Key Insights

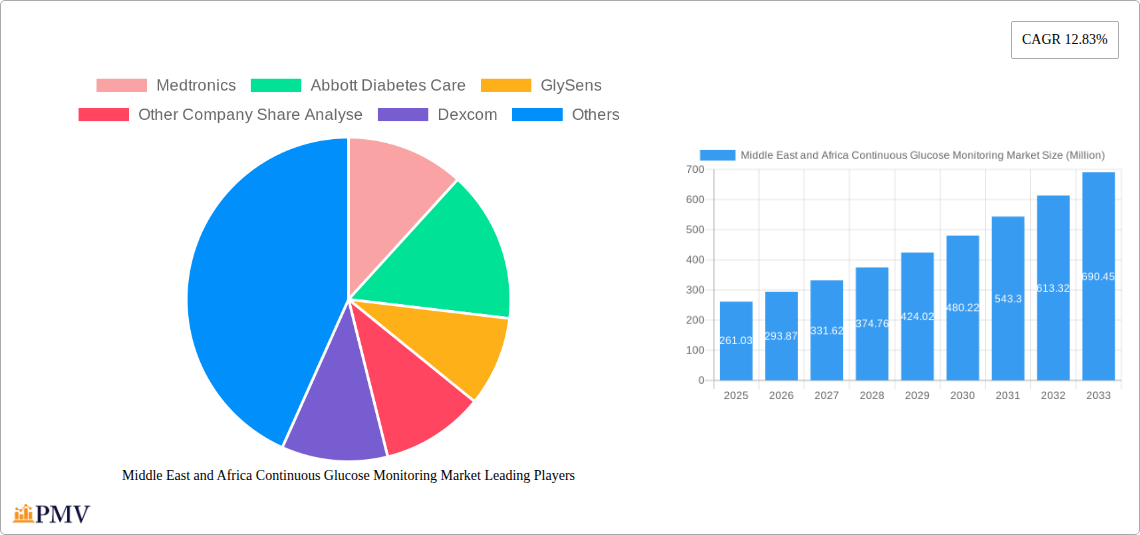

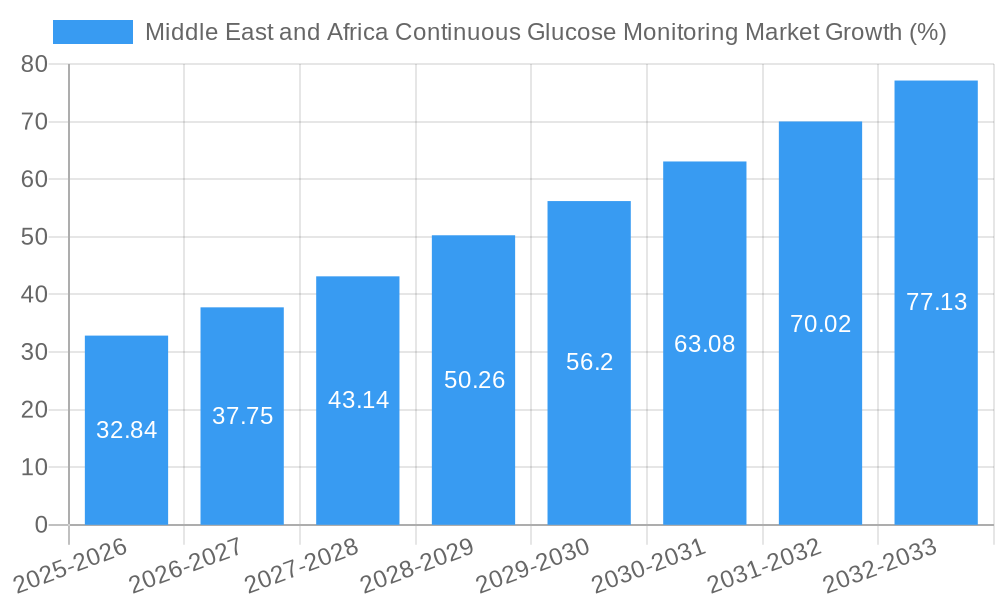

The Middle East and Africa Continuous Glucose Monitoring (CGM) market is experiencing robust growth, projected to reach a market size of $261.03 million by 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.83% from 2025 to 2033. This expansion is driven by several key factors. Rising prevalence of diabetes, particularly type 1 and type 2, across the region fuels the demand for advanced glucose management solutions. Increased awareness of CGM's benefits, such as improved glycemic control and reduced hypoglycemic events, is another significant driver. Furthermore, technological advancements leading to smaller, more accurate, and user-friendly devices are making CGMs more accessible and appealing to patients. Government initiatives promoting diabetes prevention and management programs also contribute positively to market growth. The market is segmented by components (sensors, durables) and distribution channels (online, offline). Key players like Medtronic, Abbott Diabetes Care, Dexcom, and Senseonics are driving innovation and competition within the market. While the online channel is expanding, offline distribution through clinics and hospitals remains dominant. Growth challenges include high device costs, limited insurance coverage in some areas, and a lack of awareness in certain segments of the population. Despite these restraints, the long-term outlook for the MEA CGM market remains positive, fuelled by increasing healthcare expenditure and a growing focus on improving diabetes care.

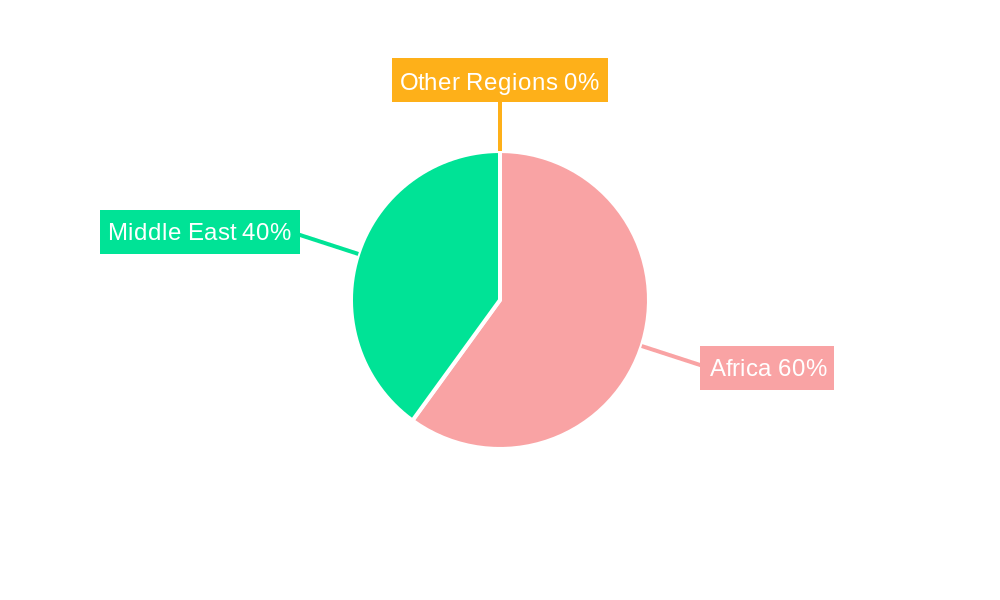

The African market, specifically, shows significant potential for future growth. Although precise data for individual African nations isn't readily available, extrapolating from the overall MEA CAGR and considering the increasing prevalence of diabetes in several key African countries, we can anticipate substantial market expansion. Factors like increasing healthcare infrastructure investment, growing disposable incomes in certain regions, and initiatives focused on improving diabetes management will play a crucial role. However, challenges like healthcare infrastructure disparities across different African countries and affordability concerns remain obstacles to overcome. Strategies focusing on public-private partnerships, affordable device options, and targeted education campaigns will be critical for unlocking the full potential of the African CGM market.

Middle East & Africa Continuous Glucose Monitoring (CGM) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa Continuous Glucose Monitoring (CGM) market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report analyzes market dynamics, competitive landscapes, and future growth potential. The report incorporates meticulous data analysis, forecasts, and expert commentary to provide a holistic understanding of this rapidly evolving market.

Middle East and Africa Continuous Glucose Monitoring Market Market Structure & Competitive Dynamics

The Middle East and Africa CGM market exhibits a moderately concentrated structure, with key players like Medtronic, Abbott Diabetes Care, Dexcom, and Senseonics holding significant market share. The market share of "Other Company Share Analyse" is estimated at xx Million in 2025. GlySens holds a smaller, yet impactful share, contributing to overall market vibrancy. The market is characterized by a dynamic innovation ecosystem, driven by technological advancements in sensor technology, data analytics, and mobile connectivity. Regulatory frameworks, while varying across the region, are increasingly supportive of CGM adoption, fueled by the rising prevalence of diabetes and the need for improved patient care. Product substitutes, such as traditional blood glucose monitoring methods, continue to exist, but their market share is gradually declining due to the superior convenience and accuracy offered by CGMs. End-user trends indicate a growing preference for user-friendly, accurate, and connected CGMs, driving the demand for advanced features like remote monitoring capabilities and data integration with healthcare systems. M&A activities in the sector have been relatively modest in recent years, with deal values averaging approximately xx Million annually during the historical period (2019-2024). This is expected to increase as larger players seek to consolidate their market positions.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Ecosystem: Driven by advancements in sensor technology, data analytics, and mobile connectivity.

- Regulatory Frameworks: Increasingly supportive of CGM adoption.

- M&A Activity: Moderate, with an average annual deal value of approximately xx Million (2019-2024).

Middle East and Africa Continuous Glucose Monitoring Market Industry Trends & Insights

The Middle East and Africa CGM market is experiencing robust growth, driven by several key factors. The rising prevalence of diabetes across the region is a primary driver, with an increasing number of individuals requiring continuous glucose monitoring for effective disease management. Technological advancements, particularly in sensor miniaturization, improved accuracy, and wireless connectivity, are further accelerating market adoption. Consumer preferences are shifting towards smaller, more comfortable, and user-friendly devices with integrated data management capabilities. Competitive dynamics are characterized by ongoing product innovation, strategic partnerships, and a focus on expanding market access through distribution channels. The market is estimated to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to increase from xx% in 2025 to xx% by 2033. This growth is being fueled by increased awareness of diabetes management, improved healthcare infrastructure in certain regions, and the increasing affordability of CGM devices. Furthermore, the growing adoption of telehealth and remote patient monitoring solutions is contributing to increased demand.

Dominant Markets & Segments in Middle East and Africa Continuous Glucose Monitoring Market

While the entire Middle East and Africa region shows promise, specific countries and segments are exhibiting faster growth. South Africa, for example, stands out due to relatively advanced healthcare infrastructure and a high prevalence of diabetes. Within segments, Sensors dominate the component market owing to higher replacement rates. The Offline distribution channel currently holds a larger share, however, the Online channel is expected to experience faster growth in the coming years.

Key Drivers:

- South Africa: Advanced healthcare infrastructure and high diabetes prevalence.

- Sensors: High replacement rates drive market growth.

- Offline Distribution: Established network and reach.

Dominance Analysis:

The dominance of specific segments is attributed to factors such as the affordability of devices, readily available healthcare infrastructure, and government initiatives to improve diabetes management. The growing acceptance of online platforms, especially among younger populations, points to a potential shift in market share towards online distribution in the coming years.

Middle East and Africa Continuous Glucose Monitoring Market Product Innovations

Recent product innovations focus on enhanced accuracy, smaller form factors, and improved user experience. Dexcom's G7, launched in South Africa in February 2023, exemplifies this trend with its user-friendly features and data-sharing capabilities. Abbott's development of a combined glucose-ketone sensor highlights the integration of advanced technologies to provide more comprehensive diabetes management tools. This is leading to better market fit and expanding the appeal of CGM devices beyond just glucose monitoring.

Report Segmentation & Scope

The report segments the Middle East and Africa CGM market across components (Sensors, Durables), and distribution channels (Online, Offline).

Components: The sensor segment is projected to experience the fastest growth due to its consumable nature. The durables segment is expected to show stable growth, primarily driven by the adoption of advanced CGM systems. Competitive dynamics within components are shaped by technological innovation and pricing strategies.

Distribution Channels: The offline channel currently dominates, primarily through hospitals, pharmacies, and clinics. The online channel is expected to witness faster growth, driven by increased e-commerce penetration and the preference for convenient home delivery. Competitive dynamics within distribution channels are shaped by the establishment of strategic partnerships and online market penetration strategies.

Key Drivers of Middle East and Africa Continuous Glucose Monitoring Market Growth

The growth of the Middle East and Africa CGM market is driven by a confluence of factors. The escalating prevalence of diabetes, coupled with improved healthcare infrastructure in certain regions, is a significant driver. Technological advancements, such as the development of smaller, more accurate, and user-friendly devices, are also propelling market expansion. Government initiatives to improve diabetes management and increase healthcare access play a crucial role. The rising adoption of telehealth and remote monitoring further fuels market growth. Finally, the increasing awareness among patients about the benefits of CGM is also a key contributor.

Challenges in the Middle East and Africa Continuous Glucose Monitoring Market Sector

Despite significant growth potential, the Middle East and Africa CGM market faces several challenges. High device costs and limited insurance coverage create access barriers for many patients. Supply chain disruptions, particularly in certain regions, can impact market availability and affordability. Furthermore, a lack of awareness about CGM benefits in some areas hinders market penetration. Regulatory hurdles and variations in healthcare systems across the region also present obstacles. These factors collectively impact market growth and limit the widespread adoption of CGM technology. The overall impact is estimated to reduce the annual market growth rate by approximately xx percentage points.

Leading Players in the Middle East and Africa Continuous Glucose Monitoring Market Market

- Medtronic

- Abbott Diabetes Care

- GlySens

- Other Company Share Analyse

- Dexcom

- Senseonics

Key Developments in Middle East and Africa Continuous Glucose Monitoring Market Sector

February 2023: Dexcom launched the Dexcom G7 CGM in South Africa, featuring the Dexcom Share and Follow feature, enhancing patient engagement and remote monitoring capabilities. This launch significantly expanded Dexcom's market reach and reinforced the trend toward user-friendly and data-sharing systems.

June 2022: Abbott announced the development of a combined glucose-ketone sensor, indicating a shift towards integrated monitoring systems and offering potential benefits to both patients and healthcare providers. This innovation positions Abbott to capture significant market share as the technology matures.

Strategic Middle East and Africa Continuous Glucose Monitoring Market Market Outlook

The Middle East and Africa CGM market presents a significant growth opportunity. Future market expansion will be driven by continued technological innovation, expansion of healthcare infrastructure, increased awareness of CGM benefits, and government support. Strategic opportunities include focusing on affordable solutions for low-income populations, strengthening distribution networks across the region, and developing targeted marketing campaigns to raise awareness. Partnerships with healthcare providers and insurance companies will be crucial to enhance market access and adoption. The market's future success hinges on addressing challenges related to affordability, access, and regulatory complexities.

Middle East and Africa Continuous Glucose Monitoring Market Segmentation

-

1. Components

- 1.1. Sensors

- 1.2. Durables

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. Iran

- 3.3. Egypt

- 3.4. Oman

- 3.5. South Africa

- 3.6. Rest of Middle East and Africa

Middle East and Africa Continuous Glucose Monitoring Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. Egypt

- 4. Oman

- 5. South Africa

- 6. Rest of Middle East and Africa

Middle East and Africa Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The sensors segment holds the highest market share in the Middle East and African Continuous Glucose Monitoring Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. Iran

- 5.3.3. Egypt

- 5.3.4. Oman

- 5.3.5. South Africa

- 5.3.6. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. Iran

- 5.4.3. Egypt

- 5.4.4. Oman

- 5.4.5. South Africa

- 5.4.6. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. Saudi Arabia Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Components

- 6.1.1. Sensors

- 6.1.2. Durables

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. Iran

- 6.3.3. Egypt

- 6.3.4. Oman

- 6.3.5. South Africa

- 6.3.6. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Components

- 7. Iran Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Components

- 7.1.1. Sensors

- 7.1.2. Durables

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. Iran

- 7.3.3. Egypt

- 7.3.4. Oman

- 7.3.5. South Africa

- 7.3.6. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Components

- 8. Egypt Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Components

- 8.1.1. Sensors

- 8.1.2. Durables

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. Iran

- 8.3.3. Egypt

- 8.3.4. Oman

- 8.3.5. South Africa

- 8.3.6. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Components

- 9. Oman Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Components

- 9.1.1. Sensors

- 9.1.2. Durables

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. Iran

- 9.3.3. Egypt

- 9.3.4. Oman

- 9.3.5. South Africa

- 9.3.6. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Components

- 10. South Africa Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Components

- 10.1.1. Sensors

- 10.1.2. Durables

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. Iran

- 10.3.3. Egypt

- 10.3.4. Oman

- 10.3.5. South Africa

- 10.3.6. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Components

- 11. Rest of Middle East and Africa Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Components

- 11.1.1. Sensors

- 11.1.2. Durables

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. Iran

- 11.3.3. Egypt

- 11.3.4. Oman

- 11.3.5. South Africa

- 11.3.6. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Components

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Medtronics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Abbott Diabetes Care

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GlySens

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Other Company Share Analyse

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dexcom

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Senseonics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 Medtronics

List of Figures

- Figure 1: Middle East and Africa Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Continuous Glucose Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 4: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 5: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 14: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 15: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 17: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 19: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 22: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 23: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 25: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 30: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 31: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 33: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 38: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 39: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 41: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 45: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 46: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 47: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 49: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 51: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2019 & 2032

- Table 54: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 55: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 56: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 57: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 58: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 59: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Continuous Glucose Monitoring Market?

The projected CAGR is approximately 12.83%.

2. Which companies are prominent players in the Middle East and Africa Continuous Glucose Monitoring Market?

Key companies in the market include Medtronics, Abbott Diabetes Care, GlySens, Other Company Share Analyse, Dexcom, Senseonics.

3. What are the main segments of the Middle East and Africa Continuous Glucose Monitoring Market?

The market segments include Components, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

The sensors segment holds the highest market share in the Middle East and African Continuous Glucose Monitoring Market in the current year.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

February 2023: Dexcom announced the launch of Dexcom G7 Continuous Glucose Monitoring in South Africa. The Dexcom G7 includes the Dexcom Share and Follow feature. The user of the Dexcom Follow app can also create customizable alerts and alarms. Additionally, the G7 system provides a more comprehensive view of glucose levels over time, giving people with diabetes and their healthcare providers more information to make decisions about treatment and diabetes management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence