Key Insights

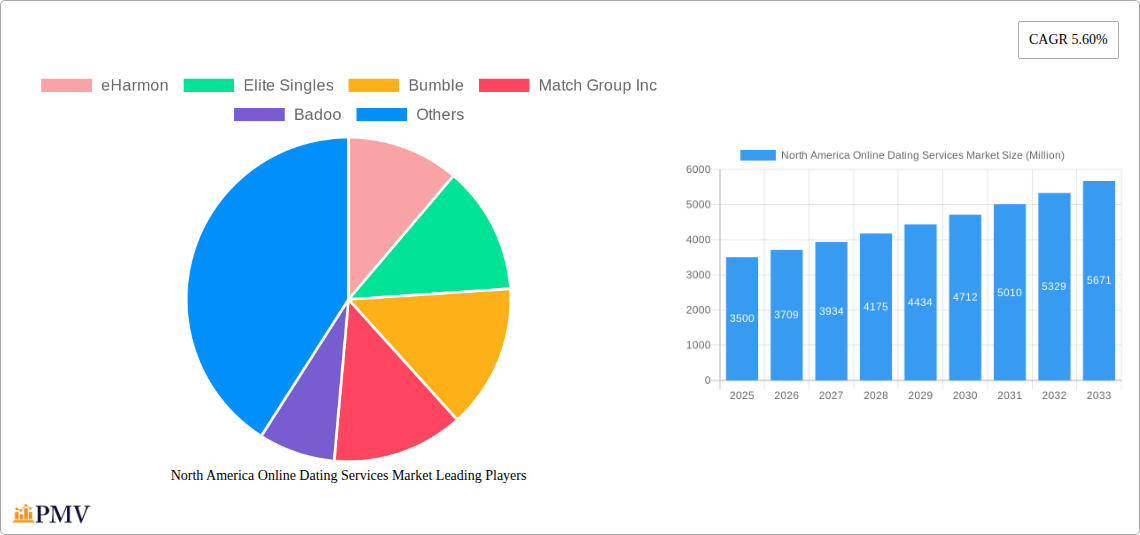

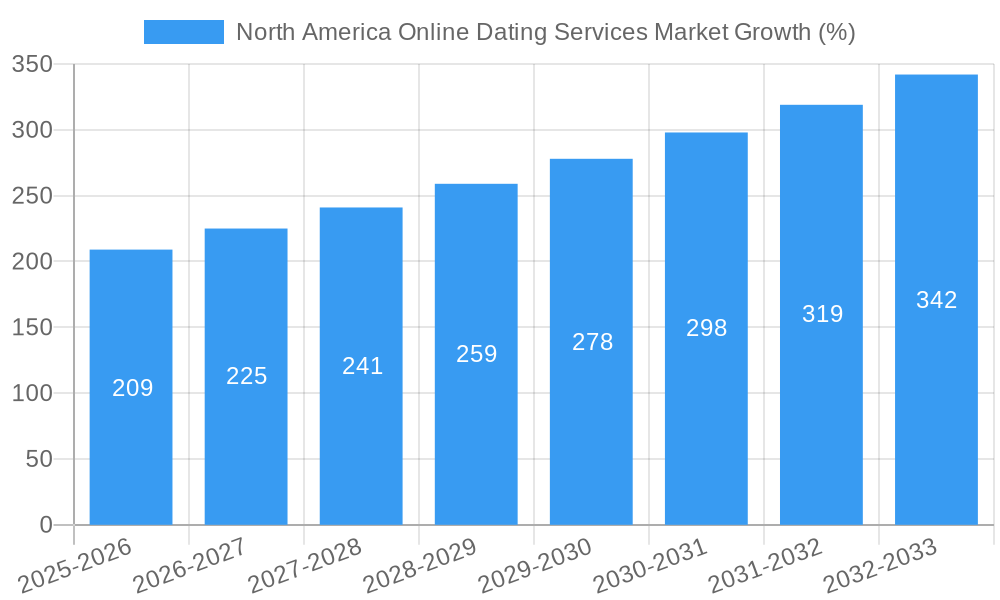

The North American online dating services market, currently experiencing robust growth, is projected to maintain a steady expansion trajectory throughout the forecast period (2025-2033). While precise market size figures for 2025 are not provided, a reasonable estimation, considering a 5.60% CAGR and a known historical period (2019-2024), would place the 2025 market value in the billions of dollars (a specific figure requires additional data points, however, we can safely infer a significant market size). This growth is fueled by several key drivers. The increasing prevalence of smartphone usage and readily available high-speed internet access have significantly broadened the reach and accessibility of online dating platforms. Furthermore, evolving societal norms and changing demographics are fostering a more accepting environment for online dating, contributing to user growth across various age groups. The market's segmentation into paying and non-paying services reflects the diverse needs and preferences of users, with premium features and targeted services appealing to a significant portion of the paying customer base. The United States, as the largest market within North America, commands a substantial share of the overall regional revenue, driven by its large population and high internet penetration rates. Competition within the market is intense, with established players like Match Group Inc and eHarmony alongside newer entrants such as Bumble and Hinge. Future growth will likely hinge on innovation in matching algorithms, enhanced user experience, and the development of more inclusive and personalized services that cater to niche demographics and relationship preferences.

The competitive landscape in North America reflects a mix of established players and disruptive newcomers, constantly vying for market share. Strategies employed by these companies range from aggressive marketing campaigns targeted towards specific user demographics to the implementation of sophisticated matching algorithms and premium subscription models. Challenges remain, particularly in addressing concerns related to online safety and security, data privacy, and the potential for user dissatisfaction due to unmet expectations. The successful companies in this segment will be those that adeptly navigate these challenges while continually innovating and delivering a superior user experience. Given the sustained growth trajectory and anticipated advancements in technology, the North American online dating services market is poised for significant expansion in the coming years. This will necessitate a continued emphasis on data-driven decision making, precise targeting of potential users, and a robust response to emerging market trends.

North America Online Dating Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America online dating services market, covering the period from 2019 to 2033. It offers crucial insights into market size, segmentation, competitive landscape, and future growth potential, equipping businesses and investors with the knowledge needed to navigate this dynamic sector. The report leverages data from the historical period (2019-2024), uses 2025 as the base and estimated year, and projects the market's trajectory until 2033 (forecast period: 2025-2033). Key players analyzed include eHarmony, EliteSingles, Bumble, Match Group Inc., Badoo, OurTime, Spark, happn, Zoosk Inc., BlackPeopleMeet, and Hinge.

North America Online Dating Services Market Structure & Competitive Dynamics

The North American online dating services market exhibits a moderately concentrated structure, dominated by a few large players like Match Group Inc. and Bumble, alongside several niche players catering to specific demographics. The market is characterized by intense competition, driven by continuous innovation in features, user experience, and monetization strategies. Regulatory frameworks vary across states and provinces, impacting data privacy and advertising practices. Product substitutes include traditional dating methods and other social networking platforms, although online dating's convenience and targeted matching continue to drive growth. End-user trends show increasing demand for niche dating apps and enhanced safety features. M&A activities have been significant, with deal values reaching xx Million in recent years, reflecting consolidation and expansion efforts within the market. Match Group's acquisitions have significantly increased its market share.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share.

- Innovation Ecosystems: Rapid innovation in AI-powered matching algorithms, virtual dating features, and enhanced safety mechanisms.

- Regulatory Frameworks: Vary across jurisdictions, influencing data privacy, security, and advertising regulations.

- Product Substitutes: Traditional dating methods and general social networking platforms present alternative options.

- End-User Trends: Growing demand for niche dating apps targeting specific demographics (e.g., LGBTQ+, single parents) and emphasis on safety and security.

- M&A Activities: Significant M&A activity observed, with deals totaling xx Million in recent years, driving market consolidation.

North America Online Dating Services Market Industry Trends & Insights

The North American online dating services market is experiencing robust growth, driven by factors such as increasing smartphone penetration, evolving social norms, and advancements in technology. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the introduction of AI-powered matchmaking and virtual reality dating experiences, are reshaping the landscape. Consumer preferences are shifting towards personalized experiences, increased transparency, and enhanced safety measures. Market penetration remains high in urban areas but is expanding into rural communities. Intense competition among established players and the emergence of new entrants are further driving innovation and market dynamics. The increasing acceptance of online dating as a legitimate way to find romantic partners has also positively impacted growth.

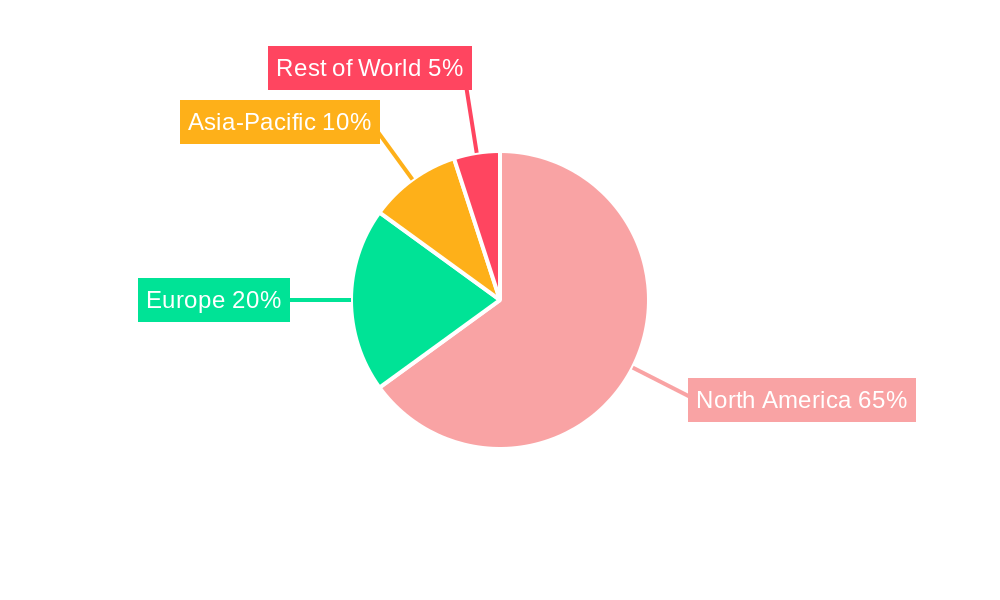

Dominant Markets & Segments in North America Online Dating Services Market

The United States dominates the North American online dating services market, accounting for xx% of the total market value in 2025. This dominance is driven by a large single population, high smartphone penetration, and a relatively mature online dating culture.

By Country:

- United States: High market penetration, large single population, advanced technological infrastructure, and established online dating culture.

- Canada: Moderate growth potential driven by increasing smartphone adoption and changing social attitudes.

- Mexico: Emerging market with significant growth potential but lower penetration compared to the US and Canada.

By Type:

- Paying Online Dating: This segment accounts for a larger share of the market revenue due to premium features and value added services offered to paying customers. The number of paying users is expected to reach xx Million in 2025.

- Non-paying Online Dating: This segment includes free dating apps, which provide basic features but rely on advertising revenue. The number of non-paying users is considerably higher than paying users, and is expected to reach xx Million in 2025.

North America Online Dating Services Market Product Innovations

Recent product innovations have focused on enhancing user experience, improving matching algorithms, and incorporating features to ensure user safety and security. AI-powered matchmaking systems are becoming increasingly sophisticated, leveraging user data and preferences to improve matching accuracy. The integration of video chat and virtual dating features has become more common, addressing the limitations of traditional text-based communication. Apps are incorporating stronger safety features, including background checks and reporting mechanisms, to address concerns about online safety and harassment.

Report Segmentation & Scope

This report segments the North America online dating services market by type (paying and non-paying online dating) and by country (United States, Canada, and Mexico). Each segment is analyzed in detail, providing insights into market size, growth projections, competitive dynamics, and key drivers. For example, the paying online dating segment is expected to grow at a CAGR of xx% from 2025 to 2033, driven by increasing user demand for premium features and personalized services. The United States market is expected to remain the dominant market throughout the forecast period.

Key Drivers of North America Online Dating Services Market Growth

Several factors are driving the growth of the North American online dating services market. Technological advancements, particularly in AI-powered matchmaking and user experience, have significantly enhanced the appeal of these services. The increasing acceptance of online dating as a legitimate way to find romantic partners is also a key driver. Furthermore, economic factors such as rising disposable incomes and increased smartphone penetration contribute to the market's expansion.

Challenges in the North America Online Dating Services Market Sector

The North American online dating services market faces several challenges, including concerns about data privacy and security, the potential for scams and fraudulent profiles, and the ongoing issue of online harassment and safety. Competition is intense, with both established players and new entrants vying for market share. Regulatory changes related to data privacy and user safety could also impact market dynamics.

Leading Players in the North America Online Dating Services Market Market

- eHarmony

- EliteSingles

- Bumble

- Match Group Inc.

- Badoo

- OurTime

- Spark

- happn

- Zoosk Inc.

- BlackPeopleMeet

- Hinge

Key Developments in North America Online Dating Services Market Sector

- March 2022: Match Group Inc. launched Stir, a dating app exclusively for single parents, aiming to cater to a previously underserved demographic of approximately 20 Million single parents in the U.S. This demonstrates an ongoing effort by major players to expand market reach and cater to niche segments.

Strategic North America Online Dating Services Market Outlook

The North America online dating services market presents significant growth opportunities, driven by continued technological advancements, evolving consumer preferences, and the expansion of the market into new demographics and geographic areas. Strategic opportunities exist for companies that can successfully innovate in areas such as AI-powered matchmaking, personalized user experiences, and enhanced safety and security features. The market's future growth will be influenced by factors such as regulatory changes, technological disruptions, and evolving social trends.

North America Online Dating Services Market Segmentation

-

1. Type

- 1.1. Non- paying online dating

- 1.2. Paying Online Dating

North America Online Dating Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Online Dating Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices

- 3.3. Market Restrains

- 3.3.1. Security Concerns of Data Privacy

- 3.4. Market Trends

- 3.4.1. Rapid innovation in service offerings is driving the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non- paying online dating

- 5.1.2. Paying Online Dating

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 eHarmon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elite Singles

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bumble

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Match Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Badoo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 OurTime

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Spark

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 happn

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zoosk Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BlackPeopleMeet

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hinge

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 eHarmon

List of Figures

- Figure 1: North America Online Dating Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Online Dating Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Online Dating Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Online Dating Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Online Dating Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Online Dating Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Online Dating Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: North America Online Dating Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Dating Services Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the North America Online Dating Services Market?

Key companies in the market include eHarmon, Elite Singles, Bumble, Match Group Inc, Badoo, OurTime, Spark, happn, Zoosk Inc, BlackPeopleMeet, Hinge.

3. What are the main segments of the North America Online Dating Services Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices.

6. What are the notable trends driving market growth?

Rapid innovation in service offerings is driving the market growth.

7. Are there any restraints impacting market growth?

Security Concerns of Data Privacy.

8. Can you provide examples of recent developments in the market?

March 2022 - Match Group has announced that it is launching the latest addition to its dating services lineup with Stir, an app designed exclusively for single parents. With the new release, the company aims to address the 20 million single parents in the U.S. who are under-served by existing dating apps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Dating Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Dating Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Dating Services Market?

To stay informed about further developments, trends, and reports in the North America Online Dating Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence