Key Insights

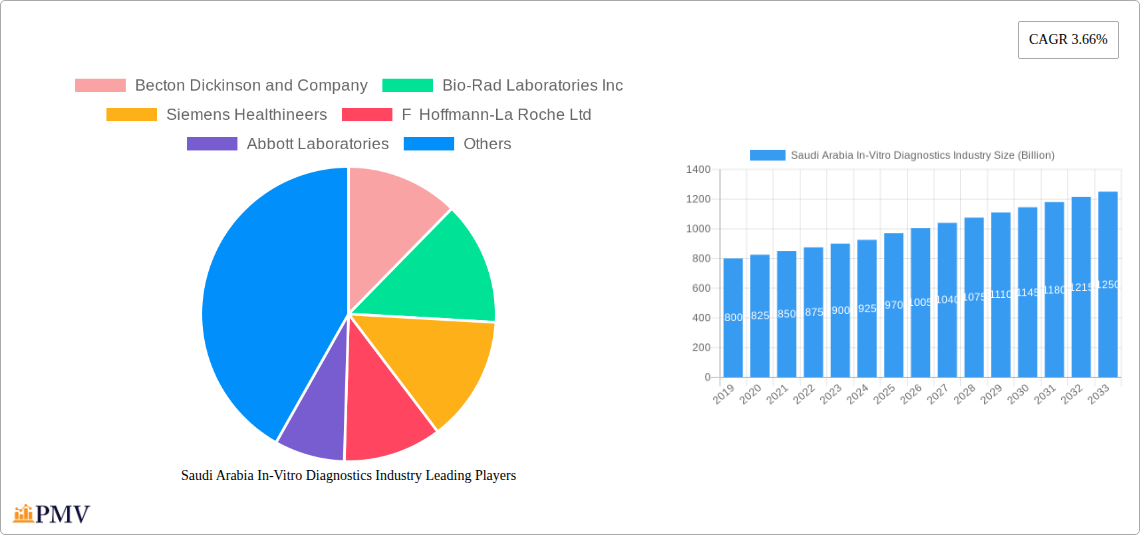

The Saudi Arabia In-Vitro Diagnostics (IVD) market is poised for significant expansion, projected to reach $0.97 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 3.66% over the forecast period of 2025-2033. Driving this upward trajectory are key factors such as the increasing prevalence of chronic diseases, a growing emphasis on early disease detection and diagnosis, and substantial government initiatives aimed at enhancing healthcare infrastructure and accessibility. The demand for advanced diagnostic solutions is further fueled by rising healthcare expenditure and a growing awareness among the populace regarding the importance of routine health check-ups. The market segments for clinical chemistry, molecular diagnostics, and immunoassays are expected to lead the charge, reflecting a broader trend towards more precise and personalized diagnostic approaches.

Saudi Arabia In-Vitro Diagnostics Industry Market Size (In Million)

The Saudi Arabian IVD market is witnessing a dynamic evolution driven by technological advancements and a strategic focus on improving healthcare outcomes. The market size of $0.97 billion in 2025 is anticipated to expand steadily, supported by the 3.66% CAGR. Key drivers include the increasing burden of infectious diseases, diabetes, and cancer, necessitating sophisticated diagnostic tools. Investment in modern healthcare facilities and a drive towards medical tourism are also significant catalysts. While the market benefits from strong government support for its Vision 2030 healthcare objectives, potential restraints could include the high cost of advanced IVD technologies and the need for skilled personnel to operate and interpret complex diagnostic equipment. Nevertheless, the market is well-positioned for sustained growth, with a strong emphasis on the adoption of innovative instruments and reagents, particularly in diagnostic laboratories and major hospitals.

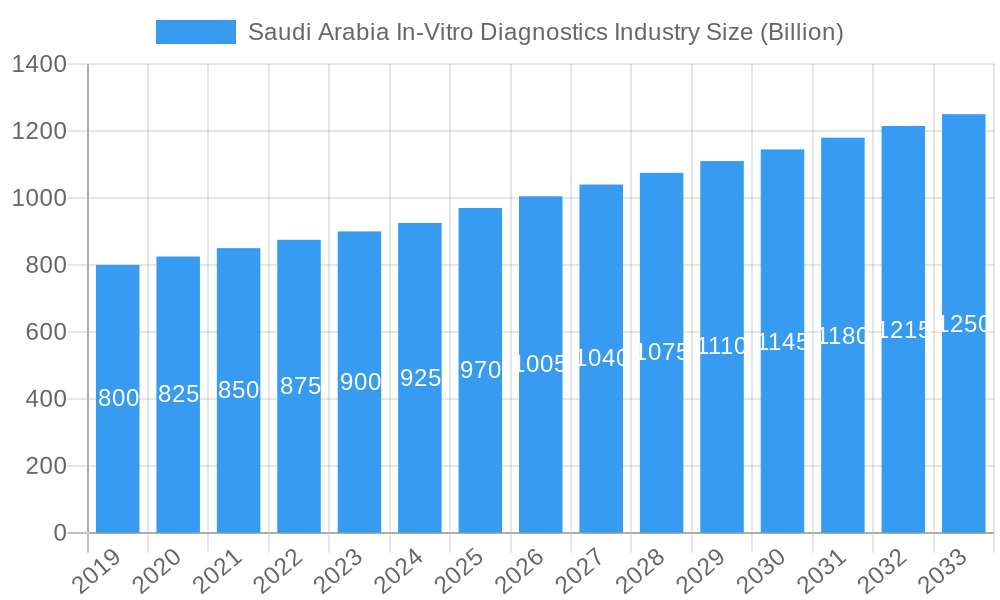

Saudi Arabia In-Vitro Diagnostics Industry Company Market Share

**Unlock deep insights into Saudi Arabia's burgeoning In-Vitro Diagnostics (IVD) market with this comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides critical data on market structure, competitive dynamics, key trends, dominant segments, product innovations, growth drivers, challenges, leading players, and strategic outlook. Essential for stakeholders seeking to understand and capitalize on the *Saudi IVD market*, *diagnostic testing Saudi Arabia*, and *healthcare technology KSA* opportunities.**

Saudi Arabia In-Vitro Diagnostics Industry Market Structure & Competitive Dynamics

The Saudi Arabian In-Vitro Diagnostics (IVD) market is characterized by a dynamic and evolving structure, with a moderate to high level of concentration driven by the presence of major global players and a growing local contingent. Innovation ecosystems are actively fostered through government initiatives aimed at advancing the healthcare sector and encouraging local manufacturing and research. Regulatory frameworks are being increasingly refined to align with international standards, ensuring the quality and safety of IVD products and services. The threat of product substitutes exists, particularly in basic diagnostic tests, but is mitigated by the increasing demand for sophisticated and specialized IVD solutions. End-user trends are shifting towards greater demand for advanced diagnostics, personalized medicine, and point-of-care testing, significantly influencing product development and market strategies. Merger and Acquisition (M&A) activities are expected to play a crucial role in consolidating market share and expanding product portfolios. For instance, the Dr. Sulaiman Al-Habib Medical Group (HMG) investment of USD 1.73 billion in new hospitals signifies a substantial boost for IVD demand. While specific market share data is proprietary, key players like Abbott Laboratories, F Hoffmann-La Roche Ltd, and Siemens Healthineers hold significant positions. The market anticipates further consolidation and strategic partnerships to navigate the competitive landscape effectively.

Saudi Arabia In-Vitro Diagnostics Industry Industry Trends & Insights

The Saudi Arabia In-Vitro Diagnostics (IVD) industry is experiencing robust growth, driven by several key factors and evolving trends. A significant growth driver is the Saudi Vision 2030 initiative, which prioritizes the expansion and modernization of the healthcare infrastructure, directly fueling the demand for advanced diagnostic technologies. This includes a strong emphasis on preventative healthcare and early disease detection, leading to increased adoption of IVD solutions across various applications. Technological disruptions are rapidly transforming the market, with advancements in molecular diagnostics, immuno diagnostics, and automation enhancing diagnostic accuracy and efficiency. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in IVD platforms is another emerging trend, promising to revolutionize data analysis and personalized treatment planning. Consumer preferences are increasingly aligned with accessibility and convenience, propelling the growth of point-of-care diagnostics and home-testing kits. Competitive dynamics are intensifying as both global leaders and emerging local companies vie for market share. The rising prevalence of chronic diseases such as diabetes and cancer, coupled with an aging population, further accentuates the need for reliable and sophisticated diagnostic tools. The market penetration of advanced IVD technologies is expected to accelerate, supported by increasing healthcare expenditure and a growing awareness of the importance of timely and accurate diagnosis. The CAGR for the Saudi IVD market is projected to be strong, reflecting sustained investment and demand for innovative healthcare solutions.

Dominant Markets & Segments in Saudi Arabia In-Vitro Diagnostics Industry

The Saudi Arabia In-Vitro Diagnostics (IVD) industry presents a landscape of dominant markets and segments, each contributing significantly to the overall growth and direction of the sector.

Test Type:

- Clinical Chemistry remains a cornerstone of the IVD market, driven by its widespread use in routine health screenings and the management of chronic conditions. The increasing prevalence of lifestyle diseases in Saudi Arabia directly correlates with the demand for clinical chemistry analyzers and reagents.

- Molecular Diagnostics is witnessing exponential growth. Fueled by advancements in genetic sequencing and the rising concern over infectious diseases, this segment is crucial for accurate disease identification and personalized treatment. The development of rapid molecular tests for conditions like COVID-19 has further solidified its importance.

- Immuno Diagnostics holds a significant share due to its application in detecting a broad spectrum of diseases, including infectious diseases, hormonal imbalances, and cancer biomarkers. The demand for high-throughput immunoassay systems in large hospitals and diagnostic laboratories contributes to its dominance.

- Haematology continues to be a stable and important segment, essential for diagnosing and monitoring blood disorders, infections, and other critical conditions.

- Other Types, encompassing toxicology and therapeutic drug monitoring, are gaining traction as healthcare focuses on precision medicine and drug efficacy.

Product:

- Reagents constitute a substantial portion of the IVD market value, as they are consumable and integral to every diagnostic test. The continuous need for high-quality reagents for various test types drives consistent demand.

- Instruments are vital for performing complex diagnostic procedures. The market sees significant investment in advanced analyzers and automated systems, especially in large healthcare facilities.

- Other Products, including consumables and accessories, also contribute to the market, supporting the operational efficiency of diagnostic laboratories.

Usability:

- Disposable IVD Devices are expected to dominate, driven by their convenience, reduced risk of contamination, and ease of use, particularly in point-of-care settings and for high-volume testing.

- Reusable IVD Devices, while requiring initial investment, offer cost-effectiveness in the long run for high-throughput laboratories, especially for complex analytical platforms.

Application:

- Infectious Disease diagnostics represent a critical and growing segment, significantly amplified by global and regional health concerns. The rapid response to outbreaks necessitates advanced and accurate infectious disease testing solutions.

- Diabetes diagnostics remain a major application area, given the high prevalence of diabetes in Saudi Arabia. Continuous glucose monitoring and other diabetes-related tests are in high demand.

- Cancer/Oncology diagnostics are a rapidly expanding segment, driven by advancements in molecular oncology, liquid biopsies, and early detection strategies. The Kingdom's focus on improving cancer care further bolsters this segment.

- Cardiology diagnostics are essential for managing cardiovascular diseases, a leading cause of mortality. Advanced diagnostic tools for cardiac markers and risk assessment are crucial.

- Other Applications, including autoimmune diseases, nephrology, and neurology, are steadily growing as healthcare services diversify and expand.

End-User:

- Hospitals and Clinics are the largest end-users, owing to their extensive diagnostic needs and comprehensive healthcare services. The ongoing expansion and modernization of hospital infrastructure directly translate to increased IVD procurement.

- Diagnostic Laboratories form another significant segment, with both standalone and integrated laboratory networks relying heavily on IVD technologies for their operations.

- Other End-users, including research institutions and public health organizations, also contribute to the market demand.

The dominance of these segments is underpinned by economic policies promoting healthcare investment, robust infrastructure development in the healthcare sector, and a growing awareness of preventive healthcare among the population.

Saudi Arabia In-Vitro Diagnostics Industry Product Innovations

Product innovations in the Saudi Arabian IVD market are largely focused on enhancing diagnostic accuracy, speed, and accessibility. Key developments include the introduction of advanced molecular diagnostic platforms for faster and more precise identification of infectious agents and genetic predispositions. Innovations in immuno diagnostics are enabling earlier detection of cancer biomarkers and autoimmune diseases. Furthermore, the trend towards miniaturization and automation is leading to the development of compact, user-friendly instruments suitable for point-of-care settings, thereby expanding the reach of diagnostic testing. The integration of AI and big data analytics into IVD systems is a significant advancement, promising to optimize workflow, interpret complex results, and personalize patient care.

Report Segmentation & Scope

This report segments the Saudi Arabia In-Vitro Diagnostics (IVD) market across several critical dimensions to provide a granular view of market dynamics and opportunities. The segmentation includes:

- Test Type: Clinical Chemistry, Molecular Diagnostics, Immuno Diagnostics, Haematology, and Other Types. Each segment's growth is influenced by disease prevalence and healthcare infrastructure development.

- Product: Instruments, Reagents, and Other Products. Reagents are expected to hold a significant market share due to their consumable nature, while instrument sales are driven by technological upgrades and expansion of healthcare facilities.

- Usability: Disposable IVD Devices and Reusable IVD Devices. Disposable devices are poised for significant growth due to convenience and infection control, especially in point-of-care settings.

- Application: Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, and Other Applications. The high prevalence of chronic diseases and ongoing concerns regarding infectious diseases will fuel growth in these respective segments.

- End-User: Diagnostic Laboratories, Hospitals and Clinics, and Other End-users. Hospitals and clinics are projected to be the largest end-user segment due to their comprehensive diagnostic needs and ongoing expansion.

The scope of this report encompasses market size, growth projections, competitive landscape, and key trends within these segmented areas from 2019 to 2033, with a base year of 2025.

Key Drivers of Saudi Arabia In-Vitro Diagnostics Industry Growth

The growth of the Saudi Arabian In-Vitro Diagnostics (IVD) industry is propelled by a confluence of powerful drivers. Government initiatives, particularly Saudi Vision 2030, are a cornerstone, with substantial investments in healthcare infrastructure and a strategic focus on improving public health outcomes. This directly translates to increased demand for advanced diagnostic technologies. The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates continuous and sophisticated diagnostic testing. Furthermore, increased healthcare expenditure and a growing emphasis on preventive healthcare and early disease detection among the population are significantly boosting market adoption. Technological advancements, leading to more accurate, faster, and accessible IVD solutions, are also key accelerators, driving innovation and market penetration. The growing demand for personalized medicine is also a significant factor.

Challenges in the Saudi Arabia In-Vitro Diagnostics Industry Sector

Despite its promising growth trajectory, the Saudi Arabian IVD industry faces several challenges. Regulatory hurdles and lengthy approval processes for new diagnostic products can sometimes slow down market entry and adoption. Supply chain complexities and reliance on imported raw materials or finished goods can lead to potential disruptions and increased costs. Intense competition from both established global players and emerging local entities necessitates continuous innovation and competitive pricing strategies. The shortage of skilled healthcare professionals to operate and interpret advanced IVD equipment can also pose a challenge, requiring investment in training and development programs. Furthermore, cost-containment pressures within the healthcare system can influence purchasing decisions, favoring cost-effective solutions without compromising quality.

Leading Players in the Saudi Arabia In-Vitro Diagnostics Industry Market

- Abbott Laboratories

- F Hoffmann-La Roche Ltd

- Siemens Healthineers

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- Qiagen N V

- Danaher Corporation

- Thermo Fischer Scientific

- Diasorin

- Nihon Kohden Corporation

Key Developments in Saudi Arabia In-Vitro Diagnostics Industry Sector

- April 2023: Dr. Sulaiman Al-Habib Medical Group (HMG) invested USD 1.73 billion to build six hospitals in Saudi Arabia with state-of-the-art medical facilities and innovative healthcare services. This investment will drive the demand for advanced diagnostic technology, such as in-vitro diagnostic devices in newly formed hospitals.

- November 2022: Cairo - Integrated Diagnostics Holdings (IDH) entered into a joint venture with Al Makhbaryoun Al Arab (Biolab) and Izhoor Holding Medical Company (Izhoor) to launch a new diagnostic venture in Saudi Arabia. This venture aims to revolutionize the diagnostic platform of Saudi Arabia through technological advancement of diagnostic procedures.

- October 2021: Noor DX launched a new King Abdullah University of Science and Technology (KAUST) developed COVID-19 test kit in Saudi Arabia to diagnose COVID-19 symptoms precisely.

Strategic Saudi Arabia In-Vitro Diagnostics Industry Market Outlook

The strategic outlook for the Saudi Arabian In-Vitro Diagnostics (IVD) market remains highly optimistic, driven by robust government support, increasing healthcare investments, and a growing population's demand for advanced medical diagnostics. The continuous pursuit of technological innovation, particularly in molecular and personalized diagnostics, presents significant growth accelerators. Opportunities lie in expanding point-of-care testing, enhancing laboratory automation, and developing localized manufacturing capabilities to meet the burgeoning demand. Strategic partnerships and collaborations between international IVD manufacturers and Saudi Arabian healthcare providers will be crucial for market penetration and sustained growth. The market is poised for significant expansion, fueled by a commitment to enhancing healthcare quality and accessibility, making it an attractive landscape for investment and innovation in the coming years.

Saudi Arabia In-Vitro Diagnostics Industry Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Haematology

- 1.5. Other Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Product

-

3. Usability

- 3.1. Disposable IVD Device

- 3.2. Reusable IVD Device

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Other Applications

-

5. End-User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

Saudi Arabia In-Vitro Diagnostics Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia In-Vitro Diagnostics Industry Regional Market Share

Geographic Coverage of Saudi Arabia In-Vitro Diagnostics Industry

Saudi Arabia In-Vitro Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Infectious and Chronic Diseases; Increasing Use of Point of Care (POC) Diagnostics & Increasing Healthcare Expenditure

- 3.3. Market Restrains

- 3.3.1. Lack of Favorable Reimbursement Policies

- 3.4. Market Trends

- 3.4.1. Clinical Chemistry is Expected to Show Good Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia In-Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Haematology

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Product

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Device

- 5.3.2. Reusable IVD Device

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bio-Rad Laboratories Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Healthineers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 F Hoffmann-La Roche Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qiagen N V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danaher Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Diasorin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thermo Fischer Scientific

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nihon Kohden Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Saudi Arabia In-Vitro Diagnostics Industry Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia In-Vitro Diagnostics Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Test Type 2020 & 2033

- Table 2: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2020 & 2033

- Table 3: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 4: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Usability 2020 & 2033

- Table 6: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 7: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 8: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by End-User 2020 & 2033

- Table 10: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Region 2020 & 2033

- Table 12: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Test Type 2020 & 2033

- Table 14: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2020 & 2033

- Table 15: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 16: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 17: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Usability 2020 & 2033

- Table 18: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 19: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 20: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by End-User 2020 & 2033

- Table 22: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 23: Saudi Arabia In-Vitro Diagnostics Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 24: Saudi Arabia In-Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia In-Vitro Diagnostics Industry?

The projected CAGR is approximately 3.66%.

2. Which companies are prominent players in the Saudi Arabia In-Vitro Diagnostics Industry?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, Siemens Healthineers, F Hoffmann-La Roche Ltd, Abbott Laboratories, Qiagen N V, Danaher Corporation, Diasorin, Thermo Fischer Scientific, Nihon Kohden Corporation.

3. What are the main segments of the Saudi Arabia In-Vitro Diagnostics Industry?

The market segments include Test Type, Product, Usability, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Infectious and Chronic Diseases; Increasing Use of Point of Care (POC) Diagnostics & Increasing Healthcare Expenditure.

6. What are the notable trends driving market growth?

Clinical Chemistry is Expected to Show Good Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Favorable Reimbursement Policies.

8. Can you provide examples of recent developments in the market?

April 2023: Dr. Sulaiman Al-Habib Medical Group (HMG) invested USD 1.73 billion to build six hospitals in Saudi Arabia with state-of-the-art medical facilities and innovative healthcare services. This will help to drive the demand for advanced diagnostic technology, such as in-vitro diagnostic devices in newly formed hospitals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia In-Vitro Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia In-Vitro Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia In-Vitro Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia In-Vitro Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence