Key Insights

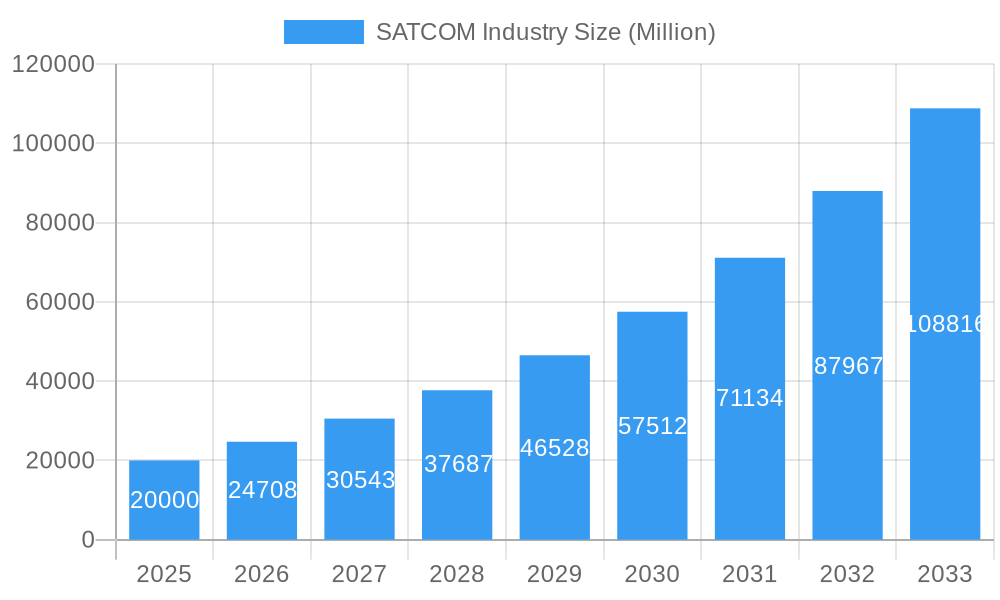

The global Satellite Communication (SATCOM) market is poised for substantial expansion, driven by escalating demand for high-bandwidth connectivity across diverse sectors. Projected to reach $98.28 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 11% from a base year of 2025, this growth is underpinned by key trends. These include the expanding Internet of Things (IoT) ecosystem necessitating robust communication, the increasing adoption of satellite broadband in remote areas, and the growing utility of satellite data and imagery for defense, environmental, and commercial applications. Market segmentation by satellite mass, orbit, communication type, and end-user reveals varied growth dynamics. Geostationary Earth Orbit (GEO) satellites, particularly larger models (500-1000kg and above 1000kg), are expected to retain considerable market share due to established infrastructure for broadcasting and mobile services. Conversely, Low Earth Orbit (LEO) constellations are experiencing rapid ascent, promising lower latency and broader coverage for mobile communication and IoT. Government and military investments in secure, high-bandwidth SATCOM solutions remain a critical growth driver.

SATCOM Industry Market Size (In Billion)

Despite its promising trajectory, the SATCOM industry confronts challenges. High upfront capital investment for satellite deployment and operation, competition from terrestrial networks like fiber optics, and intricate international regulatory frameworks pose significant hurdles. Sustained growth hinges on continuous technological innovation, including advancements in satellite efficiency and cost reduction. Pioneering companies such as SpaceX, with their Starlink initiative, are reshaping the market by lowering costs and enhancing accessibility. Incumbent leaders like Intelsat and SES are responding with strategic investments in new technologies and service portfolio expansion. These ongoing advancements and rising demand will continue to shape the SATCOM industry, presenting both opportunities and competitive pressures for established and emerging players.

SATCOM Industry Company Market Share

SATCOM Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Satellite Communication (SATCOM) industry, encompassing market size, segmentation, competitive landscape, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for businesses, investors, and stakeholders seeking to understand and navigate this dynamic market. The total market value is predicted to reach xx Million by 2033.

SATCOM Industry Market Structure & Competitive Dynamics

The SATCOM industry is characterized by a dynamic and evolving market structure. While a few major players continue to hold significant market share, the landscape is increasingly being shaped by innovative newcomers and technological advancements. Key industry leaders include **Space Exploration Technologies Corp (SpaceX)**, **L3Harris Technologies Inc**, **Intelsat**, **Airbus SE**, and **Viasat Inc**, who collectively accounted for a substantial portion of the global market in 2025. However, the emergence of agile and forward-thinking companies such as **Swarm Technologies Inc** is injecting a competitive edge and driving new opportunities.

The industry's innovation engine is fueled by rapid progress in satellite technology, including the miniaturization of components, the development of more powerful payloads, and the increasing demand for seamless, high-bandwidth connectivity. Navigating diverse and evolving regulatory frameworks across different regions presents both challenges and opportunities for market access and operational efficiency. Despite robust competition from terrestrial communication technologies like 5G, the SATCOM industry's inherent strengths in providing ubiquitous coverage for remote areas and enabling high-throughput applications ensure sustained and growing demand.

Mergers and acquisitions (M&A) remain a significant strategic tool within the SATCOM sector, with substantial investment flowing into consolidating capabilities and expanding market reach. In 2024, M&A activity reached an estimated [Insert Updated Figure] Million. These strategic moves reflect companies' ambitions to broaden their geographical presence, bolster their technological portfolios, and solidify their market positions. Recent trends also highlight a surge in strategic partnerships, aimed at leveraging complementary expertise and technologies to accelerate innovation and market penetration. Notable recent M&A and partnership activities include: Intelsat's strategic acquisition of [Acquired Company Name], valued at [Acquisition Value] Million. Furthermore, Airbus SE has entered into a significant collaboration with [Partner Company Name] to [Briefly describe the collaboration's objective].

SATCOM Industry Industry Trends & Insights

The SATCOM industry is experiencing robust growth, driven by factors such as the increasing demand for broadband internet access in remote areas, the proliferation of IoT devices, and the expanding use of satellite technology in various sectors, including defense, telecommunications, and broadcasting. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is being fueled by several key trends:

- Technological Disruptions: Miniaturization of satellites, advancements in high-throughput satellite (HTS) technology, and the deployment of mega-constellations are transforming the industry.

- Government Initiatives: Increased government investment in space exploration and satellite communication infrastructure contributes to market expansion.

- Market Penetration: The penetration of satellite broadband services is expected to increase significantly, particularly in underserved regions. Market penetration of x is projected to increase from xx% in 2025 to xx% by 2033.

- Competitive Dynamics: Competition is intensifying with both established players and new entrants constantly vying for market share.

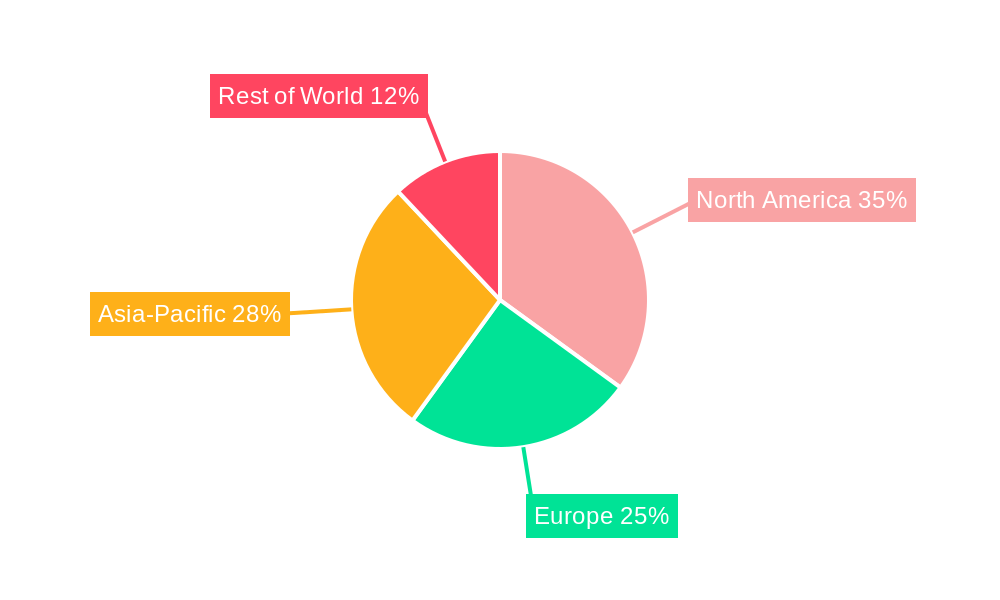

Dominant Markets & Segments in SATCOM Industry

Currently, the North American region stands as the leading market for SATCOM solutions, largely propelled by substantial government investments in defense and critical communication infrastructure, alongside the strong presence of established industry giants. Looking ahead, the Asia-Pacific region is poised for remarkable growth, fueled by its burgeoning economies, extensive infrastructure development initiatives, and an escalating need for advanced connectivity.

Leading Segments in Focus:

- Satellite Mass: The 100-500kg segment is projected to maintain its dominance, offering an optimal balance of cost-effectiveness and operational versatility for a wide array of applications.

- Orbit Class: While Geostationary Orbit (GEO) continues to be a cornerstone of the industry, Low Earth Orbit (LEO) is experiencing rapid expansion, driven by its inherent advantages in reduced latency and enhanced capacity, catering to new-generation connectivity needs.

- Communication Type: Broadcasting and Mobile Communication represent the most significant segments. Mobile communication, in particular, is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) as demand for connected devices and services intensifies.

- End User: Commercial applications currently command the largest market share, closely followed by the Military & Government sectors, which continue to be key drivers of demand for robust and secure communication solutions.

Key Drivers Powering Market Dominance:

- North America: Characterized by robust government expenditure, a high degree of technological sophistication, and the concentration of leading industry players.

- Asia-Pacific: Driven by rapid economic expansion, significant investments in telecommunications and digital infrastructure, and a growing imperative to bridge the digital divide with widespread broadband access.

SATCOM Industry Product Innovations

Recent advancements in the SATCOM industry are primarily focused on elevating bandwidth capabilities, minimizing signal latency, and maximizing operational efficiency. The maturation of High Throughput Satellite (HTS) technology, incorporating sophisticated phased-array antennas and cutting-edge modulation techniques, is revolutionizing data transmission speeds. The integration of software-defined radios and the adoption of open-architecture platforms are further enhancing the flexibility and adaptability of satellite communication systems, paving the way for new and expanded applications. These innovations are instrumental in enabling the proliferation of the Internet of Things (IoT), delivering high-definition video broadcasting with unparalleled quality, and bolstering critical government and military communication networks.

Report Segmentation & Scope

This report segments the SATCOM market based on satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg), orbit class (GEO, LEO, MEO), communication type (Broadcasting, Mobile Communication, Satellite Phone, Others), and end-user (Commercial, Military & Government, Other). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For instance, the LEO segment is predicted to experience significant growth due to the deployment of large-scale constellations. The Commercial segment will continue to dominate, although the Military & Government segment is expected to see healthy growth driven by increased defense spending.

Key Drivers of SATCOM Industry Growth

The sustained expansion of the SATCOM industry is propelled by a confluence of critical factors. Foremost among these is the escalating global demand for high-speed internet access, particularly in regions that have historically been underserved by terrestrial networks. Concurrent technological advancements in satellite design and deployment are yielding systems with significantly higher capacities and reduced latency, making satellite communication a more compelling option. Increased investment by governments in space-based infrastructure for national security, communication, and scientific research also plays a crucial role. The burgeoning adoption of IoT devices across various sectors, coupled with the persistent need for dependable communication solutions in critical industries such as defense, maritime, and aviation, further fuels this growth trajectory. While the expansion of 5G networks is a significant terrestrial development, it indirectly complements SATCOM by enabling extended coverage and hybrid connectivity solutions, thereby fostering an environment of symbiotic growth.

Challenges in the SATCOM Industry Sector

The SATCOM industry faces several challenges, including high capital expenditure requirements for satellite development and launch; the increasing competition from terrestrial communication technologies, such as fiber optics and 5G; regulatory hurdles related to spectrum allocation and licensing; and the potential for disruptions due to space debris and cybersecurity threats. These challenges could impact the industry's growth trajectory, but technological innovations and strategic partnerships are mitigating these risks. The xx Million spent on overcoming regulatory hurdles in 2024 demonstrates the magnitude of this challenge.

Leading Players in the SATCOM Industry Market

- Space Exploration Technologies Corp

- L3Harris Technologies Inc

- Swarm Technologies Inc

- Intelsat

- Airbus SE

- Viasat Inc

- Cobham Limited

- China Aerospace Science and Technology Corporation (CASC)

- Thales

- SKY Perfect JSAT Corporation

- SES S A

- Maxar Technologies Inc

- Thuraya Telecommunications Company

- EchoStar Corporation

Key Developments in SATCOM Industry Sector

- January 2023: Viasat secured a contract with the U.S. Marine Corps for end-to-end satellite communications support, showcasing the enduring demand for military SATCOM solutions.

- February 2023: Anuvu partnered with Telesat to enhance its high-speed connectivity solutions, signifying a collaborative approach to expanding global reach and network capacity.

- February 2023: SES, in collaboration with ThinKom and Hughes, launched a high-performance multi-orbit service for government aerial missions, highlighting advancements in interoperability and flexibility within satellite communication networks.

Strategic SATCOM Industry Market Outlook

The SATCOM industry is poised for continued growth, driven by technological advancements and increased demand for reliable, high-bandwidth communication solutions. The emergence of mega-constellations and the integration of AI and machine learning will further enhance the capabilities and efficiency of satellite systems. Strategic partnerships, focused on combining technological expertise and expanding market reach, will play a crucial role in shaping the future of the SATCOM landscape. The focus will shift towards offering tailored solutions for specific market segments, further driving specialization and innovation within the industry.

SATCOM Industry Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Communication Type

- 3.1. Broadcasting

- 3.2. Mobile Communication

- 3.3. Satellite Phone

- 3.4. Others

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

SATCOM Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

SATCOM Industry Regional Market Share

Geographic Coverage of SATCOM Industry

SATCOM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Communication Type

- 5.3.1. Broadcasting

- 5.3.2. Mobile Communication

- 5.3.3. Satellite Phone

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. North America SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.1.1. 10-100kg

- 6.1.2. 100-500kg

- 6.1.3. 500-1000kg

- 6.1.4. Below 10 Kg

- 6.1.5. above 1000kg

- 6.2. Market Analysis, Insights and Forecast - by Orbit Class

- 6.2.1. GEO

- 6.2.2. LEO

- 6.2.3. MEO

- 6.3. Market Analysis, Insights and Forecast - by Communication Type

- 6.3.1. Broadcasting

- 6.3.2. Mobile Communication

- 6.3.3. Satellite Phone

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Commercial

- 6.4.2. Military & Government

- 6.4.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7. South America SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.1.1. 10-100kg

- 7.1.2. 100-500kg

- 7.1.3. 500-1000kg

- 7.1.4. Below 10 Kg

- 7.1.5. above 1000kg

- 7.2. Market Analysis, Insights and Forecast - by Orbit Class

- 7.2.1. GEO

- 7.2.2. LEO

- 7.2.3. MEO

- 7.3. Market Analysis, Insights and Forecast - by Communication Type

- 7.3.1. Broadcasting

- 7.3.2. Mobile Communication

- 7.3.3. Satellite Phone

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Commercial

- 7.4.2. Military & Government

- 7.4.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8. Europe SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.1.1. 10-100kg

- 8.1.2. 100-500kg

- 8.1.3. 500-1000kg

- 8.1.4. Below 10 Kg

- 8.1.5. above 1000kg

- 8.2. Market Analysis, Insights and Forecast - by Orbit Class

- 8.2.1. GEO

- 8.2.2. LEO

- 8.2.3. MEO

- 8.3. Market Analysis, Insights and Forecast - by Communication Type

- 8.3.1. Broadcasting

- 8.3.2. Mobile Communication

- 8.3.3. Satellite Phone

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Commercial

- 8.4.2. Military & Government

- 8.4.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9. Middle East & Africa SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.1.1. 10-100kg

- 9.1.2. 100-500kg

- 9.1.3. 500-1000kg

- 9.1.4. Below 10 Kg

- 9.1.5. above 1000kg

- 9.2. Market Analysis, Insights and Forecast - by Orbit Class

- 9.2.1. GEO

- 9.2.2. LEO

- 9.2.3. MEO

- 9.3. Market Analysis, Insights and Forecast - by Communication Type

- 9.3.1. Broadcasting

- 9.3.2. Mobile Communication

- 9.3.3. Satellite Phone

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Commercial

- 9.4.2. Military & Government

- 9.4.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10. Asia Pacific SATCOM Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.1.1. 10-100kg

- 10.1.2. 100-500kg

- 10.1.3. 500-1000kg

- 10.1.4. Below 10 Kg

- 10.1.5. above 1000kg

- 10.2. Market Analysis, Insights and Forecast - by Orbit Class

- 10.2.1. GEO

- 10.2.2. LEO

- 10.2.3. MEO

- 10.3. Market Analysis, Insights and Forecast - by Communication Type

- 10.3.1. Broadcasting

- 10.3.2. Mobile Communication

- 10.3.3. Satellite Phone

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Commercial

- 10.4.2. Military & Government

- 10.4.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Exploration Technologies Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Swarm Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intelsat

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Viasat Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cobham Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Aerospace Science and Technology Corporation (CASC)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thales

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SKY Perfect JSAT Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SES S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Maxar Technologies Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thuraya Telecommunications Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 EchoStar Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global SATCOM Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America SATCOM Industry Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 3: North America SATCOM Industry Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 4: North America SATCOM Industry Revenue (billion), by Orbit Class 2025 & 2033

- Figure 5: North America SATCOM Industry Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 6: North America SATCOM Industry Revenue (billion), by Communication Type 2025 & 2033

- Figure 7: North America SATCOM Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 8: North America SATCOM Industry Revenue (billion), by End User 2025 & 2033

- Figure 9: North America SATCOM Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America SATCOM Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America SATCOM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America SATCOM Industry Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 13: South America SATCOM Industry Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 14: South America SATCOM Industry Revenue (billion), by Orbit Class 2025 & 2033

- Figure 15: South America SATCOM Industry Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: South America SATCOM Industry Revenue (billion), by Communication Type 2025 & 2033

- Figure 17: South America SATCOM Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 18: South America SATCOM Industry Revenue (billion), by End User 2025 & 2033

- Figure 19: South America SATCOM Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America SATCOM Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: South America SATCOM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe SATCOM Industry Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 23: Europe SATCOM Industry Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 24: Europe SATCOM Industry Revenue (billion), by Orbit Class 2025 & 2033

- Figure 25: Europe SATCOM Industry Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 26: Europe SATCOM Industry Revenue (billion), by Communication Type 2025 & 2033

- Figure 27: Europe SATCOM Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 28: Europe SATCOM Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: Europe SATCOM Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe SATCOM Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe SATCOM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa SATCOM Industry Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 33: Middle East & Africa SATCOM Industry Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 34: Middle East & Africa SATCOM Industry Revenue (billion), by Orbit Class 2025 & 2033

- Figure 35: Middle East & Africa SATCOM Industry Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 36: Middle East & Africa SATCOM Industry Revenue (billion), by Communication Type 2025 & 2033

- Figure 37: Middle East & Africa SATCOM Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 38: Middle East & Africa SATCOM Industry Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East & Africa SATCOM Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa SATCOM Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa SATCOM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific SATCOM Industry Revenue (billion), by Satellite Mass 2025 & 2033

- Figure 43: Asia Pacific SATCOM Industry Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 44: Asia Pacific SATCOM Industry Revenue (billion), by Orbit Class 2025 & 2033

- Figure 45: Asia Pacific SATCOM Industry Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 46: Asia Pacific SATCOM Industry Revenue (billion), by Communication Type 2025 & 2033

- Figure 47: Asia Pacific SATCOM Industry Revenue Share (%), by Communication Type 2025 & 2033

- Figure 48: Asia Pacific SATCOM Industry Revenue (billion), by End User 2025 & 2033

- Figure 49: Asia Pacific SATCOM Industry Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific SATCOM Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific SATCOM Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 2: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 4: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Global SATCOM Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 7: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 9: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global SATCOM Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 15: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 16: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 17: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global SATCOM Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 23: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 24: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 25: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global SATCOM Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 37: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 38: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 39: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global SATCOM Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global SATCOM Industry Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 48: Global SATCOM Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 49: Global SATCOM Industry Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 50: Global SATCOM Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 51: Global SATCOM Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific SATCOM Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the SATCOM Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the SATCOM Industry?

Key companies in the market include Space Exploration Technologies Corp, L3Harris Technologies Inc, Swarm Technologies Inc, Intelsat, Airbus SE, Viasat Inc, Cobham Limited, China Aerospace Science and Technology Corporation (CASC), Thales, SKY Perfect JSAT Corporation, SES S A, Maxar Technologies Inc, Thuraya Telecommunications Company, EchoStar Corporation.

3. What are the main segments of the SATCOM Industry?

The market segments include Satellite Mass, Orbit Class, Communication Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.28 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Anuvu, a provider of high-speed connectivity solutions has signed an agreement with Telesat for new antennas and ground-station infrastructure to support the development of the Anuvu Constellation.February 2023: SES, in partnership with ThinKom and Hughes, has introduced a revolutionary high-performance multi-orbit service capable of supporting multiple solutions for government aerial missions. Open Architecture ThinKom ThinAir Ka2517 aerial satcom terminal has been successfully demonstrated on SES's Medium Earth Orbit (MEO) and Geostationary (GEO) satellite networksJanuary 2023: Satellite communications provider Viasat has been awarded a contract by the United States Marine Corps to provide end-to-end satellite communications support, extending the agreement under which it provides satellite communications solutions under managed services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "SATCOM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the SATCOM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the SATCOM Industry?

To stay informed about further developments, trends, and reports in the SATCOM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence