Key Insights

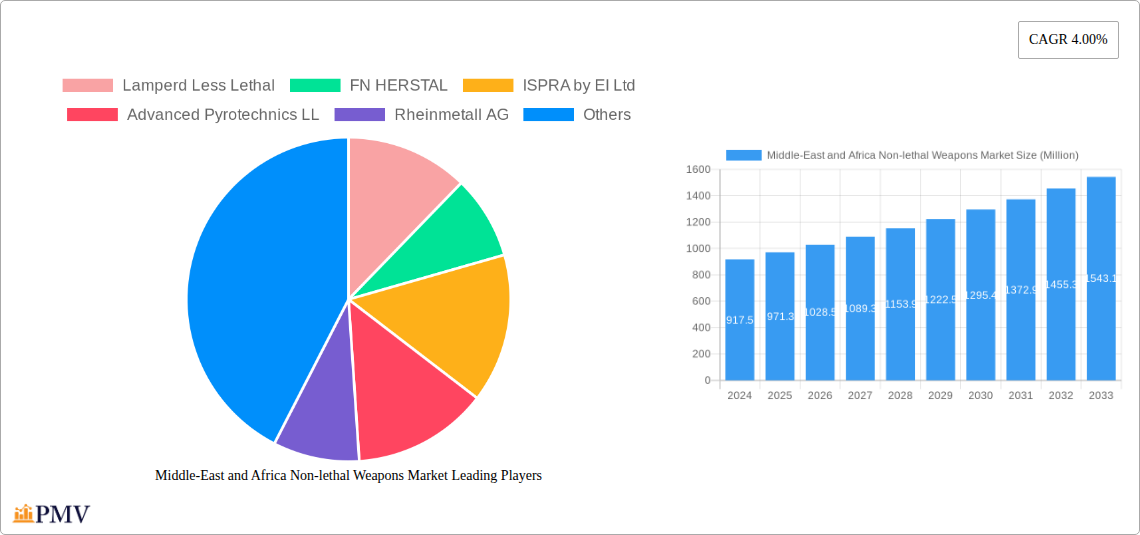

The Middle-East and Africa Non-Lethal Weapons Market is poised for substantial growth, currently valued at $917.5 million in 2024. This expansion is driven by a confluence of factors, including escalating regional security concerns, the increasing adoption of advanced crowd control solutions by law enforcement, and a growing emphasis on de-escalation tactics within military operations across the region. The market's CAGR of 5.9% over the forecast period highlights a robust upward trajectory, fueled by technological advancements in munitions and less-lethal delivery systems. Key growth segments include Ammunition and Explosives, driven by the demand for more effective and precise non-lethal projectiles, as well as Gases and Sprays, which are seeing increased application in urban policing and security. The Law Enforcement and Military end-user segments are expected to remain the primary consumers, with significant investments in upgrading existing arsenals and procuring new, innovative non-lethal technologies to enhance operational effectiveness while minimizing collateral damage.

Middle-East and Africa Non-lethal Weapons Market Market Size (In Million)

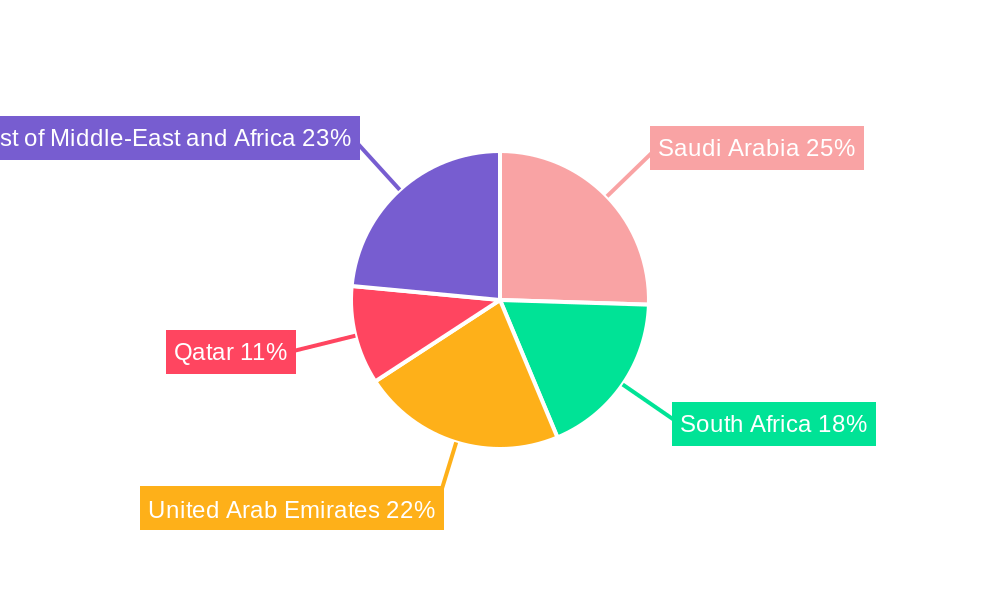

The market's dynamism is further shaped by evolving trends such as the development of smart munitions with integrated tracking and less-lethal incapacitation capabilities, alongside the deployment of advanced sensor technologies for enhanced situational awareness. Restraints, such as the high cost of some advanced non-lethal systems and varying regulatory frameworks across different MEA nations, are being addressed through continuous innovation and strategic partnerships aimed at making these solutions more accessible. Geographically, Saudi Arabia and the United Arab Emirates are expected to lead market expansion due to significant defense spending and a proactive approach to internal security. South Africa and Qatar also represent crucial growth markets. Prominent companies like Rheinmetall AG, Axon Enterprise Inc., and Safariland LLC are actively shaping the market landscape through product development and strategic expansions, catering to the unique demands of the Middle-East and Africa's security environment.

Middle-East and Africa Non-lethal Weapons Market Company Market Share

This detailed report provides an in-depth analysis of the Middle-East and Africa non-lethal weapons market. Covering the study period 2019–2033, with base year 2025 and forecast period 2025–2033, this research offers critical insights into market dynamics, growth drivers, dominant segments, competitive landscapes, and future outlook. Essential for law enforcement, military, and defense procurement professionals, the report delves into the strategic importance of less lethal technologies for internal security and crowd control in a rapidly evolving geopolitical environment.

The Middle-East and Africa non-lethal weapons market is experiencing significant growth, driven by increasing regional instability, the need for effective crowd management solutions, and advancements in less lethal ammunition, riot control agents, and tactical devices. This report meticulously segments the market by type, including Ammunition, Explosives, Gases and Sprays, and Other Types, and by end-user, focusing on Law Enforcement and Military applications. Geographically, the analysis covers key markets such as Saudi Arabia, South Africa, United Arab Emirates, Qatar, and the Rest of Middle-East and Africa.

Middle-East and Africa Non-lethal Weapons Market Market Structure & Competitive Dynamics

The Middle-East and Africa non-lethal weapons market exhibits a moderately concentrated structure, with a mix of established global players and emerging regional manufacturers vying for market share. Innovation ecosystems are developing, spurred by the increasing demand for advanced less lethal solutions and crowd control technologies. Regulatory frameworks, while varying across countries, are generally supportive of the acquisition of non-lethal defense equipment aimed at enhancing internal security and minimizing collateral damage. Product substitutes, such as traditional less lethal options and advanced kinetic impact projectiles, are present, but the trend favors integrated and intelligent non-lethal weapon systems. End-user trends highlight a growing preference for versatile, AI-integrated, and scalable less lethal force options for police and military operations. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to expand their product portfolios and geographical reach. For instance, strategic partnerships and acquisitions valued in the tens to hundreds of millions of dollars are expected to shape the competitive landscape.

- Market Concentration: Moderate, with key players holding significant market share in specific segments.

- Innovation Ecosystems: Emerging, driven by demand for advanced riot control agents and less lethal ammunition.

- Regulatory Frameworks: Supportive of internal security equipment procurement, though specific regulations differ regionally.

- Product Substitutes: Include traditional stun grenades, tear gas canisters, and kinetic impact rounds.

- End-User Trends: Rising demand for AI-powered crowd dispersal systems and advanced less lethal ammunition.

- M&A Activities: Expected to increase, driving consolidation and market expansion.

Middle-East and Africa Non-lethal Weapons Market Industry Trends & Insights

The Middle-East and Africa non-lethal weapons market is projected to witness robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is primarily fueled by the escalating need for effective and humane crowd management solutions by both law enforcement agencies and military forces across the region. The increasing prevalence of civil unrest, border security challenges, and counter-terrorism operations necessitates the deployment of advanced less lethal technologies. Technological disruptions, particularly the integration of Artificial Intelligence (AI) into non-lethal weapon systems, are transforming the market. AI-powered targeting, remote deployment capabilities, and enhanced projectile accuracy are becoming key differentiators. Consumer preferences are shifting towards less lethal options that minimize casualties and civilian harm, aligning with international standards and human rights concerns. The market penetration of advanced non-lethal munitions and disruption technologies is expected to rise significantly. Key market growth drivers include significant government investments in defense and internal security, coupled with the ongoing modernization of police equipment and military hardware. The development of sophisticated riot control agents, including advanced irritants and incapacitation sprays, is a notable trend. Furthermore, the increasing adoption of less lethal ammunition for training and operational purposes by security forces contributes to market expansion. The competitive dynamics are characterized by intense innovation, strategic alliances, and a focus on developing cost-effective yet highly effective non-lethal solutions. The Middle-East and Africa non-lethal weapons market is poised to benefit from the growing recognition of the strategic advantage offered by less lethal force options in maintaining public order and ensuring national security. The projected market size for the non-lethal weapons sector in the Middle-East and Africa is expected to reach approximately $850 million by 2025, with steady growth anticipated throughout the forecast period.

Dominant Markets & Segments in Middle-East and Africa Non-lethal Weapons Market

The Middle-East and Africa non-lethal weapons market is characterized by distinct regional dominance and segment preferences. Saudi Arabia and the United Arab Emirates are expected to emerge as leading markets due to substantial government investments in internal security infrastructure and the modernization of their law enforcement and military capabilities. These nations are actively procuring advanced non-lethal technologies to manage large-scale events, border security, and internal stability. The Law Enforcement segment is anticipated to hold a significant market share, driven by the increasing responsibilities of police forces in maintaining public order, counter-terrorism operations, and riot control. The Military segment also represents a substantial user base, employing less lethal weapons for peacekeeping operations, crowd dispersal during conflict, and situations requiring de-escalation.

- Dominant Geography: Saudi Arabia and the United Arab Emirates are projected to lead the market owing to substantial defense budgets and a strong focus on internal security.

- Key Drivers:

- Economic Policies: Robust economic growth enabling significant investment in defense and security modernization.

- Infrastructure Development: Investments in state-of-the-art training facilities and secure storage for less lethal equipment.

- Geopolitical Factors: Regional stability concerns and border security requirements driving demand for crowd control solutions.

- Key Drivers:

- Dominant End-User: Law Enforcement is expected to be the primary consumer, followed closely by the Military.

- Key Drivers for Law Enforcement:

- Public Order Management: Increasing need for effective riot control agents and less lethal munitions to manage protests and public gatherings.

- Counter-Terrorism: Deployment of non-lethal options for incapacitating threats with minimal harm to bystanders.

- De-escalation Tactics: Growing emphasis on using less lethal force as a primary response.

- Key Drivers for Military:

- Peacekeeping Operations: Use of non-lethal weapons in complex environments to maintain order without excessive force.

- Border Security: Application of less lethal perimeter defense systems.

- Training and Readiness: Integration of non-lethal training munitions to enhance soldier preparedness.

- Key Drivers for Law Enforcement:

Within the Type segmentation, Ammunition and Gases and Sprays are expected to dominate the market. Less lethal ammunition, including rubber bullets, sponge rounds, and beanbag rounds, offers versatility and precision. Gases and Sprays, such as tear gas, pepper spray, and malodorants, remain crucial for immediate crowd dispersal and incapacitation. The Rest of Middle-East and Africa segment is also a significant contributor, with countries like South Africa and Qatar showing increasing adoption rates for non-lethal security equipment. The market size for the Ammunition segment alone is estimated to be over $300 million in 2025.

Middle-East and Africa Non-lethal Weapons Market Product Innovations

Product innovations in the Middle-East and Africa non-lethal weapons market are increasingly focused on enhanced safety, precision, and integration with advanced technologies. Companies are developing less lethal ammunition with improved accuracy and reduced risk of severe injury, such as frangible projectiles and multi-projectile rounds. The development of smart riot control agents with controlled dispersal patterns and longer-lasting effects is a significant trend. Integration of AI in non-lethal weapon systems, allowing for automated target tracking and identification, is revolutionizing crowd control and tactical operations. These innovations offer a competitive advantage by providing security forces with more effective, humane, and controllable options for managing volatile situations, thereby increasing market adoption.

Report Segmentation & Scope

This report meticulously segments the Middle-East and Africa non-lethal weapons market by Type, encompassing Ammunition, Explosives, Gases and Sprays, and Other Types. Each category offers unique applications for law enforcement and military operations, with projected market sizes and growth rates detailed within the analysis. The End User segmentation focuses on Law Enforcement and Military sectors, highlighting their distinct procurement needs and usage patterns. Geographically, the report provides granular insights into Saudi Arabia, South Africa, United Arab Emirates, Qatar, and the broader Rest of Middle-East and Africa region, examining country-specific market dynamics, regulatory influences, and demand drivers. The scope includes market sizes in millions of USD for 2025 and projected growth trajectories throughout the forecast period.

- Type Segmentation:

- Ammunition: Including rubber bullets, beanbag rounds, and other kinetic impact projectiles. Expected to hold a significant market share due to versatility and widespread use in crowd control.

- Explosives: Primarily for tactical applications like breaching or signaling, with niche but critical demand.

- Gases and Sprays: Encompassing tear gas, pepper spray, malodorants, and other chemical irritants. Crucial for immediate riot dispersal.

- Other Types: Including batons, tasers, sonic devices, and less lethal grenades.

- End-User Segmentation:

- Law Enforcement: Primary focus on public order management, counter-terrorism, and de-escalation.

- Military: Applications in peacekeeping, border security, and force protection.

- Geography Segmentation:

- Saudi Arabia: Significant market share driven by substantial defense modernization.

- South Africa: Growing demand for internal security solutions.

- United Arab Emirates: Leading adopter of advanced less lethal technologies.

- Qatar: Increasing investments in security infrastructure.

- Rest of Middle-East and Africa: Diverse market with developing demand across various nations.

Key Drivers of Middle-East and Africa Non-lethal Weapons Market Growth

The Middle-East and Africa non-lethal weapons market is propelled by several interconnected drivers. Geopolitical instability and the persistent threat of terrorism across the region necessitate robust internal security measures and effective crowd control capabilities. Government expenditure on defense and public safety is on the rise, with nations investing heavily in modernizing their law enforcement and military equipment. The increasing emphasis on using less lethal options to minimize casualties and civilian harm during operations is a significant ethical and strategic driver. Technological advancements, particularly in AI integration for non-lethal weapon systems and the development of more sophisticated riot control agents and less lethal ammunition, are creating new market opportunities. For example, the development of smart tear gas launchers that can precisely target areas is enhancing their effectiveness and safety profile.

Challenges in the Middle-East and Africa Non-lethal Weapons Market Sector

Despite robust growth prospects, the Middle-East and Africa non-lethal weapons market faces several challenges. Varying regulatory frameworks across different countries can create hurdles for market entry and product standardization. Concerns regarding the ethical use and potential misuse of less lethal technologies, as well as their long-term health impacts, can lead to public and political scrutiny, potentially impacting procurement decisions. Supply chain disruptions, particularly for specialized components and raw materials, can affect production and delivery timelines. Intense competition among global and regional manufacturers also puts pressure on pricing and profit margins. Furthermore, the high initial cost of advanced non-lethal weapon systems can be a barrier for some smaller nations within the region.

Leading Players in the Middle-East and Africa Non-lethal Weapons Market Market

- Lamperd Less Lethal

- FN HERSTAL

- ISPRA by EI Ltd

- Advanced Pyrotechnics LL

- Rheinmetall AG

- Condor Non-Lethal Technologies

- Axon Enterprise Inc

- Genasys Inc

- Combined Systems Inc

- Pepperball (United Tactical Systems LLC)

- Safariland LLC

Key Developments in Middle-East and Africa Non-lethal Weapons Market Sector

- November 2022: Israel announced the installation of robotic weapons that can fire tear gas, stun grenades, and sponge-tipped bullets. These weapons utilize artificial intelligence (AI) to track targets, making them even more effective for crowd control and other tactical purposes. This development highlights the trend towards autonomous and AI-integrated less lethal systems.

- May 2021: Israel announced the induction of a new non-lethal weapon called the Skunk, developed by the Israeli company Odortec. The Skunk is a malodorant used for crowd control purposes. This signifies the ongoing innovation in riot control agents and chemical deterrents.

Strategic Middle-East and Africa Non-lethal Weapons Market Market Outlook

The strategic outlook for the Middle-East and Africa non-lethal weapons market is highly positive, driven by a confluence of factors including persistent regional security demands and continuous technological innovation. The ongoing modernization of law enforcement and military capabilities across key nations like Saudi Arabia and the UAE will continue to fuel demand for advanced less lethal solutions. The increasing integration of AI and smart technologies into non-lethal weapon systems presents significant growth opportunities for companies offering cutting-edge products, such as robotic crowd control platforms and intelligent riot dispersal systems. Strategic partnerships and collaborations between global manufacturers and regional entities are expected to become more prevalent, facilitating market penetration and localized product development. Furthermore, the growing awareness and adoption of less lethal force options as a means to de-escalate conflicts and minimize casualties will remain a primary growth accelerator, positioning the market for sustained expansion throughout the forecast period.

Middle-East and Africa Non-lethal Weapons Market Segmentation

-

1. Type

- 1.1. Ammunition

- 1.2. Explosives

- 1.3. Gases and Sprays

- 1.4. Other Types

-

2. End User

- 2.1. Law Enforcement

- 2.2. Military

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. United Arab Emirates

- 3.4. Qatar

- 3.5. Rest of Middle-East and Africa

Middle-East and Africa Non-lethal Weapons Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. United Arab Emirates

- 4. Qatar

- 5. Rest of Middle East and Africa

Middle-East and Africa Non-lethal Weapons Market Regional Market Share

Geographic Coverage of Middle-East and Africa Non-lethal Weapons Market

Middle-East and Africa Non-lethal Weapons Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Law Enforcement Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ammunition

- 5.1.2. Explosives

- 5.1.3. Gases and Sprays

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. United Arab Emirates

- 5.3.4. Qatar

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. United Arab Emirates

- 5.4.4. Qatar

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ammunition

- 6.1.2. Explosives

- 6.1.3. Gases and Sprays

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Law Enforcement

- 6.2.2. Military

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. United Arab Emirates

- 6.3.4. Qatar

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ammunition

- 7.1.2. Explosives

- 7.1.3. Gases and Sprays

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Law Enforcement

- 7.2.2. Military

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. United Arab Emirates

- 7.3.4. Qatar

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Arab Emirates Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ammunition

- 8.1.2. Explosives

- 8.1.3. Gases and Sprays

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Law Enforcement

- 8.2.2. Military

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. United Arab Emirates

- 8.3.4. Qatar

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Qatar Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ammunition

- 9.1.2. Explosives

- 9.1.3. Gases and Sprays

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Law Enforcement

- 9.2.2. Military

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. United Arab Emirates

- 9.3.4. Qatar

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle East and Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ammunition

- 10.1.2. Explosives

- 10.1.3. Gases and Sprays

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Law Enforcement

- 10.2.2. Military

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. United Arab Emirates

- 10.3.4. Qatar

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lamperd Less Lethal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FN HERSTAL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ISPRA by EI Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Advanced Pyrotechnics LL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rheinmetall AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Condor Non-Lethal Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Axon Enterprise Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Genasys Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Combined Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pepperball (United Tactical Systems LLC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Safariland LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Lamperd Less Lethal

List of Figures

- Figure 1: Middle-East and Africa Non-lethal Weapons Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Non-lethal Weapons Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 19: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Non-lethal Weapons Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Non-lethal Weapons Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Middle-East and Africa Non-lethal Weapons Market?

Key companies in the market include Lamperd Less Lethal, FN HERSTAL, ISPRA by EI Ltd, Advanced Pyrotechnics LL, Rheinmetall AG, Condor Non-Lethal Technologies, Axon Enterprise Inc, Genasys Inc, Combined Systems Inc, Pepperball (United Tactical Systems LLC), Safariland LLC.

3. What are the main segments of the Middle-East and Africa Non-lethal Weapons Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Law Enforcement Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Israel announced the installation of robotic weapons that can fire tear gas, stun grenades, and sponge-tipped bullets. These weapons utilize artificial intelligence (AI) to track targets, making them even more effective for crowd control and other tactical purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Non-lethal Weapons Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Non-lethal Weapons Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Non-lethal Weapons Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Non-lethal Weapons Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence