Key Insights

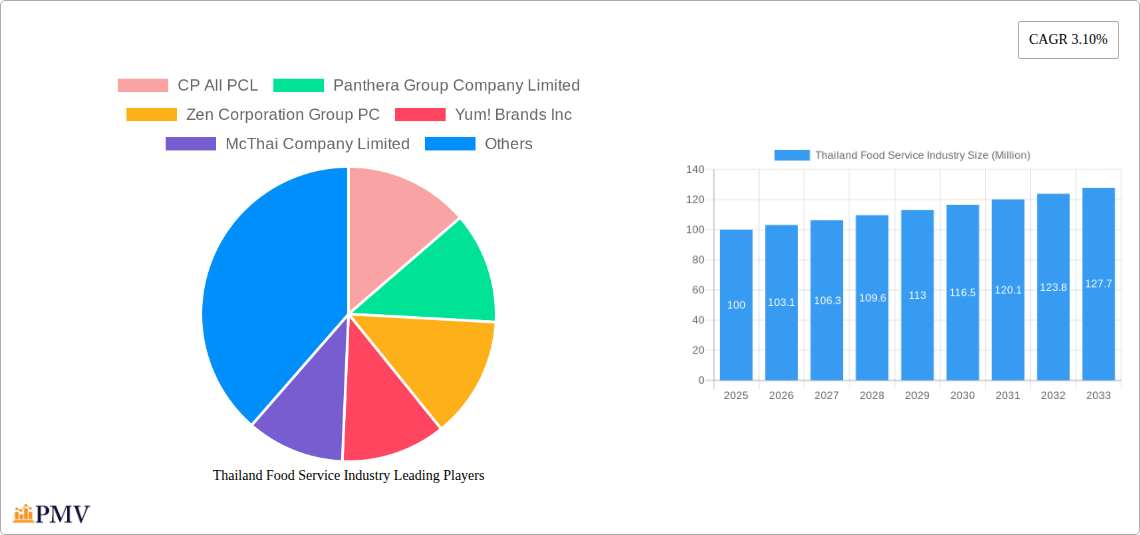

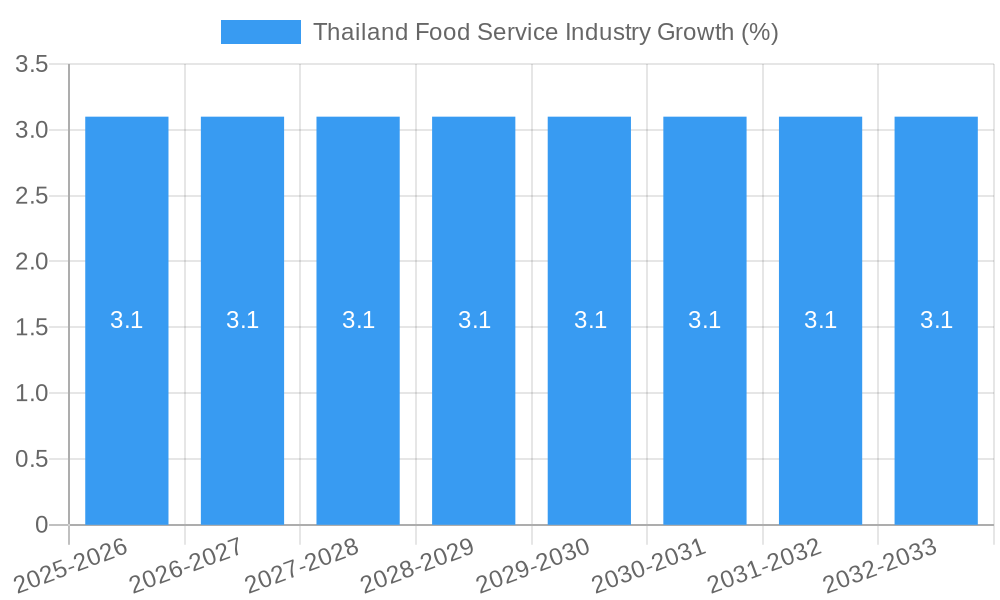

The Thailand food service industry, valued at approximately [Estimate based on market size XX and value unit Million. For example, if XX is 100, then the value is 100 Million in 2025] million in 2025, is experiencing robust growth, projected at a CAGR of 3.10% from 2025 to 2033. This expansion is fueled by several key drivers. The rise of a young, increasingly affluent population with a growing preference for dining out contributes significantly. Tourism, a major sector in Thailand's economy, further bolsters demand, particularly within the leisure and lodging segments. The diversification of culinary offerings, including the expansion of international QSR cuisines alongside established Thai favorites, caters to evolving consumer tastes and preferences. Furthermore, the increasing adoption of technology, including online ordering and delivery platforms, is streamlining operations and expanding market reach.

However, the industry also faces challenges. Rising food and labor costs present ongoing operational pressures. Increased competition, both from established players and new entrants, necessitates continuous innovation and differentiation strategies. Maintaining consistent food quality and hygiene standards is paramount, especially given the importance of tourism and the associated scrutiny. Effectively managing these restraints will be critical for sustained growth. Market segmentation reveals a strong presence of both chained outlets and independent establishments, spread across diverse locations including cafes, bars, leisure venues, hotels, retail spaces, and standalone units. Key players like CP All PCL, MK Restaurant Group, and Minor International PCL are strategically positioned to capitalize on opportunities presented by this dynamic market, while smaller independent outlets leverage localized expertise and unique culinary offerings.

Thailand Food Service Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand food service industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, dominant segments, and future growth potential. Expect detailed market sizing in Millions, CAGR calculations, and analysis of key players like CP All PCL, and others.

Thailand Food Service Industry Market Structure & Competitive Dynamics

The Thailand food service industry exhibits a dynamic interplay of established players and emerging entrants, resulting in a moderately concentrated market. Key players like CP All PCL and Minor International PCL command significant market share, though the presence of numerous smaller independent outlets prevents complete market dominance. The industry's innovation ecosystem is driven by both international franchises and local entrepreneurs, leading to a diverse range of offerings.

Regulatory frameworks, while generally supportive of the industry's growth, present some complexities related to food safety, licensing, and labor laws. Product substitutes, such as home-cooked meals and ready-to-eat packaged foods, pose a constant competitive challenge. End-user trends, heavily influenced by changing demographics, evolving consumer preferences (e.g., health consciousness, convenience), and rising disposable incomes, profoundly shape market dynamics.

Mergers and acquisitions (M&A) activity has been significant in recent years, with deal values exceeding xx Million in the period 2019-2024. Notable transactions include:

- Acquisition of xx by xx for xx Million (Year)

- Strategic partnership between xx and xx (Year)

These M&A activities reflect the industry's consolidation trend, with larger players seeking expansion and diversification. Market share estimates for key players in 2025 are projected as follows:

- CP All PCL: xx%

- Minor International PCL: xx%

- MK Restaurant Group Public Company Limited: xx%

- Others: xx%

Thailand Food Service Industry Industry Trends & Insights

The Thailand food service industry is experiencing robust growth, fueled by several key factors. The rising disposable incomes of the Thai population, coupled with rapid urbanization and a growing young adult population, drive increased spending on food away from home. A strong tourism sector further boosts demand, particularly within the leisure and travel segments. The industry's CAGR from 2019-2024 was estimated at xx%, and a forecast of xx% CAGR from 2025-2033 is projected. This growth is underpinned by:

- Increased consumer spending and disposable income.

- Tourism resurgence and international visitor spending.

- Expanding middle class with changing lifestyle preferences.

- A preference for convenience and diverse dining experiences.

Technological disruptions, such as online food delivery platforms and digital payment systems, have significantly reshaped the industry's operational dynamics and consumer behavior. Market penetration of online food delivery services reached xx% in 2024, projected to rise to xx% by 2033. Competitive dynamics are intensifying, with both domestic and international players vying for market share through innovative offerings, aggressive marketing, and strategic partnerships.

Dominant Markets & Segments in Thailand Food Service Industry

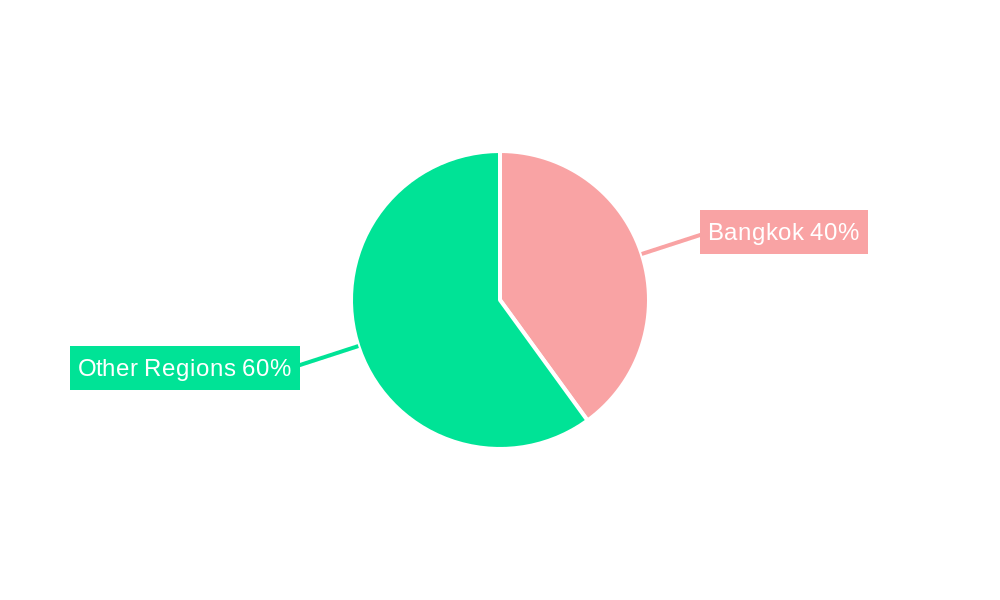

The Bangkok metropolitan area remains the dominant market within the Thailand food service industry, accounting for xx% of total revenue in 2024. Key drivers for this dominance include high population density, strong economic activity, and a high concentration of tourists. Other major regional markets include Chiang Mai and Phuket.

Dominant Segments:

- Foodservice Type: Quick Service Restaurants (QSR) including Other QSR Cuisines dominate the market due to their affordability and convenience, followed by cafes and bars which cater to a more discerning clientele.

- Outlet Type: Chained outlets hold a significant market share benefiting from economies of scale and brand recognition, while independent outlets retain a substantial presence, offering unique dining experiences.

- Location Type: Retail and standalone locations dominate, given their accessibility and high foot traffic. Lodging and Travel segments are closely tied to the tourism sector. Leisure locations experience cyclical demand peaks during holidays.

Key Drivers:

- Economic Policies: Government initiatives supporting tourism and infrastructure development contribute to the industry's growth.

- Infrastructure: Well-developed transportation networks and communication infrastructure facilitate market access and operations.

- Tourism: The vibrant tourism sector significantly fuels demand, particularly within leisure and travel locations.

Thailand Food Service Industry Product Innovations

Recent product innovations reflect the industry's response to evolving consumer preferences and technological advancements. The rise of health-conscious consumers is driving the introduction of healthier menu options and the increasing popularity of plant-based alternatives. Technology is enabling personalized dining experiences through mobile ordering and customized meal recommendations. The integration of AI and automation in kitchens is boosting operational efficiency.

Report Segmentation & Scope

This report segments the Thailand food service industry across several key dimensions:

Foodservice Type: This includes a detailed analysis of Cafes & Bars and Other QSR Cuisines, including their market size, growth projections, and competitive dynamics. Market sizes for 2025 are projected at xx Million for Cafes & Bars and xx Million for Other QSR Cuisines.

Outlet Type: The report examines Chained Outlets and Independent Outlets, assessing their relative market shares, growth trajectories, and competitive landscapes. Growth projections show xx% for Chained Outlets and xx% for Independent Outlets by 2033.

Location Type: The report analyzes Leisure, Lodging, Retail, Standalone, and Travel locations, evaluating the unique characteristics of each segment and its contribution to the overall market. Retail and Standalone locations are predicted to show the highest growth.

Key Drivers of Thailand Food Service Industry Growth

Several factors contribute to the growth of the Thailand food service industry:

- Rising Disposable Incomes: Increasing disposable incomes among Thais lead to higher spending on dining out.

- Urbanization: Urbanization drives the growth of the quick-service restaurant segment.

- Tourism: A robust tourism sector boosts demand, especially within leisure and travel-related food services.

- Technological Advancements: Online food delivery platforms and digital payment systems facilitate market expansion.

Challenges in the Thailand Food Service Industry Sector

The Thailand food service industry faces challenges including:

- Intense Competition: The market is characterized by strong competition from both domestic and international players.

- Supply Chain Disruptions: Fluctuations in food prices and supply chain disruptions can impact profitability.

- Regulatory Hurdles: Compliance with food safety and licensing regulations can pose challenges for businesses.

- Labor Costs: Rising labor costs can impact the operational efficiency of businesses.

Leading Players in the Thailand Food Service Industry Market

- CP All PCL

- Panthera Group Company Limited

- Zen Corporation Group PC

- Yum! Brands Inc

- McThai Company Limited

- Thai Beverage PCL

- MK Restaurant Group Public Company Limited

- Global Franchise Architects Company Limited

- Central Plaza Hotel Public Company Limited

- Food Capitals Public Company Limited

- Minor International PCL

- Maxim's Caterers Limited

- PTT Public Company Limited

Key Developments in Thailand Food Service Industry Sector

- April 2022: Thai Beverage PCL launched "Oishi Biztoro," a hybrid Japanese restaurant, impacting the QSR and full-service segments.

- July 2021: A&W Thailand's partnership with 7-Eleven expanded its reach into the retail channel.

- April 2021: MK Restaurant Group's premium MK Gold restaurant launched, targeting the upscale dining segment.

Strategic Thailand Food Service Industry Market Outlook

The Thailand food service industry is poised for continued growth, driven by strong economic fundamentals and evolving consumer preferences. Strategic opportunities exist for players to capitalize on the rising demand for convenience, health-conscious options, and technology-driven services. Expansion into underserved markets and leveraging strategic partnerships present significant avenues for growth. The increasing adoption of sustainable practices and focus on enhancing customer experiences will further shape the industry's trajectory.

Thailand Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Thailand Food Service Industry Segmentation By Geography

- 1. Thailand

Thailand Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Flavonoids

- 3.4. Market Trends

- 3.4.1. The rise in veganism and vegetarianism in the country led to the expansion of plant-based menu options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CP All PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panthera Group Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zen Corporation Group PC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yum! Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 McThai Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thai Beverage PCL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MK Restaurant Group Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Global Franchise Architects Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Central Plaza Hotel Public Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Food Capitals Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Minor International PCL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Maxim's Caterers Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PTT Public Company Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CP All PCL

List of Figures

- Figure 1: Thailand Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Thailand Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Thailand Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Thailand Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Thailand Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Thailand Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Thailand Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Thailand Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Food Service Industry?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Thailand Food Service Industry?

Key companies in the market include CP All PCL, Panthera Group Company Limited, Zen Corporation Group PC, Yum! Brands Inc, McThai Company Limited, Thai Beverage PCL, MK Restaurant Group Public Company Limited, Global Franchise Architects Company Limited, Central Plaza Hotel Public Company Limited, Food Capitals Public Company Limited, Minor International PCL, Maxim's Caterers Limited, PTT Public Company Limited.

3. What are the main segments of the Thailand Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework.

6. What are the notable trends driving market growth?

The rise in veganism and vegetarianism in the country led to the expansion of plant-based menu options.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Flavonoids.

8. Can you provide examples of recent developments in the market?

April 2022: Thai Beverage PCL launched a new brand, "Oishi Biztoro," which was developed as a 'hybrid' Japanese restaurant serving fast food and full service. The restaurant offers various popular and familiar Japanese dishes, divided into three main groups: "Ramen and Soba" Noodle Menu Group, "Donburi" Rice Menu Group, and Snacks Menu Group.July 2021: A&W Thailand partnered with 7-Eleven to launch three waffle products: Fish & Cheese Waffle, Grilled Teriyaki Chicken Waffle, and Spicy Chicken Waffle. This partnership is in response to the fast-food chain's shift toward packaged foods sold through the retail channel.April 2021: MK Restaurant Group opened its first MK Gold restaurant in Chiang Mai. It offers a premium dining experience with a wide range of menus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Food Service Industry?

To stay informed about further developments, trends, and reports in the Thailand Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence