Key Insights

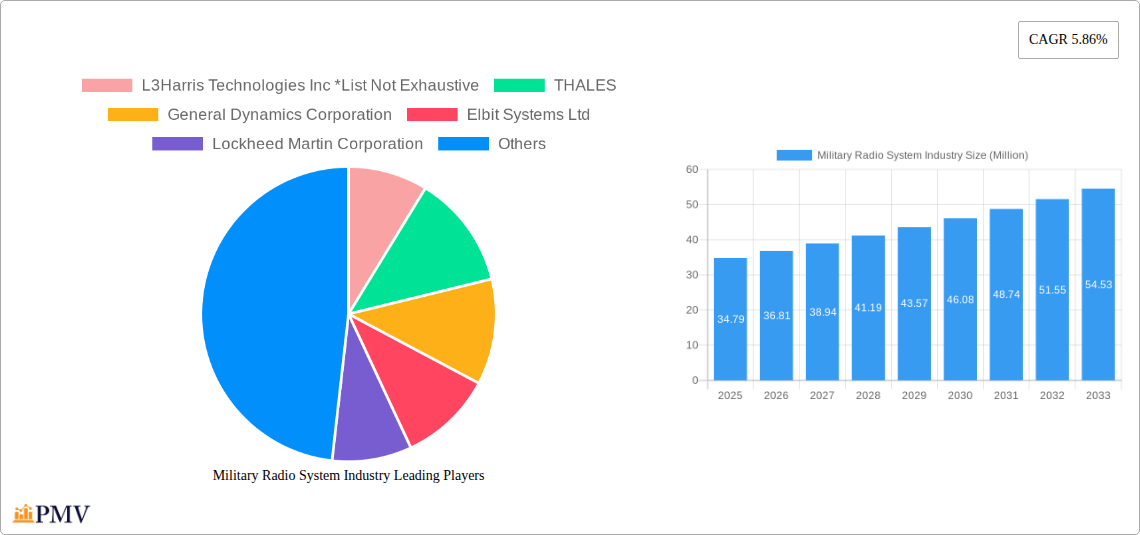

The global military radio systems market is poised for significant expansion, with a market size of $34.79 million and a projected Compound Annual Growth Rate (CAGR) of 5.86% during the forecast period of 2025-2033. This robust growth is underpinned by a confluence of factors, including the escalating geopolitical tensions worldwide, which necessitate enhanced communication capabilities for defense forces. Modern warfare increasingly relies on seamless, secure, and real-time information exchange, driving the demand for advanced military radio systems. Key drivers include the ongoing modernization of military infrastructure, the integration of advanced technologies like artificial intelligence and machine learning into communication platforms, and the growing emphasis on interoperability between different branches of the armed forces and allied nations. The increasing deployment of unmanned aerial vehicles (UAVs) and other autonomous systems also fuels the need for sophisticated command and control radio systems.

Military Radio System Industry Market Size (In Million)

The market is segmented across various communication types, with shipborne, ground-based, and airborne communications expected to witness substantial adoption. Component-wise, military satcom systems and military security systems are identified as key growth areas, reflecting the strategic importance of satellite-based communication and robust security features in modern military operations. The application spectrum, particularly command and control and situational awareness, will be central to market expansion as defense organizations prioritize strategic decision-making and battlefield visibility. While the market is generally optimistic, potential restraints could include budgetary constraints in some regions, the complexity of integrating new technologies with legacy systems, and the evolving threat landscape demanding continuous innovation and adaptation. Nevertheless, the persistent need for secure, reliable, and high-performance communication solutions for defense ensures a dynamic and growing market.

Military Radio System Industry Company Market Share

This in-depth market research report provides a detailed analysis of the global Military Radio System Industry, encompassing market structure, competitive dynamics, key trends, dominant segments, product innovations, growth drivers, challenges, leading players, and future strategic outlook. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report offers actionable insights for stakeholders seeking to understand and capitalize on the evolving landscape of military communication technologies.

Military Radio System Industry Market Structure & Competitive Dynamics

The Military Radio System Industry exhibits a moderately concentrated market structure, driven by a handful of large, established defense contractors and a growing number of specialized technology providers. Innovation ecosystems are rapidly developing, fueled by advancements in software-defined radio (SDR), artificial intelligence (AI) for signal processing, and enhanced cybersecurity protocols. Regulatory frameworks, primarily dictated by national defense procurement policies and international arms control agreements, significantly influence market entry and product development. Product substitutes, such as commercial off-the-shelf (COTS) communication solutions adapted for military use, present a competitive challenge, though specialized military-grade systems offer superior resilience, security, and interoperability. End-user trends are increasingly focused on network-centric warfare, secure voice and data transmission, and seamless integration across diverse platforms. Mergers and acquisitions (M&A) activity remains a strategic lever for market expansion and technological integration. For instance, significant M&A deals, potentially in the hundreds of millions, are reshaping competitive landscapes, with prominent players acquiring niche capabilities. Market share within the top five companies is estimated to be over 60% of the global market value.

Military Radio System Industry Industry Trends & Insights

The Military Radio System Industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period. This expansion is propelled by escalating geopolitical tensions and a growing emphasis on enhancing battlefield communication capabilities. Technological disruptions are at the forefront, with the widespread adoption of Software-Defined Radios (SDR) revolutionizing flexibility and adaptability. AI and machine learning are being integrated to improve signal processing, interference mitigation, and threat detection, leading to more intelligent and autonomous communication systems. The push towards network-centric operations and the need for enhanced situational awareness are driving demand for interoperable and secure communication solutions. End-user preferences are shifting towards compact, lightweight, and power-efficient radio systems that can operate in contested electromagnetic environments. The increasing reliance on satellite communications for beyond-line-of-sight (BLOS) connectivity, particularly for naval and airborne platforms, is a significant market penetrator, with estimated market penetration exceeding 70% in advanced military forces. Furthermore, the demand for resilient communication networks that can withstand cyberattacks and electronic warfare is creating a strong market for advanced encryption and jamming-resistant technologies. The ongoing modernization of military forces worldwide, coupled with the development of new defense platforms, necessitates continuous upgrades and replacements of existing radio systems, further fueling market demand. The report anticipates significant investments in research and development aimed at achieving cognitive radio capabilities and ensuring robust communication links in highly complex operational scenarios.

Dominant Markets & Segments in Military Radio System Industry

The North American region, particularly the United States, consistently emerges as the dominant market within the Military Radio System Industry, accounting for an estimated 35% of the global market value. This dominance is attributed to substantial defense spending, a strong focus on technological innovation, and the active engagement of its armed forces in diverse global operations.

Communication Type:

- Ground-based communication represents the largest segment, driven by the widespread use of tactical radio systems for infantry, armored vehicles, and command posts. Key drivers include the need for robust battlefield communications and the ongoing modernization of land forces.

- Airborne communication is a rapidly growing segment, fueled by the increasing integration of advanced communication suites in fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs).

- Shipborne communication holds significant market share due to the critical need for secure and reliable communication for naval fleets operating in vast maritime environments.

Component:

- Military Satcom Systems are experiencing exponential growth due to their critical role in enabling Beyond Line-of-Sight (BLOS) communication, supporting global deployments, and facilitating data-intensive operations.

- Military Radio Systems remain the foundational component, with continuous demand for advanced tactical, strategic, and manpack radios.

Application:

- Command and Control (C2) applications dominate the market, as secure and reliable communication is paramount for effective military decision-making and operational coordination.

- Situational Awareness is a rapidly expanding application area, with advancements in sensor integration and data fusion requiring robust communication channels to disseminate real-time information to all battlefield echelons.

The dominance of these segments is underpinned by factors such as government procurement policies prioritizing advanced communication technologies, infrastructure development for secure networks, and the strategic imperative to maintain communication superiority in any operational theater. The Asia-Pacific region is witnessing significant growth due to rising defense expenditures by emerging economies and the increasing adoption of advanced military technologies.

Military Radio System Industry Product Innovations

Product innovations in the Military Radio System Industry are primarily focused on enhancing interoperability, security, and resilience. The integration of Software-Defined Radio (SDR) architectures allows for greater flexibility in waveform development and adaptability to evolving communication standards. Advancements in AI and machine learning are enabling intelligent signal processing for interference avoidance and enhanced threat detection. Furthermore, miniaturization and power efficiency are key trends, leading to the development of lighter, more portable manpack and wearable radio systems. Competitive advantages are being gained through superior cybersecurity features, enhanced Electronic Counter-Countermeasures (ECCM) capabilities, and seamless integration with existing battlefield management systems.

Report Segmentation & Scope

This report meticulously segments the Military Radio System Industry across several key dimensions. The Communication Type segmentation includes Shipborne, Ground-based, Underwater, Air-Ground, and Airborne Communication. The Component segmentation covers Military Satcom Systems, Military Radio Systems, and Military Security Systems. The Application segmentation includes Command and Control, Routine Operations, Situational Awareness, and Other Applications. For each segment, the report provides detailed market size projections, growth rates, and competitive landscape analysis, offering a granular view of market dynamics. For example, the Military Satcom Systems segment is projected to witness a CAGR of over 7% in the forecast period, driven by the increasing demand for global connectivity.

Key Drivers of Military Radio System Industry Growth

The growth of the Military Radio System Industry is primarily driven by escalating geopolitical tensions and the modernization of defense forces worldwide. Increased government spending on defense, particularly in emerging economies, directly translates into higher demand for advanced communication systems. Technological advancements, such as the rapid evolution of Software-Defined Radios (SDR) and the integration of AI, are creating new opportunities for enhanced battlefield communication. Furthermore, the growing threat of cyber warfare and electronic jamming necessitates the development of more resilient and secure radio systems, driving innovation and market expansion.

Challenges in the Military Radio System Industry Sector

Despite robust growth, the Military Radio System Industry faces several challenges. Stringent regulatory compliance and lengthy procurement cycles can impede market entry and slow down the adoption of new technologies. Supply chain disruptions, particularly for specialized electronic components, can impact production timelines and costs. High research and development costs associated with cutting-edge technologies and the need for extensive testing and certification create significant financial barriers. Furthermore, interoperability challenges between legacy systems and next-generation communication platforms require substantial investment and strategic planning.

Leading Players in the Military Radio System Industry Market

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Inmarsat Global Limited

- IAI

- RTX Corporation

- ASELSAN A S

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

Key Developments in Military Radio System Industry Sector

- 2023/10: Introduction of next-generation secure tactical radio systems with enhanced AI capabilities for improved signal processing and threat detection.

- 2023/08: Major defense contractor announces significant investment in developing advanced satellite communication solutions for naval applications.

- 2023/05: Government procurement agency awards substantial contract for the upgrade of airborne communication systems across its fighter jet fleet.

- 2022/12: Launch of a new line of manpack radios featuring advanced encryption and extended battery life for extended field operations.

- 2022/09: Acquisition of a specialized cybersecurity firm by a leading defense technology company to bolster its military communication security offerings.

Strategic Military Radio System Industry Market Outlook

The strategic outlook for the Military Radio System Industry is highly positive, fueled by the persistent need for secure, resilient, and interoperable communication in an increasingly complex global security environment. Future growth will be accelerated by the continued integration of AI and machine learning for cognitive radio capabilities, enabling adaptive and autonomous communication. The expansion of satellite communication networks and the development of resilient terrestrial alternatives will be crucial for global connectivity. Strategic opportunities lie in addressing the growing demand for joint all-domain command and control (JADC2) architectures, requiring seamless communication across all military branches and domains. Investments in cybersecurity and electronic warfare resilience will remain paramount, driving innovation and market value.

Military Radio System Industry Segmentation

-

1. Communication Type

- 1.1. Shipborne

- 1.2. Ground-based

- 1.3. Underwater

- 1.4. Air-Ground

- 1.5. Airborne Communication

-

2. Component

- 2.1. Military Satcom Systems

- 2.2. Military Radio Systems

- 2.3. Military Security Systems

-

3. Application

- 3.1. Command and Control

- 3.2. Routine Operations

- 3.3. Situational Awareness

- 3.4. Other Applications

Military Radio System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Military Radio System Industry Regional Market Share

Geographic Coverage of Military Radio System Industry

Military Radio System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ground-based systems Segment is Projected to Showcase the Fastest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Communication Type

- 5.1.1. Shipborne

- 5.1.2. Ground-based

- 5.1.3. Underwater

- 5.1.4. Air-Ground

- 5.1.5. Airborne Communication

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Military Satcom Systems

- 5.2.2. Military Radio Systems

- 5.2.3. Military Security Systems

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Command and Control

- 5.3.2. Routine Operations

- 5.3.3. Situational Awareness

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Communication Type

- 6. North America Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Communication Type

- 6.1.1. Shipborne

- 6.1.2. Ground-based

- 6.1.3. Underwater

- 6.1.4. Air-Ground

- 6.1.5. Airborne Communication

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Military Satcom Systems

- 6.2.2. Military Radio Systems

- 6.2.3. Military Security Systems

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Command and Control

- 6.3.2. Routine Operations

- 6.3.3. Situational Awareness

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Communication Type

- 7. Europe Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Communication Type

- 7.1.1. Shipborne

- 7.1.2. Ground-based

- 7.1.3. Underwater

- 7.1.4. Air-Ground

- 7.1.5. Airborne Communication

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Military Satcom Systems

- 7.2.2. Military Radio Systems

- 7.2.3. Military Security Systems

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Command and Control

- 7.3.2. Routine Operations

- 7.3.3. Situational Awareness

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Communication Type

- 8. Asia Pacific Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Communication Type

- 8.1.1. Shipborne

- 8.1.2. Ground-based

- 8.1.3. Underwater

- 8.1.4. Air-Ground

- 8.1.5. Airborne Communication

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Military Satcom Systems

- 8.2.2. Military Radio Systems

- 8.2.3. Military Security Systems

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Command and Control

- 8.3.2. Routine Operations

- 8.3.3. Situational Awareness

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Communication Type

- 9. Latin America Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Communication Type

- 9.1.1. Shipborne

- 9.1.2. Ground-based

- 9.1.3. Underwater

- 9.1.4. Air-Ground

- 9.1.5. Airborne Communication

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Military Satcom Systems

- 9.2.2. Military Radio Systems

- 9.2.3. Military Security Systems

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Command and Control

- 9.3.2. Routine Operations

- 9.3.3. Situational Awareness

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Communication Type

- 10. Middle East and Africa Military Radio System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Communication Type

- 10.1.1. Shipborne

- 10.1.2. Ground-based

- 10.1.3. Underwater

- 10.1.4. Air-Ground

- 10.1.5. Airborne Communication

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Military Satcom Systems

- 10.2.2. Military Radio Systems

- 10.2.3. Military Security Systems

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Command and Control

- 10.3.2. Routine Operations

- 10.3.3. Situational Awareness

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Communication Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 THALES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Elbit Systems Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inmarsat Global Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IAI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RTX Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ASELSAN A S

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Leonardo S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BAE Systems plc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Northrop Grumman Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Military Radio System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Military Radio System Industry Revenue (Million), by Communication Type 2025 & 2033

- Figure 3: North America Military Radio System Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 4: North America Military Radio System Industry Revenue (Million), by Component 2025 & 2033

- Figure 5: North America Military Radio System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Military Radio System Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Military Radio System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Military Radio System Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Military Radio System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Military Radio System Industry Revenue (Million), by Communication Type 2025 & 2033

- Figure 11: Europe Military Radio System Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 12: Europe Military Radio System Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Military Radio System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Military Radio System Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Military Radio System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Military Radio System Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Military Radio System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Military Radio System Industry Revenue (Million), by Communication Type 2025 & 2033

- Figure 19: Asia Pacific Military Radio System Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 20: Asia Pacific Military Radio System Industry Revenue (Million), by Component 2025 & 2033

- Figure 21: Asia Pacific Military Radio System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Asia Pacific Military Radio System Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Military Radio System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Military Radio System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Military Radio System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Military Radio System Industry Revenue (Million), by Communication Type 2025 & 2033

- Figure 27: Latin America Military Radio System Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 28: Latin America Military Radio System Industry Revenue (Million), by Component 2025 & 2033

- Figure 29: Latin America Military Radio System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 30: Latin America Military Radio System Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Military Radio System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Military Radio System Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Military Radio System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Military Radio System Industry Revenue (Million), by Communication Type 2025 & 2033

- Figure 35: Middle East and Africa Military Radio System Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 36: Middle East and Africa Military Radio System Industry Revenue (Million), by Component 2025 & 2033

- Figure 37: Middle East and Africa Military Radio System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 38: Middle East and Africa Military Radio System Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Military Radio System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Military Radio System Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Military Radio System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 2: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Military Radio System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 6: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Military Radio System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 12: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 13: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Military Radio System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 21: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Military Radio System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 31: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 32: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Military Radio System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Mexico Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Latin America Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 38: Global Military Radio System Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 39: Global Military Radio System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Military Radio System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Egypt Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Israel Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Military Radio System Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Radio System Industry?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Military Radio System Industry?

Key companies in the market include L3Harris Technologies Inc *List Not Exhaustive, THALES, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Inmarsat Global Limited, IAI, RTX Corporation, ASELSAN A S, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation.

3. What are the main segments of the Military Radio System Industry?

The market segments include Communication Type, Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.79 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ground-based systems Segment is Projected to Showcase the Fastest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Radio System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Radio System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Radio System Industry?

To stay informed about further developments, trends, and reports in the Military Radio System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence