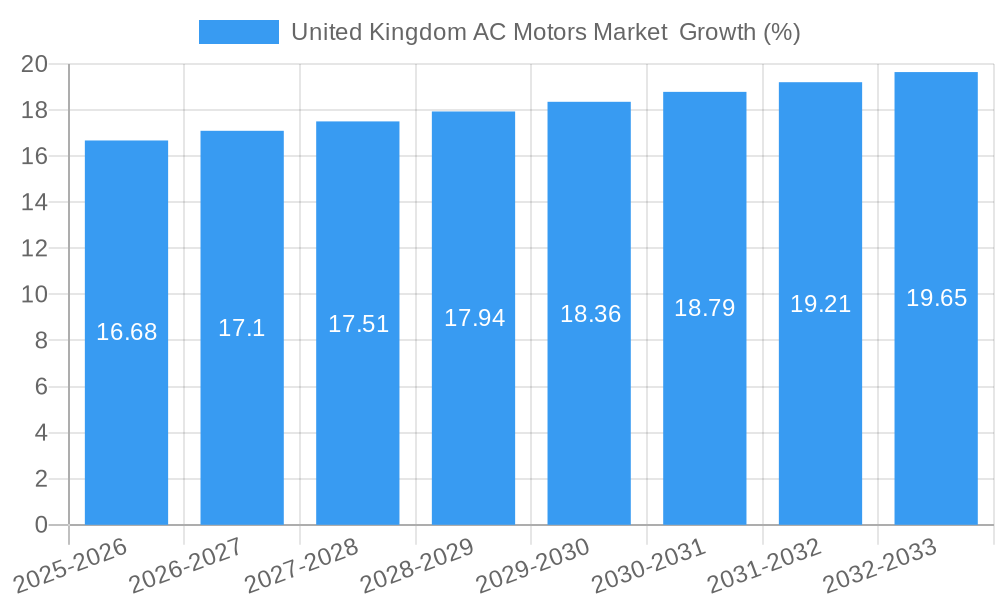

The UK AC Motors market, valued at £674.40 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.40% from 2025 to 2033. This growth is driven by several key factors. The increasing adoption of automation and electrification across various industrial sectors, including manufacturing, automotive, and energy, fuels the demand for efficient and reliable AC motors. Furthermore, government initiatives promoting energy efficiency and sustainable practices are indirectly boosting the market by incentivizing the adoption of high-efficiency AC motors. Stringent environmental regulations are also playing a role, pushing manufacturers to adopt cleaner and more energy-efficient technologies. Competitive pricing strategies employed by established players like ABB Ltd, Siemens AG, and Nidec Corporation, alongside the emergence of innovative solutions from smaller companies, contribute to market expansion. However, challenges remain. Fluctuations in raw material prices and supply chain disruptions can impact production costs and market stability. Additionally, intense competition within the market necessitates continuous innovation and improvements in product offerings to maintain a competitive edge.

Looking ahead, the market is poised for further expansion, driven by the ongoing trend of industrial automation and the increasing adoption of smart factories. The integration of advanced technologies, such as IoT and AI, into AC motor systems is expected to create new opportunities for market players. Furthermore, the growing emphasis on reducing carbon emissions and improving energy efficiency across industries will likely stimulate demand for high-performance, energy-saving AC motors. However, economic uncertainty and potential geopolitical instability could pose a risk to market growth in the long term. Companies are expected to focus on strategic partnerships and collaborations to mitigate these challenges and capitalize on emerging growth opportunities. The market segmentation will likely see continued growth in high-efficiency motors, coupled with increasing demand for specialized AC motors designed for specific applications.

United Kingdom AC Motors Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom AC Motors market, covering the period from 2019 to 2033. With a focus on market structure, competitive dynamics, industry trends, and future outlook, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), the base year (2025), and offers estimations for the estimated year (2025) and forecasts for the forecast period (2025-2033). Market values are expressed in Millions.

United Kingdom AC Motors Market Structure & Competitive Dynamics

The UK AC Motors market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Key players include ABB Ltd, Siemens AG, Johnson Electric International (UK) Ltd, Regal Rexnord Corporation, Nidec Corporation, Toshiba Mitsubishi-Electric Industrial Systems Corporation, TEC Electric Motors Ltd, Rockwell Automation, TECO Electric Europe Ltd, TTE UK & Ireland Ltd, Mellor Electrics Ltd, and WEG Electric Corporation. However, the market also accommodates several smaller, specialized players and emerging startups. The market share distribution is currently estimated (2025) at xx%, with ABB and Siemens holding the largest shares.

Innovation within the ecosystem is driven by advancements in motor design, control technologies, and materials science. Regulatory frameworks, particularly concerning energy efficiency and environmental standards, significantly impact market dynamics. The presence of substitute technologies, such as DC motors and linear actuators, creates competitive pressure. End-user trends, particularly in industrial automation and renewable energy, shape demand patterns. Recent M&A activities have been moderate, with deal values estimated at approximately £xx Million in the past five years, primarily focused on strengthening technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated.

- Innovation: Driven by advancements in motor design and control technologies.

- Regulatory Landscape: Significant impact from energy efficiency and environmental standards.

- Product Substitutes: DC motors, linear actuators.

- End-User Trends: Industrial automation, renewable energy.

- M&A Activity: Moderate activity, with total deal values estimated at approximately £xx Million (2019-2024).

United Kingdom AC Motors Market Industry Trends & Insights

The UK AC Motors market is experiencing steady growth, driven by increased industrial automation, the burgeoning renewable energy sector, and government initiatives promoting energy efficiency. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033. Technological disruptions, particularly the adoption of advanced motor control algorithms and the development of high-efficiency motors, are reshaping the competitive landscape. Consumer preferences are shifting towards energy-efficient and sustainable solutions.

Dominant Markets & Segments in United Kingdom AC Motors Market

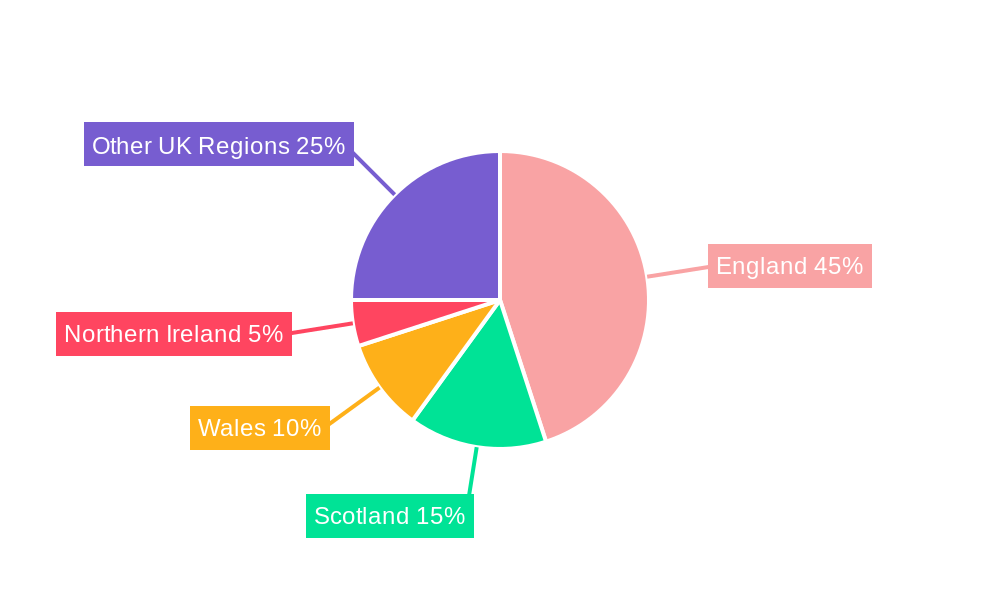

The industrial sector dominates the UK AC Motors market, with significant demand from manufacturing, automation, and infrastructure development. Specific sub-segments within the industrial sector such as automotive manufacturing, food processing, and material handling also show strong growth. The South East region leads in market share, driven by a high concentration of industrial activity and significant investments in infrastructure.

- Key Drivers for Industrial Sector Dominance:

- High levels of industrial activity and automation.

- Investments in infrastructure projects.

- Strong government support for industrial modernization.

- Adoption of advanced manufacturing technologies.

- South East Region Dominance:

- High concentration of industrial activity and manufacturing plants.

- Strong economic growth and investment in infrastructure.

- Government initiatives to support economic development in the region.

United Kingdom AC Motors Market Product Innovations

Recent innovations in the UK AC Motors market include the development of high-efficiency motors with improved power density and reduced energy consumption. Advances in materials science have led to more robust and durable motors, while improved control algorithms offer enhanced precision and responsiveness. These innovations cater to the growing demand for energy efficiency and enhanced performance across various industrial applications.

Report Segmentation & Scope

The report segments the UK AC Motors market based on motor type (e.g., induction motors, synchronous motors, servo motors), power rating, voltage, application (industrial, commercial, residential), and end-user industry. Each segment offers unique growth projections, market sizes, and competitive dynamics. For example, the high-efficiency motor segment is projected to exhibit the fastest growth, driven by increasing energy costs and stringent environmental regulations. The industrial sector is expected to maintain its dominant position, with continued growth spurred by investments in automation and modernization initiatives.

Key Drivers of United Kingdom AC Motors Market Growth

Several factors drive growth within the UK AC Motors market. Technological advancements, notably in high-efficiency motors and smart control systems, are key contributors. Government incentives supporting energy efficiency and industrial automation create a favorable environment. The expansion of the renewable energy sector, requiring robust and reliable AC motors, is another significant growth driver.

Challenges in the United Kingdom AC Motors Market Sector

The UK AC Motors market faces challenges, including fluctuations in raw material prices which impacting production costs. Supply chain disruptions can also lead to delays and increased costs, while intense competition from both domestic and international players creates a challenging business environment. Furthermore, stringent environmental regulations require continuous adaptation and investment in research and development of more sustainable technologies.

Leading Players in the United Kingdom AC Motors Market Market

- ABB Ltd (ABB Ltd)

- Siemens AG (Siemens AG)

- Johnson Electric International (UK) Ltd

- Regal Rexnord Corporation (Regal Rexnord Corporation)

- Nidec Corporation (Nidec Corporation)

- Toshiba Mitsubishi-Electric Industrial Systems Corporation (Toshiba Mitsubishi-Electric Industrial Systems Corporation)

- TEC Electric Motors Ltd

- Rockwell Automation (Rockwell Automation)

- TECO Electric Europe Ltd

- TTE UK & Ireland Ltd

- Mellor Electrics Ltd

- WEG Electric Corporation (WEG Electric Corporation) *List Not Exhaustive

Key Developments in United Kingdom AC Motors Market Sector

- September 2023: Rockwell Automation Inc. and Infinitum announced an exclusive agreement to jointly develop a new class of high-efficiency, integrated low-voltage drive and motor technology. This collaboration signifies a significant step towards more efficient and sustainable motor solutions.

- February 2024: Monumo, a British startup, announced its patented technology for a switched reluctance motor (SRM), achieving a 50% reduction in torque ripple. This breakthrough highlights the potential for innovation and disruption in the AC motor market.

Strategic United Kingdom AC Motors Market Market Outlook

The UK AC Motors market presents significant growth potential, driven by technological advancements, government policies, and the expansion of key end-user sectors. Strategic opportunities exist for companies to invest in research and development of high-efficiency motors, smart control systems, and sustainable solutions. Collaborations and partnerships are key to navigating the complexities of the market and capturing market share. The market is poised for substantial growth, fueled by industrial modernization initiatives and the transition to a greener economy.

United Kingdom AC Motors Market Segmentation

-

1. Type

-

1.1. Induction AC Motor

- 1.1.1. Single Phase

- 1.1.2. Poly Phase

-

1.2. Synchronous AC Motor

- 1.2.1. DC Excited Rotor

- 1.2.2. Permanent Magnet

- 1.2.3. Hysteresis Motor

- 1.2.4. Reluctance Motor

-

1.1. Induction AC Motor

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemical & Petrochemical

- 2.3. Power Generation

- 2.4. Water & Wastewater

- 2.5. Metal & Mining

- 2.6. Food & Beverage

- 2.7. Discrete Industries

- 2.8. Other End-user Industries

United Kingdom AC Motors Market Segmentation By Geography

- 1. United Kingdom

United Kingdom AC Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Recent Initiatives to Revive the Industrial Sector in the UK; Growing Demand for Household Appliances

- 3.3. Market Restrains

- 3.3.1. Recent Initiatives to Revive the Industrial Sector in the UK; Growing Demand for Household Appliances

- 3.4. Market Trends

- 3.4.1. Recent Initiatives to Revive the Industrial Sector in the UK to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom AC Motors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Induction AC Motor

- 5.1.1.1. Single Phase

- 5.1.1.2. Poly Phase

- 5.1.2. Synchronous AC Motor

- 5.1.2.1. DC Excited Rotor

- 5.1.2.2. Permanent Magnet

- 5.1.2.3. Hysteresis Motor

- 5.1.2.4. Reluctance Motor

- 5.1.1. Induction AC Motor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical & Petrochemical

- 5.2.3. Power Generation

- 5.2.4. Water & Wastewater

- 5.2.5. Metal & Mining

- 5.2.6. Food & Beverage

- 5.2.7. Discrete Industries

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Electric International (UK) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Regal Rexnord Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nidec Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toshiba Mitsubishi-Electric Industrial Systems Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TEC Electric Motors Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rockwell Automation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TECO Electric Europe Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TTE UK & Ireland Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mellor Electrics Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 WEG Electric Corporation*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: United Kingdom AC Motors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom AC Motors Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom AC Motors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom AC Motors Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Kingdom AC Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United Kingdom AC Motors Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: United Kingdom AC Motors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: United Kingdom AC Motors Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 7: United Kingdom AC Motors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom AC Motors Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: United Kingdom AC Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United Kingdom AC Motors Market Volume Million Forecast, by Type 2019 & 2032

- Table 11: United Kingdom AC Motors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: United Kingdom AC Motors Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 13: United Kingdom AC Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom AC Motors Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom AC Motors Market ?

The projected CAGR is approximately 2.40%.

2. Which companies are prominent players in the United Kingdom AC Motors Market ?

Key companies in the market include ABB Ltd, Siemens AG, Johnson Electric International (UK) Ltd, Regal Rexnord Corporation, Nidec Corporation, Toshiba Mitsubishi-Electric Industrial Systems Corporation, TEC Electric Motors Ltd, Rockwell Automation, TECO Electric Europe Ltd, TTE UK & Ireland Ltd, Mellor Electrics Ltd, WEG Electric Corporation*List Not Exhaustive.

3. What are the main segments of the United Kingdom AC Motors Market ?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 674.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Recent Initiatives to Revive the Industrial Sector in the UK; Growing Demand for Household Appliances.

6. What are the notable trends driving market growth?

Recent Initiatives to Revive the Industrial Sector in the UK to Support Market Growth.

7. Are there any restraints impacting market growth?

Recent Initiatives to Revive the Industrial Sector in the UK; Growing Demand for Household Appliances.

8. Can you provide examples of recent developments in the market?

February 2024 - Monumo, a British startup that leverages advanced AI technology to reimagine the electric motor, announced that its patented technology led to the development of a deep tech-engineered design for a switched reluctance motor (SRM), enabling it to achieve a 50% reduction in torque ripple throughout the drive cycle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom AC Motors Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom AC Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom AC Motors Market ?

To stay informed about further developments, trends, and reports in the United Kingdom AC Motors Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence