Key Insights

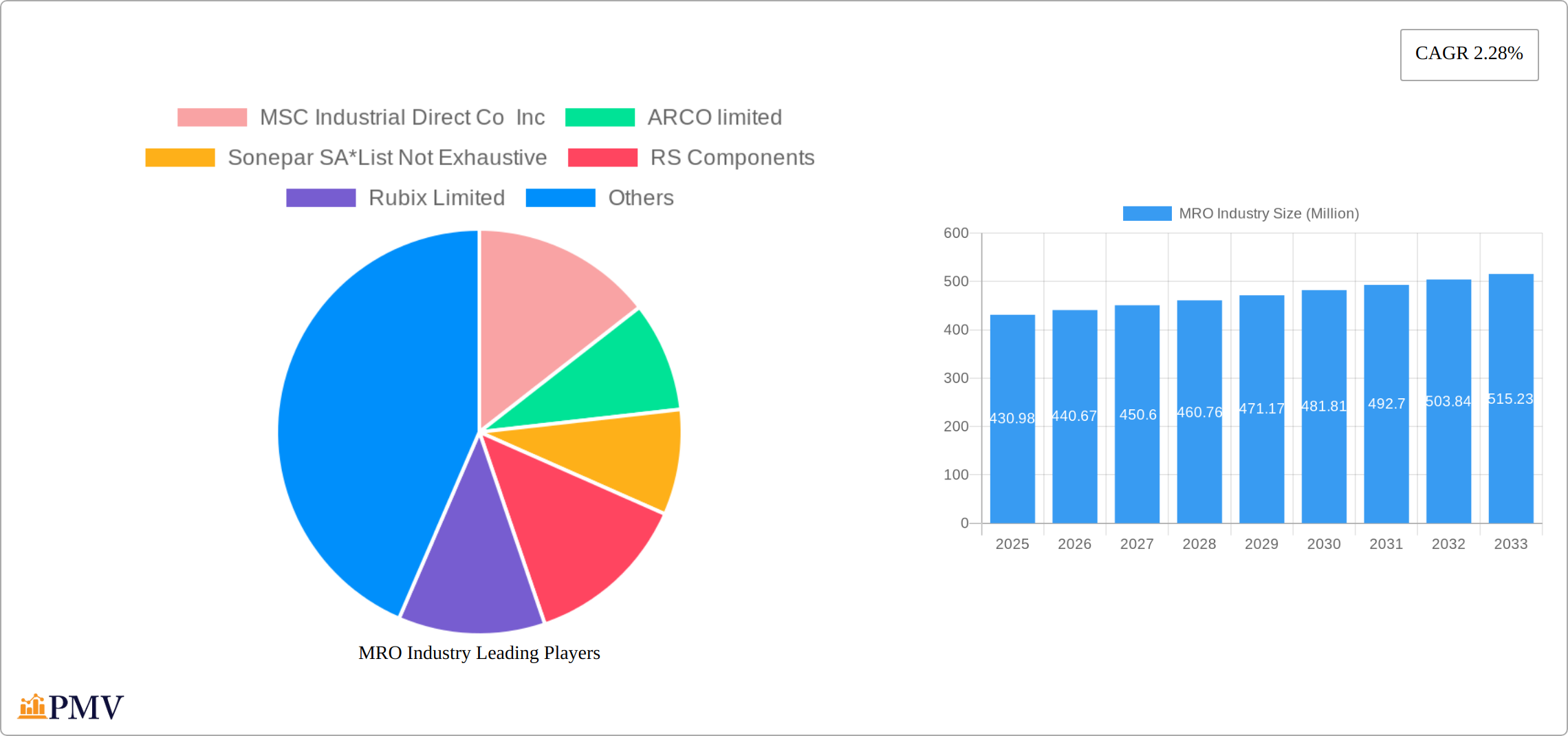

The global Maintenance, Repair, and Operations (MRO) industry, currently valued at $430.98 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.28% from 2025 to 2033. This growth is fueled by several key factors. Increased industrial automation and the adoption of Industry 4.0 technologies necessitate robust MRO services to ensure optimal equipment uptime and productivity. The expanding manufacturing sector, particularly in developing economies like those in Asia-Pacific, further contributes to market expansion. Growing emphasis on predictive maintenance strategies, leveraging data analytics to anticipate equipment failures and schedule proactive maintenance, is driving efficiency and reducing downtime costs, consequently boosting MRO demand. Furthermore, the increasing adoption of sustainable practices within manufacturing and industrial operations is influencing the demand for eco-friendly MRO products and services. Competition within the industry is fierce, with major players such as MSC Industrial Direct, W.W. Grainger, and Sonepar constantly innovating and expanding their service offerings to capture market share. The segmentation of the MRO market into Industrial, Electrical, Facility, and other MRO types reflects the diverse needs of various industries.

The MRO market is characterized by regional variations in growth trajectory. While North America and Europe currently hold significant market shares, the Asia-Pacific region is expected to witness faster growth due to its burgeoning industrialization and infrastructure development. Factors such as economic fluctuations, supply chain disruptions, and potential shifts in global manufacturing patterns represent potential restraints on market growth. However, the long-term outlook for the MRO industry remains positive, driven by the inherent need for maintenance and repair services across all industrial sectors. Companies are increasingly focusing on value-added services like integrated solutions and supply chain optimization to improve their competitive edge and meet the evolving needs of their clients. This shift toward comprehensive solutions is a key trend shaping the future of the MRO landscape.

This comprehensive report provides an in-depth analysis of the Maintenance, Repair, and Operations (MRO) industry, offering valuable insights for businesses and investors navigating this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report analyzes market trends, competitive dynamics, and growth opportunities, providing actionable intelligence for strategic decision-making. The total market size is estimated at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

MRO Industry Market Structure & Competitive Dynamics

The global MRO industry is characterized by a moderately concentrated market structure, with a few major players holding significant market share. Key players like MSC Industrial Direct Co Inc, ARCO limited, Sonepar SA, RS Components, Rubix Limited, WESCO International Inc, Hayley Group Limited, W W Grainger Inc, Wurth Group GmbH, Applied Industrial Technologies Inc, ERIKS N V (SHV Holdings), Airgas Inc (Air Liquide SA), and Motion Industries Inc (Genuine Parts Company) compete fiercely. However, numerous smaller regional and specialized distributors also contribute significantly.

- Market Concentration: The top 5 players collectively hold approximately XX% of the global market share in 2025.

- Innovation Ecosystems: Significant investments in digital technologies, including e-commerce platforms and inventory management systems, are driving innovation.

- Regulatory Frameworks: Environmental regulations, particularly concerning hazardous waste disposal and sustainable sourcing, are shaping industry practices.

- Product Substitutes: The rise of 3D printing and additive manufacturing presents potential substitutes for certain MRO components.

- End-User Trends: A growing emphasis on predictive maintenance and operational efficiency is influencing MRO procurement strategies.

- M&A Activities: The acquisition of Buckeye Industrial Supply Co. and True-Edge Grinding Inc. by MSC Industrial Supply Co. in January 2023 highlights the ongoing consolidation within the industry. The total value of M&A deals in the MRO sector exceeded $XX Million in 2024.

MRO Industry Industry Trends & Insights

The MRO industry is experiencing robust growth, driven by several key factors. The increasing adoption of Industry 4.0 technologies, such as the Industrial Internet of Things (IIoT) and advanced analytics, is facilitating predictive maintenance and optimizing inventory management. This leads to reduced downtime, improved operational efficiency, and cost savings. Furthermore, the global expansion of manufacturing and industrial activities, especially in developing economies, fuels the demand for MRO products and services. The shift towards sustainable and environmentally friendly MRO solutions is gaining momentum, creating new market opportunities for eco-conscious businesses. Competitive pressures are forcing companies to innovate, improve supply chain efficiency, and enhance customer service. The market penetration of digital MRO platforms is steadily increasing, offering convenient and efficient procurement options.

Dominant Markets & Segments in MRO Industry

The North American market is currently the dominant region for the MRO industry, primarily driven by a robust manufacturing sector and extensive infrastructure. However, the Asia-Pacific region is experiencing rapid growth, spurred by economic expansion and industrialization.

- By MRO Type:

- Industrial MRO: This segment holds the largest market share, owing to the widespread adoption of industrial automation and the continuous need for maintenance across diverse sectors. Key drivers include rising industrial production and the increasing complexity of machinery.

- Electrical MRO: This segment is experiencing healthy growth, driven by the rising demand for electricity and the expansion of electrical infrastructure.

- Facility MRO: This segment is driven by the increasing need to maintain and improve building operations.

- Other MRO Types: This segment includes various niche MRO types, each having unique growth drivers and challenges.

MRO Industry Product Innovations

Recent product innovations in the MRO sector focus on enhanced durability, improved efficiency, and the integration of smart technologies. For example, the launch of Applied Industrial Technologies' fifth edition of its Applied Maintenance Supply & Solutions Master Product Catalog showcases a wide array of technologically advanced maintenance products. These advancements are aimed at optimizing maintenance schedules, reducing downtime, and improving overall operational efficiency. This meets the growing demand for more efficient and effective maintenance solutions.

Report Segmentation & Scope

The report segments the MRO market by type: Industrial MRO, Electrical MRO, Facility MRO, and Other MRO Types. Each segment is analyzed based on historical data, current market size, growth projections, and competitive dynamics. The analysis reveals varied growth rates for each segment, reflecting the unique factors influencing each market. The Industrial MRO segment is projected to maintain the largest market share throughout the forecast period, followed by Electrical MRO.

Key Drivers of MRO Industry Growth

The MRO industry's growth is propelled by several factors. Technological advancements in predictive maintenance and digitalization streamline operations, while the increasing complexity of machinery necessitates specialized MRO services. Economic growth in emerging markets expands the industrial base, driving demand for MRO solutions. Furthermore, stringent environmental regulations encourage the adoption of sustainable MRO practices.

Challenges in the MRO Industry Sector

The MRO industry faces challenges such as supply chain disruptions, particularly concerning sourcing of raw materials and specialized components. Price volatility for raw materials adds another layer of complexity. Furthermore, intense competition from both established players and new entrants puts downward pressure on margins.

Leading Players in the MRO Industry Market

- MSC Industrial Direct Co Inc

- ARCO limited

- Sonepar SA

- RS Components

- Rubix Limited

- WESCO International Inc

- Hayley Group Limited

- W W Grainger Inc

- Wurth Group GmbH

- Applied Industrial Technologies Inc

- ERIKS N V (SHV Holdings)

- Airgas Inc (Air Liquide SA)

- Motion Industries Inc (Genuine Parts Company)

Key Developments in MRO Industry Sector

- January 2023: Applied Industrial Technologies launched its fifth edition of the Applied Maintenance Supply & Solutions Master Product Catalog, featuring over 47,000 products. This significantly expands its product offerings and caters to MROP users' diverse needs.

- January 2023: MSC Industrial Supply Co.'s acquisition of Buckeye Industrial Supply Co. and True-Edge Grinding Inc. strengthens its market position and expands its capabilities in custom tool manufacturing and MRO product distribution.

Strategic MRO Industry Market Outlook

The MRO industry is poised for continued growth, driven by ongoing technological advancements, expanding industrial activity, and the increasing adoption of sustainable practices. Companies that proactively invest in digital technologies, enhance their supply chain resilience, and offer innovative solutions are well-positioned to capitalize on the significant market opportunities that lie ahead. The focus will be on providing customized, value-added solutions tailored to specific end-user needs.

MRO Industry Segmentation

-

1. MRO Type

- 1.1. Industrial MRO

- 1.2. Electrical MRO

- 1.3. Facility MRO

- 1.4. Other MRO Types

MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Efficiency in Supply Chain; Increasing Focus on Industry 4.0

- 3.2.2 Leading to More Manufacturing Facilities

- 3.3. Market Restrains

- 3.3.1. Spread of COVID-19 to Affect the Supply Chain

- 3.4. Market Trends

- 3.4.1. Industrial MRO to Occupy Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MRO Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Industrial MRO

- 5.1.2. Electrical MRO

- 5.1.3. Facility MRO

- 5.1.4. Other MRO Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Industrial MRO

- 6.1.2. Electrical MRO

- 6.1.3. Facility MRO

- 6.1.4. Other MRO Types

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe MRO Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Industrial MRO

- 7.1.2. Electrical MRO

- 7.1.3. Facility MRO

- 7.1.4. Other MRO Types

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific MRO Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Industrial MRO

- 8.1.2. Electrical MRO

- 8.1.3. Facility MRO

- 8.1.4. Other MRO Types

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Industrial MRO

- 9.1.2. Electrical MRO

- 9.1.3. Facility MRO

- 9.1.4. Other MRO Types

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa MRO Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Industrial MRO

- 10.1.2. Electrical MRO

- 10.1.3. Facility MRO

- 10.1.4. Other MRO Types

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. North America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe MRO Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific MRO Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa MRO Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MSC Industrial Direct Co Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ARCO limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonepar SA*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 RS Components

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Rubix Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 WESCO International Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hayley Group Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 W W Grainger Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Wurth Group GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Applied Industrial Technologies Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 ERIKS N V (SHV Holdings)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Airgas Inc (Air Liquide SA)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Motion Industries Inc (Genuine Parts Company)

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 MSC Industrial Direct Co Inc

List of Figures

- Figure 1: MRO Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MRO Industry Share (%) by Company 2024

List of Tables

- Table 1: MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 3: MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 15: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 17: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 19: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 21: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 23: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MRO Industry?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the MRO Industry?

Key companies in the market include MSC Industrial Direct Co Inc, ARCO limited, Sonepar SA*List Not Exhaustive, RS Components, Rubix Limited, WESCO International Inc, Hayley Group Limited, W W Grainger Inc, Wurth Group GmbH, Applied Industrial Technologies Inc, ERIKS N V (SHV Holdings), Airgas Inc (Air Liquide SA), Motion Industries Inc (Genuine Parts Company).

3. What are the main segments of the MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 430.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Efficiency in Supply Chain; Increasing Focus on Industry 4.0. Leading to More Manufacturing Facilities.

6. What are the notable trends driving market growth?

Industrial MRO to Occupy Significant Market Share.

7. Are there any restraints impacting market growth?

Spread of COVID-19 to Affect the Supply Chain.

8. Can you provide examples of recent developments in the market?

January 2023: Applied Industrial Technologies launched the fifth edition of its Applied Maintenance Supply & Solutions Master Product Catalog, which features over 47,000 maintenance products specifically chosen for maintenance, repair, operations, and production (MROP) users. The catalog includes a diverse selection of products ranging from transportation, fasteners, shop supplies, electrical, welding, janitorial, fittings & hoses, paints & chemicals, cutting tools & abrasives, safety, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MRO Industry?

To stay informed about further developments, trends, and reports in the MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence