Key Insights

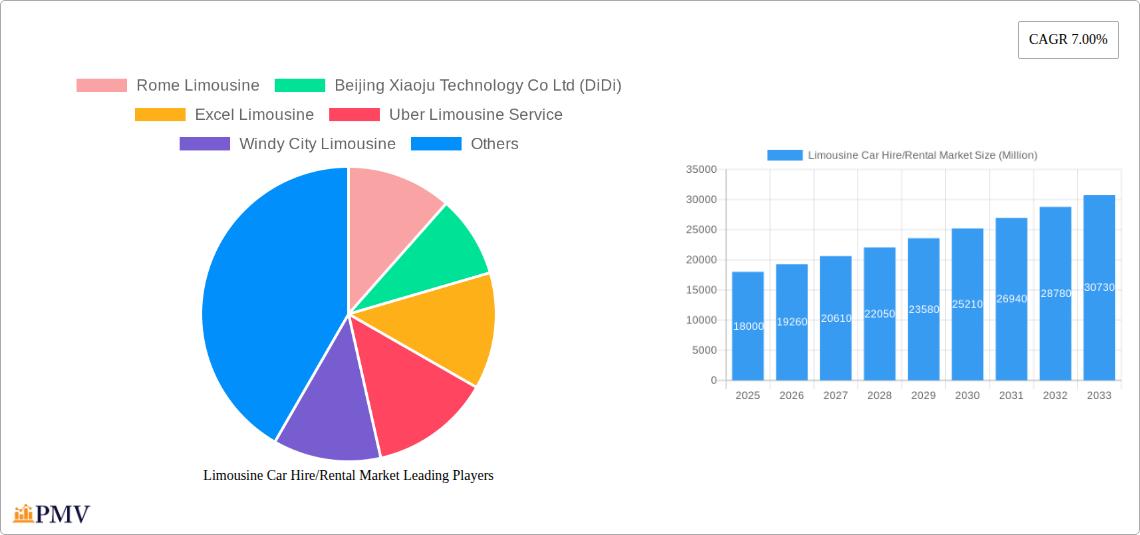

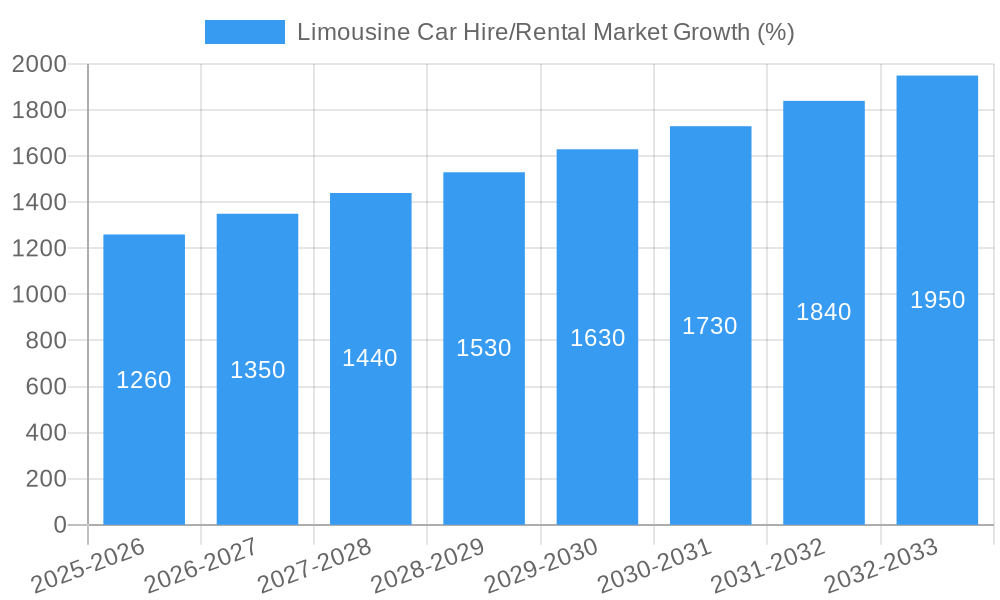

The global limousine car hire and rental market is experiencing robust growth, projected to maintain a 7% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning tourism and leisure sectors significantly contribute to demand, with increasing disposable incomes and a preference for luxury travel experiences driving bookings. The rise of online booking platforms simplifies the process, enhancing convenience and accessibility for customers. Furthermore, the business travel segment continues to provide a substantial revenue stream, particularly for corporate events and high-profile meetings. The market is segmented by application type (leisure/tourism, administrative, business), booking type (offline, online), and vehicle type (ultra-luxury, premium cars). While the exact market size in 2025 is not provided, we can extrapolate a reasonable estimate using the given CAGR and industry knowledge. Considering similar luxury transportation segments, a plausible figure for the 2025 market size could range from $15 billion to $20 billion, depending on the specific definition of "limousine car hire" (inclusive of chauffeured services or not). This would align with the significant growth projected over the forecast period.

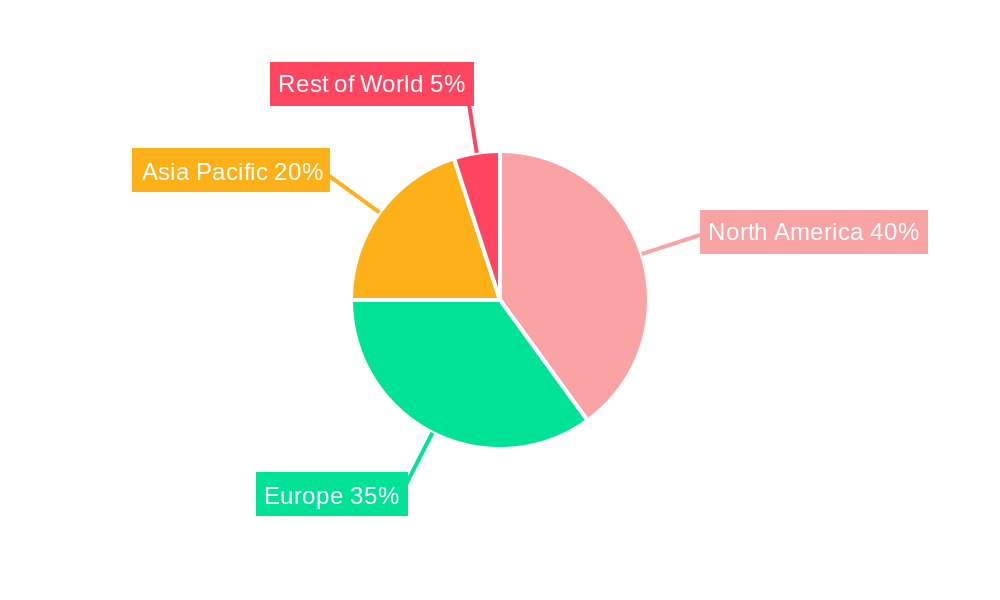

Geographic distribution reflects varying market maturity. North America and Europe currently hold a larger share, benefitting from established infrastructure and a strong culture of premium transportation services. However, the Asia-Pacific region exhibits significant growth potential driven by rapidly expanding economies and a rising middle class with increased spending power on luxury goods and services. Competition is intense, with a mix of large multinational corporations like Sixt SE and Uber alongside smaller, regionally focused limousine services like Windy City Limousine and Cabo Baja Limousines. The industry faces challenges, including fluctuating fuel prices, stringent regulations on vehicle emissions and licensing, and the impact of economic downturns on discretionary spending. Nevertheless, the overall market outlook remains positive, with continued growth expected throughout the forecast period.

Limousine Car Hire/Rental Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Limousine Car Hire/Rental market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, competitive landscapes, and future growth potential, incorporating detailed segmentation and key player analysis. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Limousine Car Hire/Rental Market Market Structure & Competitive Dynamics

The global limousine car hire/rental market exhibits a moderately concentrated structure, with several key players vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating the presence of both established industry giants and emerging competitors. Innovation within the sector is driven by technological advancements in vehicle electrification, ride-hailing apps, and customer service optimization. Regulatory frameworks, particularly concerning licensing, insurance, and emission standards, significantly impact market operations. The availability of alternative transportation options, such as private car ownership and ride-sharing services, acts as a substitute, influencing market demand. Consumer trends toward luxury experiences and convenience are key factors driving growth, while ongoing M&A activities reshape the competitive landscape. Deal values in recent years have averaged xx Million, with a significant number of acquisitions focused on expanding geographic reach and technological capabilities.

- Key Market Concentration Metrics: CR4 (xx%), CR5 (xx%)

- Major M&A Activities (2019-2024): xx Number of deals totaling xx Million in value.

- Key Regulatory Factors: Licensing requirements, insurance regulations, emission standards.

- Substitute Products/Services: Private car ownership, ride-sharing services (e.g., Uber, Lyft).

Limousine Car Hire/Rental Market Industry Trends & Insights

The limousine car hire/rental market is experiencing robust growth, driven by several factors. Increasing disposable incomes, particularly in emerging economies, fuel demand for luxury transportation services. The burgeoning tourism sector significantly contributes to market expansion, with leisure travelers seeking premium travel experiences. Technological disruptions, such as the rise of online booking platforms and mobile apps, enhance convenience and accessibility. Furthermore, the integration of advanced technologies, including GPS tracking, real-time booking systems, and electric vehicle integration, improves operational efficiency and enhances the customer experience. Competitive dynamics are shaped by pricing strategies, service quality, and brand reputation. The market exhibits a high degree of customer loyalty, driven by personalized service and premium offerings. The market penetration of online booking platforms is rapidly increasing, with a projected xx% penetration rate by 2033.

Dominant Markets & Segments in Limousine Car Hire/Rental Market

The North American region currently dominates the global limousine car hire/rental market, driven by strong economic growth, a large tourism sector, and a well-established infrastructure. Within the application type segment, the Business segment holds the largest market share, followed by Leisure/Tourism. Online booking continues its strong upward trend in market share, surpassing offline booking. Within Vehicle Type, Premium Cars hold a significantly larger market share than Ultra Luxury Cars at the present time, driven by affordability and broader appeal.

- Key Drivers in North America: Strong economic growth, large tourism sector, developed infrastructure.

- Application Type Segmentation:

- Business: High demand driven by corporate events and executive travel.

- Leisure/Tourism: Significant growth from luxury travel and airport transfers.

- Administrative: Steady demand from government and institutional needs.

- Booking Type Segmentation:

- Online Booking: Rapid growth fueled by convenience and accessibility.

- Offline Booking: Traditional booking methods maintain a significant presence.

- Vehicle Type Segmentation:

- Premium Cars: High demand due to balance of luxury and affordability.

- Ultra Luxury Cars: Niche market catering to high-net-worth individuals.

Limousine Car Hire/Rental Market Product Innovations

Recent product innovations focus on enhancing customer experience and operational efficiency. Electric and hybrid limousine options are gaining traction, driven by environmental concerns and cost savings. Integration of advanced in-car entertainment systems, personalized comfort features, and enhanced safety technologies are key differentiators. The adoption of sophisticated route optimization software and integrated booking platforms improves service delivery and reduces operational costs.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the limousine car hire/rental market across various parameters:

- Application Type: Leisure/Tourism, Administrative, Business (each segment includes market size, growth projections, and competitive dynamics).

- Booking Type: Offline Booking, Online Booking (each segment includes market size, growth projections, and competitive dynamics).

- Vehicle Type: Ultra Luxury Cars, Premium Cars (each segment includes market size, growth projections, and competitive dynamics).

Key Drivers of Limousine Car Hire/Rental Market Growth

Several factors contribute to the growth of the limousine car hire/rental market:

- Rising Disposable Incomes: Increased spending power fuels demand for luxury services.

- Growth of the Tourism Sector: Increased tourism drives demand for airport transfers and sightseeing tours.

- Technological Advancements: Online booking platforms and advanced vehicle features enhance convenience and service quality.

- Favorable Government Regulations: Supportive policies facilitate market expansion.

Challenges in the Limousine Car Hire/Rental Market Sector

The market faces several challenges:

- High Operational Costs: Fuel prices, vehicle maintenance, and driver salaries contribute to high operational expenses.

- Intense Competition: The presence of several players creates a competitive market environment.

- Economic Downturns: Economic recessions can significantly impact demand for luxury services.

Leading Players in the Limousine Car Hire/Rental Market Market

- Rome Limousine

- Beijing Xiaoju Technology Co Ltd (DiDi)

- Excel Limousine

- Uber Limousine Service

- Windy City Limousine

- Cabo Baja Limousines

- EMPIRECLS COM

- Penguin Limousine Services

- Sixt SE

- Addison Lee

Key Developments in Limousine Car Hire/Rental Market Sector

- July 2022: Sixt SE expands facilities across Canada, strengthening its North American presence.

- October 2021: Sixt SE introduces hybrid and fully electric limousine rental services across Europe.

- August 2021: Limousine Cabs Limited launches AI-powered taxi services in Telangana, India, with plans for national expansion.

Strategic Limousine Car Hire/Rental Market Market Outlook

The future of the limousine car hire/rental market appears promising, driven by continued economic growth, technological innovation, and evolving consumer preferences. Strategic opportunities lie in expanding into underserved markets, leveraging technological advancements, and offering customized service packages to cater to diverse customer needs. The market's continued growth hinges on addressing operational challenges, adapting to evolving regulatory landscapes, and maintaining a competitive edge through differentiated offerings.

Limousine Car Hire/Rental Market Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Administrative

- 1.3. Business

-

2. Booking Type

- 2.1. Offline Booking

- 2.2. Online Booking

-

3. Vehicle Type

- 3.1. Ultra Luxury Cars

- 3.2. Premium Cars

Limousine Car Hire/Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Limousine Car Hire/Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Sector and leisure travelling

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Administrative

- 5.1.3. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline Booking

- 5.2.2. Online Booking

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Ultra Luxury Cars

- 5.3.2. Premium Cars

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Leisure/Tourism

- 6.1.2. Administrative

- 6.1.3. Business

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Offline Booking

- 6.2.2. Online Booking

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Ultra Luxury Cars

- 6.3.2. Premium Cars

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Leisure/Tourism

- 7.1.2. Administrative

- 7.1.3. Business

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Offline Booking

- 7.2.2. Online Booking

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Ultra Luxury Cars

- 7.3.2. Premium Cars

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Leisure/Tourism

- 8.1.2. Administrative

- 8.1.3. Business

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Offline Booking

- 8.2.2. Online Booking

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Ultra Luxury Cars

- 8.3.2. Premium Cars

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of World Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Leisure/Tourism

- 9.1.2. Administrative

- 9.1.3. Business

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Offline Booking

- 9.2.2. Online Booking

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Ultra Luxury Cars

- 9.3.2. Premium Cars

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. North America Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of World Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Rome Limousine

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Beijing Xiaoju Technology Co Ltd (DiDi)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Excel Limousine

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Uber Limousine Service

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Windy City Limousine

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cabo Baja Limousines

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 EMPIRECLS COM

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Penguin Limousine Services

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sixt SE

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Addison Lee

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Rome Limousine

List of Figures

- Figure 1: Global Limousine Car Hire/Rental Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of World Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Limousine Car Hire/Rental Market Revenue (Million), by Application Type 2024 & 2032

- Figure 11: North America Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 12: North America Limousine Car Hire/Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 13: North America Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 14: North America Limousine Car Hire/Rental Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Limousine Car Hire/Rental Market Revenue (Million), by Application Type 2024 & 2032

- Figure 19: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 20: Europe Limousine Car Hire/Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 21: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 22: Europe Limousine Car Hire/Rental Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Europe Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Limousine Car Hire/Rental Market Revenue (Million), by Application Type 2024 & 2032

- Figure 27: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 28: Asia Pacific Limousine Car Hire/Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Asia Pacific Limousine Car Hire/Rental Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Asia Pacific Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of World Limousine Car Hire/Rental Market Revenue (Million), by Application Type 2024 & 2032

- Figure 35: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 36: Rest of World Limousine Car Hire/Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 37: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 38: Rest of World Limousine Car Hire/Rental Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Rest of World Limousine Car Hire/Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 4: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Middle East and Africa Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 24: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 25: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 26: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of North America Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 31: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 32: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 33: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 39: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 40: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 41: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: India Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: China Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Asia Pacific Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 47: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 48: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 49: Global Limousine Car Hire/Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: South America Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Middle East and Africa Limousine Car Hire/Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Limousine Car Hire/Rental Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Limousine Car Hire/Rental Market?

Key companies in the market include Rome Limousine, Beijing Xiaoju Technology Co Ltd (DiDi), Excel Limousine, Uber Limousine Service, Windy City Limousine, Cabo Baja Limousines, EMPIRECLS COM, Penguin Limousine Services, Sixt SE, Addison Lee.

3. What are the main segments of the Limousine Car Hire/Rental Market?

The market segments include Application Type, Booking Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

Rise in Tourism Sector and leisure travelling.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

In July 2022, Sixt SE expanded its facilities across Canada. Through this expansion, the company expands across the North American continent with a growing network that offers best-in-class service for business and leisure travelers in the US and Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Limousine Car Hire/Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Limousine Car Hire/Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Limousine Car Hire/Rental Market?

To stay informed about further developments, trends, and reports in the Limousine Car Hire/Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence