Key Insights

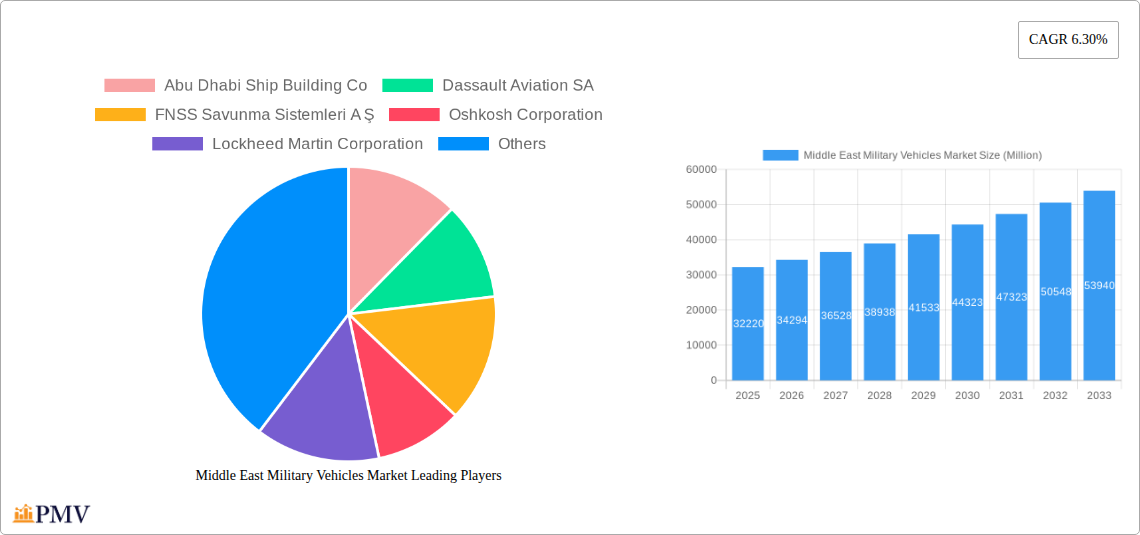

The Middle East Military Vehicles Market, valued at $32.22 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization initiatives across armed forces, and increasing defense budgets in the region. The market's Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033 indicates a significant expansion, exceeding $50 billion by the end of the forecast period. Key drivers include the rising demand for sophisticated combat aircraft like fighter jets and advanced helicopters for enhanced aerial superiority, the continuous need for modern naval vessels (destroyers, frigates, submarines) to safeguard coastal waters and maritime interests, and the acquisition of advanced armored vehicles (APCs, IFVs, tanks) for land-based operations. The segmental breakdown reveals a strong demand across all categories, though combat aircraft and armored personnel carriers are likely to dominate due to their crucial role in modern warfare. Furthermore, regional power dynamics and cross-border security concerns are significantly influencing procurement decisions, leading to substantial investments in military technology upgrades across the Middle East, specifically in countries like Saudi Arabia, the UAE, and Israel.

Significant market trends include the increasing adoption of unmanned aerial vehicles (UAVs) for reconnaissance and surveillance, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into military vehicles for improved situational awareness and autonomous capabilities, and a growing emphasis on cybersecurity to protect sensitive military systems. Restraints on market growth include economic fluctuations, fluctuating oil prices, and potential shifts in regional geopolitical stability. However, the long-term outlook remains positive due to the inherent strategic importance of military strength in the region and the continuous need for defense modernization to counter evolving threats. The competitive landscape is characterized by a mix of global and regional players, each striving to secure lucrative contracts through technological innovation and strategic partnerships.

Middle East Military Vehicles Market: A Comprehensive Market Analysis (2019-2033)

This detailed report provides a comprehensive analysis of the Middle East Military Vehicles market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report meticulously examines market size, growth drivers, competitive landscape, and future trends, offering actionable intelligence for navigating this dynamic sector. The market is segmented by vehicle type, encompassing military aircraft, naval vessels, and armored vehicles, with further sub-segmentation detailed within the report. The report values are expressed in Millions of US Dollars.

Middle East Military Vehicles Market Structure & Competitive Dynamics

The Middle East Military Vehicles market exhibits a moderately concentrated structure, with a handful of multinational corporations and regional players holding significant market share. Market share analysis reveals that the top five players account for approximately xx% of the total market revenue in 2025. Innovation ecosystems are evolving, with increasing emphasis on technological advancements in areas like unmanned systems and AI-integrated weaponry. Regulatory frameworks vary across the region, influencing procurement strategies and investment decisions. Product substitutes are limited, given the specialized nature of military vehicles, but ongoing technological developments present potential challenges to incumbents. End-user trends show a growing demand for advanced capabilities, higher survivability, and interoperability. M&A activities have been relatively modest in recent years, with deal values averaging xx Million USD annually during the historical period (2019-2024), although an increase is predicted for the forecast period. This is likely fueled by consolidation among smaller players and strategic partnerships to enhance technological capabilities.

Middle East Military Vehicles Market Industry Trends & Insights

The Middle East Military Vehicles market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several key factors, including escalating geopolitical tensions, increasing defense budgets across the region, modernization efforts by armed forces, and the adoption of advanced technologies. Technological disruptions, such as the integration of artificial intelligence and autonomous systems, are reshaping the competitive landscape. Furthermore, evolving consumer preferences towards improved situational awareness, enhanced lethality, and reduced logistical burden further contribute to this growth. Market penetration of advanced technologies remains relatively low but is expected to increase significantly over the forecast period. Competitive dynamics are intensifying, with companies investing heavily in R&D and forging strategic partnerships to maintain a leading edge. Specific examples include the increasing use of unmanned aerial vehicles (UAVs) and the demand for improved cybersecurity measures for military vehicles.

Dominant Markets & Segments in Middle East Military Vehicles Market

Leading Region: The Gulf Cooperation Council (GCC) countries are projected to dominate the Middle East Military Vehicles market, accounting for xx% of the total market value in 2025. Key drivers include substantial defense budgets, modernization programs, and heightened security concerns.

Leading Country: Saudi Arabia and the UAE are the leading national markets, driven by large-scale defense investments, military expansion, and participation in regional conflicts.

Leading Segments:

- Armored Vehicles: This segment is expected to maintain its leading position, driven by the continuous demand for armored personnel carriers (APCs), infantry fighting vehicles (IFVs), and main battle tanks (MBTs).

- Military Aircraft: The Combat Aircraft segment is anticipated to witness significant growth due to modernization of air forces and increasing demand for advanced fighter jets.

- Naval Vessels: This segment exhibits strong growth prospects with increasing focus on naval capabilities and maritime security. Frigates and corvettes are anticipated to see robust demand.

Factors contributing to the dominance of these segments include sustained regional instability, a focus on border security, and modernization programs aimed at improving military capabilities. Economic policies promoting domestic manufacturing and the development of indigenous defense industries further fuel market growth.

Middle East Military Vehicles Market Product Innovations

The Middle East Military Vehicles market is witnessing significant product innovation, with a focus on enhancing vehicle survivability, lethality, and technological integration. Key developments include advanced armor systems, improved fire control systems, enhanced situational awareness technologies, and the integration of unmanned systems. These advancements aim to provide military forces with a decisive advantage on the battlefield, leading to increased market demand and competitive advantage for manufacturers who offer such cutting-edge technologies. The market is also seeing increased focus on vehicle mobility and operational efficiency, coupled with advancements in digital technologies and connectivity systems.

Report Segmentation & Scope

This report segments the Middle East Military Vehicles market by vehicle type:

Military Aircraft: This segment is further divided into Combat Aircraft and Non-combat Aircraft (including Combat Helicopters). Growth is projected at xx% CAGR driven by modernization and technological upgrades. Competition is intense, with major international players vying for contracts.

Naval Vessels: This segment includes Destroyers, Frigates, Corvettes, Submarines, and Other Naval Vessels. The market size for 2025 is estimated at xx Million USD, with a CAGR of xx% fueled by maritime security concerns and naval expansion. Competition in this area involves both international and regional shipbuilders.

Armored Vehicles: This segment includes Armored Personnel Carriers, Infantry Fighting Vehicles, Mine-Resistant Ambush Protected (MRAP) vehicles, Main Battle Tanks, and Other Armored Vehicles. The 2025 market size is projected at xx Million USD, with a CAGR of xx% driven by ongoing conflicts and the need for enhanced land warfare capabilities. Competition is fierce, with several key players actively competing for contracts.

Key Drivers of Middle East Military Vehicles Market Growth

The Middle East Military Vehicles market is propelled by several key factors. Geopolitical instability and regional conflicts drive significant demand for advanced military equipment. Furthermore, substantial defense budgets allocated by various nations in the region fuel acquisitions of cutting-edge military vehicles. Technological advancements, such as the incorporation of AI and autonomous systems, further contribute to market growth. Finally, government initiatives focused on modernizing armed forces and bolstering domestic defense industries provide additional impetus for market expansion.

Challenges in the Middle East Military Vehicles Market Sector

The Middle East Military Vehicles market faces certain challenges. Fluctuations in oil prices and economic downturns can impact government spending on defense. Supply chain disruptions and logistical complexities can affect procurement timelines and costs. Intense competition from both international and regional manufacturers creates a challenging landscape. Furthermore, stringent regulatory requirements and export controls can limit market access for some players. These factors can lead to delays in project implementations and ultimately, potentially lower overall market growth than initially projected.

Leading Players in the Middle East Military Vehicles Market Market

- Abu Dhabi Ship Building Co

- Dassault Aviation SA

- FNSS Savunma Sistemleri A Ş

- Oshkosh Corporation

- Lockheed Martin Corporation

- Rostec

- Airbus SE

- Naval Group

- Patria Group

- Fincantieri S p A

- Denel SOC Ltd

- Saudi Arabian Military Industries (SAMI)

- IAI

- BMC Otomotiv Sanayi ve Ticaret A Ş

- Leonardo S p A

- BAE Systems plc

- The Boeing Company

Key Developments in Middle East Military Vehicles Market Sector

October 2023: The Estonian Centre for Defence Investments awarded contracts to Turkish manufacturers Otokar and Nurol Makina for approximately 230 armored vehicles, valued at USD 211 Million. This highlights the increasing international demand for Turkish-made military vehicles.

June 2022: Israel awarded a USD 28 Million contract to IAI for hundreds of combat vehicles for its special forces. This underscores the ongoing demand for advanced combat vehicles even in countries with a strong indigenous defense industry.

Strategic Middle East Military Vehicles Market Outlook

The Middle East Military Vehicles market presents significant growth potential. Continued regional instability and modernization efforts by armed forces across the region will drive demand. Technological advancements, particularly in autonomous systems and artificial intelligence, will shape future market dynamics. Strategic partnerships and collaborations between international and regional players are expected to increase, leading to further market consolidation and innovation. Companies that adapt to the evolving technological landscape and meet the specific needs of regional customers will be well-positioned for success in this dynamic market.

Middle East Military Vehicles Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East Military Vehicles Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Military Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Armored Vehicles Segment to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United Arab Emirates Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Military Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Abu Dhabi Ship Building Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dassault Aviation SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 FNSS Savunma Sistemleri A Ş

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Oshkosh Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lockheed Martin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rostec

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Airbus SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Naval Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Patria Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Fincantieri S p A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Denel SOC Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Saudi Arabian Military Industries (SAMI)

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 IAI

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 BMC Otomotiv Sanayi ve Ticaret A Ş

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Leonardo S p A

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 BAE Systems plc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 The Boeing Company

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Abu Dhabi Ship Building Co

List of Figures

- Figure 1: Middle East Military Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Military Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Military Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Military Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Middle East Military Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Middle East Military Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Middle East Military Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Middle East Military Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Middle East Military Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East Military Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Qatar Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Israel Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Egypt Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Oman Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Middle East Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Middle East Military Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Middle East Military Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Middle East Military Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Middle East Military Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Middle East Military Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Middle East Military Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Saudi Arabia Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Israel Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Qatar Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kuwait Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Oman Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bahrain Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Jordan Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Lebanon Middle East Military Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Military Vehicles Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Middle East Military Vehicles Market?

Key companies in the market include Abu Dhabi Ship Building Co, Dassault Aviation SA, FNSS Savunma Sistemleri A Ş, Oshkosh Corporation, Lockheed Martin Corporation, Rostec, Airbus SE, Naval Group, Patria Group, Fincantieri S p A, Denel SOC Ltd, Saudi Arabian Military Industries (SAMI), IAI, BMC Otomotiv Sanayi ve Ticaret A Ş, Leonardo S p A, BAE Systems plc, The Boeing Company.

3. What are the main segments of the Middle East Military Vehicles Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.22 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Armored Vehicles Segment to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

In October 2023, the Estonian Centre for Defence Investments awarded contracts to Turkish manufacturers Otokar and Nurol Makina to purchase roughly 230 armored vehicles for a total of about USD 211 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Military Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Military Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Military Vehicles Market?

To stay informed about further developments, trends, and reports in the Middle East Military Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence