Key Insights

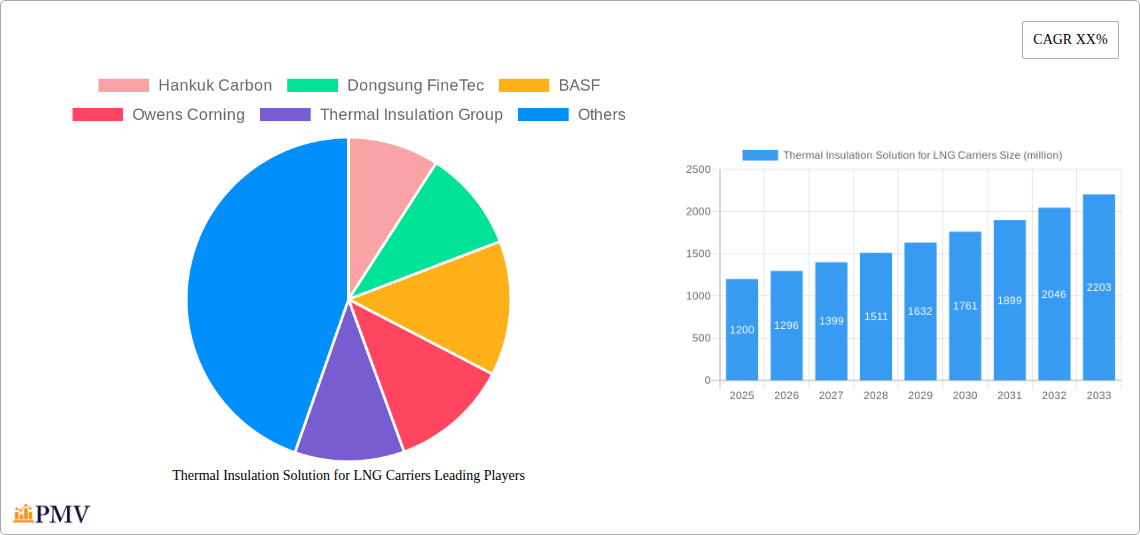

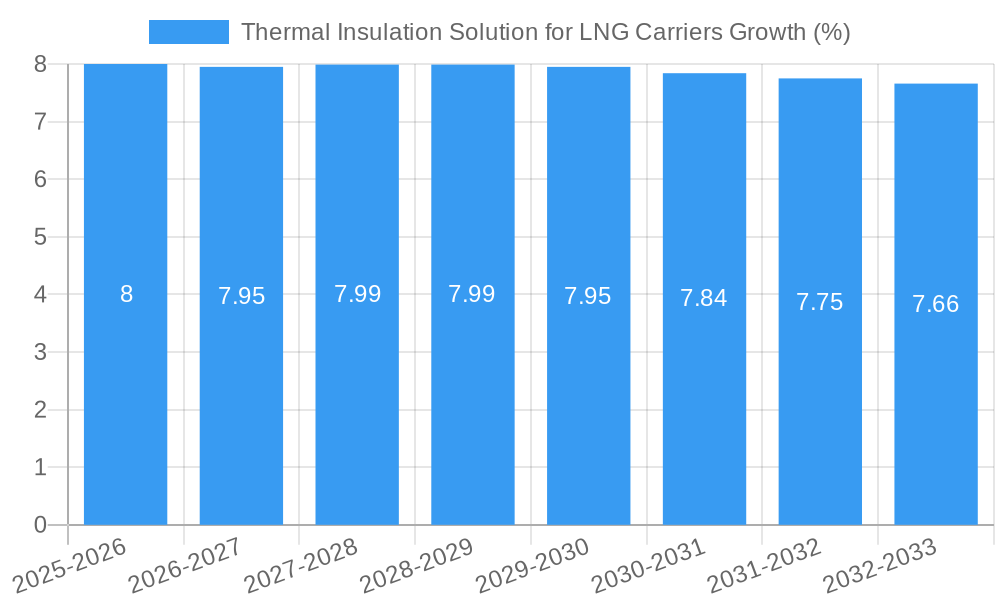

The global market for thermal insulation solutions for LNG carriers is experiencing robust growth, propelled by the escalating demand for liquefied natural gas (LNG) as a cleaner energy source and the subsequent expansion of the global LNG fleet. This burgeoning market is estimated to be valued at approximately $1,200 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This growth is primarily driven by the critical need for efficient and reliable insulation systems to maintain the cryogenic temperatures required for LNG transport, thereby minimizing boil-off gas and ensuring safety. The increasing construction of new LNG carriers, coupled with retrofitting efforts on existing vessels to meet stricter environmental regulations and enhance operational efficiency, further fuels market expansion. Key applications like LNG storage tanks and cargo enclosure systems are witnessing substantial investment, underscoring the importance of advanced insulation materials.

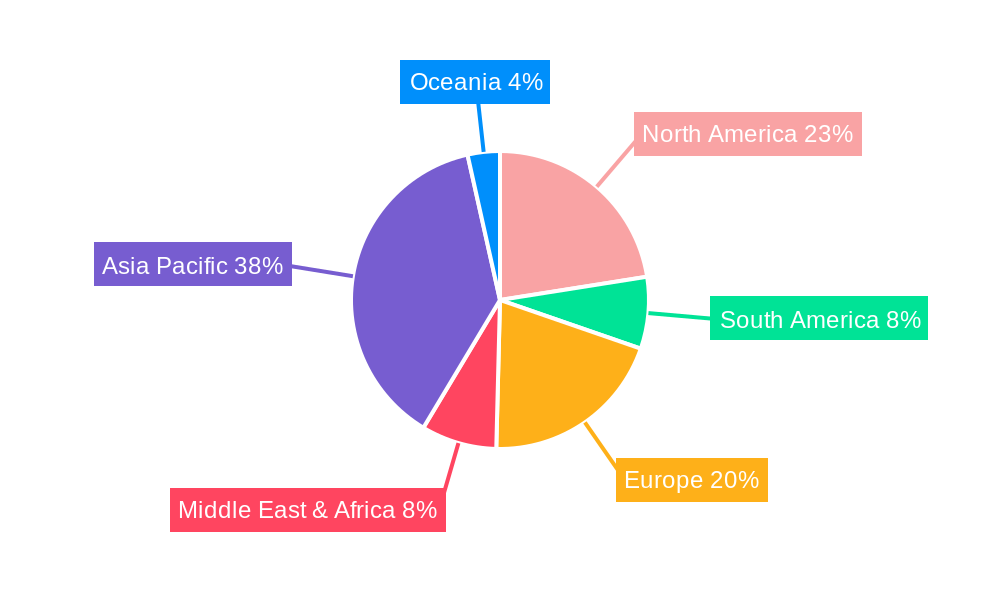

The market is characterized by significant trends such as the rising adoption of Polyurethane (PUR) and Polyisocyanurate (PIR) insulation materials due to their superior thermal performance, durability, and fire-resistant properties. Innovations in material science are continuously leading to the development of lighter, more efficient, and cost-effective insulation solutions. Geographically, Asia Pacific, particularly China and South Korea, is emerging as a dominant region, owing to its substantial shipbuilding capacity and its role as a major importer of LNG. North America and Europe also represent significant markets, driven by their extensive LNG infrastructure and ongoing fleet modernization. While the market enjoys strong growth drivers, potential restraints include the volatile price of raw materials for insulation products and the intricate regulatory landscape governing maritime safety and environmental standards.

This comprehensive report delves into the Thermal Insulation Solution for LNG Carriers market, offering an in-depth analysis of its structure, competitive landscape, and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report provides actionable insights for industry stakeholders. The global market for LNG carrier insulation is experiencing robust growth, driven by increasing demand for Liquefied Natural Gas (LNG) worldwide and the critical need for efficient and reliable thermal insulation solutions in LNG transportation.

Thermal Insulation Solution for LNG Carriers Market Structure & Competitive Dynamics

The Thermal Insulation Solution for LNG Carriers market exhibits a moderately concentrated structure. Key players are actively engaged in innovation and strategic partnerships to capture market share. The innovation ecosystem is fueled by continuous research and development in advanced insulation materials and application techniques, particularly focusing on enhancing cryogenic performance and reducing boil-off gas. Regulatory frameworks, such as stringent safety standards for LNG transport and environmental regulations, play a significant role in shaping market dynamics. Product substitutes, while present in broader insulation markets, are less prevalent for specialized cryogenic applications in LNG carriers due to the unique performance requirements. End-user trends are strongly influenced by the growing global LNG trade and the increasing size and complexity of LNG carrier fleets. Mergers and acquisitions (M&A) activities, valued at over one million for significant deals, are observed as companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and geographic markets. The market share distribution for leading companies is dynamic, with significant players like Hankuk Carbon, Dongsung FineTec, and BASF holding substantial portions, driven by their established track records and advanced product offerings. The pursuit of high-performance, lightweight, and cost-effective insulation solutions continues to define competitive advantages.

Thermal Insulation Solution for LNG Carriers Industry Trends & Insights

The Thermal Insulation Solution for LNG Carriers industry is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is primarily driven by the escalating global demand for cleaner energy sources, which necessitates an increased volume of LNG trade and consequently, a larger fleet of LNG carriers. Technological advancements are revolutionizing the sector, with a significant trend towards the development and adoption of advanced insulation materials offering superior thermal performance and reduced boil-off rates. These innovations include the utilization of advanced composites, vacuum insulation panels (VIPs), and improved polyurethane (PUR) and polyisocyanurate (PIR) foam formulations. Consumer preferences are shifting towards solutions that not only enhance operational efficiency and safety but also contribute to environmental sustainability by minimizing energy loss. The competitive dynamics are characterized by a strong emphasis on product differentiation, with companies vying to offer the most durable, lightweight, and cost-effective insulation systems. Market penetration of advanced insulation technologies is steadily increasing, driven by the economic benefits of reduced fuel consumption and enhanced cargo retention. Industry developments in materials science, manufacturing processes, and application methodologies are continuously reshaping the competitive landscape, pushing boundaries for performance and reliability in the demanding cryogenic environment of LNG transportation. The ongoing expansion of LNG infrastructure projects globally acts as a significant catalyst, directly fueling the demand for new LNG carriers and their associated insulation systems. Furthermore, the drive towards greater energy efficiency in maritime operations, coupled with increasingly stringent international maritime regulations, further propels the adoption of cutting-edge thermal insulation solutions. The market is also witnessing a growing interest in lifecycle cost analysis, prompting a preference for insulation solutions that offer long-term performance and reduced maintenance needs, thereby reinforcing the adoption of premium insulation products.

Dominant Markets & Segments in Thermal Insulation Solution for LNG Carriers

The LNG Storage Tank segment currently dominates the Thermal Insulation Solution for LNG Carriers market, accounting for a significant market share of over xx% in the base year 2025. This dominance is attributed to the critical role of efficient insulation in maintaining the cryogenic temperatures required for LNG storage, both onboard vessels and in onshore facilities. Key drivers for this segment's leadership include robust government policies supporting energy infrastructure development and the massive investments in expanding global LNG storage capacities.

- LNG Storage Tank:

- Economic Policies: Favorable government subsidies and tax incentives for LNG infrastructure development, including storage facilities, are a primary driver.

- Infrastructure Development: The continuous construction and expansion of LNG import and export terminals worldwide necessitate large-scale, high-performance insulation for their storage tanks.

- Safety Regulations: Stringent safety mandates for LNG containment and handling directly translate to a demand for highly reliable and effective insulation solutions.

- Technological Advancements: Innovations in cryogenic insulation materials specifically designed for large-volume storage tanks are enhancing performance and reducing operational costs.

Within the Types segmentation, PUR Insulation Material emerges as the leading segment, holding an estimated market share of xx% in 2025. Polyurethane foams are widely favored due to their excellent thermal resistance, low density, and ease of application, making them ideal for the complex geometries of LNG carriers.

- PUR Insulation Material:

- Cost-Effectiveness: PUR offers a compelling balance of performance and cost, making it a preferred choice for large-scale applications.

- Versatility: Its adaptability in terms of formulation and application methods (spray, rigid foam boards) allows for tailored solutions across various LNG carrier components.

- Proven Performance: Decades of successful application in cryogenic environments have solidified its reputation for reliability.

- Environmental Considerations: Ongoing advancements in PUR formulations are addressing sustainability concerns, with an increasing focus on lower global warming potential (GWP) blowing agents.

Geographically, Asia-Pacific is the dominant region, driven by its burgeoning LNG import and export activities and significant investments in shipbuilding and LNG infrastructure. Countries like China, Japan, and South Korea are at the forefront of this growth. The LNG Cargo Enclosure System segment is also experiencing substantial growth, propelled by the increasing number of newbuild LNG carriers and the need for advanced insulation to minimize cargo loss during transit.

Thermal Insulation Solution for LNG Carriers Product Innovations

Recent product innovations in Thermal Insulation Solution for LNG Carriers are centered on enhancing thermal efficiency, reducing weight, and improving fire resistance. Companies are developing next-generation PUR and PIR insulation materials with enhanced cryogenic properties, capable of withstanding extreme temperatures with minimal heat transfer. Advanced composite materials and vacuum insulation panels are also gaining traction, offering superior performance per unit thickness and contributing to lighter vessel construction, which translates to fuel savings. These innovations are directly addressing the industry's need for solutions that minimize boil-off gas and ensure cargo integrity throughout long voyages.

Report Segmentation & Scope

This report meticulously segments the Thermal Insulation Solution for LNG Carriers market based on key parameters. The Application segment is further divided into LNG Storage Tank, LNG Cargo Enclosure System, and Other applications, each with distinct growth projections and market sizes driven by their specific operational demands and the overall LNG infrastructure landscape. The Types segment encompasses PUR Insulation Material, PIR Insulation Material, and Other insulation types, providing detailed analysis of their market penetration, competitive advantages, and projected market share. For instance, the PUR Insulation Material segment is expected to see a market size of $xx million in 2025, with a projected growth to $xx million by 2033, reflecting its continued dominance.

Key Drivers of Thermal Insulation Solution for LNG Carriers Growth

The growth of the Thermal Insulation Solution for LNG Carriers market is propelled by several key factors. The surging global demand for LNG as a cleaner energy alternative to fossil fuels is a primary driver, necessitating an expansion of LNG transportation fleets. Technological advancements in insulation materials, such as improved PUR and PIR formulations and the integration of lightweight composites, are enhancing performance and reducing operational costs for carriers. Stricter international maritime regulations mandating improved safety and environmental performance, including reduced emissions and boil-off gas, further incentivize the adoption of advanced insulation solutions. Government initiatives promoting LNG as a transition fuel and supporting the development of LNG infrastructure also contribute significantly to market expansion.

Challenges in the Thermal Insulation Solution for LNG Carriers Sector

Despite its robust growth, the Thermal Insulation Solution for LNG Carriers sector faces several challenges. High upfront costs associated with advanced insulation materials and their installation can be a barrier, especially for smaller operators. The complexity of installation and the need for specialized expertise can also pose logistical challenges. Intense competition among material suppliers and manufacturers, coupled with potential supply chain disruptions for raw materials, can impact pricing and availability. Furthermore, the development of novel, high-performance insulation technologies requires significant R&D investment, and the long lifecycle of LNG carriers means that adoption of new solutions can be gradual. Regulatory changes or the emergence of alternative energy carriers could also present long-term uncertainties.

Leading Players in the Thermal Insulation Solution for LNG Carriers Market

- Hankuk Carbon

- Dongsung FineTec

- BASF

- Owens Corning

- Thermal Insulation Group

- Röchling Group

- Diab Group

- Kawasaki Heavy Industries, Ltd.

- Johns Manville

- MEISEI INDUSTRIAL CO.,LTD.

- Pearl Polyurethane Systems

- K-FLEX

- Trident

- Jiangsu Yoke Technology

- ZES

Key Developments in Thermal Insulation Solution for LNG Carriers Sector

- 2023/08: Hankuk Carbon announces a new generation of cryogenic insulation for LNG tanks, offering enhanced thermal performance.

- 2023/06: Dongsung FineTec secures a major contract for insulation systems for a new series of LNG carriers.

- 2022/11: BASF introduces a more sustainable PUR foam formulation for maritime insulation applications.

- 2022/09: Owens Corning expands its portfolio of glass fiber reinforcements for composite insulation solutions.

- 2022/04: Thermal Insulation Group partners with a leading shipyard to develop customized insulation solutions for LNG carriers.

- 2021/10: Röchling Group showcases advanced lightweight insulation materials for improved fuel efficiency in maritime transport.

- 2021/07: Diab Group launches a new range of high-density core materials for composite insulation structures.

- 2020/05: Kawasaki Heavy Industries, Ltd. highlights its integrated insulation and containment systems for LNG carriers.

- 2020/01: Johns Manville introduces advanced insulation solutions to meet stringent fire safety standards in the maritime sector.

- 2019/09: MEISEI INDUSTRIAL CO.,LTD. demonstrates innovative application techniques for cryogenic insulation.

- 2019/06: Pearl Polyurethane Systems develops custom insulation solutions for specialized LNG containment systems.

- 2019/03: K-FLEX expands its global manufacturing capacity for elastomeric insulation products.

- 2019/01: Trident unveils a novel approach to insulation for enhanced thermal stability.

- 2018/12: Jiangsu Yoke Technology invests in R&D for advanced insulation materials with lower GWP.

- 2018/09: ZES collaborates on projects to optimize insulation performance in extreme marine environments.

Strategic Thermal Insulation Solution for LNG Carriers Market Outlook

The future outlook for the Thermal Insulation Solution for LNG Carriers market is exceptionally positive, driven by sustained global energy demand and the continued transition to cleaner fuels. Growth accelerators include ongoing advancements in material science, leading to more efficient, lightweight, and environmentally friendly insulation solutions. Strategic opportunities lie in collaborations between insulation providers, shipbuilders, and LNG operators to develop integrated and optimized containment and insulation systems. The increasing focus on lifecycle cost analysis and sustainability will further drive the adoption of premium, long-lasting insulation products. Emerging markets and the ongoing retrofitting of older LNG carriers also present significant growth potential. The market is expected to continue its upward trajectory, offering substantial potential for companies investing in innovation and strategic market positioning.

Thermal Insulation Solution for LNG Carriers Segmentation

-

1. Application

- 1.1. LNG Storage Tank

- 1.2. LNG Cargo Enclosure System

- 1.3. Other

-

2. Types

- 2.1. PUR Insulation Material

- 2.2. PIR Insulation Material

- 2.3. Other

Thermal Insulation Solution for LNG Carriers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermal Insulation Solution for LNG Carriers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. LNG Storage Tank

- 5.1.2. LNG Cargo Enclosure System

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. PUR Insulation Material

- 5.2.2. PIR Insulation Material

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. LNG Storage Tank

- 6.1.2. LNG Cargo Enclosure System

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. PUR Insulation Material

- 6.2.2. PIR Insulation Material

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. LNG Storage Tank

- 7.1.2. LNG Cargo Enclosure System

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. PUR Insulation Material

- 7.2.2. PIR Insulation Material

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. LNG Storage Tank

- 8.1.2. LNG Cargo Enclosure System

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. PUR Insulation Material

- 8.2.2. PIR Insulation Material

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. LNG Storage Tank

- 9.1.2. LNG Cargo Enclosure System

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. PUR Insulation Material

- 9.2.2. PIR Insulation Material

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermal Insulation Solution for LNG Carriers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. LNG Storage Tank

- 10.1.2. LNG Cargo Enclosure System

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. PUR Insulation Material

- 10.2.2. PIR Insulation Material

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hankuk Carbon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dongsung FineTec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Owens Corning

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermal Insulation Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Röchling Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Diab Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kawasaki Heavy Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johns Manville

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MEISEI INDUSTRIAL CO.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LTD.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pearl Polyurethane Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 K-FLEX

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Trident

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Jiangsu Yoke Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ZES

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Hankuk Carbon

List of Figures

- Figure 1: Global Thermal Insulation Solution for LNG Carriers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thermal Insulation Solution for LNG Carriers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thermal Insulation Solution for LNG Carriers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thermal Insulation Solution for LNG Carriers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thermal Insulation Solution for LNG Carriers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thermal Insulation Solution for LNG Carriers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thermal Insulation Solution for LNG Carriers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thermal Insulation Solution for LNG Carriers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thermal Insulation Solution for LNG Carriers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thermal Insulation Solution for LNG Carriers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thermal Insulation Solution for LNG Carriers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thermal Insulation Solution for LNG Carriers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Insulation Solution for LNG Carriers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Thermal Insulation Solution for LNG Carriers?

Key companies in the market include Hankuk Carbon, Dongsung FineTec, BASF, Owens Corning, Thermal Insulation Group, Röchling Group, Diab Group, Kawasaki Heavy Industries, Ltd., Johns Manville, MEISEI INDUSTRIAL CO., LTD., Pearl Polyurethane Systems, K-FLEX, Trident, Jiangsu Yoke Technology, ZES.

3. What are the main segments of the Thermal Insulation Solution for LNG Carriers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Insulation Solution for LNG Carriers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Insulation Solution for LNG Carriers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Insulation Solution for LNG Carriers?

To stay informed about further developments, trends, and reports in the Thermal Insulation Solution for LNG Carriers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence