Key Insights

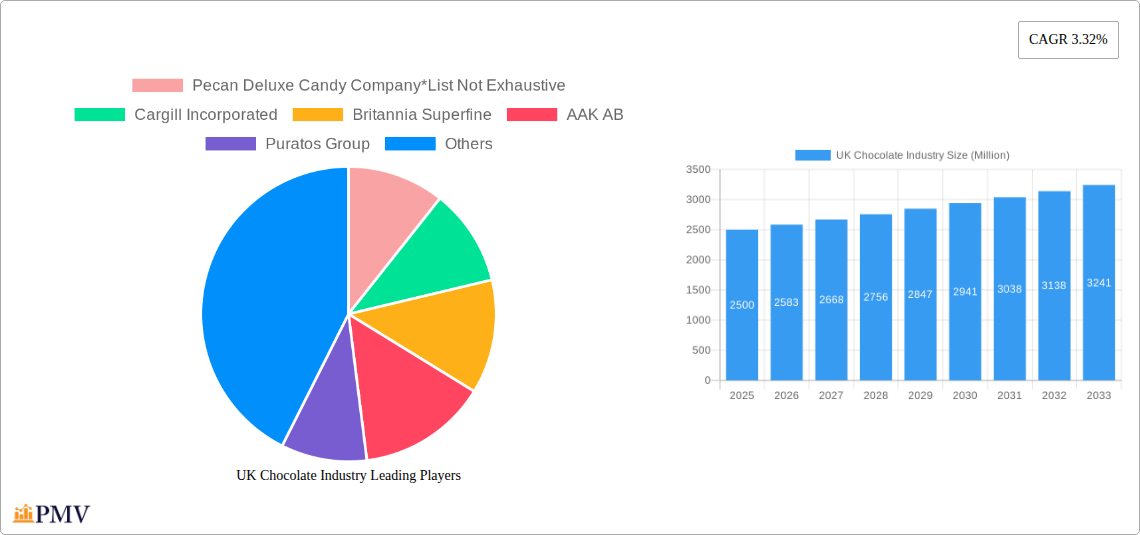

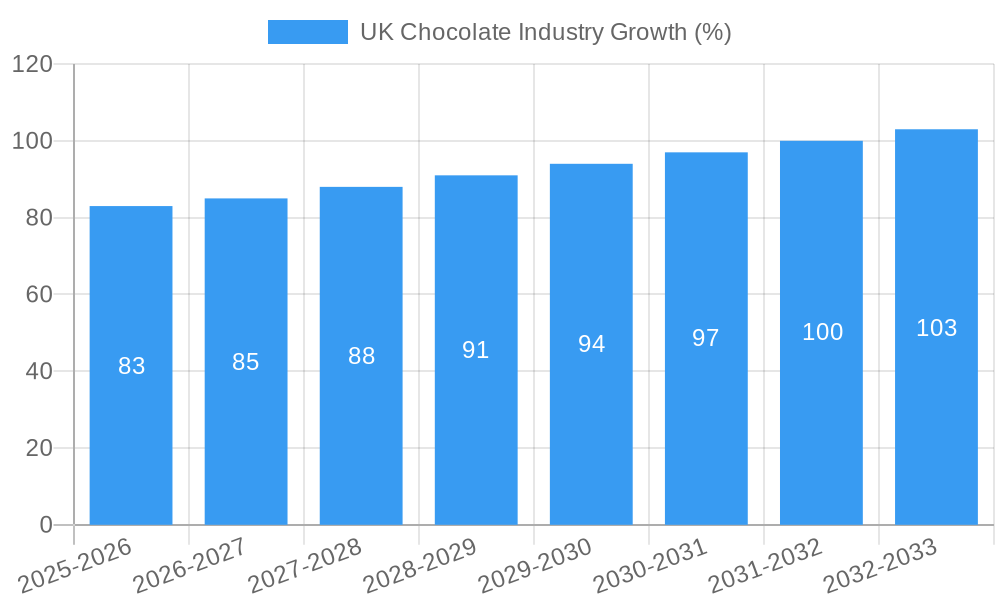

The UK chocolate market, valued at approximately £2.5 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for premium chocolate, innovative product formats, and the expanding popularity of chocolate in diverse applications beyond traditional confectionery. The 3.32% CAGR indicates a consistent upward trajectory, with projected market expansion to approximately £3.2 billion by 2033. Key growth drivers include the rising popularity of gourmet and ethically sourced chocolate, fueled by increased consumer awareness of sustainability and ingredient origin. The market segmentation reveals strong performance in chocolate chips and drops for the baking sector, alongside substantial demand for chocolate in frozen desserts and ice cream. Dark chocolate continues to be a significant segment, driven by health-conscious consumers seeking antioxidants and perceived health benefits. However, the market faces challenges, such as fluctuating cocoa prices and increased competition from international brands. The market’s success hinges on manufacturers’ ability to innovate with new flavors, formats (such as vegan and sugar-free options), and sustainable sourcing practices to cater to evolving consumer preferences.

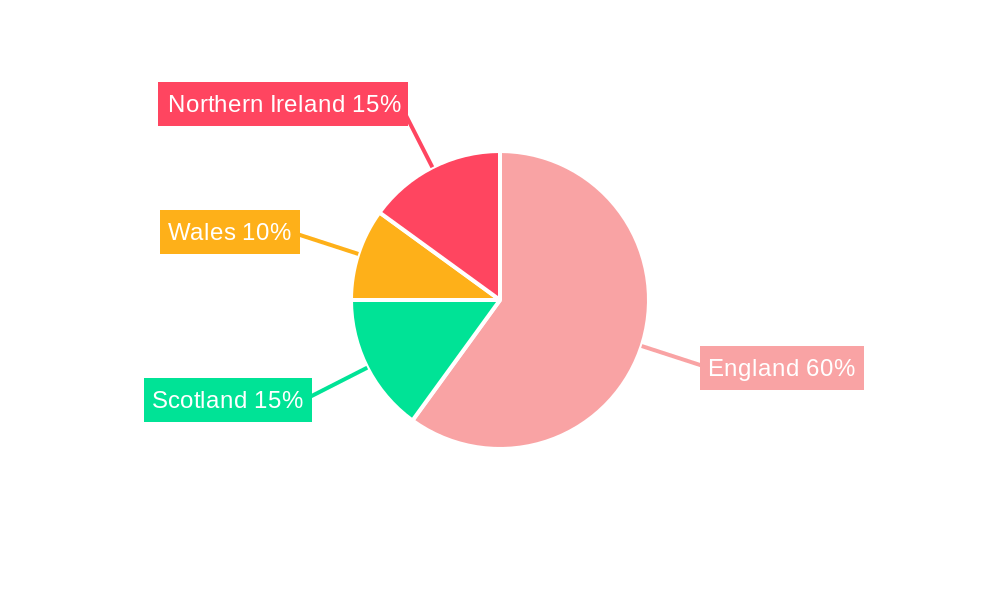

The UK chocolate market's regional variations reflect established consumption patterns within England, Wales, Scotland, and Northern Ireland. While precise regional breakdowns are unavailable, it's reasonable to assume that larger, more densely populated regions like England command a larger market share. The competitive landscape is dominated by established players like Cargill Incorporated, Barry Callebaut Group, and Britannia Superfine, alongside smaller specialist companies like Pecan Deluxe Candy Company and Ingredients UK Ltd. The success of these companies hinges on their ability to leverage branding, product diversification, and effective supply chain management to maintain market share in a dynamic and competitive environment. Future growth opportunities exist in exploring niche segments, such as high-protein chocolate or functional chocolates enriched with vitamins and minerals, to cater to the evolving health and wellness trends among UK consumers.

Unlocking the Sweet Success: A Comprehensive Report on the UK Chocolate Industry (2019-2033)

This in-depth report provides a comprehensive analysis of the UK chocolate industry, offering invaluable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, trends, and future potential. The UK chocolate market, valued at £xx Million in 2024, is poised for significant growth, projected to reach £xx Million by 2033. This report delves into the intricacies of this lucrative market, providing actionable intelligence to navigate its complexities.

UK Chocolate Industry Market Structure & Competitive Dynamics

The UK chocolate market exhibits a moderately concentrated structure, with a few dominant players and a multitude of smaller niche brands. Key players like Barry Callebaut Group, Cargill Incorporated, and Puratos Group hold significant market share, leveraging their established brand recognition and extensive distribution networks. However, the market also witnesses significant competition from smaller, specialized chocolate makers focusing on organic, fair-trade, or artisanal products. The industry's innovation ecosystem is vibrant, with continuous developments in product formulations, packaging, and sustainable sourcing practices.

The regulatory framework within the UK influences product labeling, ingredient sourcing, and marketing claims, promoting transparency and ethical practices. Product substitutes, such as fruit-based snacks and confectionery alternatives, exert some competitive pressure, but the enduring appeal of chocolate remains strong. End-user trends point towards increasing demand for premium, ethically sourced, and healthier chocolate options. M&A activity in the sector has been moderate in recent years, with deal values ranging from £xx Million to £xx Million. Key transactions often focus on expanding distribution networks, acquiring specialized production capabilities, or gaining access to new product lines. Analysis reveals that major players are adopting both organic and inorganic growth strategies, constantly adapting to changing consumer preferences and market demands.

UK Chocolate Industry Industry Trends & Insights

The UK chocolate market is witnessing robust growth, driven by several key factors. A rising disposable income, coupled with the strong popularity of chocolate as a treat and gifting item, is fuelling demand. Technological advancements in chocolate production, including automation and precision engineering, are enhancing efficiency and reducing costs. Consumer preferences are increasingly shifting toward healthier options, with a growing demand for dark chocolate, sugar-reduced formulations, and products with functional benefits. Furthermore, the burgeoning popularity of vegan and free-from chocolate offerings contributes to market diversification. The Compound Annual Growth Rate (CAGR) for the UK chocolate market during the forecast period is estimated at xx%, while market penetration for premium chocolate segments is projected to increase by xx%. Competitive dynamics are shaped by intense branding efforts, product differentiation, and the relentless pursuit of innovative formulations. The market is also witnessing the emergence of direct-to-consumer brands, challenging the traditional distribution models.

Dominant Markets & Segments in UK Chocolate Industry

The UK chocolate market displays regional variations in consumption patterns, with urban areas generally exhibiting higher per capita consumption. However, nationwide distribution networks ensure product availability across the country. Segment analysis reveals that the confectionery application segment holds the largest market share, driven by strong demand for chocolate bars, candies, and other confectionery products. Within product types, milk chocolate maintains the highest market share, followed closely by dark chocolate, reflecting consumer preferences for both familiar tastes and the growing appeal of dark chocolate's health benefits. Within forms, chocolate slabs dominate, while chocolate chips/drops/chunks are gaining traction due to their versatility in the bakery segment.

- Key Drivers for Confectionery Application Segment Dominance: Strong consumer demand for chocolate bars and other confectionery items; wide range of available products; established distribution networks; effective marketing and branding strategies.

- Key Drivers for Milk Chocolate Dominance: Familiar taste profile; widespread appeal across all demographics; affordability compared to other chocolate types.

- Key Drivers for Chocolate Slab Dominance: Ease of consumption; convenient packaging; suitable for various occasions; wide range of flavors and brands available.

UK Chocolate Industry Product Innovations

Recent product innovations focus on addressing health consciousness and meeting diverse dietary needs. Manufacturers are increasingly introducing sugar-reduced chocolate, vegan options, and products with added health benefits, like probiotics or antioxidants. Technological advancements in processing techniques are enhancing the texture and flavor profile of chocolate, leading to more refined products. The market is witnessing the rise of innovative packaging formats, aimed at improving shelf life, reducing environmental impact, and enhancing product presentation. Successful product launches have been strategically targeting specific consumer segments based on dietary preferences and health concerns, leading to stronger market penetration and competitive advantages.

Report Segmentation & Scope

This report segments the UK chocolate market across several key parameters:

- Form: Chocolate Chips/Drops/Chunks, Chocolate Slab, Chocolate Coatings, Other Forms. Growth projections vary across forms, with chocolate chips/drops/chunks showing strong growth potential due to increasing demand from the bakery sector.

- Application: Bakery, Confectionery, Frozen Desserts & Ice Cream, Beverages, Cereals, Other Applications. Confectionery remains the dominant application segment, with strong growth projected for the bakery and frozen desserts applications.

- Product Type: Dark, Milk, White Chocolate. Milk chocolate retains its dominant position, while dark chocolate is witnessing significant growth driven by health-conscious consumers.

Each segment's market size, competitive dynamics, and growth projections are detailed within the full report.

Key Drivers of UK Chocolate Industry Growth

Several factors contribute to the growth of the UK chocolate industry:

- Rising Disposable Incomes: Increased purchasing power allows consumers to indulge in premium chocolate products.

- Innovation in Product Formulations: Healthier and more diverse options cater to evolving consumer preferences.

- Technological Advancements: Efficiency gains in production lower costs and improve product quality.

- Strong Brand Loyalty: Established brands maintain their market share through effective marketing.

Challenges in the UK Chocolate Industry Sector

The UK chocolate industry faces several challenges:

- Fluctuating Cocoa Prices: Global supply chain disruptions impact profitability.

- Increased Competition: Both established and emerging brands compete fiercely.

- Health Concerns: Growing awareness of sugar consumption may impact demand for some products.

- Sustainability Concerns: Consumers demand ethical and environmentally friendly sourcing practices.

Leading Players in the UK Chocolate Industry Market

- Pecan Deluxe Candy Company

- Cargill Incorporated

- Britannia Superfine

- AAK AB

- Puratos Group

- Sephra

- Natra

- Barry Callebaut Group

- Fuji Oil Holdings Inc

- Ingredients UK Ltd

Key Developments in UK Chocolate Industry Sector

- June 2021: Puratos launched two new Belgian chocolate products with 40% less sugar. This reflects the growing consumer demand for healthier options.

- April 2020: Brenntag Food & Nutrition and Cargill expanded their distribution relationship in the UK and Ireland, enhancing market reach for cocoa and chocolate products.

- January 2020: Barry Callebaut opened a new Chocolate Academy in Banbury, UK, highlighting its commitment to innovation and skill development within the industry.

Strategic UK Chocolate Industry Market Outlook

The UK chocolate market presents significant growth opportunities for companies that can effectively address consumer preferences for healthier, ethically sourced, and innovative products. Strategic investments in research and development, sustainable sourcing practices, and targeted marketing campaigns are crucial for success. The market's evolution towards premiumization and specialization offers attractive prospects for brands that can effectively differentiate themselves through unique product offerings and compelling brand narratives. The focus on health and sustainability will continue to shape the market landscape, creating opportunities for companies that can successfully integrate these elements into their business models.

UK Chocolate Industry Segmentation

-

1. Product Type

- 1.1. Dark

- 1.2. Milk

- 1.3. White Chocolate

-

2. Form

- 2.1. Chocolate Chips/Drops/Chunks

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

- 2.4. Other Forms

-

3. Application

- 3.1. Bakery

- 3.2. Confectionery

- 3.3. Frozen Desserts & Ice Cream

- 3.4. Beverages

- 3.5. Cereals

- 3.6. Other Applications

UK Chocolate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Upsurge in Consumption of Bakery and Confectionery Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dark

- 5.1.2. Milk

- 5.1.3. White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Chocolate Chips/Drops/Chunks

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.2.4. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Confectionery

- 5.3.3. Frozen Desserts & Ice Cream

- 5.3.4. Beverages

- 5.3.5. Cereals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dark

- 6.1.2. Milk

- 6.1.3. White Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Chocolate Chips/Drops/Chunks

- 6.2.2. Chocolate Slab

- 6.2.3. Chocolate Coatings

- 6.2.4. Other Forms

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Confectionery

- 6.3.3. Frozen Desserts & Ice Cream

- 6.3.4. Beverages

- 6.3.5. Cereals

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dark

- 7.1.2. Milk

- 7.1.3. White Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Chocolate Chips/Drops/Chunks

- 7.2.2. Chocolate Slab

- 7.2.3. Chocolate Coatings

- 7.2.4. Other Forms

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Confectionery

- 7.3.3. Frozen Desserts & Ice Cream

- 7.3.4. Beverages

- 7.3.5. Cereals

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dark

- 8.1.2. Milk

- 8.1.3. White Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Chocolate Chips/Drops/Chunks

- 8.2.2. Chocolate Slab

- 8.2.3. Chocolate Coatings

- 8.2.4. Other Forms

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery

- 8.3.2. Confectionery

- 8.3.3. Frozen Desserts & Ice Cream

- 8.3.4. Beverages

- 8.3.5. Cereals

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dark

- 9.1.2. Milk

- 9.1.3. White Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Chocolate Chips/Drops/Chunks

- 9.2.2. Chocolate Slab

- 9.2.3. Chocolate Coatings

- 9.2.4. Other Forms

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery

- 9.3.2. Confectionery

- 9.3.3. Frozen Desserts & Ice Cream

- 9.3.4. Beverages

- 9.3.5. Cereals

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Dark

- 10.1.2. Milk

- 10.1.3. White Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Chocolate Chips/Drops/Chunks

- 10.2.2. Chocolate Slab

- 10.2.3. Chocolate Coatings

- 10.2.4. Other Forms

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Bakery

- 10.3.2. Confectionery

- 10.3.3. Frozen Desserts & Ice Cream

- 10.3.4. Beverages

- 10.3.5. Cereals

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. England UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Pecan Deluxe Candy Company*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cargill Incorporated

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Britannia Superfine

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 AAK AB

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Puratos Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sephra

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Natra

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Barry Callebaut Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Fuji Oil Holdings Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ingredients UK Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Pecan Deluxe Candy Company*List Not Exhaustive

List of Figures

- Figure 1: Global UK Chocolate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Chocolate Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America UK Chocolate Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America UK Chocolate Industry Revenue (Million), by Form 2024 & 2032

- Figure 7: North America UK Chocolate Industry Revenue Share (%), by Form 2024 & 2032

- Figure 8: North America UK Chocolate Industry Revenue (Million), by Application 2024 & 2032

- Figure 9: North America UK Chocolate Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UK Chocolate Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: South America UK Chocolate Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: South America UK Chocolate Industry Revenue (Million), by Form 2024 & 2032

- Figure 15: South America UK Chocolate Industry Revenue Share (%), by Form 2024 & 2032

- Figure 16: South America UK Chocolate Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: South America UK Chocolate Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UK Chocolate Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe UK Chocolate Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe UK Chocolate Industry Revenue (Million), by Form 2024 & 2032

- Figure 23: Europe UK Chocolate Industry Revenue Share (%), by Form 2024 & 2032

- Figure 24: Europe UK Chocolate Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe UK Chocolate Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UK Chocolate Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Middle East & Africa UK Chocolate Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Middle East & Africa UK Chocolate Industry Revenue (Million), by Form 2024 & 2032

- Figure 31: Middle East & Africa UK Chocolate Industry Revenue Share (%), by Form 2024 & 2032

- Figure 32: Middle East & Africa UK Chocolate Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East & Africa UK Chocolate Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East & Africa UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UK Chocolate Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Asia Pacific UK Chocolate Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Pacific UK Chocolate Industry Revenue (Million), by Form 2024 & 2032

- Figure 39: Asia Pacific UK Chocolate Industry Revenue Share (%), by Form 2024 & 2032

- Figure 40: Asia Pacific UK Chocolate Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Asia Pacific UK Chocolate Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Asia Pacific UK Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UK Chocolate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global UK Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: England UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Wales UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Scotland UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Ireland UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 21: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 28: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 41: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global UK Chocolate Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global UK Chocolate Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 51: Global UK Chocolate Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global UK Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific UK Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Chocolate Industry?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the UK Chocolate Industry?

Key companies in the market include Pecan Deluxe Candy Company*List Not Exhaustive, Cargill Incorporated, Britannia Superfine, AAK AB, Puratos Group, Sephra, Natra, Barry Callebaut Group, Fuji Oil Holdings Inc, Ingredients UK Ltd.

3. What are the main segments of the UK Chocolate Industry?

The market segments include Product Type, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Upsurge in Consumption of Bakery and Confectionery Products.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

June 2021: The Puratos, United Kingdom-based company, launched two new Belgian chocolate products with 40% less sugar than their previous offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Chocolate Industry?

To stay informed about further developments, trends, and reports in the UK Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence