Key Insights

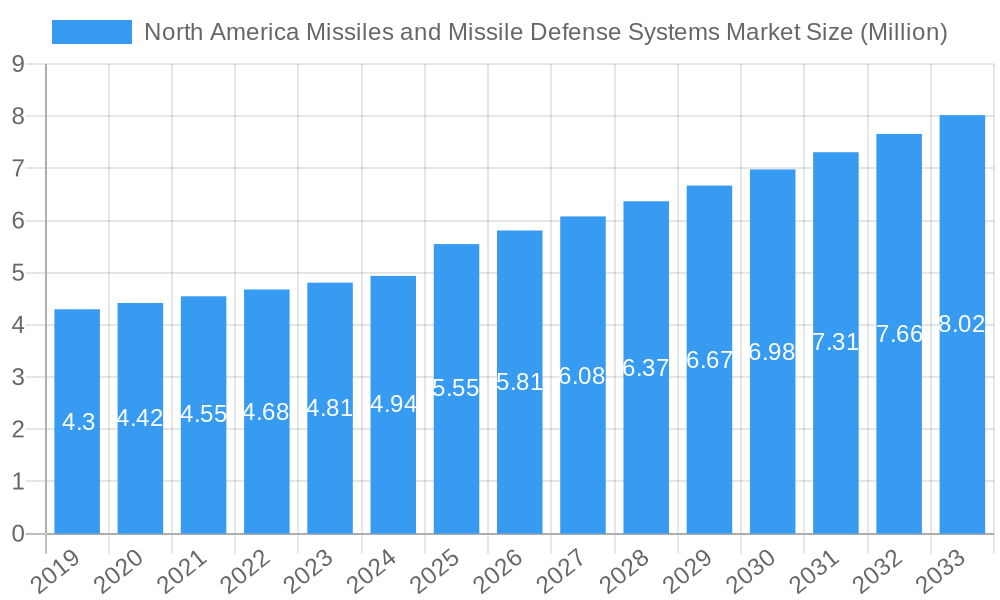

The North America Missiles and Missile Defense Systems Market is poised for substantial growth, projected to reach $5.55 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 4.84% expected throughout the forecast period. This robust expansion is fueled by escalating geopolitical tensions, increasing defense budgets across North American nations, and the relentless pursuit of advanced threat mitigation capabilities. The escalating demand for sophisticated missile defense solutions, ranging from tactical short-range systems to strategic long-range interceptors, underscores the critical role these technologies play in national security. Furthermore, ongoing technological advancements in areas such as artificial intelligence, hypersonic missile development, and integrated air and missile defense (IAMD) architectures are creating new opportunities for market players. Investments in research and development are critical to staying ahead in this dynamic landscape, with a focus on enhancing detection, tracking, and engagement capabilities against evolving threats.

North America Missiles and Missile Defense Systems Market Market Size (In Million)

The market's trajectory is shaped by a complex interplay of drivers and restraints. Key drivers include the perceived threat landscape, the need for modernization of existing defense infrastructure, and government initiatives to bolster domestic defense industries. Conversely, high development costs, lengthy procurement cycles, and the potential for international cooperation on arms control can act as moderating factors. Key segments within the North America Missiles and Missile Defense Systems Market include production, consumption, import/export dynamics, and price trends. The United States dominates the North American landscape, with Canada and Mexico also contributing to the overall market size and demand. Leading companies such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman are at the forefront of innovation, developing cutting-edge solutions that address the sophisticated security challenges of the 21st century. The focus remains on developing resilient and multi-layered defense systems capable of countering a wide array of missile threats.

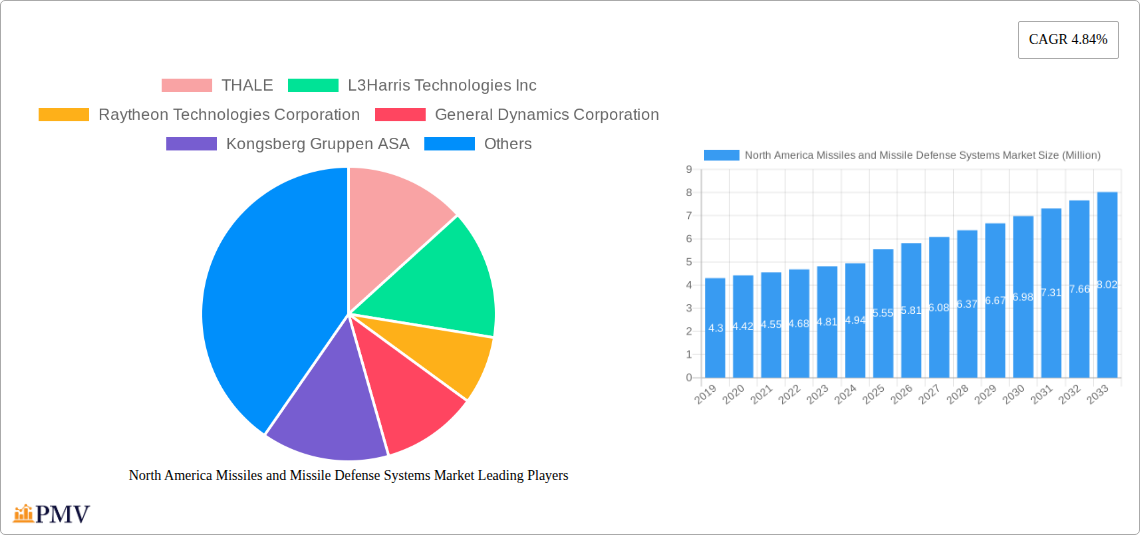

North America Missiles and Missile Defense Systems Market Company Market Share

This comprehensive report delivers an exhaustive analysis of the North America missiles and missile defense systems market, covering critical aspects from production analysis to price trend analysis. Leveraging advanced air defense systems, hypersonic missiles, and strategic defense modernization, this study provides actionable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. The report encompasses a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, including a detailed historical analysis from 2019–2024. Key players such as Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, The Boeing Company, General Dynamics Corporation, L3Harris Technologies Inc, BAE Systems plc, Leidos, THALE, and Kongsberg Gruppen ASA are thoroughly examined.

North America Missiles and Missile Defense Systems Market Market Structure & Competitive Dynamics

The North America missiles and missile defense systems market is characterized by a high degree of concentration, dominated by a few major defense contractors holding significant market share. Innovation ecosystems are thriving, driven by substantial government investment in research and development for cutting-edge technologies like hypersonic missiles and advanced countermeasures. Regulatory frameworks, particularly within the United States and Canada, play a pivotal role in shaping market entry and product development, with stringent export controls and defense procurement processes. Product substitutes are limited due to the specialized nature of missile defense, but advancements in cyber warfare and electronic countermeasures present indirect competitive threats. End-user trends are increasingly focused on multi-layered defense capabilities, integrated systems, and rapid response mechanisms to counter evolving threats. Mergers and acquisitions (M&A) are strategic tools for consolidating capabilities and expanding market reach, with significant M&A deal values often linked to acquiring specialized technologies or gaining access to key government contracts. The market actively seeks to enhance Arctic air and missile defenses, reflecting a growing geopolitical imperative.

North America Missiles and Missile Defense Systems Market Industry Trends & Insights

The North America missiles and missile defense systems market is experiencing robust growth, propelled by escalating geopolitical tensions, the rise of peer adversaries, and the imperative to protect critical infrastructure and civilian populations. A significant CAGR is projected over the forecast period, driven by continuous innovation in areas such as interceptor technologies, advanced sensor fusion, and artificial intelligence for threat detection and engagement. The increasing proliferation of advanced missile capabilities, including ballistic, cruise, and emerging hypersonic missiles, is a primary market growth driver. Governments across North America are responding with substantial defense spending increases and modernization programs. Consumer preferences, aligned with defense ministries' strategic objectives, are shifting towards integrated, networked defense solutions that offer seamless interoperability and real-time situational awareness. Technological disruptions are primarily focused on improving missile accuracy, speed, and survivability, alongside the development of more effective countermeasures. Competitive dynamics are intensified by the drive for technological superiority, with companies investing heavily in R&D to secure lucrative government contracts. The market penetration of advanced missile defense solutions is expected to deepen as nations prioritize comprehensive security architectures.

Dominant Markets & Segments in North America Missiles and Missile Defense Systems Market

The United States unequivocally dominates the North America missiles and missile defense systems market. This dominance stems from its substantial defense budget, extensive military R&D investments, and its role as a global security leader.

- Production Analysis: The US leads in the production of a wide array of missiles and sophisticated missile defense systems, including advanced interceptors, command and control systems, and radar technologies. Key drivers include strong government procurement policies, a robust industrial base, and continuous technological innovation.

- Consumption Analysis: The US military is the largest consumer, driven by its strategic need to counter diverse threats and maintain global power projection. Canada, while a smaller market, is significantly increasing its consumption, particularly in the realm of Arctic air and missile defenses and its commitment to supporting allies like Ukraine.

- Import Market Analysis (Value & Volume): While the US is largely self-sufficient, certain specialized components or niche technologies might be imported. Canada's import market is more significant, focusing on acquiring advanced defense capabilities to bolster its own security and contribute to collective defense efforts. The value of imports is influenced by the complexity and sophistication of the acquired systems.

- Export Market Analysis (Value & Volume): The US is a major exporter of missile and missile defense systems globally, contributing significantly to its trade balance in defense. Canada's export market is more nascent but growing, particularly in areas where it possesses unique expertise.

- Price Trend Analysis: Prices are generally high due to the complexity, R&D costs, and specialized nature of these systems. Fluctuations are often tied to government contract awards, technological advancements, and the scale of production runs. The increasing demand for advanced air defense systems and responses to emerging threats like hypersonic missiles can also influence price trends.

North America Missiles and Missile Defense Systems Market Product Innovations

Product innovations in the North America missiles and missile defense systems market are revolutionizing battlefield capabilities. Developments include the integration of AI for faster threat identification and engagement, enhanced seeker technologies for improved accuracy against maneuvering targets, and the creation of multi-domain defense networks. The focus on hypersonic missile defense is driving advancements in agile interceptors and advanced sensor systems capable of tracking hyper-velocity threats. Innovations also extend to modular system designs for easier upgrades and reduced lifecycle costs, ensuring market fit for evolving defense requirements and providing significant competitive advantages to early adopters.

Report Segmentation & Scope

The North America missiles and missile defense systems market is segmented by system type, including ballistic missile defense, cruise missile defense, and air defense systems. Another key segmentation is by component, encompassing interceptors, launchers, command and control systems, and sensors/radars. Geographically, the market is primarily divided into the United States and Canada, with growth projections indicating substantial investment from both nations in modernizing their defense capabilities. The scope includes detailed analysis of production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis, offering a granular view of market sizes and competitive dynamics within each segment.

Key Drivers of North America Missiles and Missile Defense Systems Market Growth

The growth of the North America missiles and missile defense systems market is propelled by several critical factors. Geopolitical instability and the resurgence of great power competition are primary drivers, necessitating robust defense capabilities against emerging threats, including hypersonic missiles. Significant government investment in defense modernization programs, aimed at upgrading aging infrastructure and acquiring advanced air defense systems, is a crucial economic factor. Technological advancements, such as AI integration and improved sensor technologies, are fueling innovation and demand for next-generation systems. Furthermore, increasing concerns over Arctic air and missile defenses and the ongoing commitment to supporting allies like Ukraine underscore the strategic importance and market expansion for these critical defense assets.

Challenges in the North America Missiles and Missile Defense Systems Market Sector

Despite robust growth, the North America missiles and missile defense systems market faces several challenges. High research and development costs associated with cutting-edge technologies, particularly for countering hypersonic missiles, can be a significant barrier to entry and a constraint on smaller players. Stringent regulatory frameworks and lengthy procurement cycles, while ensuring rigorous standards, can slow down the deployment of new systems. Global supply chain disruptions and the reliance on specialized materials can impact production timelines and costs. Furthermore, intense competition among major defense contractors often leads to price pressures, even for highly sophisticated advanced air defense systems, requiring companies to optimize their operational efficiency and supply chain management.

Leading Players in the North America Missiles and Missile Defense Systems Market Market

- THALE

- L3Harris Technologies Inc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Kongsberg Gruppen ASA

- Lockheed Martin Corporation

- Leidos

- BAE Systems plc

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in North America Missiles and Missile Defense Systems Market Sector

- June 2022: Canada's defense minister announced upgrades to Arctic air and missile defenses with the United States, citing the need to address new technologies such as hypersonic missiles. The Canadian government outlined USD 3.8 billion in military spending over the next six years to bolster these capabilities.

- January 2023: The Defense Minister of Canada announced that the country is set to spend USD 406 million on an advanced air defense system and associated missiles for Ukraine, highlighting Canada's commitment to supporting allied defense efforts and its role in global security.

Strategic North America Missiles and Missile Defense Systems Market Market Outlook

The strategic outlook for the North America missiles and missile defense systems market remains exceptionally strong. The escalating global threat landscape, coupled with significant governmental commitment to defense modernization, will continue to drive demand for advanced capabilities, especially in countering hypersonic missiles and enhancing Arctic air and missile defenses. Increased collaboration between the US and Canada on integrated defense solutions presents further growth opportunities. Innovations in AI, directed energy weapons, and networked defense will shape future market strategies. The ongoing support for allies like Ukraine further solidifies the strategic imperative for robust missile defense, positioning the market for sustained expansion and technological advancement.

North America Missiles and Missile Defense Systems Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

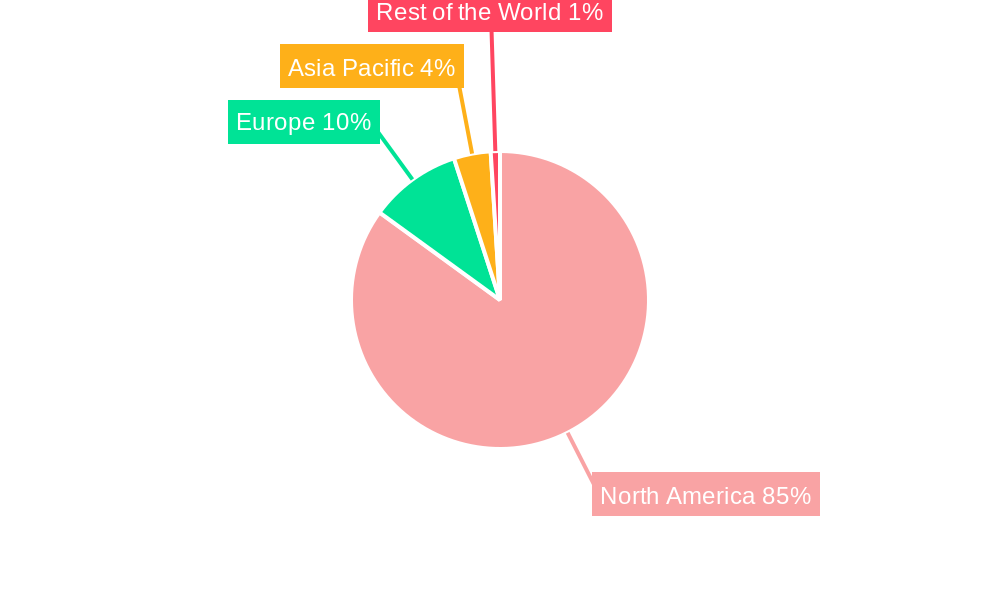

North America Missiles and Missile Defense Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Missiles and Missile Defense Systems Market Regional Market Share

Geographic Coverage of North America Missiles and Missile Defense Systems Market

North America Missiles and Missile Defense Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Missile Defense Systems is Expected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Missiles and Missile Defense Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L3Harris Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raytheon Technologies Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Dynamics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kongsberg Gruppen ASA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leidos

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAE Systems plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northrop Grumman Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 THALE

List of Figures

- Figure 1: North America Missiles and Missile Defense Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Missiles and Missile Defense Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Missiles and Missile Defense Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Missiles and Missile Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Missiles and Missile Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Missiles and Missile Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Missiles and Missile Defense Systems Market?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the North America Missiles and Missile Defense Systems Market?

Key companies in the market include THALE, L3Harris Technologies Inc, Raytheon Technologies Corporation, General Dynamics Corporation, Kongsberg Gruppen ASA, Lockheed Martin Corporation, Leidos, BAE Systems plc, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the North America Missiles and Missile Defense Systems Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.55 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Missile Defense Systems is Expected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

In June 2022, Canada's defense minister announced upgrades to Arctic air and missile defenses with the United States and cited new technologies such as hypersonic missiles. The Canadian government outlined USD 3.8 billion in military spending over the next six years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Missiles and Missile Defense Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Missiles and Missile Defense Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Missiles and Missile Defense Systems Market?

To stay informed about further developments, trends, and reports in the North America Missiles and Missile Defense Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence