Key Insights

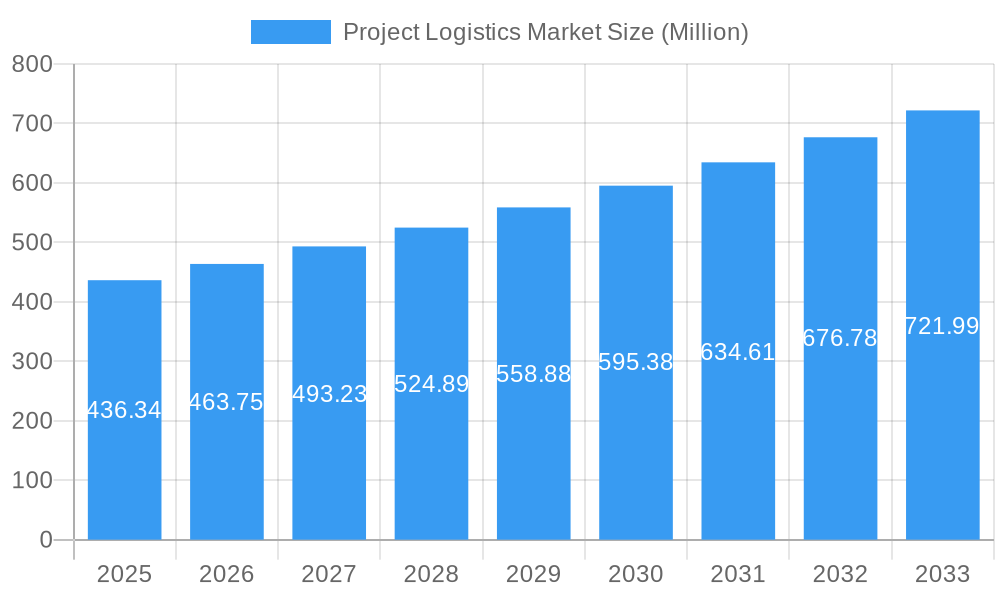

The global project logistics market, valued at $436.34 million in 2025, is projected to experience robust growth, driven by increasing global infrastructure development, particularly in emerging economies. The market's Compound Annual Growth Rate (CAGR) of 5.95% from 2019 to 2024 suggests a consistently expanding demand for specialized services in transporting and managing oversized and complex cargo for projects across diverse sectors. Key drivers include the rising need for efficient and reliable logistics solutions within the oil and gas, mining, energy, construction, and manufacturing industries. Growth is further fueled by advancements in technology, including digitalization and automation, which enhance supply chain visibility, tracking, and overall efficiency. However, geopolitical uncertainties, fluctuating fuel prices, and potential disruptions to global supply chains represent key restraints that could impact market expansion. The market is segmented by service type (transportation, forwarding, inventory management, warehousing, and other value-added services) and end-user industries. The Asia-Pacific region is expected to witness significant growth due to substantial infrastructure projects and industrialization. Competition is fierce, with both large multinational players (like DB Schenker, Kuehne + Nagel, and DHL) and regional specialists vying for market share. The increasing emphasis on sustainability and environmentally friendly logistics practices will further shape market dynamics in the coming years.

Project Logistics Market Market Size (In Million)

The forecast period (2025-2033) anticipates sustained growth, primarily due to the ongoing expansion of global trade and investment in large-scale infrastructure developments. The continued rise of emerging economies and their growing demand for complex project logistics services will be a significant catalyst for market expansion. The market will likely witness further consolidation among industry players, with larger firms acquiring smaller companies to enhance their service portfolio and geographical reach. Furthermore, innovative solutions that leverage technologies like blockchain and artificial intelligence (AI) are expected to improve the overall efficiency and transparency of project logistics operations. This will lead to enhanced cost optimization and better risk management for stakeholders across the supply chain. The development and implementation of stricter safety regulations and environmental standards will also shape the competitive landscape, incentivizing companies to adopt greener and safer practices.

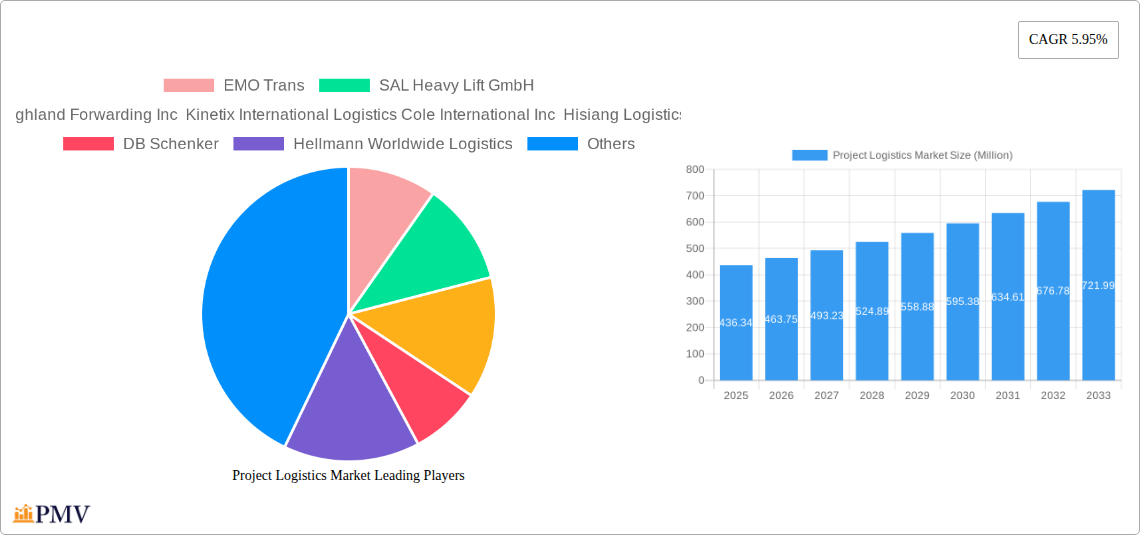

Project Logistics Market Company Market Share

Project Logistics Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Project Logistics Market, offering invaluable insights for businesses and investors seeking to understand and navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers a detailed examination of market structure, trends, key players, and future outlook. The market size is predicted to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Project Logistics Market Market Structure & Competitive Dynamics

The Project Logistics Market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a significant number of smaller, specialized companies also contribute to the overall market activity. The market is characterized by intense competition, driven by factors such as pricing strategies, service differentiation, and geographical reach. Innovation plays a crucial role, with companies continuously investing in advanced technologies and logistics solutions to gain a competitive edge. The regulatory landscape varies across regions, influencing operational costs and compliance requirements. Product substitution is limited due to the specialized nature of project logistics; however, companies are constantly striving to optimize their services to meet the evolving needs of their clients. End-user trends indicate a growing demand for integrated, end-to-end solutions. Mergers and acquisitions (M&A) activity has been significant in recent years, with deals primarily focused on expanding geographical reach, enhancing service portfolios, and strengthening technological capabilities. While precise M&A deal values are not publicly available for all transactions, estimates suggest a total value of approximately xx Million in deals concluded during the historical period (2019-2024). Market share data is difficult to obtain precisely for all players but key players hold substantial portions, with the top 5 estimated to control approximately xx% of the market share.

- Market Concentration: Moderately concentrated, with a mix of large and small players.

- Innovation Ecosystems: Active, with ongoing investments in technology and service optimization.

- Regulatory Frameworks: Varying across regions, impacting operational costs and compliance.

- Product Substitutes: Limited, due to the specialized nature of project cargo handling.

- End-User Trends: Increasing demand for integrated and optimized logistics solutions.

- M&A Activity: Significant, driven by expansion and technological enhancement strategies.

Project Logistics Market Industry Trends & Insights

The Project Logistics Market is experiencing robust growth, fueled by several key factors. The global infrastructure development boom, particularly in emerging economies, is a major driver, demanding efficient and specialized logistics solutions for large-scale projects. The increasing complexity of global supply chains further necessitates the expertise offered by project logistics providers. Technological advancements, such as improved tracking systems, data analytics, and automation, are streamlining operations and enhancing efficiency. These improvements have resulted in reduced transit times and enhanced transparency, leading to increased client satisfaction and repeat business. Changing consumer preferences are also impacting the sector, with a growing emphasis on sustainability and environmentally friendly practices. This has pushed project logistics providers to adopt greener technologies and transportation methods. The competitive landscape remains fiercely competitive, with companies continually striving to offer superior services, competitive pricing, and innovative solutions to maintain market share. The market is expected to maintain a robust growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), driven by continued investment in infrastructure projects, technological advancements, and evolving client demands. Market penetration rates vary widely by region, with mature markets demonstrating higher penetration than emerging economies, driven by factors such as infrastructure maturity and economic growth.

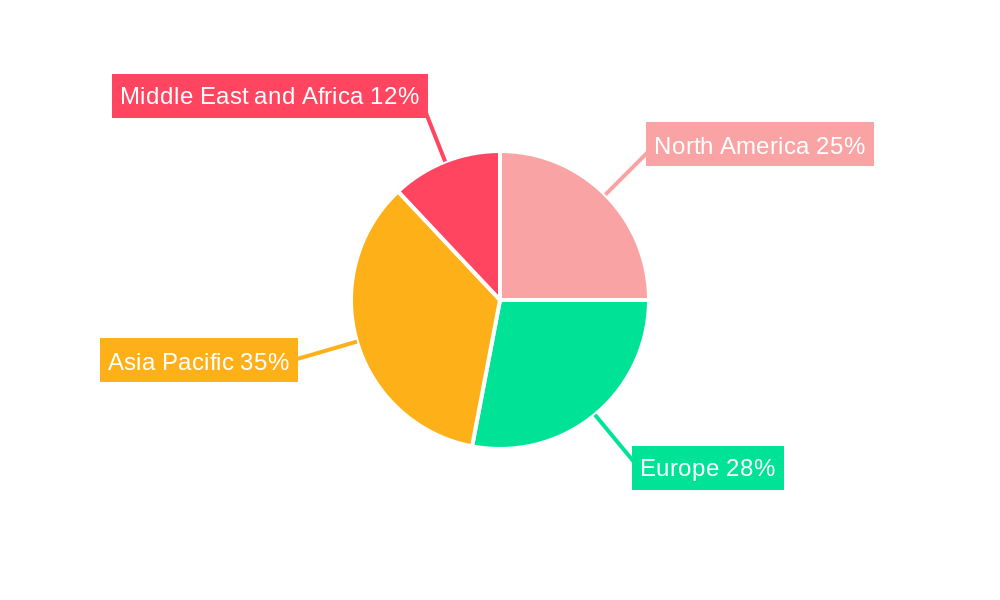

Dominant Markets & Segments in Project Logistics Market

The Project Logistics Market displays regional variations in dominance, with a considerable amount of activity in regions with significant infrastructure development. Specific country-level data is not available for all regions, but leading regions include those with significant energy projects, large-scale infrastructure development, or substantial manufacturing activities. Within segments, Transportation services hold the largest share due to the fundamental nature of moving project cargo. The Oil and Gas, Mining, and Quarrying sector is the largest end-user, driven by the substantial logistical needs of projects in these industries.

- Leading Regions: (Data unavailable, predictions needed for specific regions)

- Leading Country: (Data unavailable, predictions needed for specific countries)

- Leading Service Segment: Transportation

- Leading End-User Segment: Oil and Gas, Mining, and Quarrying

Key Drivers for Dominant Segments:

- Oil & Gas, Mining, & Quarrying: Large-scale projects, remote locations, specialized equipment transportation needs.

- Transportation Services: Fundamental to project logistics; increasing demand for specialized transport modes.

- Energy and Power: Growth in renewable energy projects drives demand for logistics support.

Project Logistics Market Product Innovations

Recent product innovations in the project logistics market focus on technological enhancements to improve efficiency, tracking, and safety. This includes the adoption of advanced digital platforms for real-time tracking, predictive analytics for optimizing routes and minimizing delays, and the implementation of blockchain technology to enhance transparency and security throughout the supply chain. These improvements have resulted in reduced operational costs and enhanced customer satisfaction. Companies are further developing specialized equipment and solutions, tailored to the unique requirements of different project types, improving the safety and efficiency of handling oversized and heavy cargo.

Report Segmentation & Scope

This report segments the Project Logistics Market based on Service (Transportation, Forwarding, Inventory Management and Warehousing, Other Value-added Services) and End-User (Oil and Gas, Mining, and Quarrying, Energy and Power, Construction, Manufacturing, Other End Users). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. Growth projections for each segment vary, depending on the underlying market drivers and specific conditions. Overall market size estimates range from xx Million in 2025 to xx Million in 2033.

- Service Segmentation: Detailed market size and growth projections for each service category are included in the full report.

- End-User Segmentation: Detailed analysis of market size, growth, and competitive dynamics for each end-user segment are provided in the full report.

Key Drivers of Project Logistics Market Growth

Several factors are driving the growth of the Project Logistics Market:

- Infrastructure Development: Global investment in infrastructure projects is significantly expanding the market.

- Technological Advancements: Digitalization, automation, and data analytics are improving efficiency and transparency.

- Economic Growth: Sustained global economic expansion is supporting demand for project logistics services.

- Energy Transition: The shift towards renewable energy sources is creating new opportunities for project logistics providers.

Challenges in the Project Logistics Market Sector

The Project Logistics Market faces several challenges:

- Geopolitical Instability: Conflicts and trade disputes can disrupt supply chains and increase costs.

- Supply Chain Disruptions: Global events and natural disasters can cause delays and shortages.

- Regulatory Compliance: Navigating diverse and evolving regulatory frameworks is complex.

- Skills Shortages: A shortage of skilled labor can constrain growth.

Leading Players in the Project Logistics Market Market

- EMO Trans

- SAL Heavy Lift GmbH

- FLS Transportation Services

- Crowley Logistics

- Highland Forwarding Inc

- Kinetix International Logistics

- Cole International Inc

- Hisiang Logistics Co Ltd

- Sea Cargo Air Cargo Logistics Inc

- Bati Grou

- DB Schenker

- Hellmann Worldwide Logistics

- Ceva Logistics

- Dako Worldwide Transport GmbH

- Deutsche Post DHL

- C H Robinson Worldwide Inc

- Rohlig Logistics

- Kuehne + Nagel International AG

- Agility Logistics

- Kerry Logistics

- Bollore Logistics

- Megalift Sdn Bhd

- CKB Logistics Group

- Rhenus Logistics

- Expeditors International of Washington Inc

- NMT Global Project Logistics

- Ryder System Inc

Key Developments in Project Logistics Market Sector

- August 2023: Aprojects Austria and Antwerp Metal Logistics collaborated to ship heavy loads (reactor, condenser, stripper) using a direct vessel loading method due to the lack of suitable shore cranes. This highlights the challenges and specialized solutions required for exceptionally heavy cargo.

- August 2023: Huisman secured a contract from Seaway7 for the delivery of a monopile installation spread for the jack-up vessel Seaway Ventus. This underscores the importance of specialized equipment and the demand for efficient handling of complex components in the offshore energy sector.

Strategic Project Logistics Market Market Outlook

The future of the Project Logistics Market appears bright, with continued growth driven by ongoing infrastructure development, technological innovation, and a growing need for efficient and specialized logistics solutions. Strategic opportunities exist for companies that can effectively leverage technology, develop specialized solutions for niche markets, and establish strong partnerships across the supply chain. By embracing sustainability and adhering to evolving regulatory standards, project logistics providers can gain a competitive edge and capitalize on the long-term growth potential of this dynamic sector.

Project Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Inventory Management and Warehousing

- 1.4. Other Value-added Services

-

2. End User

- 2.1. Oil and Gas, Mining, and Quarrying

- 2.2. Energy and Power

- 2.3. Construction

- 2.4. Manufacturing

- 2.5. Other End Users

Project Logistics Market Segmentation By Geography

- 1. Asia Pacific

- 2. Americas

- 3. Europe

- 4. Middle East and Africa

Project Logistics Market Regional Market Share

Geographic Coverage of Project Logistics Market

Project Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Inventory Management and Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas, Mining, and Quarrying

- 5.2.2. Energy and Power

- 5.2.3. Construction

- 5.2.4. Manufacturing

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Americas

- 5.3.3. Europe

- 5.3.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Inventory Management and Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas, Mining, and Quarrying

- 6.2.2. Energy and Power

- 6.2.3. Construction

- 6.2.4. Manufacturing

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Americas Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Inventory Management and Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas, Mining, and Quarrying

- 7.2.2. Energy and Power

- 7.2.3. Construction

- 7.2.4. Manufacturing

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Inventory Management and Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas, Mining, and Quarrying

- 8.2.2. Energy and Power

- 8.2.3. Construction

- 8.2.4. Manufacturing

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Inventory Management and Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Oil and Gas, Mining, and Quarrying

- 9.2.2. Energy and Power

- 9.2.3. Construction

- 9.2.4. Manufacturing

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EMO Trans

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SAL Heavy Lift GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DB Schenker

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hellmann Worldwide Logistics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ceva Logistics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dako Worldwide Transport GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 C H Robinson Worldwide Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rohlig Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kuehne + Nagel International AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Agility Logistics

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kerry Logistics

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bollore Logistics

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Megalift Sdn Bhd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 CKB Logistics Group

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Rhenus Logistics

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Expeditors International of Washington Inc

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 NMT Global Project Logistics

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Ryder System Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 EMO Trans

List of Figures

- Figure 1: Global Project Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: Asia Pacific Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: Asia Pacific Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Americas Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Americas Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Americas Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Americas Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Americas Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Americas Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East and Africa Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East and Africa Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East and Africa Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Project Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Project Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Project Logistics Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Project Logistics Market?

Key companies in the market include EMO Trans, SAL Heavy Lift GmbH, FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou, DB Schenker, Hellmann Worldwide Logistics, Ceva Logistics, Dako Worldwide Transport GmbH, Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market, C H Robinson Worldwide Inc, Rohlig Logistics, Kuehne + Nagel International AG, Agility Logistics, Kerry Logistics, Bollore Logistics, Megalift Sdn Bhd, CKB Logistics Group, Rhenus Logistics, Expeditors International of Washington Inc, NMT Global Project Logistics, Ryder System Inc.

3. What are the main segments of the Project Logistics Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 436.34 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure.

6. What are the notable trends driving market growth?

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

August 2023 - Aprojects Austria, a member of the Project Logistics Alliance, joined forces together with their long-trusted partner, Antwerp Metal Logistics, to ship heavy loads comprising: A reactor weighing 359 tons, a pool condenser weighing 286 tons and a stripper weighing 243 tons. Given the cargo’s weight, the only viable approach was to load it directly onto the ocean vessel using the vessel’s equipment, as no shore crane in Constanța had the capability to lift such heavy loads, even with multiple cranes working in tandem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Project Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Project Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Project Logistics Market?

To stay informed about further developments, trends, and reports in the Project Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence