Key Insights

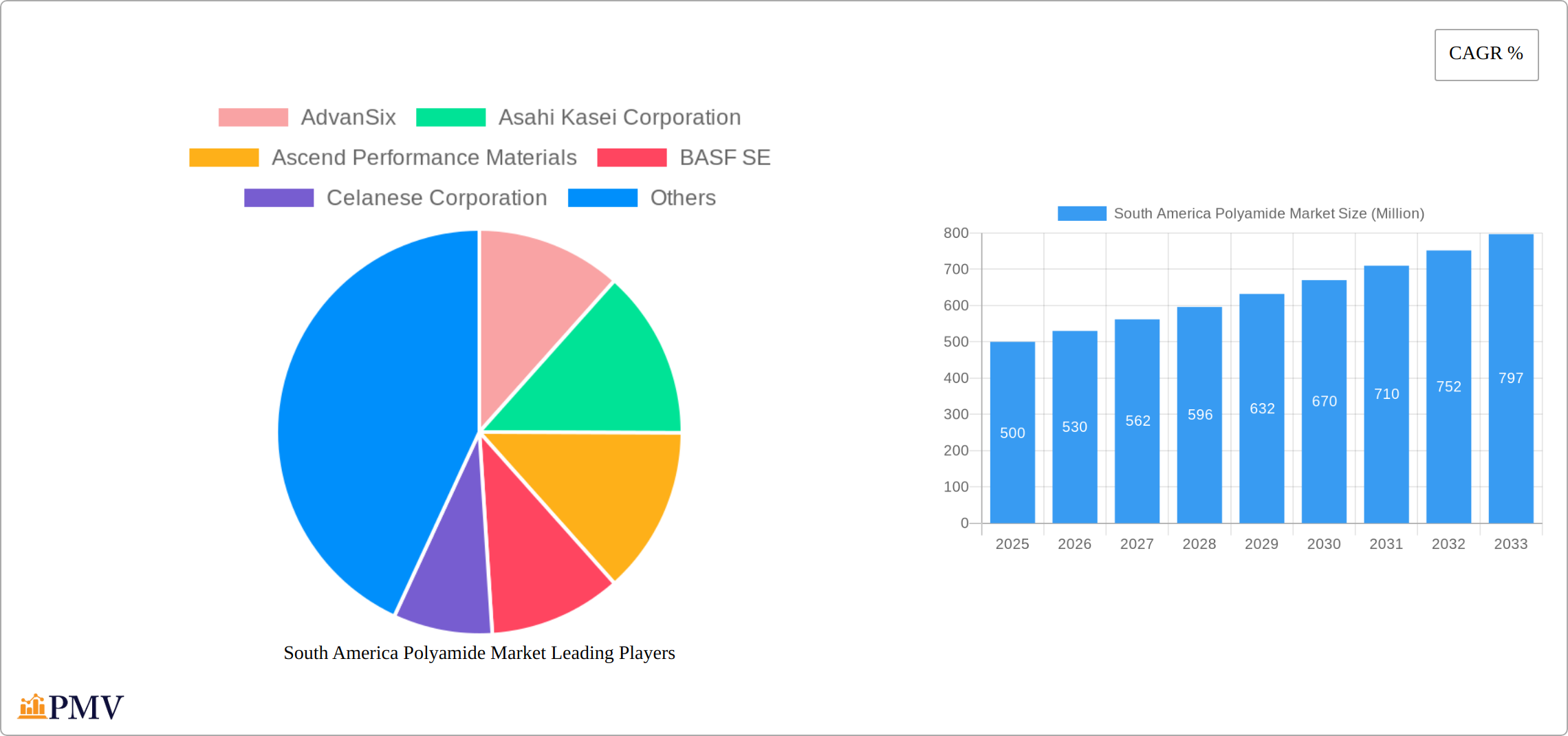

The South American polyamide market presents a compelling investment opportunity, driven by robust growth across various sectors. While precise market size figures for 2025 are unavailable, a logical estimation based on global trends and regional economic indicators suggests a market value of approximately $500 million USD. This substantial value is propelled by increasing demand from the automotive, textile, and packaging industries, fueled by a growing population and rising disposable incomes across the region. Furthermore, significant infrastructure development projects throughout South America are further stimulating demand for high-performance polyamides in construction and related applications. The market's Compound Annual Growth Rate (CAGR) is projected to be around 6%, indicating steady and consistent expansion through 2033. This positive outlook is reinforced by ongoing technological advancements in polyamide production leading to improved material properties and cost-effectiveness, making them increasingly competitive compared to alternatives. However, factors such as fluctuating raw material prices and economic volatility within certain South American countries pose potential challenges to market growth.

Nevertheless, the long-term prospects remain positive, especially with the focus on sustainable and eco-friendly polyamide solutions. The market is segmented by type (nylon 6, nylon 66, etc.), application (fibers, films, molding compounds), and end-use sectors (automotive, textile, packaging, etc.). Key players like AdvanSix, Asahi Kasei, Ascend Performance Materials, and BASF are vying for market share, leveraging their advanced manufacturing capabilities and extensive distribution networks. Their strategic investments in R&D and expanding production capacities will significantly impact the market's evolution in the coming years. The region's growth is expected to be uneven, with countries experiencing faster economic development showing stronger polyamide demand.

South America Polyamide Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South America Polyamide Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence for navigating this dynamic market.

South America Polyamide Market Market Structure & Competitive Dynamics

The South American polyamide market presents a moderately concentrated competitive landscape, shaped by a few key players commanding significant market share. Intense innovation drives this dynamic market, with companies heavily investing in R&D to develop advanced polyamide grades catering to diverse applications. However, this competitiveness is also influenced by varying regulatory frameworks across South American nations, impacting production costs and market access. The presence of substitute materials, such as other polymers and bio-based alternatives, adds another layer of complexity to the competitive dynamics.

End-user trends, notably the increasing demand for lightweight and sustainable materials, are significantly impacting market demand, favoring high-performance polyamides. Recent years have witnessed substantial M&A activity, with acquisitions aimed at expanding product portfolios and geographical reach. A notable example is Celanese Corporation's acquisition of DuPont's M&M business, which significantly reshaped the competitive landscape. A detailed market share analysis reveals that the top five players collectively hold approximately [Insert Percentage]% of the market. The average value of M&A deals within the last five years has been approximately [Insert Amount] million, highlighting the significant investment and consolidation within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding [Insert Percentage]% market share.

- Innovation Ecosystems: Robust R&D investments fueling the development of novel polyamide grades and applications.

- Regulatory Frameworks: Varying national regulations across South America influence production costs, market access, and sustainability practices.

- Product Substitutes: Competition from alternative polymers, bio-based materials, and other engineered materials.

- End-User Trends: Growing demand for lightweight, high-performance, and sustainable polyamide solutions across diverse sectors.

- M&A Activity: Significant consolidation through acquisitions, driving market share redistribution and strategic expansion.

South America Polyamide Market Industry Trends & Insights

The South American polyamide market is poised for robust growth, projected to experience a CAGR of [Insert Percentage]% during the forecast period (2025-2033). This growth is primarily fueled by increasing demand from key sectors such as automotive, packaging, textiles, and electronics. Technological advancements in high-performance polyamides, including enhanced properties like UV stability, impact resistance, and improved chemical resistance, are driving market expansion. The rising preference for sustainable and eco-friendly materials is further stimulating innovation in bio-based polyamides and recycled content incorporation. The penetration of high-performance polyamides is increasing steadily, driven by their superior properties compared to conventional materials. This growth trajectory is also influenced by economic factors, including industrial growth and infrastructure development across the region. Competitive dynamics remain crucial, with companies differentiating through product innovation, strategic partnerships, and efficient supply chain management.

Dominant Markets & Segments in South America Polyamide Market

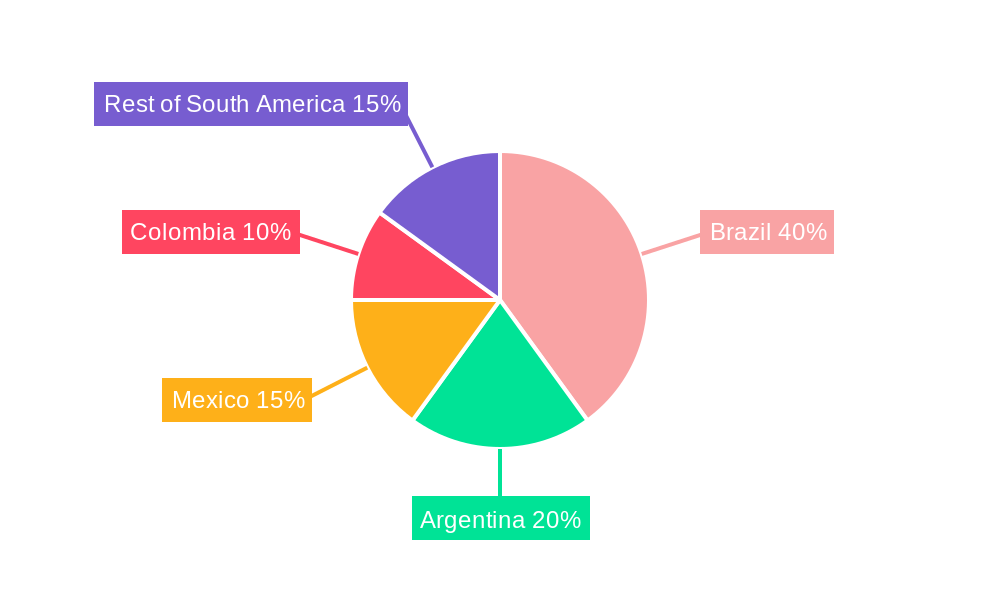

This section identifies the leading regions, countries, and segments within the South America Polyamide market. Brazil stands as the dominant market, accounting for approximately xx% of the total market size in 2025. This dominance is attributed to factors such as:

- Strong Automotive Sector: A robust automotive industry fuels significant demand for polyamides in vehicle components.

- Growing Packaging Industry: Expanding packaging needs drive the use of polyamides in films and containers.

- Favorable Government Policies: Supportive government initiatives promote industrial growth and infrastructure development.

The industrial segment represents the largest application area, contributing xx% to the overall market value in 2025, primarily due to the increasing demand for high-performance polyamides in machinery and equipment. Argentina and Colombia also hold significant market shares, though their growth rates are projected to be slightly lower than Brazil's. Mexico, while not part of South America geographically, is included in this analysis due to its significant economic ties and trade relationships with the region.

South America Polyamide Market Product Innovations

Recent years have witnessed significant product innovations in the South America Polyamide market. Companies are focusing on developing specialized polyamide grades with improved properties such as enhanced UV resistance, higher temperature tolerance, and improved mechanical strength. These innovations cater to specific end-user needs across various applications. For instance, the introduction of new polyamide grades suitable for hydrogen storage (DSM's Akulon FLX-LP and Akulon FLX40-HP) highlights the focus on sustainable and high-performance materials. Metal replacement applications, as demonstrated by EMS-Chemie Holding AG’s Grivory G7V, showcases a growing trend towards lightweighting and material substitution. These innovations are driving market expansion by opening new applications and improving performance across existing segments.

Report Segmentation & Scope

The South America Polyamide Market is segmented by type (PA6, PA66, others), application (automotive, textiles, packaging, industrial, others), and region (Brazil, Argentina, Colombia, Mexico, and others). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The industrial segment is projected to witness the highest growth rate, driven by the growing demand from various industrial sectors, while Brazil holds the largest market share in terms of regional segmentation.

Key Drivers of South America Polyamide Market Growth

Several key factors are driving the expansion of the South American polyamide market: Firstly, the robust growth in the automotive and packaging sectors fuels significant demand for high-performance polyamides. Secondly, government initiatives focused on industrial development and infrastructure investment in several South American countries stimulate market expansion. Thirdly, technological advancements enabling the production of specialized polyamide grades with enhanced properties (e.g., UV resistance, high-temperature tolerance) further boost market growth. Finally, the growing adoption of sustainable and eco-friendly materials is a major driver, fostering innovation in bio-based polyamides and recycled alternatives.

Challenges in the South America Polyamide Market Sector

Despite its promising growth prospects, the South American polyamide market faces several challenges. Volatile raw material prices significantly impact production costs and profitability. Supply chain disruptions can cause production delays and affect market availability. Intense competition from alternative polymer materials necessitates continuous innovation and product differentiation. Furthermore, regulatory hurdles and varying environmental standards across different South American countries create complexities for manufacturers. Effectively navigating these challenges is crucial for sustained growth and profitability within the sector.

Leading Players in the South America Polyamide Market Market

- AdvanSix

- Asahi Kasei Corporation

- Ascend Performance Materials

- BASF SE

- Celanese Corporation

- Domo Chemicals

- DSM

- EMS-Chemie Holding AG

- Koch Industries Inc

- UBE Corporation

Key Developments in South America Polyamide Market Sector

- January 2023: DSM introduced two new polyamide grades, Akulon FLX-LP and Akulon FLX40-HP, for hydrogen storage applications. This expands the use of polyamides into the growing renewable energy sector.

- November 2022: Celanese Corporation's acquisition of DuPont's M&M business significantly strengthened its position in engineered thermoplastics.

- October 2021: EMS-Chemie Holding AG developed Grivory G7V, a polyamide resin for metal replacement, enhancing its competitiveness in various applications.

Strategic South America Polyamide Market Market Outlook

The South America Polyamide Market presents significant growth opportunities. The increasing demand from diverse end-use sectors, coupled with ongoing technological advancements and supportive government policies, points to a positive outlook. Strategic partnerships, investments in R&D, and a focus on sustainable product offerings will be crucial for companies seeking to capitalize on the market's potential. Expansion into new applications and geographical areas, particularly in high-growth segments, offers significant growth prospects. Addressing challenges related to raw material volatility and supply chain resilience will be essential for long-term success.

South America Polyamide Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Aramid

- 2.2. Polyamide (PA) 6

- 2.3. Polyamide (PA) 66

- 2.4. Polyphthalamide

South America Polyamide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Polyamide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Aramid

- 5.2.2. Polyamide (PA) 6

- 5.2.3. Polyamide (PA) 66

- 5.2.4. Polyphthalamide

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AdvanSix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Asahi Kasei Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascend Performance Materials

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Celanese Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domo Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DSM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EMS-Chemie Holding AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koch Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 UBE Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AdvanSix

List of Figures

- Figure 1: South America Polyamide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Polyamide Market Share (%) by Company 2024

List of Tables

- Table 1: South America Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: South America Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 4: South America Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: South America Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 7: South America Polyamide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Colombia South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Peru South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Venezuela South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ecuador South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Bolivia South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Paraguay South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Uruguay South America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Polyamide Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the South America Polyamide Market?

Key companies in the market include AdvanSix, Asahi Kasei Corporation, Ascend Performance Materials, BASF SE, Celanese Corporation, Domo Chemicals, DSM, EMS-Chemie Holding AG, Koch Industries Inc, UBE Corporatio.

3. What are the main segments of the South America Polyamide Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: DSM introduced two new polyamide grades, Akulon FLX-LP and Akulon FLX40-HP, which will be used as liner materials and will provide robust performance in Type IV pressure vessels used for hydrogen storage.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.October 2021: EMS-Chemie Holding AG developed polyamide resin to be used as metal replacement under the brand Grivory G7V with high UV stability for increased surface finish applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Polyamide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Polyamide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Polyamide Market?

To stay informed about further developments, trends, and reports in the South America Polyamide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence