Key Insights

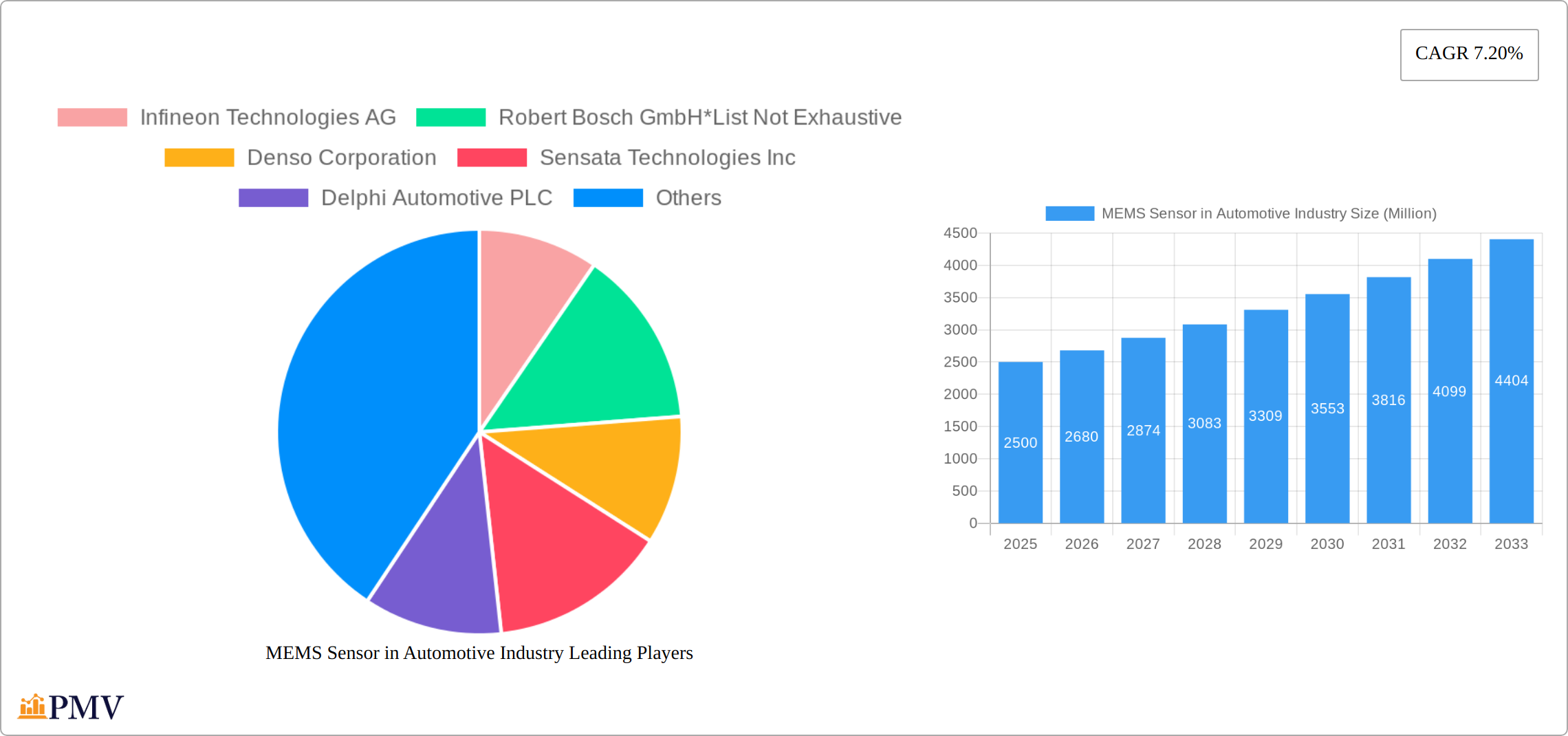

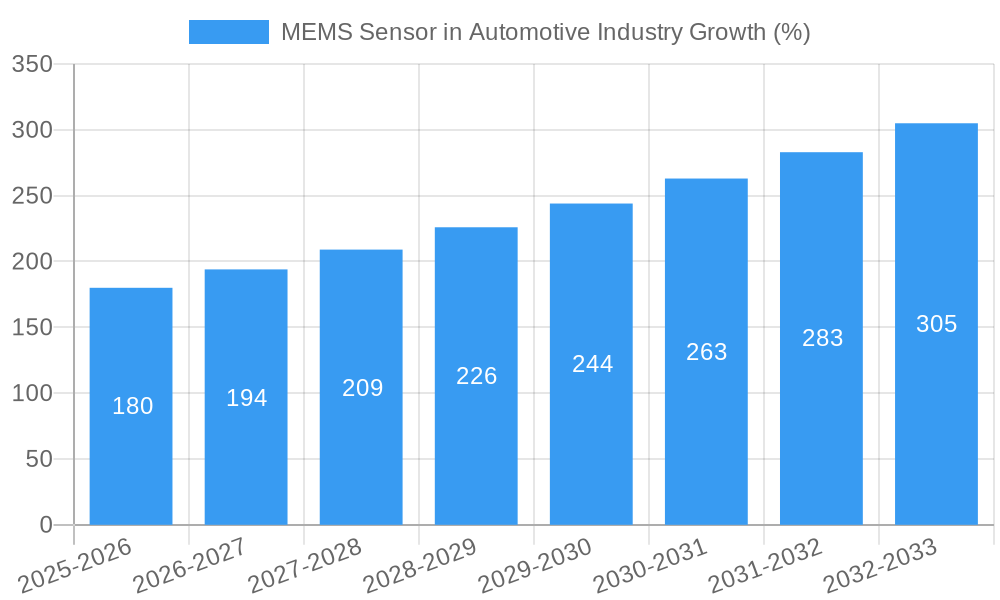

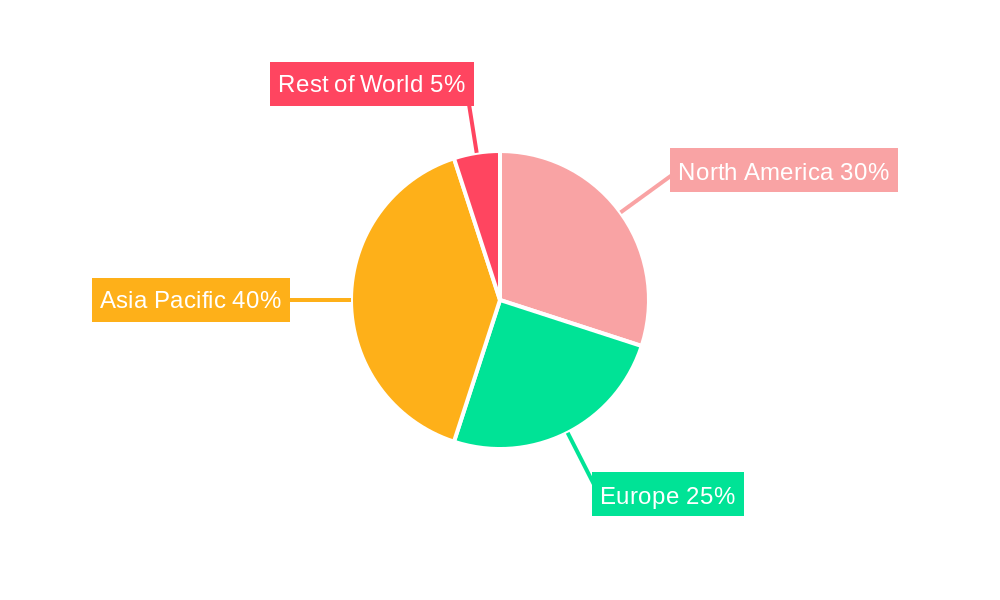

The automotive MEMS sensor market is experiencing robust growth, driven by increasing vehicle automation, advanced driver-assistance systems (ADAS), and the rising demand for electric and hybrid vehicles. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided 2019-2024 historical period and 7.20% CAGR), is projected to expand significantly over the forecast period (2025-2033). Key growth drivers include the integration of sophisticated safety features like airbag deployment sensors, electronic stability control, and lane departure warning systems. Furthermore, the increasing adoption of connected car technologies, requiring precise positioning and environmental sensing capabilities, fuels demand for MEMS sensors like gyroscopes and accelerometers. Segment-wise, tire pressure monitoring systems (TPMS) and engine control sensors currently dominate the market, but growth is anticipated across all segments, particularly in fuel injection and fuel pump sensors driven by efficiency improvements in internal combustion engines and increasing electrification. While challenges exist related to the high cost of advanced sensor technologies and stringent regulatory requirements, ongoing technological advancements, miniaturization, and cost reductions are expected to mitigate these restraints. Leading players like Infineon Technologies, Bosch, Denso, and Sensata Technologies are investing heavily in R&D to capitalize on this expanding market. Regional growth is projected to be highest in Asia Pacific due to the burgeoning automotive industry in China and India.

The competitive landscape is marked by intense rivalry among established players and emerging companies. Successful strategies include focusing on innovation, developing highly integrated solutions, and building strong partnerships within the automotive ecosystem. The forecast period (2025-2033) will witness a continuous increase in the sophistication of automotive MEMS sensors, with a shift towards higher accuracy, improved reliability, and enhanced functionalities. This will lead to increased sensor integration into diverse vehicle applications, including infotainment systems, autonomous driving features, and vehicle health monitoring. The market's future is promising, particularly given the global push towards safer, more efficient, and technologically advanced vehicles.

MEMS Sensor in Automotive Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the MEMS Sensor in Automotive Industry market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous market research. The global market is projected to reach xx Million by 2033.

MEMS Sensor in Automotive Industry Market Structure & Competitive Dynamics

The automotive MEMS sensor market exhibits a moderately concentrated structure, with several key players holding significant market share. The competitive landscape is characterized by intense R&D investments, strategic partnerships, and frequent mergers and acquisitions (M&A) aimed at expanding product portfolios and geographical reach. Infineon Technologies AG, Robert Bosch GmbH, Denso Corporation, and Sensata Technologies Inc. are among the dominant players, collectively holding an estimated xx% market share in 2025. Recent M&A activity has focused on consolidating smaller players and enhancing technological capabilities. For example, while exact deal values aren't publicly available for all transactions, the total value of M&A deals in the sector during 2022 is estimated at approximately xx Million. Regulatory frameworks, particularly those concerning vehicle safety and emissions, heavily influence market dynamics. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles further fuels market growth and drives innovation. Product substitutes, such as alternative sensing technologies, pose a moderate threat, but the superior precision and cost-effectiveness of MEMS sensors generally maintain their dominance. End-user trends show a clear shift toward higher levels of vehicle automation, driving demand for more sophisticated sensor systems.

MEMS Sensor in Automotive Industry Industry Trends & Insights

The automotive MEMS sensor market is experiencing robust growth, driven by the increasing demand for advanced safety features, enhanced fuel efficiency, and improved vehicle performance. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly in areas such as miniaturization, improved sensor accuracy, and the integration of artificial intelligence (AI) are reshaping the industry. Market penetration of MEMS sensors in various vehicle applications is steadily increasing, with a significant portion of new vehicles incorporating numerous MEMS-based sensors. Consumer preferences lean toward vehicles offering advanced safety features, contributing to the increased adoption of MEMS sensors. The competitive dynamics remain intense, with companies continuously striving for innovation and cost optimization to maintain their market position. This competition is fostering a positive feedback loop, leading to accelerated innovation and improved performance within the MEMS sensor market.

Dominant Markets & Segments in MEMS Sensor in Automotive Industry

The Asia-Pacific region, particularly China and Japan, currently dominates the global automotive MEMS sensor market. This dominance is driven by several key factors:

- Rapid growth of the automotive industry: High vehicle production volumes in these regions directly translate into increased demand for automotive sensors.

- Government support for technological advancements: Favorable economic policies and significant investments in automotive R&D are accelerating market expansion.

- Extensive automotive infrastructure: A well-developed automotive manufacturing ecosystem provides a solid foundation for growth.

Segment Dominance: Within the MEMS sensor types, Tire Pressure Monitoring Systems (TPMS) currently hold the largest market share, fueled by stringent safety regulations and growing consumer awareness of tire safety. However, the fastest-growing segment is projected to be ADAS-related sensors, including gyroscopes and accelerometers, owing to the rapid adoption of autonomous driving technologies. Other rapidly growing segments include: Fuel Injection and Fuel Pump Sensors, Air Bag Deployment Sensors, and Engine Oil Sensors, driven by the continued need for precise engine management and safety features.

MEMS Sensor in Automotive Industry Product Innovations

Recent innovations in MEMS sensors encompass improvements in sensitivity, accuracy, and power consumption. Miniaturization remains a key focus, enabling the integration of more sensors within increasingly compact automotive systems. The integration of MEMS sensors with AI and machine learning algorithms is enhancing sensor data processing capabilities, leading to improved decision-making in advanced safety systems. These technological advancements offer significant competitive advantages, enabling manufacturers to provide more reliable, efficient, and cost-effective solutions. This increased efficiency and reliability are particularly attractive to the automotive industry with its inherent demand for sophisticated sensors.

Report Segmentation & Scope

This report segments the automotive MEMS sensor market by type:

- Tire Pressure Sensors: This segment is experiencing steady growth due to increasing safety regulations and consumer demand. Market size is projected at xx Million in 2025.

- Engine Oil Sensors: Essential for engine health monitoring, this segment demonstrates consistent growth, projected at xx Million in 2025.

- Combustion Sensors: Crucial for efficient engine operation, this segment shows moderate growth with a projected size of xx Million in 2025.

- Fuel Injection and Fuel Pump Sensors: This segment exhibits strong growth potential driven by advancements in fuel injection technology. Projected market size in 2025: xx Million.

- Air Bag Deployment Sensors: Safety regulations are a major driver for this segment, with a projected market size of xx Million in 2025.

- Gyroscopes: Rapid growth is anticipated due to their role in ADAS and autonomous driving. Projected market size in 2025: xx Million.

- Fuel Rail Pressure Sensors: This segment shows steady growth driven by improving fuel efficiency standards. Projected market size in 2025: xx Million.

- Other Types: This includes airflow control, crankshaft position, roll-over detection, and automatic door lock sensors, presenting a diverse range of growth opportunities. Projected market size in 2025: xx Million.

Key Drivers of MEMS Sensor in Automotive Industry Growth

Several key factors are driving the growth of the MEMS sensor market in the automotive industry:

- Increasing adoption of ADAS and autonomous driving technologies: These systems rely heavily on numerous MEMS sensors for precise data acquisition.

- Stringent safety regulations: Governments worldwide are implementing stricter safety standards, mandating the use of advanced sensor technologies.

- Demand for enhanced fuel efficiency: Improved engine management systems relying on MEMS sensors contribute significantly to fuel economy.

- Advancements in MEMS technology: Continuous innovation in sensor design and manufacturing processes leads to smaller, more efficient, and more cost-effective sensors.

Challenges in the MEMS Sensor in Automotive Industry Sector

Despite significant growth potential, the automotive MEMS sensor market faces several challenges:

- Supply chain disruptions: Global supply chain instability can impact the availability and cost of raw materials and components.

- High initial investment costs: Developing and manufacturing advanced MEMS sensors requires substantial capital investment.

- Stringent quality and reliability requirements: Automotive applications demand the highest levels of sensor quality and reliability, requiring stringent testing and validation procedures.

- Competition from alternative sensor technologies: MEMS sensors face competition from other sensing technologies, requiring continuous innovation to maintain a competitive edge.

Leading Players in the MEMS Sensor in Automotive Industry Market

- Infineon Technologies AG

- Robert Bosch GmbH

- Denso Corporation

- Sensata Technologies Inc

- Delphi Automotive PLC

- Freescale Semiconductors Ltd

- General Electric Co

- STMicroelectronics NV

- Analog Devices Inc

- Panasonic Corporation

Key Developments in MEMS Sensor in Automotive Industry Sector

- October 2022: MicroVision, Inc. announced that its MAVIN DR dynamic view lidar system is supported by the NVIDIA DRIVE AGX platform, enhancing ADAS capabilities. This highlights the growing integration of MEMS-based lidar in autonomous driving systems.

- February 2022: TDK Corporation launched the InvenSense Product Longevity Program (PLP), ensuring long-term availability of high-performance MEMS sensors for automotive and industrial applications. This addresses a critical need for long-term component supply in the automotive sector.

Strategic MEMS Sensor in Automotive Industry Market Outlook

The future of the automotive MEMS sensor market looks promising, fueled by the continued growth of ADAS and autonomous driving, increasing demand for enhanced safety and fuel efficiency, and continuous innovation in sensor technology. Strategic opportunities lie in developing advanced sensor fusion techniques, integrating AI and machine learning algorithms, and expanding into new applications such as sensor-based predictive maintenance. Companies focused on innovation and strategic partnerships are well-positioned to capitalize on the significant growth potential within this dynamic market.

MEMS Sensor in Automotive Industry Segmentation

-

1. Type

- 1.1. Tire Pressure Sensors

- 1.2. Engine Oil Sensors

- 1.3. Combustion Sensors

- 1.4. Fuel Injection and Fuel Pump Sensors

- 1.5. Air Bag Deployment Sensors

- 1.6. Gyroscopes

- 1.7. Fuel Rail Pressure Sensors

- 1.8. Other Ty

MEMS Sensor in Automotive Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of World

MEMS Sensor in Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Passenger Safety and Security Regulations

- 3.2.2 and Increased Focus on Compliance; Increased Automation Features and Performance Improvements Preferred by Customers

- 3.3. Market Restrains

- 3.3.1. Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations

- 3.4. Market Trends

- 3.4.1. Gyroscope to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tire Pressure Sensors

- 5.1.2. Engine Oil Sensors

- 5.1.3. Combustion Sensors

- 5.1.4. Fuel Injection and Fuel Pump Sensors

- 5.1.5. Air Bag Deployment Sensors

- 5.1.6. Gyroscopes

- 5.1.7. Fuel Rail Pressure Sensors

- 5.1.8. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tire Pressure Sensors

- 6.1.2. Engine Oil Sensors

- 6.1.3. Combustion Sensors

- 6.1.4. Fuel Injection and Fuel Pump Sensors

- 6.1.5. Air Bag Deployment Sensors

- 6.1.6. Gyroscopes

- 6.1.7. Fuel Rail Pressure Sensors

- 6.1.8. Other Ty

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tire Pressure Sensors

- 7.1.2. Engine Oil Sensors

- 7.1.3. Combustion Sensors

- 7.1.4. Fuel Injection and Fuel Pump Sensors

- 7.1.5. Air Bag Deployment Sensors

- 7.1.6. Gyroscopes

- 7.1.7. Fuel Rail Pressure Sensors

- 7.1.8. Other Ty

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tire Pressure Sensors

- 8.1.2. Engine Oil Sensors

- 8.1.3. Combustion Sensors

- 8.1.4. Fuel Injection and Fuel Pump Sensors

- 8.1.5. Air Bag Deployment Sensors

- 8.1.6. Gyroscopes

- 8.1.7. Fuel Rail Pressure Sensors

- 8.1.8. Other Ty

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of World MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tire Pressure Sensors

- 9.1.2. Engine Oil Sensors

- 9.1.3. Combustion Sensors

- 9.1.4. Fuel Injection and Fuel Pump Sensors

- 9.1.5. Air Bag Deployment Sensors

- 9.1.6. Gyroscopes

- 9.1.7. Fuel Rail Pressure Sensors

- 9.1.8. Other Ty

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 UK

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 Rest of Asia Pacific

- 13. Rest of World MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Infineon Technologies AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Robert Bosch GmbH*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Denso Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Sensata Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Delphi Automotive PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Freescale Semiconductors Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 General Electric Co

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 STMicroelectronics NV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Analog Devices Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Infineon Technologies AG

List of Figures

- Figure 1: MEMS Sensor in Automotive Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEMS Sensor in Automotive Industry Share (%) by Company 2024

List of Tables

- Table 1: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: UK MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Germany MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: UK MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: China MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Japan MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Sensor in Automotive Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the MEMS Sensor in Automotive Industry?

Key companies in the market include Infineon Technologies AG, Robert Bosch GmbH*List Not Exhaustive, Denso Corporation, Sensata Technologies Inc, Delphi Automotive PLC, Freescale Semiconductors Ltd, General Electric Co, STMicroelectronics NV, Analog Devices Inc, Panasonic Corporation.

3. What are the main segments of the MEMS Sensor in Automotive Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Passenger Safety and Security Regulations. and Increased Focus on Compliance; Increased Automation Features and Performance Improvements Preferred by Customers.

6. What are the notable trends driving market growth?

Gyroscope to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations.

8. Can you provide examples of recent developments in the market?

October 2022: MicroVision, Inc., a leader in MEMS-based solid-state automotive lidar and advanced driver-assistance systems (ADAS) solutions, announced that the MAVIN DR dynamic view lidar system is supported by the NVIDIA DRIVE AGX platform. In order to achieve superior highway pilot functionality with low latency and high performance, MicroVision's solution utilizes high-fidelity lidar sensors and unique perception software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Sensor in Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Sensor in Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Sensor in Automotive Industry?

To stay informed about further developments, trends, and reports in the MEMS Sensor in Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence