Key Insights

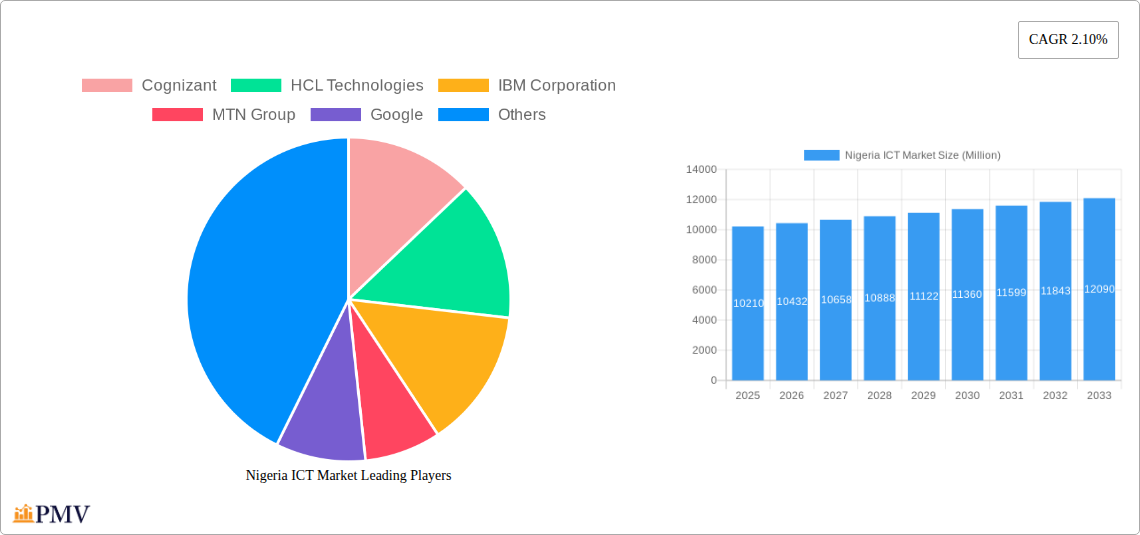

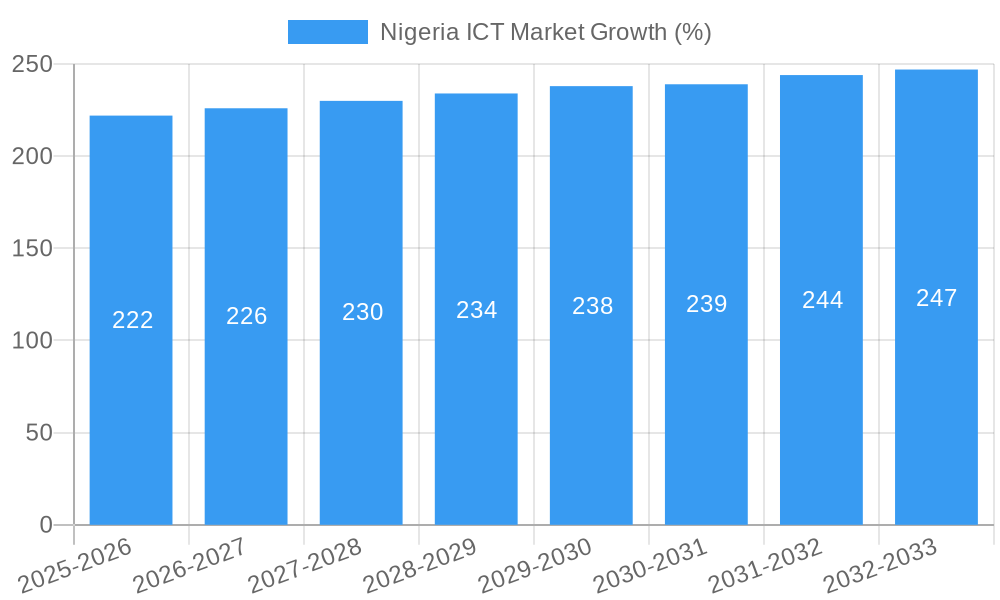

The Nigerian ICT market, exhibiting a CAGR of 2.10%, presents a significant growth opportunity. While the precise market size for 2025 isn't provided, leveraging the 2019-2024 historical period and projecting forward with the given CAGR allows for a reasonable estimate. Assuming a 2024 market size (a reasonable assumption given the forecast period begins in 2025) of approximately $10 billion (a figure consistent with similar developing economies' ICT sectors), the 2025 market size can be estimated at around $10.21 billion. This growth is fueled by several key drivers. Increased smartphone penetration and expanding internet access across the country are creating a massive consumer base for ICT products and services. Government initiatives promoting digitalization, alongside the burgeoning fintech sector, are further boosting demand. The significant presence of multinational corporations like MTN, Globacom, and Etisalat, alongside strong domestic players, ensures a competitive yet dynamic landscape. However, challenges remain, including infrastructure limitations (power supply and internet connectivity in remote areas) and a skills gap in the ICT workforce. These restraints need to be addressed for the market to reach its full potential. Segmentation analysis shows BFSI, IT & Telecom, and Government are major consumers of ICT solutions, with large enterprises leading in adoption. The market's growth trajectory suggests strong potential for hardware, software, and IT services, with telecommunication services continuing to be a cornerstone.

The forecast period (2025-2033) promises sustained growth, driven by increasing digital literacy, government investments in infrastructure development, and the adoption of emerging technologies like cloud computing, AI, and IoT. The continued expansion of mobile money and e-commerce will fuel demand across segments. To maximize potential, addressing infrastructural limitations, focusing on digital skills development, and fostering a supportive regulatory environment are crucial. This will ensure Nigeria's ICT market becomes a significant contributor to the nation’s economic growth and digital transformation. Further diversification into areas like data analytics and cybersecurity will be vital for long-term sustainability and competitiveness.

Nigeria ICT Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the dynamic Nigeria ICT market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, offering valuable insights for investors, businesses, and policymakers. With a base year of 2025 and a forecast period extending to 2033, this report provides a robust understanding of this rapidly evolving sector. The market size is projected to reach xx Million by 2025 and xx Million by 2033.

Nigeria ICT Market Market Structure & Competitive Dynamics

The Nigerian ICT market exhibits a complex interplay of established multinational corporations and agile local players. Market concentration is moderate, with a few dominant players like MTN Group and Globacom holding significant market share in telecommunications, while global giants like Cognizant, HCL Technologies, IBM Corporation, Google, Microsoft Corporation, Infosys, and Oracle Corporation competing intensely in IT services and software. The regulatory framework, while evolving, presents both opportunities and challenges. The presence of numerous smaller players fosters innovation but also intensifies competition. Product substitution is driven by technological advancements, with cloud-based solutions increasingly replacing traditional on-premise systems. End-user trends reveal a growing demand for mobile internet access, cloud services, and digital solutions across various sectors. M&A activity is moderate, with deal values ranging from xx Million to xx Million in recent years. Key M&A activities include (examples needed for specific details - data unavailable for this section).

- Market Concentration: Moderate, with a few dominant players in specific segments.

- Innovation Ecosystems: Active, driven by both local startups and multinational companies.

- Regulatory Framework: Evolving, impacting market entry and operations.

- Product Substitutes: Cloud-based solutions are replacing traditional systems.

- End-User Trends: Growing demand for mobile internet, cloud, and digital solutions.

- M&A Activity: Moderate, with deal values ranging from xx Million to xx Million.

Nigeria ICT Market Industry Trends & Insights

The Nigerian ICT market is experiencing robust growth, driven by increasing internet penetration, mobile phone adoption, and government initiatives to promote digitalization. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of 5G, AI, and IoT, are reshaping the market landscape. Consumer preferences are shifting towards affordable, accessible, and user-friendly technologies. Competitive dynamics are characterized by both price competition and differentiation through innovative offerings. Market penetration of key technologies like cloud computing and mobile money is steadily increasing. The BFSI sector is a major driver of ICT spending, followed by the IT and Telecom sector itself. Government initiatives aimed at digital inclusion are further fueling market growth. Challenges remain, however, including infrastructure gaps, cybersecurity concerns, and digital literacy levels.

Dominant Markets & Segments in Nigeria ICT Market

The Nigerian ICT market demonstrates significant growth across various segments.

By Industry Vertical: The BFSI (Banking, Financial Services, and Insurance) sector exhibits the highest growth, driven by the increasing adoption of fintech solutions and digital banking. The IT and Telecom sector also dominates, fueled by the expansion of mobile network operators and increasing demand for IT services. The government sector is investing heavily in ICT infrastructure and digital transformation initiatives.

By Type: The IT Services segment displays the highest growth due to the increasing outsourcing of IT functions. Telecommunication Services also constitute a significant portion of the market, driven by the widespread adoption of mobile phones and internet services.

By Size of Enterprise: Large Enterprises are the major consumers of ICT solutions, but the SME segment is also showing significant growth as businesses increasingly adopt digital tools.

Key Drivers of Dominance:

- BFSI: Increased adoption of fintech and digital banking.

- IT & Telecom: Expansion of mobile network operators and rising demand for IT services.

- Government: Investments in ICT infrastructure and digital transformation.

- Large Enterprises: High ICT spending capacity.

- SMEs: Increasing adoption of digital tools for business operations.

Nigeria ICT Market Product Innovations

Recent innovations in the Nigerian ICT market include the development of locally relevant software solutions, advancements in mobile money platforms, and the expansion of cloud computing services. These advancements are tailored to address specific market needs and improve user experience. The focus on affordability and accessibility plays a crucial role in the success of these new products, bridging the digital divide and driving market penetration. Competition is further intensified by the introduction of new features and technologies, enhancing the overall user experience.

Report Segmentation & Scope

This report segments the Nigerian ICT market in three ways: by industry vertical, by type of ICT product or service, and by enterprise size.

By Industry Vertical: BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Other Industry Verticals. Each vertical shows distinct growth projections based on specific needs and adoption rates.

By Type: Hardware, Software, IT Services, Telecommunication Services. Growth varies depending on technological trends and market demand.

By Size of Enterprise: Small and Medium Enterprises (SMEs) and Large Enterprises. Growth projections differ considering their varying technological needs and budgets. Competitive landscapes within each segment are analyzed to provide a complete understanding of market dynamics.

Key Drivers of Nigeria ICT Market Growth

Several key factors are driving the growth of Nigeria's ICT market: increasing internet and mobile phone penetration, government initiatives promoting digital inclusion, expanding investment in ICT infrastructure, a burgeoning startup ecosystem, and the growing demand for digital solutions across diverse sectors. The rising adoption of mobile money and fintech services further fuels market expansion.

Challenges in the Nigeria ICT Market Sector

The Nigerian ICT market faces challenges, including limited access to electricity in certain regions, cybersecurity threats, infrastructure limitations (especially broadband access), high cost of internet access, and a skills gap in the ICT workforce. These factors can hinder market growth and penetration. Addressing these challenges is crucial for sustainable development of the sector.

Leading Players in the Nigeria ICT Market Market

- Cognizant

- HCL Technologies

- IBM Corporation

- MTN Group

- Microsoft Corporation

- Infosys

- Globacom

- Oracle Corporation

- Dataflex

- Etisalat

Key Developments in Nigeria ICT Market Sector

- December 2022: Microsoft Corporation announced plans to expand internet access to over 100 million Africans by 2025 through satellite partnerships, paving the way for greater cloud adoption.

- October 2022: Google announced the launch of a cloud region in South Africa, with Cloud Interconnect sites in Lagos (Nigeria), boosting cloud capabilities for customers and partners across Africa.

Strategic Nigeria ICT Market Market Outlook

The future of the Nigerian ICT market appears promising, with continued growth driven by increasing digitalization, investment in infrastructure, and government support. Strategic opportunities exist for companies to leverage technological advancements, cater to the growing demand for digital solutions across various sectors, and address the unique challenges facing the market. Focusing on affordability, accessibility, and local relevance will be crucial for success.

Nigeria ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Nigeria ICT Market Segmentation By Geography

- 1. Niger

Nigeria ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Digitalization and Scalable IT Infrastructure4.; Deployment of 5G network in the Country

- 3.3. Market Restrains

- 3.3.1. Difficulties in the Smooth Handling of Enterprise Data during Mergers and Acquisitions; Security Issues Associated With Cloud and Mobile Technologies

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Digitalization and Scalable IT Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cognizant

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HCL Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MTN Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Microsoft Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Infosys

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Globacom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dataflex*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Etisalat

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cognizant

List of Figures

- Figure 1: Nigeria ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Nigeria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Nigeria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Nigeria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Nigeria ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Nigeria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Nigeria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Nigeria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Nigeria ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria ICT Market?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Nigeria ICT Market?

Key companies in the market include Cognizant, HCL Technologies, IBM Corporation, MTN Group, Google, Microsoft Corporation, Infosys, Globacom, Oracle Corporation, Dataflex*List Not Exhaustive, Etisalat.

3. What are the main segments of the Nigeria ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Digitalization and Scalable IT Infrastructure4.; Deployment of 5G network in the Country.

6. What are the notable trends driving market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure.

7. Are there any restraints impacting market growth?

Difficulties in the Smooth Handling of Enterprise Data during Mergers and Acquisitions; Security Issues Associated With Cloud and Mobile Technologies.

8. Can you provide examples of recent developments in the market?

December 2022: Microsoft Corporation planned to ensure internet access for over 100 million Africans by 2025 by collaborating with a satellite provider and setting the groundwork for long-term cloud adoption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria ICT Market?

To stay informed about further developments, trends, and reports in the Nigeria ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence