Key Insights

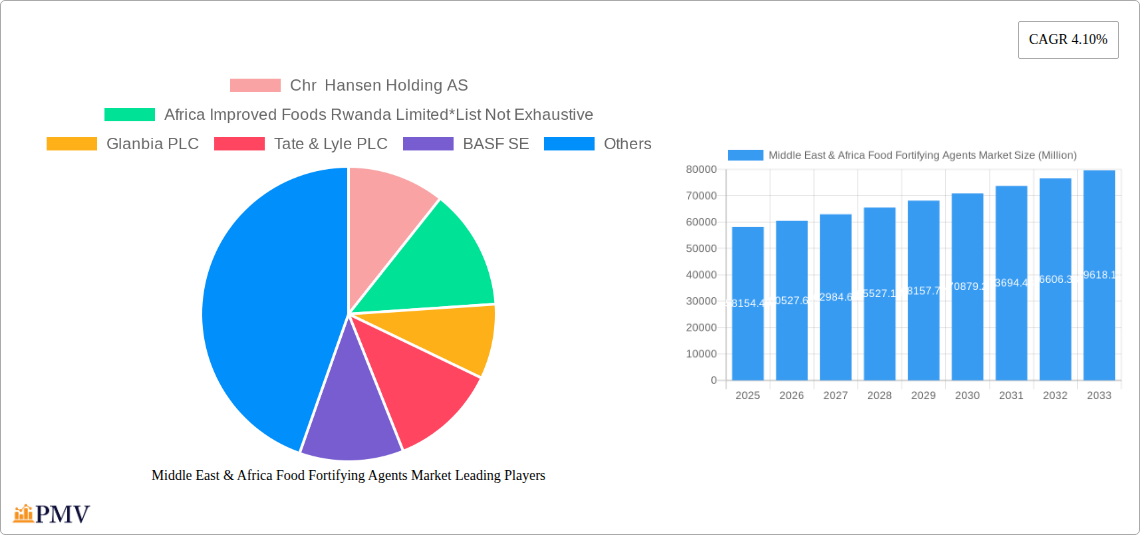

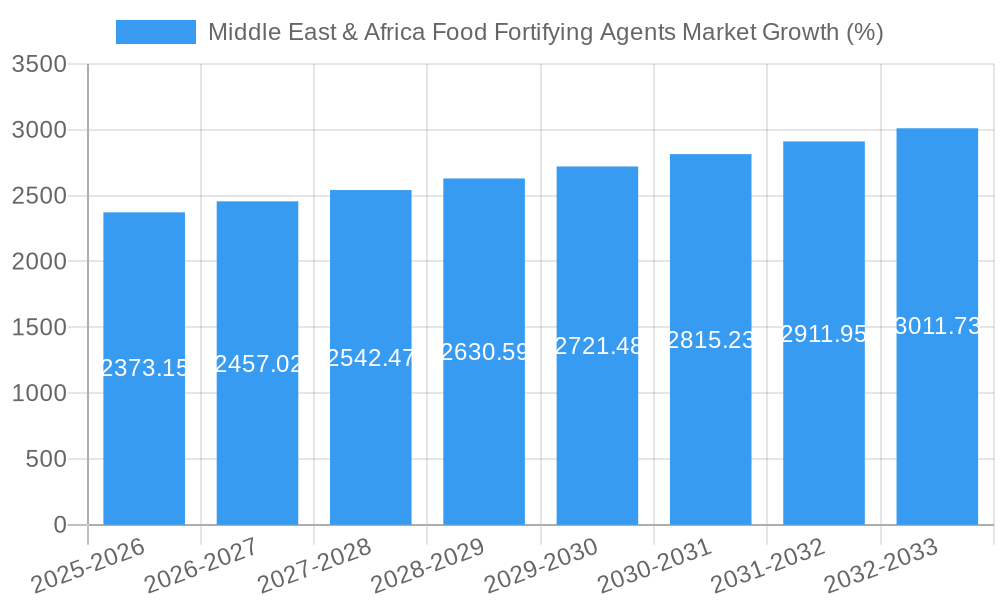

The Middle East & Africa Food Fortifying Agents market, valued at $58,154.49 million in 2025, is projected to experience robust growth, driven by increasing awareness of malnutrition and the rising prevalence of micronutrient deficiencies across the region. Government initiatives promoting food fortification, coupled with rising disposable incomes and a shift towards healthier lifestyles, are significant catalysts for market expansion. The demand for fortified infant formula and dairy products is particularly strong, fueled by a growing young population and increased adoption of convenient, nutritionally enhanced food options. The market segmentation reveals a strong preference for proteins & amino acids, vitamins & minerals, and prebiotics & probiotics as key fortifying agents. While the region faces challenges such as fluctuating raw material prices and inconsistent regulatory frameworks, these are largely offset by the substantial demand and potential for growth. Key players like Chr. Hansen Holding AS, Glanbia PLC, and BASF SE are strategically investing in research and development to cater to the specific nutritional needs of the region and enhance their market presence. The forecast period (2025-2033) suggests sustained growth driven by continuous improvements in food processing techniques, increasing urbanization, and growing consumer preference for fortified foods, leading to a significant market expansion.

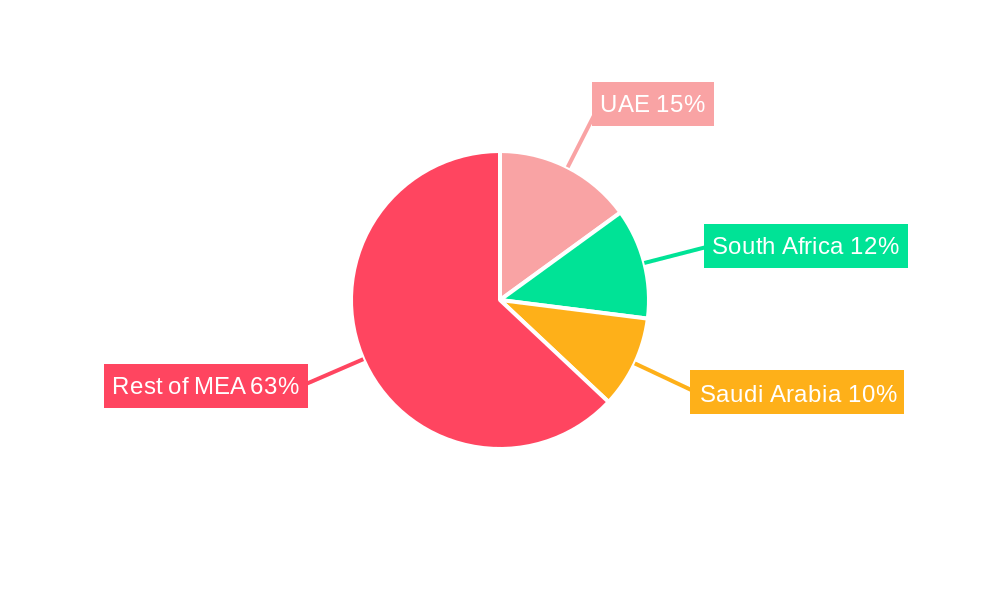

The diverse range of applications, including cereals, beverages, and dietary supplements, contributes to the market's dynamism. Growth is further fueled by the rising prevalence of lifestyle diseases like obesity and diabetes, leading to increased consumer demand for functional foods with added nutritional value. Specific regional growth will vary, with countries like the UAE and South Africa showing higher adoption rates due to advanced infrastructure and greater consumer awareness. The competitive landscape is marked by both large multinational corporations and local players, fostering innovation and competition. Ongoing technological advancements in fortification techniques are contributing to the development of more efficient and effective fortification solutions, further driving market expansion. Continued investment in research and development and targeted marketing strategies aimed at addressing regional nutritional challenges will be crucial for sustained market growth.

Middle East & Africa Food Fortifying Agents Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East & Africa Food Fortifying Agents Market, offering valuable insights into market dynamics, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033, this report is an essential resource for industry stakeholders seeking to understand and navigate this evolving market. The report segments the market by type (Proteins & Amino Acids, Vitamins & Minerals, Lipids, Prebiotics & Probiotics, Others) and application (Infant Formula, Dairy & Dairy-Based Products, Cereals & Cereal-based Products, Fats & Oils, Beverages, Dietary Supplements, Others). Key players analyzed include Chr. Hansen Holding AS, Africa Improved Foods Rwanda Limited, Glanbia PLC, Tate & Lyle PLC, BASF SE, Koninklijke DSM NV, and Ingredion Incorporated.

Middle East & Africa Food Fortifying Agents Market Market Structure & Competitive Dynamics

The Middle East & Africa Food Fortifying Agents market exhibits a moderately concentrated structure, with a few large multinational players holding significant market share. However, the presence of several regional and smaller players indicates a competitive landscape. Innovation ecosystems are developing, driven by increasing consumer demand for fortified foods and the need to address nutritional deficiencies. Regulatory frameworks vary across the region, influencing product approvals and market access. The market witnesses continuous product substitution, as newer, more effective, and sustainable fortification agents are introduced. End-user trends such as growing health consciousness and increasing awareness of the importance of micronutrients are major market drivers. M&A activities in the food and nutrition sector have been moderate, with deal values estimated at xx Million in 2024. Key market share metrics include:

- Vitamins & Minerals: Holding approximately xx% market share, driven by high demand for affordable fortification solutions.

- Proteins & Amino Acids: Showing a growing share of approximately xx%, fueled by the increasing emphasis on protein intake.

- Large Players Market Share: The top five players collectively control an estimated xx% of the market.

Middle East & Africa Food Fortifying Agents Market Industry Trends & Insights

The Middle East & Africa Food Fortifying Agents market is experiencing robust growth, driven primarily by rising health awareness, increasing disposable incomes, and government initiatives promoting food fortification programs. The CAGR for the forecast period (2025-2033) is projected at xx%, with market penetration reaching an estimated xx% by 2033. Technological advancements, such as the development of more bioavailable and stable fortification agents, are further fueling market expansion. Consumer preferences are shifting toward natural and organic fortification agents, creating opportunities for manufacturers offering such products. Competitive dynamics are shaped by pricing strategies, product innovation, and brand building. The market is witnessing increased adoption of sustainable sourcing and manufacturing practices. Specific trends include:

- Increasing demand for fortified infant formula and dairy products: Driven by rising birth rates and increasing awareness of early childhood nutrition.

- Growth in the demand for fortified cereals and cereal-based products: Aligned with increasing consumption of breakfast cereals and convenience foods.

- Expansion of the dietary supplement segment: Reflecting a greater focus on personalized nutrition and functional foods.

Dominant Markets & Segments in Middle East & Africa Food Fortifying Agents Market

The North African region currently dominates the Middle East & Africa Food Fortifying Agents Market, with countries like Egypt and Morocco showcasing significant growth. Within segments:

- By Type: Vitamins & Minerals constitute the largest segment, driven by their wide application across various food products and cost-effectiveness.

- By Application: The infant formula segment exhibits the highest growth rate, fueled by stringent regulations and increasing awareness of infant nutrition.

Key Drivers for Dominant Regions:

- Strong economic growth: Increased disposable incomes lead to higher spending on food and beverages, including fortified products.

- Government initiatives: Government-sponsored fortification programs and regulations are boosting market growth.

- Favorable demographic trends: Rising populations and changing dietary habits contribute to increased demand.

Dominance Analysis: The dominance of North Africa stems from a combination of factors including high population density, rising health consciousness, and the presence of established food processing industries.

Middle East & Africa Food Fortifying Agents Market Product Innovations

Recent product innovations focus on developing more bioavailable and stable fortification agents, including microencapsulation techniques and the use of novel delivery systems. These improvements enhance the shelf life and efficacy of fortified foods. Furthermore, there is a strong focus on developing natural and organic fortification agents to cater to the growing consumer preference for clean-label products. This reflects a shift towards sustainability and improved product quality.

Report Segmentation & Scope

This report segments the Middle East & Africa Food Fortifying Agents market by:

By Type:

- Proteins & Amino Acids: This segment is experiencing steady growth due to the rising awareness of protein's importance in health and nutrition. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

- Vitamins & Minerals: This segment holds the largest market share, fueled by the widespread use of these agents in various food products. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

- Lipids: This segment shows a moderate growth rate, driven by increasing demand for fortified fats and oils. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

- Prebiotics & Probiotics: This segment is witnessing rapid growth, propelled by rising consumer interest in gut health and functional foods. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

- Others: This segment includes other fortification agents and is expected to show moderate growth. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

By Application: Each application segment shows unique growth trajectories based on regional consumption patterns and regulatory frameworks.

Key Drivers of Middle East & Africa Food Fortifying Agents Market Growth

Several factors fuel the market’s growth: the increasing prevalence of micronutrient deficiencies, rising consumer awareness of health and wellness, government initiatives promoting food fortification, and the growing demand for convenience foods. Technological advancements in fortification technologies also contribute, alongside the expanding food processing industry and rising disposable incomes in certain regions.

Challenges in the Middle East & Africa Food Fortifying Agents Market Sector

Challenges include the varying regulatory landscapes across the region, inconsistent infrastructure impacting supply chain management, high costs of certain fortification agents, and competition from other food and beverage companies. Furthermore, ensuring the stability and bioavailability of fortification agents in different food matrices remains a challenge for manufacturers.

Leading Players in the Middle East & Africa Food Fortifying Agents Market Market

- Chr. Hansen Holding AS

- Africa Improved Foods Rwanda Limited

- Glanbia PLC

- Tate & Lyle PLC

- BASF SE

- Koninklijke DSM NV

- Ingredion Incorporated

Key Developments in Middle East & Africa Food Fortifying Agents Market Sector

- 2023 (Q4): Koninklijke DSM NV launched a new line of sustainable fortification agents.

- 2022 (Q3): A major merger between two regional food fortification companies resulted in increased market concentration.

- 2021 (Q1): New regulations regarding food fortification were implemented in several key markets. (Further details on specific events with month/year would be added in the full report.)

Strategic Middle East & Africa Food Fortifying Agents Market Market Outlook

The Middle East & Africa Food Fortifying Agents market is poised for significant growth, driven by sustained demand, technological innovations, and favorable government policies. Strategic opportunities exist for companies focusing on developing sustainable, cost-effective, and consumer-friendly fortification solutions. Companies with strong R&D capabilities and a focus on product differentiation are well-positioned to capitalize on this growth.

Middle East & Africa Food Fortifying Agents Market Segmentation

-

1. Type

- 1.1. Proteins & Amino Acids

- 1.2. Vitamins & Minerals

- 1.3. Lipids

- 1.4. Prebiotics & Probiotics

- 1.5. Others

-

2. Application

- 2.1. Infant Formula

- 2.2. Dairy & Dairy-Based Products

- 2.3. Cereals & Cereal-based Products

- 2.4. Fats & Oils

- 2.5. Beverages

- 2.6. Dietary Supplements

- 2.7. Others

-

3. Geography

- 3.1. South Africa

- 3.2. United Arab Emirates

- 3.3. Rest of Middle East & Africa

Middle East & Africa Food Fortifying Agents Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Rest of Middle East

Middle East & Africa Food Fortifying Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Rising Demand for Prebiotics & Probiotics Fortified Food in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proteins & Amino Acids

- 5.1.2. Vitamins & Minerals

- 5.1.3. Lipids

- 5.1.4. Prebiotics & Probiotics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Dairy & Dairy-Based Products

- 5.2.3. Cereals & Cereal-based Products

- 5.2.4. Fats & Oils

- 5.2.5. Beverages

- 5.2.6. Dietary Supplements

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. United Arab Emirates

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Proteins & Amino Acids

- 6.1.2. Vitamins & Minerals

- 6.1.3. Lipids

- 6.1.4. Prebiotics & Probiotics

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Dairy & Dairy-Based Products

- 6.2.3. Cereals & Cereal-based Products

- 6.2.4. Fats & Oils

- 6.2.5. Beverages

- 6.2.6. Dietary Supplements

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. United Arab Emirates

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Proteins & Amino Acids

- 7.1.2. Vitamins & Minerals

- 7.1.3. Lipids

- 7.1.4. Prebiotics & Probiotics

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Dairy & Dairy-Based Products

- 7.2.3. Cereals & Cereal-based Products

- 7.2.4. Fats & Oils

- 7.2.5. Beverages

- 7.2.6. Dietary Supplements

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. United Arab Emirates

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Middle East Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Proteins & Amino Acids

- 8.1.2. Vitamins & Minerals

- 8.1.3. Lipids

- 8.1.4. Prebiotics & Probiotics

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Dairy & Dairy-Based Products

- 8.2.3. Cereals & Cereal-based Products

- 8.2.4. Fats & Oils

- 8.2.5. Beverages

- 8.2.6. Dietary Supplements

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. United Arab Emirates

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. UAE Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 10. South Africa Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of MEA Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Chr Hansen Holding AS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Africa Improved Foods Rwanda Limited*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Glanbia PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tate & Lyle PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke DSM NV

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ingredion Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Chr Hansen Holding AS

List of Figures

- Figure 1: Middle East & Africa Food Fortifying Agents Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Food Fortifying Agents Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Food Fortifying Agents Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Middle East & Africa Food Fortifying Agents Market?

Key companies in the market include Chr Hansen Holding AS, Africa Improved Foods Rwanda Limited*List Not Exhaustive, Glanbia PLC, Tate & Lyle PLC, BASF SE, Koninklijke DSM NV, Ingredion Incorporated.

3. What are the main segments of the Middle East & Africa Food Fortifying Agents Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 58154.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Rising Demand for Prebiotics & Probiotics Fortified Food in the Region.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Food Fortifying Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Food Fortifying Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Food Fortifying Agents Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Food Fortifying Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence