Key Insights

The Philippines courier, express, and parcel (CEP) market is experiencing significant expansion, propelled by the rapid growth of e-commerce and escalating demand for efficient delivery solutions. The market is projected to reach a substantial size of $1.61 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.6% from 2025 to 2033. This growth is attributed to rising consumer spending, advancements in logistics infrastructure, and the increasing adoption of digital technologies. The business-to-consumer (B2C) segment, largely driven by e-commerce, is expected to lead market share. While express delivery services are dominant, the non-express segment remains vital for cost-conscious and less time-sensitive shipments. Enhanced road and air transportation networks are facilitating this growth, although regional infrastructure disparities present ongoing challenges, particularly for last-mile delivery to remote locations.

Philippines CEP Market Market Size (In Billion)

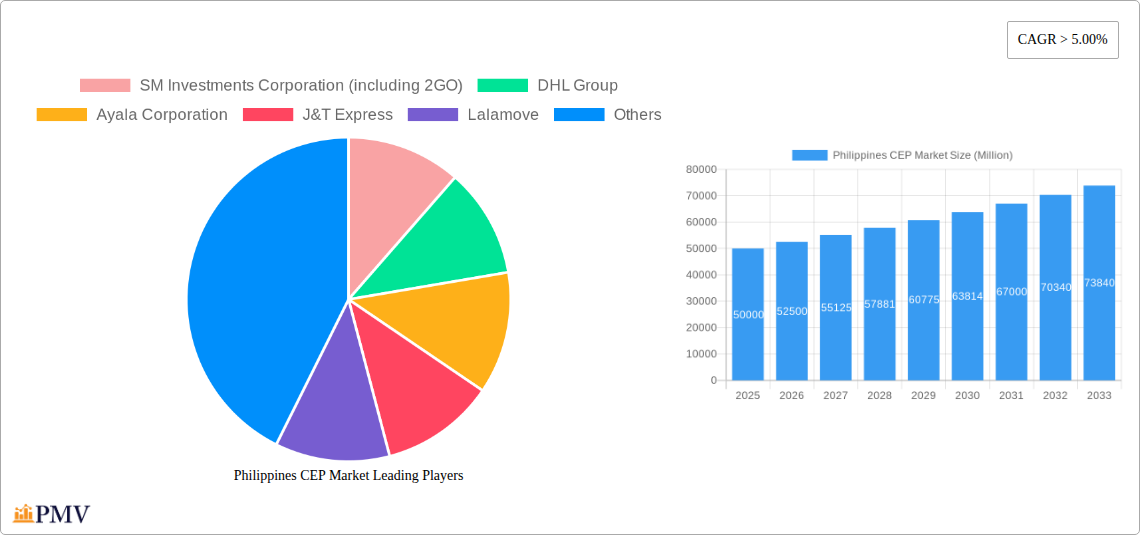

Key market participants, including global leaders like DHL and FedEx, alongside prominent local operators such as J&T Express and LBC Express, are actively competing for market share. This competitive landscape fosters innovation in technology, service diversification, and dynamic pricing. The market is segmented by destination (domestic/international), delivery speed, business model (B2B, B2C, C2C), shipment weight, transportation mode, and end-user industry. The healthcare, e-commerce, and BFSI sectors are major growth engines. Potential impediments include volatile fuel costs, regulatory complexities, and the ongoing requirement for technological investments to optimize operational efficiency and tracking accuracy. Continued market expansion is likely to encourage further industry consolidation, with larger entities acquiring smaller competitors to broaden their geographical reach and service portfolios.

Philippines CEP Market Company Market Share

Philippines CEP Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Philippines CEP (Courier, Express, and Parcel) market, offering invaluable insights for industry stakeholders. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It meticulously examines market structure, competitive dynamics, key trends, and growth drivers, providing actionable data and strategic recommendations. The report analyzes market segments based on destination (domestic, international), speed of delivery (express, non-express), model (B2B, B2C, C2C), shipment weight (light, medium, heavy), mode of transport (air, road, others), and end-user industry (e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale & retail trade, others). The market size is estimated to be xx Million in 2025 and is projected to reach xx Million by 2033.

Philippines CEP Market Market Structure & Competitive Dynamics

The Philippines CEP market exhibits a dynamic interplay of established players and emerging disruptors. Market concentration is moderate, with several key players holding significant shares, yet numerous smaller companies contribute to a competitive landscape. The innovation ecosystem is burgeoning, fueled by technological advancements in logistics technology and the rise of e-commerce. Regulatory frameworks, while evolving, aim to foster growth while ensuring fair competition. Product substitutes are limited, largely confined to traditional postal services. End-user trends indicate a strong preference for faster, more reliable, and technologically advanced delivery solutions.

M&A activity has been observed, particularly among smaller players seeking to expand their reach and capabilities. While precise deal values are not publicly available for all transactions, significant deals have involved companies such as xx, with values estimated in the range of xx Million. Key players like SM Investments Corporation (including 2GO), DHL Group, and Ayala Corporation dominate the market, possessing extensive networks and brand recognition. However, J&T Express, Lalamove, and other emerging players are gaining market share by leveraging technology and focusing on specific niches.

Philippines CEP Market Industry Trends & Insights

The Philippines CEP market is experiencing robust growth, driven primarily by the flourishing e-commerce sector and increasing consumer demand for faster and more convenient delivery options. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%. Market penetration continues to increase as more Filipinos embrace online shopping and digital transactions. Technological disruptions, such as the adoption of AI-powered logistics solutions and the expansion of digital payment options, are significantly impacting efficiency and customer experience. Consumer preferences show a strong bias towards same-day or next-day delivery services, influencing investment in express delivery infrastructure and capabilities. The competitive landscape remains highly dynamic, with continuous innovation and expansion strategies employed by leading players. This competitive pressure fuels efficiency gains and pricing optimization within the market.

Dominant Markets & Segments in Philippines CEP Market

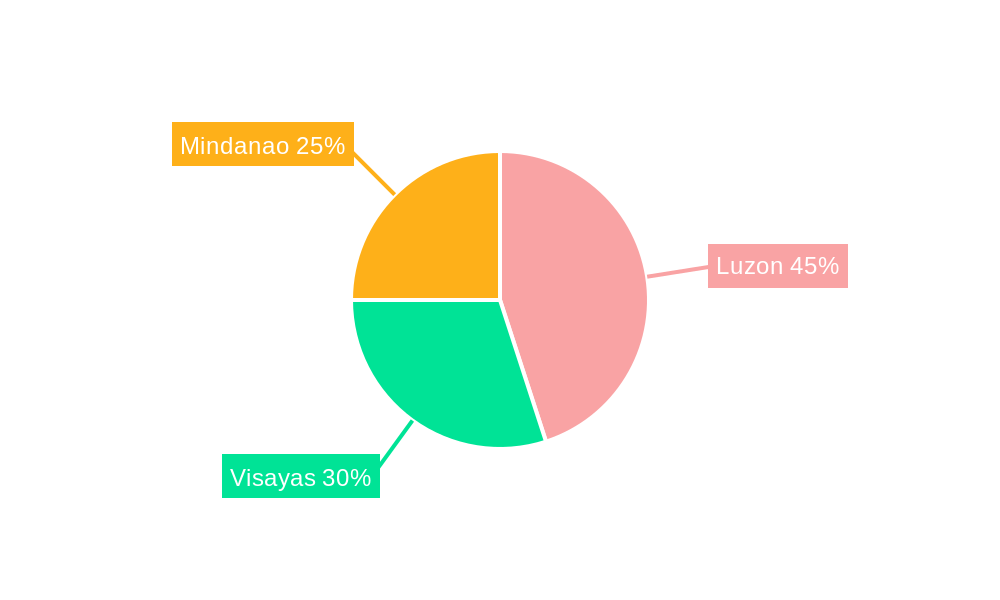

- Leading Region: Luzon, due to high population density and robust e-commerce activity.

- Dominant Segment:

- Destination: Domestic, driven by the increasing popularity of e-commerce within the Philippines.

- Speed of Delivery: Express, reflecting consumer preference for speed and convenience.

- Model: B2C, aligned with the significant growth in online retail.

- Shipment Weight: Light and Medium Weight Shipments cater to the high volume of e-commerce packages.

- Mode of Transport: Road, due to its extensive reach and cost-effectiveness.

- End-User Industry: E-commerce, the most significant driver of CEP market growth.

The dominance of Luzon is attributable to factors like higher disposable income, increased internet penetration, and better infrastructure compared to other regions. The strong preference for express delivery stems from the expectation of rapid and reliable service in today's fast-paced digital world. The dominance of the B2C segment mirrors the e-commerce boom, while the prevalence of light and medium-weight shipments reflect the typical size and weight of online purchases. Road transport's dominance is due to its extensive network, affordability, and accessibility throughout the archipelago, despite challenges to efficiency.

Philippines CEP Market Product Innovations

Recent innovations focus on improving delivery speed and tracking capabilities. Integration of technology like AI, IoT, and big data analytics allows for optimized routing, real-time tracking, and improved last-mile delivery efficiency. The emergence of automated sorting facilities and drone delivery trials enhances efficiency and addresses challenges in densely populated areas. These innovations directly address consumer demands for faster and more transparent delivery services, improving customer satisfaction and creating a competitive advantage.

Report Segmentation & Scope

This report segments the Philippines CEP market comprehensively across various parameters, providing detailed analysis for each segment:

- Destination: Domestic and International, with separate growth projections and competitive landscapes.

- Speed of Delivery: Express and Non-Express, analyzing the market size and dynamics of each speed tier.

- Model: B2B, B2C, and C2C, providing insights into the unique characteristics and growth potential of each segment.

- Shipment Weight: Light, Medium, and Heavy Weight Shipments, detailing the market share and competitive dynamics of each weight category.

- Mode of Transport: Air, Road, and Others, analyzing the market size and factors influencing the usage of each mode.

- End-User Industry: E-commerce, BFSI, Healthcare, Manufacturing, Primary Industry, Wholesale & Retail Trade (Offline), and Others, offering a detailed understanding of each sector's contribution to market growth.

Key Drivers of Philippines CEP Market Growth

The Philippines CEP market is experiencing significant growth, primarily due to several key factors: the burgeoning e-commerce industry, increasing smartphone and internet penetration, the government's focus on infrastructure development, and the rising adoption of digital payment methods. These factors collectively contribute to a rapid increase in the volume of online transactions and parcels requiring efficient delivery services. Furthermore, technological advancements, such as the implementation of sophisticated logistics software and tracking systems, play a crucial role in optimizing delivery efficiency and enhancing customer experiences.

Challenges in the Philippines CEP Market Sector

The Philippines CEP market faces several challenges, including the country's complex geography which can affect delivery times and costs, the need for further infrastructure development, particularly in rural areas, and inconsistent regulatory frameworks which can hamper the development of the industry. Competition is fierce, putting downward pressure on pricing. These factors pose considerable challenges to the sector's continued growth.

Leading Players in the Philippines CEP Market Market

- SM Investments Corporation (including 2GO)

- DHL Group

- Ayala Corporation

- J&T Express

- Lalamove

- FedEx

- United Parcel Service of America Inc (UPS)

- Ximex Delivery Express Logistics Inc (XDE)

- LBC Express Holdings Inc

- Entrego

- Philippine Postal Corporation (PHLPost)

- Ninja Logistics

Key Developments in Philippines CEP Market Sector

- December 2023: Etiquetta PH partnered with Lalamove, enhancing its delivery efficiency.

- August 2023: Lalamove launched its “Abot-Kaya” campaign, targeting entrepreneurs with affordable truck delivery services.

- March 2023: UPS partnered with Google Cloud to improve package tracking using RFID technology.

Strategic Philippines CEP Market Market Outlook

The Philippines CEP market presents significant opportunities for growth and expansion. Continued investment in infrastructure and technology, coupled with the sustained growth of e-commerce, will drive market expansion. Strategic partnerships, innovative delivery models (e.g., drone delivery), and the focus on optimizing the last-mile delivery experience will become increasingly crucial for success. The market's potential is significant, promising lucrative returns for those who can effectively adapt to evolving consumer demands and navigate the challenges inherent in the Philippine market.

Philippines CEP Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Philippines CEP Market Segmentation By Geography

- 1. Philippines

Philippines CEP Market Regional Market Share

Geographic Coverage of Philippines CEP Market

Philippines CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SM Investments Corporation (including 2GO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ayala Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 J&T Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lalamove

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ximex Delivery Express Logistics Inc (XDE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LBC Express Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Entrego

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Philippine Postal Corporation (PHLPost)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ninja Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SM Investments Corporation (including 2GO)

List of Figures

- Figure 1: Philippines CEP Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Philippines CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines CEP Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Philippines CEP Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Philippines CEP Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Philippines CEP Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Philippines CEP Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Philippines CEP Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Philippines CEP Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Philippines CEP Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Philippines CEP Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Philippines CEP Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Philippines CEP Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Philippines CEP Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Philippines CEP Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Philippines CEP Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines CEP Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Philippines CEP Market?

Key companies in the market include SM Investments Corporation (including 2GO), DHL Group, Ayala Corporation, J&T Express, Lalamove, FedEx, United Parcel Service of America Inc (UPS), Ximex Delivery Express Logistics Inc (XDE, LBC Express Holdings Inc, Entrego, Philippine Postal Corporation (PHLPost), Ninja Logistics.

3. What are the main segments of the Philippines CEP Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

December 2023: Etiquetta PH has partnered with Lalamove and this has opened more resources for a more efficient and convenient delivery experience for their customers through the same-day or next-day delivery service. It has also been utilizing the wide range of vehicles that Lalamove offers to help it adapt to the ever-changing demands of its customers during the peak season.August 2023: Lalamove had launched its “Abot-Kaya” campaign to empower entrepreneurs through affordable and reliable same-day truck delivery services across areas in Luzon and island-wide coverage in Cebu. Lalamove’s latest ad shows how business owners can sustainably manage and scale up their businesses as they fulfill their day-to-day transactions and deliveries with Lalamove delivery trucks, ranging from 1,000 KG, 2,000 KG, to 6-wheel and 10-wheel wing van trucks.March 2023: UPS entered a partnership with Google Cloud, where Google will help UPS by putting radio-frequency identification chips on packages to track them efficiently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines CEP Market?

To stay informed about further developments, trends, and reports in the Philippines CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence