Key Insights

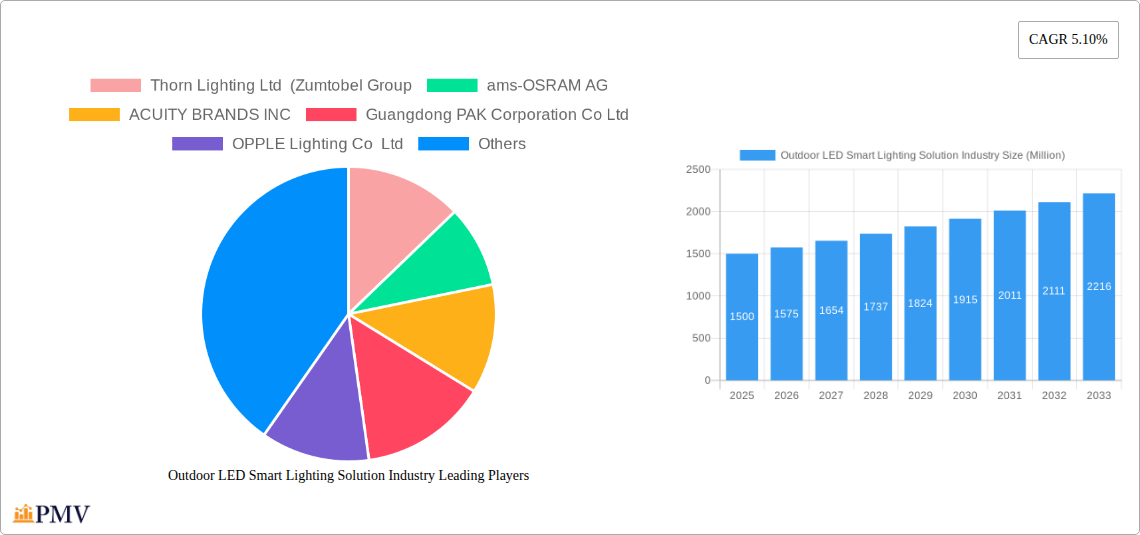

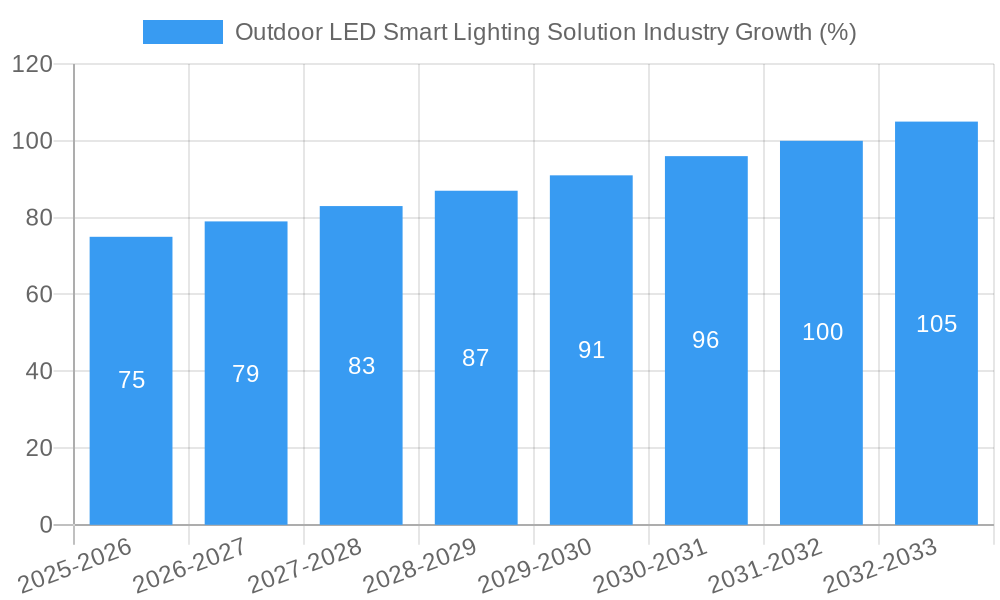

The global outdoor LED smart lighting solutions market is experiencing robust growth, driven by increasing urbanization, rising energy efficiency concerns, and the burgeoning adoption of smart city initiatives. The market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is projected to maintain a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the transition from traditional lighting technologies to energy-efficient LED solutions is accelerating, driven by governmental regulations promoting sustainability and reducing carbon footprints. Secondly, the integration of smart features like remote monitoring, control, and data analytics enhances operational efficiency and reduces maintenance costs, making these systems attractive to municipalities and businesses alike. Furthermore, advancements in LED technology, such as improved brightness, lifespan, and design flexibility, are expanding the range of applications across various outdoor settings.

However, high initial investment costs for implementation and the complexity associated with integrating smart lighting systems into existing infrastructure pose challenges to market expansion. Nevertheless, the long-term cost savings associated with reduced energy consumption and maintenance, combined with the increasing availability of cost-effective smart lighting solutions, are expected to overcome these restraints. Market segmentation reveals strong demand across various lighting types, including LED streetlights, floodlights, bollard lights, and wall lights, with applications primarily concentrated in public places, streets, and roadways. Key players in the market, including Thorn Lighting Ltd, ams-OSRAM AG, Acuity Brands Inc., and Signify Holding (Philips), are strategically investing in research and development to innovate and enhance product offerings, further driving market expansion. The market's regional distribution will likely see significant growth in developing economies, mirroring the rapid expansion of infrastructure projects and smart city initiatives in these regions.

Outdoor LED Smart Lighting Solution Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Outdoor LED Smart Lighting Solution industry, offering actionable insights for stakeholders across the value chain. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Outdoor LED Smart Lighting Solution Industry Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the outdoor LED smart lighting solution industry, encompassing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities.

The industry exhibits a moderately consolidated structure with several major players holding significant market share. Signify Holding (Philips) and Acuity Brands Inc. are prominent examples, commanding a combined xx% market share in 2024. However, the presence of numerous regional and specialized players indicates a competitive landscape. Innovation is driven by advancements in LED technology, smart connectivity, and energy efficiency. Stringent regulatory frameworks regarding energy consumption and light pollution are shaping industry practices. The market also faces competition from traditional lighting technologies, although the adoption of LED is steadily increasing. M&A activities have been significant, with deal values exceeding xx Million in the past five years. These acquisitions have predominantly focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately Consolidated (xx HHI in 2024)

- Key Players' Market Share (2024): Signify (xx%), Acuity Brands (xx%), Others (xx%)

- M&A Deal Value (2019-2024): Over xx Million

- End-User Trends: Growing demand for smart, energy-efficient solutions in public spaces and private properties.

Outdoor LED Smart Lighting Solution Industry Industry Trends & Insights

The outdoor LED smart lighting solution industry is experiencing robust growth fueled by several key factors. Increasing urbanization and infrastructure development are driving demand for efficient and sustainable lighting solutions. The transition from traditional lighting technologies to energy-efficient LEDs is a significant market driver. Governments worldwide are implementing policies to promote energy efficiency and reduce carbon emissions, further boosting the adoption of LED smart lighting solutions. Technological disruptions, such as the integration of IoT capabilities and advanced control systems, are enhancing the functionality and appeal of these solutions. Consumer preferences are shifting towards smart, connected devices that offer enhanced convenience, safety, and aesthetic appeal. This trend is influencing product development and marketing strategies within the industry. The competitive dynamics are characterized by innovation, consolidation, and globalization, with companies focusing on differentiation through product features and smart capabilities.

Dominant Markets & Segments in Outdoor LED Smart Lighting Solution Industry

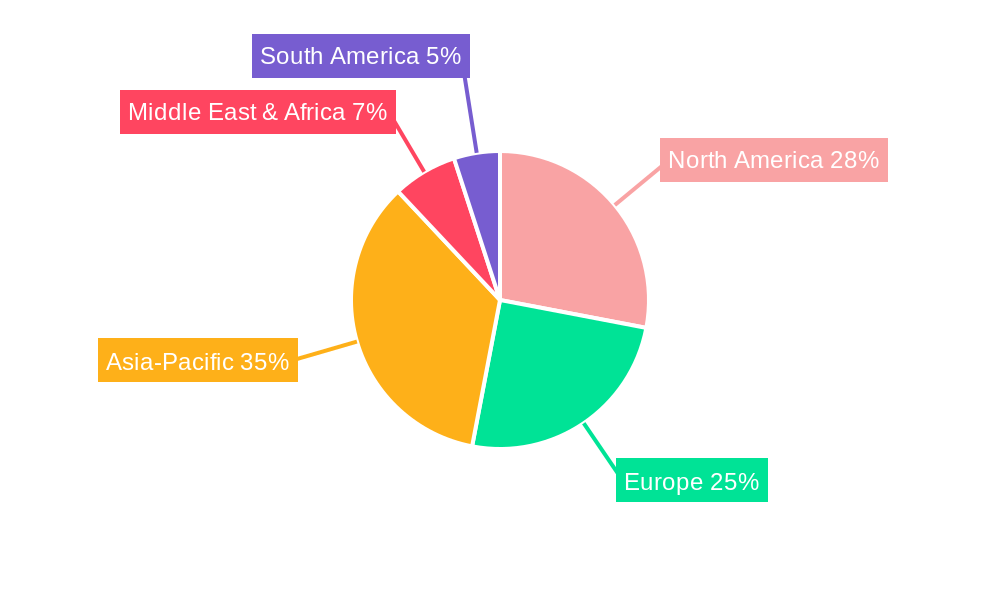

The report identifies key regions and segments driving market growth. North America and Europe currently hold significant market share, due to high adoption rates and established infrastructure. However, Asia-Pacific is projected to witness rapid growth in the coming years, driven by substantial infrastructure investments and government initiatives. Within product segments, LED streetlights hold the largest market share, followed by LED floodlights and LED bollard lights. The public places and streets & roadways application segment dominates overall market revenue.

Leading Region: North America (Market size xx Million in 2024)

Fastest-Growing Region: Asia-Pacific (Projected CAGR xx%)

Largest Segment (Type): LED Streetlights (Market size xx Million in 2024)

Largest Segment (Application): Public Places and Streets & Roadways (Market size xx Million in 2024)

Key Drivers for North America: Strong governmental support for energy-efficient lighting initiatives.

Key Drivers for Asia-Pacific: Rapid urbanization and infrastructure development.

Key Drivers for Europe: Stringent environmental regulations and high consumer awareness of energy efficiency.

Outdoor LED Smart Lighting Solution Industry Product Innovations

Recent product innovations focus on enhanced energy efficiency, improved smart connectivity features, and greater design flexibility. New products incorporate advanced sensor technologies, enabling remote monitoring and control, as well as adaptive lighting features that respond to ambient conditions. The market is seeing a trend towards integrated systems that combine lighting with other smart city infrastructure elements. These innovations are improving the overall value proposition of outdoor LED smart lighting solutions, driving higher adoption rates.

Report Segmentation & Scope

This report segments the outdoor LED smart lighting solution market based on type (LED Streetlights, LED Floodlights, LED Bollard Lights, LED Wall Lights) and application (Public Places, Streets and Roadways, Others). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. LED Streetlights currently dominate the market, while the public places application segment is expected to exhibit the highest growth rate in the coming years.

Key Drivers of Outdoor LED Smart Lighting Solution Industry Growth

The industry's growth is driven by several factors, including: increasing government regulations promoting energy efficiency and environmental sustainability; the rising adoption of smart city initiatives globally; technological advancements in LED technology, such as improved energy efficiency and longer lifespans; and the growing consumer demand for enhanced safety and security features in outdoor lighting solutions.

Challenges in the Outdoor LED Smart Lighting Solution Industry Sector

The industry faces challenges such as high initial investment costs for smart lighting systems, potential supply chain disruptions impacting component availability, and intense competition among numerous players, leading to pricing pressures. Furthermore, regulatory hurdles and compatibility issues with existing infrastructure can hinder market penetration.

Leading Players in the Outdoor LED Smart Lighting Solution Industry Market

- Thorn Lighting Ltd (Zumtobel Group)

- ams-OSRAM AG

- ACUITY BRANDS INC

- Guangdong PAK Corporation Co Ltd

- OPPLE Lighting Co Ltd

- LEDVANCE GmbH (MLS Co Ltd)

- EGLO Leuchten GmbH

- Current Lighting Solutions LLC

- Signify Holding (Philips)

- Panasonic Holdings Corporation

Key Developments in Outdoor LED Smart Lighting Solution Industry Sector

- September 2023: Signify launches Philips Smart LED bulbs under the "Wiz Connected" brand.

- May 2023: Cyclone Lighting (Acuity Brands) debuts Elencia luminaire, an upscale post-top lighting solution.

- April 2023: Hydrel (Acuity Brands) adds M9700 RGBW fixture to its M9000 ingrade luminaire family.

These developments highlight the industry's focus on smart technology integration and innovative product design.

Strategic Outdoor LED Smart Lighting Solution Industry Market Outlook

The future of the outdoor LED smart lighting solution industry is bright, with significant growth potential driven by continued technological advancements, expanding smart city initiatives, and increasing government support for energy-efficient infrastructure. Strategic opportunities exist for companies that can effectively leverage smart technologies, develop innovative solutions, and establish strong partnerships within the smart city ecosystem. The market's future trajectory is positive, driven by the long-term trend towards energy efficiency and smart urban development.

Outdoor LED Smart Lighting Solution Industry Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

Outdoor LED Smart Lighting Solution Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Outdoor LED Smart Lighting Solution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. North America Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6.1.1. Public Places

- 6.1.2. Streets and Roadways

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7. South America Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7.1.1. Public Places

- 7.1.2. Streets and Roadways

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8. Europe Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8.1.1. Public Places

- 8.1.2. Streets and Roadways

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9. Middle East & Africa Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9.1.1. Public Places

- 9.1.2. Streets and Roadways

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10. Asia Pacific Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10.1.1. Public Places

- 10.1.2. Streets and Roadways

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ams-OSRAM AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACUITY BRANDS INC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangdong PAK Corporation Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OPPLE Lighting Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EGLO Leuchten GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Current Lighting Solutions LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signify Holding (Philips)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group

List of Figures

- Figure 1: Global Outdoor LED Smart Lighting Solution Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 3: North America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 4: North America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 7: South America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 8: South America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 11: Europe Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 12: Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 15: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 16: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 19: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 20: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 3: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 5: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 10: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 15: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 26: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 34: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor LED Smart Lighting Solution Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Outdoor LED Smart Lighting Solution Industry?

Key companies in the market include Thorn Lighting Ltd (Zumtobel Group, ams-OSRAM AG, ACUITY BRANDS INC, Guangdong PAK Corporation Co Ltd, OPPLE Lighting Co Ltd, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, Signify Holding (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Outdoor LED Smart Lighting Solution Industry?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

September 2023: Signify, the owner of the Philips Hue brand announced the global launch of its Philips Smart LED bulbs. The new portfolio is the result of Signify's 2019 acquisition of Wiz, and it is distinguished from Hue products by the "Wiz Connected" badge on its blue box.May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires of Acuity brand announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look thanks to high-performance optics and revised, modern lantern style.April 2023: Hydrel, an established innovator and producer of outdoor architectural and landscape lighting systems of Acuity brand, announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Outdoor LED Smart Lighting Solution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Outdoor LED Smart Lighting Solution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Outdoor LED Smart Lighting Solution Industry?

To stay informed about further developments, trends, and reports in the Outdoor LED Smart Lighting Solution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence