Key Insights

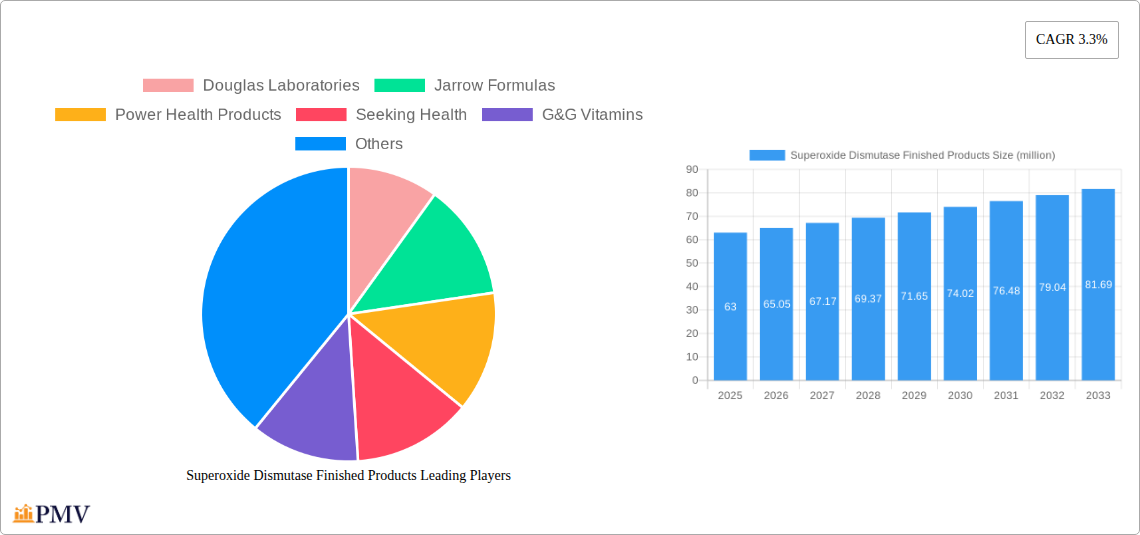

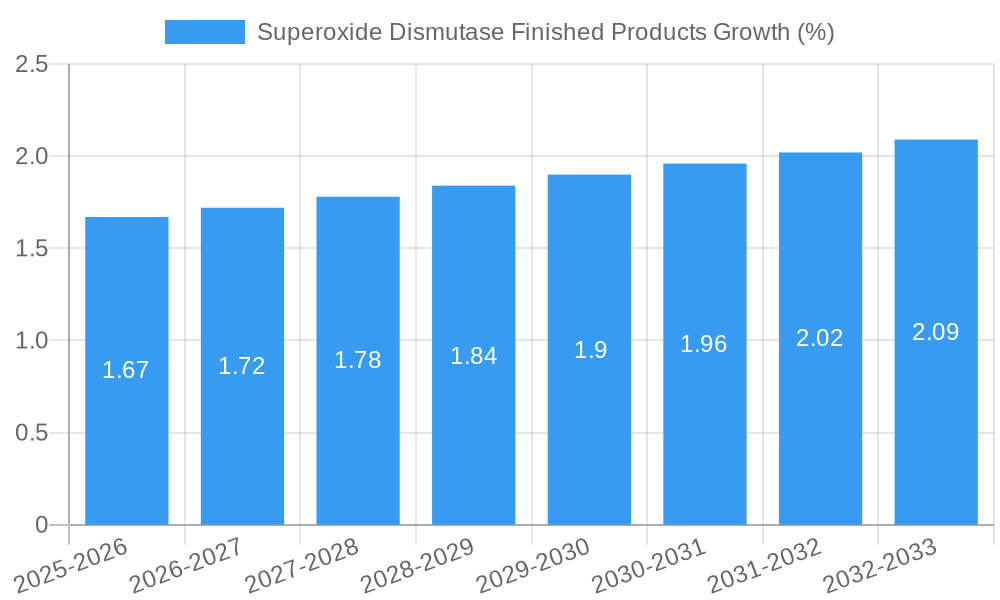

The global Superoxide Dismutase (SOD) Finished Products market is projected to reach a substantial valuation of $63 million by 2025, demonstrating a steady Compound Annual Growth Rate (CAGR) of 3.3% throughout the forecast period of 2025-2033. This growth is primarily propelled by increasing consumer awareness regarding the antioxidant properties of SOD and its subsequent integration into various health and wellness products. The rising prevalence of lifestyle-related diseases and the growing demand for natural supplements to combat oxidative stress are significant drivers. Furthermore, advancements in product formulations and a wider availability of SOD-based products across diverse distribution channels, including pharmacies, supermarkets, and e-commerce platforms, are contributing to market expansion. The health benefits associated with SOD, such as its role in cellular protection and anti-aging, are gaining traction, fueling consumer interest and market demand.

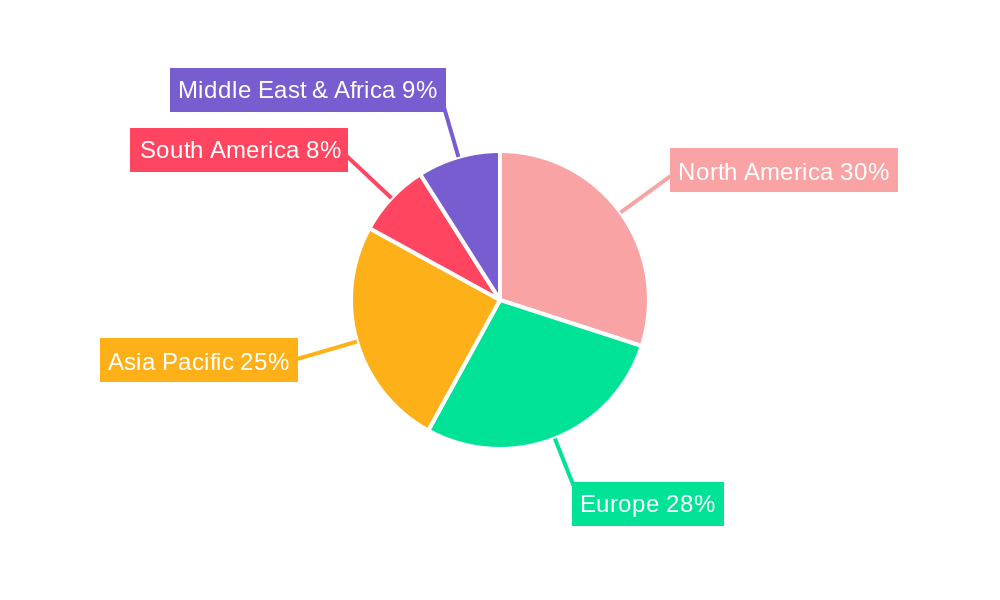

The market is segmented into distinct product types, with tablets and capsules constituting the dominant categories due to their ease of consumption and established market presence. The "Others" segment, likely encompassing topical applications and functional foods, is also expected to witness growth as product innovation continues. Geographically, North America and Europe are anticipated to lead the market share, driven by high disposable incomes, developed healthcare infrastructures, and a proactive approach to preventive healthcare. Asia Pacific, however, is poised for the fastest growth, fueled by a burgeoning middle class, increasing health consciousness, and a growing preference for dietary supplements. Restraints to market growth may include stringent regulatory landscapes in certain regions and the potential for high manufacturing costs for certain high-purity SOD formulations. Nevertheless, the overall outlook for the Superoxide Dismutase Finished Products market remains robust, supported by its inherent health benefits and expanding consumer acceptance.

Superoxide Dismutase Finished Products Market Research Report: 2019-2033 Forecast

This comprehensive market research report delves into the dynamic landscape of Superoxide Dismutase (SOD) finished products, offering an in-depth analysis of market structure, competitive dynamics, emerging trends, and future outlook. With a study period spanning from 2019 to 2033, and a robust focus on the base and forecast years of 2025 to 2033, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning opportunities within the SOD finished products market. We meticulously analyze key segments, dominant regions, product innovations, and strategic imperatives, all while embedding high-ranking keywords to ensure maximum search visibility and engagement for industry professionals. The global market for Superoxide Dismutase Finished Products is projected to reach an estimated value exceeding one million dollars by the end of the forecast period, driven by increasing consumer awareness of antioxidant benefits and a growing prevalence of lifestyle-related diseases.

Superoxide Dismutase Finished Products Market Structure & Competitive Dynamics

The Superoxide Dismutase Finished Products market exhibits a moderate to high degree of concentration, with a few key players holding significant market share. Innovation ecosystems are flourishing, driven by ongoing research into novel extraction methods, improved bioavailability, and expanded therapeutic applications of SOD. Regulatory frameworks, while generally supportive of dietary supplements and functional foods, can vary across regions, influencing market entry and product development strategies. Potential product substitutes, primarily other antioxidant compounds and dietary supplements, pose a competitive challenge, necessitating continuous differentiation and value proposition enhancement for SOD-based products. End-user trends are increasingly favoring natural and science-backed ingredients, creating a favorable environment for SOD. Mergers and acquisitions (M&A) activities, valued in the millions of dollars, have been observed as companies seek to consolidate market presence, acquire advanced technologies, and expand their product portfolios. For instance, strategic partnerships and acquisitions in the pharmacy and drug store and e-commerce segments are key indicators of this trend. The market share of leading companies is estimated to be substantial, with ongoing M&A deal values contributing to market consolidation and estimated at millions of dollars annually.

Superoxide Dismutase Finished Products Industry Trends & Insights

The Superoxide Dismutase Finished Products industry is poised for significant expansion, fueled by a confluence of compelling market growth drivers. A primary accelerator is the escalating global health consciousness, with consumers actively seeking dietary supplements and functional foods that offer robust antioxidant protection and support overall well-being. This trend is particularly pronounced in developed economies, where disposable incomes are higher and preventative healthcare is prioritized. The growing understanding of oxidative stress's role in various chronic diseases, including cardiovascular conditions, neurodegenerative disorders, and age-related ailments, directly translates into increased demand for SOD as a powerful endogenous antioxidant. Technological advancements in extraction and purification processes are enhancing the efficacy and bioavailability of SOD, making it a more attractive ingredient for finished product manufacturers. This innovation is paving the way for novel product formulations and expanded applications.

Consumer preferences are also evolving, with a discernible shift towards natural, science-backed ingredients. Superoxide Dismutase, being a naturally occurring enzyme crucial for cellular defense, aligns perfectly with this demand. The proliferation of e-commerce channels has democratized access to a wide array of SOD finished products, allowing consumers to conveniently research, compare, and purchase these items. This has broadened the market reach and contributed to increased sales volumes. Furthermore, the aging global population is a significant demographic trend driving demand for products that promote longevity and combat age-related health issues. SOD's potent antioxidant properties are highly valued in this demographic.

Competitive dynamics within the industry are characterized by both collaboration and intense rivalry. Companies are investing heavily in research and development to uncover new health benefits and optimize delivery systems for SOD. Strategic alliances and licensing agreements are becoming more common as businesses aim to leverage each other's strengths and accelerate market penetration. The projected Compound Annual Growth Rate (CAGR) for the Superoxide Dismutase Finished Products market is robust, estimated at millions of percentage points annually, indicating substantial growth potential. Market penetration is expected to rise steadily, driven by increased awareness campaigns, product availability, and a growing body of scientific evidence supporting SOD's efficacy. The expansion of distribution channels, including pharmacy and drug stores and hypermarkets and supermarkets, further bolsters market accessibility and consumer adoption. The value chain is becoming increasingly sophisticated, with manufacturers focusing on premium formulations and targeted health solutions.

Dominant Markets & Segments in Superoxide Dismutase Finished Products

The global Superoxide Dismutase Finished Products market is characterized by regional dominance and specific segment leadership, driven by a combination of economic policies, healthcare infrastructure, and consumer behavior. North America, particularly the United States, currently holds a dominant position. This leadership is attributed to high consumer awareness regarding dietary supplements and antioxidants, a well-established healthcare system that encourages preventative measures, and a robust regulatory environment that supports the growth of the nutraceutical industry. Economic policies favoring innovation and investment in research and development further bolster this region's standing.

The Pharmacy and Drug Store segment is a leading distribution channel, owing to the trust consumers place in these outlets for health-related products and the availability of expert advice from pharmacists. The increasing prescription and recommendation of SOD-based supplements for various health conditions further solidify this segment's importance. The E-commerce segment is witnessing explosive growth, driven by convenience, wider product selection, and competitive pricing. This channel is particularly popular among younger demographics and those seeking specialized formulations not readily available in brick-and-mortar stores. The accessibility and reach of online platforms have significantly contributed to the market's expansion, with projected online sales exceeding millions of dollars annually.

Regarding product types, Capsules represent a dominant form factor. This preference is driven by ease of consumption, accurate dosage, and the perceived higher bioavailability of SOD delivered in capsule form. Manufacturers are investing in advanced encapsulation technologies to enhance product stability and efficacy, further cementing the dominance of capsules. Tablets also hold a significant market share, offering a cost-effective alternative and catering to consumers who prefer solid dosage forms. However, the market is also seeing a rise in "Others," which includes innovative delivery systems like powders, topical creams, and even functional beverages. This segment, though smaller, is expected to exhibit the highest growth rate as new applications and delivery mechanisms are explored, potentially reaching a market value of millions of dollars in the coming years. The strong economic policies supporting health and wellness initiatives in leading countries and the sophisticated healthcare infrastructure in regions like North America are key drivers for the continued dominance of these segments.

Superoxide Dismutase Finished Products Product Innovations

Product innovations in the Superoxide Dismutase Finished Products sector are primarily focused on enhancing efficacy, expanding applications, and improving consumer experience. Companies are developing advanced formulations with higher concentrations of SOD, often derived from superior sources like bovine colostrum or plant-based extracts. Research into liposomal encapsulation and other bioavailability-enhancing technologies is a key trend, ensuring that more of the active enzyme reaches its target sites within the body. Novel applications are emerging in areas such as sports nutrition, where SOD's role in muscle recovery and reducing exercise-induced oxidative stress is being explored, and in dermatological products for anti-aging benefits. Competitive advantages are being gained through the development of synergistic blends, combining SOD with other antioxidants or beneficial compounds, and by offering vegetarian or vegan-friendly options to cater to diverse consumer needs. The market is expected to see a significant influx of these improved and innovative products, contributing to an estimated market value increase of millions of dollars.

Report Segmentation & Scope

This report segments the Superoxide Dismutase Finished Products market across key applications and product types, providing granular insights into each area. The Application: Pharmacy and Drug Store segment is projected to experience steady growth, driven by increasing consumer trust and pharmacist recommendations. This segment is anticipated to capture a significant portion of the market value, estimated at millions of dollars by the end of the forecast period. The Hypermarket and Supermarket segment offers broad accessibility and is expected to grow at a moderate pace, catering to impulse purchases and everyday health needs. The E-commerce segment is poised for the highest growth trajectory, fueled by its expanding reach and convenience, with its market share projected to exceed millions of dollars.

In terms of product types, Tablets represent a mature segment with stable growth, expected to maintain a substantial market presence. Capsules are anticipated to continue their dominance, driven by perceived efficacy and consumer preference, with their market value projected to reach millions of dollars. The Others segment, encompassing powders, beverages, and specialized delivery systems, is expected to witness the most dynamic growth, as innovation drives new product development and consumer adoption of novel forms, contributing an estimated millions of dollars in market value.

Key Drivers of Superoxide Dismutase Finished Products Growth

The growth of the Superoxide Dismutase Finished Products market is propelled by several key factors. Firstly, increasing global awareness of oxidative stress and its detrimental effects on health is a major driver. Consumers are actively seeking solutions to combat cellular damage, leading to a higher demand for potent antioxidants like SOD. Secondly, advancements in scientific research are continuously uncovering and validating the health benefits of SOD, strengthening its position as a credible ingredient. This scientific backing fuels consumer confidence and encourages product adoption. Thirdly, the growing popularity of dietary supplements and nutraceuticals as a proactive approach to health maintenance and disease prevention plays a crucial role. Economic prosperity in many regions allows for increased discretionary spending on health and wellness products, further boosting market growth. The estimated annual growth contribution from these drivers is in the millions of dollars.

Challenges in the Superoxide Dismutase Finished Products Sector

Despite its promising growth, the Superoxide Dismutase Finished Products sector faces several challenges. Regulatory hurdles, particularly in different geographical regions with varying approval processes for dietary supplements, can impede market entry and product diversification. Supply chain disruptions, such as sourcing high-quality raw materials and ensuring product stability during transportation, can impact product availability and cost. Intense competitive pressure from other antioxidant supplements and functional food ingredients necessitates continuous innovation and effective marketing strategies. Furthermore, the relatively high cost of premium SOD formulations compared to other supplements can be a barrier for price-sensitive consumers. These challenges collectively pose a restraint on the market, potentially impacting its growth trajectory by an estimated millions of dollars annually.

Leading Players in the Superoxide Dismutase Finished Products Market

- Douglas Laboratories

- Jarrow Formulas

- Power Health Products

- Seeking Health

- G&G Vitamins

- Life Extension

- Sun Pharmaceutical

Key Developments in Superoxide Dismutase Finished Products Sector

- 2023 Q4: Launch of enhanced bioavailability SOD capsules by Jarrow Formulas, improving absorption rates.

- 2024 Q1: Douglas Laboratories introduces a new SOD formulation with added synergistic antioxidants for comprehensive cellular protection.

- 2024 Q2: Seeking Health expands its product line with a plant-based SOD supplement, catering to vegan consumers.

- 2024 Q3: Power Health Products announces a strategic partnership to increase distribution in Asian markets.

- 2024 Q4: Life Extension innovates with a novel topical SOD cream for anti-aging skincare applications.

Strategic Superoxide Dismutase Finished Products Market Outlook

The strategic outlook for the Superoxide Dismutase Finished Products market is exceptionally positive, characterized by substantial growth acceleration. The increasing consumer demand for scientifically validated, natural health solutions, coupled with ongoing product innovation, will continue to be key growth accelerators. The expansion of e-commerce platforms and a growing focus on preventative healthcare worldwide present significant opportunities for market penetration. Companies that invest in research and development to uncover new therapeutic applications, enhance product efficacy, and adopt sustainable sourcing practices will be well-positioned to capitalize on the market's immense potential. Strategic collaborations and a focus on niche markets, such as sports nutrition and age-related health, will further drive market expansion, contributing an estimated millions of dollars to future market value.

Superoxide Dismutase Finished Products Segmentation

-

1. Application

- 1.1. Pharmacy and Drug Store

- 1.2. Hypermarket and Supermarket

- 1.3. E-commerce

-

2. Types

- 2.1. Tablets

- 2.2. Capsules

- 2.3. Others

Superoxide Dismutase Finished Products Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Superoxide Dismutase Finished Products REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmacy and Drug Store

- 5.1.2. Hypermarket and Supermarket

- 5.1.3. E-commerce

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tablets

- 5.2.2. Capsules

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmacy and Drug Store

- 6.1.2. Hypermarket and Supermarket

- 6.1.3. E-commerce

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tablets

- 6.2.2. Capsules

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmacy and Drug Store

- 7.1.2. Hypermarket and Supermarket

- 7.1.3. E-commerce

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tablets

- 7.2.2. Capsules

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmacy and Drug Store

- 8.1.2. Hypermarket and Supermarket

- 8.1.3. E-commerce

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tablets

- 8.2.2. Capsules

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmacy and Drug Store

- 9.1.2. Hypermarket and Supermarket

- 9.1.3. E-commerce

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Superoxide Dismutase Finished Products Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmacy and Drug Store

- 10.1.2. Hypermarket and Supermarket

- 10.1.3. E-commerce

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tablets

- 10.2.2. Capsules

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Douglas Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jarrow Formulas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Power Health Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Seeking Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G&G Vitamins

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Life Extension

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun Pharmaceutical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Douglas Laboratories

List of Figures

- Figure 1: Global Superoxide Dismutase Finished Products Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Superoxide Dismutase Finished Products Revenue (million), by Application 2024 & 2032

- Figure 3: North America Superoxide Dismutase Finished Products Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Superoxide Dismutase Finished Products Revenue (million), by Types 2024 & 2032

- Figure 5: North America Superoxide Dismutase Finished Products Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Superoxide Dismutase Finished Products Revenue (million), by Country 2024 & 2032

- Figure 7: North America Superoxide Dismutase Finished Products Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Superoxide Dismutase Finished Products Revenue (million), by Application 2024 & 2032

- Figure 9: South America Superoxide Dismutase Finished Products Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Superoxide Dismutase Finished Products Revenue (million), by Types 2024 & 2032

- Figure 11: South America Superoxide Dismutase Finished Products Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Superoxide Dismutase Finished Products Revenue (million), by Country 2024 & 2032

- Figure 13: South America Superoxide Dismutase Finished Products Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Superoxide Dismutase Finished Products Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Superoxide Dismutase Finished Products Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Superoxide Dismutase Finished Products Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Superoxide Dismutase Finished Products Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Superoxide Dismutase Finished Products Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Superoxide Dismutase Finished Products Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Superoxide Dismutase Finished Products Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Superoxide Dismutase Finished Products Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Superoxide Dismutase Finished Products Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Superoxide Dismutase Finished Products Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Superoxide Dismutase Finished Products Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Superoxide Dismutase Finished Products Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Superoxide Dismutase Finished Products Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Superoxide Dismutase Finished Products Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Superoxide Dismutase Finished Products Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Superoxide Dismutase Finished Products Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Superoxide Dismutase Finished Products Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Superoxide Dismutase Finished Products Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Superoxide Dismutase Finished Products Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Superoxide Dismutase Finished Products Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Superoxide Dismutase Finished Products?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Superoxide Dismutase Finished Products?

Key companies in the market include Douglas Laboratories, Jarrow Formulas, Power Health Products, Seeking Health, G&G Vitamins, Life Extension, Sun Pharmaceutical.

3. What are the main segments of the Superoxide Dismutase Finished Products?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 63 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Superoxide Dismutase Finished Products," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Superoxide Dismutase Finished Products report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Superoxide Dismutase Finished Products?

To stay informed about further developments, trends, and reports in the Superoxide Dismutase Finished Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence