Key Insights

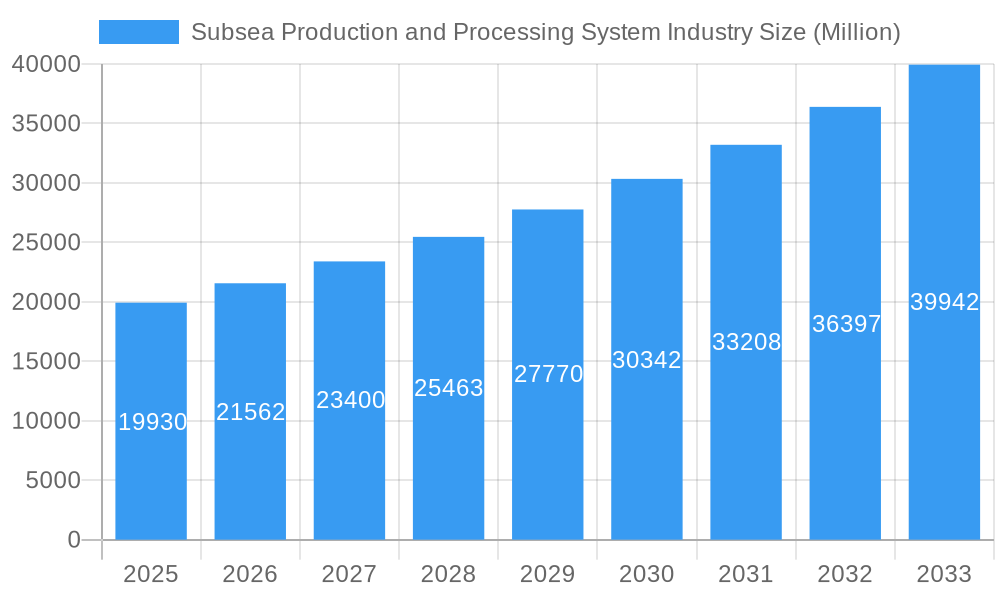

The subsea production and processing systems market is experiencing robust growth, projected to reach a market size of $19.93 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 8.51%. This expansion is driven by several key factors. Firstly, the increasing demand for offshore oil and gas resources, particularly in deepwater and ultra-deepwater environments, necessitates sophisticated subsea technologies for efficient extraction and processing. Secondly, advancements in subsea processing technologies, including improved boosting, separation, and injection systems, enable the development of more complex and remote offshore fields. Furthermore, the ongoing transition towards cleaner energy sources is also playing a role, with subsea systems being increasingly integrated into carbon capture and storage projects. Finally, stringent environmental regulations are driving the adoption of advanced technologies aimed at minimizing environmental impact during offshore operations.

Subsea Production and Processing System Industry Market Size (In Billion)

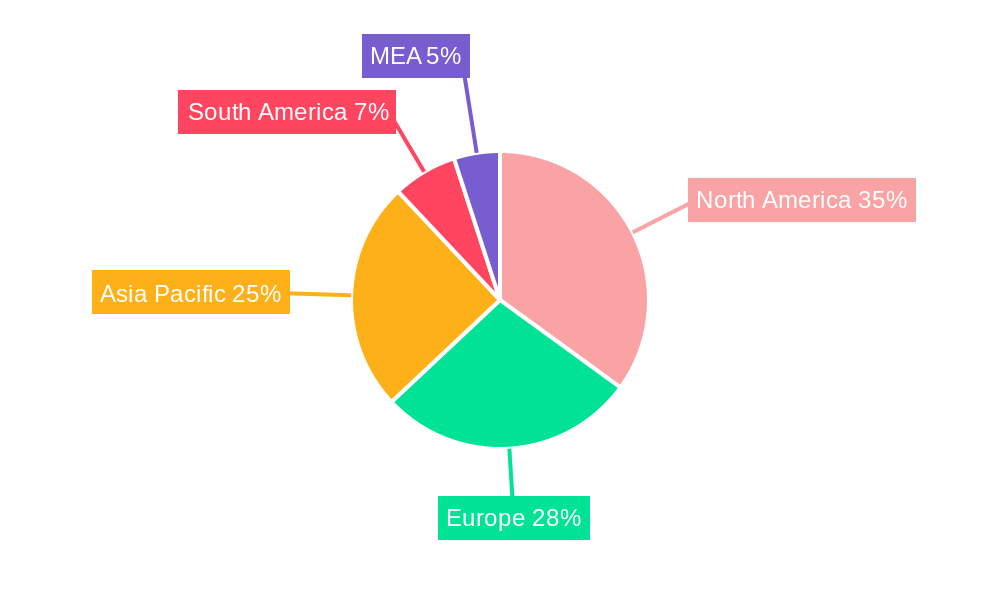

Growth is expected to continue throughout the forecast period (2025-2033), fueled by ongoing exploration and development activities in key regions such as North America, Europe, and the Asia-Pacific. The market segmentation reveals significant opportunities across various components (subsea trees, umbilicals, risers, flowlines, and wellheads) and processing types (boosting, separation, injection, and gas compression). While the dominance of established players like Aker Solutions, Subsea 7, and Schlumberger is undeniable, the market is also witnessing the emergence of innovative companies offering specialized solutions. Geographic variations in market growth will be influenced by factors such as government policies, regulatory frameworks, and the availability of resources. The ongoing technological advancements and increasing investment in offshore infrastructure are poised to further drive the growth of the subsea production and processing systems market over the next decade.

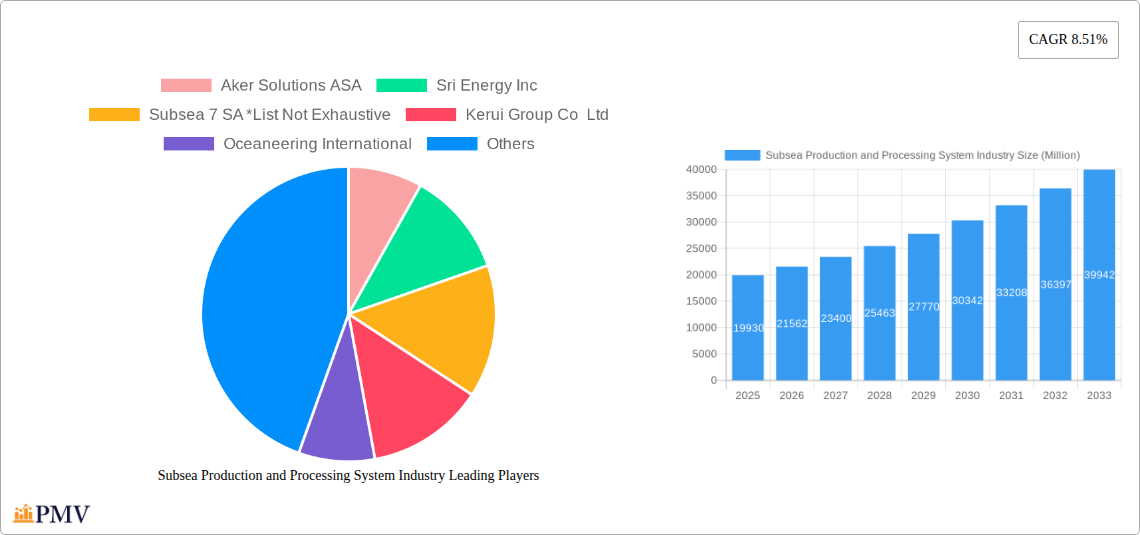

Subsea Production and Processing System Industry Company Market Share

This detailed report provides a comprehensive analysis of the Subsea Production and Processing System industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report analyzes key market segments, identifies leading players like Aker Solutions ASA, Sri Energy Inc, Subsea 7 SA, Kerui Group Co Ltd, Oceaneering International, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Schlumberger Limited, and TechnipFMC PLC (list not exhaustive), and forecasts future growth trajectories. The report's value exceeds xx Million.

Subsea Production and Processing System Industry Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the subsea production and processing systems market, considering market concentration, innovation, regulatory frameworks, and M&A activities. The industry exhibits a moderately concentrated structure, with several major players holding significant market share. Aker Solutions ASA, Schlumberger Limited, and TechnipFMC PLC, for example, command substantial portions of the market, estimated at xx% , xx%, and xx%, respectively, in 2025. However, several smaller, specialized companies also contribute significantly to innovation and niche market segments.

The innovation ecosystem is highly active, driven by the need for improved efficiency, enhanced safety, and deeper water operation capabilities. Regulatory frameworks, particularly concerning environmental protection and operational safety, significantly impact industry players. Stringent regulations concerning emissions and waste management drive investment in environmentally friendly technologies. Product substitutes are limited, as subsea production systems are crucial for offshore oil and gas extraction. However, the increasing adoption of renewable energy sources presents a long-term challenge to market growth.

M&A activity has been relatively consistent, with deal values totaling approximately xx Million in the last five years. These mergers and acquisitions primarily aim to expand geographic reach, acquire technological expertise, and strengthen market position. Future M&A activity is expected to be driven by the need to consolidate market share and access new technologies.

Subsea Production and Processing System Industry Industry Trends & Insights

The subsea production and processing system market is witnessing robust growth, driven by several factors. The increasing demand for offshore oil and gas, coupled with exploration and production activities in deepwater and ultra-deepwater environments, is a primary driver. Technological advancements in subsea equipment, such as improved materials, enhanced automation, and remote operational capabilities, are also fueling market growth. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Consumer preferences, mainly from oil and gas companies, are shifting towards more efficient, reliable, and environmentally friendly systems. This trend is prompting manufacturers to invest in research and development to offer advanced solutions. Market penetration of advanced technologies like subsea processing and remotely operated vehicles (ROVs) is steadily increasing, expected to reach xx% by 2033. Competitive dynamics remain intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to secure market share.

Dominant Markets & Segments in Subsea Production and Processing System Industry

The deepwater segment currently dominates the subsea production and processing system market, driven by the ongoing exploration and production activities in deepwater and ultra-deepwater regions globally. Specifically, the regions of the Gulf of Mexico, Brazil, and the North Sea exhibit the highest growth potential and market size.

- Key Drivers for Deepwater Dominance:

- Vast reserves of oil and gas in deepwater areas

- Technological advancements enabling efficient deepwater operations

- Significant investments by major oil and gas companies in deepwater exploration and production

- Favorable government policies and regulatory frameworks in some key regions

Within the production system components, Subsea Trees and Subsea Umbilicals, Risers, & Flowlines hold the largest market share due to their critical role in the extraction process. The gas compression segment is a rapidly growing sub-segment in the processing system type, driven by rising demand for natural gas.

Subsea Production and Processing System Industry Product Innovations

Recent product innovations center on enhanced automation, remote monitoring, and digitalization. Subsea processing systems are becoming increasingly sophisticated, enabling increased production efficiency and reduced environmental impact. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is further enhancing the operational efficiency and predictive maintenance capabilities of these systems, offering substantial competitive advantages.

Report Segmentation & Scope

This report segments the subsea production and processing system market based on production system components (Subsea Trees, Subsea Umbilicals, Risers & Flowlines, Subsea Wellhead, Other), processing system type (Boosting, Separation, Injection, Gas Compression), and water depth (Shallow Water, Deepwater, Ultra-Deepwater). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail within the complete report. For instance, the deepwater segment is projected to show a faster growth rate compared to shallow water, while the subsea trees component is expected to dominate the production system segment.

Key Drivers of Subsea Production and Processing System Industry Growth

Several factors drive the growth of the subsea production and processing system market. These include:

- Technological advancements: Improvements in materials, automation, and remote operation capabilities enhance efficiency and reduce costs.

- Rising demand for offshore oil and gas: Global energy demand fuels exploration and production activities in challenging environments.

- Government initiatives and policies: Supportive regulations and incentives promote offshore energy exploration and development.

Challenges in the Subsea Production and Processing System Industry Sector

Despite significant growth potential, the industry faces several challenges:

- High capital expenditure: Developing and deploying subsea systems requires substantial upfront investment.

- Complex operations and maintenance: Operating in harsh underwater environments poses significant technical and logistical challenges.

- Environmental regulations: Stringent environmental regulations can constrain operations and increase costs.

Leading Players in the Subsea Production and Processing System Industry Market

- Aker Solutions ASA

- Sri Energy Inc

- Subsea 7 SA

- Kerui Group Co Ltd

- Oceaneering International

- Baker Hughes Company

- Halliburton Company

- National-Oilwell Varco Inc

- Schlumberger Limited

- TechnipFMC PLC

Key Developments in Subsea Production and Processing System Industry Sector

March 2023: One Subsea secured a contract to supply 16 wet Christmas trees for the Búzios field (Phase 10) in Brazil's Santos Basin pre-salt area. This highlights the growing demand for subsea equipment in major offshore projects.

February 2023: Aker Solutions won a contract from Eni Angola for subsea umbilicals for the Agogo field development, showcasing the continued investment in deepwater projects in Africa.

February 2023: TechnipFMC secured a contract from Equinor for subsea production systems for the Irpa oil and gas development on the Norwegian Continental Shelf. This signifies the importance of comprehensive subsea solutions in established offshore regions.

Strategic Subsea Production and Processing System Industry Market Outlook

The future of the subsea production and processing system market appears bright, driven by sustained demand for offshore oil and gas, technological innovation, and exploration activities in previously inaccessible areas. Strategic opportunities lie in developing advanced technologies, optimizing operational efficiency, and embracing sustainable practices. Companies focusing on innovation, cost optimization, and environmental compliance are poised for significant market success in the years to come.

Subsea Production and Processing System Industry Segmentation

-

1. Production System Component

- 1.1. Subsea Trees

- 1.2. Subsea Umbilicals, Risers, & Flowlines

- 1.3. Subsea Wellhead

- 1.4. Other

-

2. Processing System Type

- 2.1. Boosting

- 2.2. Separation

- 2.3. Injection

- 2.4. Gas Compression

-

3. Water Depth

- 3.1. Shallow Water

- 3.2. Deepwater and Ultra-Deepwater

Subsea Production and Processing System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Subsea Production and Processing System Industry Regional Market Share

Geographic Coverage of Subsea Production and Processing System Industry

Subsea Production and Processing System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Deepwater and Ultra-Deepwater to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production System Component

- 5.1.1. Subsea Trees

- 5.1.2. Subsea Umbilicals, Risers, & Flowlines

- 5.1.3. Subsea Wellhead

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Processing System Type

- 5.2.1. Boosting

- 5.2.2. Separation

- 5.2.3. Injection

- 5.2.4. Gas Compression

- 5.3. Market Analysis, Insights and Forecast - by Water Depth

- 5.3.1. Shallow Water

- 5.3.2. Deepwater and Ultra-Deepwater

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production System Component

- 6. North America Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production System Component

- 6.1.1. Subsea Trees

- 6.1.2. Subsea Umbilicals, Risers, & Flowlines

- 6.1.3. Subsea Wellhead

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Processing System Type

- 6.2.1. Boosting

- 6.2.2. Separation

- 6.2.3. Injection

- 6.2.4. Gas Compression

- 6.3. Market Analysis, Insights and Forecast - by Water Depth

- 6.3.1. Shallow Water

- 6.3.2. Deepwater and Ultra-Deepwater

- 6.1. Market Analysis, Insights and Forecast - by Production System Component

- 7. Europe Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production System Component

- 7.1.1. Subsea Trees

- 7.1.2. Subsea Umbilicals, Risers, & Flowlines

- 7.1.3. Subsea Wellhead

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Processing System Type

- 7.2.1. Boosting

- 7.2.2. Separation

- 7.2.3. Injection

- 7.2.4. Gas Compression

- 7.3. Market Analysis, Insights and Forecast - by Water Depth

- 7.3.1. Shallow Water

- 7.3.2. Deepwater and Ultra-Deepwater

- 7.1. Market Analysis, Insights and Forecast - by Production System Component

- 8. Asia Pacific Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production System Component

- 8.1.1. Subsea Trees

- 8.1.2. Subsea Umbilicals, Risers, & Flowlines

- 8.1.3. Subsea Wellhead

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Processing System Type

- 8.2.1. Boosting

- 8.2.2. Separation

- 8.2.3. Injection

- 8.2.4. Gas Compression

- 8.3. Market Analysis, Insights and Forecast - by Water Depth

- 8.3.1. Shallow Water

- 8.3.2. Deepwater and Ultra-Deepwater

- 8.1. Market Analysis, Insights and Forecast - by Production System Component

- 9. South America Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production System Component

- 9.1.1. Subsea Trees

- 9.1.2. Subsea Umbilicals, Risers, & Flowlines

- 9.1.3. Subsea Wellhead

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Processing System Type

- 9.2.1. Boosting

- 9.2.2. Separation

- 9.2.3. Injection

- 9.2.4. Gas Compression

- 9.3. Market Analysis, Insights and Forecast - by Water Depth

- 9.3.1. Shallow Water

- 9.3.2. Deepwater and Ultra-Deepwater

- 9.1. Market Analysis, Insights and Forecast - by Production System Component

- 10. Middle East and Africa Subsea Production and Processing System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production System Component

- 10.1.1. Subsea Trees

- 10.1.2. Subsea Umbilicals, Risers, & Flowlines

- 10.1.3. Subsea Wellhead

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Processing System Type

- 10.2.1. Boosting

- 10.2.2. Separation

- 10.2.3. Injection

- 10.2.4. Gas Compression

- 10.3. Market Analysis, Insights and Forecast - by Water Depth

- 10.3.1. Shallow Water

- 10.3.2. Deepwater and Ultra-Deepwater

- 10.1. Market Analysis, Insights and Forecast - by Production System Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aker Solutions ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sri Energy Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Subsea 7 SA *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kerui Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oceaneering International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 National-Oilwell Varco Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TechnipFMC PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Global Subsea Production and Processing System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Subsea Production and Processing System Industry Revenue (Million), by Production System Component 2025 & 2033

- Figure 3: North America Subsea Production and Processing System Industry Revenue Share (%), by Production System Component 2025 & 2033

- Figure 4: North America Subsea Production and Processing System Industry Revenue (Million), by Processing System Type 2025 & 2033

- Figure 5: North America Subsea Production and Processing System Industry Revenue Share (%), by Processing System Type 2025 & 2033

- Figure 6: North America Subsea Production and Processing System Industry Revenue (Million), by Water Depth 2025 & 2033

- Figure 7: North America Subsea Production and Processing System Industry Revenue Share (%), by Water Depth 2025 & 2033

- Figure 8: North America Subsea Production and Processing System Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Subsea Production and Processing System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Subsea Production and Processing System Industry Revenue (Million), by Production System Component 2025 & 2033

- Figure 11: Europe Subsea Production and Processing System Industry Revenue Share (%), by Production System Component 2025 & 2033

- Figure 12: Europe Subsea Production and Processing System Industry Revenue (Million), by Processing System Type 2025 & 2033

- Figure 13: Europe Subsea Production and Processing System Industry Revenue Share (%), by Processing System Type 2025 & 2033

- Figure 14: Europe Subsea Production and Processing System Industry Revenue (Million), by Water Depth 2025 & 2033

- Figure 15: Europe Subsea Production and Processing System Industry Revenue Share (%), by Water Depth 2025 & 2033

- Figure 16: Europe Subsea Production and Processing System Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Subsea Production and Processing System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Subsea Production and Processing System Industry Revenue (Million), by Production System Component 2025 & 2033

- Figure 19: Asia Pacific Subsea Production and Processing System Industry Revenue Share (%), by Production System Component 2025 & 2033

- Figure 20: Asia Pacific Subsea Production and Processing System Industry Revenue (Million), by Processing System Type 2025 & 2033

- Figure 21: Asia Pacific Subsea Production and Processing System Industry Revenue Share (%), by Processing System Type 2025 & 2033

- Figure 22: Asia Pacific Subsea Production and Processing System Industry Revenue (Million), by Water Depth 2025 & 2033

- Figure 23: Asia Pacific Subsea Production and Processing System Industry Revenue Share (%), by Water Depth 2025 & 2033

- Figure 24: Asia Pacific Subsea Production and Processing System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Subsea Production and Processing System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Subsea Production and Processing System Industry Revenue (Million), by Production System Component 2025 & 2033

- Figure 27: South America Subsea Production and Processing System Industry Revenue Share (%), by Production System Component 2025 & 2033

- Figure 28: South America Subsea Production and Processing System Industry Revenue (Million), by Processing System Type 2025 & 2033

- Figure 29: South America Subsea Production and Processing System Industry Revenue Share (%), by Processing System Type 2025 & 2033

- Figure 30: South America Subsea Production and Processing System Industry Revenue (Million), by Water Depth 2025 & 2033

- Figure 31: South America Subsea Production and Processing System Industry Revenue Share (%), by Water Depth 2025 & 2033

- Figure 32: South America Subsea Production and Processing System Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Subsea Production and Processing System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Subsea Production and Processing System Industry Revenue (Million), by Production System Component 2025 & 2033

- Figure 35: Middle East and Africa Subsea Production and Processing System Industry Revenue Share (%), by Production System Component 2025 & 2033

- Figure 36: Middle East and Africa Subsea Production and Processing System Industry Revenue (Million), by Processing System Type 2025 & 2033

- Figure 37: Middle East and Africa Subsea Production and Processing System Industry Revenue Share (%), by Processing System Type 2025 & 2033

- Figure 38: Middle East and Africa Subsea Production and Processing System Industry Revenue (Million), by Water Depth 2025 & 2033

- Figure 39: Middle East and Africa Subsea Production and Processing System Industry Revenue Share (%), by Water Depth 2025 & 2033

- Figure 40: Middle East and Africa Subsea Production and Processing System Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Subsea Production and Processing System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 2: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 3: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 4: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 6: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 7: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 8: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 10: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 11: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 12: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 14: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 15: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 16: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 18: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 19: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 20: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Production System Component 2020 & 2033

- Table 22: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Processing System Type 2020 & 2033

- Table 23: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Water Depth 2020 & 2033

- Table 24: Global Subsea Production and Processing System Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Subsea Production and Processing System Industry?

The projected CAGR is approximately 8.51%.

2. Which companies are prominent players in the Subsea Production and Processing System Industry?

Key companies in the market include Aker Solutions ASA, Sri Energy Inc, Subsea 7 SA *List Not Exhaustive, Kerui Group Co Ltd, Oceaneering International, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Schlumberger Limited, TechnipFMC PLC.

3. What are the main segments of the Subsea Production and Processing System Industry?

The market segments include Production System Component, Processing System Type, Water Depth.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.93 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Deepwater and Ultra-Deepwater to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

March 2023: One Subsea announced it had won a tender to provide the equipment for the Búziosfield in the Santos Basin pre-salt. The contract offers the delivery of 16 wet Christmas trees (ANMs) in phase 10 of the field's exploration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Subsea Production and Processing System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Subsea Production and Processing System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Subsea Production and Processing System Industry?

To stay informed about further developments, trends, and reports in the Subsea Production and Processing System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence