Key Insights

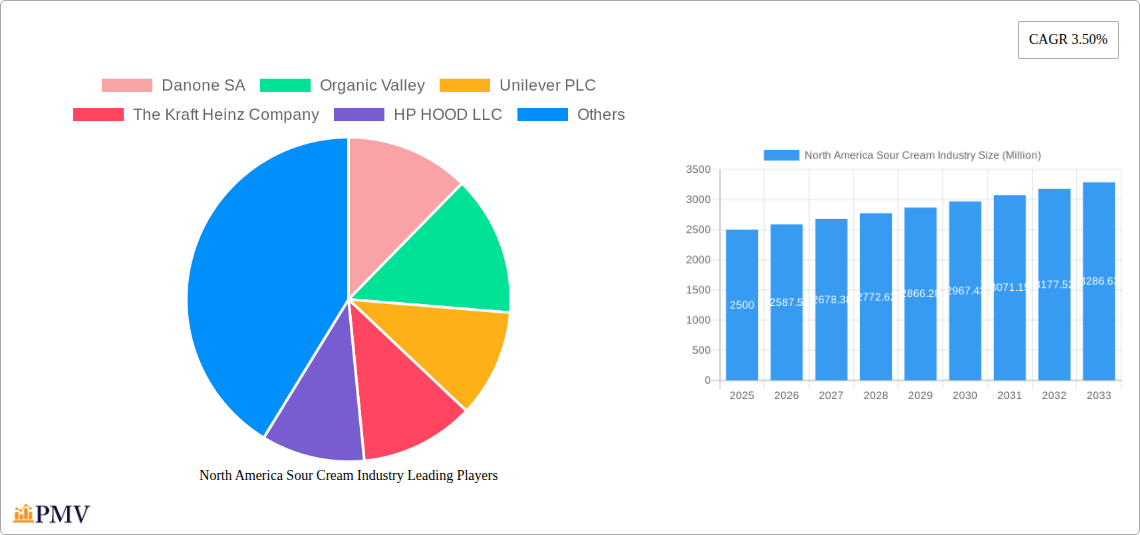

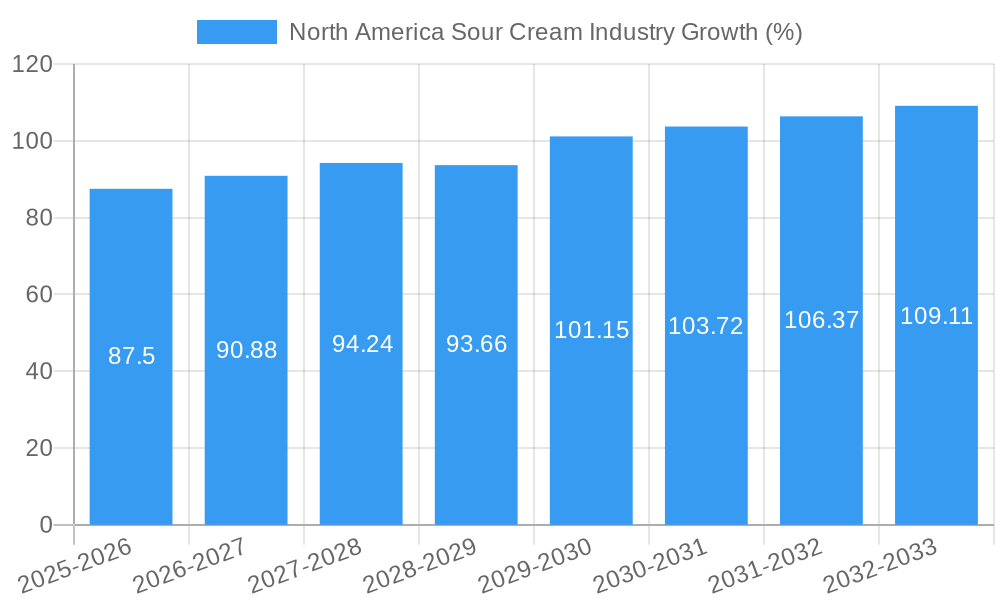

The North American sour cream market, valued at approximately $2.5 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing consumption of Mexican and Tex-Mex cuisine, which heavily features sour cream as a key ingredient, is a significant contributor to market expansion. Furthermore, the rising demand for convenient and ready-to-eat meals, particularly among busy professionals and young families, fuels the growth of sour cream in dips, sauces, and as a topping for various dishes. The market's segmentation reveals that supermarkets and hypermarkets continue to dominate distribution channels, accounting for the largest share of sales, although online retail stores are experiencing a notable surge in demand, reflecting the overall shift towards e-commerce in the food and beverage sector. The preference for healthier options is also influencing the market, with a noticeable increase in demand for low-fat and organic sour cream varieties within the dairy and non-dairy product segments. Competitive landscape analysis indicates that major players like Danone, Unilever, and Kraft Heinz are strategically focusing on product innovation, brand extensions, and acquisitions to maintain their market share amidst growing competition from regional and smaller brands.

Despite positive growth projections, the North American sour cream market faces certain challenges. Fluctuations in dairy prices and the increasing cost of raw materials pose a significant threat to profitability. Moreover, the growing popularity of plant-based alternatives, such as vegan sour cream made from coconut or cashew cream, is presenting a significant challenge to traditional dairy-based sour cream producers. This requires established players to invest in research and development to create innovative and competitive plant-based alternatives. Addressing consumer concerns regarding high fat content and sugar levels through product reformulation is also crucial for maintaining sustainable market growth. Finally, maintaining consistent supply chain efficiency in the face of geopolitical uncertainties and potential disruptions remains critical for market stability and growth. The forecast period of 2025-2033 presents opportunities for market players to capitalize on emerging trends and address the challenges through strategic investments and product innovation to further expand market share.

This comprehensive report provides an in-depth analysis of the North America sour cream industry, offering valuable insights for industry professionals, investors, and stakeholders. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report projects a market size of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Sour Cream Industry Market Structure & Competitive Dynamics

The North American sour cream market exhibits a moderately consolidated structure, with key players like Danone SA, Unilever PLC, The Kraft Heinz Company, and HP Hood LLC holding significant market share. The industry's competitive landscape is shaped by intense rivalry, driven by factors including product innovation, pricing strategies, and distribution network expansion. Market share fluctuates based on new product launches and successful marketing campaigns. For example, Danone SA’s market share is estimated to be xx%, while Unilever PLC holds approximately xx%. The competitive intensity is further amplified by the emergence of smaller, niche players focusing on organic and plant-based options.

Innovation within the industry centers on product diversification, encompassing flavors, packaging formats (e.g., squeezable pouches), and the increasing popularity of plant-based alternatives. Regulatory frameworks, particularly those concerning food safety and labeling, significantly influence market operations. The presence of substitute products, such as yogurt and vegan cream alternatives, adds another layer of competition. End-user trends, such as growing health consciousness and demand for convenient food options, are driving the adoption of healthier and more versatile sour cream products. M&A activity in the sector has been moderate, with deal values ranging from xx Million to xx Million over the past five years, primarily focusing on expanding product portfolios and geographic reach.

North America Sour Cream Industry Industry Trends & Insights

The North America sour cream market is experiencing steady growth, fueled by several key trends. Rising disposable incomes and changing consumer preferences towards convenient and flavorful food products are major drivers. The increasing popularity of Mexican and other ethnic cuisines that heavily feature sour cream is also boosting market demand. Technological advancements, such as improved packaging and processing technologies, are enhancing product shelf life and quality. The shift towards healthier lifestyles is driving the demand for low-fat and organic sour cream options. The industry is also witnessing the rise of plant-based alternatives, which is capturing a growing segment of the market. Market penetration of plant-based sour cream is currently estimated at xx% and is projected to increase to xx% by 2033. The competitive landscape is dynamic, with established players facing challenges from both new entrants and the growing preference for healthier options.

Dominant Markets & Segments in North America Sour Cream Industry

By Distribution Channel: Supermarkets/hypermarkets remain the dominant distribution channel for sour cream, accounting for approximately xx% of total sales. This dominance is due to their extensive reach and established supply chains. Convenience stores represent a smaller but growing segment, driven by increased consumer demand for on-the-go snacking options. Online retail is also emerging as a significant channel, particularly for niche and specialized products.

By Product Type: Dairy sour cream continues to dominate the market, owing to its established consumer base and familiarity. However, the non-dairy segment is experiencing significant growth, fueled by the increasing popularity of veganism and plant-based diets. Key drivers for the dairy segment include established consumer preference, while the non-dairy segment benefits from growing health consciousness and demand for dairy-free alternatives.

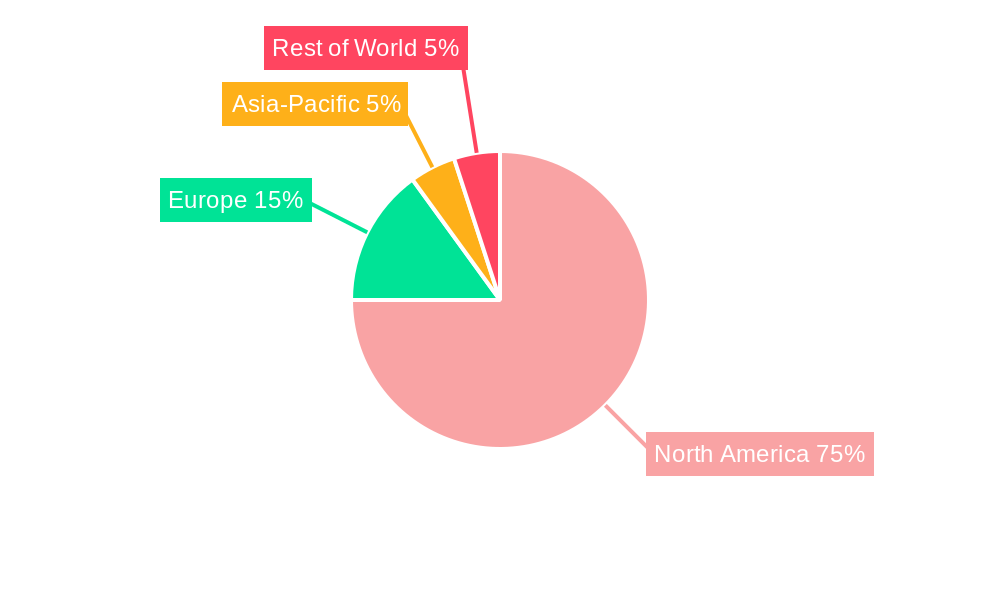

The United States is the largest market within North America, driven by high consumption rates and a well-established retail infrastructure. Key drivers include strong consumer demand, established distribution networks, and a preference for convenient and ready-to-eat food products. Canada represents a significant secondary market, exhibiting similar trends although at a slightly lower consumption level.

North America Sour Cream Industry Product Innovations

Recent innovations in the sour cream industry focus on improving taste, texture, and health attributes. New product launches include organic, low-fat, and plant-based options. The introduction of convenient packaging formats, such as squeezable pouches, is enhancing consumer appeal. Technological advancements in processing and preservation methods are expanding product shelf life and improving quality. These innovations cater to evolving consumer preferences for healthier, convenient, and diverse food options.

Report Segmentation & Scope

The report segments the North America sour cream market by distribution channel (supermarkets/hypermarkets, convenience stores, online retail stores, other distribution channels) and product type (dairy, non-dairy). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The dairy segment is expected to maintain a substantial market share throughout the forecast period, while the non-dairy segment is projected to exhibit robust growth. Within the distribution channels, supermarkets/hypermarkets are expected to retain their dominance, while online retail is projected to experience significant expansion.

Key Drivers of North America Sour Cream Industry Growth

The North American sour cream market is propelled by rising disposable incomes, shifting dietary habits favoring convenience foods, and growing demand for diverse flavors and formats. Technological advancements in production and packaging are also contributing to the market's expansion. Favorable government regulations related to food safety and labeling enhance consumer confidence. The increasing popularity of cuisines that use sour cream significantly influences market growth.

Challenges in the North America Sour Cream Industry Sector

The industry faces challenges including increasing raw material costs, intense competition from both established and emerging players, and the growing prevalence of substitute products. Fluctuations in milk prices directly impact production costs, and stricter regulations on food labeling and processing add to operational complexities. Supply chain disruptions can also cause production delays and impact the overall availability of the product.

Leading Players in the North America Sour Cream Industry Market

- Danone SA

- Organic Valley

- Unilever PLC

- The Kraft Heinz Company

- HP Hood LLC

- Meiji Holdings Co Ltd

- Dairy Farmers of America Inc

- Daisy Brand LLC

- Saputo Inc

- Redwood Hill Farm & Creamery Inc

Key Developments in North America Sour Cream Industry Sector

- September 2021: Only Plant-Based! launched vegan mayo, sour cream, and dressings nationwide, expanding the plant-based options in the market.

- August 2021: Vermont Creamery introduced its first cultured sour cream, adding to the variety of dairy options.

- November 2021: Prairie Farms Dairy expanded its product line to include squeezable pouches of all-natural sour cream, enhancing convenience.

Strategic North America Sour Cream Industry Market Outlook

The North American sour cream market holds significant future potential, driven by sustained consumer demand, innovation in product offerings, and the expansion of distribution channels. Strategic opportunities lie in catering to the growing demand for plant-based and healthier options, focusing on convenient packaging formats, and expanding into emerging online retail channels. Companies can capitalize on these trends by investing in research and development, enhancing their supply chains, and building strong brand recognition.

North America Sour Cream Industry Segmentation

-

1. Product Type

- 1.1. Dairy

- 1.2. Non-Dairy

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Sour Cream Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Sour Cream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lactose-Free Sour Cream

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dairy

- 5.1.2. Non-Dairy

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dairy

- 6.1.2. Non-Dairy

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dairy

- 7.1.2. Non-Dairy

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dairy

- 8.1.2. Non-Dairy

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dairy

- 9.1.2. Non-Dairy

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Sour Cream Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Danone SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Organic Valley

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Unilever PLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 The Kraft Heinz Company

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 HP HOOD LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Meiji Holdings Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Dairy Farmers of America Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Daisy Brand LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Saputo Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Redwood Hill Farm & Creamery Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Danone SA

List of Figures

- Figure 1: North America Sour Cream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Sour Cream Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Sour Cream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Sour Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Sour Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Sour Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Sour Cream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Sour Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Sour Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Sour Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Sour Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Sour Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Sour Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Sour Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Sour Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Sour Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Sour Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Sour Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: North America Sour Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Sour Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Sour Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Sour Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: North America Sour Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Sour Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Sour Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Sour Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Sour Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Sour Cream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sour Cream Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the North America Sour Cream Industry?

Key companies in the market include Danone SA, Organic Valley, Unilever PLC, The Kraft Heinz Company, HP HOOD LLC, Meiji Holdings Co Ltd, Dairy Farmers of America Inc, Daisy Brand LLC, Saputo Inc, Redwood Hill Farm & Creamery Inc.

3. What are the main segments of the North America Sour Cream Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Growing Demand for Lactose-Free Sour Cream.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Only Plant-Based! launched vegan mayo, sour cream, and dressings at retailers nationwide. The plant-based brand uses ingredients including rapeseed oil, spirit vinegar, vegetables, and spices to craft their condiments, which come in varieties such as garlic mayo, chipotle mayo, ranch, and sour cream.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sour Cream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sour Cream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sour Cream Industry?

To stay informed about further developments, trends, and reports in the North America Sour Cream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence