Key Insights

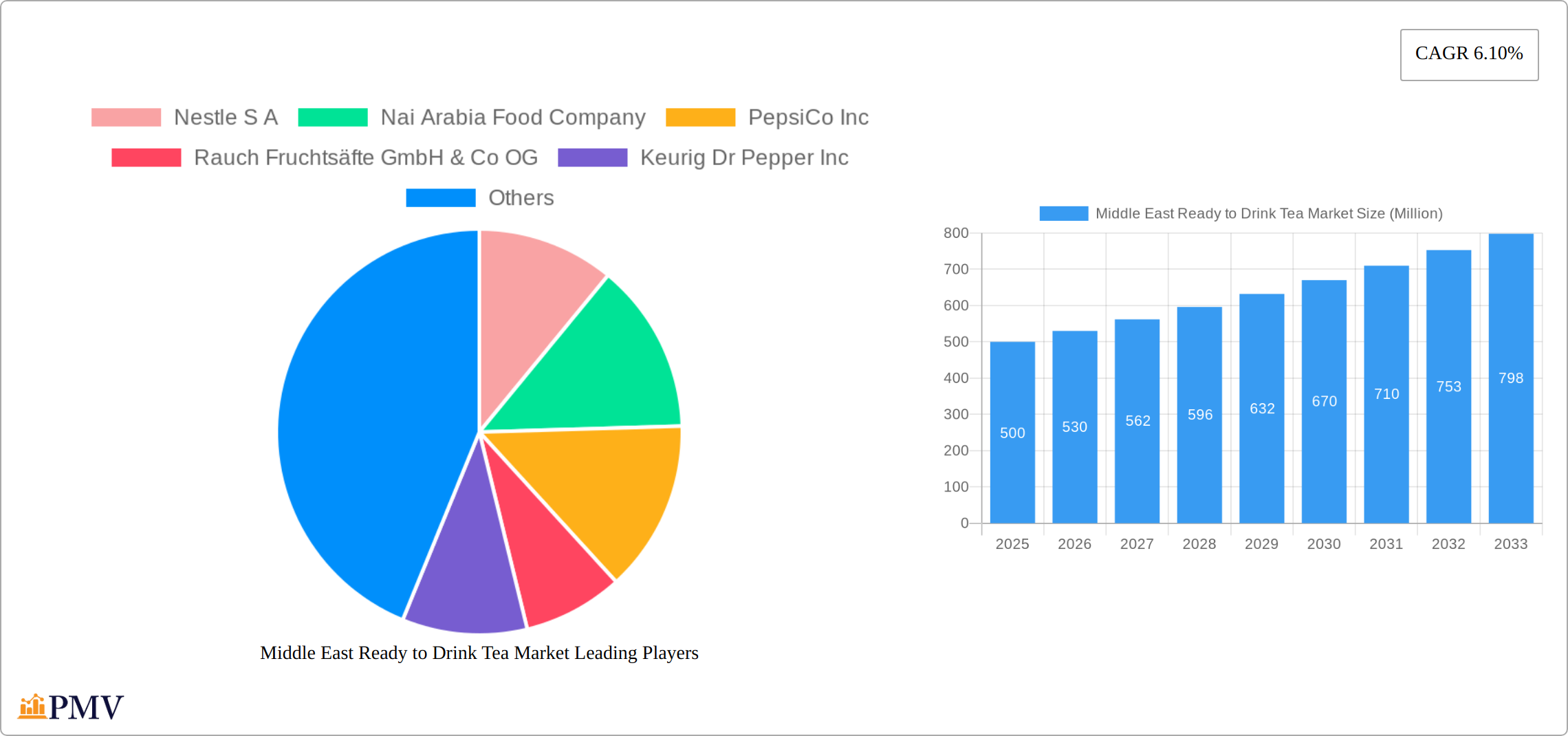

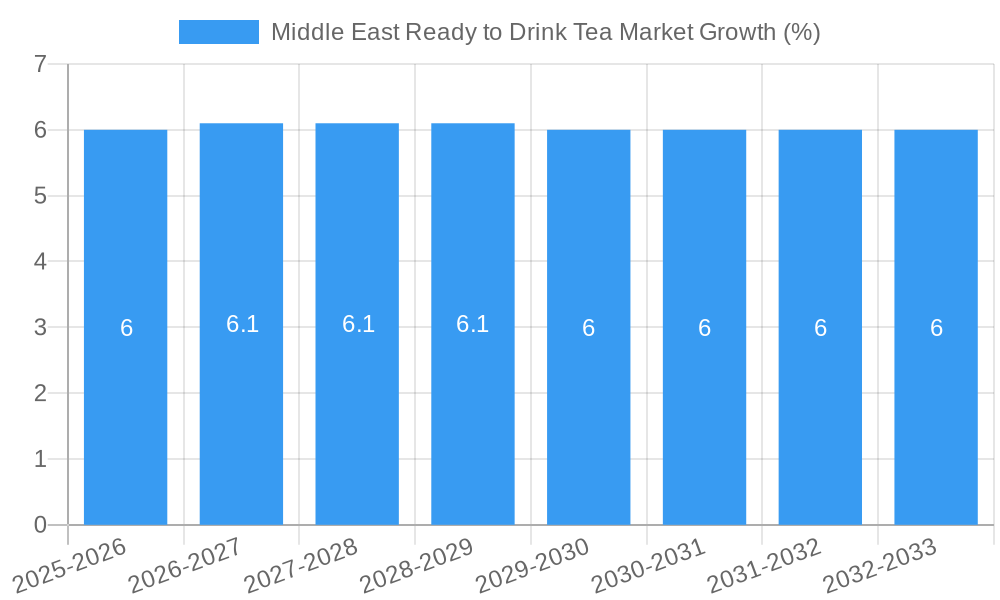

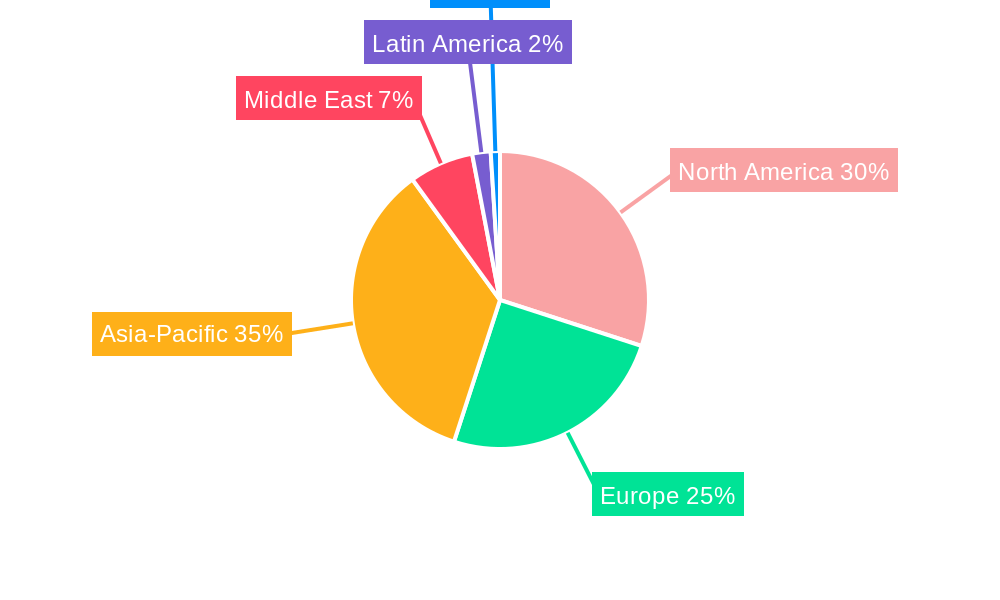

The Middle East Ready to Drink (RTD) Tea Market is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This growth is fueled by increasing consumer demand for convenient and health-oriented beverages, with a particular emphasis on green tea, herbal tea, and iced tea varieties. The market is segmented by soft drink types, packaging types, distribution channels, and countries, providing a comprehensive view of the market dynamics. Key countries such as Saudi Arabia, the United Arab Emirates, and Qatar are leading the market, driven by a growing health-conscious population and the expansion of retail channels. Major players like Nestle S.A., PepsiCo Inc., and The Coca-Cola Company are intensifying their presence through innovative product offerings and strategic partnerships, further catalyzing market growth.

Significant trends shaping the market include the rising popularity of functional beverages, which offer additional health benefits, and the shift towards sustainable packaging solutions such as aseptic packages and PET bottles. These trends align with consumer preferences for eco-friendly and health-focused products. However, the market faces restraints such as fluctuating raw material prices and stringent regulations on beverage ingredients. Despite these challenges, the RTD tea market in the Middle East is poised for significant expansion, supported by robust economic growth and increasing urbanization. The off-trade distribution channel dominates the market, attributed to the convenience of purchasing RTD tea from supermarkets and hypermarkets. As the market evolves, companies are expected to focus on product diversification and market penetration strategies to capitalize on emerging opportunities.

Middle East Ready to Drink Tea Market Market Structure & Competitive Dynamics

The Middle East Ready to Drink (RTD) Tea Market exhibits a competitive landscape marked by a mix of global and regional players striving to capture market share through innovation and strategic acquisitions. Market concentration is moderate, with key players such as Nestle S.A., PepsiCo Inc., and The Coca-Cola Company holding significant shares. These companies leverage their extensive distribution networks to maintain a competitive edge. The innovation ecosystem in the Middle East RTD tea market is thriving, with a focus on developing healthier and more sustainable products. Regulatory frameworks are evolving, with stricter guidelines on sugar content and packaging materials influencing product development.

- Market Share: Nestle S.A. holds approximately 20% of the market, while PepsiCo Inc. and The Coca-Cola Company each have around 15%.

- M&A Activities: The acquisition of a 30% stake in Nai Arabia by Fine Hygienic Holding in October 2019, valued at over USD 10 Million, underscores the strategic moves within the sector to consolidate market presence.

- Product Substitutes: The market faces competition from other beverages such as energy drinks and bottled water, with companies diversifying their portfolios to include RTD tea variants.

- End-User Trends: Consumers are increasingly seeking healthier beverage options, driving demand for low-sugar and organic RTD teas.

- Regulatory Frameworks: Governments are implementing regulations to reduce sugar content, impacting product formulations and marketing strategies.

Middle East Ready to Drink Tea Market Industry Trends & Insights

The Middle East RTD tea market is witnessing robust growth, driven by increasing health consciousness and a shift towards convenient beverage options. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period of 2025-2033. Technological disruptions, such as the adoption of smart packaging solutions and e-commerce platforms, are enhancing market penetration and consumer engagement. Consumer preferences are shifting towards natural and organic products, with green tea and herbal tea segments gaining traction due to their perceived health benefits.

The competitive dynamics are intense, with major players investing in product innovation and marketing campaigns to capture a larger market share. For instance, PepsiCo Inc.'s launch of Rockstar Focus™ in February 2024, which includes innovative ingredients like Lion's Mane, demonstrates the trend towards functional beverages. The Coca-Cola Company's expansion of its Honest Tea portfolio with the introduction of Honest Yerba Mate in April 2021 in Saudi Arabia further illustrates the focus on health-oriented products. The market's growth is also supported by increasing disposable incomes and urbanization, which are boosting the demand for on-the-go beverage options.

Dominant Markets & Segments in Middle East Ready to Drink Tea Market

The Middle East ready-to-drink (RTD) tea market is a dynamic landscape, with Saudi Arabia holding a commanding position due to its substantial population and high per capita consumption. Green tea enjoys significant market share, fueled by the region's growing health-consciousness and the perception of green tea as an antioxidant-rich beverage. The off-trade channel (supermarkets, hypermarkets, convenience stores) remains the dominant distribution method, catering to consumer preference for readily available options.

Saudi Arabia: A key market driver is the burgeoning young population, coupled with increasing health awareness. Government initiatives promoting healthy lifestyles and the strong presence of major retail chains further contribute to market growth.

Green Tea Segment: This segment's dominance stems from the widely recognized health benefits of green tea, including its perceived role in weight management and its rich antioxidant properties. Supportive economic policies that favor health and wellness products further bolster this segment's expansion.

Off-Trade Distribution Channel: The convenience afforded by supermarkets and hypermarkets makes this channel the most prominent. Ongoing infrastructure development, such as the expansion of major retail chains, significantly supports the growth of this distribution method.

The United Arab Emirates (UAE) and Qatar also exhibit substantial growth potential. The UAE market is particularly robust, driven by its large expatriate population and thriving tourism sector. Beyond green tea, other RTD tea varieties, including black and white teas, are gaining traction as consumers explore diverse flavor profiles. Aseptic packaging and PET bottles are the preferred packaging formats, offering both convenience and a perception of sustainability.

Middle East Ready to Drink Tea Market Product Innovations

Product innovations in the Middle East RTD tea market focus on health and functionality, with companies introducing beverages that cater to specific consumer needs. For instance, PepsiCo Inc.'s Rockstar Focus™, launched in February 2024, combines energy-boosting ingredients like Lion's Mane with 200 mg of caffeine, targeting consumers seeking mental clarity. These innovations align with the growing trend of functional beverages, which offer additional health benefits beyond hydration. The market fit for these products is strong, as they meet the demand for convenient, health-oriented options.

Report Segmentation & Scope

The Middle East RTD tea market is segmented by soft drink type, packaging type, distribution channel, and country.

Soft Drink Type: The green tea segment is expected to grow at a CAGR of 6.0% during the forecast period, driven by health-conscious consumers. Herbal tea and iced tea segments also show promising growth, with CAGRs of 5.2% and 4.8%, respectively.

Packaging Type: Aseptic packages and PET bottles are dominant, with market sizes projected to reach USD 500 Million and USD 400 Million by 2033, respectively. Glass bottles and metal cans are niche segments with slower growth.

Distribution Channel: The off-trade channel accounts for over 70% of the market, with a projected market size of USD 1.2 Billion by 2033. On-trade channels are growing at a slower pace, with a market size of USD 300 Million.

Country: Saudi Arabia leads the market, with a projected market size of USD 800 Million by 2033. The UAE and Qatar are also significant, with projected market sizes of USD 350 Million and USD 250 Million, respectively. The rest of the Middle East is expected to reach USD 400 Million.

Key Drivers of Middle East Ready to Drink Tea Market Growth

The Middle East RTD tea market is driven by several key factors. Technological advancements in packaging and distribution are enhancing product shelf life and accessibility. Economic factors such as rising disposable incomes and urbanization are increasing demand for convenient beverage options. Regulatory initiatives promoting healthier lifestyles are also supporting market growth. For example, government campaigns in Saudi Arabia and the UAE are encouraging consumers to choose healthier drink options, thereby boosting the RTD tea market.

Challenges in the Middle East Ready to Drink Tea Market Sector

The Middle East RTD tea market faces several challenges. Regulatory hurdles, such as stringent sugar content regulations, can limit product innovation and increase production costs. Supply chain issues, including disruptions due to geopolitical tensions, can affect product availability and pricing. Competitive pressures from other beverage categories, such as energy drinks and bottled water, also pose a threat to market growth. These challenges can result in a 2-3% reduction in market growth rates during the forecast period.

Leading Players in the Middle East Ready to Drink Tea Market Market

- Nestle S.A

- Nai Arabia Food Company

- PepsiCo Inc

- Rauch Fruchtsäfte GmbH & Co OG

- Keurig Dr Pepper Inc

- Barakat Group of Companies

- The Coca-Cola Company

- The Savola Group

- Sapporo Holdings Limited

Key Developments in Middle East Ready to Drink Tea Market Sector

- February 2024: Rockstar® Energy Drink, a subsidiary of PepsiCo, Inc, unveiled “Rockstar Focus™,” a new line of energy drinks delivering energy & mental boost made with innovative ingredients like Lion’s Mane, a mushroom used in traditional eastern cultures, and providing 200 mg of caffeine. These products are available in retail channels in Saudi Arabia, UAE, and Qatar. This launch expands the RTD tea market into the functional beverage segment, attracting health-conscious consumers.

- April 2021: Honest Tea, a subsidiary of The Coca-Cola Company, expanded its bottled beverage portfolio with the launch of Honest Yerba Mate in the Saudi Arabian market. The new caffeinated ready-to-drink (RTD) contains 13g of sugar and 60 calories per 16oz can. This development caters to the growing demand for healthier RTD options.

- October 2019: Fine Hygienic Holding, a paper products manufacturer, became the largest single shareholder with a 30% stake in Dubai's natural food and beverage company Nai Arabia in a deal valued at over USD 10 Million. This acquisition strengthens Nai Arabia's position in the RTD tea market and enhances its product offerings.

Strategic Middle East Ready to Drink Tea Market Market Outlook

The Middle East RTD tea market is poised for significant growth, driven by increasing health consciousness and the demand for convenient beverage options. Strategic opportunities lie in product innovation, focusing on functional and health-oriented beverages. Companies can capitalize on the trend towards sustainability by adopting eco-friendly packaging solutions. Expanding distribution networks, particularly through e-commerce platforms, will enhance market reach. The market's future potential is strong, with expected growth fueled by rising disposable incomes and urbanization across the region.

Middle East Ready to Drink Tea Market Segmentation

-

1. Soft Drink Type

- 1.1. Green Tea

- 1.2. Herbal Tea

- 1.3. Iced Tea

- 1.4. Other RTD Tea

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Middle East Ready to Drink Tea Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Ready to Drink Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Green Tea

- 5.1.2. Herbal Tea

- 5.1.3. Iced Tea

- 5.1.4. Other RTD Tea

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. United Arab Emirates Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestle S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nai Arabia Food Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rauch Fruchtsäfte GmbH & Co OG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Keurig Dr Pepper Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Barakat Group of Companies

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Coca-Cola Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Savola Grou

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sapporo Holdings Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Nestle S A

List of Figures

- Figure 1: Middle East Ready to Drink Tea Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Ready to Drink Tea Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 15: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 16: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Ready to Drink Tea Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East Ready to Drink Tea Market?

Key companies in the market include Nestle S A, Nai Arabia Food Company, PepsiCo Inc, Rauch Fruchtsäfte GmbH & Co OG, Keurig Dr Pepper Inc, Barakat Group of Companies, The Coca-Cola Company, The Savola Grou, Sapporo Holdings Limited.

3. What are the main segments of the Middle East Ready to Drink Tea Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

February 2024: Rockstar® Energy Drink, a subsidiary of PepsiCo, Inc unveiled “Rockstar Focus™,” a new line of energy drinks delivering energy & mental boost made with innovative ingredients like Lion’s Mane, a mushroom used in traditional eastern cultures, and providing 200 mg of caffeine. These products are avilable in retail channels in Saudi Arabia, UAE and Qatar.April 2021: Honest Tea, a subsidiary of The Coca-Cola Company, has expanded its bottled beverage portfolio with the launch of Honest Yerba Mate in the Saudi Arabian market. The new caffeinated ready-to-drink (RTD) contains 13g of sugar and 60 calories per 16oz can.October 2019: Fine Hygienic Holding, a paper products manufacturer, became the largest single shareholder with 30% stake in Dubai's natural food and beverage company Nai Arabia in a deal valued at over USD 10 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Ready to Drink Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Ready to Drink Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Ready to Drink Tea Market?

To stay informed about further developments, trends, and reports in the Middle East Ready to Drink Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence