Key Insights

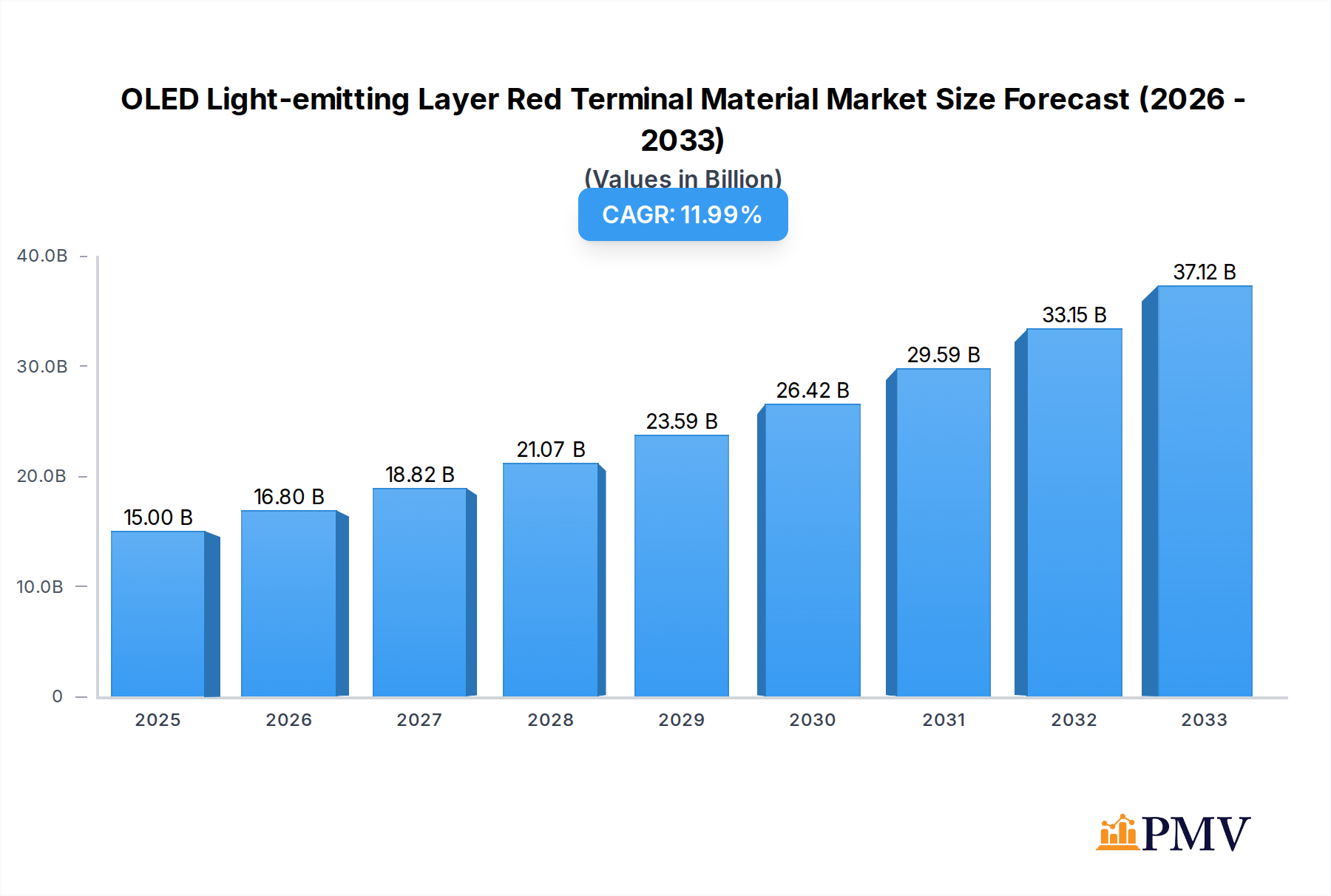

The global market for OLED Light-emitting Layer Red Terminal Materials is poised for significant expansion, projected to reach USD 15,000 million by 2025. This robust growth is fueled by a compelling CAGR of 12%, indicating a dynamic and rapidly evolving industry. The primary drivers behind this surge include the escalating demand for advanced display technologies across consumer electronics such as televisions and mobile phones. As consumers increasingly prioritize vibrant colors, superior contrast ratios, and energy efficiency, OLED technology continues to gain traction, directly benefiting the red terminal materials segment. Furthermore, advancements in material science, leading to improved performance and cost-effectiveness of these specialized chemicals, are critical growth catalysts. The market is characterized by intense innovation, with companies continuously investing in research and development to enhance emission efficiency, lifespan, and color purity of red OLEDs.

OLED Light-emitting Layer Red Terminal Material Market Size (In Billion)

The market segmentation reveals a diversified landscape. In terms of applications, televisions and mobile phones represent the dominant segments, reflecting their widespread adoption of OLED displays. However, the "Others" category, likely encompassing emerging applications like wearables, automotive displays, and lighting, is expected to witness substantial growth as OLED technology penetrates new markets. On the material type front, both Red Host Materials and Red Dopant Materials are crucial components, with their development and supply chains being pivotal to the overall market performance. Key players like UDC, DOW, DuPont, Novaled, and Idemitsu Kosan are at the forefront, driving innovation and catering to the evolving needs of display manufacturers. Emerging economies, particularly in the Asia Pacific region, are expected to contribute significantly to market expansion due to their strong manufacturing base and increasing consumer spending on high-end electronics.

OLED Light-emitting Layer Red Terminal Material Company Market Share

This in-depth market research report provides a critical analysis of the global OLED light-emitting layer red terminal material market, a vital component powering the vibrant colors and superior display quality of modern electronic devices. With a study period spanning 2019 to 2033, this report offers unparalleled insights into market dynamics, emerging trends, and future growth trajectories. We delve deep into the crucial red host material and red dopant material segments, dissecting their role in applications ranging from high-definition TVs and immersive mobile phones to a multitude of other innovative uses.

This report is an indispensable resource for manufacturers, material suppliers, R&D professionals, investors, and strategic planners operating within the fast-evolving OLED display technology landscape. It forecasts market size, analyzes competitive strategies, and identifies key growth drivers and challenges, all grounded in robust data and expert analysis.

OLED Light-emitting Layer Red Terminal Material Market Structure & Competitive Dynamics

The OLED light-emitting layer red terminal material market exhibits a moderate to high concentration, with a few dominant players like UDC and DOW controlling significant market share, estimated in the hundreds of millions of dollars. Innovation ecosystems are fiercely competitive, driven by ongoing R&D efforts to improve efficiency, color purity, and operational lifetime of red emitters. Regulatory frameworks primarily focus on environmental compliance and material safety, influencing formulation and manufacturing processes. Product substitutes, though nascent, are being explored, particularly in emerging display technologies, necessitating continuous innovation. End-user trends are heavily skewed towards enhanced visual experiences, demanding brighter, more accurate, and energy-efficient red pixels. Merger and acquisition (M&A) activities are strategic, aimed at consolidating market presence, acquiring patented technologies, or expanding geographical reach. M&A deal values are projected to be in the hundreds of millions of dollars, reflecting the strategic importance of these materials.

- Market Concentration: Dominated by key innovators, with an estimated market share in the hundreds of millions for leading entities.

- Innovation Ecosystems: Driven by advancements in host and dopant materials, leading to significant R&D investments in the hundreds of millions.

- Regulatory Frameworks: Focus on material safety and environmental standards, impacting production costs in the hundreds of millions.

- Product Substitutes: Emerging technologies pose potential long-term threats, requiring continuous R&D investments.

- End-User Trends: Demand for superior display quality and energy efficiency drives material development.

- M&A Activities: Strategic consolidations to acquire technology and market share, with deal values estimated in the hundreds of millions.

OLED Light-emitting Layer Red Terminal Material Industry Trends & Insights

The global OLED light-emitting layer red terminal material market is poised for substantial growth, projected at a CAGR of xx% between the base year 2025 and the forecast period ending 2033. This expansion is fueled by several interconnected trends. Firstly, the insatiable demand for superior visual experiences across consumer electronics, particularly OLED TVs and mobile phones, continues to be a primary growth driver. Consumers increasingly expect brighter, more vibrant colors, deeper blacks, and faster response times, all of which depend on advanced red emitter materials. The technological advancement in OLED display panels, including the transition to larger screen sizes and higher resolutions, directly translates into increased material consumption.

Secondly, innovation in red host material and red dopant material is paramount. Researchers are tirelessly working on developing materials with higher quantum efficiencies, longer operational lifetimes, and improved color purity (e.g., achieving closer to a true red spectrum, measured in nanometers). This includes the exploration of novel molecular structures and synthesis methods, with R&D spending estimated in the hundreds of millions annually. The shift from phosphorescent to TADF (Thermally Activated Delayed Fluorescence) emitters, while still in its developmental stages for red, represents a significant technological disruption with the potential to revolutionize efficiency and cost-effectiveness.

Furthermore, evolving consumer preferences play a crucial role. The premiumization of consumer electronics, with OLED technology increasingly becoming a standard in mid-to-high-end devices, drives market penetration. As production scales up and manufacturing processes mature, the cost of OLED displays is expected to decline, further accelerating adoption across a wider range of applications. The integration of OLED technology into automotive displays, wearables, and other emerging sectors also presents a significant avenue for market expansion, contributing to projected market penetration rates in the hundreds of millions of units. The competitive landscape is characterized by intense rivalry, with companies constantly vying for technological leadership and market share, leading to strategic partnerships and collaborations, with significant investments in new manufacturing facilities and R&D centers, totaling hundreds of millions of dollars.

Dominant Markets & Segments in OLED Light-emitting Layer Red Terminal Material

The OLED light-emitting layer red terminal material market is currently dominated by the Mobile Phone segment, driven by the ubiquitous adoption of OLED displays in smartphones. This segment accounts for a substantial portion of the global market value, estimated to be in the hundreds of millions of dollars annually, owing to the sheer volume of devices produced and the continuous demand for premium display features. Key drivers for this dominance include the economic policies supporting consumer electronics manufacturing in Asia-Pacific, robust infrastructure for display panel production, and the high disposable income in key markets facilitating smartphone upgrades. The TV segment follows closely, with the increasing penetration of OLED TVs in premium home entertainment systems. As screen sizes continue to grow and prices become more competitive, the demand for red emitter materials in this segment is expected to witness robust growth, contributing hundreds of millions to the overall market.

The red dopant material segment is particularly critical within the overall market. These materials are responsible for emitting light at specific wavelengths and are crucial for achieving vibrant red hues. Innovation in dopant chemistry, leading to higher efficiency and longer lifespan, is a primary focus for R&D, with investments in this area estimated to be in the hundreds of millions. Economic policies encouraging technological innovation and intellectual property protection in leading countries like South Korea and China are vital for the growth of this segment.

Geographically, Asia-Pacific stands out as the leading region, largely due to the presence of major display manufacturers and a significant consumer base for electronic devices. Countries like South Korea, China, and Japan are at the forefront of OLED production and consumption, contributing billions to the global market value. Favorable government initiatives, including subsidies and research grants aimed at boosting the semiconductor and display industries, further solidify Asia-Pacific's dominance. The Others application segment, encompassing areas like wearables, automotive displays, and VR/AR devices, represents a burgeoning market with significant long-term growth potential, albeit currently smaller in scale compared to mobile phones and TVs. Investments in this segment are projected to reach hundreds of millions as these technologies mature.

- Leading Segment (Application): Mobile Phone, driven by high production volumes and premium feature demand.

- Key Drivers (Mobile Phone): Economic policies, advanced manufacturing infrastructure, consumer purchasing power.

- Dominant Segment (Application): TV, fueled by premium home entertainment adoption and growing screen sizes.

- Critical Segment (Type): Red Dopant Material, crucial for color purity and efficiency, with significant R&D investments.

- Leading Region: Asia-Pacific, home to major display manufacturers and consumer markets.

- Key Drivers (Asia-Pacific): Government initiatives, R&D focus, strong manufacturing base.

- Emerging Segment (Application): Others (Wearables, Automotive, VR/AR), poised for substantial future growth.

OLED Light-emitting Layer Red Terminal Material Product Innovations

The OLED light-emitting layer red terminal material market is characterized by continuous product innovation aimed at enhancing display performance and efficiency. Key developments include the refinement of red host materials to improve charge transport and excitation energy transfer, contributing to brighter and more stable emissions. Simultaneously, advancements in red dopant materials are focusing on achieving deeper, more saturated red colors with extended operational lifetimes, crucial for applications like high-resolution televisions and immersive virtual reality devices. Companies are investing heavily in developing novel molecular structures and synthesis techniques, with R&D expenditures in the hundreds of millions of dollars. These innovations offer competitive advantages by enabling manufacturers to produce displays with superior color accuracy, reduced power consumption, and increased durability, meeting the ever-increasing demands of the consumer electronics market.

Report Segmentation & Scope

This comprehensive report meticulously segments the OLED light-emitting layer red terminal material market to provide granular insights. The market is analyzed across key applications: TV, Mobile Phone, and Others, which encompasses wearables, automotive displays, and emerging electronic devices. Further segmentation is provided by material type, distinguishing between Red Host Material and Red Dopant Material. For the TV segment, growth projections indicate a substantial market size in the hundreds of millions, driven by increasing adoption of OLED technology in premium home entertainment. The Mobile Phone segment, already a dominant force, is expected to continue its upward trajectory with robust growth in the hundreds of millions, fueled by the sheer volume of smartphone production. The Others segment, while currently smaller, presents significant future growth opportunities, with projected market sizes in the hundreds of millions as new applications gain traction. The Red Host Material segment is critical for efficient charge transport and energy transfer, while the Red Dopant Material segment is vital for achieving precise color emission and longevity.

Key Drivers of OLED Light-emitting Layer Red Terminal Material Growth

The OLED light-emitting layer red terminal material market is propelled by several potent growth drivers. Technologically, the relentless pursuit of enhanced display quality, including improved color accuracy, brightness, and energy efficiency in OLED panels, is a primary impetus. This fuels demand for advanced red host materials and red dopant materials. Economically, the increasing global disposable income and the premiumization trend in consumer electronics, particularly in mobile phones and TVs, are driving higher adoption rates of OLED technology. Government initiatives and favorable industrial policies in key manufacturing regions, such as tax incentives and R&D subsidies for the display industry, also play a significant role, fostering innovation and production capacity, with investments in these areas amounting to hundreds of millions. Furthermore, the expanding application of OLED technology beyond traditional displays, into areas like automotive and wearables, opens new avenues for market expansion, contributing significantly to growth projections.

Challenges in the OLED Light-emitting Layer Red Terminal Material Sector

Despite its promising growth, the OLED light-emitting layer red terminal material sector faces several challenges. One significant barrier is the high cost of production associated with advanced OLED materials, which can limit broader market penetration, particularly in cost-sensitive applications. Developing red emitters with both high efficiency and extended operational lifetime remains a persistent technical hurdle, impacting product longevity and overall display performance. Supply chain complexities, particularly for specialized precursor chemicals and manufacturing equipment, can lead to potential disruptions and price volatility, with impacts estimated in the hundreds of millions of dollars. Intense competitive pressures among material suppliers and display manufacturers also drive down profit margins. Furthermore, the ongoing exploration of alternative display technologies, though not yet a direct threat, represents a potential long-term challenge that necessitates continuous innovation and adaptation within the OLED material space.

Leading Players in the OLED Light-emitting Layer Red Terminal Material Market

- UDC

- DOW

- DuPont

- Novaled

- Idemitsu Kosan

- Mitsubishi Chemical

- artience Toyo Ink

- Toray

- Nippon Fine Chemical

- Jilin Oled Material Tech

Key Developments in OLED Light-emitting Layer Red Terminal Material Sector

- 2023: UDC announces breakthrough advancements in red phosphorescent emitter efficiency, impacting the next generation of OLED displays.

- 2022: DOW and Idemitsu Kosan form a strategic partnership to co-develop novel red emitter materials, focusing on enhanced stability and color purity.

- 2021: Novaled introduces a new generation of host materials for red OLEDs, demonstrating significant improvements in device lifetime.

- 2020: Mitsubishi Chemical unveils a highly efficient red dopant material for mobile phone applications, achieving near-perfect color saturation.

- 2019: artience Toyo Ink expands its R&D capabilities in OLED materials, investing hundreds of millions in a new research facility.

Strategic OLED Light-emitting Layer Red Terminal Material Market Outlook

The strategic outlook for the OLED light-emitting layer red terminal material market is exceptionally bright, driven by the enduring demand for superior display technology. Growth accelerators include the relentless innovation in red host and red dopant materials, leading to enhanced color gamut, efficiency, and lifespan, further bolstering the appeal of OLED displays across all segments, from TVs and mobile phones to emerging applications. The increasing adoption of OLED in automotive infotainment systems and next-generation wearables presents significant untapped potential, promising market expansion in the hundreds of millions. Furthermore, the ongoing efforts to reduce manufacturing costs and improve scalability will democratize OLED technology, driving higher market penetration. Strategic opportunities lie in vertical integration, strategic collaborations for R&D, and focusing on niche applications with high growth potential, all while navigating the evolving competitive and regulatory landscapes.

OLED Light-emitting Layer Red Terminal Material Segmentation

-

1. Application

- 1.1. TV

- 1.2. Mobile Phone

- 1.3. Others

-

2. Types

- 2.1. Red Host Material

- 2.2. Red Dopant Material

OLED Light-emitting Layer Red Terminal Material Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

OLED Light-emitting Layer Red Terminal Material Regional Market Share

Geographic Coverage of OLED Light-emitting Layer Red Terminal Material

OLED Light-emitting Layer Red Terminal Material REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. TV

- 5.1.2. Mobile Phone

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Red Host Material

- 5.2.2. Red Dopant Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. TV

- 6.1.2. Mobile Phone

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Red Host Material

- 6.2.2. Red Dopant Material

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. TV

- 7.1.2. Mobile Phone

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Red Host Material

- 7.2.2. Red Dopant Material

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. TV

- 8.1.2. Mobile Phone

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Red Host Material

- 8.2.2. Red Dopant Material

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. TV

- 9.1.2. Mobile Phone

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Red Host Material

- 9.2.2. Red Dopant Material

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific OLED Light-emitting Layer Red Terminal Material Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. TV

- 10.1.2. Mobile Phone

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Red Host Material

- 10.2.2. Red Dopant Material

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UDC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DOW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novaled

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Idemitsu Kosan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Chemical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 artience Toyo Ink

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toray

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nippon Fine Chemical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jilin Oled Material Tech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UDC

List of Figures

- Figure 1: Global OLED Light-emitting Layer Red Terminal Material Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global OLED Light-emitting Layer Red Terminal Material Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific OLED Light-emitting Layer Red Terminal Material Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the OLED Light-emitting Layer Red Terminal Material?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the OLED Light-emitting Layer Red Terminal Material?

Key companies in the market include UDC, DOW, DuPont, Novaled, Idemitsu Kosan, Mitsubishi Chemical, artience Toyo Ink, Toray, Nippon Fine Chemical, Jilin Oled Material Tech.

3. What are the main segments of the OLED Light-emitting Layer Red Terminal Material?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "OLED Light-emitting Layer Red Terminal Material," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the OLED Light-emitting Layer Red Terminal Material report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the OLED Light-emitting Layer Red Terminal Material?

To stay informed about further developments, trends, and reports in the OLED Light-emitting Layer Red Terminal Material, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence