Key Insights

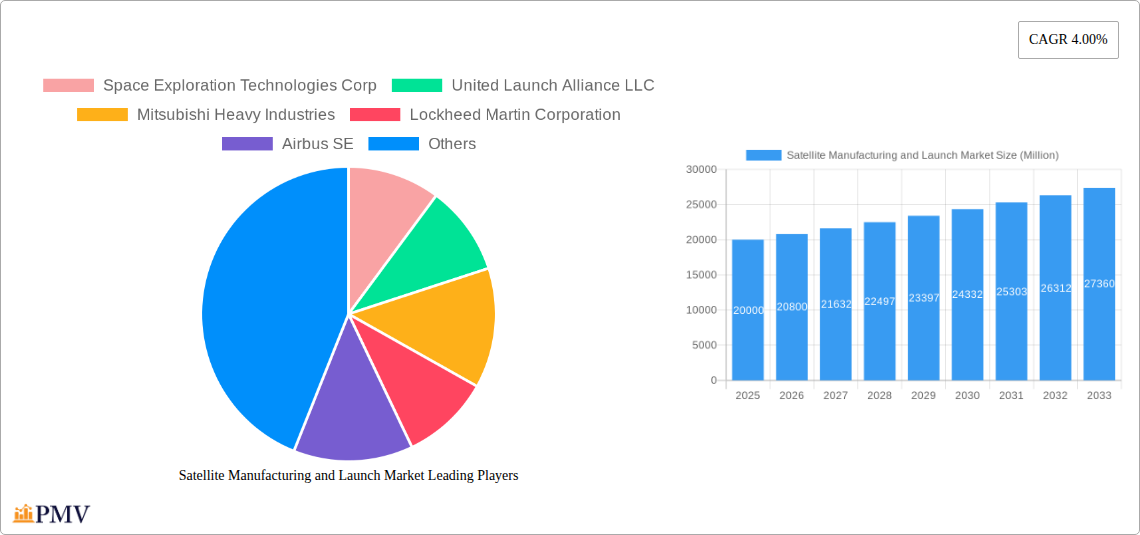

The global satellite manufacturing and launch market is poised for significant expansion, projected to achieve a CAGR of 4.00% from 2025 to 2033. This growth trajectory is propelled by escalating demand for high-bandwidth communications, particularly in developing regions, alongside technological advancements in miniaturization and satellite constellations. Government investments in national security and space exploration, coupled with the expanding use of satellite imagery across diverse sectors like agriculture, environmental monitoring, and disaster management, are further stimulating market growth. Key challenges include substantial initial capital investment, regulatory complexities, and inherent operational risks. Intense competition is fostering innovation and influencing pricing strategies.

Satellite Manufacturing and Launch Market Market Size (In Billion)

Market segmentation highlights several pivotal trends. The Low Earth Orbit (LEO) segment is experiencing accelerated growth due to reduced latency and superior signal quality. Medium-sized launch vehicles exhibit strong potential, balancing payload capacity and cost-effectiveness. The commercial sector leads end-user demand, supported by crucial government and military applications. Within satellite subsystems, propulsion hardware, propellant, and satellite bus components are in high demand, driven by technological progress and increased satellite complexity. Electric propulsion systems are gaining prominence for their improved fuel efficiency and extended mission lifespans. Communication applications currently hold the largest market share, followed by earth observation and navigation. The satellite mass segment is varied, reflecting diverse applications. The market demonstrates robust growth potential across all segments, with SmallSats emerging as a key driver of innovation and accessibility.

Satellite Manufacturing and Launch Market Company Market Share

Satellite Manufacturing and Launch Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Satellite Manufacturing and Launch Market, covering the period 2019-2033. It offers in-depth insights into market dynamics, competitive landscape, technological advancements, and future growth projections, equipping stakeholders with actionable intelligence for informed decision-making. The report segments the market across various parameters, including orbit class (GEO, LEO, MEO), launch vehicle MTOW (heavy, light, medium), end-user (commercial, military & government, other), satellite subsystem (propulsion, bus & subsystems, solar array, structures, harness & mechanisms), propulsion technology (electric, gas-based, liquid fuel), application (communication, earth observation, navigation, space observation, others), and satellite mass (below 10kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg). The base year for the report is 2025, with an estimated year of 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. Key players analyzed include Space Exploration Technologies Corp, United Launch Alliance LLC, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, Sierra Nevada Corporation, China Aerospace Science and Technology Corporation (CASC), Thales, Ariane Group, Maxar Technologies Inc, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO), and The Boeing Company. The report projects a xx Million market value by 2033.

Satellite Manufacturing and Launch Market Market Structure & Competitive Dynamics

The Satellite Manufacturing and Launch Market is characterized by a moderately concentrated structure, with a core group of established leaders and a dynamic landscape of emerging players. Key players such as SpaceX, United Launch Alliance, and Arianespace are at the forefront, engaging in intense competition driven by a combination of factors including launch reliability, cost optimization, and cutting-edge technological advancements. The industry fosters robust innovation ecosystems, with continuous breakthroughs in propulsion systems, sophisticated satellite technologies, and advanced launch vehicle designs. The competitive arena is further shaped by stringent regulatory frameworks governing spectrum allocation and launch licensing, which impact market entry and overall competitiveness. While direct product substitutes are limited, primarily revolving around alternative terrestrial communication methods, the overarching demand for satellite-derived services continues to experience substantial growth. A significant shift in end-user trends is observed, leaning towards increased commercialization, propelled by the escalating demand for high-speed broadband internet access, comprehensive Earth observation data, and precise navigation services.

Mergers and acquisitions (M&A) are a recurring feature, actively reshaping the market's trajectory. For instance, Maxar Technologies' strategic acquisition of Wovenware in November 2022 underscores the growing significance of software and artificial intelligence (AI) capabilities within the sector. The cumulative value of M&A transactions over the past five years is estimated to be in the range of **[Insert Specific Value Here, e.g., hundreds of millions, billions]** USD. Market share is highly fluid, influenced by pivotal factors such as disruptive technological breakthroughs, the success rate of launch missions, and the procurement strategies of governmental bodies. A comprehensive analysis of key market share metrics across various segments is detailed within the complete report.

Satellite Manufacturing and Launch Market Industry Trends & Insights

The Satellite Manufacturing and Launch Market is on a trajectory of significant expansion, propelled by a confluence of critical growth drivers. The surging demand for high-throughput satellite broadband services stands out as a primary catalyst. Concurrently, the expanding array of applications for Earth observation data across diverse industries—ranging from precision agriculture and environmental monitoring to sophisticated urban planning—is further augmenting market growth. Technological disruptions, particularly in the realm of satellite miniaturization and the development of reusable launch vehicle technology, are profoundly influencing both cost-effectiveness and accessibility, thereby accelerating market expansion. Consumer preferences are increasingly prioritizing affordability, unwavering reliability, and enhanced data transmission speeds, fostering an environment of intense competition and continuous innovation. The market is also witnessing the dynamic emergence of "NewSpace" companies, which are effectively disrupting established players through their agile methodologies, innovative technologies, and novel business models. The Compound Annual Growth Rate (CAGR) is projected to reach **[Insert Specific CAGR Here, e.g., 10-15%]** during the forecast period, with market penetration steadily increasing across a wide spectrum of geographical regions.

Dominant Markets & Segments in Satellite Manufacturing and Launch Market

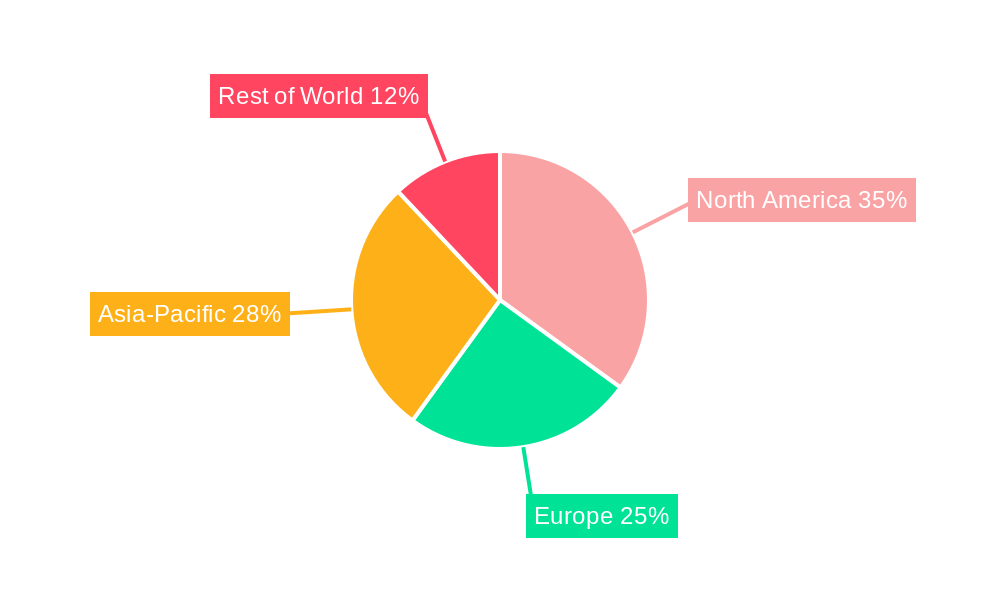

Leading Region: North America currently commands a dominant position, a status reinforced by substantial governmental support, robust private sector investment, and a deeply entrenched and advanced space industry infrastructure. Europe also represents a significant market, characterized by strong governmental backing and substantial contributions from major aerospace conglomerates like Airbus. The Asia-Pacific region is demonstrating rapidly accelerating potential, exhibiting robust growth across both its commercial and governmental space sectors.

Dominant Orbit Class: Low Earth Orbit (LEO) is experiencing the most rapid expansion, primarily driven by the escalating demand for high-bandwidth satellite constellations designed to deliver broadband services and comprehensive Earth observation capabilities. Geostationary Earth Orbit (GEO) continues to be a vital component for established communication services. Medium Earth Orbit (MEO) also contributes meaningfully to the overall market growth.

Dominant Launch Vehicle MTOW: The Medium segment within the launch vehicle market is exhibiting strong growth, a trend directly correlated with the increasing demand for smaller, more frequent launch opportunities. The Heavy segment remains critical for the deployment of large-scale satellite payloads and for executing crucial governmental missions.

Dominant End-User: The Commercial segment currently holds the largest market share, largely propelled by the burgeoning telecommunications and Earth observation industries. The Military & Government segment maintains a significant and enduring presence, with a strategic focus on national security and critical defense applications.

Dominant Satellite Subsystem: The Satellite Bus & Subsystems and Solar Array & Power Hardware are identified as crucial segments driving market growth. Innovations within these areas directly influence a satellite's overall functionality, operational lifespan, and mission effectiveness.

Dominant Propulsion Tech: Electric propulsion systems are gaining increasing traction and popularity due to their inherent efficiency advantages. However, Liquid Fuel propulsion continues to dominate for larger launch vehicles requiring significant thrust.

Dominant Application: Communication applications remain the most dominant sector within the market. However, Earth Observation is rapidly emerging as a significant and expanding segment. Navigation and other specialized niche applications, while smaller in scale, represent important and growing markets.

Dominant Satellite Mass: The 100-500kg satellite mass segment is experiencing accelerated growth, largely attributed to the widespread adoption and deployment of smallsat constellations.

Key enablers for regional dominance encompass supportive government policies, substantial investment in space infrastructure development, and the availability of a highly skilled and specialized workforce.

Satellite Manufacturing and Launch Market Product Innovations

The satellite manufacturing and launch sector has been a hotbed of innovation in recent years. A major breakthrough has been the significant miniaturization of satellites, which has not only led to reduced launch costs but has also enabled the ambitious deployment of extensive satellite constellations. Advancements in propulsion technologies, particularly the widespread adoption of electric propulsion, have demonstrably enhanced satellite operational efficiency and extended mission lifespans. The development and increasing use of reusable launch vehicles are fundamentally altering the economics of space access, dramatically lowering launch costs and facilitating a higher frequency of missions. These collective innovations are democratizing access to space and fostering the emergence of novel players and groundbreaking applications. Furthermore, the growing emphasis on software-defined satellites and the integration of AI-driven analytics are transforming operational capabilities and driving enhanced efficiency across the industry.

Report Segmentation & Scope

This report segments the Satellite Manufacturing and Launch market by orbit class (GEO, LEO, MEO), launch vehicle MTOW (heavy, medium, light), end-user (commercial, military & government, other), satellite subsystem (propulsion hardware and propellant, satellite bus & subsystems, solar array & power hardware, structures, harness & mechanisms), propulsion technology (electric, gas-based, liquid fuel), application (communication, earth observation, navigation, space observation, others), and satellite mass (below 10 kg, 10-100 kg, 100-500 kg, 500-1000 kg, above 1000 kg). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. The report provides a comprehensive overview of the market's structure, growth drivers, and challenges, offering valuable insights into the opportunities and risks within each segment.

Key Drivers of Satellite Manufacturing and Launch Market Growth

The expansion of the satellite manufacturing and launch market is being propelled by a multifaceted array of critical factors. Paramount among these are continuous technological advancements, specifically breakthroughs in satellite miniaturization, the development of reusable launch vehicles, and the refinement of electric propulsion systems, all of which contribute to reduced costs and improved accessibility. The burgeoning global demand for reliable broadband internet access, particularly in previously underserved regions, is a major catalyst for substantial investment in satellite constellation development. Supportive government initiatives, forward-looking policies that champion space exploration and commercialization, and streamlined regulatory processes are creating an increasingly favorable environment for market growth. Finally, the ever-expanding utility of satellite-derived data across diverse sectors such as agriculture, environmental monitoring, climate change analysis, and disaster management is driving widespread adoption and accelerating market penetration.

Challenges in the Satellite Manufacturing and Launch Market Sector

The satellite manufacturing and launch market faces several challenges. Regulatory hurdles, including stringent licensing requirements and spectrum allocation complexities, can impede market entry and expansion. Supply chain disruptions, particularly concerning critical components and materials, can impact production and launch schedules. Intense competition among established and emerging players puts pressure on pricing and profitability. The high capital expenditure required for satellite development and launch represents a barrier to entry for smaller players. Furthermore, environmental concerns about space debris and the sustainability of space operations are increasingly relevant.

Leading Players in the Satellite Manufacturing and Launch Market Market

- Space Exploration Technologies Corp

- United Launch Alliance LLC

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Airbus SE

- Sierra Nevada Corporation

- China Aerospace Science and Technology Corporation (CASC)

- Thales

- Ariane Group

- Maxar Technologies Inc

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

- The Boeing Company

Key Developments in Satellite Manufacturing and Launch Market Sector

- November 2022: Maxar Technologies acquired Wovenware, enhancing its software engineering and AI capabilities.

- November 2022: EchoStar Corporation and Maxar Technologies finalized an agreement to manufacture the EchoStar XXIV (JUPITER™ 3) satellite.

- January 2023: Airbus secured a 15-year contract with the Belgian Ministry of Defense for tactical satellite communication services, planning a new UHF service by 2024 for other European nations and NATO allies.

Strategic Satellite Manufacturing and Launch Market Market Outlook

The future of the Satellite Manufacturing and Launch Market is bright, characterized by sustained growth driven by increasing demand for satellite-based services and technological advancements. The market will witness continued miniaturization and the deployment of mega-constellations providing global broadband access. Governmental investments in space exploration and commercialization will remain a significant driver. Focus on sustainability and mitigation of space debris will influence industry practices and technological advancements. The market offers significant opportunities for established players and new entrants alike, particularly in innovative areas like electric propulsion, reusable launch systems, and AI-driven satellite operations.

Satellite Manufacturing and Launch Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. Launch Vehicle Mtow

- 4.1. Heavy

- 4.2. Light

- 4.3. Medium

-

5. End User

- 5.1. Commercial

- 5.2. Military & Government

- 5.3. Other

-

6. Satellite Subsystem

- 6.1. Propulsion Hardware and Propellant

- 6.2. Satellite Bus & Subsystems

- 6.3. Solar Array & Power Hardware

- 6.4. Structures, Harness & Mechanisms

-

7. Propulsion Tech

- 7.1. Electric

- 7.2. Gas based

- 7.3. Liquid Fuel

Satellite Manufacturing and Launch Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Manufacturing and Launch Market Regional Market Share

Geographic Coverage of Satellite Manufacturing and Launch Market

Satellite Manufacturing and Launch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 5.4.1. Heavy

- 5.4.2. Light

- 5.4.3. Medium

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Commercial

- 5.5.2. Military & Government

- 5.5.3. Other

- 5.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.6.1. Propulsion Hardware and Propellant

- 5.6.2. Satellite Bus & Subsystems

- 5.6.3. Solar Array & Power Hardware

- 5.6.4. Structures, Harness & Mechanisms

- 5.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.7.1. Electric

- 5.7.2. Gas based

- 5.7.3. Liquid Fuel

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Space Observation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.2.1. 10-100kg

- 6.2.2. 100-500kg

- 6.2.3. 500-1000kg

- 6.2.4. Below 10 Kg

- 6.2.5. above 1000kg

- 6.3. Market Analysis, Insights and Forecast - by Orbit Class

- 6.3.1. GEO

- 6.3.2. LEO

- 6.3.3. MEO

- 6.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 6.4.1. Heavy

- 6.4.2. Light

- 6.4.3. Medium

- 6.5. Market Analysis, Insights and Forecast - by End User

- 6.5.1. Commercial

- 6.5.2. Military & Government

- 6.5.3. Other

- 6.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 6.6.1. Propulsion Hardware and Propellant

- 6.6.2. Satellite Bus & Subsystems

- 6.6.3. Solar Array & Power Hardware

- 6.6.4. Structures, Harness & Mechanisms

- 6.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.7.1. Electric

- 6.7.2. Gas based

- 6.7.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Space Observation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.2.1. 10-100kg

- 7.2.2. 100-500kg

- 7.2.3. 500-1000kg

- 7.2.4. Below 10 Kg

- 7.2.5. above 1000kg

- 7.3. Market Analysis, Insights and Forecast - by Orbit Class

- 7.3.1. GEO

- 7.3.2. LEO

- 7.3.3. MEO

- 7.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 7.4.1. Heavy

- 7.4.2. Light

- 7.4.3. Medium

- 7.5. Market Analysis, Insights and Forecast - by End User

- 7.5.1. Commercial

- 7.5.2. Military & Government

- 7.5.3. Other

- 7.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 7.6.1. Propulsion Hardware and Propellant

- 7.6.2. Satellite Bus & Subsystems

- 7.6.3. Solar Array & Power Hardware

- 7.6.4. Structures, Harness & Mechanisms

- 7.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.7.1. Electric

- 7.7.2. Gas based

- 7.7.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Space Observation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.2.1. 10-100kg

- 8.2.2. 100-500kg

- 8.2.3. 500-1000kg

- 8.2.4. Below 10 Kg

- 8.2.5. above 1000kg

- 8.3. Market Analysis, Insights and Forecast - by Orbit Class

- 8.3.1. GEO

- 8.3.2. LEO

- 8.3.3. MEO

- 8.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 8.4.1. Heavy

- 8.4.2. Light

- 8.4.3. Medium

- 8.5. Market Analysis, Insights and Forecast - by End User

- 8.5.1. Commercial

- 8.5.2. Military & Government

- 8.5.3. Other

- 8.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 8.6.1. Propulsion Hardware and Propellant

- 8.6.2. Satellite Bus & Subsystems

- 8.6.3. Solar Array & Power Hardware

- 8.6.4. Structures, Harness & Mechanisms

- 8.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.7.1. Electric

- 8.7.2. Gas based

- 8.7.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Space Observation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.2.1. 10-100kg

- 9.2.2. 100-500kg

- 9.2.3. 500-1000kg

- 9.2.4. Below 10 Kg

- 9.2.5. above 1000kg

- 9.3. Market Analysis, Insights and Forecast - by Orbit Class

- 9.3.1. GEO

- 9.3.2. LEO

- 9.3.3. MEO

- 9.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 9.4.1. Heavy

- 9.4.2. Light

- 9.4.3. Medium

- 9.5. Market Analysis, Insights and Forecast - by End User

- 9.5.1. Commercial

- 9.5.2. Military & Government

- 9.5.3. Other

- 9.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 9.6.1. Propulsion Hardware and Propellant

- 9.6.2. Satellite Bus & Subsystems

- 9.6.3. Solar Array & Power Hardware

- 9.6.4. Structures, Harness & Mechanisms

- 9.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.7.1. Electric

- 9.7.2. Gas based

- 9.7.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Satellite Manufacturing and Launch Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Space Observation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.2.1. 10-100kg

- 10.2.2. 100-500kg

- 10.2.3. 500-1000kg

- 10.2.4. Below 10 Kg

- 10.2.5. above 1000kg

- 10.3. Market Analysis, Insights and Forecast - by Orbit Class

- 10.3.1. GEO

- 10.3.2. LEO

- 10.3.3. MEO

- 10.4. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 10.4.1. Heavy

- 10.4.2. Light

- 10.4.3. Medium

- 10.5. Market Analysis, Insights and Forecast - by End User

- 10.5.1. Commercial

- 10.5.2. Military & Government

- 10.5.3. Other

- 10.6. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 10.6.1. Propulsion Hardware and Propellant

- 10.6.2. Satellite Bus & Subsystems

- 10.6.3. Solar Array & Power Hardware

- 10.6.4. Structures, Harness & Mechanisms

- 10.7. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.7.1. Electric

- 10.7.2. Gas based

- 10.7.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Exploration Technologies Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Launch Alliance LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Heavy Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sierra Nevada Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Aerospace Science and Technology Corporation (CASC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ariane Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxar Technologies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Indian Space Research Organisation (ISRO)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Boeing Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Satellite Manufacturing and Launch Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 5: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 6: North America Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 7: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 8: North America Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 9: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 10: North America Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 11: North America Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: North America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 13: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 14: North America Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 15: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 16: North America Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 19: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 21: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 22: South America Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 23: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 24: South America Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 25: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 26: South America Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 27: South America Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: South America Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 29: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 30: South America Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 31: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 32: South America Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 35: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 37: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 38: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 39: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 40: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 41: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 42: Europe Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 43: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 44: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 45: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 46: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 47: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 48: Europe Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Europe Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 51: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 52: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 53: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 54: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 55: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 56: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 57: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 58: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 59: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 60: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 61: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 62: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 63: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 64: Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Application 2025 & 2033

- Figure 67: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Application 2025 & 2033

- Figure 68: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 69: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 70: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Orbit Class 2025 & 2033

- Figure 71: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 72: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Launch Vehicle Mtow 2025 & 2033

- Figure 73: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Launch Vehicle Mtow 2025 & 2033

- Figure 74: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by End User 2025 & 2033

- Figure 75: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by End User 2025 & 2033

- Figure 76: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Satellite Subsystem 2025 & 2033

- Figure 77: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 78: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Propulsion Tech 2025 & 2033

- Figure 79: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 80: Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion), by Country 2025 & 2033

- Figure 81: Asia Pacific Satellite Manufacturing and Launch Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 5: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 7: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 8: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 11: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 12: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 13: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 15: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 16: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United States Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Canada Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Mexico Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 22: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 23: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 24: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 26: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 27: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Argentina Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 33: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 34: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 35: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 37: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 38: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: France Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Italy Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Spain Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Russia Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Benelux Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Nordics Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 49: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 50: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 51: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 52: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 53: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 54: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 55: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Turkey Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Israel Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: GCC Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: North Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Application 2020 & 2033

- Table 63: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 64: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 65: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 66: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by End User 2020 & 2033

- Table 67: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 68: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 69: Global Satellite Manufacturing and Launch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: China Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 71: India Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 75: Oceania Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Satellite Manufacturing and Launch Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Manufacturing and Launch Market?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the Satellite Manufacturing and Launch Market?

Key companies in the market include Space Exploration Technologies Corp, United Launch Alliance LLC, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, Sierra Nevada Corporation, China Aerospace Science and Technology Corporation (CASC), Thales, Ariane Group, Maxar Technologies Inc, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO), The Boeing Company.

3. What are the main segments of the Satellite Manufacturing and Launch Market?

The market segments include Application, Satellite Mass, Orbit Class, Launch Vehicle Mtow, End User, Satellite Subsystem, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Airbus has signed a contract with the Belgian Ministry of Defense, the company announced last week. Airbus will provide tactical satellite communications services to the armed forces for a period of 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies.November 2022: EchoStar Corporation announced a revised agreement with Maxar Technologies to manufacture the EchoStar XXIV satellite, also known as JUPITER™ 3. The satellite, designed for EchoStar's Hughes Network Systems division, is being manufactured at Maxar's facility in Palo Alto, California.November 2022: Maxar Technologies has acquired software development and artificial intelligence company Wovenware. This acquisition adds significantly to Maxar's Software Engineering and AI capabilities

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Manufacturing and Launch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Manufacturing and Launch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Manufacturing and Launch Market?

To stay informed about further developments, trends, and reports in the Satellite Manufacturing and Launch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence