Key Insights

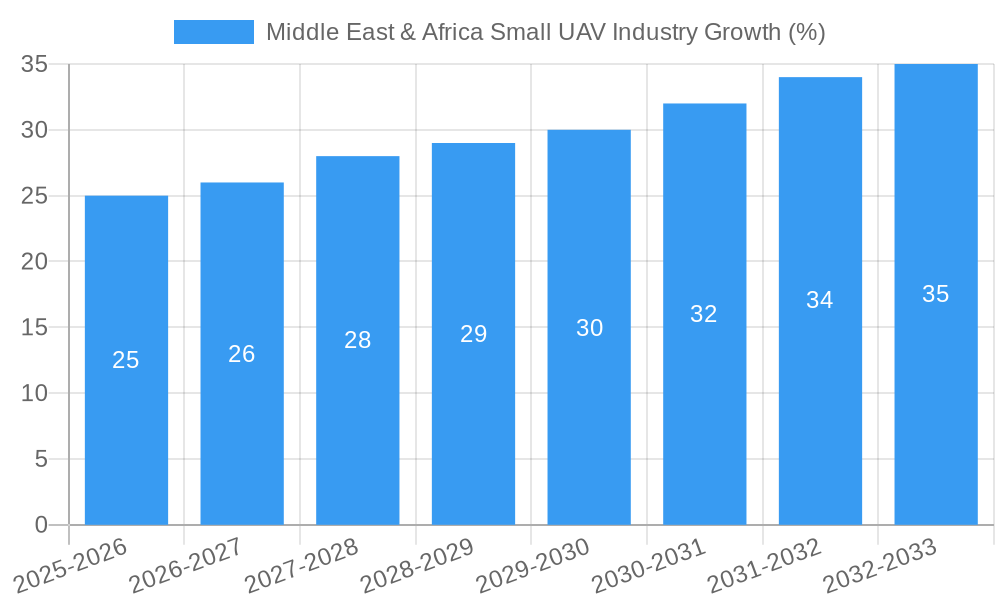

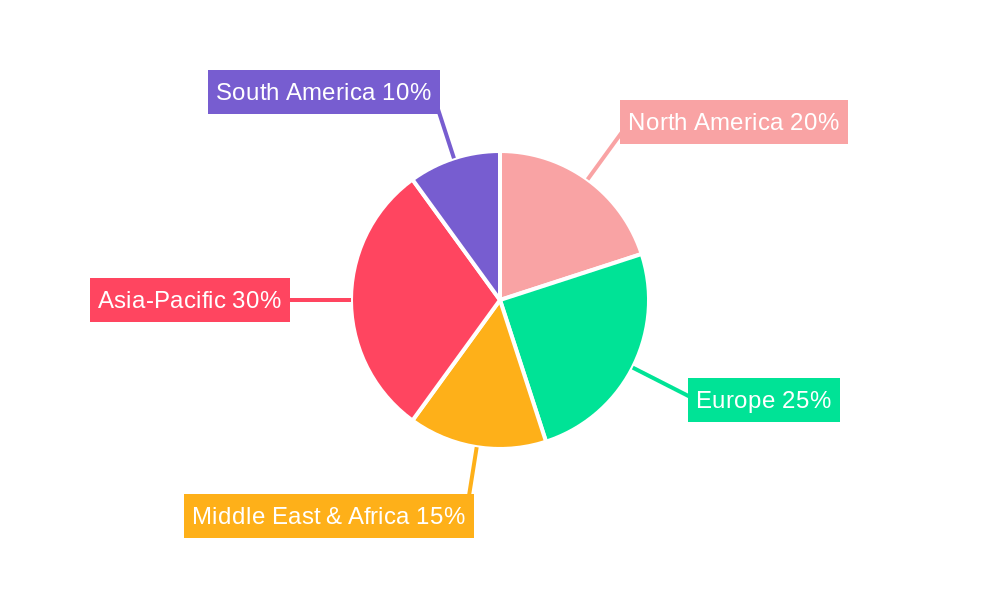

The Middle East & Africa small unmanned aerial vehicle (UAV) market is experiencing robust growth, driven by increasing demand from military and law enforcement agencies, as well as the burgeoning civil and commercial sectors. The market's expansion is fueled by factors such as rising security concerns, the need for efficient surveillance and monitoring, and the increasing adoption of UAVs for applications like agriculture, infrastructure inspection, and disaster relief. While precise market sizing for the Middle East & Africa region isn't provided, extrapolating from the global CAGR of over 5% and considering the region's unique security landscape and infrastructural needs, we can project significant growth. The market is segmented by UAV type (fixed-wing and rotary-wing) and application (military/law enforcement and civil/commercial). Fixed-wing UAVs are likely to dominate due to their longer range and endurance, particularly valuable for surveillance and mapping in vast territories. However, rotary-wing UAVs, offering greater maneuverability and precision, are expected to see strong growth in the civil and commercial sectors for applications like delivery and inspection. Key players in the region include both international giants and regional companies, indicating a dynamic and competitive landscape. Growth may be constrained by factors such as regulatory hurdles, technological limitations in certain areas, and the high initial investment costs associated with UAV acquisition and maintenance.

Despite potential restraints, the long-term outlook for the Middle East & Africa small UAV market remains positive. Continued technological advancements leading to more affordable and user-friendly systems, coupled with supportive government policies aimed at fostering technological innovation and boosting domestic industries, will likely accelerate market expansion. The increasing adoption of UAVs for various applications across different sectors promises substantial growth in the coming years, making it an attractive market for both established players and new entrants. The diverse applications across both military and civilian sectors suggest a market poised for sustained, if not accelerated, growth throughout the forecast period (2025-2033). Specific regional growth within Africa will be influenced by economic development, political stability, and the varying adoption rates across different nations.

Middle East & Africa Small UAV Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa Small Unmanned Aerial Vehicle (UAV) industry, offering crucial insights for stakeholders seeking to navigate this rapidly evolving market. The report covers the period 2019-2033, with a focus on the estimated year 2025, and includes historical data (2019-2024) and forecast projections (2025-2033). The total market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period.

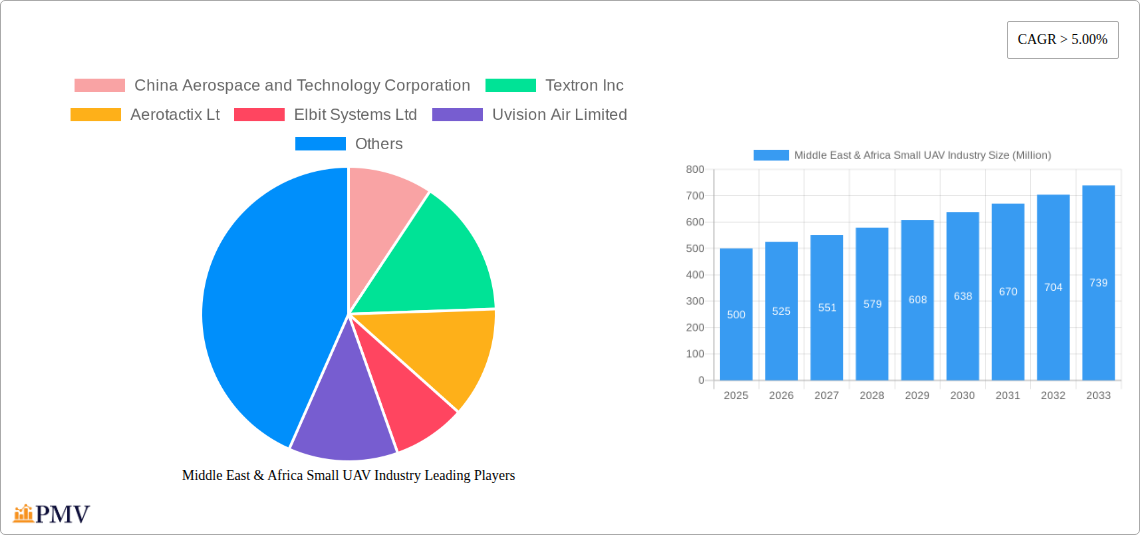

Middle East & Africa Small UAV Industry Market Structure & Competitive Dynamics

The Middle East & Africa small UAV market exhibits a moderately concentrated structure, with several key players commanding significant market share. The market's competitive landscape is dynamic, characterized by intense innovation and strategic partnerships. Leading players such as China Aerospace and Technology Corporation, Textron Inc, Elbit Systems Ltd, Uvision Air Limited, Rafael Advanced Defense Systems, DJI, AeroVironment Inc, Parrot Drones SAS, Northrop Grumman, Israel Aerospace Industries, BlueBird Aero Systems Ltd, and Microdrones GmbH are continuously vying for dominance through product innovation and strategic acquisitions.

Market share distribution varies significantly across segments (Fixed-wing vs. Rotary-wing, Military & Law Enforcement vs. Civil & Commercial). The Military and Law Enforcement segments currently hold a larger market share due to increased government spending on defense and security. However, the Civil and Commercial segment is witnessing exponential growth driven by applications in surveying, agriculture, and infrastructure monitoring.

M&A activity has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million. These mergers and acquisitions primarily focus on acquiring specialized technologies, expanding geographic reach, or strengthening product portfolios. Regulatory frameworks vary across the region, influencing market access and product certifications. The presence of substitute technologies, such as satellites, poses a competitive challenge, however, UAVs' unique capabilities in terms of cost-effectiveness and agility maintain their advantage. End-user preferences are evolving towards advanced features such as autonomous flight, enhanced payload capacity, and improved data analytics capabilities.

Middle East & Africa Small UAV Industry Industry Trends & Insights

The Middle East & Africa small UAV market is experiencing robust growth, fueled by several key factors. Increasing government investment in defense and security is a primary driver, particularly in nations facing geopolitical instability. Simultaneously, the burgeoning civil and commercial sectors are embracing UAVs for diverse applications such as precision agriculture, infrastructure inspection, and delivery services. The market is witnessing a significant shift towards autonomous flight capabilities, fueled by technological advancements in AI and machine learning. This trend is enhancing operational efficiency and reducing reliance on skilled operators. Consumer preferences increasingly favor UAVs with improved payload capacities and enhanced data processing capabilities.

The competitive landscape is characterized by both established defense contractors and emerging technology companies, leading to an active market with a healthy level of innovation. The market penetration of small UAVs is increasing rapidly, driven by decreasing costs and improving functionalities. While the military and law enforcement sectors are currently dominant, civil and commercial applications are expected to experience more significant growth in the forecast period. The overall market is projected to achieve a CAGR of xx% between 2025 and 2033.

Dominant Markets & Segments in Middle East & Africa Small UAV Industry

Leading Region: The UAE and Saudi Arabia are currently the leading markets in the region, driven by strong government investment in technology and infrastructure development. Other countries such as Egypt, South Africa, and Nigeria are also emerging as significant players.

Leading Country: The UAE stands out due to its proactive adoption of UAV technology for various applications, including security, logistics, and infrastructure development. The government’s support for technological advancements and the country's sophisticated infrastructure contribute to its dominance.

Dominant Segments:

- Type: Rotary-wing UAVs currently hold a larger market share due to their versatility and suitability for diverse applications. However, fixed-wing UAVs are gaining traction for long-range surveillance and mapping tasks.

- Application: The military and law enforcement segment currently dominates due to high government spending on security and defense. The civil and commercial sector, however, exhibits faster growth potential, driven by increased private sector adoption in agriculture, construction, and logistics.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting technological advancements and investments in infrastructure.

- Infrastructure: Well-developed infrastructure in certain countries facilitates the deployment and operation of UAVs.

- Geopolitical Factors: Security concerns in several countries are driving demand for UAVs for surveillance and security applications.

Middle East & Africa Small UAV Industry Product Innovations

The Middle East & Africa small UAV market is characterized by continuous product innovation, focusing on improving autonomy, payload capacity, and data analytics capabilities. Miniaturization, enhanced sensor integration, and improved battery technology are key technological trends shaping the market. The market is witnessing the emergence of hybrid UAV designs, combining the strengths of fixed-wing and rotary-wing platforms. This continuous innovation ensures that UAVs are well-suited for a wide range of applications and market demands.

Report Segmentation & Scope

This report segments the Middle East & Africa small UAV market based on type (fixed-wing and rotary-wing) and application (military and law enforcement, civil and commercial). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The report also incorporates a detailed analysis of the leading players in each segment. Specific growth projections for each segment are detailed within the full report. The competitive landscape is analyzed, highlighting key players and their strategies for market penetration.

Key Drivers of Middle East & Africa Small UAV Industry Growth

Several factors contribute to the growth of the Middle East & Africa small UAV industry. Technological advancements, particularly in autonomous flight and AI, are driving efficiency and expanding applications. Government investments in defense and security, coupled with increasing private sector adoption in various industries such as agriculture and infrastructure, fuel market expansion. Favorable regulatory environments in some countries further stimulate market growth.

Challenges in the Middle East & Africa Small UAV Industry Sector

The Middle East & Africa small UAV market faces challenges such as stringent regulatory frameworks in some countries, hindering market access and creating complexities for manufacturers. Supply chain disruptions, particularly concerning critical components like batteries and sensors, also pose a significant threat to market growth. Furthermore, intense competition among established players and new entrants creates price pressures. These constraints are estimated to have impacted growth rates by an estimated xx% in the historical period.

Leading Players in the Middle East & Africa Small UAV Industry Market

- China Aerospace and Technology Corporation

- Textron Inc

- Aerotactix Lt

- Elbit Systems Ltd

- Uvision Air Limited

- Rafael Advanced Defense Systems

- DJI

- AeroVironment Inc

- Parrot Drones SAS

- Northrop Grumman

- Israel Aerospace Industries

- BlueBird Aero Systems Ltd

- Microdrones GmbH

Key Developments in Middle East & Africa Small UAV Industry Sector

- October 2021: Israel Aerospace Industries (IAI) partnered with IAR-Brasov to offer advanced UAV solutions, expanding their market reach and product offerings.

- November 2022: A UAE government entity ordered a fleet of smart drones from Airobotics for urban deployment, showcasing the growing adoption of UAVs in public services.

Strategic Middle East & Africa Small UAV Industry Market Outlook

The Middle East & Africa small UAV market presents significant growth opportunities. Continued technological advancements, increasing government and private sector investments, and the expansion of applications across diverse sectors will drive market expansion. Strategic partnerships, focusing on technological collaborations and market penetration, will play a crucial role in shaping the future market landscape. The market holds considerable potential for innovative companies with a strong focus on technological advancements and customized solutions for the region's specific needs.

Middle East & Africa Small UAV Industry Segmentation

-

1. Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Application

- 2.1. Military and Law Enforcement

- 2.2. Civil and Commercial

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Israel

- 3.4. Rest of Middle-East and Africa

Middle East & Africa Small UAV Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Israel

- 4. Rest of Middle East and Africa

Middle East & Africa Small UAV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Military and Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Law Enforcement

- 5.2.2. Civil and Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Israel

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Israel

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed-wing

- 6.1.2. Rotary-wing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Military and Law Enforcement

- 6.2.2. Civil and Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Israel

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed-wing

- 7.1.2. Rotary-wing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Military and Law Enforcement

- 7.2.2. Civil and Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Israel

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Israel Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed-wing

- 8.1.2. Rotary-wing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Military and Law Enforcement

- 8.2.2. Civil and Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Israel

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed-wing

- 9.1.2. Rotary-wing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Military and Law Enforcement

- 9.2.2. Civil and Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Israel

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East & Africa Small UAV Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 China Aerospace and Technology Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Textron Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Aerotactix Lt

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Elbit Systems Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Uvision Air Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Rafael Advanced Defense Systems

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 DJI

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AeroVironment Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Parrot Drones SAS

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Northrop Grumman

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Israel Aerospace Industries

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 BlueBird Aero Systems Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Microdrones GmbH

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 China Aerospace and Technology Corporation

List of Figures

- Figure 1: Middle East & Africa Small UAV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Small UAV Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East & Africa Small UAV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East & Africa Small UAV Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Small UAV Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Middle East & Africa Small UAV Industry?

Key companies in the market include China Aerospace and Technology Corporation, Textron Inc, Aerotactix Lt, Elbit Systems Ltd, Uvision Air Limited, Rafael Advanced Defense Systems, DJI, AeroVironment Inc, Parrot Drones SAS, Northrop Grumman, Israel Aerospace Industries, BlueBird Aero Systems Ltd, Microdrones GmbH.

3. What are the main segments of the Middle East & Africa Small UAV Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Military and Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021: Israeli defense company Israel Aerospace Industries (IAI) signed a cooperation agreement with Romanian defense company IAR-Brasov to offer advanced UAV solutions. This agreement will allow the two companies to collaborate on the development and production of unmanned aerial vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Small UAV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Small UAV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Small UAV Industry?

To stay informed about further developments, trends, and reports in the Middle East & Africa Small UAV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence