Key Insights

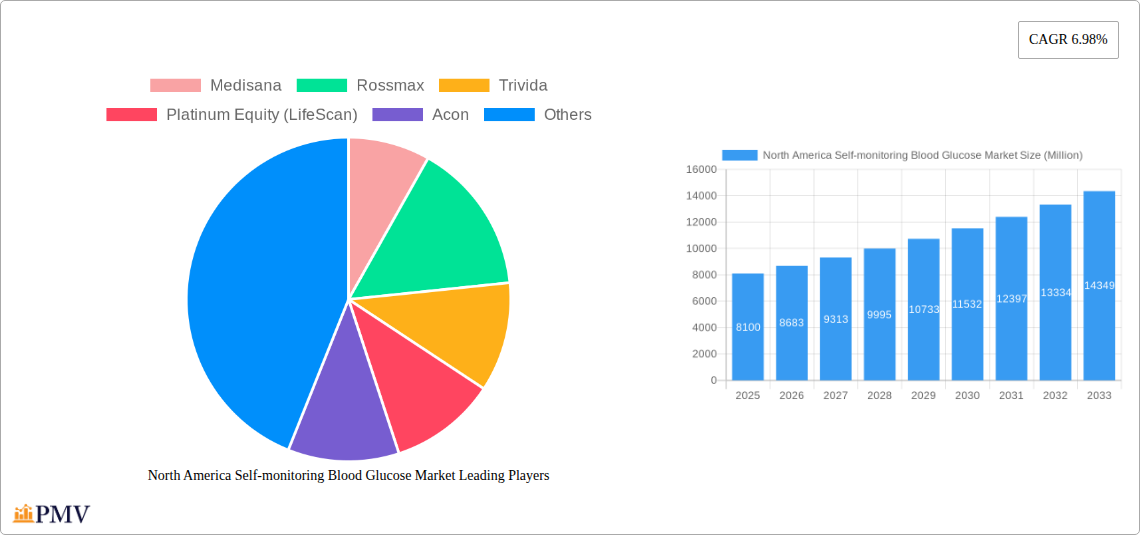

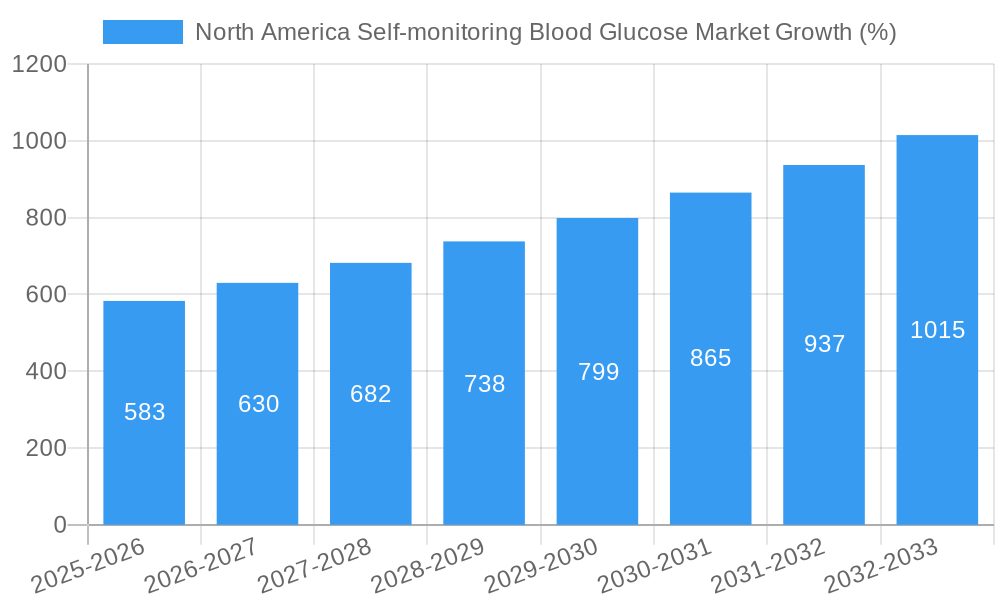

The North American self-monitoring blood glucose (SMBG) market, valued at approximately $8.10 billion in 2025, is projected to experience robust growth, driven by the escalating prevalence of diabetes and increasing geriatric population. A compound annual growth rate (CAGR) of 6.98% from 2025 to 2033 indicates a significant market expansion. This growth is fueled by rising awareness of diabetes management, technological advancements in SMBG devices (such as continuous glucose monitoring systems and wireless connectivity), and increased accessibility to healthcare. Furthermore, favorable reimbursement policies and the rising adoption of personalized medicine are contributing to market expansion. The market is segmented by components, including glucose meters, test strips, lancets, and lancing devices, each contributing to the overall growth trajectory. Major players such as Abbott, Roche, and Medtronic are actively investing in research and development, introducing innovative products, and expanding their market reach through strategic partnerships and acquisitions. The strong presence of established companies coupled with the emergence of new technological advancements suggests a positive outlook for sustained growth in the North American SMBG market.

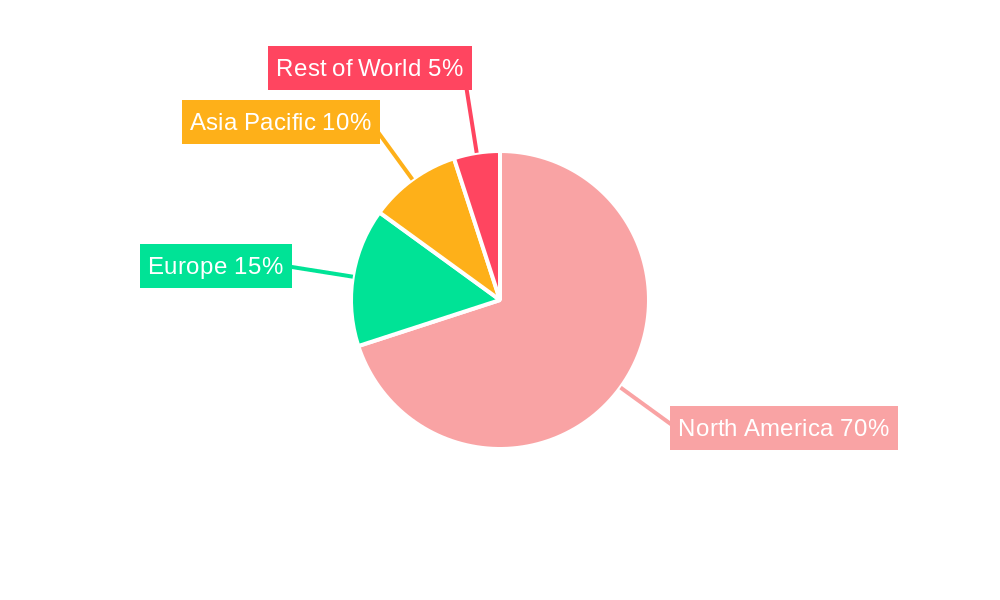

The United States, as the largest market within North America, significantly contributes to the overall regional revenue. Canada and Mexico also demonstrate substantial growth potential, driven by factors including increasing diabetes prevalence and improved healthcare infrastructure. However, market growth might face restraints such as pricing pressures from generic test strips, potential regulatory hurdles for new technologies, and the rise of alternative diabetes management therapies. Despite these challenges, the continued focus on preventative healthcare, technological innovation within the SMBG devices sector, and an expanding diabetic population will likely overcome these hurdles, maintaining a healthy growth trajectory for the foreseeable future. The competitive landscape is characterized by both established multinational corporations and smaller specialized companies vying for market share through product differentiation and strategic market positioning.

North America Self-Monitoring Blood Glucose Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America self-monitoring blood glucose (SMBG) market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report analyzes market size (in Millions), segmentation, competitive landscape, and key growth drivers to provide a holistic understanding of this vital sector.

North America Self-monitoring Blood Glucose Market Market Structure & Competitive Dynamics

The North American SMBG market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by intense competition driven by product innovation, technological advancements, and strategic mergers and acquisitions (M&A). Regulatory frameworks, particularly those related to medical device approvals and reimbursement policies, significantly influence market dynamics. Substitute products, such as continuous glucose monitoring (CGM) systems, are gaining traction, impacting the SMBG market's growth trajectory. End-user preferences, increasingly favoring connected devices and user-friendly interfaces, are reshaping the market landscape. M&A activity has been substantial, with deals primarily focused on expanding product portfolios and strengthening market presence. For example, while precise deal values are unavailable for all transactions, significant M&A activity has been observed, representing a substantial investment into the sector. Market share estimations for key players, while not available in this précis, are detailed within the complete report. The report also provides a granular analysis of the innovation ecosystem, highlighting key players' R&D investments and collaborations.

North America Self-monitoring Blood Glucose Market Industry Trends & Insights

The North American SMBG market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the rising prevalence of diabetes, increasing awareness of blood glucose management, and technological advancements leading to more accurate, convenient, and connected SMBG devices. Technological disruptions, such as the integration of Bluetooth connectivity and mobile app integration, are enhancing patient engagement and improving data management. Consumer preferences are shifting towards smaller, more user-friendly devices with improved accuracy and data-sharing capabilities. Market penetration of SMBG devices remains high within the diabetic population, but significant opportunities exist to increase adoption rates among at-risk individuals and improve adherence to regular testing. The competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups. The report provides a detailed analysis of these trends, supported by relevant market data.

Dominant Markets & Segments in North America Self-monitoring Blood Glucose Market

While the complete report provides a comprehensive regional and segmental breakdown, the United States currently represents the dominant market within North America for SMBG devices. Key drivers for this dominance include a larger diabetic population, advanced healthcare infrastructure, and robust reimbursement policies. The dominance is further bolstered by:

- Strong Healthcare Infrastructure: Well-established healthcare systems ensure widespread access to SMBG devices and related services.

- High Diabetes Prevalence: The high prevalence of diabetes in the U.S. fuels demand for SMBG devices.

- Favorable Reimbursement Policies: Reimbursement policies facilitate access to SMBG devices for patients.

The report provides in-depth analysis of other countries and their market shares. Within the "Self-monitoring Blood Glucose Devices: By Component" segmentation, specific component dominance analysis will be found in the full report.

North America Self-monitoring Blood Glucose Market Product Innovations

Recent product innovations in the SMBG market focus on improving accuracy, convenience, and connectivity. Miniaturization of devices, improved sensor technology, and integration with smart devices and mobile apps are key trends. These innovations enhance patient compliance and provide valuable data for healthcare professionals. The competitive advantage lies in offering superior accuracy, ease of use, and data management capabilities. The market is seeing a shift towards integrated solutions combining SMBG devices with data analysis and remote monitoring capabilities.

Report Segmentation & Scope

This report segments the North America SMBG market comprehensively, including analysis by device type (e.g., meter, strips, lancets) and by end-user (e.g., hospitals, clinics, home use). Each segment's market size, growth projections, and competitive dynamics are extensively analyzed within the full report, providing insights into the relative opportunities and challenges for each area. Further segmentation by distribution channel (e.g., online, retail pharmacies) also provides valuable market intelligence.

Key Drivers of North America Self-monitoring Blood Glucose Market Growth

Several factors propel the growth of the North American SMBG market. The rising prevalence of diabetes and prediabetes is a key driver, alongside the increasing demand for convenient and accurate blood glucose monitoring solutions. Technological advancements, like improved sensor technology and connected devices, further enhance market growth. Government initiatives promoting diabetes management and improved healthcare infrastructure also contribute significantly. The aging population, a key demographic affected by diabetes, also fuels market demand.

Challenges in the North America Self-monitoring Blood Glucose Market Sector

The North American SMBG market faces several challenges. Stringent regulatory requirements for medical device approval and reimbursement policies can impact market entry and growth. Supply chain disruptions and fluctuations in raw material costs affect production and pricing. Intense competition and the emergence of substitute products like CGM systems pose challenges to market share. The high cost of SMBG devices, particularly for uninsured or underinsured patients, remains a significant barrier. The report quantifies the impact of these challenges on market growth.

Leading Players in the North America Self-monitoring Blood Glucose Market Market

- Medisana

- Rossmax

- Trivida

- Platinum Equity (LifeScan)

- Acon

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Abbott

- Bionime Corporation

- Arkray

- Ascensia

Key Developments in North America Self-monitoring Blood Glucose Market Sector

- January 2023: LifeScan announced the publication of real-world data from over 144,000 people with diabetes demonstrating improved glycemic control using their Bluetooth-connected blood glucose meter and mobile app.

- May 2023: LifeScan published further positive data from a real-world study (55,000+ participants) in Diabetes Therapy, supporting the sustained improvements in readings in range from its OneTouch Bluetooth-connected blood glucose meter and mobile app.

Strategic North America Self-monitoring Blood Glucose Market Market Outlook

The North American SMBG market holds substantial growth potential driven by the expanding diabetic population, technological advancements leading to improved device accuracy and connectivity, and increasing healthcare investments. Strategic opportunities lie in developing innovative products focusing on enhanced user experience, data analytics, and integration with broader healthcare ecosystems. Focus on personalized diabetes management solutions and partnerships with telehealth providers will likely shape future market growth.

North America Self-monitoring Blood Glucose Market Segmentation

-

1. Self-monitoring Blood Glucose Devices

-

1.1. By Component

- 1.1.1. Glucometer Devices

- 1.1.2. Lancets

-

1.1. By Component

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Self-monitoring Blood Glucose Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Self-monitoring Blood Glucose Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Blood Glucose Test Strips Held the Largest Market Share in Current Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 5.1.1. By Component

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Lancets

- 5.1.1. By Component

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 6. United States North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 6.1.1. By Component

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Lancets

- 6.1.1. By Component

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 7. Canada North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 7.1.1. By Component

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Lancets

- 7.1.1. By Component

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 8. Rest of North America North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 8.1.1. By Component

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Lancets

- 8.1.1. By Component

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring Blood Glucose Devices

- 9. United States North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Self-monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Medisana

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rossmax

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Trivida

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Platinum Equity (LifeScan)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Acon

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Agamatrix Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 F Hoffmann-La Roche AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Abbott

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bionime Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Arkray

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ascensia

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Medisana

List of Figures

- Figure 1: North America Self-monitoring Blood Glucose Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Self-monitoring Blood Glucose Market Share (%) by Company 2024

List of Tables

- Table 1: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 4: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 5: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Self-monitoring Blood Glucose Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Self-monitoring Blood Glucose Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Self-monitoring Blood Glucose Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Self-monitoring Blood Glucose Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Self-monitoring Blood Glucose Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Self-monitoring Blood Glucose Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Self-monitoring Blood Glucose Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Self-monitoring Blood Glucose Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 20: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 21: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 26: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 27: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 32: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Self-monitoring Blood Glucose Devices 2019 & 2032

- Table 33: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Self-monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Self-monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Self-monitoring Blood Glucose Market?

The projected CAGR is approximately 6.98%.

2. Which companies are prominent players in the North America Self-monitoring Blood Glucose Market?

Key companies in the market include Medisana, Rossmax, Trivida, Platinum Equity (LifeScan), Acon, Agamatrix Inc, F Hoffmann-La Roche AG, Abbott, Bionime Corporation, Arkray, Ascensia.

3. What are the main segments of the North America Self-monitoring Blood Glucose Market?

The market segments include Self-monitoring Blood Glucose Devices, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Blood Glucose Test Strips Held the Largest Market Share in Current Year.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2023: LifeScan announced positive data from a study of real-world evidence supporting its Bluetooth-connected blood glucose meter. Evidence from more than 55,000 people with diabetes demonstrated sustained improvements in readings in range. The analysis focuses on changes over 180 days. LifeScan published results in the peer-reviewed journal Diabetes Therapy. The company’s OneTouch Bluetooth-connected blood glucose meter and mobile diabetes app provide simplicity, accuracy, and trust.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Self-monitoring Blood Glucose Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Self-monitoring Blood Glucose Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Self-monitoring Blood Glucose Market?

To stay informed about further developments, trends, and reports in the North America Self-monitoring Blood Glucose Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence