Key Insights

The UK indoor LED lighting market is poised for significant expansion, propelled by stringent energy efficiency mandates, heightened environmental consciousness, and the inherent long-term cost benefits of LED technology. The market, currently valued at $2.9 billion, is projected to achieve a Compound Annual Growth Rate (CAGR) of 8.3% from 2024 through 2033. This robust growth trajectory is underpinned by the widespread integration of smart lighting systems, the convergence of LED technology with Internet of Things (IoT) applications, and a pervasive demand for energy-efficient solutions across diverse industries. The residential sector anticipates substantial growth, fueled by rising disposable incomes and consumer preference for aesthetically pleasing, energy-conscious lighting. Similarly, the commercial and industrial sectors are expected to contribute significantly, driven by government incentives for energy-saving upgrades and an intensified focus on operational cost reduction.

UK Indoor LED Lighting Market Market Size (In Billion)

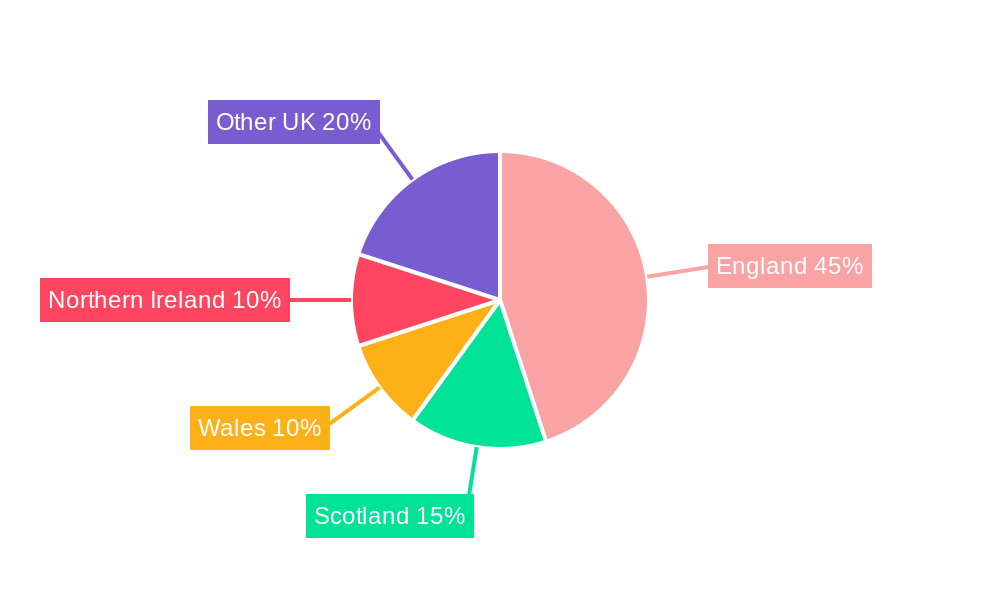

Market segmentation highlights key opportunities. Agricultural lighting is experiencing increased adoption for its ability to optimize plant growth and enhance crop yields. Commercial applications, such as offices and retail environments, benefit from the energy savings and aesthetic improvements offered by LED solutions. The industrial and warehouse segments, categorized under "Others," are witnessing growth driven by the necessity for durable, long-lasting, and energy-efficient lighting. Leading players, including OSRAM and Signify (Philips), are actively engaged in continuous innovation, strategic partnerships, and market segment expansion to maintain a competitive advantage. Geographically, the UK market exhibits a relatively uniform distribution across England, Wales, Scotland, and Northern Ireland, with localized variations in market penetration influenced by building regulations, government initiatives, and population density.

UK Indoor LED Lighting Market Company Market Share

UK Indoor LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK indoor LED lighting market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025, this study forecasts market trends, identifies key players, and unveils lucrative opportunities for growth. The report's detailed segmentation, competitive landscape analysis, and industry trend exploration equip businesses with actionable intelligence to navigate the dynamic UK LED lighting market. The total market size in 2025 is estimated at £XX Million, projected to reach £XX Million by 2033, exhibiting a CAGR of xx%.

UK Indoor LED Lighting Market Structure & Competitive Dynamics

The UK indoor LED lighting market exhibits a moderately concentrated structure, with several major players vying for market share. Key factors influencing the market dynamics include innovation ecosystems driving product differentiation, stringent regulatory frameworks promoting energy efficiency, the availability of alternative lighting technologies (product substitutes), evolving end-user preferences towards smart and sustainable solutions, and ongoing mergers and acquisitions (M&A) activity reshaping the competitive landscape.

Market Concentration: The top 5 players hold an estimated xx% market share in 2025. This concentration is expected to slightly decrease by 2033 due to the entry of new players and increased competition.

Innovation Ecosystems: Significant investments in R&D are fueling innovation in areas such as smart lighting, IoT integration, and energy-harvesting technologies. This leads to new product categories and enhanced functionalities.

Regulatory Frameworks: Stringent energy efficiency regulations and building codes drive the adoption of energy-saving LED lighting solutions. Government incentives and initiatives further stimulate market growth.

Product Substitutes: Competition exists from other lighting technologies, such as halogen and fluorescent lighting. However, the superior energy efficiency and longevity of LEDs continue to fuel market dominance.

End-User Trends: The increasing demand for energy-efficient, aesthetically pleasing, and smart lighting solutions across residential, commercial, and industrial sectors fuels market expansion.

M&A Activities: The last five years have seen xx M&A deals in the UK indoor LED lighting market, with a total estimated value of £xx Million. These activities are often driven by strategies to expand market reach, enhance product portfolios, and access new technologies.

UK Indoor LED Lighting Market Industry Trends & Insights

The UK indoor LED lighting market is experiencing robust growth, propelled by several factors. The increasing awareness of energy efficiency and cost savings associated with LEDs is a key driver. Technological advancements, such as smart lighting systems and IoT integration, are transforming the market, offering enhanced control, automation, and data analytics capabilities. Consumer preferences are shifting towards stylish and customizable lighting solutions that align with individual needs and aesthetics. The competitive landscape remains dynamic, with companies continually striving for innovation and differentiation through product features, pricing strategies, and service offerings. The market is also influenced by government initiatives promoting sustainable practices and reducing carbon footprints. The CAGR for the forecast period (2025-2033) is estimated at xx%, indicating a healthy growth trajectory. Market penetration of LED lighting in various segments continues to rise, exceeding xx% in the residential sector and approaching xx% in the commercial sector by 2025.

Dominant Markets & Segments in UK Indoor LED Lighting Market

The commercial segment currently dominates the UK indoor LED lighting market, driven by high adoption rates in offices, retail spaces, and hospitality settings. The residential segment exhibits strong growth potential, fueled by increasing disposable incomes and a preference for energy-efficient solutions. The industrial and warehouse segment is also witnessing significant growth due to cost savings associated with reduced energy consumption. The agricultural lighting segment, while currently smaller, shows promise due to increasing automation and optimized growing techniques.

Key Drivers for Commercial Dominance:

- High concentration of commercial buildings requiring lighting upgrades.

- Strong government incentives and energy efficiency mandates.

- Higher adoption of smart lighting systems for enhanced efficiency and cost savings.

Key Drivers for Residential Growth:

- Rising awareness of energy efficiency and cost benefits of LEDs.

- Growing demand for aesthetically pleasing and customizable lighting solutions.

- Increased affordability of high-quality LED lighting products.

Key Drivers for Industrial and Warehouse Growth:

- Focus on cost reduction and operational efficiency improvements.

- Higher adoption of high-bay and low-bay LED lighting solutions.

- Improved lighting quality leading to enhanced productivity and safety.

The detailed analysis within the report explores the specific market size and growth projections for each segment and provides a regional breakdown of market dominance.

UK Indoor LED Lighting Market Product Innovations

Recent product innovations focus on enhancing energy efficiency, improving aesthetics, and integrating smart functionalities. Manufacturers are increasingly offering smart lighting systems with advanced control options, dimming capabilities, and IoT connectivity. There is a strong emphasis on developing innovative designs that meet diverse aesthetic needs, ranging from minimalist to ornate styles. The competitive landscape necessitates continuous innovation in terms of cost reduction, performance improvements, and value-added features to stay ahead of competitors. New product features, such as tunable white lighting and human-centric lighting, are gaining traction, aligning with emerging health and wellbeing trends.

Report Segmentation & Scope

This report segments the UK indoor LED lighting market based on the following key parameters:

Indoor Lighting: This segment encompasses applications across residential, commercial, and industrial settings. Growth is largely driven by increased awareness of energy efficiency and the desire for enhanced lighting quality. Competitive dynamics are intense, with key players focusing on differentiation through design, features, and smart functionalities.

Agricultural Lighting: This niche segment is witnessing increasing adoption due to its ability to optimize plant growth. The segment's market size is smaller compared to other segments, however it shows significant potential given increasing demand for food security and modern agricultural practices.

Commercial: This segment represents a significant portion of the market, driven by the need for energy efficiency and improved lighting quality in offices, retail spaces, and hospitality settings. Key players focus on cost-effective solutions and advanced lighting control systems.

Industrial and Warehouse: Energy savings and improved worker safety and productivity drive the growth of this segment. High-bay and low-bay LED lighting systems dominate the market. Competitive advantages focus on durability, efficacy, and ease of installation.

Residential: This segment is characterized by a broad range of consumer preferences and budget considerations. Products are differentiated by design, style, and smart features. Growth is fueled by increasing adoption of energy-efficient lighting and smart home technologies.

Key Drivers of UK Indoor LED Lighting Market Growth

Several key factors are driving the growth of the UK indoor LED lighting market. Stringent government regulations promoting energy efficiency and the reduction of carbon emissions are significant drivers, making LED lighting a preferred choice. The declining cost of LED technology makes it more affordable and accessible, encouraging wider adoption across various sectors. Technological advancements, leading to improved product performance, longer lifespan, and enhanced features, are also significant growth accelerators. The growing demand for smart lighting solutions and the integration of IoT capabilities further contribute to market expansion.

Challenges in the UK Indoor LED Lighting Market Sector

Despite the positive growth outlook, several challenges persist. The volatile pricing of raw materials and components can impact the overall profitability. Intense competition among market players necessitates continuous innovation and differentiation. Supply chain disruptions and logistical challenges, particularly after recent global events, pose ongoing uncertainties. While regulations promote the adoption of LED lighting, navigating the regulatory landscape can be complex for businesses.

Leading Players in the UK Indoor LED Lighting Market Market

- OSRAM GmbH

- Crompton Lamps Limited (GCH Corporation Limited)

- LEDVANCE GmbH (MLS Co Ltd)

- Feilo Sylvania (Shanghai Feilo Acoustics Co Ltd)

- NVC International Holdings Limited

- EGLO Leuchten GmbH

- Acuity Brands Inc

- Signify (Philips)

- Thorn Lighting Ltd (Zumtobel Group)

- Thorlux Lighting (FW Thorpe PLC)

Key Developments in UK Indoor LED Lighting Market Sector

January 2023: Juno (Acuity Brands) showcased RetroBasics™ LED Trim Kits at the NAHB International Builders Show, demonstrating the increasing demand for flexible smart and switchable downlights in both residential and commercial sectors.

March 2023: Aculux announced improvements to its AXE series recessed downlights, enhancing glare control and furthering market leadership in architectural lighting. This highlights the ongoing pursuit of superior lighting quality.

April 2023: Luminaire LED launched its Vandal Resistant Downlight (VRDL) line, expanding its product portfolio into a new segment and addressing the specific needs of challenging environments.

Strategic UK Indoor LED Lighting Market Outlook

The future of the UK indoor LED lighting market looks bright, with continued growth projected throughout the forecast period. Strategic opportunities lie in the development and adoption of smart lighting systems, integration with IoT platforms, and the exploration of innovative lighting designs. Focusing on sustainability and environmentally friendly solutions will be key to remaining competitive. Companies that can successfully navigate the challenges and capitalize on emerging trends are poised for significant growth in this dynamic market.

UK Indoor LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

- 1.2. Commercial

- 1.3. Industrial and Warehouse

- 1.4. Residential

UK Indoor LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Indoor LED Lighting Market Regional Market Share

Geographic Coverage of UK Indoor LED Lighting Market

UK Indoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installations

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. North America UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6.1.1. Agricultural Lighting

- 6.1.2. Commercial

- 6.1.3. Industrial and Warehouse

- 6.1.4. Residential

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7. South America UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7.1.1. Agricultural Lighting

- 7.1.2. Commercial

- 7.1.3. Industrial and Warehouse

- 7.1.4. Residential

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8. Europe UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8.1.1. Agricultural Lighting

- 8.1.2. Commercial

- 8.1.3. Industrial and Warehouse

- 8.1.4. Residential

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9. Middle East & Africa UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9.1.1. Agricultural Lighting

- 9.1.2. Commercial

- 9.1.3. Industrial and Warehouse

- 9.1.4. Residential

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10. Asia Pacific UK Indoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10.1.1. Agricultural Lighting

- 10.1.2. Commercial

- 10.1.3. Industrial and Warehouse

- 10.1.4. Residential

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 OSRAM GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crompton Lamps Limited (GCH Corporation Limited)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Feilo Sylvania (Shanghai Feilo Acoustics Co Ltd)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NVC International Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EGLO Leuchten GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Acuity Brands Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Signify (Philips)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thorn Lighting Ltd (Zumtobel Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thorlux Lighting (FW Thorpe PLC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OSRAM GmbH

List of Figures

- Figure 1: Global UK Indoor LED Lighting Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global UK Indoor LED Lighting Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America UK Indoor LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 4: North America UK Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2025 & 2033

- Figure 5: North America UK Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 6: North America UK Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2025 & 2033

- Figure 7: North America UK Indoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America UK Indoor LED Lighting Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America UK Indoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UK Indoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UK Indoor LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 12: South America UK Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2025 & 2033

- Figure 13: South America UK Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 14: South America UK Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2025 & 2033

- Figure 15: South America UK Indoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 16: South America UK Indoor LED Lighting Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: South America UK Indoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UK Indoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UK Indoor LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 20: Europe UK Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2025 & 2033

- Figure 21: Europe UK Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 22: Europe UK Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2025 & 2033

- Figure 23: Europe UK Indoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe UK Indoor LED Lighting Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe UK Indoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UK Indoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UK Indoor LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 28: Middle East & Africa UK Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2025 & 2033

- Figure 29: Middle East & Africa UK Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 30: Middle East & Africa UK Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2025 & 2033

- Figure 31: Middle East & Africa UK Indoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Indoor LED Lighting Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Indoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UK Indoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UK Indoor LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 36: Asia Pacific UK Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2025 & 2033

- Figure 37: Asia Pacific UK Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 38: Asia Pacific UK Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2025 & 2033

- Figure 39: Asia Pacific UK Indoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Asia Pacific UK Indoor LED Lighting Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Indoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Indoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 2: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 3: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 6: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 7: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 16: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 17: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Brazil UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Argentina UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 26: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 27: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Benelux UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Nordics UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 48: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 49: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Turkey UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Israel UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: GCC UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North Africa UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 64: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2020 & 2033

- Table 65: Global UK Indoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global UK Indoor LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: China UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: India UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Korea UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Oceania UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UK Indoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UK Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Indoor LED Lighting Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the UK Indoor LED Lighting Market?

Key companies in the market include OSRAM GmbH, Crompton Lamps Limited (GCH Corporation Limited), LEDVANCE GmbH (MLS Co Ltd), Feilo Sylvania (Shanghai Feilo Acoustics Co Ltd), NVC International Holdings Limited, EGLO Leuchten GmbH, Acuity Brands Inc, Signify (Philips), Thorn Lighting Ltd (Zumtobel Group, Thorlux Lighting (FW Thorpe PLC).

3. What are the main segments of the UK Indoor LED Lighting Market?

The market segments include Indoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life .

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Initial Cost of Installations.

8. Can you provide examples of recent developments in the market?

April 2023: Luminaire LED, a recognized leader in vandal-resistant lighting systems, announced the launch of its Vandal Resistant Downlight (VRDL) line, the company's first downlight. The architecturally designed series has a clean, elegant style while also being able to withstand hard abuse and demanding situations.March 2023: Aculux, a precision luminaire manufacturer, has announced improvements to its AXE series, its highest-performing family of architectural recessed downlights that feature industry-leading cut-off and glare control to produce quiet ceilings.January 2023: Juno displayed RetroBasicsTM LED Trim Kits, which contain both switchable and smart downlights to mix and match in residential and light commercial settings, at the NAHB International Builders Show (IBS) in Acuity Brands Booth W2974 from January 31 to February 2.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Indoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Indoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Indoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the UK Indoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence