Key Insights

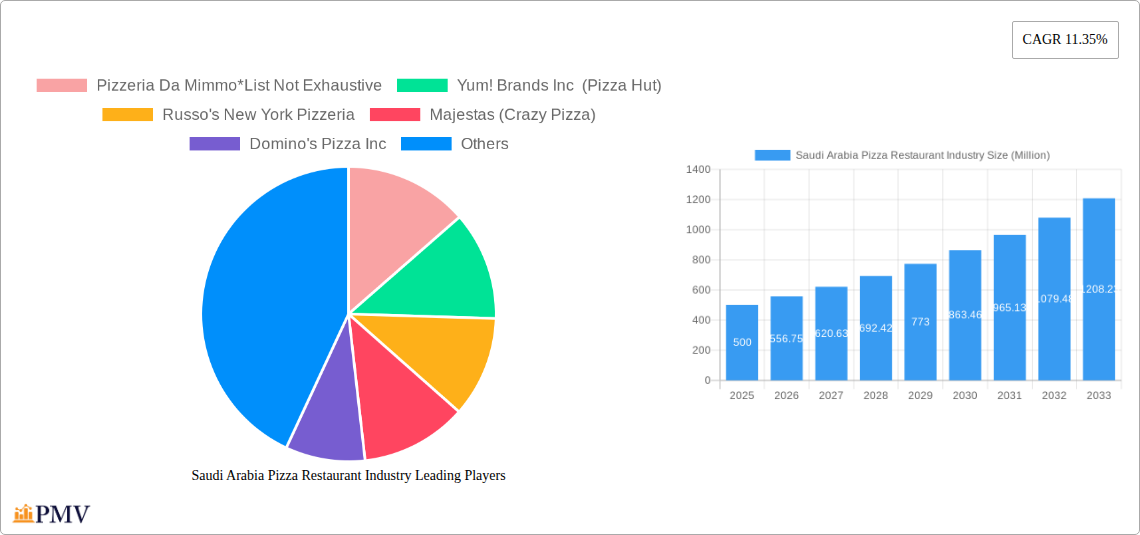

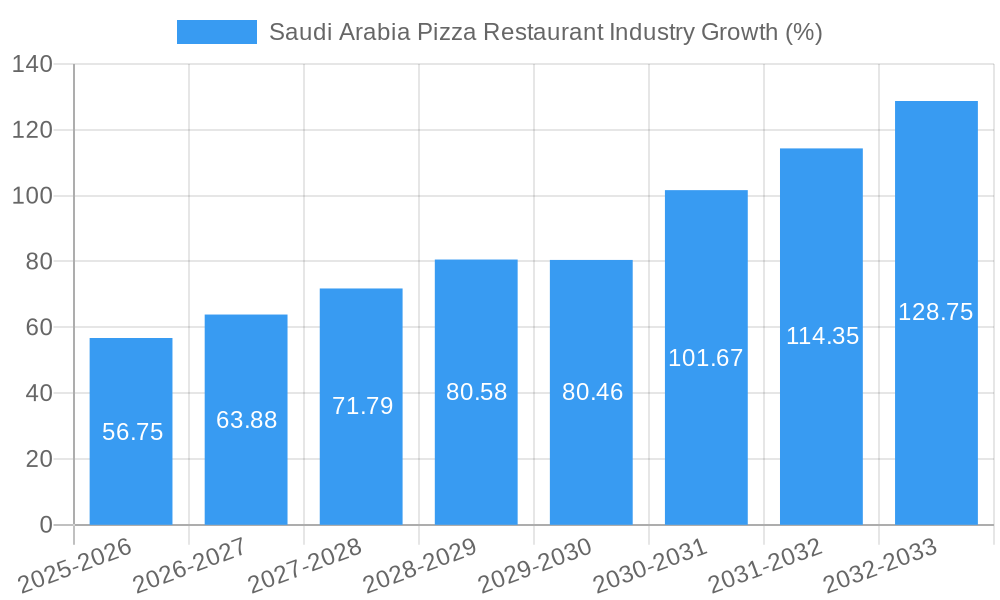

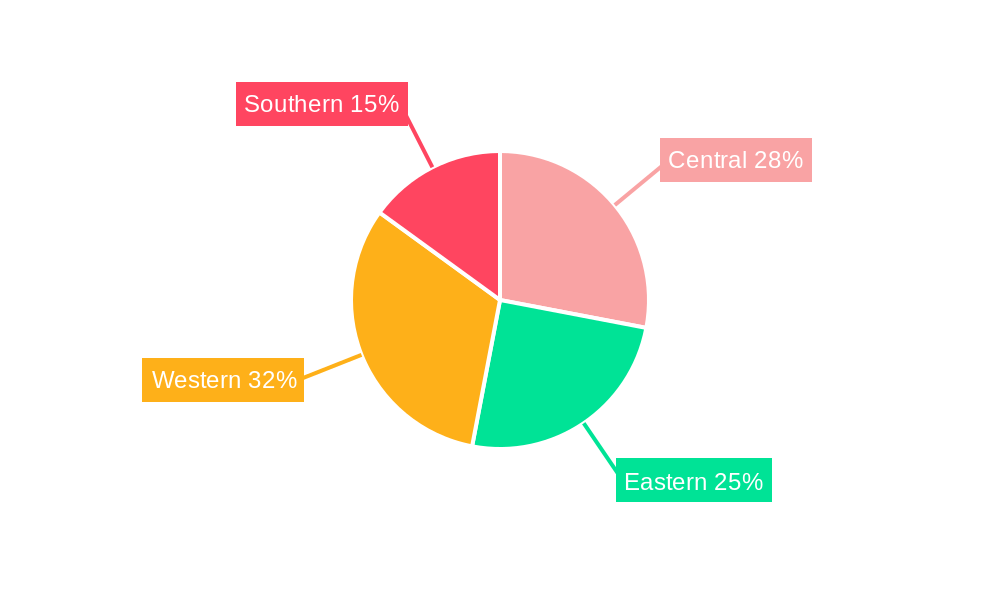

The Saudi Arabian pizza restaurant industry, currently experiencing robust growth, is projected to maintain a significant upward trajectory. With a Compound Annual Growth Rate (CAGR) of 11.35% from 2019 to 2033, the market demonstrates strong potential for both established chains and independent players. The market's expansion is fueled by several key factors. The rising disposable incomes within the Saudi population, coupled with a growing preference for convenient and readily available food options, significantly boosts demand. Furthermore, the increasing youth population and a shift towards Westernized dietary habits contribute to the industry's sustained growth. The market segmentation reveals a dynamic landscape with both chained pizza outlets and independent businesses competing for market share. While established international chains like Pizza Hut and Domino's benefit from brand recognition and established supply chains, local and independent pizzerias thrive by offering unique menu items, catering to local tastes, and providing competitive pricing. The regional disparity within Saudi Arabia itself offers opportunities for targeted expansion, with variations in consumer preferences and market saturation levels across Central, Eastern, Western, and Southern regions. Competition is likely to intensify, pushing innovation in menu offerings, delivery services, and customer experience to maintain a competitive edge.

The success of pizza restaurants in Saudi Arabia hinges on adapting to local preferences and cultural nuances. While international chains bring familiarity, localization strategies, such as offering halal-certified options and catering to specific dietary needs, are crucial for capturing a larger market share. The industry will need to navigate challenges such as fluctuating ingredient costs and maintaining consistent quality standards across various locations. However, the overall outlook for the Saudi Arabian pizza market remains positive, with considerable potential for continued growth and expansion throughout the forecast period (2025-2033). The interplay between established international brands and thriving local pizzerias promises a diverse and dynamic market, with opportunities for various business models and strategies to succeed.

Saudi Arabia Pizza Restaurant Industry: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia pizza restaurant industry, covering market size, growth drivers, competitive dynamics, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for investors, industry players, and strategic decision-makers seeking a clear understanding of this dynamic market. The report projects a xx Million market value by 2033.

Saudi Arabia Pizza Restaurant Industry Market Structure & Competitive Dynamics

The Saudi Arabian pizza restaurant industry displays a blend of established international chains and local independent outlets. Market concentration is moderate, with major players like Yum! Brands Inc (Pizza Hut), Domino's Pizza Inc, and Little Caesar Enterprises Inc holding significant market share, while independent outlets contribute substantially to the overall market volume. Precise market share figures for each player remain unavailable; however, estimations based on store count and brand recognition suggest Pizza Hut and Domino's hold the largest shares. The industry is characterized by a relatively open innovation ecosystem, with new players and product variations emerging regularly. Regulatory frameworks are generally supportive of the food service industry, with standard health and safety regulations in place. Product substitutes include other quick-service restaurants (QSR) offering similar convenience and value propositions. End-user trends show a growing preference for healthier options, gourmet toppings, and online ordering. Recent M&A activities include the 2022 agreement between Yum Brands and Americana Pizza (deal value undisclosed), illustrating increased market consolidation.

Saudi Arabia Pizza Restaurant Industry Industry Trends & Insights

The Saudi Arabian pizza restaurant market exhibits robust growth, driven by factors such as a rising young population, increasing disposable incomes, and changing lifestyles. The compound annual growth rate (CAGR) during the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Market penetration remains relatively high in urban areas, with significant growth potential in less-developed regions. Technological disruptions, such as online ordering platforms and delivery services, are transforming the industry, enhancing convenience and reach. Consumer preferences are shifting toward healthier options, premium ingredients, and customized pizzas. Competitive dynamics are intense, with established international brands and local players vying for market share through pricing strategies, product innovation, and marketing campaigns.

Dominant Markets & Segments in Saudi Arabia Pizza Restaurant Industry

The Riyadh and Jeddah regions constitute the most dominant markets within the Saudi Arabian pizza industry. This dominance stems from factors such as high population density, high concentration of young adults and families, and improved infrastructural development in these cities.

Key Drivers for Chained Pizza Outlets:

- High brand recognition and established supply chains.

- Economies of scale and efficient operations.

- Access to advanced technology and marketing capabilities.

Key Drivers for Independent Pizza Outlets:

- Flexibility in product offerings and customization.

- Close proximity to customers and personalized service.

- Strong local market knowledge and community connections.

The chained pizza outlet segment demonstrates higher growth potential due to its inherent advantages in terms of scale, marketing, and brand recognition. However, independent outlets maintain a significant presence and cater to specific customer preferences and local tastes.

Saudi Arabia Pizza Restaurant Industry Product Innovations

Recent product innovations focus on premium ingredients, healthier options, and unique flavor combinations. The entry of Russo's New York Pizzeria introduced a more upscale Italian-American dining experience, catering to a sophisticated segment of the market. Crazy Pizza's wood-fired pizzas with premium toppings underscore the trend of offering gourmet choices. Technological advancements in pizza ovens and preparation methods further contribute to enhanced efficiency and product quality. The adoption of online ordering and delivery systems remains crucial for optimizing customer experience and driving growth.

Report Segmentation & Scope

The report segments the Saudi Arabia pizza restaurant market into two primary categories:

Chained Pizza Outlets: This segment comprises established international and national pizza chains with multiple branches. Growth projections for this segment are fueled by expansion plans, brand loyalty, and marketing campaigns. Market size is estimated at xx Million in 2025, projecting to xx Million by 2033. Competitive dynamics involve brand competition and strategic partnerships.

Independent Pizza Outlets: This segment encompasses locally owned and operated pizza restaurants. Growth projections are driven by local demand, product diversification, and competitive pricing. Market size is estimated at xx Million in 2025 and projected to reach xx Million by 2033. Competitive dynamics involve price competition and customer service.

Key Drivers of Saudi Arabia Pizza Restaurant Industry Growth

The Saudi Arabia pizza restaurant industry's growth is propelled by several key factors: a burgeoning young population with high disposable incomes, increasing urbanization, a shift towards convenient food options, and a rise in online food ordering and delivery services. Government initiatives aimed at developing the hospitality sector also contribute. Furthermore, the growing popularity of international food brands and the adaptation of menu items to suit local tastes are key elements.

Challenges in the Saudi Arabia Pizza Restaurant Industry Sector

Challenges include intense competition from numerous players, fluctuations in food costs ( impacting profitability), and maintaining consistent food quality across multiple locations. Maintaining high standards of hygiene and food safety regulations represent ongoing challenges. Furthermore, rising labor costs and real estate expenses pose significant operational difficulties for many players within the industry.

Leading Players in the Saudi Arabia Pizza Restaurant Industry Market

- Pizzeria Da Mimmo

- Yum! Brands Inc (Pizza Hut)

- Russo's New York Pizzeria

- Majestas (Crazy Pizza)

- Domino's Pizza Inc

- Pizza Era

- Little Caesar Enterprises Inc

- DAILY FOOD CO (Maestro Pizza)

- Sbarro LLC

- Rave Restaurant Group (Pizza Inn)

Key Developments in Saudi Arabia Pizza Restaurant Industry Sector

- June 2022: Crazy Pizza, a brand of Majestas, opened its second outlet in Riyadh, expanding its presence in the market.

- July 2022: Yum Brands partnered with Americana Pizza to launch 30 new Pizza Hut locations across Saudi Arabia, significantly expanding its market reach.

- December 2022: Russo's New York Pizzeria opened a new restaurant in Riyadh, introducing a premium Italian-American dining experience.

Strategic Saudi Arabia Pizza Restaurant Industry Market Outlook

The Saudi Arabian pizza restaurant market presents significant growth opportunities. Strategic initiatives should focus on leveraging technological advancements (online ordering, delivery), catering to evolving consumer preferences (healthier options, premium ingredients), and expanding into underserved markets. Partnerships with local businesses and focusing on efficient operations will be crucial for success. The market’s projected expansion offers compelling opportunities for both established chains and new entrants to capture market share.

Saudi Arabia Pizza Restaurant Industry Segmentation

-

1. Category

- 1.1. Chained Pizza Outlets

- 1.2. Independent Pizza Outlets

Saudi Arabia Pizza Restaurant Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Pizza Restaurant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Strong Influence of Western Culture in the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Chained Pizza Outlets

- 5.1.2. Independent Pizza Outlets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Central Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Pizzeria Da Mimmo*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Yum! Brands Inc (Pizza Hut)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Russo's New York Pizzeria

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Majestas (Crazy Pizza)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Domino's Pizza Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pizza Era

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Little Caesar Enterprises Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DAILY FOOD CO (Maestro Pizza)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sbarro LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rave Restaurant Group (Pizza Inn)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pizzeria Da Mimmo*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Pizza Restaurant Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Pizza Restaurant Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 10: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Pizza Restaurant Industry?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Saudi Arabia Pizza Restaurant Industry?

Key companies in the market include Pizzeria Da Mimmo*List Not Exhaustive, Yum! Brands Inc (Pizza Hut), Russo's New York Pizzeria, Majestas (Crazy Pizza), Domino's Pizza Inc, Pizza Era, Little Caesar Enterprises Inc, DAILY FOOD CO (Maestro Pizza), Sbarro LLC, Rave Restaurant Group (Pizza Inn).

3. What are the main segments of the Saudi Arabia Pizza Restaurant Industry?

The market segments include Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Strong Influence of Western Culture in the Market..

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

In December 2022, United States-based Russo's New York Pizzeria & Italian Kitchen opened a new restaurant in Riyadh, Saudi Arabia. The products available in the restaurant include salads, burrata cheese cooked from fresh mozzarella, Italian soups, pasta as well as pizzas baked in brick ovens, calzones, and desserts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Pizza Restaurant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Pizza Restaurant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Pizza Restaurant Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Pizza Restaurant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence