Key Insights

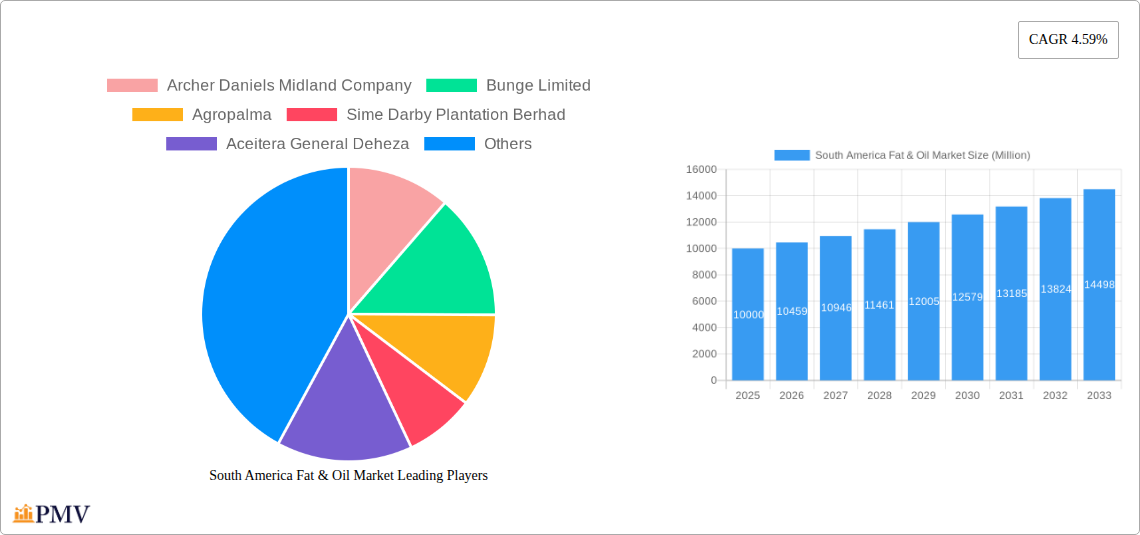

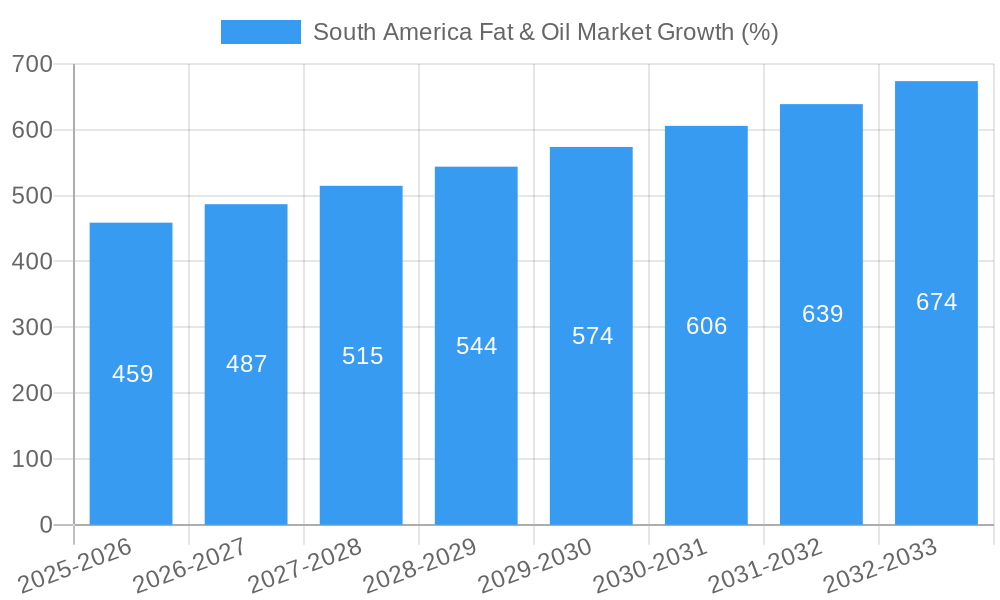

The South American fat and oil market, encompassing fats, oils, lard, and specialty fats, is experiencing robust growth, driven by increasing demand from the food, industrial, and animal feed sectors. Brazil and Argentina represent the largest markets within the region, fueled by expanding populations, rising disposable incomes, and evolving dietary habits. The food application segment is the major contributor, with a significant portion dedicated to processed foods, confectionery, and baked goods. The industrial segment's growth is propelled by the expanding biofuel industry and the increasing use of fats and oils in cosmetics and other industrial applications. The animal feed sector's demand is largely dictated by livestock production levels and fluctuating feed prices. While a precise market size for 2025 isn't provided, considering a CAGR of 4.59% and a presumably substantial base year value (given the size of South America’s agricultural sector and consumption patterns), a reasonable estimation would place the 2025 market value at approximately $8 billion to $12 billion (USD), depending on specific market segmentation. This range accounts for potential variations in growth across different applications. Challenges for market expansion include price volatility in raw materials, sustainable sourcing concerns, and competition from substitute products. However, continued investments in efficient processing technologies and the growing emphasis on healthier and sustainable fat and oil options will present significant growth opportunities in the forecast period of 2025-2033.

The competitive landscape in South America is characterized by a mix of large multinational corporations and regional players. Companies like Archer Daniels Midland, Bunge, and Cargill hold significant market share, leveraging their global supply chains and processing capabilities. However, local companies are also actively participating, particularly in the production and distribution of regionally specific oils and fats. The market is likely to witness increased consolidation in the coming years, driven by mergers and acquisitions as companies strive for economies of scale and enhanced market access. Further growth will be influenced by government policies regarding agricultural production, sustainability initiatives, and regulations impacting food safety and processing standards. The strategic focus of major players will be on expanding their product portfolios to cater to specific consumer demands for healthier, sustainably produced fats and oils, and expanding their presence in high-growth segments within the food and industrial sectors.

South America Fat & Oil Market: A Comprehensive Analysis (2019-2033)

This meticulously researched report provides a detailed analysis of the South America Fat & Oil Market, offering invaluable insights for industry stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with 2025 as the base year, this report dissects market structure, competitive dynamics, industry trends, and future growth prospects. The report utilizes extensive data and analysis to provide actionable intelligence, aiding strategic decision-making for businesses operating in or planning to enter the South American fat and oil market. The total market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

South America Fat & Oil Market Market Structure & Competitive Dynamics

The South America Fat & Oil market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. Key players include Archer Daniels Midland Company, Bunge Limited, Agropalma, Sime Darby Plantation Berhad, Aceitera General Deheza, Cargill Inc, Olam International Limited, AAK, Fuji Oil Holding Inc, and Wilmar International. The market share of these leading companies is estimated at approximately xx% in 2025. Innovation within the sector is driven by advancements in extraction technologies, refining processes, and the development of specialized fat and oil products catering to specific applications. The regulatory framework varies across South American countries, impacting operations and compliance. Product substitutes, such as alternative protein sources and plant-based fats, exert competitive pressure, although their market penetration remains relatively low. End-user trends towards healthier food options and sustainable sourcing are also shaping the market. M&A activities in the sector are relatively frequent, with deal values totaling approximately xx Million in the past five years, reflecting the industry's consolidation and expansion strategies. The market is further characterized by:

- High Barriers to Entry: Significant capital investment and established supply chains create barriers for new entrants.

- Price Volatility: Fluctuations in raw material prices and global demand significantly impact profitability.

- Sustainability Concerns: Growing emphasis on sustainable sourcing and ethical production practices necessitates adaptation.

South America Fat & Oil Market Industry Trends & Insights

The South American Fat & Oil market is experiencing robust growth fueled by increasing demand from the food, industrial, and animal feed sectors. Rising disposable incomes and changing dietary habits in several key countries are driving consumption of processed foods containing fats and oils. Technological advancements in extraction methods and processing technologies are enhancing efficiency and quality. Consumer preferences are shifting towards healthier options, including specialty fats and oils with functional benefits. The competitive dynamics are characterized by intense price competition, especially among larger players. The market is witnessing increased adoption of sustainable and ethical sourcing practices. Growth is uneven across different segments and countries, reflecting the varied economic development and regulatory landscapes. The market's CAGR during the historical period (2019-2024) was xx%, driven primarily by expansion in the food application segment. Market penetration for specialty fats and oils is relatively low but growing rapidly, with an anticipated xx% increase by 2033.

Dominant Markets & Segments in South America Fat & Oil Market

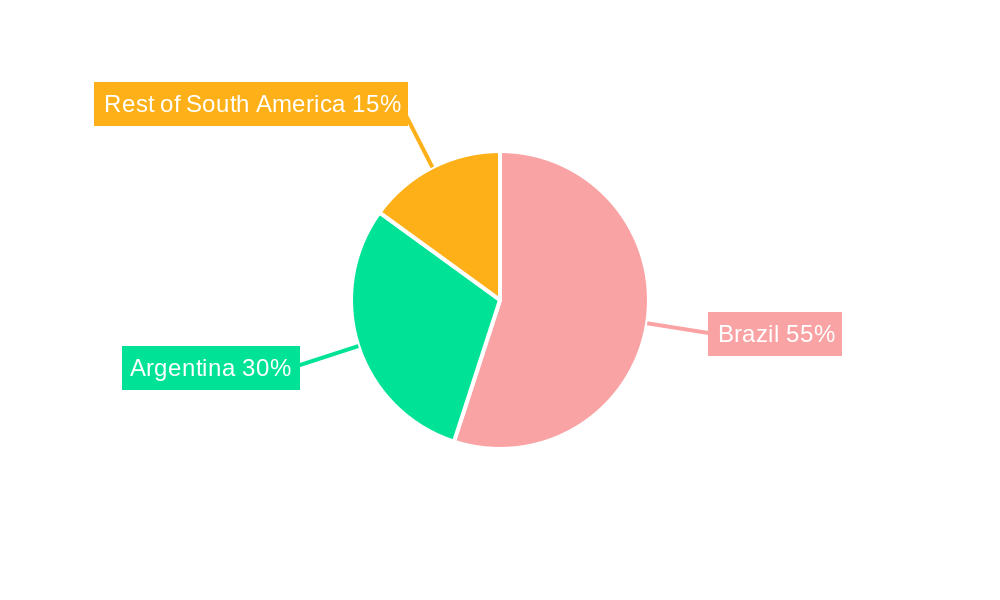

Brazil holds the largest market share within South America for fats and oils, representing approximately xx% of the regional market in 2025. This dominance is attributed to:

- Large Agricultural Production: Brazil is a major producer of soybeans, palm oil, and other oilseeds, providing a readily available raw material base.

- Robust Food Processing Industry: A well-established food processing sector drives demand for fats and oils in food applications.

- Growing Animal Feed Sector: Expansion in the livestock industry fuels demand for animal feed, creating a significant market for animal fats.

Within the segments:

- By Type: Oils represent the largest segment, capturing xx% of the market in 2025, followed by fats (xx%) and specialty fats (xx%). Lard’s market share is relatively small, accounting for approximately xx%.

- By Application: The food industry dominates, accounting for approximately xx% of total demand, followed by industrial applications (xx%) and animal feed (xx%).

Argentina and Colombia also represent significant markets, driven by their robust agricultural sectors and growing populations. However, infrastructure limitations and regulatory inconsistencies in certain areas present challenges to uniform growth across all countries.

South America Fat & Oil Market Product Innovations

Recent product innovations focus on enhancing the functionality and health benefits of fats and oils. This includes the development of healthier alternatives with reduced saturated fat content and increased levels of omega-3 and omega-6 fatty acids. Technological advancements in extraction techniques enable higher yields and improved quality. Companies are increasingly focusing on sustainable sourcing and ethical production practices to meet consumer demand. These innovations are helping companies gain a competitive advantage by catering to specific consumer segments.

Report Segmentation & Scope

This report segments the South American Fat & Oil market by Type (Fats, Oils, Lard, Specialty Fats) and Application (Food, Industrial, Animal Feed). Each segment is analyzed in detail, including market size, growth projections, competitive dynamics, and key trends. The forecast period for all segments is 2025-2033, with historical data from 2019-2024 providing valuable context for future projections.

Key Drivers of South America Fat & Oil Market Growth

The South American Fat & Oil market's growth is driven by several factors, including:

- Expanding Food Processing Industry: The region's growing population and rising disposable incomes are fueling demand for processed foods.

- Growth of the Animal Feed Sector: Expansion of the livestock industry creates significant demand for animal fats and oils.

- Technological Advancements: Efficient extraction and processing technologies improve yields and quality.

- Government Support for Agriculture: Initiatives to promote agricultural production positively impact raw material availability.

Challenges in the South America Fat & Oil Market Sector

The South America Fat & Oil market faces challenges such as:

- Price Volatility of Raw Materials: Fluctuations in commodity prices directly impact profitability.

- Supply Chain Disruptions: Infrastructure limitations and logistical challenges can impact the timely delivery of products.

- Regulatory Variations across Countries: Inconsistent regulatory frameworks across the region can complicate operations.

- Increased Competition: The presence of both international and regional players leads to intense competition. This competition, coupled with price volatility, can reduce profit margins by as much as xx% in certain segments.

Leading Players in the South America Fat & Oil Market Market

- Archer Daniels Midland Company

- Bunge Limited

- Agropalma

- Sime Darby Plantation Berhad

- Aceitera General Deheza

- Cargill Inc

- Olam International Limited

- AAK

- Fuji Oil Holding Inc

- Wilmar International *List Not Exhaustive

Key Developments in South America Fat & Oil Market Sector

- 2023 Q3: Cargill announces a significant investment in expanding its soybean processing capacity in Brazil.

- 2022 Q4: Bunge Limited completes the acquisition of a regional oilseed processing facility in Argentina.

- 2021 Q2: Archer Daniels Midland introduces a new line of sustainable palm oil sourced from certified plantations.

Strategic South America Fat & Oil Market Market Outlook

The South America Fat & Oil market presents considerable growth potential over the next decade. Continued investment in infrastructure, technological advancements, and a growing focus on sustainable practices will shape future growth trajectories. Strategic opportunities lie in expanding into niche segments, such as specialty fats and oils, focusing on value-added products, and leveraging technological advancements to improve efficiency and reduce costs. Companies that focus on sustainable sourcing and ethical production practices are expected to gain a competitive edge. The expanding food processing and animal feed sectors create substantial market opportunities, providing lucrative avenues for both established players and new entrants.

South America Fat & Oil Market Segmentation

-

1. Type

-

1.1. Fats

- 1.1.1. Butter

- 1.1.2. Tallow

- 1.1.3. Lard

-

1.2. Specialty Fats

- 1.2.1. Cocoa Butter Equivalents

- 1.2.2. Cocoa Butter Replacers

- 1.2.3. Cocoa Butter Substitutes

- 1.2.4. Cocoa Butter Improver

- 1.2.5. Milk Fat Replacer

- 1.2.6. Other Specialty Fats

-

1.3. Oils

- 1.3.1. Soybean Oil

- 1.3.2. Palm Oil

- 1.3.3. Coconut Oil

- 1.3.4. Olive Oil

- 1.3.5. Sunflower Seed Oil

- 1.3.6. Other Oils

-

1.1. Fats

-

2. Application

-

2.1. Food

- 2.1.1. Confectionary

- 2.1.2. Bakery Products

- 2.1.3. Dairy Products

- 2.1.4. Other Foods

- 2.2. Industrial

- 2.3. Animal Feed

-

2.1. Food

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Chile

- 3.4. Rest of South America

South America Fat & Oil Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest of South America

South America Fat & Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy

- 3.2.2 Peanut and Other Legumes is Increasing

- 3.3. Market Restrains

- 3.3.1. Strict Regulation and Policies Pertaining to Hemp Protein

- 3.4. Market Trends

- 3.4.1. Palm Oil is Likely to Foster the Growth of the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fats

- 5.1.1.1. Butter

- 5.1.1.2. Tallow

- 5.1.1.3. Lard

- 5.1.2. Specialty Fats

- 5.1.2.1. Cocoa Butter Equivalents

- 5.1.2.2. Cocoa Butter Replacers

- 5.1.2.3. Cocoa Butter Substitutes

- 5.1.2.4. Cocoa Butter Improver

- 5.1.2.5. Milk Fat Replacer

- 5.1.2.6. Other Specialty Fats

- 5.1.3. Oils

- 5.1.3.1. Soybean Oil

- 5.1.3.2. Palm Oil

- 5.1.3.3. Coconut Oil

- 5.1.3.4. Olive Oil

- 5.1.3.5. Sunflower Seed Oil

- 5.1.3.6. Other Oils

- 5.1.1. Fats

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.1.1. Confectionary

- 5.2.1.2. Bakery Products

- 5.2.1.3. Dairy Products

- 5.2.1.4. Other Foods

- 5.2.2. Industrial

- 5.2.3. Animal Feed

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Chile

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Chile

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fats

- 6.1.1.1. Butter

- 6.1.1.2. Tallow

- 6.1.1.3. Lard

- 6.1.2. Specialty Fats

- 6.1.2.1. Cocoa Butter Equivalents

- 6.1.2.2. Cocoa Butter Replacers

- 6.1.2.3. Cocoa Butter Substitutes

- 6.1.2.4. Cocoa Butter Improver

- 6.1.2.5. Milk Fat Replacer

- 6.1.2.6. Other Specialty Fats

- 6.1.3. Oils

- 6.1.3.1. Soybean Oil

- 6.1.3.2. Palm Oil

- 6.1.3.3. Coconut Oil

- 6.1.3.4. Olive Oil

- 6.1.3.5. Sunflower Seed Oil

- 6.1.3.6. Other Oils

- 6.1.1. Fats

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.1.1. Confectionary

- 6.2.1.2. Bakery Products

- 6.2.1.3. Dairy Products

- 6.2.1.4. Other Foods

- 6.2.2. Industrial

- 6.2.3. Animal Feed

- 6.2.1. Food

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Chile

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fats

- 7.1.1.1. Butter

- 7.1.1.2. Tallow

- 7.1.1.3. Lard

- 7.1.2. Specialty Fats

- 7.1.2.1. Cocoa Butter Equivalents

- 7.1.2.2. Cocoa Butter Replacers

- 7.1.2.3. Cocoa Butter Substitutes

- 7.1.2.4. Cocoa Butter Improver

- 7.1.2.5. Milk Fat Replacer

- 7.1.2.6. Other Specialty Fats

- 7.1.3. Oils

- 7.1.3.1. Soybean Oil

- 7.1.3.2. Palm Oil

- 7.1.3.3. Coconut Oil

- 7.1.3.4. Olive Oil

- 7.1.3.5. Sunflower Seed Oil

- 7.1.3.6. Other Oils

- 7.1.1. Fats

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.1.1. Confectionary

- 7.2.1.2. Bakery Products

- 7.2.1.3. Dairy Products

- 7.2.1.4. Other Foods

- 7.2.2. Industrial

- 7.2.3. Animal Feed

- 7.2.1. Food

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Chile

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Chile South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fats

- 8.1.1.1. Butter

- 8.1.1.2. Tallow

- 8.1.1.3. Lard

- 8.1.2. Specialty Fats

- 8.1.2.1. Cocoa Butter Equivalents

- 8.1.2.2. Cocoa Butter Replacers

- 8.1.2.3. Cocoa Butter Substitutes

- 8.1.2.4. Cocoa Butter Improver

- 8.1.2.5. Milk Fat Replacer

- 8.1.2.6. Other Specialty Fats

- 8.1.3. Oils

- 8.1.3.1. Soybean Oil

- 8.1.3.2. Palm Oil

- 8.1.3.3. Coconut Oil

- 8.1.3.4. Olive Oil

- 8.1.3.5. Sunflower Seed Oil

- 8.1.3.6. Other Oils

- 8.1.1. Fats

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.1.1. Confectionary

- 8.2.1.2. Bakery Products

- 8.2.1.3. Dairy Products

- 8.2.1.4. Other Foods

- 8.2.2. Industrial

- 8.2.3. Animal Feed

- 8.2.1. Food

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Chile

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fats

- 9.1.1.1. Butter

- 9.1.1.2. Tallow

- 9.1.1.3. Lard

- 9.1.2. Specialty Fats

- 9.1.2.1. Cocoa Butter Equivalents

- 9.1.2.2. Cocoa Butter Replacers

- 9.1.2.3. Cocoa Butter Substitutes

- 9.1.2.4. Cocoa Butter Improver

- 9.1.2.5. Milk Fat Replacer

- 9.1.2.6. Other Specialty Fats

- 9.1.3. Oils

- 9.1.3.1. Soybean Oil

- 9.1.3.2. Palm Oil

- 9.1.3.3. Coconut Oil

- 9.1.3.4. Olive Oil

- 9.1.3.5. Sunflower Seed Oil

- 9.1.3.6. Other Oils

- 9.1.1. Fats

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food

- 9.2.1.1. Confectionary

- 9.2.1.2. Bakery Products

- 9.2.1.3. Dairy Products

- 9.2.1.4. Other Foods

- 9.2.2. Industrial

- 9.2.3. Animal Feed

- 9.2.1. Food

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Chile

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Fat & Oil Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Archer Daniels Midland Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bunge Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Agropalma

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sime Darby Plantation Berhad

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Aceitera General Deheza

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cargill Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Olam International Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AAK

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fuji Oil Holding Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Wilmar International*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Archer Daniels Midland Company

List of Figures

- Figure 1: South America Fat & Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Fat & Oil Market Share (%) by Company 2024

List of Tables

- Table 1: South America Fat & Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Fat & Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Fat & Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Fat & Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Fat & Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Fat & Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Fat & Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Fat & Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Fat & Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Fat & Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Fat & Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Fat & Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Fat & Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Fat & Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Fat & Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Fat & Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Fat & Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Fat & Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Fat & Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Fat & Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Fat & Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Fat & Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: South America Fat & Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South America Fat & Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Fat & Oil Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fat & Oil Market?

The projected CAGR is approximately 4.59%.

2. Which companies are prominent players in the South America Fat & Oil Market?

Key companies in the market include Archer Daniels Midland Company, Bunge Limited, Agropalma, Sime Darby Plantation Berhad, Aceitera General Deheza, Cargill Inc, Olam International Limited, AAK, Fuji Oil Holding Inc, Wilmar International*List Not Exhaustive.

3. What are the main segments of the South America Fat & Oil Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy. Peanut and Other Legumes is Increasing.

6. What are the notable trends driving market growth?

Palm Oil is Likely to Foster the Growth of the Market in the Region.

7. Are there any restraints impacting market growth?

Strict Regulation and Policies Pertaining to Hemp Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fat & Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fat & Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fat & Oil Market?

To stay informed about further developments, trends, and reports in the South America Fat & Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence