Key Insights

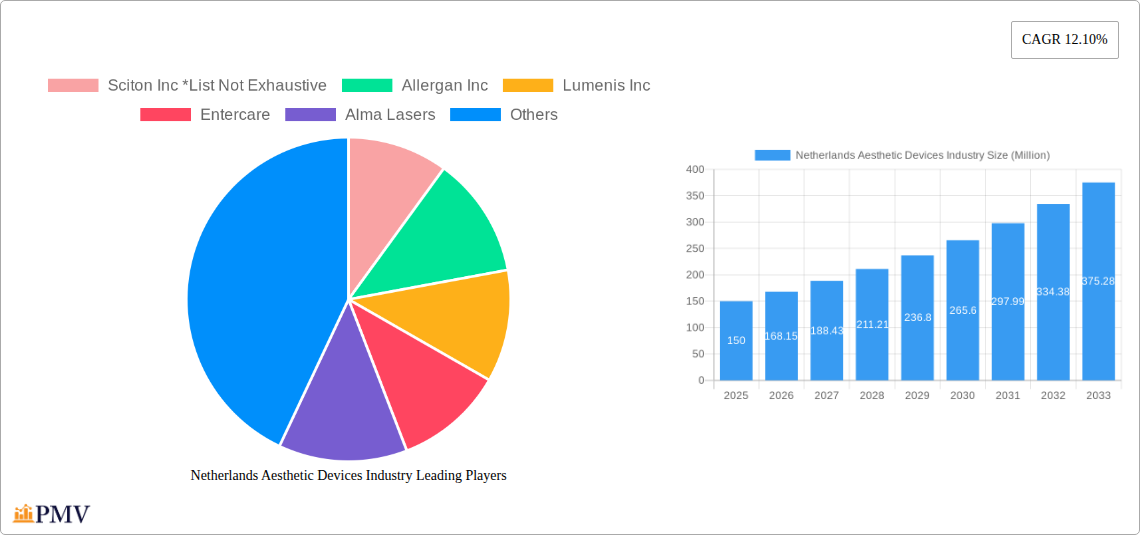

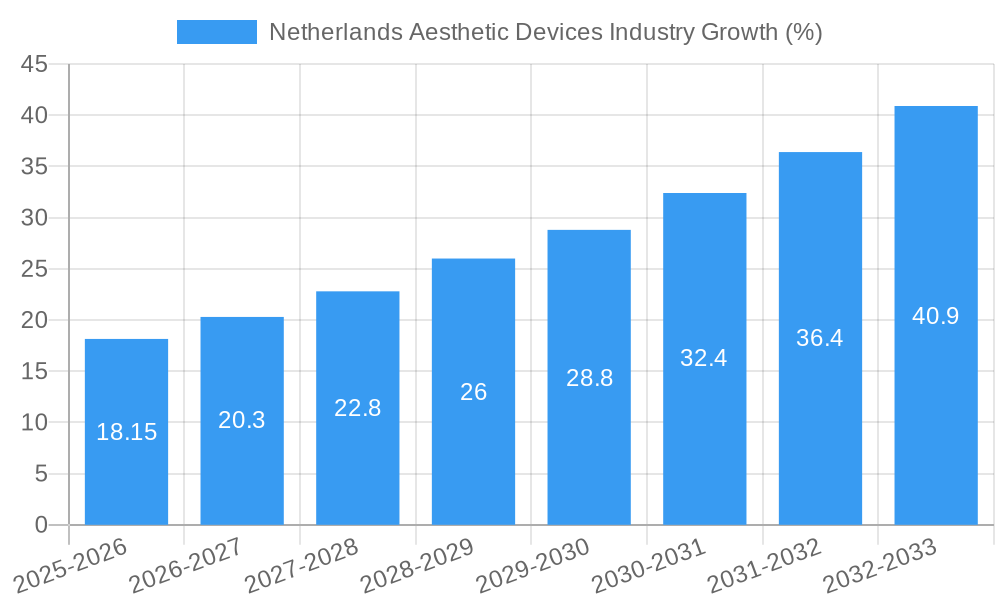

The Netherlands aesthetic devices market, valued at approximately €150 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 12.10% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing disposable incomes among the Dutch population are allowing for greater investment in cosmetic procedures. Furthermore, a rising awareness of aesthetic treatments and their efficacy, coupled with readily accessible information online and through social media, is significantly boosting demand. Technological advancements in devices, offering minimally invasive procedures with faster recovery times and improved results, further contribute to market growth. The market is segmented by device type (energy-based, ultrasound, non-energy-based, and implants), application (skin resurfacing, body contouring, hair removal, etc.), and end-user (hospitals, clinics, and home settings). The energy-based devices segment currently holds the largest market share due to their effectiveness and versatility across various applications.

However, the market also faces certain restraints. The relatively high cost of procedures can limit accessibility for some segments of the population. Furthermore, potential risks and side effects associated with some aesthetic devices, along with stringent regulatory requirements, could pose challenges to market growth. Nevertheless, the strong underlying growth drivers, particularly the increasing demand for non-invasive procedures and technological innovation, suggest a positive outlook for the Netherlands aesthetic devices market. Key players such as Sciton Inc., Allergan Inc., Lumenis Inc., and others are actively shaping the market landscape through product innovation, strategic partnerships, and expansion efforts. The increasing penetration of home-use devices is also a noteworthy trend influencing market dynamics, particularly in segments such as hair removal.

Netherlands Aesthetic Devices Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Netherlands aesthetic devices industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The report offers actionable insights for stakeholders, including manufacturers, distributors, investors, and regulatory bodies. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Netherlands Aesthetic Devices Industry Market Structure & Competitive Dynamics

The Netherlands aesthetic devices market exhibits a moderately concentrated structure, with several multinational corporations and local players competing for market share. Key players include Sciton Inc, Allergan Inc, Lumenis Inc, Entercare, Alma Lasers, Johnson & Johnson, and Galderma SA (Nestle). However, the market also features a dynamic landscape of smaller, specialized companies focusing on niche technologies or applications. The market share held by the top 5 players is estimated at approximately 60% in 2025.

The regulatory framework in the Netherlands influences market dynamics significantly. Stringent safety and efficacy regulations for medical devices impact product approvals and market entry. The presence of strong consumer protection laws also affects market competitiveness.

Innovation ecosystems play a crucial role. Academic institutions, research centers, and industry collaborations drive technological advancements, leading to the introduction of innovative aesthetic devices and treatments. Mergers and acquisitions (M&A) activities are relatively common, with deal values ranging from xx Million to xx Million in recent years, primarily driven by strategic expansion and portfolio diversification. Recent M&A activity has mainly focused on consolidating smaller companies with established players. Substitutes such as non-invasive cosmetic procedures and alternative therapies are influencing market share within specific segments. End-user trends indicate a growing preference for minimally invasive procedures, driving demand for technologically advanced devices.

Netherlands Aesthetic Devices Industry Industry Trends & Insights

The Netherlands aesthetic devices market is experiencing robust growth, driven by several factors. Increasing disposable incomes, growing awareness of aesthetic treatments, and a rising demand for non-invasive procedures contribute significantly to market expansion. The compound annual growth rate (CAGR) from 2025 to 2033 is projected to be xx%, with market penetration steadily increasing across various segments.

Technological advancements are revolutionizing the market, with the introduction of sophisticated devices offering enhanced precision, efficacy, and safety. The development of energy-based devices, ultrasound devices, and advanced implant technologies contributes to market growth. Consumer preferences are shifting towards personalized treatments, minimally invasive procedures, and shorter recovery times. The competitive dynamics are intensifying, with companies investing heavily in research and development to create innovative products and enhance their market positions. The increasing availability of financing options for cosmetic procedures also contributes to market expansion.

Dominant Markets & Segments in Netherlands Aesthetic Devices Industry

The Netherlands aesthetic devices market demonstrates strong growth across various segments. Dominant segments and their key drivers include:

By Type of Device: Energy-based aesthetic devices hold a significant market share, driven by technological advancements and increasing adoption. Ultrasound devices are also witnessing substantial growth, propelled by their non-invasive nature and efficacy.

By Application: Skin resurfacing and tightening, body contouring, and hair removal represent the most prominent application segments, reflecting consumer preferences and market demand.

By End User: Clinics and hospitals constitute the largest end-user segment, owing to their established infrastructure and expertise in performing aesthetic procedures. However, the home settings segment is emerging as a significant contributor due to the increasing availability of at-home devices.

The dominance of these segments is driven by factors such as favorable government policies supporting the healthcare sector, well-developed healthcare infrastructure, and the increasing willingness of individuals to invest in improving their appearance.

Netherlands Aesthetic Devices Industry Product Innovations

Recent product innovations highlight a strong emphasis on non-invasive procedures, enhanced efficacy, and shorter recovery times. Energy-based devices are incorporating advanced technologies like HIFEM (high-intensity focused electromagnetic) for muscle building and sculpting. Ultrasound devices are becoming increasingly sophisticated in their ability to target specific tissues and improve treatment outcomes. Implants are being designed with biocompatible materials for improved safety and integration with the body. These innovations cater to the evolving needs of consumers who demand superior treatment outcomes with minimal downtime.

Report Segmentation & Scope

This report segments the Netherlands aesthetic devices market comprehensively across various parameters:

By Type of Device: Energy-based devices, ultrasound devices, non-energy-based devices, and implants (facial, breast, other). Each segment exhibits distinct growth trajectories based on technological advancements and adoption rates. Market sizes for each segment are projected for the forecast period.

By Application: Skin resurfacing and tightening, body contouring, hair removal, tattoo removal, breast augmentation, and other applications. Growth projections for each application are included, reflecting consumer demand and market trends.

By End User: Hospitals, clinics, and home settings, with market size estimations provided for each end-user category. Competitive dynamics and growth opportunities within each segment are analyzed.

Key Drivers of Netherlands Aesthetic Devices Industry Growth

The Netherlands aesthetic devices market is fueled by several key drivers:

Technological advancements: The continuous innovation in device technology leads to more effective and safer treatments, driving adoption among both patients and practitioners.

Growing disposable incomes: Increased purchasing power allows more individuals to invest in aesthetic procedures, expanding the market.

Favorable regulatory environment: Supportive regulatory frameworks promote market growth and ensure patient safety.

Rising awareness and acceptance: Increased societal acceptance of aesthetic procedures is widening the target market.

Challenges in the Netherlands Aesthetic Devices Industry Sector

The market faces several challenges:

Stringent regulatory approvals: The rigorous approval process for medical devices can lead to delays in product launch and increased development costs.

High treatment costs: The relatively high cost of aesthetic procedures can limit accessibility for some consumer segments.

Competition from alternative therapies: Non-invasive procedures and alternative therapies pose competitive challenges.

Potential legal liabilities: Incidents like the Allergan breast implant lawsuit highlight potential legal risks and regulatory scrutiny.

Leading Players in the Netherlands Aesthetic Devices Industry Market

- Sciton Inc

- Allergan Inc

- Lumenis Inc

- Entercare

- Alma Lasers

- Johnson & Johnson

- Galderma SA (Nestle)

Key Developments in Netherlands Aesthetic Devices Industry Sector

July 2021: Bureau Clara Wichmann filed a lawsuit against Allergan, impacting breast implant sales due to concerns about lymphoma risk. This significantly impacted market growth and consumer confidence.

January 2022: BTL Industries launched Emsculpt NEO and Emsella, stimulating growth in the non-invasive body sculpting segment. These new technologies offer a strong competitive advantage.

Strategic Netherlands Aesthetic Devices Industry Market Outlook

The Netherlands aesthetic devices market holds significant growth potential. Continued technological advancements, increasing consumer awareness, and favorable economic conditions are expected to fuel market expansion in the coming years. Strategic opportunities exist for companies to innovate and cater to the evolving demands of the market, focusing on non-invasive procedures, personalized treatments, and enhanced safety features. Companies focusing on technological innovation and efficient regulatory pathways are poised to capture a greater market share.

Netherlands Aesthetic Devices Industry Segmentation

-

1. Type of Device

-

1.1. Energy-based Aesthetic Devices

- 1.1.1. Laser-based Aesthetic Devices

- 1.1.2. Radiofrequency- (RF) based Aesthetic Devices

- 1.1.3. Light-based Aesthetic Devices

- 1.1.4. Ultrasound Aesthetic Devices

-

1.2. Non-energy-based Aesthetic Devices

- 1.2.1. Botulinum Toxin

- 1.2.2. Dermal Fillers and Aesthetic Threads

- 1.2.3. Chemical Peels

- 1.2.4. Microdermabrasion

-

1.2.5. Implants

- 1.2.5.1. Facial Implants

- 1.2.5.2. Breast Implants

- 1.2.5.3. Other Impalnts

- 1.2.6. Other Aesthetic Devices

-

1.1. Energy-based Aesthetic Devices

-

2. Application

- 2.1. Skin Resurfacing and Tightening

- 2.2. Body Contouring and Cellulite Reduction

- 2.3. Hair Removal

- 2.4. Tattoo Removal

- 2.5. Breast Augmentation

- 2.6. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Home Settings

Netherlands Aesthetic Devices Industry Segmentation By Geography

- 1. Netherlands

Netherlands Aesthetic Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Cosmetic Surgeries; Rising Adoption of Minimally Invasive Devices

- 3.3. Market Restrains

- 3.3.1. Poor Reimbursement Scenario

- 3.4. Market Trends

- 3.4.1. Breast Implants Segment Expects to Register a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Aesthetic Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Energy-based Aesthetic Devices

- 5.1.1.1. Laser-based Aesthetic Devices

- 5.1.1.2. Radiofrequency- (RF) based Aesthetic Devices

- 5.1.1.3. Light-based Aesthetic Devices

- 5.1.1.4. Ultrasound Aesthetic Devices

- 5.1.2. Non-energy-based Aesthetic Devices

- 5.1.2.1. Botulinum Toxin

- 5.1.2.2. Dermal Fillers and Aesthetic Threads

- 5.1.2.3. Chemical Peels

- 5.1.2.4. Microdermabrasion

- 5.1.2.5. Implants

- 5.1.2.5.1. Facial Implants

- 5.1.2.5.2. Breast Implants

- 5.1.2.5.3. Other Impalnts

- 5.1.2.6. Other Aesthetic Devices

- 5.1.1. Energy-based Aesthetic Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Skin Resurfacing and Tightening

- 5.2.2. Body Contouring and Cellulite Reduction

- 5.2.3. Hair Removal

- 5.2.4. Tattoo Removal

- 5.2.5. Breast Augmentation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Home Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sciton Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allergan Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lumenis Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Entercare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alma Lasers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Galderma SA (Nestle)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sciton Inc *List Not Exhaustive

List of Figures

- Figure 1: Netherlands Aesthetic Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Aesthetic Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 8: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Netherlands Aesthetic Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Aesthetic Devices Industry?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the Netherlands Aesthetic Devices Industry?

Key companies in the market include Sciton Inc *List Not Exhaustive, Allergan Inc, Lumenis Inc, Entercare, Alma Lasers, Johnson & Johnson, Galderma SA (Nestle).

3. What are the main segments of the Netherlands Aesthetic Devices Industry?

The market segments include Type of Device, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Cosmetic Surgeries; Rising Adoption of Minimally Invasive Devices.

6. What are the notable trends driving market growth?

Breast Implants Segment Expects to Register a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Poor Reimbursement Scenario.

8. Can you provide examples of recent developments in the market?

January 2022: BTL Industries launched disruptive technologies and high-intensity focused electromagnetic (HIFEM) muscle-building therapies, Emsculpt NEO and Emsella, that help in revolutionizing non-invasive body sculpting.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Aesthetic Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Aesthetic Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Aesthetic Devices Industry?

To stay informed about further developments, trends, and reports in the Netherlands Aesthetic Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence