Key Insights

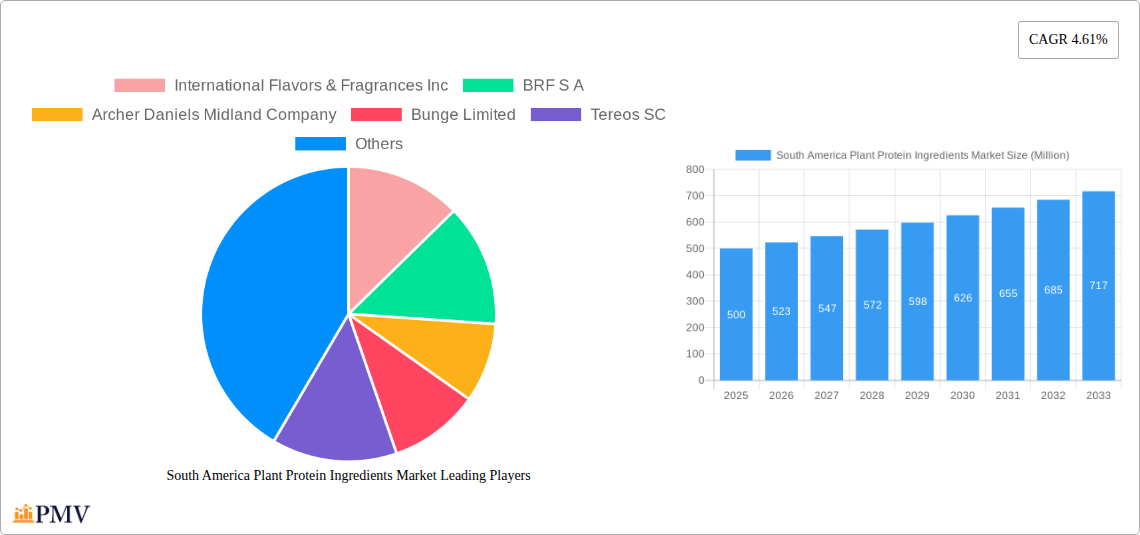

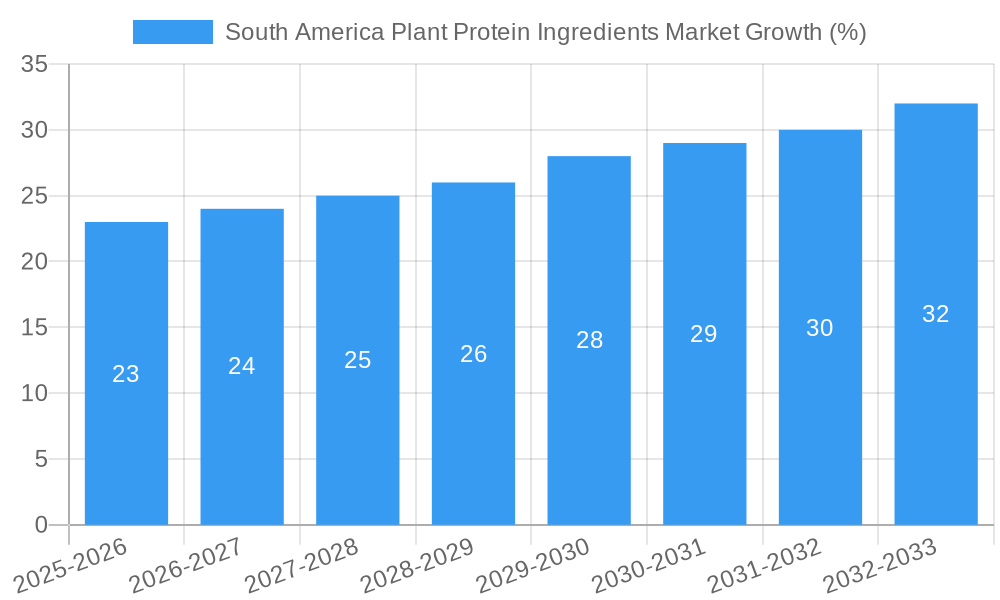

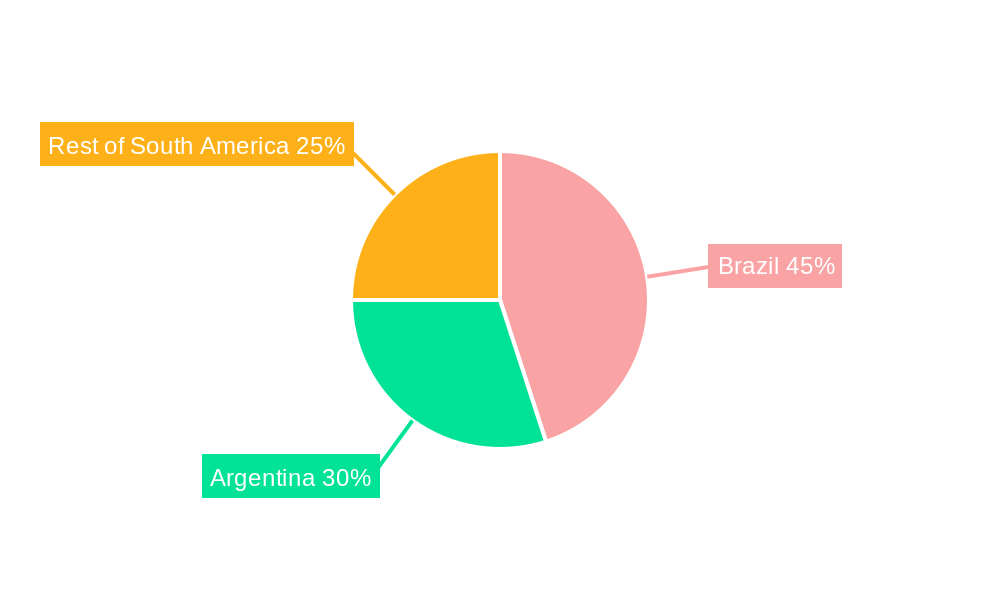

The South American plant protein ingredients market, currently experiencing robust growth, is projected to maintain a healthy expansion trajectory throughout the forecast period (2025-2033). Driven by increasing consumer demand for plant-based diets, a growing awareness of health and sustainability concerns, and the burgeoning popularity of vegetarian and vegan lifestyles, the market is poised for significant expansion. Key protein types fueling this growth include soy protein, pea protein, and hemp protein, with substantial application in food and beverages, animal feed, and the rapidly expanding sports/performance nutrition segments. Brazil and Argentina represent the largest national markets within South America, contributing significantly to the overall regional market size. While challenges exist, such as price fluctuations in raw materials and potential regulatory hurdles, the long-term outlook remains positive, fueled by continuous innovation in plant protein processing technologies and the rising adoption of plant-based alternatives across diverse consumer segments. The market's CAGR of 4.61% indicates a consistent upward trend, though this may fluctuate slightly year-to-year based on economic factors and consumer preferences. Factors such as government support for sustainable agriculture and the increasing availability of plant-based protein products in retail channels further enhance market prospects.

The competitive landscape features both multinational corporations and regional players, underscoring the market's maturity and diverse range of offerings. Key players like Archer Daniels Midland Company, Bunge Limited, and Ingredion Incorporated are leveraging their established distribution networks and strong R&D capabilities to maintain a leading position. Smaller, specialized companies are also thriving by focusing on niche applications and innovative product formulations. Future growth will likely be driven by advancements in protein extraction techniques, the development of novel protein blends with enhanced nutritional profiles, and the continued expansion of the market into new geographic areas within South America, capitalizing on evolving consumer preferences and the rise of health-conscious lifestyles. Opportunities for growth also lie in functional food and beverage applications that incorporate plant proteins, particularly for consumers seeking convenient, healthy, and sustainable choices.

This comprehensive report provides a detailed analysis of the South America Plant Protein Ingredients market, offering invaluable insights for businesses operating in or seeking to enter this dynamic sector. Spanning the period from 2019 to 2033, with a focus on 2025, this study offers a robust understanding of market trends, competitive dynamics, and future growth prospects. The report meticulously segments the market by protein type (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein) and end-user (Animal Feed, Food and Beverages, Sport/Performance Nutrition), providing granular analysis for informed decision-making. The total market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period (2025-2033).

South America Plant Protein Ingredients Market Market Structure & Competitive Dynamics

The South American plant protein ingredients market exhibits a moderately concentrated structure, with key players like International Flavors & Fragrances Inc, BRF S A, Archer Daniels Midland Company, Bunge Limited, Tereos SC, Südzucker AG, Ingredion Incorporated, Bremil Group, and Kerry Group plc holding significant market share. Market share distribution is dynamic, influenced by factors such as product innovation, strategic partnerships, and mergers and acquisitions (M&A). Innovation ecosystems are developing, driven by increasing demand for sustainable and functional food ingredients. Regulatory frameworks vary across South American nations, impacting ingredient sourcing and labeling requirements. Product substitutes, such as traditional protein sources (meat, dairy), continue to compete, though plant-based alternatives are gaining traction. End-user trends indicate a strong preference for healthier, more sustainable food choices, fueling market growth. M&A activity has been noteworthy, with deals like BENEO's acquisition of Meatless BV, demonstrating a consolidation trend within the industry. The estimated value of M&A deals in the past 5 years in this market segment totals approximately xx Million. The market concentration ratio (CR4) is estimated at xx%, indicating a moderately concentrated market.

South America Plant Protein Ingredients Market Industry Trends & Insights

The South American plant protein ingredients market is experiencing robust growth, driven by several key factors. The rising prevalence of vegetarianism and veganism is a major impetus, coupled with growing awareness of the health benefits associated with plant-based proteins. Technological advancements in protein extraction and processing are improving the quality and functionality of these ingredients, leading to broader applications. Consumer preferences are shifting towards cleaner labels and sustainably sourced ingredients, prompting manufacturers to adapt their production processes. The market exhibits a strong competitive landscape, with companies investing heavily in R&D and marketing to gain market share. This competition is fostering innovation and driving down prices, making plant-based proteins more accessible to consumers. The market penetration of plant-based proteins in various food and beverage categories is growing steadily, with a projected penetration rate of xx% by 2033. The CAGR for the overall market is estimated at xx% during the forecast period, reflecting this positive growth trajectory. Further driving this growth is the burgeoning sports nutrition sector, where plant-based proteins are increasingly favored for their health benefits and sustainability.

Dominant Markets & Segments in South America Plant Protein Ingredients Market

Within South America, Brazil stands as the dominant market for plant protein ingredients, driven by its large and growing population, rising disposable incomes, and increasing demand for convenient and healthy food options. Key drivers for Brazil's dominance include strong economic growth, well-developed infrastructure, and supportive government policies promoting sustainable agriculture.

- Key Drivers for Brazil's Dominance:

- Large and growing population

- Rising middle class with increasing disposable incomes

- Growing awareness of health and wellness

- Increasing demand for convenient and ready-to-eat foods

- Supportive government policies promoting sustainable agriculture

- Well-developed food processing infrastructure

Soy protein currently holds the largest market share among protein types, fueled by its established presence, relatively lower cost, and versatility. The food and beverage sector is the leading end-user segment, largely driven by the incorporation of plant-based proteins into a wide array of products, including meat alternatives, dairy alternatives, and protein bars.

South America Plant Protein Ingredients Market Product Innovations

Recent years have witnessed significant advancements in plant protein ingredient technology, focusing on improving texture, taste, and functionality. Companies are developing innovative formulations to address the challenges associated with plant-based proteins, such as off-flavors and limited functionality. This includes the use of advanced extraction techniques and the development of novel ingredient blends to enhance the overall sensory experience of plant-based products. The focus is on creating ingredients that seamlessly integrate into existing food and beverage applications, meeting consumer demands for taste and functionality.

Report Segmentation & Scope

This report comprehensively segments the South America Plant Protein Ingredients market based on protein type and end-user.

Protein Type: Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein. Each segment is analyzed based on its market size, growth projections, and competitive dynamics. Soy protein is currently the largest segment, projected to maintain its dominance throughout the forecast period, though other segments like pea and hemp protein are exhibiting faster growth rates.

End-User: Animal Feed, Food and Beverages, Sport/Performance Nutrition. The food and beverage segment currently dominates, with continued strong growth anticipated, fueled by increasing demand for plant-based alternatives and functional foods. The animal feed segment is also experiencing growth, driven by the increasing focus on sustainable and cost-effective animal feed solutions. The sport/performance nutrition segment shows high growth potential, driven by the increasing popularity of plant-based protein supplements.

Key Drivers of South America Plant Protein Ingredients Market Growth

The South American plant protein ingredients market is propelled by several key factors: a rising awareness of the health benefits of plant-based diets, leading to increased consumer demand; technological advancements resulting in improved protein extraction methods, increased functionality, and better taste profiles; growing government support for sustainable agriculture and food production; and the increasing popularity of vegetarian and vegan lifestyles. Economic growth and rising disposable incomes in several South American countries further contribute to market expansion. The rise of flexitarianism, a dietary pattern that incorporates plant-based protein in moderation, further fuels this positive growth trajectory.

Challenges in the South America Plant Protein Ingredients Market Sector

Despite its promising outlook, the South American plant protein ingredients market faces several challenges. Fluctuations in raw material prices and supply chain disruptions impact production costs and profitability. Stringent regulatory frameworks and labeling requirements in different countries necessitate compliance efforts, adding to operational complexity. Competition from established players and new entrants creates a fiercely competitive landscape, requiring continuous innovation and adaptation. Consumer perceptions about taste and texture of plant-based proteins still pose challenges to widespread adoption in some segments. The overall estimated impact of these challenges on annual market growth is approximately xx%.

Leading Players in the South America Plant Protein Ingredients Market Market

- International Flavors & Fragrances Inc

- BRF S A

- Archer Daniels Midland Company

- Bunge Limited

- Tereos SC

- Südzucker AG

- Ingredion Incorporated

- Bremil Group

- Kerry Group plc

Key Developments in South America Plant Protein Ingredients Market Sector

- February 2021: DuPont's Nutrition & Biosciences and IFF merged, creating a stronger player in the soy protein market.

- April 2021: Ingredion Inc. launched new pea protein and starch ingredients, strengthening its position in the sustainable sourcing segment.

- May 2022: BENEO's acquisition of Meatless BV expanded its offerings in texturizing solutions for meat alternatives, indicating a shift towards value-added products.

Strategic South America Plant Protein Ingredients Market Market Outlook

The South American plant protein ingredients market is poised for continued robust growth, driven by sustained demand for healthy and sustainable food options. Strategic opportunities lie in developing innovative products, expanding into new applications, and investing in sustainable sourcing and production practices. Companies that focus on product differentiation, consumer education, and strategic partnerships will be well-positioned to capitalize on the significant growth potential within this market. Further growth is expected in the areas of novel plant protein sources, improved processing technology, and a continued rise in consumer demand for plant-based proteins in various food and beverage products.

South America Plant Protein Ingredients Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

South America Plant Protein Ingredients Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Plant Protein Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Plant Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Brazil South America Plant Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Plant Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Plant Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 International Flavors & Fragrances Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 BRF S A

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Archer Daniels Midland Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bunge Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tereos SC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Südzucker AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ingredion Incorporated

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Bremil Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Kerry Group plc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 International Flavors & Fragrances Inc

List of Figures

- Figure 1: South America Plant Protein Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Plant Protein Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: South America Plant Protein Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Plant Protein Ingredients Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 3: South America Plant Protein Ingredients Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: South America Plant Protein Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Plant Protein Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Plant Protein Ingredients Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 10: South America Plant Protein Ingredients Market Revenue Million Forecast, by End User 2019 & 2032

- Table 11: South America Plant Protein Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Colombia South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Peru South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Venezuela South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Ecuador South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bolivia South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Paraguay South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Uruguay South America Plant Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Plant Protein Ingredients Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the South America Plant Protein Ingredients Market?

Key companies in the market include International Flavors & Fragrances Inc, BRF S A, Archer Daniels Midland Company, Bunge Limited, Tereos SC, Südzucker AG, Ingredion Incorporated, Bremil Group, Kerry Group plc.

3. What are the main segments of the South America Plant Protein Ingredients Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

May 2022: BENEO, a subsidiary of Südzucker, entered a purchase agreement to acquire Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.April 2021: Ingredion Inc. launched two new ingredients to its plant-based pea protein segment. It launched VITESSENSE pulse 1853 pea protein isolate and Purity P 1002 pea starch, which are 100% sustainably sourced from North American farms.February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Plant Protein Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Plant Protein Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Plant Protein Ingredients Market?

To stay informed about further developments, trends, and reports in the South America Plant Protein Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence