Key Insights

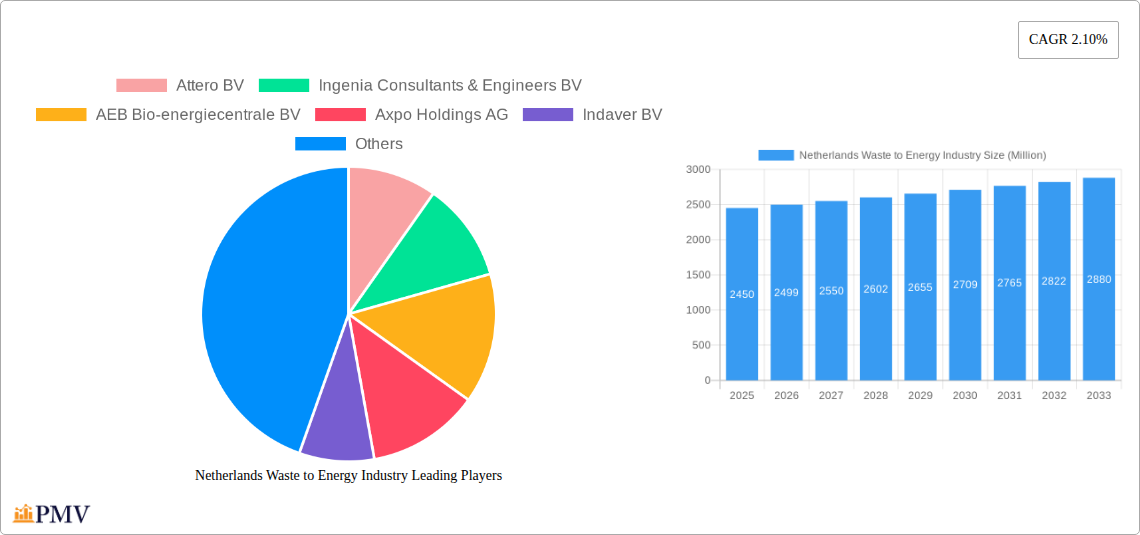

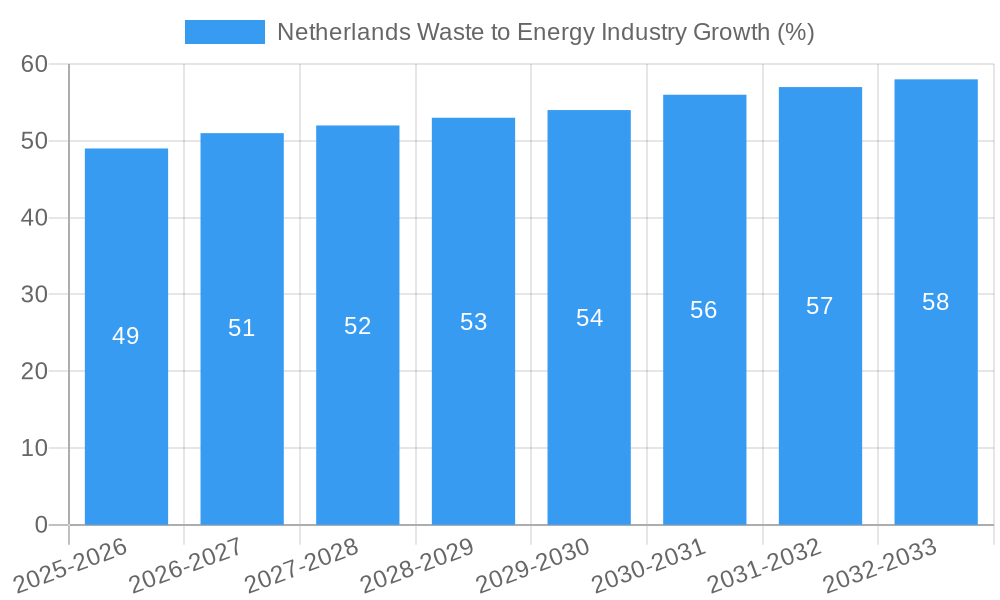

The Netherlands waste-to-energy (WtE) market, valued at €2.45 billion in 2025, is poised for steady growth, projected at a Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. This growth is driven by several key factors. Stringent EU regulations on landfill waste disposal are pushing municipalities and industries to adopt more sustainable waste management practices, increasing the demand for WtE solutions. Furthermore, rising energy prices and the Netherlands' commitment to renewable energy targets are incentivizing investment in WtE technologies, which provide a reliable and environmentally friendly source of energy. Technological advancements in incineration, gasification, and anaerobic digestion are also contributing to increased efficiency and reduced environmental impact, making WtE a more attractive option. The market is segmented by technology (incineration being the dominant player, followed by anaerobic digestion and gasification), waste type (municipal solid waste forming the largest segment), and end-user (industrial and commercial sectors leading the demand). While challenges remain, such as the need for robust infrastructure and public perception regarding WtE technologies, the overall market outlook remains positive. The presence of established players like Attero BV and Indaver BV, alongside international companies like Mitsubishi Heavy Industries, indicates a competitive yet promising landscape.

The specific regional breakdown within the Netherlands is not provided. However, given the country's dense population and strong environmental policies, we can assume a concentrated market primarily driven by municipal solid waste from major urban areas. The dominance of incineration likely stems from its mature technology and existing infrastructure. However, future growth is likely to be fueled by the adoption of more advanced technologies, particularly anaerobic digestion, which offers opportunities for biogas production and reduced greenhouse gas emissions. This shift reflects the broader European trend toward a circular economy, where waste is treated as a resource rather than a disposal problem. The competition amongst established players and new entrants will further drive innovation and efficiency within the Netherlands WtE sector, leading to continued growth.

This comprehensive report provides an in-depth analysis of the Netherlands waste-to-energy industry, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and analysis to inform strategic decision-making. The report covers key segments including incineration, gasification, pyrolysis, anaerobic digestion, and refuse-derived fuel technologies, encompassing municipal solid waste, industrial waste, hazardous waste, and agricultural waste streams for residential, commercial, and industrial end-users. The market size is projected to reach xx Million by 2033.

Netherlands Waste to Energy Industry Market Structure & Competitive Dynamics

The Netherlands waste-to-energy market exhibits a moderately concentrated structure, with several major players alongside numerous smaller operators. Key players include Attero BV, Ingenia Consultants & Engineers BV, AEB Bio-energiecentrale BV, Axpo Holdings AG, Indaver BV, Dutch Incinerators BV, AEB Amsterdam, and Mitsubishi Heavy Industries Ltd. However, the market is characterized by a dynamic competitive landscape influenced by technological advancements, regulatory changes, and evolving waste management strategies. Market share data for 2024 indicates that Attero BV holds approximately xx% market share, followed by Indaver BV with xx%. Several smaller companies constitute the remaining xx% of the market.

The regulatory framework, emphasizing sustainable waste management and carbon reduction targets, significantly influences market dynamics. Recent years have witnessed a rise in M&A activity, driven by consolidation efforts and the pursuit of economies of scale. Deal values have fluctuated; with one notable transaction reaching approximately xx Million in 2022 (example transaction). Innovative technologies, such as carbon capture and hydrogen production from waste, are emerging as key growth drivers, attracting significant investments. The substitution of landfill disposal with waste-to-energy solutions is another significant market driver. Finally, consumer preferences for environmentally friendly waste management practices are also shaping industry trends.

Netherlands Waste to Energy Industry Industry Trends & Insights

The Netherlands waste-to-energy market is experiencing robust growth, driven by stringent environmental regulations, increasing waste generation, and government incentives for renewable energy. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the increasing adoption of waste-to-energy technologies. Market penetration of advanced technologies like gasification and pyrolysis is gradually increasing, although incineration remains the dominant technology due to its established infrastructure and cost-effectiveness.

Technological disruptions, such as the integration of carbon capture technologies and the development of waste-to-hydrogen solutions, are reshaping the industry. The market is witnessing a shift towards more efficient and sustainable waste processing methods, driven by the circular economy principles and the pursuit of carbon neutrality. Consumer preferences are also increasingly favoring environmentally responsible waste management solutions, leading to increased demand for waste-to-energy services. Competitive dynamics are marked by innovation, technological leadership, and strategic partnerships among industry players to expand market reach and enhance service offerings.

Dominant Markets & Segments in Netherlands Waste to Energy Industry

The Netherlands waste-to-energy market is broadly segmented by technology, waste type, and end-user. Incineration currently dominates the technology segment due to its established infrastructure and cost-efficiency. However, the market is witnessing a growing interest in alternative technologies like anaerobic digestion and gasification, driven by their environmental benefits. Municipal solid waste accounts for the largest share of waste processed, followed by industrial waste. The residential sector is the primary end-user, with a significant contribution from the commercial and industrial sectors.

Key Drivers for Incineration Dominance:

- Established infrastructure

- Cost-effectiveness

- High energy recovery rates

- Proven technological maturity

Key Drivers for Growth in Anaerobic Digestion:

- Renewable energy generation from biogas

- Reduced greenhouse gas emissions

- Potential for producing biofertilizers

The dominance of these segments is primarily attributed to:

- High Waste Generation: The Netherlands generates a substantial volume of waste, creating a substantial demand for waste processing solutions.

- Stringent Environmental Regulations: Stricter environmental regulations and targets aimed at reducing landfill waste and greenhouse gas emissions are driving the adoption of waste-to-energy technologies.

- Government Support: Government incentives and subsidies for renewable energy sources and sustainable waste management practices are further stimulating market growth.

Netherlands Waste to Energy Industry Product Innovations

Recent innovations include advanced incineration systems with enhanced energy recovery, integrated carbon capture technologies, and the development of waste-to-hydrogen plants. These advancements are enhancing the environmental performance of waste-to-energy facilities, reducing greenhouse gas emissions and diversifying energy production pathways. The improved efficiency and environmental footprint of these new technologies increase their market attractiveness. Moreover, the integration of digital technologies for optimized process control and waste management further enhances these systems' competitiveness.

Report Segmentation & Scope

The report provides a comprehensive segmentation of the Netherlands waste-to-energy market based on the following parameters:

Technology: Incineration, Gasification, Pyrolysis, Anaerobic Digestion, Refuse-Derived Fuel. Each technology segment's growth projection, market size, and competitive dynamics are analyzed. Incineration is projected to maintain its dominance, while newer technologies are showing promising growth potential.

Waste Type: Municipal Solid Waste, Industrial Waste, Hazardous Waste, Agricultural Waste. Market sizes and growth rates vary significantly across these segments, with municipal solid waste representing the largest share.

End-User: Industrial, Commercial, Residential. Each segment's unique characteristics, waste generation patterns, and demand for waste-to-energy services are extensively analyzed. The residential sector is projected to remain the largest end-user due to high volumes of municipal solid waste generated.

Key Drivers of Netherlands Waste to Energy Industry Growth

The growth of the Netherlands waste-to-energy industry is fueled by several key factors: stringent environmental regulations promoting sustainable waste management; increasing waste generation due to population growth and economic activity; government incentives and subsidies supporting renewable energy sources; and the rising adoption of advanced technologies offering enhanced energy recovery and reduced environmental impact. Furthermore, the increasing focus on a circular economy and the integration of carbon capture technologies further drives market expansion.

Challenges in the Netherlands Waste to Energy Industry Sector

Challenges include securing necessary permits and navigating complex regulatory processes; managing fluctuating waste streams and ensuring consistent feedstock supply; intense competition from other waste management technologies; and securing sufficient funding for large-scale projects. High capital expenditure requirements for new plants and the need for skilled labor to operate complex systems also pose significant challenges. The potential for public opposition to new facilities also forms a significant obstacle.

Leading Players in the Netherlands Waste to Energy Industry Market

- Attero BV

- Ingenia Consultants & Engineers BV

- AEB Bio-energiecentrale BV

- Axpo Holdings AG

- Indaver BV

- Dutch Incinerators BV

- AEB Amsterdam

- Mitsubishi Heavy Industries Ltd

Key Developments in Netherlands Waste to Energy Industry Sector

January 2023: RWE received USD 117 Million from the European Union's Innovation Fund to build a waste-to-hydrogen project in the Netherlands. This highlights the increasing focus on innovative technologies and the substantial funding available for green initiatives.

May 2022: Aker Carbon Capture began building its Just Catch modular carbon capture plant at Twence's waste-to-energy plant in Hengelo. This signifies a significant step towards reducing CO2 emissions from waste incineration and shows the adoption of carbon capture technologies in the sector. The plant's expected annual capture of 100,000 metric tons of CO2 by the end of 2023 demonstrates the scale of technological advancements.

Strategic Netherlands Waste to Energy Industry Market Outlook

The Netherlands waste-to-energy market holds significant growth potential, driven by the continuous need for sustainable waste management solutions, ambitious environmental targets, and advancements in waste-to-energy technologies. Strategic opportunities lie in developing innovative technologies such as waste-to-hydrogen and carbon capture, expanding existing infrastructure, and forging strategic partnerships to consolidate market share. Investments in research and development to improve the efficiency and sustainability of waste-to-energy processes will be crucial for future growth. The increasing awareness of climate change and the circular economy principles will further propel the growth of this industry.

Netherlands Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Incineration

- 1.2. Gasification

- 1.3. Pyrolysis

- 1.4. Anaerobic Digestion

- 1.5. Refuse-Derived Fuel

-

2. Waste Type

- 2.1. Municipal Solid Waste

- 2.2. Industrial Waste

- 2.3. Hazardous Waste

- 2.4. Agricultural Waste

-

3. End-User

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

Netherlands Waste to Energy Industry Segmentation By Geography

- 1. Netherlands

Netherlands Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Thermal Technologies Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Incineration

- 5.1.2. Gasification

- 5.1.3. Pyrolysis

- 5.1.4. Anaerobic Digestion

- 5.1.5. Refuse-Derived Fuel

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Municipal Solid Waste

- 5.2.2. Industrial Waste

- 5.2.3. Hazardous Waste

- 5.2.4. Agricultural Waste

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Attero BV

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ingenia Consultants & Engineers BV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 AEB Bio-energiecentrale BV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Axpo Holdings AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Indaver BV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dutch Incinerators BV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 AEB Amsterdam

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Mitsubishi Heavy Industries Ltd *List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Attero BV

List of Figures

- Figure 1: Netherlands Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Waste to Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2019 & 2032

- Table 4: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Netherlands Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Netherlands Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2019 & 2032

- Table 15: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Netherlands Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Waste to Energy Industry?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Netherlands Waste to Energy Industry?

Key companies in the market include Attero BV, Ingenia Consultants & Engineers BV, AEB Bio-energiecentrale BV, Axpo Holdings AG, Indaver BV, Dutch Incinerators BV, AEB Amsterdam, Mitsubishi Heavy Industries Ltd *List Not Exhaustive.

3. What are the main segments of the Netherlands Waste to Energy Industry?

The market segments include Technology, Waste Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Thermal Technologies Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

January 2023: RWE received USD 117 million from the European Union's Innovation Fund to help build a waste-to-hydrogen project in an industrial cluster in the Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the Netherlands Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence