Key Insights

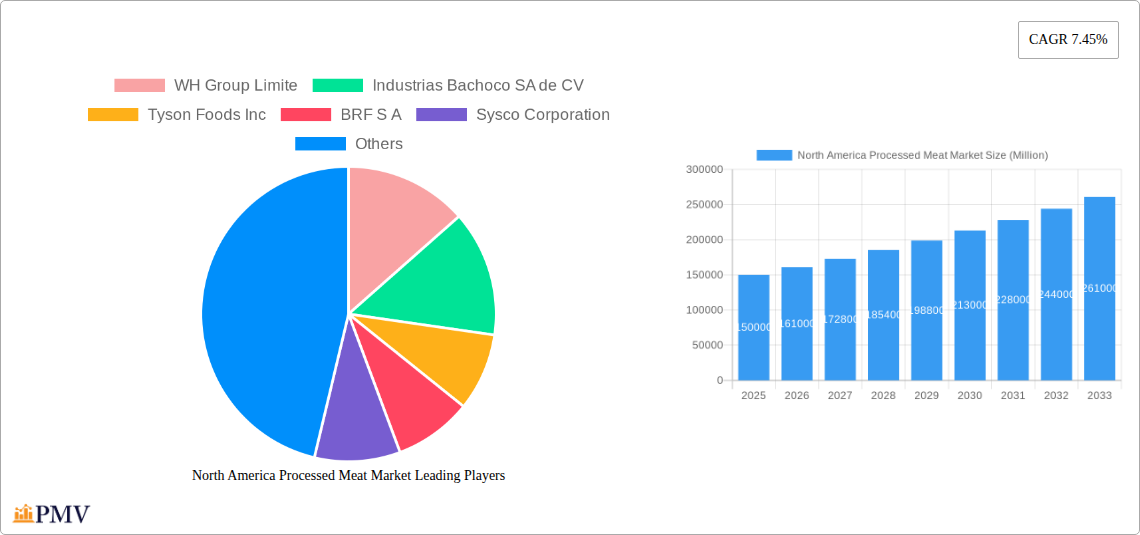

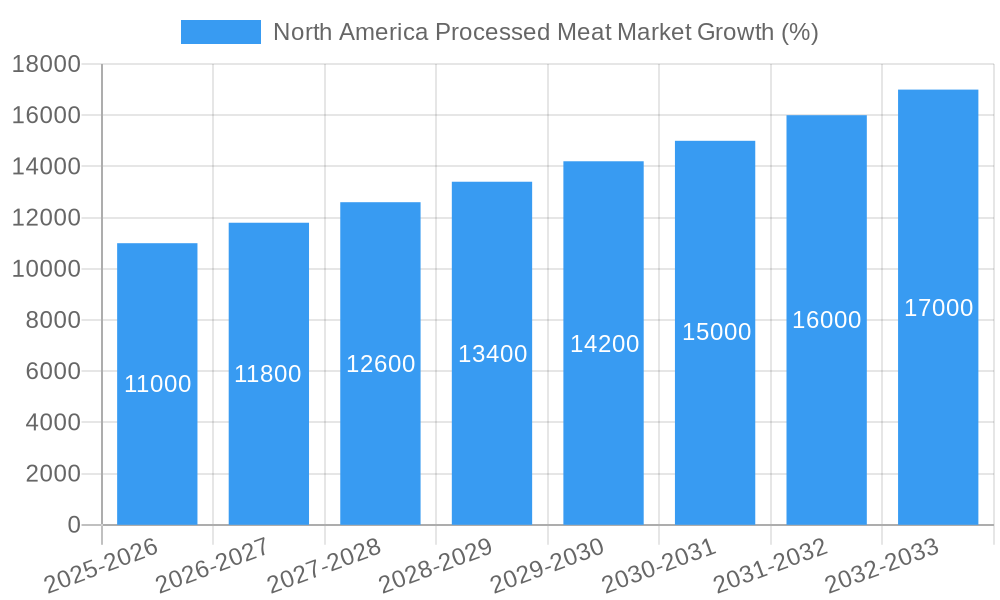

The North American processed meat market, valued at approximately $150 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.45% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer demand for convenient and ready-to-eat meals, particularly within busy lifestyles, significantly boosts the market. Furthermore, the rising popularity of processed meat products in various culinary applications, from sandwiches and burgers to sausages and deli meats, fuels consumption. Innovation in product offerings, such as healthier alternatives with reduced sodium or fat content, and the expansion of diverse flavor profiles cater to evolving consumer preferences, contributing to market growth. The dominance of major players like Tyson Foods, JBS SA, and Hormel Foods, coupled with their strong distribution networks across the US, Canada, and Mexico, further solidifies market strength. However, growing health concerns surrounding the consumption of processed meats, coupled with increasing awareness of their potential link to certain health issues, pose a significant restraint. The market also faces challenges from rising raw material costs and fluctuating livestock prices, which impact profitability. The market segmentation, encompassing various meat types (beef, pork, poultry, mutton), distribution channels (off-trade and on-trade), and regional variations within North America, presents both opportunities and complexities for market players. Future growth will likely be shaped by a balance between consumer demand for convenience, the introduction of healthier options, and effective management of associated health concerns and cost pressures.

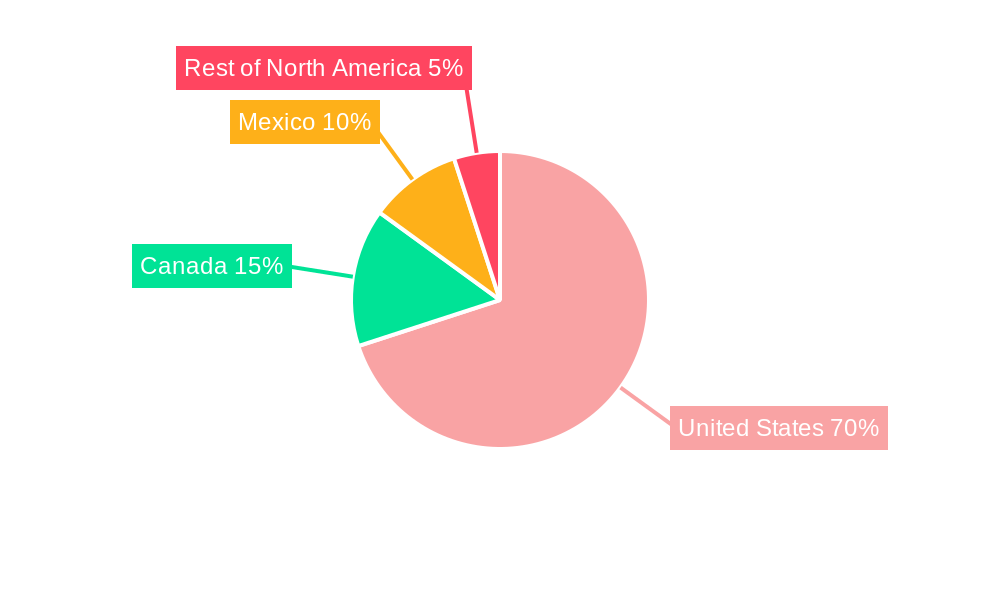

The competitive landscape is highly consolidated, with established multinational corporations holding significant market shares. These companies are actively investing in research and development to improve product quality, expand their product portfolio, and enhance their supply chain efficiency. Strategic partnerships, mergers, and acquisitions are likely to further shape the competitive dynamics in the coming years. The market's success will depend on companies' ability to adapt to changing consumer preferences, address health concerns effectively, and maintain a cost-effective and sustainable production model. Regional variations in consumer preferences and regulatory frameworks within North America will also play a crucial role in shaping future market trends. Specifically, the US market is anticipated to remain the largest contributor to overall market growth, followed by Canada and Mexico, though growth rates in the latter two countries could potentially outpace the US due to factors such as a growing middle class and changing dietary habits.

North America Processed Meat Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides a detailed analysis of the North America processed meat market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The study covers key market segments, competitive landscape, growth drivers, challenges, and emerging trends, offering valuable insights for industry stakeholders. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Processed Meat Market Market Structure & Competitive Dynamics

The North American processed meat market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market's competitive dynamics are shaped by factors including innovation, regulatory compliance, and the increasing demand for healthier and convenient processed meat options. Key players are engaged in various strategic activities such as mergers & acquisitions (M&A), product diversification, and geographic expansion to solidify their position.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This concentration is driven by economies of scale and established distribution networks.

- Innovation Ecosystem: Significant investments in R&D are driving the development of innovative products, including plant-based alternatives and processed meats with enhanced nutritional profiles. This innovation is fueled by consumer demand and competitive pressures.

- Regulatory Frameworks: Stringent food safety regulations and labeling requirements influence market dynamics. Compliance with these regulations is a key factor for market success.

- Product Substitutes: The rising popularity of plant-based meat alternatives poses a growing competitive threat, forcing traditional players to adapt and innovate.

- End-User Trends: Consumer preferences are shifting towards healthier, more sustainable, and convenient processed meat options. This is driving demand for value-added products and smaller pack sizes.

- M&A Activities: The market has witnessed several M&A activities in recent years, with deal values totaling xx Million in the last 5 years. These activities are aimed at expanding market reach, acquiring new technologies, and consolidating market share.

North America Processed Meat Market Industry Trends & Insights

The North American processed meat market is experiencing significant transformation driven by evolving consumer preferences, technological advancements, and economic factors. The market is expected to witness substantial growth, fueled by factors such as rising disposable incomes, changing dietary habits, and the increasing demand for convenient and ready-to-eat meals. However, challenges such as health concerns associated with processed meat consumption and the rising popularity of meat substitutes are impacting market growth.

The market's growth is also influenced by technological advancements in processing and preservation techniques, leading to improved product quality and extended shelf life. The increasing adoption of sustainable practices throughout the supply chain is also gaining traction among environmentally conscious consumers. Competitive dynamics remain intense, with major players focusing on product diversification, brand building, and strategic partnerships to capture market share. The market is expected to experience steady growth, with a projected CAGR of xx% between 2025 and 2033, driven by increasing consumption and innovation. Market penetration of value-added products is estimated at xx% in 2025, expected to rise to xx% by 2033.

Dominant Markets & Segments in North America Processed Meat Market

The United States dominates the North American processed meat market, accounting for the largest market share due to its large population, high meat consumption, and well-established processing infrastructure.

Key Drivers for US Dominance:

- Large and affluent population with high meat consumption.

- Well-developed infrastructure and supply chain.

- Strong presence of major processed meat companies.

- Favorable economic conditions.

Other Significant Markets: Canada and Mexico also contribute significantly to the market, driven by growing demand for processed meat products. The Rest of North America segment exhibits comparatively lower growth, mainly due to factors such as limited population and economic conditions.

Dominant Segments: Poultry and pork represent the largest segments in terms of volume and value, driven by their relatively lower cost and widespread acceptance among consumers. The Beef segment also commands a significant share and is experiencing growth due to rising demand for premium and value-added beef products. The "Other Meat" segment includes mutton and other specialty meats and displays slower growth. The Off-Trade distribution channel dominates due to the majority of processed meat sales occurring in grocery stores and supermarkets.

North America Processed Meat Market Product Innovations

Recent product innovations focus on healthier options, convenience, and improved taste. This includes the introduction of leaner processed meat products, reduced sodium options, and the incorporation of natural flavors and ingredients. Technological advancements in processing and packaging are enabling longer shelf life and improved food safety. The rise of plant-based alternatives presents both a challenge and an opportunity, pushing traditional players to innovate and develop products that cater to changing consumer demands.

Report Segmentation & Scope

This report segments the North American processed meat market based on several key factors:

By Country: United States, Canada, Mexico, Rest of North America. Each country's segment is analyzed based on its specific market dynamics and growth prospects. The United States holds the largest market share, followed by Canada and Mexico. Rest of North America shows comparatively slower growth.

By Type: Beef, Pork, Poultry, Mutton, Other Meat. The poultry and pork segments are the largest, while beef shows strong potential due to rising demand for premium products. Mutton and Other Meat segments have niche demand.

By Distribution Channel: Off-Trade (retail, wholesale) and On-Trade (food service). Off-Trade is the largest distribution channel.

Growth projections for each segment are provided in the full report, along with market size estimations and an analysis of competitive dynamics within each segment.

Key Drivers of North America Processed Meat Market Growth

The North American processed meat market is driven by several key factors:

- Rising Disposable Incomes: Increasing purchasing power enables greater spending on convenience foods.

- Changing Lifestyles and Demographics: Busy lifestyles increase demand for convenient ready-to-eat meals.

- Technological Advancements: Improved processing techniques improve product quality and shelf life.

- Government Support and Initiatives: Supportive policies and investments help streamline the industry.

Challenges in the North America Processed Meat Market Sector

The market faces several challenges including:

- Health Concerns: Concerns regarding the link between processed meat and health issues influence consumer behavior. This is mitigated by the rise in healthier options.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and increase costs. Resilient supply chains are key.

- Intense Competition: The market is highly competitive, with players vying for market share through innovation and pricing strategies.

Leading Players in the North America Processed Meat Market Market

- WH Group Limited

- Industrias Bachoco SA de CV

- Tyson Foods Inc

- BRF S A

- Sysco Corporation

- Continental Grain Company

- Hormel Foods Corporation

- Marfrig Global Foods S A

- Maple Leaf Foods

- JBS SA

- OSI Group

Key Developments in North America Processed Meat Market Sector

- May 2023: Tyson Foods Claryville expanded its cocktail sausage manufacturing capacity by 50%, investing USD 83 Million to meet high customer demand for Hillshire Farm products.

- April 2023: HERDEZ launched its Mexican Refrigerated Entrées line, expanding its product portfolio.

- March 2023: Tyson Foods introduced chicken sandwiches and sliders, targeting the convenience food market.

Strategic North America Processed Meat Market Market Outlook

The North American processed meat market presents significant growth potential in the coming years. Strategic opportunities exist for companies focusing on innovation, sustainability, and health-conscious products. The demand for convenient, ready-to-eat meals and value-added products will continue to drive market growth. Companies that adapt to changing consumer preferences and leverage technological advancements will be well-positioned for success.

North America Processed Meat Market Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Pork

- 1.4. Poultry

- 1.5. Other Meat

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

North America Processed Meat Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Processed Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Pork

- 5.1.4. Poultry

- 5.1.5. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 WH Group Limite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industrias Bachoco SA de CV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tyson Foods Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BRF S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sysco Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental Grain Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hormel Foods Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Marfrig Global Foods S A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Maple Leaf Foods

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JBS SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 OSI Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 WH Group Limite

List of Figures

- Figure 1: North America Processed Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Processed Meat Market Share (%) by Company 2024

List of Tables

- Table 1: North America Processed Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Processed Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Processed Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Processed Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: North America Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Processed Meat Market?

The projected CAGR is approximately 7.45%.

2. Which companies are prominent players in the North America Processed Meat Market?

Key companies in the market include WH Group Limite, Industrias Bachoco SA de CV, Tyson Foods Inc, BRF S A, Sysco Corporation, Continental Grain Company, Hormel Foods Corporation, Marfrig Global Foods S A, Maple Leaf Foods, JBS SA, OSI Group.

3. What are the main segments of the North America Processed Meat Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

May 2023: Tyson Foods Claryville announced its newly expanded cocktail sausage manufacturing capacity, allowing the company to meet high customer demand for its Hillshire Farm brand products. This USD 83 million expansion will add 15,000 square feet to its 342,000 square foot facility and state-of-the-art equipment to increase production by 50% to better serve customers.April 2023: The makers of the HERDEZ® brand announced the launch of its HERDEZ™ Mexican Refrigerated Entrées line with two delicious varieties, including HERDEZ™ Chicken Shredded in Mild Chipotle Sauce and HERDEZ™ Carnitas Slow Cooked Pork.March 2023: Tyson® brand introduces chicken sandwiches and sliders, bringing restaurant-quality taste to home. The new Tyson Chicken Breast Sandwiches and Sliders are available in Original and Spicy. The new product is available in the frozen snacks section at retailers nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Processed Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Processed Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Processed Meat Market?

To stay informed about further developments, trends, and reports in the North America Processed Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence