Key Insights

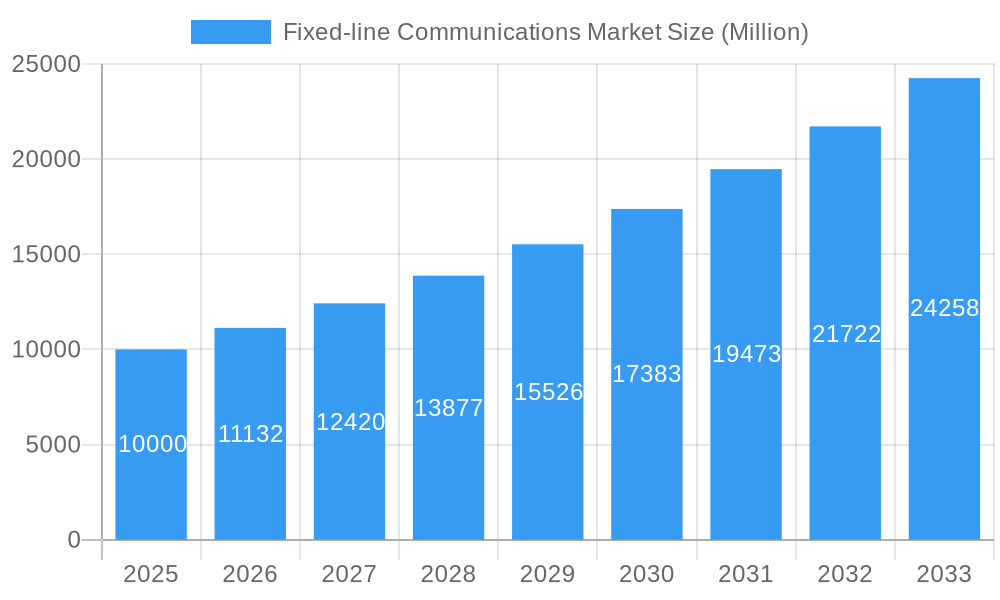

The fixed-line communications market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11.32% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-speed internet access for both residential and commercial purposes, driven by the rise of remote work, online education, and streaming services, is a significant factor. Furthermore, ongoing investments in fiber optic infrastructure and the expansion of 5G networks are laying the groundwork for improved connectivity and higher bandwidth capabilities. Government initiatives promoting digitalization and broadband accessibility in underserved areas are also contributing to market growth. However, the market faces some challenges. Competition from wireless technologies, especially in mobile broadband, and the high cost of infrastructure deployment, particularly in remote regions, represent significant restraints. The market is segmented by product type (routers, set-top boxes (STBs), fiber-optic cables) and end-user (residential, commercial). The residential segment is currently larger, but the commercial sector is expected to see faster growth due to increasing adoption of advanced communication solutions by businesses. Geographically, North America and Europe are currently leading the market, but the Asia-Pacific region is poised for significant growth, driven by rapid economic development and expanding internet penetration in countries like China and India. The competitive landscape includes both established players like Broadcom and Huawei, and smaller, specialized companies focusing on niche technologies. The market's future trajectory hinges on continued technological advancements, regulatory support for infrastructure development, and the evolving needs of consumers and businesses.

Fixed-line Communications Market Market Size (In Billion)

The forecast for the fixed-line communications market through 2033 indicates continued expansion, though the rate of growth may moderate slightly in later years as market saturation is approached in certain regions. The ongoing shift towards fiber-optic technology will continue to reshape the market landscape, pushing providers to invest in infrastructure upgrades and offering higher bandwidth services. This will likely lead to increased competition and price pressures, potentially impacting margins. Strategies focused on delivering superior customer service, bundled service offerings, and expanding into underserved markets will be crucial for success. The ability to adapt to changing technological trends and regulatory frameworks will be vital for companies to maintain a competitive edge and capture market share in this dynamic sector.

Fixed-line Communications Market Company Market Share

Fixed-line Communications Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Fixed-line Communications Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and competitive dynamics. The report segments the market by product type (Routers, Set-top Box (STB), Fiber-optic Cables) and end-user (Residential, Commercial), providing detailed analysis for each segment. Key players like Aerohive Networks Inc, Arista Networks Inc, Albis Technologies AG, Peak Communications Inc, Broadcom Inc, Manx Telecom Trading Ltd, Avaya Inc, Raycap Inc, Huawei Technologies Co Ltd, Allied Telesis Inc, and Arris International PLC are profiled, with their market strategies and competitive landscapes analyzed.

Fixed-line Communications Market Market Structure & Competitive Dynamics

The fixed-line communications market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The market share distribution is dynamic, influenced by continuous innovation, mergers & acquisitions (M&A), and evolving regulatory landscapes. Innovation ecosystems are thriving, with companies investing heavily in research and development to enhance existing technologies and explore new solutions, such as advanced fiber optics and software-defined networking (SDN). Regulatory frameworks vary across regions, influencing market access and operational costs. Product substitutes, including wireless technologies and satellite communication, pose a competitive threat, driving innovation and price competition. End-user trends, particularly the increasing demand for high-bandwidth services in residential and commercial sectors, are shaping market growth.

M&A activity has been significant in recent years, with deal values exceeding xx Million in the period of 2019-2024. For example, the acquisition of smaller companies by larger players indicates a trend towards consolidation and expansion of market reach. The top 5 players hold an estimated xx% market share, while the remaining xx% is distributed among numerous smaller players.

Fixed-line Communications Market Industry Trends & Insights

The fixed-line communications market is experiencing robust growth, driven by factors such as increasing broadband penetration, the proliferation of smart devices, and rising demand for high-speed internet access. The market is witnessing significant technological disruptions, with the adoption of fiber optics, 5G technologies, and software-defined networking (SDN) transforming network infrastructure and service delivery. Consumer preferences are shifting toward higher bandwidth, lower latency, and more reliable connectivity, pushing companies to continually innovate and improve their service offerings.

The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, while market penetration continues to rise, particularly in developing economies. Competitive dynamics remain intense, with players vying for market share through pricing strategies, product differentiation, and strategic partnerships. The market is further segmented by various technologies like DSL, Cable, Fiber, etc. leading to varied market penetration rates. The residential segment is expected to dominate in terms of growth, driven by increasing household broadband subscriptions. The commercial segment also presents significant growth opportunities driven by the growing demand for reliable high speed connectivity for businesses.

Dominant Markets & Segments in Fixed-line Communications Market

The North American region currently holds the dominant position in the fixed-line communications market, driven by high broadband penetration rates, robust infrastructure investments, and a strong regulatory environment fostering competition. The European market is also a significant contributor, witnessing considerable growth due to government initiatives promoting digitalization and the expanding use of fiber-optic networks. Within the product type segments, fiber-optic cables are experiencing the fastest growth due to their superior bandwidth capacity and long-term cost-effectiveness.

Key Drivers for North America:

- Extensive fiber optic infrastructure development.

- Strong government support for broadband expansion.

- High adoption rates of high-speed internet services in residential and commercial sectors.

Key Drivers for Europe:

- Growing investments in next-generation broadband networks.

- Government initiatives to bridge the digital divide.

- Increasing demand for high-bandwidth applications.

The residential end-user segment dominates the market due to the high number of households subscribing to broadband services. However, the commercial sector exhibits strong growth potential driven by increasing enterprise adoption of cloud-based services and the rising need for reliable high-speed internet connectivity.

Fixed-line Communications Market Product Innovations

Recent product innovations in the fixed-line communications market focus on enhancing speed, reliability, and security. The development of advanced fiber-optic cables, supporting significantly higher bandwidths, is a major trend. Furthermore, the integration of software-defined networking (SDN) and network function virtualization (NFV) enables network operators to enhance network agility, scalability, and operational efficiency. These innovations provide competitive advantages by delivering superior customer experiences, increased network capacity, and improved operational efficiency for service providers.

Report Segmentation & Scope

This report segments the fixed-line communications market based on product type (Routers, Set-top Box (STB), Fiber-optic Cables) and end-user (Residential, Commercial).

By Product Type:

Routers: This segment is expected to witness steady growth driven by the increasing demand for high-speed internet access and advanced networking features. The market is highly competitive, with several players offering a wide range of products with varying features and price points.

Set-top Box (STB): This segment is experiencing moderate growth, influenced by the evolving television landscape and the increasing adoption of streaming services. Competition is intense due to technological advancements and the entry of new players.

Fiber-optic Cables: This segment exhibits the highest growth potential, driven by the superior bandwidth capacity and long-term cost-effectiveness of fiber optic technology. The market is relatively concentrated, with a few key players dominating the supply chain.

By End User:

Residential: This segment holds the largest market share, fueled by increasing broadband penetration and the growing demand for high-speed internet services in households. Competition is fierce, with service providers vying for customers through pricing, bundled offers, and improved service quality.

Commercial: This segment is experiencing robust growth driven by the increasing adoption of cloud-based services and the rising need for reliable high-speed internet connectivity in businesses. The market is segmented based on business sizes (small, medium, and large enterprises), each with unique connectivity needs and requirements.

Key Drivers of Fixed-line Communications Market Growth

Several factors are driving the growth of the fixed-line communications market. Technological advancements, such as the widespread adoption of fiber optics and 5G networks, are significantly enhancing network speeds and capacity. Favorable economic conditions, particularly in developing economies, are boosting demand for broadband services. Government regulations promoting digital infrastructure development are creating a supportive environment for market expansion. Furthermore, the increasing demand for bandwidth-intensive applications, such as video streaming and online gaming, are fuelling the growth of the fixed-line communication market.

Challenges in the Fixed-line Communications Market Sector

The fixed-line communications market faces several challenges. Regulatory hurdles, such as licensing requirements and interconnection agreements, can hinder market entry and expansion. Supply chain disruptions, particularly related to the availability of key components, can impact production and delivery timelines. Intense competition from alternative technologies, like wireless communication, puts pressure on pricing and profitability. Furthermore, the need for continuous investment in network infrastructure to meet rising bandwidth demands represents a significant capital expenditure for market players.

Leading Players in the Fixed-line Communications Market Market

- Aerohive Networks Inc

- Arista Networks Inc

- Albis Technologies AG

- Peak Communications Inc

- Broadcom Inc

- Manx Telecom Trading Ltd

- Avaya Inc

- Raycap Inc

- Huawei Technologies Co Ltd

- Allied Telesis Inc

- Arris International PLC

Key Developments in Fixed-line Communications Market Sector

August 2022: Allied Telesis launched the AR4050S-5G Mobile Broadband UTM Firewall, enhancing security solutions for businesses. This launch catered to the increasing demand for secure and reliable connectivity for modern distributed business models.

November 2022: Ciena's acquisition of Benu Networks and Tibit Communication expanded its PON capabilities, improving subscriber management services and broadening access to high-speed internet connectivity. This strategic move strengthens Ciena's position in the fixed-line communication market by improving its service offerings and expanding its customer base.

Strategic Fixed-line Communications Market Market Outlook

The future of the fixed-line communications market appears bright, with continued growth driven by technological advancements, increasing broadband penetration, and supportive government policies. Strategic opportunities lie in investing in advanced fiber optic infrastructure, developing innovative networking solutions, and expanding into underserved markets. Companies that can effectively manage technological disruptions, adapt to changing consumer preferences, and navigate regulatory complexities are well-positioned to capture significant market share and achieve long-term success. The expansion of 5G technology and fiber optics is expected to fuel considerable growth in the coming years.

Fixed-line Communications Market Segmentation

-

1. Product Type

- 1.1. Routers

- 1.2. Set-top Box (STB)

- 1.3. Fiber-optic Cables

-

2. End User

- 2.1. Residential

- 2.2. Commerical

-

3. Application

- 3.1. Voice

- 3.2. Data

- 3.3. Video

Fixed-line Communications Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fixed-line Communications Market Regional Market Share

Geographic Coverage of Fixed-line Communications Market

Fixed-line Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Faster Internet Services by Public; Increasing Demand for Data Centers through Network Equipment; Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Training and Development of Technicians

- 3.4. Market Trends

- 3.4.1. Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Routers

- 5.1.2. Set-top Box (STB)

- 5.1.3. Fiber-optic Cables

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commerical

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Voice

- 5.3.2. Data

- 5.3.3. Video

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Routers

- 6.1.2. Set-top Box (STB)

- 6.1.3. Fiber-optic Cables

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commerical

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Voice

- 6.3.2. Data

- 6.3.3. Video

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Routers

- 7.1.2. Set-top Box (STB)

- 7.1.3. Fiber-optic Cables

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commerical

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Voice

- 7.3.2. Data

- 7.3.3. Video

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Routers

- 8.1.2. Set-top Box (STB)

- 8.1.3. Fiber-optic Cables

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commerical

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Voice

- 8.3.2. Data

- 8.3.3. Video

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Routers

- 9.1.2. Set-top Box (STB)

- 9.1.3. Fiber-optic Cables

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commerical

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Voice

- 9.3.2. Data

- 9.3.3. Video

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Fixed-line Communications Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Routers

- 10.1.2. Set-top Box (STB)

- 10.1.3. Fiber-optic Cables

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commerical

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Voice

- 10.3.2. Data

- 10.3.3. Video

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aerohive Networks Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arista Networks Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Albis Technologies AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Peak Communications Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadcom Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Manx Telecom Trading Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Avaya Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raycap Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allied Telesis Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arris International PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Aerohive Networks Inc

List of Figures

- Figure 1: Global Fixed-line Communications Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Fixed-line Communications Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Fixed-line Communications Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Fixed-line Communications Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Fixed-line Communications Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Fixed-line Communications Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Fixed-line Communications Market Revenue (undefined), by End User 2025 & 2033

- Figure 8: North America Fixed-line Communications Market Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Fixed-line Communications Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Fixed-line Communications Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Fixed-line Communications Market Revenue (undefined), by Application 2025 & 2033

- Figure 12: North America Fixed-line Communications Market Volume (K Unit), by Application 2025 & 2033

- Figure 13: North America Fixed-line Communications Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Fixed-line Communications Market Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Fixed-line Communications Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Fixed-line Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Fixed-line Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Fixed-line Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Fixed-line Communications Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Europe Fixed-line Communications Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Fixed-line Communications Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Fixed-line Communications Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Fixed-line Communications Market Revenue (undefined), by End User 2025 & 2033

- Figure 24: Europe Fixed-line Communications Market Volume (K Unit), by End User 2025 & 2033

- Figure 25: Europe Fixed-line Communications Market Revenue Share (%), by End User 2025 & 2033

- Figure 26: Europe Fixed-line Communications Market Volume Share (%), by End User 2025 & 2033

- Figure 27: Europe Fixed-line Communications Market Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Fixed-line Communications Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe Fixed-line Communications Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Fixed-line Communications Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Fixed-line Communications Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Fixed-line Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Fixed-line Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Fixed-line Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Fixed-line Communications Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Fixed-line Communications Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Fixed-line Communications Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Fixed-line Communications Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Fixed-line Communications Market Revenue (undefined), by End User 2025 & 2033

- Figure 40: Asia Pacific Fixed-line Communications Market Volume (K Unit), by End User 2025 & 2033

- Figure 41: Asia Pacific Fixed-line Communications Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: Asia Pacific Fixed-line Communications Market Volume Share (%), by End User 2025 & 2033

- Figure 43: Asia Pacific Fixed-line Communications Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: Asia Pacific Fixed-line Communications Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Asia Pacific Fixed-line Communications Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Fixed-line Communications Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Fixed-line Communications Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Fixed-line Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Fixed-line Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Fixed-line Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Fixed-line Communications Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Latin America Fixed-line Communications Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Latin America Fixed-line Communications Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Latin America Fixed-line Communications Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Latin America Fixed-line Communications Market Revenue (undefined), by End User 2025 & 2033

- Figure 56: Latin America Fixed-line Communications Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: Latin America Fixed-line Communications Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Latin America Fixed-line Communications Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Latin America Fixed-line Communications Market Revenue (undefined), by Application 2025 & 2033

- Figure 60: Latin America Fixed-line Communications Market Volume (K Unit), by Application 2025 & 2033

- Figure 61: Latin America Fixed-line Communications Market Revenue Share (%), by Application 2025 & 2033

- Figure 62: Latin America Fixed-line Communications Market Volume Share (%), by Application 2025 & 2033

- Figure 63: Latin America Fixed-line Communications Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: Latin America Fixed-line Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Fixed-line Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Fixed-line Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Fixed-line Communications Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 68: Middle East Fixed-line Communications Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Middle East Fixed-line Communications Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Middle East Fixed-line Communications Market Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Middle East Fixed-line Communications Market Revenue (undefined), by End User 2025 & 2033

- Figure 72: Middle East Fixed-line Communications Market Volume (K Unit), by End User 2025 & 2033

- Figure 73: Middle East Fixed-line Communications Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Middle East Fixed-line Communications Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Middle East Fixed-line Communications Market Revenue (undefined), by Application 2025 & 2033

- Figure 76: Middle East Fixed-line Communications Market Volume (K Unit), by Application 2025 & 2033

- Figure 77: Middle East Fixed-line Communications Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: Middle East Fixed-line Communications Market Volume Share (%), by Application 2025 & 2033

- Figure 79: Middle East Fixed-line Communications Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East Fixed-line Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East Fixed-line Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Fixed-line Communications Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Fixed-line Communications Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Fixed-line Communications Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Fixed-line Communications Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Fixed-line Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 19: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 20: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 21: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Fixed-line Communications Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Fixed-line Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 31: Global Fixed-line Communications Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Fixed-line Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 35: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Fixed-line Communications Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Fixed-line Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Fixed-line Communications Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 42: Global Fixed-line Communications Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: Global Fixed-line Communications Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 44: Global Fixed-line Communications Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 45: Global Fixed-line Communications Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 46: Global Fixed-line Communications Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Fixed-line Communications Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Fixed-line Communications Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed-line Communications Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Fixed-line Communications Market?

Key companies in the market include Aerohive Networks Inc, Arista Networks Inc, Albis Technologies AG, Peak Communications Inc, Broadcom Inc, Manx Telecom Trading Ltd, Avaya Inc, Raycap Inc, Huawei Technologies Co Ltd, Allied Telesis Inc, Arris International PLC.

3. What are the main segments of the Fixed-line Communications Market?

The market segments include Product Type, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for Faster Internet Services by Public; Increasing Demand for Data Centers through Network Equipment; Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth.

6. What are the notable trends driving market growth?

Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Training and Development of Technicians.

8. Can you provide examples of recent developments in the market?

November 2022: Ciena, a network equipment and software services supplier, acquired Benu Networks and agreed to acquire Tibit Communication. Ciena will use Tibit's products to add passive optical network (PON) capabilities to its switches and routers to improve subscriber management services and extend PON access to make connectivity easier for end users. These investments support fiber infrastructure, fixed lines, fixed wireless, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed-line Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed-line Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed-line Communications Market?

To stay informed about further developments, trends, and reports in the Fixed-line Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence