Key Insights

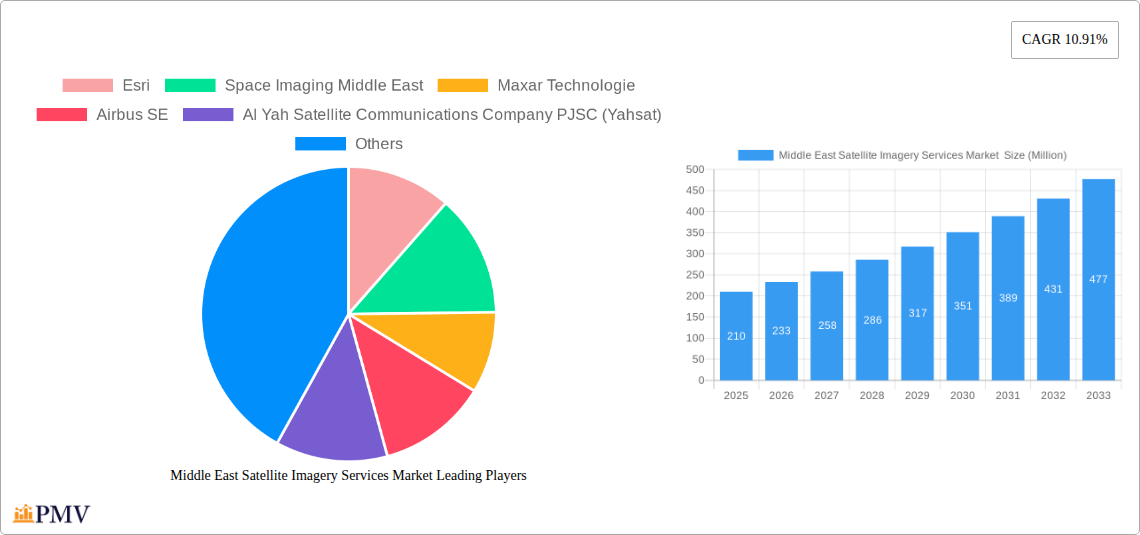

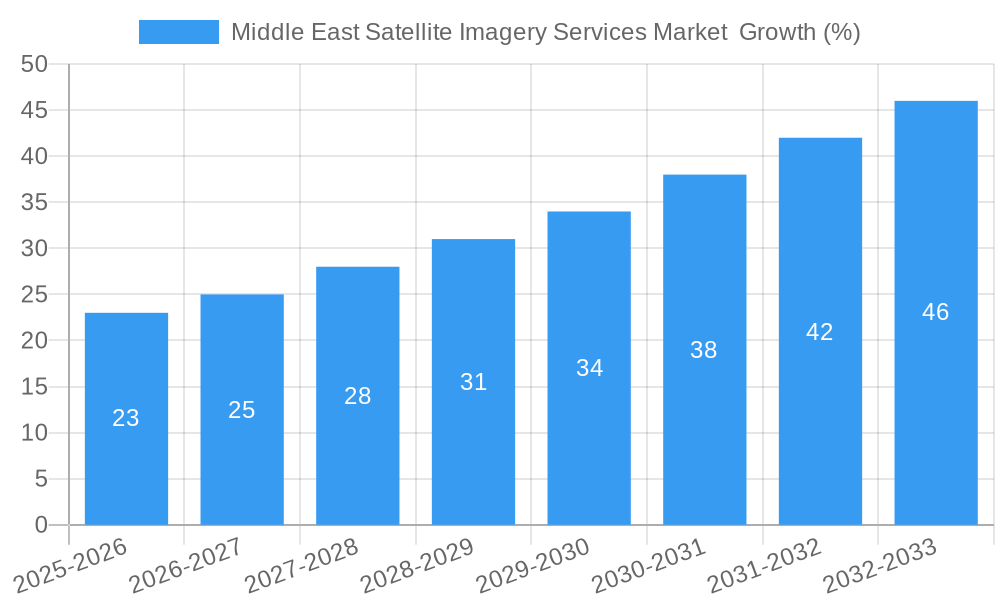

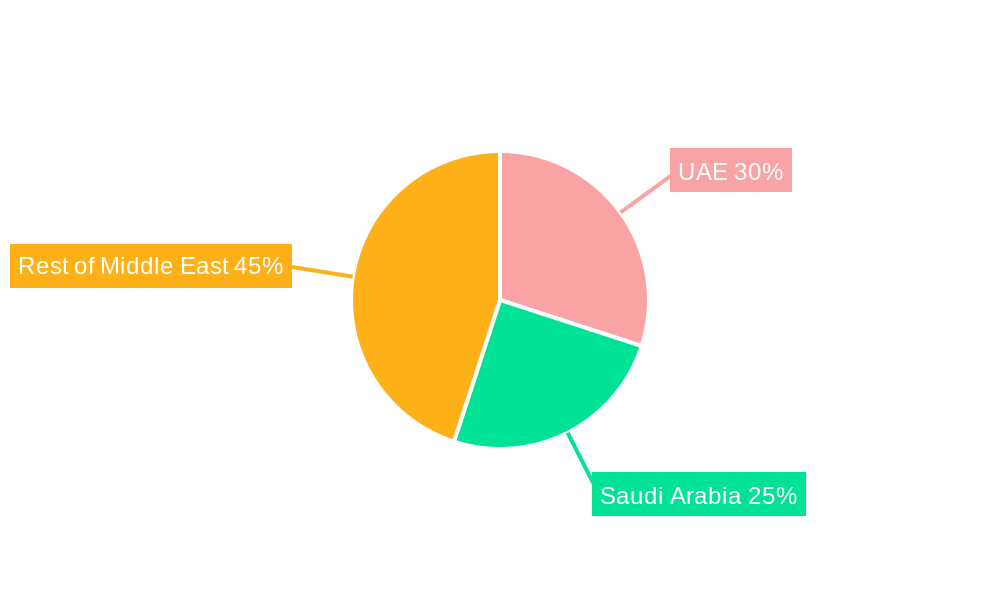

The Middle East Satellite Imagery Services market, valued at $210 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.91% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government investments in infrastructure development across the region, particularly in the UAE and Saudi Arabia, fuel demand for high-resolution imagery for urban planning, construction monitoring, and resource management. Secondly, the burgeoning need for enhanced security and surveillance, particularly in border control and counter-terrorism efforts, is a significant driver. Furthermore, the growing adoption of precision agriculture techniques in countries like Egypt and Oman necessitates the use of satellite imagery for crop monitoring and yield optimization. Finally, the rising prominence of geospatial data analysis in various sectors, coupled with advancements in satellite technology offering improved image resolution and processing capabilities, further accelerates market growth.

Despite these positive drivers, certain challenges exist. Data privacy concerns and regulatory hurdles surrounding the use of satellite imagery might hinder market expansion. The high initial investment costs associated with acquiring and implementing satellite imagery technologies can also act as a barrier to entry for smaller players. However, the long-term benefits in terms of cost-effectiveness and efficiency are likely to outweigh these initial investment concerns, driving market growth throughout the forecast period. The market is segmented by application (geospatial data acquisition and mapping, natural resource management, surveillance and security, conservation and research, disaster management, intelligence) and end-user (government, construction, transportation and logistics, military and defense, forestry and agriculture, other end-users). Major players like Esri, Maxar Technologies, and Airbus SE are well-positioned to capitalize on these trends, while regional players like Yahsat and SARsat Arabia are expected to play a crucial role in local market penetration.

Middle East Satellite Imagery Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Satellite Imagery Services Market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for businesses, investors, and policymakers operating within this dynamic sector.

Middle East Satellite Imagery Services Market Market Structure & Competitive Dynamics

The Middle East Satellite Imagery Services Market exhibits a moderately consolidated structure, with key players like Esri, Maxar Technologies, and Airbus SE holding significant market share. However, the market is also witnessing increased participation from regional players, fostering a competitive landscape marked by innovation and strategic partnerships. The regulatory framework varies across the region, impacting market access and operational strategies. The market's innovation ecosystem is fueled by advancements in satellite technology, AI-driven analytics, and the growing demand for high-resolution imagery. Product substitutes, such as aerial photography, are limited due to cost and logistical constraints. End-user trends favor high-resolution, real-time data for diverse applications. M&A activity in the sector has been moderate, with deal values averaging around xx Million in recent years. Key M&A events have primarily involved the acquisition of smaller specialized firms by major players seeking to expand their service portfolios.

- Market Concentration: Moderately Consolidated

- Innovation Ecosystems: Strong, driven by technological advancements.

- Regulatory Frameworks: Varied across the region, influencing market access.

- Product Substitutes: Limited, primarily aerial photography.

- End-User Trends: Demand for high-resolution, real-time data is increasing.

- M&A Activity: Moderate, with average deal values of xx Million.

Middle East Satellite Imagery Services Market Industry Trends & Insights

The Middle East Satellite Imagery Services Market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include increasing government spending on defense and security, rising demand for geospatial data in infrastructure development, and the adoption of advanced technologies like AI and machine learning for image analysis. Technological disruptions, such as the deployment of high-resolution satellites and improved data processing capabilities, are further accelerating market expansion. Consumer preferences are shifting towards cost-effective, high-quality, and readily accessible satellite imagery solutions. Competitive dynamics are shaped by the entry of new players, strategic alliances, and the ongoing evolution of data processing and analytical technologies. Market penetration rates are steadily increasing, particularly in sectors like government, defense, and construction.

Dominant Markets & Segments in Middle East Satellite Imagery Services Market

The Government sector dominates the end-user segment, driven by substantial investments in national security and infrastructure development. The Surveillance and Security application segment leads in terms of market value and growth, fueled by increasing geopolitical tensions and the need for advanced monitoring capabilities.

- Leading Region: xx (likely UAE or Saudi Arabia)

- Dominant End-User: Government

- Dominant Application: Surveillance and Security

Key Drivers for Government Dominance:

- Significant government spending on defense and security.

- Large-scale infrastructure projects demanding precise geospatial data.

- National initiatives promoting digital transformation and smart city development.

Key Drivers for Surveillance and Security Dominance:

- Geopolitical instability and the need for enhanced border security.

- Growing demand for real-time intelligence gathering and threat assessment.

- Increasing adoption of advanced surveillance technologies.

Middle East Satellite Imagery Services Market Product Innovations

Recent product innovations focus on enhancing image resolution, improving data processing speed, and integrating advanced analytics capabilities, particularly AI-powered solutions for improved data interpretation. These advancements cater to the growing demand for detailed, actionable insights derived from satellite imagery, improving the market fit for diverse applications across various sectors.

Report Segmentation & Scope

The report segments the Middle East Satellite Imagery Services Market by application (Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, Intelligence) and end-user (Government, Construction, Transportation and Logistics, Military and Defense, Forestry and Agriculture, Other End-Users). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The market is further segmented by resolution, data type, and service offerings.

Key Drivers of Middle East Satellite Imagery Services Market Growth

Technological advancements (e.g., higher-resolution sensors, AI-powered analytics), increased government investments in infrastructure and defense, and rising demand for precise geospatial data across various sectors drive market growth. The region's economic diversification strategies and initiatives promoting digital transformation also play a crucial role.

Challenges in the Middle East Satellite Imagery Services Market Sector

Challenges include regulatory complexities related to data access and usage, potential supply chain disruptions impacting satellite data acquisition, and the intense competition among established and emerging players. These factors collectively can affect the market's overall growth trajectory by approximately xx%.

Leading Players in the Middle East Satellite Imagery Services Market Market

- Esri

- Space Imaging Middle East

- Maxar Technologies

- Airbus SE

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Serco Group plc

- Thales Group

- GEOMAP Consultants

- SARsat Arabia

- Northstar Saudi Arabia

Key Developments in Middle East Satellite Imagery Services Market Sector

- July 2023: Impact Observatory and Planet Labs PBC partnership for enhanced LULC monitoring using AI. This significantly improves the availability of high-frequency data and analytics.

- December 2022: SpaceX successfully deploys an Israeli Earth-imaging satellite for military and intelligence applications, highlighting the growing importance of space-based solutions for security.

Strategic Middle East Satellite Imagery Services Market Market Outlook

The Middle East Satellite Imagery Services Market presents significant growth potential driven by continuous technological innovation, substantial investments in infrastructure, and the increasing demand for data-driven decision-making. Strategic opportunities exist in developing specialized solutions for niche applications, expanding into emerging markets, and forging strategic partnerships to enhance service offerings. The market is poised for sustained expansion, driven by both public and private sector investment.

Middle East Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Other End-Users

-

3. Geography

- 3.1. UAE

- 3.2. Saudi Arabia

Middle East Satellite Imagery Services Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

Middle East Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Location-based Services; Surge in the usage of Satellite data

- 3.3. Market Restrains

- 3.3.1. High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Location-based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UAE

- 5.4.2. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. UAE Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Geospatial Data Acquisition and Mapping

- 6.1.2. Natural Resource Management

- 6.1.3. Surveillance and Security

- 6.1.4. Conservation and Research

- 6.1.5. Disaster Management

- 6.1.6. Intelligence

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Government

- 6.2.2. Construction

- 6.2.3. Transportation and Logistics

- 6.2.4. Military and Defense

- 6.2.5. Forestry and Agriculture

- 6.2.6. Other End-Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. UAE

- 6.3.2. Saudi Arabia

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Saudi Arabia Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Geospatial Data Acquisition and Mapping

- 7.1.2. Natural Resource Management

- 7.1.3. Surveillance and Security

- 7.1.4. Conservation and Research

- 7.1.5. Disaster Management

- 7.1.6. Intelligence

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Government

- 7.2.2. Construction

- 7.2.3. Transportation and Logistics

- 7.2.4. Military and Defense

- 7.2.5. Forestry and Agriculture

- 7.2.6. Other End-Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. UAE

- 7.3.2. Saudi Arabia

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. United Arab Emirates Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Saudi Arabia Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Qatar Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Israel Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Egypt Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Oman Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Middle East Middle East Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Esri

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Space Imaging Middle East

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Maxar Technologie

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Airbus SE

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Al Yah Satellite Communications Company PJSC (Yahsat)

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Serco Group plc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Thales Group

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 GEOMAP Consultants

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 SARsat Arabia

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Northstar Saudi Arabia

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Esri

List of Figures

- Figure 1: Middle East Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 5: Middle East Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United Arab Emirates Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Qatar Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Egypt Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Egypt Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Oman Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East Middle East Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East Middle East Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Middle East Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 30: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 31: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: Middle East Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 38: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 39: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: Middle East Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Middle East Satellite Imagery Services Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Satellite Imagery Services Market ?

The projected CAGR is approximately 10.91%.

2. Which companies are prominent players in the Middle East Satellite Imagery Services Market ?

Key companies in the market include Esri, Space Imaging Middle East, Maxar Technologie, Airbus SE, Al Yah Satellite Communications Company PJSC (Yahsat), Serco Group plc, Thales Group, GEOMAP Consultants, SARsat Arabia, Northstar Saudi Arabia.

3. What are the main segments of the Middle East Satellite Imagery Services Market ?

The market segments include Application, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Location-based Services; Surge in the usage of Satellite data.

6. What are the notable trends driving market growth?

Increasing Adoption of Location-based Services.

7. Are there any restraints impacting market growth?

High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

July 2023: Impact Obsеrvatory, a prominеnt US-basеd spacе obsеrvation systеm company, forgеd a stratеgic partnеrship with Planеt Labs PBC, a global providеr of daily data and insights. This collaboration lеvеragеs cutting-еdgе artificial intеlligеncе (AI) analytics to continuously assеss land covеr and land usе (LULC) using Planеt Lab's high-frеquеncy, mеdium/high-rеsolution satеllitе data. Thе primary objеctivе of this partnеrship is to providе customеrs with supеrior spacе-basеd global mapping and monitoring solutions, surpassing thе capabilitiеs of publicly availablе satеllitе imagеry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Satellite Imagery Services Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Satellite Imagery Services Market ?

To stay informed about further developments, trends, and reports in the Middle East Satellite Imagery Services Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence