Key Insights

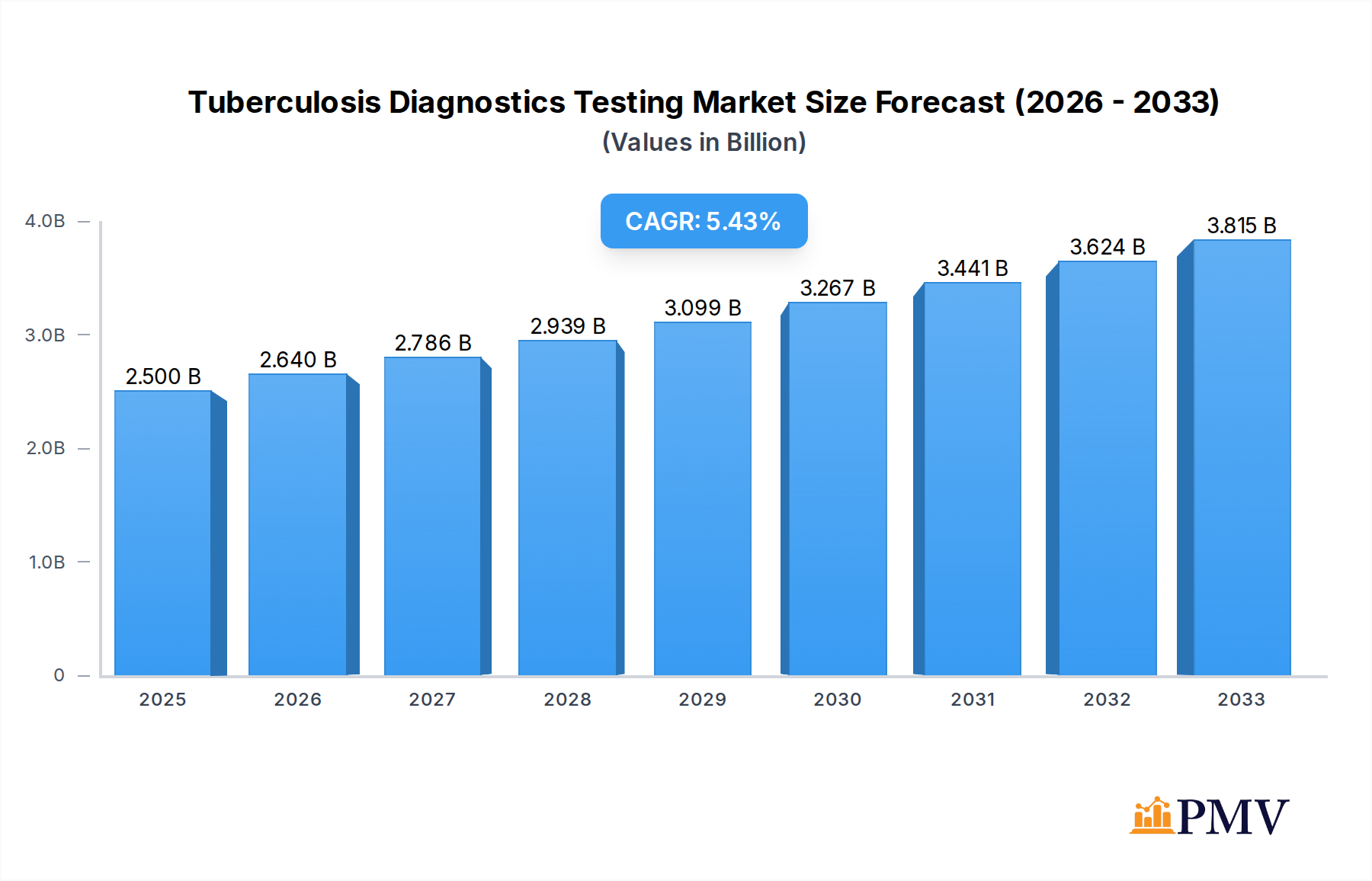

The global Tuberculosis Diagnostics Testing market is poised for significant expansion, projected to reach approximately $2.5 billion by 2025. This growth is driven by a confluence of factors including the persistent global burden of tuberculosis, increasing demand for rapid and accurate diagnostic solutions, and advancements in molecular diagnostic technologies. The market is expected to witness a robust Compound Annual Growth Rate (CAGR) of 5.6% over the forecast period of 2025-2033, underscoring its strong upward trajectory. Key applications driving this expansion include Medical Diagnosis, Epidemiologic Investigations, and Public Health Control, with Molecular Diagnostics emerging as a dominant segment within the types of testing available. The continuous innovation in this space, leading to more sensitive and specific tests, plays a crucial role in early detection and effective management of TB, thereby fueling market demand.

Tuberculosis Diagnostics Testing Market Size (In Billion)

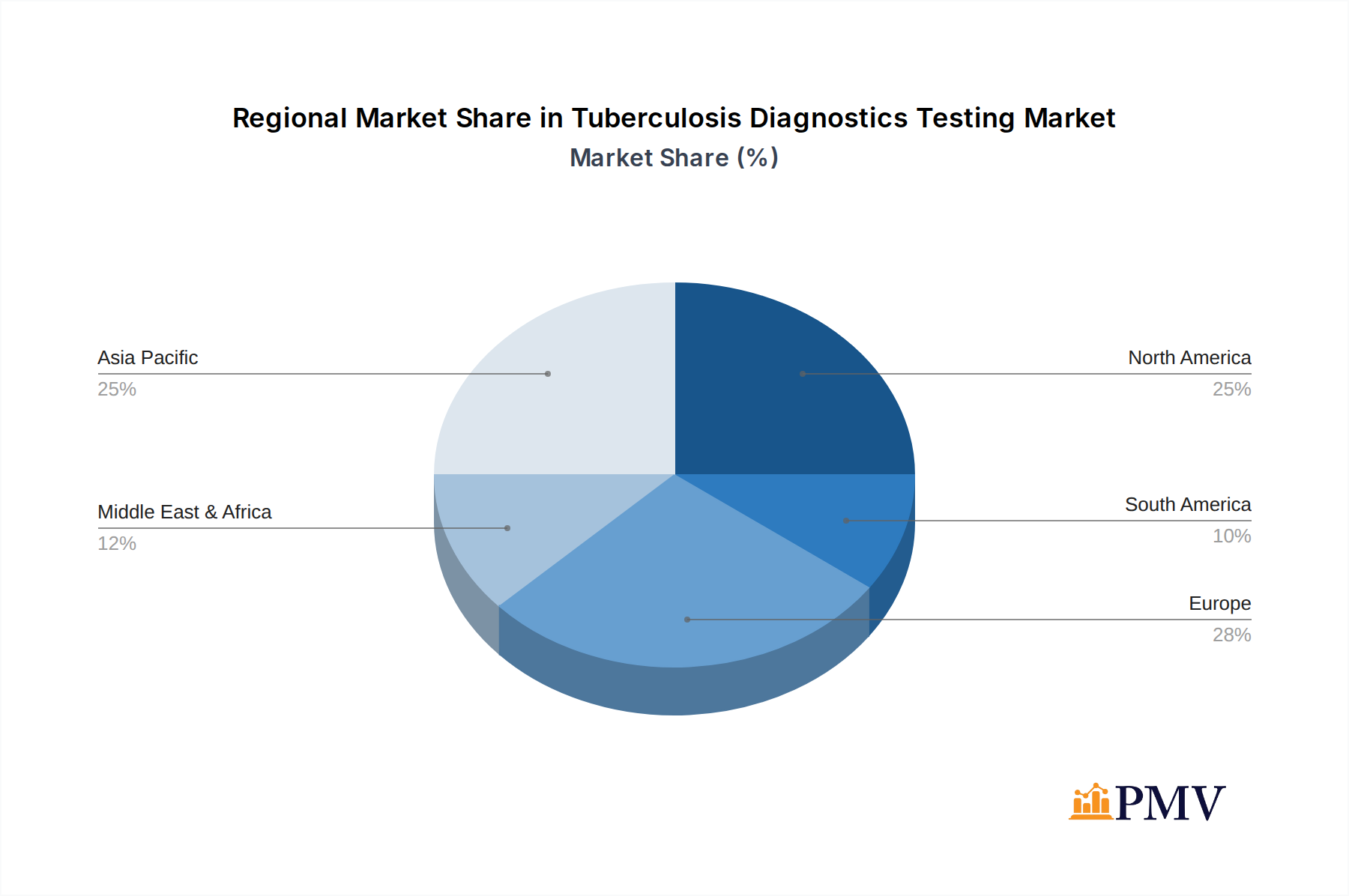

The strategic importance of tuberculosis diagnostics is amplified by ongoing efforts to combat drug-resistant strains of the disease and the need for enhanced surveillance mechanisms. Leading companies such as Abbott Laboratories, Roche Molecular Systems Inc., and Thermo Fisher Scientific Inc. are at the forefront of developing and commercializing innovative diagnostic tools, contributing to market dynamics. Geographically, North America and Europe are expected to maintain substantial market shares due to advanced healthcare infrastructure and significant R&D investments. However, the Asia Pacific region, particularly countries like China and India with high TB prevalence, is anticipated to exhibit the fastest growth, driven by increased government initiatives and a growing focus on public health. Emerging trends such as the integration of AI in diagnostic interpretation and the development of point-of-care testing solutions will further shape the market landscape, presenting both opportunities and challenges for stakeholders in the coming years.

Tuberculosis Diagnostics Testing Company Market Share

This in-depth report provides a definitive analysis of the global Tuberculosis Diagnostics Testing market, covering its intricate structure, dynamic trends, and future outlook. With a focus on actionable insights and high-ranking SEO keywords, this report is indispensable for industry stakeholders seeking to understand market dynamics, identify growth opportunities, and formulate effective strategies. The study encompasses the historical period from 2019 to 2024, a base year of 2025, and a comprehensive forecast period extending to 2033.

Tuberculosis Diagnostics Testing Market Structure & Competitive Dynamics

The Tuberculosis Diagnostics Testing market exhibits a moderate to high concentration, driven by a few dominant players alongside a growing number of specialized innovators. Key market participants include Abbott Laboratories, Becton, Dickinson and Company (BD), BioMerieux SA, Cepheid (Danaher Corporation), Hologic, Inc., Hain Lifescience GmbH, Oxford Immunotec (PerkinElmer), Qiagen N.V., Roche Molecular Systems Inc., Siemens Healthineers AG, and Thermo Fisher Scientific Inc. These companies collectively hold a significant market share, estimated to be over 800 billion dollars in 2025. The innovation ecosystem is characterized by continuous research and development in molecular diagnostics and rapid point-of-care testing, aiming to improve sensitivity, specificity, and turnaround times for TB diagnosis. Regulatory frameworks, particularly from bodies like the FDA and EMA, play a crucial role in market entry and product approval, influencing the pace of innovation and market access. Product substitutes, such as traditional microscopy and culture methods, are gradually being displaced by more advanced diagnostic solutions, although they still hold a considerable presence in resource-limited settings. End-user trends highlight an increasing demand for early and accurate TB diagnosis to facilitate prompt treatment and prevent disease spread, especially in the context of rising multidrug-resistant tuberculosis (MDR-TB) cases. Mergers and acquisitions (M&A) activities are anticipated to remain a significant trend, with an estimated 50 billion dollars in deal values projected over the forecast period, as larger companies seek to expand their portfolios and geographical reach.

Tuberculosis Diagnostics Testing Industry Trends & Insights

The Tuberculosis Diagnostics Testing industry is poised for substantial growth, driven by a confluence of factors that are reshaping the diagnostic landscape. A significant market growth driver is the increasing global prevalence of tuberculosis, exacerbated by factors such as HIV co-infection, the emergence of drug-resistant strains, and inadequate public health infrastructure in certain regions. The market penetration of advanced diagnostic technologies, particularly molecular diagnostics, is expected to surge, driven by their superior accuracy and speed compared to conventional methods. Technological disruptions are at the forefront, with advancements in nucleic acid amplification tests (NAATs), next-generation sequencing (NGS) for resistance profiling, and the development of point-of-care diagnostic devices offering rapid results at the patient's bedside. Consumer preferences are shifting towards diagnostic solutions that provide faster results, higher sensitivity, and lower invasiveness, enabling earlier treatment initiation and improved patient outcomes. The competitive dynamics are characterized by intense R&D efforts to develop novel biomarkers, improve assay performance, and reduce diagnostic costs. The Compound Annual Growth Rate (CAGR) for the Tuberculosis Diagnostics Testing market is projected to be robust, estimated at 12.50% from 2025 to 2033, signifying a rapidly expanding market worth over 2.5 trillion dollars by 2033. The increasing investment in global TB control programs and public health initiatives further bolsters market expansion.

Dominant Markets & Segments in Tuberculosis Diagnostics Testing

The Asia Pacific region is expected to emerge as a dominant market for Tuberculosis Diagnostics Testing, driven by its high TB burden and significant investments in healthcare infrastructure. Within this region, countries like India and China, with their vast populations and concentrated TB cases, will lead the demand. The Application segment of Medical Diagnosis will command the largest market share, accounting for over 60% of the total market value, estimated at 900 billion dollars in 2025. This dominance is fueled by the continuous need for accurate and timely diagnosis of active TB cases in clinical settings to guide treatment decisions. The Type segment of Molecular Diagnostics will exhibit the fastest growth and hold a substantial market share, projected to reach over 700 billion dollars by 2025. This surge is attributable to the unparalleled sensitivity and specificity of molecular techniques in detecting Mycobacterium tuberculosis and identifying drug resistance mutations.

Key drivers for the dominance of these regions and segments include:

- Economic Policies: Government initiatives and increased healthcare spending in developing economies to combat the TB epidemic.

- Infrastructure Development: Expansion of laboratory facilities and accessibility to advanced diagnostic tools, particularly in rural and underserved areas.

- Public Health Programs: Robust implementation of national TB control programs that prioritize early detection and surveillance.

- Disease Burden: The high incidence and prevalence of TB in specific geographical locations, necessitating widespread diagnostic testing.

- Technological Adoption: Increasing acceptance and adoption of advanced diagnostic technologies by healthcare providers.

- Regulatory Support: Favorable regulatory environments that facilitate the approval and deployment of innovative TB diagnostic solutions.

Furthermore, the Epidemiologic Investigations application segment will also witness significant growth due to the ongoing need for tracking TB outbreaks and monitoring disease trends. The Diagnostic Laboratory type, while established, will see its growth augmented by the integration of advanced molecular technologies.

Tuberculosis Diagnostics Testing Product Innovations

Recent product innovations in Tuberculosis Diagnostics Testing are primarily focused on enhancing speed, accuracy, and accessibility. Key developments include the launch of highly sensitive and specific molecular diagnostic assays capable of detecting M. tuberculosis complex and rifampicin resistance within hours. Advances in point-of-care (POC) testing platforms are enabling rapid diagnosis in decentralized settings, reducing the reliance on centralized laboratories. Furthermore, research into biomarker discovery for early detection and differentiation of latent TB from active TB is gaining momentum. These innovations offer significant competitive advantages by improving patient management, reducing transmission, and lowering healthcare costs. The market is witnessing a trend towards multiplex assays that can simultaneously detect multiple respiratory pathogens and resistance markers, offering a more comprehensive diagnostic solution.

Report Segmentation & Scope

This report meticulously segments the Tuberculosis Diagnostics Testing market across key parameters to provide granular insights. The segmentation encompasses:

Application:

- Medical Diagnosis: This segment focuses on the direct diagnosis of active TB in individual patients, accounting for a substantial market share driven by clinical necessity. Projections indicate continued strong growth as healthcare systems prioritize accurate patient management.

- Epidemiologic Investigations: This segment caters to public health efforts in tracking disease spread, identifying outbreaks, and monitoring surveillance data. Growth is fueled by global health initiatives and the need for robust disease control.

- Public Health Control: This segment encompasses large-scale screening programs and interventions aimed at reducing TB incidence. Investment in public health infrastructure directly impacts this segment's expansion.

- Others: This category includes niche applications and emerging uses for TB diagnostic technologies.

Types:

- Diagnostic Laboratory: This segment represents traditional laboratory-based testing methods, which are being increasingly integrated with advanced molecular techniques. It forms a foundational segment with steady growth.

- Molecular Diagnostics: This segment is the fastest-growing, encompassing NAATs, PCR-based assays, and other DNA/RNA detection methods, offering superior performance. Market size and growth projections are exceptionally strong.

- Cytokine Detection Assay: This segment focuses on assays that measure immune responses to TB, often used for differentiating latent from active TB. While a specialized segment, it holds significant potential for early diagnosis.

- Others: This includes emerging technologies and less common diagnostic approaches.

The scope of this report extends to a detailed analysis of market sizes, growth rates, and competitive landscapes within each of these segments, providing a comprehensive view of the Tuberculosis Diagnostics Testing market's future trajectory.

Key Drivers of Tuberculosis Diagnostics Testing Growth

The Tuberculosis Diagnostics Testing market is propelled by a multi-faceted set of growth drivers. Increasing global incidence and prevalence of TB, particularly drug-resistant strains, necessitates advanced diagnostic solutions for accurate and timely detection. Technological advancements in molecular diagnostics, such as rapid NAATs and point-of-care devices, are enhancing sensitivity, specificity, and speed, making them indispensable tools. Growing investments in global TB control programs by governments and international organizations, coupled with favorable regulatory frameworks that encourage innovation and market access, further accelerate growth. The rising awareness among healthcare professionals and patients about the benefits of early and accurate diagnosis also plays a crucial role. Furthermore, the development of integrated diagnostic platforms that can detect multiple pathogens and resistance markers simultaneously is a significant growth accelerator.

Challenges in the Tuberculosis Diagnostics Testing Sector

Despite robust growth prospects, the Tuberculosis Diagnostics Testing sector faces several challenges. High cost of advanced diagnostic technologies, particularly for molecular tests, can be a barrier to widespread adoption in low-resource settings, limiting market penetration. Limited access to sophisticated laboratory infrastructure and skilled personnel in certain regions hinders the implementation of advanced diagnostic solutions. Stringent regulatory approval processes for new diagnostic tests, while ensuring quality and safety, can lead to prolonged time-to-market. Supply chain disruptions and the availability of reagents and consumables can also impact the consistent delivery of diagnostic services. Finally, the emergence of new diagnostic substitutes and the continuous need for assay validation against evolving M. tuberculosis strains present ongoing competitive pressures.

Leading Players in the Tuberculosis Diagnostics Testing Market

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- BioMerieux SA

- Cepheid (Danaher Corporation)

- Hologic, Inc.

- Hain Lifescience GmbH

- Oxford Immunotec (PerkinElmer)

- Qiagen N.V.

- Roche Molecular Systems Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Key Developments in Tuberculosis Diagnostics Testing Sector

- 2023/Q4: Launch of a new rapid molecular diagnostic assay for the detection of XDR-TB by [Company Name], enhancing treatment guidance for highly resistant cases.

- 2023/Q3: Acquisition of a leading POC diagnostic platform developer by [Company Name] to expand its portfolio in decentralized TB testing.

- 2023/Q1: FDA approval for a novel biomarker-based test to differentiate latent TB infection from active disease, enabling earlier and more targeted interventions.

- 2022/Q4: Introduction of an AI-powered diagnostic software that analyzes imaging data for TB detection, improving accuracy and efficiency.

- 2022/Q2: Strategic partnership between [Company Name] and a global health organization to deploy affordable TB diagnostic solutions in sub-Saharan Africa.

Strategic Tuberculosis Diagnostics Testing Market Outlook

The strategic outlook for the Tuberculosis Diagnostics Testing market is exceptionally promising, driven by an ongoing global commitment to TB eradication and advancements in diagnostic technology. Growth accelerators include the increasing demand for rapid and accurate diagnostics at the point of care, facilitating decentralized testing and timely patient management. The rising threat of drug-resistant TB further intensifies the need for sophisticated molecular diagnostic tools. Investments in healthcare infrastructure and the implementation of comprehensive national TB control strategies in high-burden countries will continue to fuel market expansion. Strategic opportunities lie in developing cost-effective, user-friendly diagnostic solutions, expanding market access to underserved regions, and fostering collaborations between diagnostic manufacturers, healthcare providers, and public health organizations. The integration of digital health solutions and AI-powered analytics will also play a pivotal role in optimizing TB diagnosis and patient care pathways.

Tuberculosis Diagnostics Testing Segmentation

-

1. Application

- 1.1. Medical Diagnosis

- 1.2. Epidemiologic Investigations

- 1.3. Public Health Control

- 1.4. Others

-

2. Types

- 2.1. Diagnostic Laboratory

- 2.2. Molecular Diagnostics

- 2.3. Cytokine Detection Assay

- 2.4. Others

Tuberculosis Diagnostics Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tuberculosis Diagnostics Testing Regional Market Share

Geographic Coverage of Tuberculosis Diagnostics Testing

Tuberculosis Diagnostics Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Diagnosis

- 5.1.2. Epidemiologic Investigations

- 5.1.3. Public Health Control

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Diagnostic Laboratory

- 5.2.2. Molecular Diagnostics

- 5.2.3. Cytokine Detection Assay

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Diagnosis

- 6.1.2. Epidemiologic Investigations

- 6.1.3. Public Health Control

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Diagnostic Laboratory

- 6.2.2. Molecular Diagnostics

- 6.2.3. Cytokine Detection Assay

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Diagnosis

- 7.1.2. Epidemiologic Investigations

- 7.1.3. Public Health Control

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Diagnostic Laboratory

- 7.2.2. Molecular Diagnostics

- 7.2.3. Cytokine Detection Assay

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Diagnosis

- 8.1.2. Epidemiologic Investigations

- 8.1.3. Public Health Control

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Diagnostic Laboratory

- 8.2.2. Molecular Diagnostics

- 8.2.3. Cytokine Detection Assay

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Diagnosis

- 9.1.2. Epidemiologic Investigations

- 9.1.3. Public Health Control

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Diagnostic Laboratory

- 9.2.2. Molecular Diagnostics

- 9.2.3. Cytokine Detection Assay

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tuberculosis Diagnostics Testing Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Diagnosis

- 10.1.2. Epidemiologic Investigations

- 10.1.3. Public Health Control

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Diagnostic Laboratory

- 10.2.2. Molecular Diagnostics

- 10.2.3. Cytokine Detection Assay

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abbott Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dickinson and Company (BD)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BioMerieux SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cepheid (Danaher Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hologic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hain Lifescience GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oxford Immunotec (PerkinElmer)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qiagen N.V.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Roche Molecular Systems Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Siemens Healthineers AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thermo Fisher Scientific Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Abbott Laboratories

List of Figures

- Figure 1: Global Tuberculosis Diagnostics Testing Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tuberculosis Diagnostics Testing Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Tuberculosis Diagnostics Testing Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Tuberculosis Diagnostics Testing Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Tuberculosis Diagnostics Testing Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Tuberculosis Diagnostics Testing Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Tuberculosis Diagnostics Testing Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Tuberculosis Diagnostics Testing Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Tuberculosis Diagnostics Testing Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Tuberculosis Diagnostics Testing Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Tuberculosis Diagnostics Testing Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Tuberculosis Diagnostics Testing Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Tuberculosis Diagnostics Testing Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Tuberculosis Diagnostics Testing Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Tuberculosis Diagnostics Testing Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Tuberculosis Diagnostics Testing Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Tuberculosis Diagnostics Testing Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Tuberculosis Diagnostics Testing Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Tuberculosis Diagnostics Testing Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Tuberculosis Diagnostics Testing Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Tuberculosis Diagnostics Testing Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Tuberculosis Diagnostics Testing Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Tuberculosis Diagnostics Testing Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Tuberculosis Diagnostics Testing Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Tuberculosis Diagnostics Testing Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Tuberculosis Diagnostics Testing Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Tuberculosis Diagnostics Testing Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Tuberculosis Diagnostics Testing Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Tuberculosis Diagnostics Testing Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Tuberculosis Diagnostics Testing Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Tuberculosis Diagnostics Testing Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Tuberculosis Diagnostics Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Tuberculosis Diagnostics Testing Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tuberculosis Diagnostics Testing?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Tuberculosis Diagnostics Testing?

Key companies in the market include Abbott Laboratories, Becton, Dickinson and Company (BD), BioMerieux SA, Cepheid (Danaher Corporation), Hologic, Inc., Hain Lifescience GmbH, Oxford Immunotec (PerkinElmer), Qiagen N.V., Roche Molecular Systems Inc., Siemens Healthineers AG, Thermo Fisher Scientific Inc..

3. What are the main segments of the Tuberculosis Diagnostics Testing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tuberculosis Diagnostics Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tuberculosis Diagnostics Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tuberculosis Diagnostics Testing?

To stay informed about further developments, trends, and reports in the Tuberculosis Diagnostics Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence