Key Insights

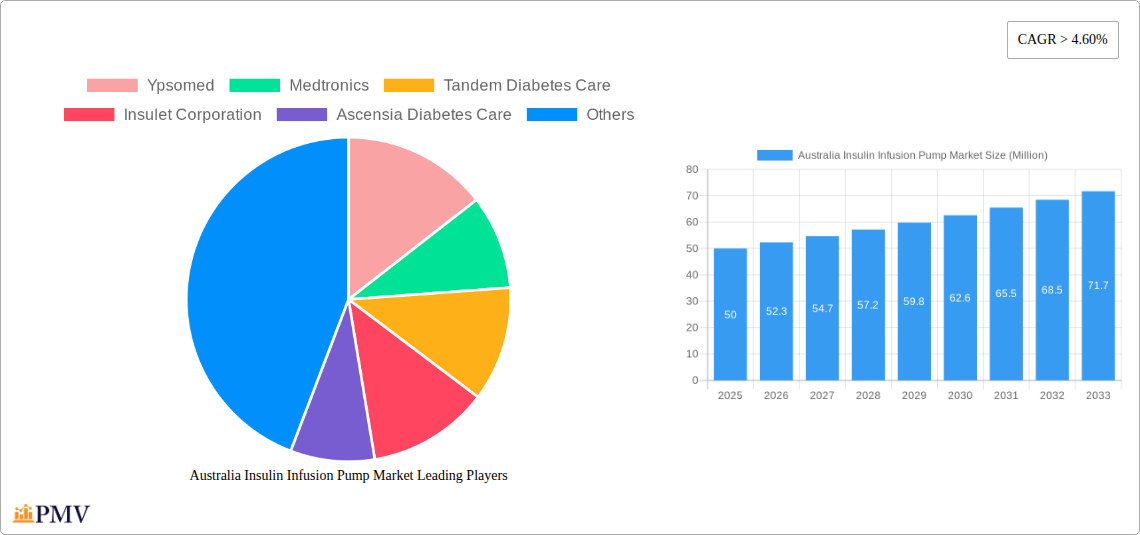

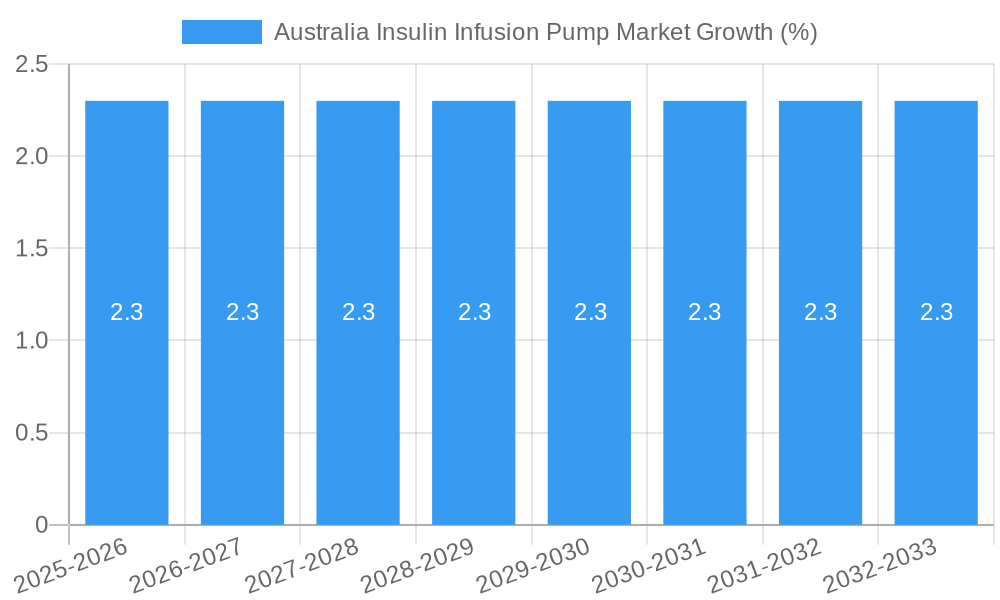

The Australian insulin infusion pump market is experiencing robust growth, driven by increasing prevalence of diabetes, technological advancements in pump features (such as improved accuracy, smaller size, and smart connectivity), and rising awareness of the benefits of insulin pump therapy compared to traditional insulin injections. The market, valued at approximately $50 million AUD in 2025 (estimated based on global market trends and a logical assessment for the Australian context), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.60% from 2025 to 2033. This growth is fueled by several key factors: a growing aging population predisposed to type 2 diabetes, increased government initiatives for diabetes management, and the ongoing development of more sophisticated and user-friendly insulin pump systems. Furthermore, the market segmentation reveals a significant contribution from insulin pump devices, closely followed by infusion sets and reservoirs, reflecting the importance of ongoing supplies and consumables within this sector. The presence of established multinational players like Medtronic and Insulet Corporation, alongside regional players such as Ypsomed, indicates a competitive market with opportunities for innovation and expansion.

The market's growth is however, subject to certain constraints. High initial costs of acquiring insulin pumps and the associated consumables present a significant barrier to entry for some patients. Furthermore, potential complications related to insulin pump therapy and the need for thorough patient training and ongoing monitoring could somewhat temper growth. Despite these challenges, the increasing availability of government subsidies and insurance coverage, coupled with ongoing technological advancements and enhanced patient support programs, is expected to mitigate these challenges and maintain the robust growth trajectory of the Australian insulin infusion pump market throughout the forecast period. Specific regional variations within Australia might be explored in further detailed analysis, however, the national market shows strong growth prospects.

This comprehensive report provides a detailed analysis of the Australia Insulin Infusion Pump Market, covering the period 2019-2033. It offers in-depth insights into market size, growth drivers, competitive landscape, and future opportunities. The report is essential for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic market. With a focus on actionable data and strategic recommendations, this report empowers informed decision-making in the Australian insulin infusion pump sector.

Australia Insulin Infusion Pump Market Structure & Competitive Dynamics

The Australian insulin infusion pump market exhibits a moderately concentrated structure, with key players like Ypsomed, Medtronic, Tandem Diabetes Care, Insulet Corporation, and Ascensia Diabetes Care holding significant market share. The market's innovative ecosystem is driven by ongoing technological advancements in pump design, connectivity, and data analytics. Regulatory frameworks, such as those overseen by the Therapeutic Goods Administration (TGA), play a crucial role in shaping market access and product approvals. The market also faces competition from alternative diabetes management solutions, including insulin pens and oral medications.

End-user trends, particularly the increasing prevalence of diabetes and a growing preference for sophisticated, technologically advanced pump systems, are major growth drivers. Mergers and acquisitions (M&A) activity in the sector, while not prolific in recent years, remains a potential avenue for consolidation and expansion. The total value of M&A deals within the Australian insulin infusion pump market during the historical period (2019-2024) is estimated at xx Million. Market share data for key players is outlined below:

- Medtronic: xx%

- Ypsomed: xx%

- Tandem Diabetes Care: xx%

- Insulet Corporation: xx%

- Ascensia Diabetes Care: xx%

- Others: xx%

Australia Insulin Infusion Pump Market Industry Trends & Insights

The Australian insulin infusion pump market is projected to experience significant growth during the forecast period (2025-2033), driven by factors such as increasing diabetes prevalence, rising healthcare expenditure, and technological advancements. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during this period. Market penetration is currently at approximately xx% of the total diabetes population, indicating considerable growth potential. Technological disruptions, like the integration of continuous glucose monitoring (CGM) systems and improved data management capabilities, are reshaping the market. Consumer preferences are shifting towards smaller, more discreet, and user-friendly devices with advanced features such as automated insulin delivery. Furthermore, government initiatives to improve diabetes care access, such as those detailed below, are instrumental in driving market expansion. Competitive dynamics remain robust, with companies constantly striving to enhance product offerings, improve user experience, and expand market reach. The estimated market size in 2025 is xx Million, projected to reach xx Million by 2033.

Dominant Markets & Segments in Australia Insulin Infusion Pump Market

The Australian insulin infusion pump market is dominated by the urban areas of major cities, due to higher healthcare infrastructure and diabetes prevalence. The key segment within the Insulin Infusion Pump category is the Insulin Pump Device segment which holds the largest market share of xx%, owing to the increasing demand for automated insulin delivery systems.

Key Drivers for Market Dominance:

- High prevalence of diabetes: Australia has a significant population with type 1 and type 2 diabetes.

- Government funding and subsidies: Initiatives like the NDSS have significantly expanded access to insulin pumps.

- Rising healthcare expenditure: Increased government funding and private insurance coverage contribute to market growth.

- Technological advancements: Continuous innovation in device design and features.

Dominance Analysis: The Insulin Pump Device segment dominates due to its effectiveness in managing blood glucose levels. This is further fuelled by the growing awareness of advanced features like bolus calculators and remote monitoring capabilities. The Infusion Set and Reservoir segments are closely linked and experience a dependent growth pattern, directly correlating with the growth of the Insulin Pump Device segment.

Australia Insulin Infusion Pump Market Product Innovations

Recent product innovations in the Australian market highlight a trend towards improved usability and connectivity. Miniaturization, improved accuracy, and seamless integration with CGM systems are key features. These innovations enhance patient compliance and treatment efficacy, gaining a competitive advantage by offering better patient experience and outcomes. The introduction of closed-loop systems promises to revolutionize insulin management by automating insulin delivery based on CGM data.

Report Segmentation & Scope

The report segments the Australian insulin infusion pump market based on product type:

Insulin Pump Device: This segment includes various types of insulin pumps, categorized by features and technology. The segment is expected to experience significant growth due to ongoing technological advancements and rising demand for automated insulin delivery. The market size for 2025 is estimated at xx Million.

Infusion Set: This segment comprises cannulas, insertion sets, and other related accessories. Its growth is intrinsically linked to the growth of the Insulin Pump Device market, with projected growth mirroring that of the parent segment. The market size for 2025 is estimated at xx Million.

Reservoir: This segment encompasses various reservoir types used for storing insulin in insulin pumps. Growth in this segment is directly correlated with the adoption of insulin pump devices. The market size for 2025 is estimated at xx Million.

Key Drivers of Australia Insulin Infusion Pump Market Growth

Several factors contribute to the growth of the Australian insulin infusion pump market. These include:

- Rising prevalence of diabetes: The increasing number of people diagnosed with type 1 and type 2 diabetes fuels demand for effective management solutions.

- Government initiatives: Subsidies and programs like the NDSS significantly improve accessibility to insulin pumps.

- Technological advancements: Continuous improvements in pump technology, such as smaller sizes, improved accuracy, and wireless connectivity, enhance usability and appeal.

- Increased healthcare expenditure: Growing investment in healthcare infrastructure and technology further supports market expansion.

Challenges in the Australia Insulin Infusion Pump Market Sector

The Australian insulin infusion pump market faces several challenges:

- High cost of devices: The high initial cost of insulin pumps remains a barrier to access for many patients.

- Complexity of use: Some devices can be complex to operate and maintain, potentially impacting patient adherence.

- Supply chain disruptions: Global supply chain issues can affect the availability of pumps and related supplies.

- Competition from alternative therapies: Other diabetes management strategies compete for market share.

Leading Players in the Australia Insulin Infusion Pump Market Market

- Ypsomed

- Medtronics

- Tandem Diabetes Care

- Insulet Corporation

- Ascensia Diabetes Care

Key Developments in Australia Insulin Infusion Pump Market Sector

- November 2022: The Albanese Government announced subsidies for the Omnipod insulin pump under the NDSS, significantly increasing access for 130,000 Australians with type 1 diabetes. This boosted market demand and sales.

- July 2022: The Albanese Government's AUD 273.1 Million investment in subsidized CGM products under the NDSS further enhanced access to comprehensive diabetes management, indirectly boosting insulin pump adoption rates.

Strategic Australia Insulin Infusion Pump Market Outlook

The Australian insulin infusion pump market holds significant future potential. Continued government support, technological innovation, and increasing awareness of the benefits of insulin pump therapy will drive market expansion. Strategic opportunities exist for companies to develop innovative products, improve affordability, and expand access to underserved populations. The growing integration of connected health technologies and the potential for advanced closed-loop systems present exciting possibilities for future growth.

Australia Insulin Infusion Pump Market Segmentation

-

1. Component Type

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

-

2. End Users

- 2.1. Hospitals/Clinics

- 2.2. Home Care

- 2.3. Others

Australia Insulin Infusion Pump Market Segmentation By Geography

- 1. Australia

Australia Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing prevalence of Chronic Diseases; Recent Technological Innovations (at the component level) and the Fast-Tracking of Regulatory Approvals in the Field of Wearables; Growth in Demand for Home Care Monitoring

- 3.3. Market Restrains

- 3.3.1. User Readiness and Unresponsiveness of Some Monitoring Devices; Competitive Pricing Pressure and Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals/Clinics

- 5.2.2. Home Care

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ypsomed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tandem Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insulet Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ypsomed

List of Figures

- Figure 1: Australia Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Insulin Infusion Pump Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Component Type 2019 & 2032

- Table 5: Australia Insulin Infusion Pump Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 6: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by End Users 2019 & 2032

- Table 7: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 12: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Component Type 2019 & 2032

- Table 13: Australia Insulin Infusion Pump Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 14: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by End Users 2019 & 2032

- Table 15: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Insulin Infusion Pump Market?

The projected CAGR is approximately > 4.60%.

2. Which companies are prominent players in the Australia Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronics, Tandem Diabetes Care, Insulet Corporation, Ascensia Diabetes Care.

3. What are the main segments of the Australia Insulin Infusion Pump Market?

The market segments include Component Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing prevalence of Chronic Diseases; Recent Technological Innovations (at the component level) and the Fast-Tracking of Regulatory Approvals in the Field of Wearables; Growth in Demand for Home Care Monitoring.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

User Readiness and Unresponsiveness of Some Monitoring Devices; Competitive Pricing Pressure and Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: The Albanese Government is subsidizing the next generation of Omnipod insulin pumps for the 130,000 Australians living with type 1 diabetes. The Government is subsidizing the disposable pods through the National Diabetes Services Scheme (NDSS) at community pharmacies. The Omnipod DASH Insulin Management system includes a waterproof adhesive pod that delivers insulin to the patient alongside a touchscreen device to program and control the pod.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the Australia Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence